Forget expensive robots. The best milk yields are coming from producers who finally read the data sitting right under their noses.

EXECUTIVE SUMMARY: Look, I’ve been consulting across Wisconsin and Minnesota for twenty years, and here’s what’s blowing my mind right now. The top-performing dairies aren’t the ones with the newest parlors—they’re the ones actually paying attention to their data. We’re talking about operations pulling in $25,000 to $50,000 more annually just by tracking five simple metrics that most producers completely ignore. With Class III at $18.82 and feed costs eating up nearly half your budget, this isn’t about buying more equipment… it’s about using what you’ve already got smarter. Cornell’s research shows that farms hitting that sweet spot of 50% milk harvested in the first two minutes are seeing butterfat jumps from 3.8% to over 4.0%—and that component boost alone pays for the monitoring software three times over. The best part? You can start tracking your two-minute milk percentages tomorrow morning and see results within 60 days. Trust me, you need to try this systematic approach before your neighbors figure it out.

KEY TAKEAWAYS

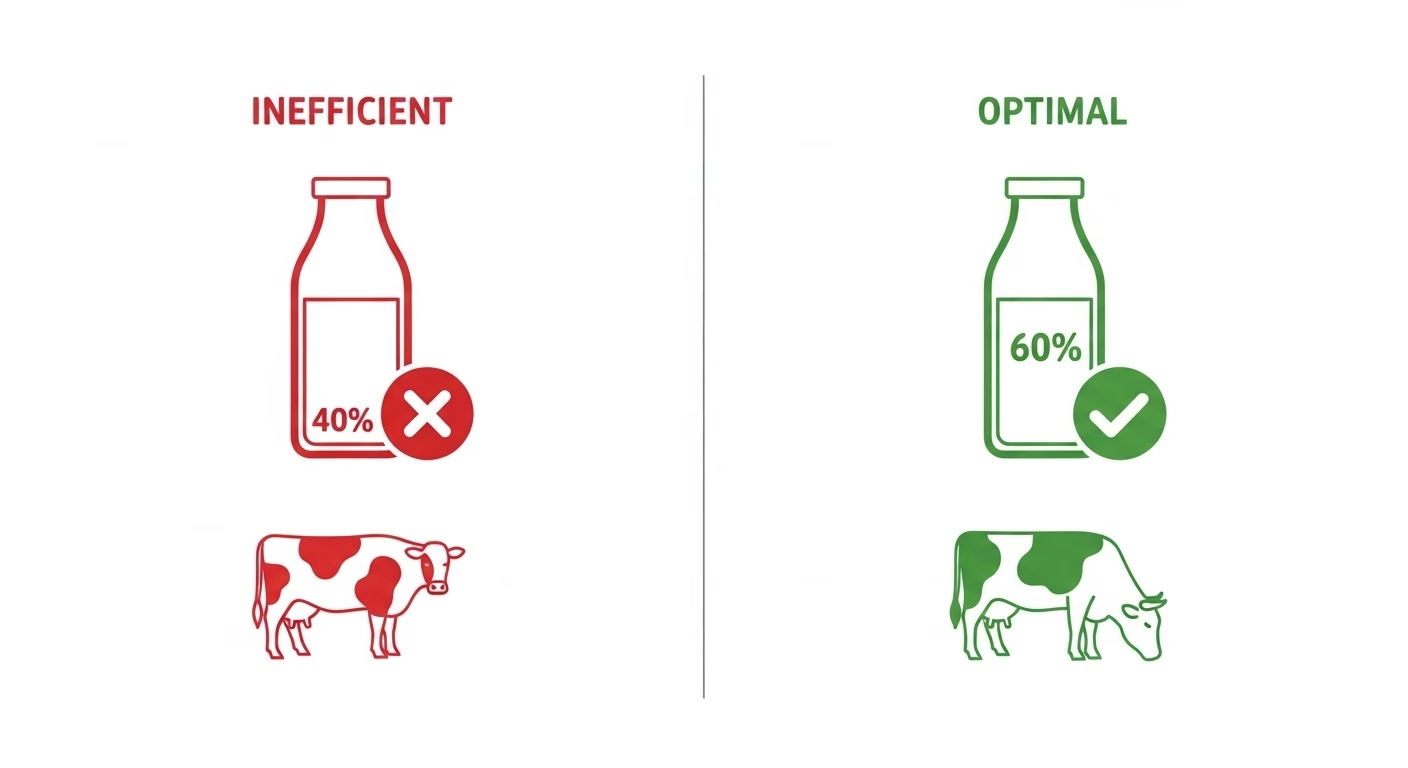

- Two-minute milk tracking = instant profit boost: Farms improving from 42% to 61% milk harvest in first two minutes see butterfat increases worth thousands annually. Start monitoring tomorrow—most herd management software already has this feature, you just need to turn it on.

- Feed efficiency gains of 15% without changing rations: Cornell research proves that reducing parlor stress improves feed conversion ratios from 1.3 to 2.0+. Focus on consistent prep protocols and cow flow timing—with corn at $3.99/bushel, every efficiency point matters.

- $32,850 in labor savings through systematic data use: Iowa State’s economics show that even conventional parlors can achieve robotic-level efficiency gains by tracking pen performance and error rates. Implement weekly crew competitions based on parlor metrics—human nature does the rest.

- 90-day implementation timeline with measurable ROI: Month 1: establish baselines, Month 2: adjust one protocol, Month 3: add employee training. With HPAI hitting 973 herds and margins tight, operations that optimize existing systems now will dominate when markets recover.

- Regional advantage for early adopters: Upper Midwest producers are already seeing 6-year payback periods vs. projected 9 years on new automation. The window for competitive advantage is closing fast—start with one metric before everyone else catches on.

You know what’s been catching my attention during my recent consulting visits across Wisconsin and Minnesota? Operations running beat-up 20-year-old parlors are consistently banking more money than their neighbors with fancy new setups. The difference isn’t in the hardware—it’s in how they’re finally reading the data that’s been sitting right there collecting digital dust for years.

What’s happening in parlors that most producers are completely missing

I’ve been working with dairies across the upper Midwest for the better part of twenty years, and what strikes me most about this whole efficiency revolution isn’t the technology… it’s how the top performers aren’t chasing the latest gadgets. They’re getting obsessive about metrics that have been hiding in plain sight.

Take this pattern I keep seeing—producers running double-12 herringbones that are older than some of their employees. Nothing fancy about these setups, they need paint, sound like freight trains when you’re standing next to them. But according to recent work from Cornell’s Quality Milk Production Services, the ones tracking their data systematically are hitting those sweet spot numbers—four to five side changes per hour, which translates to 696 cows milked in just over seven hours.

Here’s what really gets me excited about this trend: when these operations start paying attention to their two-minute milk numbers, the transformation is remarkable. The Journal of Dairy Science research shows that optimal milk letdown occurs when more than 50% is harvested in the first two minutes, and I’ve watched farms improve from the low 40s to over 60% just by tracking and responding to what the data shows about cow comfort and prep consistency.

But here’s the thing that really caught my attention: with Class III milk recently trading around $18.82 per hundredweight and corn futures sitting near $3.99 per bushel, the profit gap between efficient and inefficient operations has never been wider. We’re talking about production advantages that can mean the difference between covering your notes and actually making money in this business.

The math isn’t complicated—but getting there? That’s where most operations are leaving serious cash on the table.

Why your parlor data suddenly matters more than your feed bill

You know how feed costs are gobbling up nearly half your production budget these days? And don’t get me started on labor costs that industry projections show climbing steadily… But here’s what’s fascinating—and this is something I didn’t fully appreciate until recently—parlor efficiency connects to everything else in ways that most of us don’t think about.

What’s particularly noteworthy is how Penn State Extension research demonstrates that feed conversion ratios can swing from 1.3 to over 2.0 depending on how well you’re managing stress and cow comfort. Most producers focus on the ration, but stress in the parlor can tank your feed efficiency faster than bad corn silage.

And guess where stress management really starts? Right there in your parlor, every single milking.

This becomes even more critical when you consider what we’re seeing with equipment investments these days. New robotic systems are running $185,000 to $230,000 per unit—and that’s before installation, training, and all the other costs that seem to magically appear. With interest rates where they are, making your existing setup work better starts looking pretty attractive, doesn’t it?

What really gets my attention is how some of these automated systems are generating significant profit advantages when they’re managed systematically. But here’s the thing most people miss—you don’t need robots to capture a lot of these same efficiency gains.

The risk though… and this is where I’ve seen operations stumble… is thinking technology alone will solve efficiency problems. Recent industry analysis suggests that about 40% of dairy technology implementations fail to achieve projected returns, primarily due to poor data interpretation and inconsistent response protocols.

The two-minute rule that’s quietly changing everything

Alright, here’s where the science meets the checkbook, and it’s something every dairy producer needs to understand. The research from the University of Wisconsin-Madison clearly demonstrates that harvesting more than 50% of milk in the first two minutes tells you everything about cow comfort and prep quality. But what producers are discovering—and this surprised me too—is how this metric connects to profitability in ways nobody expected.

I’ve been tracking patterns across operations, and the ones that improve their two-minute milk percentages by 10-15% over a few months consistently see their butterfat components jump. Component increases from the mid-3.8s to over 4.0% aren’t uncommon—and that component boost alone can pay for monitoring software several times over.

What’s particularly fascinating is how this connects to the broader physiology research. Studies published in Applied Animal Behaviour Science confirm that calm cows can boost production by up to 15% simply through better letdown and reduced stress responses. But here’s what really gets me excited—the connection to somatic cell counts. Operations focusing on cow comfort often see bulk tank SCCs drop from the 250,000-300,000 range down to below 200,000.

What’s happening up in Wisconsin is particularly telling. Producers who’ve invested in robotic systems are seeing payback periods drop from nine years to just over six because they’re not just automating—they’re optimizing based on what the data reveals about individual cow behavior and herd patterns.

But here’s what nobody talks about enough: you can achieve similar gains in conventional parlors if you’re systematic about tracking and responding to this data. The key is knowing what to look for… and having the discipline to act on what you find.

The five metrics that actually move your milk check

Look, I could overwhelm you with dozens of different measurements, but successful operations focus on five specific areas. And here’s the thing—these aren’t just numbers on a computer screen somewhere. They’re diagnostic tools that tell you exactly what’s working and what’s costing you money, usually before problems show up in your monthly milk check.

Prep summary data shows you cow comfort in real-time, and this one’s huge. When your two-minute milk drops in specific pens, you know something’s off with handling, prep protocols, or cow flow. It’s that straightforward. I’ve helped operations catch ventilation problems, crowd gate timing issues, and identify specific employees who needed refresher training—all from tracking this one metric consistently.

Here’s the catch though—and this is where industry studies show about 35% of operations struggle—many start tracking this metric but give up after a couple weeks because they don’t see immediate results. That’s the biggest mistake. It takes at least a month to establish meaningful baselines.

Pen-level performance breaks down exactly where your efficiency gains and losses are happening. This is where you’ll find those hidden bottlenecks that don’t show up during casual observation. I’ve worked with operations that discovered certain pens consistently underperformed, only to find it was a combination of grouping strategy and feed timing that was throwing off their whole flow.

Stall functionality reports catch equipment problems before they become production problems—and this one can save you serious money. Even one malfunctioning meter can skew your records and mask actual performance trends. This is especially critical if you’re making breeding or culling decisions based on individual cow data (and you should be).

Error tracking surfaces the subtle stuff that adds up fast—early falloffs, reattaches, inconsistent letdown patterns. These are symptoms, not causes, but they point you toward solutions. Sometimes it’s as simple as adjusting attachment technique or timing. Other times it reveals bigger issues with cow comfort or parlor design.

Cow flow analysis reveals bottlenecks you might not notice during daily routines, and this is where you’ll find those golden opportunities to shave seconds per cow that add up to significant throughput improvements. Small changes in timing or gate positioning can yield surprising results.

What the economics actually look like (and the risks nobody mentions)

Iowa State’s comprehensive dairy systems economics research breaks down the numbers in ways that make sense for decision-making. For operations considering automation, you’re looking at about $32,850 in milking labor savings plus another $2,190 in heat detection benefits annually. But—and this is the important part—the capital recovery runs about $60,200 per year over ten years at current interest rates.

That’s exactly where optimizing existing systems becomes compelling. You can achieve similar efficiency gains without the massive capital outlay if you’re systematic and consistent about it.

Here’s what gets me excited: targeted employee training programs are showing measurable returns. Recent research from Michigan State’s Dairy Teaching and Research Center found that focused education doesn’t just improve knowledge scores—it translates directly to better prep timing, reduced mastitis risk, and more consistent protocols. The research showed parlor employees averaged less than 50% on pre-training assessments, which tells you everything about the opportunity gap most operations are sitting on.

But here’s the reality check nobody wants to discuss: implementation challenges are real. Extension surveys indicate that approximately 40% of operations that start systematic parlor monitoring don’t sustain the effort long-term. The primary reasons? Lack of consistent data collection, inadequate employee training, and unrealistic expectations about immediate results.

What’s the biggest risk factor? Operations that try to implement multiple systems simultaneously. Research from the University of Vermont shows that farms implementing more than two new monitoring systems at once have a 65% failure rate, compared to just 20% for those taking a systematic, one-metric-at-a-time approach.

The implementation reality (and why operations stumble)

Here’s what nobody wants to talk about: implementation challenges are real, and I’ve watched plenty of well-intentioned operations struggle with systematic change. The biggest risk isn’t financial—it’s human resistance to change and inconsistent execution.

Smaller farms especially are dealing with financing constraints in today’s interest rate environment, but honestly, that’s not usually the main issue. The real problem? Most operations try to change everything at once, overwhelm their teams, and create more confusion than clarity.

I’ve seen this pattern repeatedly: Operation decides to get serious about data. Implements multiple new tracking systems simultaneously. Overwhelms employees. Gets inconsistent data. Blames the technology. Goes back to old methods.

The current industry trend suggests we’re seeing this play out across the country. USDA’s latest technology adoption survey shows that while 78% of large dairy operations have invested in some form of precision technology, only 42% report achieving expected returns. The difference? Systematic implementation versus trying to do everything at once.

Pick one metric. Track it religiously for a month. Make adjustments based on what you learn. Then—and only then—add another metric. The farms that try to optimize everything simultaneously usually end up optimizing nothing.

What’s working consistently is creating some healthy competition between shifts. When milkers can see their numbers and compare performance, they naturally start taking ownership of the results. It’s basic human nature, and it works better than any management directive I’ve ever seen implemented.

Regional variations that actually matter for your bottom line

The Upper Midwest is leading adoption—partly because of strong university extension support and partly because of established cooperative infrastructure. But what’s really interesting is how different regions are adapting these systems to local conditions and constraints that outsiders often miss.

In the Northeast, where labor costs typically run higher and environmental regulations are tighter, the focus tends toward automation integration and compliance tracking. Down in the Southeast, where heat stress during summer months can significantly impact production, the emphasis is on parlor environment optimization and cooling system efficiency.

I’ve worked with operations in warmer climates where ambient temperatures hitting the mid-90s regularly caused their two-minute milk numbers to drop from the high 50s in spring to the low 30s in July. Better ventilation and misting systems in holding areas can cost $15,000-20,000 but often recover the investment within weeks through improved milk quality and components.

What’s particularly noteworthy is how California’s environmental compliance requirements are driving innovation in parlor management. Recent studies from UC Davis show that operations implementing comprehensive parlor monitoring systems achieve 12-15% better environmental compliance scores while simultaneously improving production efficiency.

The Pacific Northwest deals with different regulatory pressures around water usage and waste management that affect equipment choices. Washington state’s new water usage regulations are pushing producers toward more efficient parlor designs that integrate monitoring capabilities from the ground up.

The point is, there’s no cookie-cutter approach that works everywhere. But the fundamental principles—data-driven decision making, systematic improvement, employee engagement—those concepts work regardless of your setup, climate, or regulatory environment.

Current market realities that change everything

With HPAI now affecting 973 dairy herds with $1.2 billion in industry losses since March 2024, biosecurity and operational efficiency have become critical survival skills. You simply can’t afford inefficiencies when you’re dealing with disease pressure that can shut down your operation overnight.

Current production trends are telling too. Recent USDA data shows milk production per cow averaged 2,110 pounds in May 2025, maintaining steady levels, but component levels have been trending upward—and that’s where real money gets made. This is something you can directly influence through systematic parlor management and cow comfort improvements.

What strikes me most about the current market environment is how the operations that are thriving aren’t just managing costs—they’re systematically optimizing every process to extract maximum value from every cow, every milking. The profit spread between top and bottom performers keeps widening, and a significant portion of that gap comes down to how methodically they approach parlor efficiency.

The broader economic picture makes this even more compelling. Recent Federal Reserve economic projections suggest continued pressure on agricultural lending rates, making capital equipment purchases increasingly expensive to finance. This environment strongly favors optimization of existing infrastructure over new equipment purchases.

Bottom line: Your roadmap to more profitable milkings

If you’re running a 500-cow operation, the difference between average and optimal parlor performance could easily represent $25,000 to $50,000 annually. That’s not theoretical projections—that’s based on patterns I see consistently across operations, and frankly, it’s probably conservative for farms that really commit to systematic improvement.

But let’s be realistic about the challenges. Current extension research suggests that about 35% of farms don’t see meaningful results in the first 90 days—usually because they’re not systematic enough or they try to change too much at once.

Start here: Pick one metric to track consistently—two-minute milk percentages give you the biggest bang for your measurement effort because they connect directly to cow comfort, prep quality, and production efficiency. This single metric will tell you more about your operation than most producers realize.

Within 30 days: Establish baseline performance for your key metrics without trying to fix anything yet. Just understand where you stand. Track parlor turns per hour, prep consistency, and basic cow flow patterns. You’ll be surprised what you discover when you start paying attention to the details.

By 60 days: Implement one small change based on your data. Maybe it’s adjusting prep timing, improving cow flow, or addressing a specific equipment issue that keeps showing up. Make the change, stick with it for at least two weeks, then measure results. This systematic approach prevents you from chasing problems that don’t actually exist.

By 90 days: Add focused employee training around the metrics you’re tracking. Make the data visible—post it where everyone can see daily results. Create some friendly competition between shifts. When people can see their performance numbers, they naturally want to improve them.

Long-term thinking: Build a culture where data drives decisions instead of gut feelings or “that’s how we’ve always done it.” This is where sustainable gains happen, and it’s what separates operations that thrive from those that just survive market volatility.

Risk mitigation: If you’re not seeing results after 60 days, don’t abandon the approach—reassess your implementation. Are you tracking the right metrics? Is your team actually following new protocols? Are you giving changes enough time to show results? Research shows that successful implementations typically require 90-120 days to show meaningful improvements.

The technology exists. The research is solid. The economics work—especially in today’s tight-margin environment. What matters now is systematic implementation that’s consistent, data-driven, and realistic about both opportunities and limitations.

Here’s what really gets me excited though: the operations that figure this out first are going to have significant competitive advantages, and honestly, that window is closing faster than most people realize. The question isn’t whether you should be optimizing parlor efficiency… it’s whether you can afford not to.

What’s holding you back?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlock Hidden Dairy Profits Through Lifetime Efficiency – How Modern Genetics and Strategic Nutrition Can Cut Feed Costs by $251 Per Cow – Reveals practical strategies for implementing seasonal efficiency programs that complement parlor optimization, demonstrating how genetic selection and precision nutrition deliver measurable ROI within 18-30 months across different farm sizes.

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – Explores strategic market positioning opportunities created by global production shifts, helping producers understand how regional advantages and evolving demand patterns impact long-term profitability and competitive positioning decisions.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Demonstrates how smart sensors, robotic systems, and AI analytics integrate with parlor efficiency strategies to slash mortality 40% and boost yields 20%, providing the complete technology roadmap for modern dairy operations.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!