Four breeders made four impossible bets. Every Holstein alive today is the payoff. Here’s what they knew that we forgot.

In 1926, a 69-year-old insurance executive did something that made the entire Holstein world think he’d lost his mind.

T.B. Macaulay—president of Sun Life Assurance, a man who’d spent his career calculating risk down to the decimal point—wrote a check for $15,000 for a single bull. According to the Bank of Canada’s inflation calculations, that’s roughly $260,000 in today’s dollars. For one animal. In a post-WWI economy where farmers were still digging out from the crash.

The old-timers called it insanity. The industry press questioned his judgment.

And here’s the thing—virtually every registered Holstein walking the planet today carries that bull’s blood. That’s not hyperbole. Holstein Canada pedigree records confirm that Johanna Rag Apple Pabst appears in the ancestry of essentially every animal in the modern registered population.

Which got me thinking: where did all this actually come from? We spend so much time staring at genomic indexes and GTPI rankings—debating inbreeding levels and trait selection—that we forget every number on that screen traces back to flesh-and-blood decisions. Made by breeders who couldn’t run a computer simulation to save their lives. They had paper records, sharp eyes, and guts.

So let’s talk about the ones who shaped everything. Four distinct philosophies, five legendary figures—because sometimes the right partnership counts double.

The Actuary Who Outbred Everyone: T.B. Macaulay

Here’s what made Macaulay different from every other breeder of his era: he didn’t grow up in cattle. No family farm, no inherited wisdom about which bloodlines “nick” well together. According to Sun Life corporate histories, he built one of Canada’s largest insurance companies through rigorous statistical analysis. He came from actuarial science—probability tables and risk calculation.

That turned out to be his superpower.

Picture Mount Victoria Farm in the 1920s. The buildings were functional, the land unremarkable—historical accounts describe it as a sandy plot in Quebec that nobody expected much from. The magic was all in the records. While neighboring operations made breeding decisions based on “well, his grandsire threw nice calves,” Macaulay’s office walls were covered in charts. Milk weights. Butterfat percentages. Daughter comparisons across lactations. They say he’d review those records the way other men read the morning paper—coffee in hand, pencil making notes in the margins.

He was doing progeny testing—evaluating bulls by their daughters’ actual performance rather than the bull’s own appearance—decades before the Holstein Association formalized the practice in the 1930s.

The man treated genetic improvement like a math problem. And he was solving for a specific value: 4% butterfat.

This might seem obvious today. With GLP-1 weight-loss drugs now shifting consumer demand toward protein—something the University of Wisconsin dairy economists have been tracking closely—and component pricing dominating most milk checks, we’re all thinking about what’s in the milk, not just how much of it there is. But in Macaulay’s time? Everyone chased volume. More milk, more milk, more milk. He looked at the numbers and saw where the industry was heading before the industry knew it.

His methods? Aggressive. Linebreeding. Calculated inbreeding. The kind of tight matings that would make some modern breeders nervous—though honestly, with average inbreeding coefficients now exceeding 9% according to CDCB data, maybe we should be having that conversation more openly. But Macaulay understood something crucial: if you want to fix a trait, you concentrate on genetics. You can’t be timid.

Which brings us back to that $15,000 bull—Johanna Rag Apple Pabst, “Old Joe.”

The critics had a field day. Fifteen thousand dollars! In 1926! But Macaulay had done his homework. He’d traced the butterfat genetics through the pedigree, analyzed Joe’s dam and grandam records, and calculated the probability that this bull would sire daughters that hit his 4% target.

He was right. Holstein Canada production records from the era show Old Joe’s daughters consistently met that benchmark. And his genetic influence spread so far that—I’m not exaggerating—it’s essentially impossible to find a registered Holstein today that doesn’t trace back to him.

Think about that next time you’re scrolling through bull proofs.

Discover the legacy of Mount Victoria Farms, where one man’s vision revolutionized Holstein breeding. From unlikely beginnings to global influence: The Vision of Mount Victoria: T.B. Macaulay’s Holstein Legacy

The Empire Builder: Stephen Roman

Two men. Opposite approaches. Roman bought everything. Ormiston bought one cow for $750. Both changed the breed forever—just in completely different ways.

Stephen Roman’s story is pure immigrant ambition. According to Canadian business histories, he arrived from Slovakia with basically nothing, worked the assembly line at General Motors, and somehow—through uranium mining at Denison Mines—became a billionaire by the 1960s. When he turned to Holsteins, he didn’t want to breed good cattle. He wanted to build an empire.

Romandale Farms became exactly that. But Roman was smart enough to know his limitations. He had the capital to buy the best cattle in North America. But he needed someone who could see cattle the way the great ones did. So he hired Dave Houck as herd superintendent—a man people in Ontario breeding circles described as having an almost spiritual connection to Holsteins. An old-timer once told me that watching Houck evaluate a heifer was like watching a sculptor see the statue inside the marble.

Money plus cow sense. That combination is almost unbeatable.

Roman’s real genius was understanding that the show ring wasn’t about ribbons. It was marketing. Every Supreme Champion, every Royal Winter Fair banner—that was brand building. “Through the show ring,” he said, according to accounts from breeders who worked with him, “lay the path to the Holstein mountain-top.”

And his sale tactics? Still copied today. He’d sell elite females in pairs on “choice”—the highest bidder picked one, Romandale kept the other. Record prices and retained genetics. The man understood both sides of the sale ring.

The crown jewel was Romandale Reflection Marquis. “The white male monster,” people called him—not affection, exactly. More like grudging respect mixed with a little fear. In 1964, Marquis topped the Romandale sale at $37,000 to Curtiss Breeding Service—a price documented in Holstein sale records from that era. I heard someone describe watching him enter that sale ring—said you could feel the air change in the building. Everyone knew they were seeing something.

What does Roman teach us now? Look around at successful embryo programs, operations with strong social media presence, and breeders who understand that perception drives demand. Great genetics need great marketing. That hasn’t changed.

Read more about how a Slovakian immigrant’s millions and a young breeder’s eye for cattle transformed the dairy world forever: THE ROMANDALE REVOLUTION: How a Uranium Billionaire & Cow Sense Conquered the Holstein World

The Cow Family Purist: Roy Ormiston

They called him “The Holstein Man’s Holstein Man,” and if you spent time around Ontario dairy circles mid-century, you understood why. According to Holstein Canada records, Ormiston had served as a fieldman for the association—walked through hundreds of herds, handled thousands of cattle, developed the kind of eye that can’t be taught. Only earned.

His philosophy was almost Zen-like.

“I like to compare a dairy cow to a building,” he explained in interviews preserved by breed historians. “If you don’t have a very good foundation, then it isn’t going to stand up too long.”

One foundation. One cow. Build everything from her.

In 1956, he found her.

Balsam Brae Pluto Sovereign wasn’t flashy. Wasn’t the cow everyone talked about. At $750, according to sale records, she was priced like an afterthought. But Ormiston saw something others missed—some combination of structure, constitution, and… something else. Call it transmitting ability. Call it prepotency. Whatever it was, The White Cow had it.

Here’s the moment that changed everything. Ormiston bred her to different bulls over several calvings, watching daughters develop. And something became clear.

“It was then I realized,” he said, “that no matter what she was bred to, The White Cow would always produce a good daughter. That’s when I knew I could line breed on her.”

If she threw excellence regardless of the sire, he could concentrate her genetics without fear. That insight was the Roybrook program. He didn’t chase outside genetics. He built on what he had.

The result? Telstar, Starlite, and Tempo—three bulls whose influence is documented in Holstein pedigree databases worldwide. Telstar’s impact in Japan was so profound that Japanese breeders erected a life-size bronze statue in his honor. A statue. For a Canadian bull. It still stands today as a testament to how far one cow family’s influence can reach.

What does Ormiston teach us in the genomic age? Something counterintuitive, maybe. We’ve got more sire diversity than ever. Can sort embryos by sex, screen for dozens of recessives, and select for indexes that didn’t exist five years ago. But Ormiston’s lesson wasn’t about tools. It was conviction. Find the cow family that works. Have patience to build on it. Stick with what works, and it keeps working.

Some of the most successful programs I see today do exactly that. Not chasing every new sire topping the rankings. Developing maternal lines, generation after generation.

Read more about Roy’s legacy: Roy Ormiston: The Holstein Man’s Holstein Man Who Revolutionized Modern Breeding

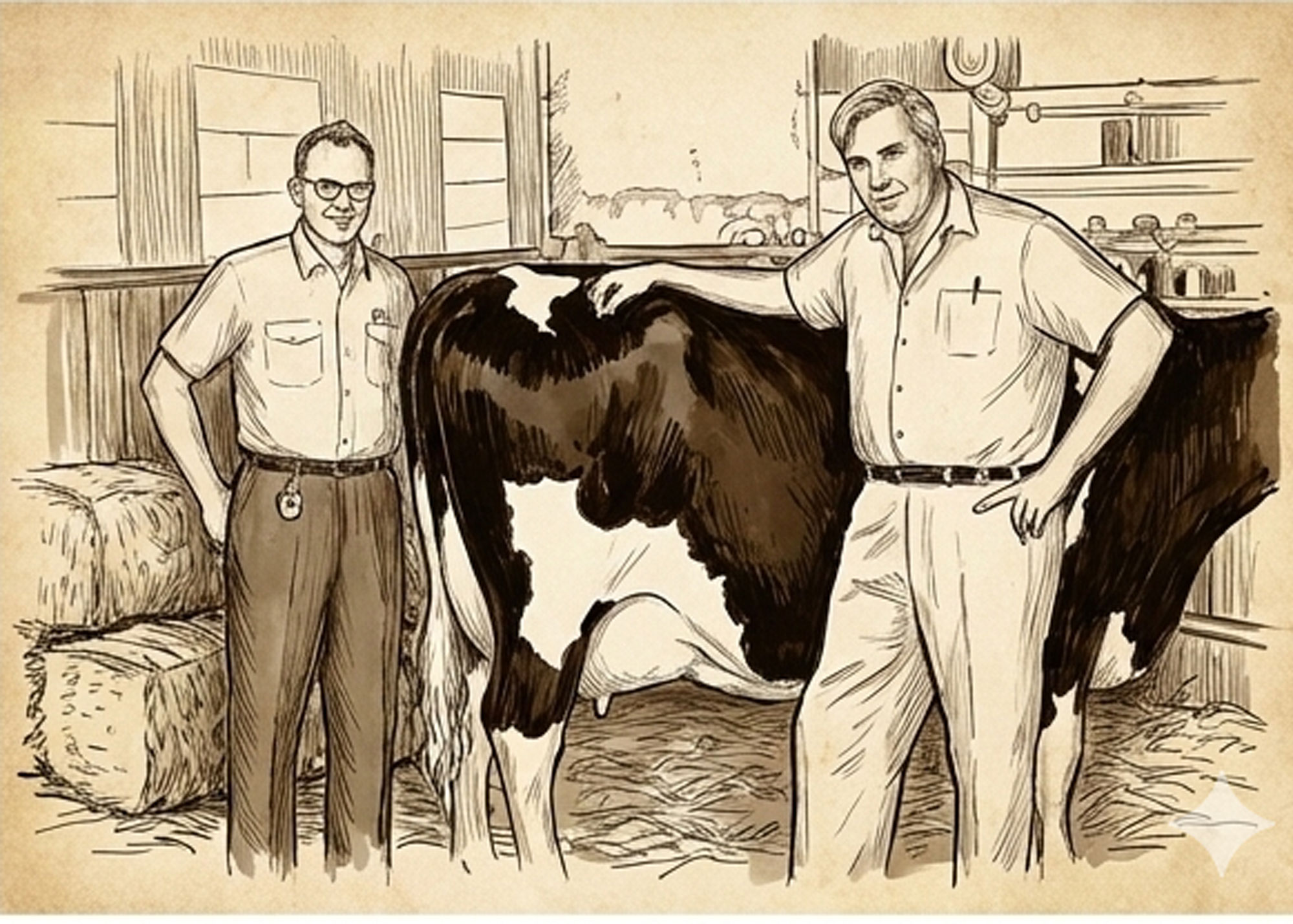

The Partnership That Multiplied Everything: Hanover Hill Holsteins

Our final visionaries proved something the others couldn’t—that the right partnership doesn’t just add skills. It multiplies them.

In the spring of 1973, Peter Heffering and Ken Trevena moved from New York to a 300-acre farm in Port Perry, Ontario. They’d already built reputations south of the border. But Hanover Hill—the operation they created together—would reshape the entire industry.

“We didn’t set out to create a dynasty,” Heffering once said. “Our aim was simple: breed the best Holsteins in the world.”

What made them different was how they divided the work. Trevena was in the barn at 1:00 AM for the first milking, evaluating movement and watching how the heifers carried themselves. By the time Heffering arrived with the day’s marketing strategy, Trevena already knew which animals were ready for their next photo shoot. They’d meet over coffee, decisions would get made, and neither man held the other back. I’ve seen plenty of partnerships collapse over the years. This one just… worked.

But here’s what really set them apart: they rejected the numbers game.

By the early 1970s, American geneticists were pushing hard toward index-based evaluation—production numbers above all else. Heffering called it out publicly. He argued the indexes ignored what actually keeps a herd profitable: cow families, type, and longevity. Sound familiar? The tension between index-chasing and holistic evaluation hasn’t gone away—it’s just moved to genomic proofs. Same argument, different decade.

Their timing was impeccable. And their marketing? Relentless. They showed cattle everywhere, racking up 140 All-American and 87 All-Canadian nominations. From 1983 to 1988, they were Premier Breeders at both the Royal Winter Fair and World Dairy Expo. Their 1972 dispersal—before the Canada move—saw 286 head cross the auction block, averaging over $4,000 each. Numbers unheard of at the time.

But the crowning achievement came in 1985. Picture the scene: twenty-five hundred people packed around the sale ring. When bidding on Brookview Tony Charity crossed a million dollars, the crowd went silent. Then Stephen Roman’s hand went up one more time. $1,450,000. Two Holstein legends—Roman the empire builder, Hanover Hill the partnership that rewrote the rules—converging in a single moment.

The real legacy, though? Starbuck.

Hanoverhill Starbuck might be the most influential Holstein sire in modern history. A son of Round Oak Rag Apple Elevation out of Anacres Astronaut Ivanhoe, he combined the production Heffering and Trevena demanded with the type and cow family depth they’d staked their reputation on. His daughters milked. They lasted. They bred on. They produced nine Class Extra sires in total—a concentration of top-tier bloodlines that no other single operation has matched.

For the complete Hanover Hill story, including their legendary cow families and the full list of influential bulls, see our detailed profile.

What These Legends Teach Us Now

So here we are, late 2025. Genomics have transformed selection. Sexed semen is standard. We’ve got precision feeding, robotic milking, and indexes our grandparents couldn’t have imagined. The debates continue—just swap “progeny testing” for “genomics” and “linebreeding” for “inbreeding depression,” and we’re having the same arguments these breeders had decades ago.

The tools are different. The philosophies haven’t changed.

Macaulay teaches us that data—rigorously collected, honestly analyzed—beats intuition. More true than ever. If you’re not using herd management software to drive breeding decisions, you’re leaving money on the table.

Roman teaches us that great genetics need great marketing. In an age of Instagram breeders and embryo auctions livestreamed to three continents, that lesson hits harder than ever.

Ormiston teaches patience and conviction. Find your cow family. Build on it. Don’t get distracted by every shiny new thing topping the proof run.

And Heffering and Trevena? They teach us that the right partnership multiplies everything—and that rejecting index-only thinking in favor of holistic breeding isn’t stubbornness. It’s a strategy. Something worth considering as operations navigate succession and the next generation steps up to take the reins.

Four philosophies. Five legends. All still valid.

Next time you see a sire topping the rankings, ask yourself: which of these philosophies got him there? And which one guides your operation? Or—maybe this is the real answer—which combination are you building?

Because the producers I see succeeding right now pull from all of them. Data-driven decisions. Marketing awareness. Commitment to maternal lines. Strategic partnerships. Willingness to reject conventional wisdom when it doesn’t serve the cow.

The legends left us the playbook. We just have to read it.

Which breeding philosophy resonates most with your operation? Drop a comment below or find us on social media—these conversations are how we all get better.

Key Takeaways:

- Data beats intuition: Macaulay paid $15,000 for one bull when everyone called him crazy. His daughters hit 4% butterfat. His genetics run through every Holstein alive. Trust the numbers.

- Genetics without marketing is wasted potential: Roman treated the show ring as advertising, not trophies. Today, that’s Instagram, livestreamed embryo sales, and understanding that perception drives price.

- One cow family. Total commitment: Ormiston bought a $750 cow nobody wanted and built a dynasty that earned a bronze statue in Japan. Find your foundation. Stop chasing.

- Partnerships multiply—when you divide right: Trevena worked the 1 AM milkings. Heffering ran the strategy. Neither held the other back. Hanover Hill dominated two continents for a decade.

- Same four choices. Different tools: Data, marketing, conviction, and collaboration. The philosophies that built the breed are the philosophies that’ll carry your operation forward. Which combination are you building?

Executive Summary:

Every registered Holstein alive today carries genetics shaped by four breeders who ignored what everyone else believed. T.B. Macaulay paid $15,000 for one bull in 1926—critics called it insanity, but his data-driven gamble now flows through your entire herd. Stephen Roman built Romandale into an empire by treating the show ring as marketing, not trophies. Roy Ormiston turned a single $750 cow into bloodlines that earned a bronze statue in Japan. Heffering and Trevena rejected index-only thinking and proved that the right partnership multiplies everything. Four philosophies—data, marketing, conviction, collaboration—all still shaping who succeeds. The only question: which combination are you building?

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!