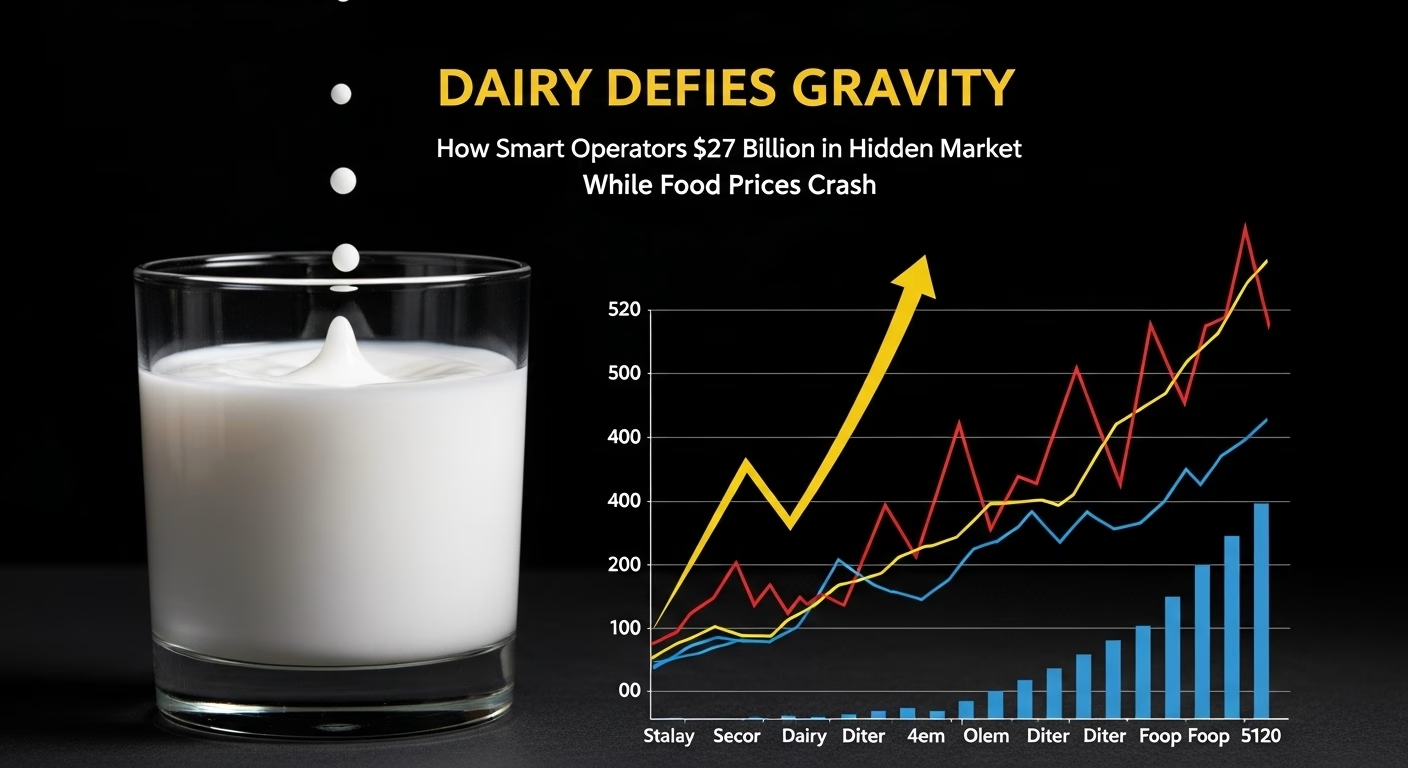

Why are some producers expanding herds during margin squeezes? The answer reveals a fundamental shift in dairy economics

EXECUTIVE SUMMARY:

Recent research shows U.S. milk production increased 3.4% through July 2025 despite challenging margins, with New Zealand up 8.9% and South America rising 7.7%—a pattern that breaks traditional market correction cycles. What farmers are discovering is that beef-on-dairy crossbred calves now generate revenue streams that can offset monthly feed costs, fundamentally altering culling decisions that historically balanced supply and demand. This shift coincides with processing consolidation, as demonstrated by Lactalis’s $4.22 billion acquisition of Fonterra, creating fewer competitive alternatives for milk marketing. University research indicates that when processing facilities operate above 95% capacity, basis relationships deteriorate for producers—a situation becoming more common as companies optimize throughput over redundancy. The convergence of alternative revenue sources, reduced processing competition, and government programs like Dairy Margin Coverage creates market dynamics in which traditional price signals no longer effectively drive supply adjustments. For progressive producers, this means developing risk management strategies that account for combined milk-plus-calf returns while diversifying processing relationships. Understanding these structural changes—rather than waiting for cyclical recovery—positions operations to navigate an industry where market fundamentals are being permanently rewritten.

So I’m having coffee with this producer last week—big operation, been at it for decades—and he says something that’s been bugging me ever since. “You know what’s weird?” he goes. “My margins are terrible, milk check keeps shrinking, but I’m milking more cows than I ever have.”

And I’m thinking… wait, what?

See, I’ve been covering these markets since Clinton was president (yeah, I’m that old), and this just doesn’t follow the old playbook. You know how it’s supposed to work, right? Prices tank, producers cull hard, supply drops, prices recover. Economics 101 stuff.

Except look at what the USDA put out last month. U.S. milk production up 3.4% through July—during what should be a massive correction period. New Zealand’s running 8.9% ahead of last year, according to Global Dairy Trade reports. South America’s up 7.7%. These numbers keep coming in month after month.

I mean, when’s the last time you saw production climbing during a price crash? Never, right? Because it makes no damn sense economically.

And honestly? That should scare every independent producer reading this.

The Beef-Cross Money That’s Breaking All the Rules

You guys all know about these beef-on-dairy calves bringing serious money lately. I’m talking… well, let’s just say crossbred calves are covering expenses that used to come straight out of the milk check.

But here’s where it gets nuts—that calf money is completely screwing up everything we thought we knew about supply and demand responses.

Think back to 2014. I remember writing about operations that culled hard when Class III dropped. Supply tightened up real quick. Prices recovered. Basic market mechanisms are working like they should.

Not anymore.

You’ve got cows bleeding money on every hundredweight of milk, but that same cow’s beef-cross calf might cover months of feed costs. So instead of sending her down the road like you would’ve done back then, you keep her around for the calf revenue.

Makes total sense from a cash flow standpoint, I get it. But multiply that decision across every dairy operation dealing with tight margins… and suddenly you’ve got this bizarre situation where terrible milk prices are actually keeping more cows in production.

What are the feedback loops that are used to correct market imbalances automatically? They’re not just broken—they’re working backwards.

When Your Processor Starts Playing Games

You know what really bothers me? How tightly these processing networks run nowadays. I keep hearing about plant shutdowns that create these massive disruptions—milk backing up at farm tanks, basis going to hell, producers scrambling to find alternative processing.

And the basis? Starts at maybe a small discount and just keeps sliding. Gets ugly real fast.

But what really gets me is how it exposes just how deliberately lean these processors run their operations. Mark Stephenson up at Wisconsin Extension—sharp guy, does good work—he’s mentioned how when processing plants approach capacity limits, basis relationships start deteriorating for producers.

Which makes you wonder… why are so many facilities always running right at that edge?

My theory? Because they figured out that tight capacity gives them leverage. When every processor in your region is maxed out, where else are you gonna haul your milk? They can knock your basis down, and you’ll take it because—what choice do you have?

Talk to producers lately. Basis penalties that used to be seasonal exceptions are becoming… well, more frequent occurrences. Because some genius in corporate figured out that running short on capacity works better than building enough to actually serve their suppliers properly.

The Lactalis Deal That Shows How This Game Really Works

You want to see corporate timing that’d make a Wall Street trader jealous? Watch how Lactalis—try saying that name three times fast—played their Fonterra buyout.

So these guys are already the biggest dairy company on the planet, right? Pulling in over €30 billion annually according to their own financial reports. They could’ve struck this deal anytime they wanted.

But did they move when milk prices were strong and farmers actually had some negotiating power? Hell no.

They waited until this year, right when global oversupply was building and operations were getting squeezed on margins. Those Australian Competition and Consumer Commission documents show the negotiations happening right as market pressure was building. Final deal: $4.22 billion for Fonterra’s consumer and foodservice businesses.

Coincidence? I seriously doubt it.

Want proof this is a pattern? Look at what they did in France after they consolidated operations there. Despite making record money—record money—they cut milk collection by 450 million liters last year. That’s nearly 10% of their French volume, according to European dairy reports. French producers were screaming about it, but by then, competitive alternatives were already gone.

Funny how that timing works out, isn’t it?

Why “Cheaper Feed” Is Mostly Marketing Nonsense

Every trade publication—and I read way too many of them—has some consultant talking about how lower grain costs are gonna save our margins. Corn backing off from highs, soybeans down… sounds encouraging in theory.

Until you actually run the numbers on real operations.

So let’s say feed costs drop significantly—and I mean really drop, more than you’d normally see. When you break that down per cow per day versus what most operations are losing on milk revenue… well, it’s like trying to fill a swimming pool with a garden hose while someone’s got the drain wide open.

I keep hearing from producers who’ve done the math. Feed improvements might save you fifty cents, maybe seventy-five cents per cow daily. But if milk revenue’s down two-fifty, three dollars per cow… you see the problem?

| Metric | Daily Per Cow Impact | Monthly Per Cow | Annual Per Herd (500 cows) |

|---|---|---|---|

| Milk Revenue Loss | -$2.50 | -$75.00 | -$456,250 |

| Feed Cost Savings | +$0.60 | +$18.00 | +$109,500 |

| NET IMPACT | -$1.90 | -$57.00 | -$346,750 |

But these consultants keep pushing feed procurement strategies because—and I suspect this is part of the game plan—it keeps producers focused on optimizing costs while the real money flows toward corporate consolidation. Keep us busy saving pennies while Rome burns.

The Processing “Emergency” Pattern

What bothers me about these plant shutdowns? Every time one goes down, it requires this massive coordination effort—state agencies getting involved, emergency rerouting across multiple states, even companies that don’t normally handle dairy getting pressed into service.

When one facility failure requires government-level intervention, that tells you everything about how this system’s designed to operate. Zero redundancy is built in. Everything is running right at the breaking point.

If any of us ran our dairy operations with that little backup… hell, we’d never sleep at night. But for processors? Apparently, running lean means every breakdown creates regional pricing opportunities they can use to their advantage.

And that’s becoming the pattern. Processing disruptions that create permanent changes to local basis relationships. Never temporary adjustments that recover—always permanent shifts that favor the processor.

Makes you wonder how accidental some of these emergencies really are…

What the Experienced Guys Are Actually Doing

I’ve been talking to producers who’ve figured out this cycle’s different from anything we’ve seen before. The ones positioning to survive aren’t sitting around waiting for some magical market recovery.

They’re getting serious about risk management for Q4 production. Class III put options for fourth quarter production—locking in price floors when things could get uglier. Some operations regularly rotate milk between multiple processors. Soon as one plant starts offering heavy discounts, they shift volume to keep everyone competitive.

DMC enrollment deadline’s coming up fast—September 30th, that’s next Monday. Coverage costs you maybe fifteen cents per hundredweight but pays out when margins collapse below certain thresholds. Joe Outlaw at Texas A&M’s Agricultural and Food Policy Center ran the numbers after that 2023 squeeze—program paid out $1.27 billion to enrolled producers. With margins running where they are now? Enrolled operations could see substantial government checks.

Strategic culling’s getting weird, too. Some producers I know are scoring every cow on total economic return—milk revenue plus calf value minus feed costs. Some of their best milk producers are getting shipped because their calves don’t bring premium money. Makes sense mathematically, but it feels backwards, you know?

Regional feed coordination with neighbors still makes sense if you can coordinate bulk purchases and negotiate decent freight rates. Every dollar saved per ton adds up when you’re feeding this many animals.

The Government Program Making Everything Worse

This probably won’t make me popular with the bureaucrats in Washington, but I gotta say it: Dairy Margin Coverage isn’t protecting family farms. It’s subsidizing the oversupply that’s letting corporate processors buy cheap milk.

Think about the logic here. DMC literally pays producers to keep milking cows that lose money on every hundredweight. Who benefits from a sustained cheap milk supply? Processing companies are buying raw materials at below-market rates.

It’s corporate welfare disguised as farmer relief, and most of us are too desperate to turn it down.

The program uses national averages that completely ignore regional basis manipulation games. Producers dealing with heavy local discounts see DMC calculations based on milk prices they’ve never actually received in their mailbox. It’s like calculating your gas mileage based on highway speeds when you’re stuck in city traffic all day.

Still, with margins this brutal, you probably need the coverage. Just understand what you’re really signing up for—subsidizing a system that’s working against your long-term interests.

The Reality Nobody Wants to Discuss Publicly

Hell, I’ve been doing this since the late 90s, and I’ve never seen market mechanisms get systematically dismantled like this. What are the automatic balancing systems that are used to correct supply-demand imbalances? They’ve been neutralized.

Beef-cross revenue eliminates price-driven culling incentives. Processing consolidation kills competition for our milk. Global production growth creates sustained oversupply conditions. Government programs subsidize below-cost production.

This isn’t your typical cyclical correction. It’s a managed transition toward corporate control of milk pricing, with independent farmers becoming contract suppliers instead of actual market participants.

Back when we had real competition for our milk—and some of you remember those days—you could play processors against each other. Get a better basis here, threaten to move volume there. Now? Good luck with that strategy.

Industry publications keep using words like “partnership” when they talk about these corporate acquisitions. Lactalis is partnering with farmers after they buys up assets. Partnership. Right. Like David partnering with Goliath—how’d that work out?

When one party controls processing capacity and the other has nowhere else to sell their product… that ain’t partnership. That’s dependency, presented in fancy marketing language.

Bottom Line for Producers Who Understand What’s Happening

Smart farmers are repositioning for an industry where volume might matter more than efficiency per cow, where calf checks could drive more herd decisions than milk production metrics, and where basis management becomes more critical than traditional futures hedging.

Reality check time. Feed cost improvements can’t offset milk revenue losses when prices drop faster than input costs. Government programs provide short-term cash flow but perpetuate the structural problems driving margin compression. Beef-cross returns generate immediate revenue while potentially undermining long-term market stability.

Operations implementing serious risk management strategies—protecting production with options, diversifying processor relationships, culling based on total economic returns instead of just milk numbers—those farms will survive this transition period.

The ones waiting for a traditional cyclical recovery? They’re gonna discover that “normal” doesn’t include the competitive market relationships that made independent dairy farming economically viable.

Corporate consolidation is accelerating rapidly across the industry. Producers who recognize this as a permanent structural change rather than a temporary market weakness have limited time to position defensively before competitive alternatives disappear entirely.

Your operation’s survival depends on understanding that current market conditions aren’t just natural economic forces playing out. They reflect corporate strategies designed to concentrate industry control while systematically reducing the number of independent producers.

The question isn’t whether markets will eventually improve—they might. The question’s whether your farm can adapt to survive in the corporate-controlled industry that’s emerging from this transformation.

Makes me sick to write that last part, but it’s the truth as I see it developing.

KEY TAKEAWAYS:

- Combined revenue optimization: Producers tracking total economic returns per cow (milk revenue plus calf value minus feed costs) are making more profitable culling decisions, with beef-cross calves potentially covering 2-3 months of feed expenses per animal

- Risk management enhancement: Class III put options for Q4 production and Dairy Margin Coverage enrollment (deadline September 30th) provide essential downside protection, with 2023 DMC payments totaling $1.27 billion to enrolled operations during margin squeezes

- Processing relationship diversification: Operations rotating milk between multiple processors monthly, maintain competitive basis pricing, and avoid the 15-20¢/cwt penalties that can occur when single-plant dependencies face capacity constraints

- Strategic feed procurement coordination: Regional cooperatives coordinating bulk grain purchases and freight optimization can achieve meaningful cost reductions, though these savings alone cannot offset significant milk revenue declines

- Market structure adaptation: Successful operations are positioning for an industry where basis management becomes more critical than traditional futures hedging, requiring a deeper understanding of local processing dynamics and capacity utilization patterns

Production data sourced from the USDA Economic Research Service monthly dairy reports and Global Dairy Trade auction results that track international supply trends. Corporate financial information from publicly available Lactalis Group reports and Australian Competition and Consumer Commission regulatory filings. Academic analysis from the University of Wisconsin Extension dairy economics research and Texas A&M’s Agricultural and Food Policy Center studies on government program impacts.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beef-on-Dairy in 2025: Turning Calf Premiums into Real Profit Without Blowing Up Your Herd – Reveals practical methods for implementing beef-cross strategies that netted one operation $370 more per head than Holsteins, including genomic sorting protocols and replacement pipeline management to avoid costly heifer shortages.

- Analysis: A New Dairy World Order – How Europe’s €33 Billion Mega-Mergers Will Impact Your Farm – Demonstrates how European consolidation creates worldwide pricing ripple effects and provides region-specific survival strategies for navigating processor consolidation, feed volatility, and environmental compliance pressures.

- Stop Hemorrhaging Money on Feed: The Million-Dollar Risk Management Arsenal That’s Separating Profitable Dairies from the Walking Dead – Exposes sophisticated risk management strategies that reduce feed cost volatility by 35% and save operations $135,000+ annually, providing the financial defense tools needed to survive corporate-controlled market manipulation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!