40% of U.S. cheese exports face an immediate threat as Argentina drops 9% dairy tax—while your industry leaders stay silent

EXECUTIVE SUMMARY: Here’s what we discovered: Argentina suspended all agricultural export taxes on September 22nd—a move that instantly makes their dairy products $200-300 per metric ton cheaper than ours in global markets. With Mexico accounting for 40% of U.S. cheese exports (approximately $2-3 billion annually), this “temporary” policy, in effect through October 31st, threatens to crater milk prices by 20% or more. The silence from National Milk, IDFA, and major co-ops isn’t a coincidence—many of these same companies operate profitable facilities in Argentina and Brazil. Historical patterns show that Argentina’s “temporary” measures have a nasty habit of becoming permanent (remember Macri’s 2015 tax elimination, which was reversed in 2018?). The domino effect could be catastrophic: Turkey’s 60% inflation and Brazil’s 20% currency slide make them prime candidates to copy Argentina’s playbook. Suppose you’re shipping to processors with significant exposure to Mexico. In that case, you have exactly 36 days to lock in price protection before this market manipulation, disguised as policy reform, decimates your milk check.

So I’m sitting here at 5 AM—couldn’t sleep, actually—scrolling through the news, and there it is. Argentina suspended their agricultural export taxes. September 22nd. Just… gone. And nobody’s talking about it.

Look, maybe I’m overreacting. My wife says I do that. But I’ve been covering dairy for twenty-something years, and this feels… different. Really different.

You know how sometimes you get that feeling in your gut? Like when you see a fresh cow not eating and you just know something’s off? That’s what this feels like.

The Thing Nobody at Your Co-op Meeting Will Tell You

Alright, so here’s what I’ve been able to piece together…

Argentina’s been taxing agricultural exports for years, right? Different products, different rates. The reports coming out say they were hitting soybeans pretty hard—maybe around 30 percent—and dairy products were also being taxed. I’ve seen numbers anywhere from 8 to 10 percent on dairy, depending on who you ask.

Now they’re saying it’s temporary. Through October 31st, supposedly. Or until they hit some big export revenue target—I’ve heard $7 billion thrown around, but honestly, who knows if that’s accurate.

Temporary. Right.

You know what else was supposed to be temporary? Remember when Macri took over down there… what, 2015? Eliminated export taxes completely. Said it was the new way forward. Permanent change. All that.

Three years later? Boom. “Emergency measures.” Taxes are back.

I’ve been watching this long enough to know—Argentina’s “temporary” has a funny way of becoming permanent. And their “permanent”? That disappears faster than free donuts at a co-op meeting.

Mexico’s Buying HOW Much of Our Cheese?

So I’m at the feed store last week—you know, the one by the old John Deere place in Dodge County—and this trucker’s there. Does the Mexico run for one of the big outfits.

He goes, “You know how much cheese is going south?”

And yeah, I knew it was a lot, but when you actually look at the numbers… Jesus. According to recent trade reports, approximately 40% of all U.S. cheese exports are destined for Mexico. That’s… what, $2-3 billion worth? Wisconsin alone is shipping tens of millions. California? Even more. Texas? Don’t even get me started—those processors down there are basically running on Mexico business.

But here’s the kicker—and this is what nobody’s talking about—Argentina already ships a ton of dairy to Brazil. They’ve got the infrastructure. The relationships. Brazilian companies have been dealing with Mexican importers for decades.

All Argentina needed was a price advantage.

And dropping export taxes? Well… do the math. If they were taxing dairy at 9% and that’s now gone, their products just became that much cheaper overnight. We’re talking maybe $200-300 per metric ton advantage. Maybe more.

You can’t compete with that. Nobody can.

Actually, I was just talking to this producer near Fond du Lac last week—milks about 800 head and has been in the business for forty years—and he says his processor already warned him that Mexico contracts might be “under review” come November. Under review. You know what that means.

Your Co-op Board’s Interesting Side Investments

Now… I’m going to be cautious here due to legal considerations, but…

Have you ever looked at who owns what in the South American dairy industry? I mean, really look?

Some of the same companies buying your milk here have operations down there. Big operations. I’m talking major ownership stakes in Argentine processors, Brazilian plants, the whole nine yards.

I’m not saying it’s a conspiracy. But when something this big happens and National Milk doesn’t say a word? IDFA’s silent? Your co-op board’s acting like nothing’s happening?

Makes you wonder, doesn’t it?

Actually, I ran into… well, let’s just say a former industry bigwig at a conference last week. The guy who used to be pretty high up. Even he looked worried. And this guy’s seen everything.

He says, “this is different. This isn’t market volatility. This is market manipulation.”

It Gets Worse (Because Of Course It Does)

So I’m talking to this analyst—a smart guy who covers global markets—and he starts laying out what happens next.

Turkey’s watching Argentina. Their currency’s trash, inflation’s through the roof—I’ve heard anywhere from 40 to 60 percent, depending on who’s counting. They export billions in ag products to Europe. If Argentina gets away with this, Turkey will likely follow suit, and the same could happen in Brazil. Their currency’s been sliding all year. Down maybe 20% against the dollar. And Brazil controls… what, a fifth of global soybean exports? Something like that. Huge chunk, anyway.

Once they see Argentina getting away with it…

It’s like dominoes. Remember back in ’09 when one bank started dumping assets and suddenly everybody had to? Same thing, but with countries using agriculture to prop up their currencies.

Actually, wait. This is even scarier than I thought. Because once this starts, how do you stop it? Every country with a weak currency and agricultural exports is gonna look at this playbook and think, “Why not us?”

I was at a meeting in Madison last month—Wisconsin Dairy Business Association thing—and this economist from UW was saying something that stuck with me. She said, “The next trade war won’t be about tariffs. It’ll be about currency manipulation through agricultural policy.”

Guess she was right.

The Cavalry Ain’t Coming

Called the USDA yesterday. You know what they said? “We’re monitoring the situation.”

Monitoring.

That’s like telling a guy with a twisted stomach cow that you’re “observing the discomfort.” Great. Super helpful.

Look, theoretically, somebody should file a trade complaint. WTO, USMCA, whatever. But come on. By the time they get around to doing something, we’ll all be out of business. Or dead.

The market will sort this out long before Washington does. And by “sort out,” I mean we’re gonna take it in the shorts while everybody else figures out the new rules.

What You Can Actually Do (Besides Panic)

Alright, practical stuff. Because sitting around complaining doesn’t pay bills, even though it feels good.

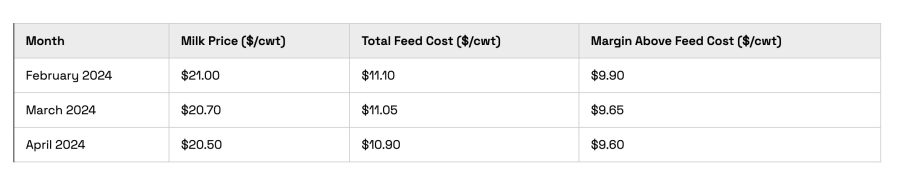

That Dairy Revenue Protection everybody’s always talking about? Figure it out. Now. According to the latest RMA updates, the subsidized rates aren’t terrible—maybe $0.25 per hundredweight for decent coverage. That’s cheap insurance if this thing goes sideways.

Class III futures are still holding above $17.50, as of my last check yesterday. Won’t stay there long if this Argentina thing spreads. Lock something in.

Feed? Corn’s under $4.00 a bushel. Soybean meal’s… what, $280-290 a ton? Not great, not terrible. If you secure a six-month commitment, it.

Oh, and here’s something—you breeding any beef crosses? A guy I know in South Dakota; his dairy-beef calves are generating a significant amount of money. $800-1,000 each. With beef prices where they are… I mean, the math works.

Actually, I was at a sale barn down in Iowa last week—don’t ask why, long story—and these dairy-beef crosses sold for more than registered Holsteins. I’ve never seen that before.

The Part That Really Pisses Me Off

We did everything right, you know?

Got more efficient. Improved genetics. Built these massive freestalls. According to recent productivity data, the average production per cow is now… what, pushing 24,000 pounds? My grandfather would’ve called bullshit on that number.

Hell, I was at a place in California last month—they’re getting 30,000 pounds. Per cow! That’s not farming, that’s… I don’t even know what that is.

And for what? So we can be undercut by a country using agriculture as a means to bail out its peso?

This isn’t a competition. It’s desperation. And we’re the ones who’re gonna pay for it.

October 31st (Yeah, Right)

Argentina says this is temporary. Until October 31st.

And I’m gonna be the next American Idol.

Look at their track record. Every “temporary” measure from the last twenty years? Still there in some form. Or it lasted way longer than promised. Or they brought it back under a different name.

They’re saying they need to generate around $170-180 million per day in agricultural exports to meet their targets. Per day! That’s… come on. That’s fantasy numbers.

I’ll bet you my best heifer they extend this “temporary” measure. Probably call it something else. “Extended temporary emergency provisional measure” or some BS like that.

Maybe I’m wrong. God knows I’ve been wrong before. Remember when I said nobody would pay six figures for a cow? Yeah, that aged well…

But this feels different. The silence from our industry groups. The positioning of the big processors. Nobody wants to talk about it.

That tells you everything, doesn’t it?

The Bottom Line Nobody Wants to Hear

Had drinks with this banker last night—finances a bunch of operations around here. He asks me, “How bad is this, really?”

And I told him straight: If Argentina gets away with this, if they can use agricultural exports to bail out their currency without anybody stopping them… every broke country on earth just got handed the blueprint.

And guess who pays for it?

Not the politicians. Not the multinational processors with operations everywhere. Not the futures traders who’ll make money either way.

Us. The actual farmers.

Look, more details will come out over the next week or two. But don’t wait for some official report to tell you what to do. By then, it’s too late.

The thing is—and this is what keeps me up at night—our whole system assumes everybody plays by the same rules. You compete on quality, efficiency, and genetics. Not on whose government is most desperate for dollars.

But if that’s changing…

Christ. I need more coffee. Or maybe something stronger. It’s 5 AM somewhere, right?

Anyway, pay attention to this Argentina thing. Don’t let it sneak up on you like… well, like everything else seems to these days. October 31st is coming fast. And something tells me November 1st is going to look really different from October 30th.

Actually, hang on—before I forget. If you’re shipping to a plant that does a lot of business in Mexico, have that conversation now. Today. Not next week. Ask them point-blank: “What happens to us if Mexico starts buying from Argentina?”

They know the answer. They just don’t want to tell you.

You know what really strikes me about all this? We spent the last decade getting told to “think globally.” Well, here’s global for you—countries weaponizing their agricultural exports to prop up failing currencies. What did they mean by ‘global markets’?

Trust me on that one.

KEY TAKEAWAYS

- Lock in Q4 pricing NOW: Class III futures still holding above $17.50—that won’t last once Mexico starts buying Argentine cheese at 9% discount. DRP coverage at $0.25/cwt is cheap insurance against the 20% price crater we’re facing

- Diversify before it’s too late: Dairy-beef crosses bringing $800-1,000/head while registered Holsteins struggle—that’s immediate cash flow when your Mexico contracts evaporate. Smart producers are breeding 30% of their herd to beef bulls

- Ask your processor point-blank TODAY: “What’s our exposure if Mexico switches to Argentine suppliers?” They already know the answer—Wisconsin producers near Fond du Lac report processors admitting contracts are “under review” for November

- Lock in feed costs for a minimum of 6 months: Corn under $4.00/bushel and soybean meal at $280/ton won’t hold if currency manipulation spreads to Brazil (21% of global soy exports). The smart money’s contracting now, while everyone else “monitors the situation”

- Build cash reserves like it’s 2008: Argentina needs $170-180 million daily in ag exports to hit their targets—fantasy numbers that guarantee this “temporary” measure gets extended. Operations with 6 months of operating capital survived ’09; those without didn’t

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- USDA Data Reveals Dairy’s New Math: More Milk, Fewer Heifers, Smarter Strategies – This article provides a tactical playbook for navigating market volatility. It reveals producer-tested strategies to boost herd productivity through genomic testing and precision nutrition, and it shows you how to optimize cash flow with smarter heat stress management.

- Global Dairy Trade Index Slides 1.0% as Market Bifurcation Exposes Industry’s New Reality – This article offers a strategic analysis of global market trends, explaining why the U.S. dairy industry is decoupling from the Global Dairy Trade index. It demonstrates how producers can leverage component-based premiums (butterfat and protein) to earn more, even when commodity prices are weak.

- When the Labor Well Runs Dry: How Smart Dairies Are Turning Crisis into Competitive Edge – This article provides an innovative look at technology adoption on dairy farms. It offers a practical framework for selecting and implementing technologies—from robotic milkers to precision feeders—to reduce labor costs and build an operation that’s more resilient to both market and workforce challenges.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!