Taiwan imports $600M+ dairy annually but requires 100K pounds monthly—shutting out 85% of U.S. farms

EXECUTIVE SUMMARY: What farmers are discovering about the Taiwan dairy memorandum of understanding is that access requires scale, which most operations simply don’t have—a minimum of 100,000 pounds monthly is required just to qualify for export programs. USDA data confirms that Taiwan imports over $600 million in dairy products annually, with domestic production covering less than a third of its needs. However, there’s a catch: New Zealand already dominates with tariff-free access, while U.S. dairy faces 15-20% duties plus three weeks longer shipping times. For the 2,000-head operations that can absorb certification costs and manage 60-90 day payment terms, Taiwan represents a genuine opportunity and a gateway to Southeast Asia’s rapidly expanding markets. Yet for mid-size dairies—the backbone of many rural communities—the economics suggest focusing on regional institutional buyers, value-added production, or collaborative export ventures might deliver better returns without the complexity. The most successful path forward depends on honestly matching your operation’s capabilities to market requirements, not chasing opportunities designed for different scales. Your cooperative needs to hear from members about developing tiered programs that recognize these realities—because the future of rural dairy depends on strategies that work for more than just the most significant operations.

You know, when USDEC and NMPF announced their memorandum of understanding with Taiwan’s Dairy Association, it really got people talking. Now, let me clarify something upfront—an MOU isn’t a binding trade agreement. It’s essentially a framework for cooperation, a statement of intent to work together on market development. Unlike a formal trade deal that might reduce tariffs or guarantee market access, this MOU signals that both sides want to explore opportunities. Think of it as laying groundwork rather than breaking ground.

There’s good reason to pay attention—USDA Foreign Agricultural Service data show that Taiwan imports over $600 million in dairy products annually, with its domestic production covering less than a third of its needs. That’s a substantial opportunity by any measure.

However, what’s interesting as we delve deeper into the requirements and market dynamics is that this opportunity unfolds very differently depending on your operation’s capabilities. Let me share what the data’s revealing.

Understanding Taiwan’s Market Position

Taiwan’s dairy market has been steadily expanding, and federal trade reports confirm that they’re importing more than half a billion dollars’ worth of dairy products each year—a figure that continues to trend upward. This builds on broader Asian dietary shifts that we’ve been watching for the past decade, where dairy consumption continues to grow as incomes rise and dietary preferences evolve.

What’s particularly noteworthy is their institutional demand through school milk programs. You probably know this already, but these kinds of programs typically provide stable, predictable volume—something we all value in today’s volatile markets. And Taiwan’s infrastructure? They’ve invested heavily in cold chain capabilities that rival what you’d find in Wisconsin or California.

The strategic piece that’s worth considering… Taiwan’s position potentially makes them a gateway to Southeast Asian markets. FAO statistics show that the region has the fastest-growing dairy consumption globally. So we’re not just talking about one island market here—we’re looking at potential access to something much broader.

TAIWAN EXPORT REQUIREMENTS AT A GLANCE:

- Volume: 100,000+ pounds monthly minimum

- Components: 4.2%+ butterfat, 3.3%+ protein

- Payment: 60-90 day terms standard

- Competition: New Zealand tariff-free access

The Reality of Export Requirements

Now, when you look at what the major cooperatives require for export programs—and DFA, Land O’Lakes, and others have been pretty consistent about this—there are some significant thresholds to meet.

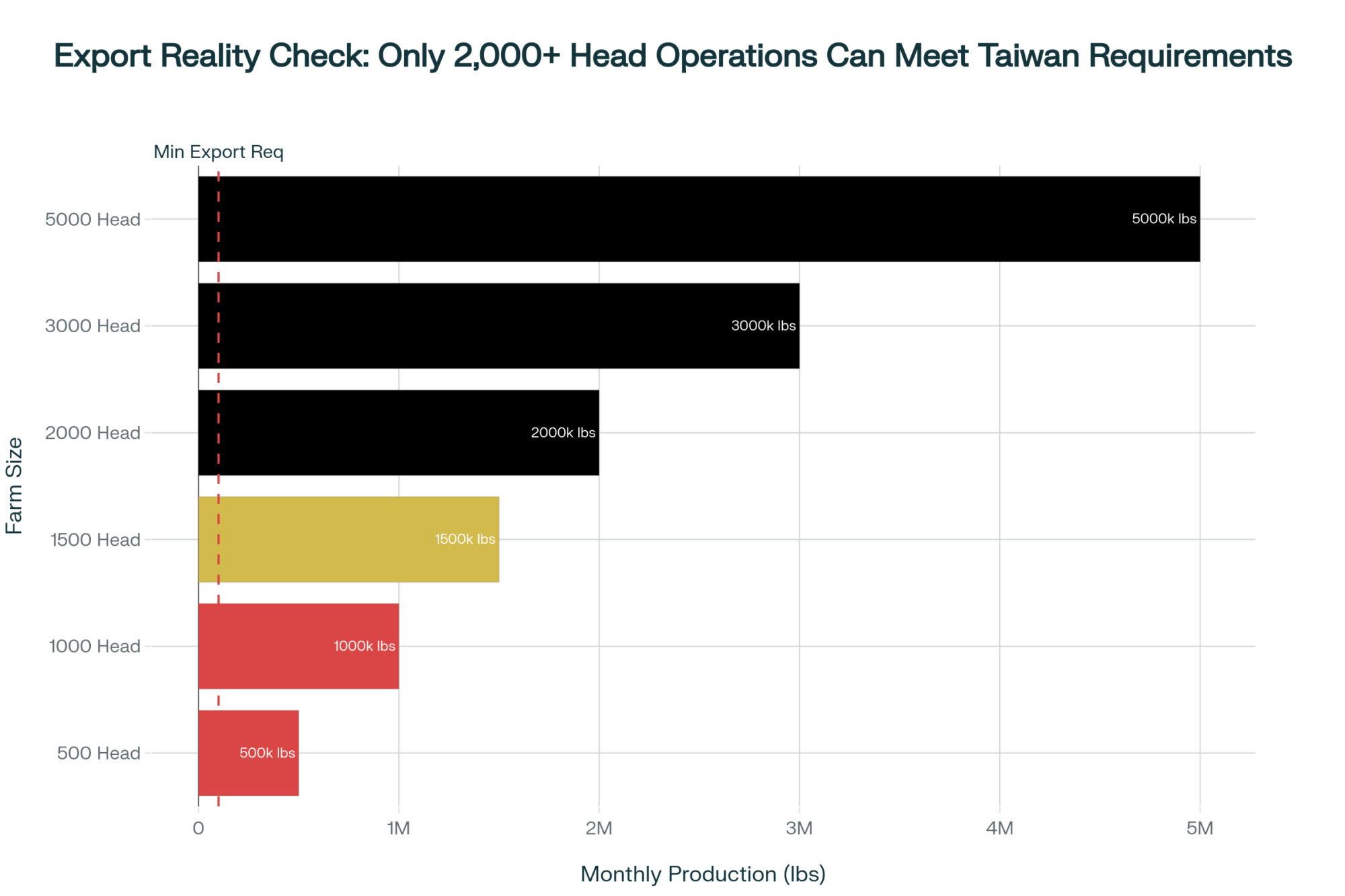

Volume commitments typically begin at a minimum of two truckloads per month. That’s roughly 100,000 pounds, give or take. For perspective, if you’re running 500 head that produce around 12 million pounds annually, you’re generating about one truckload per month. See where this is going?

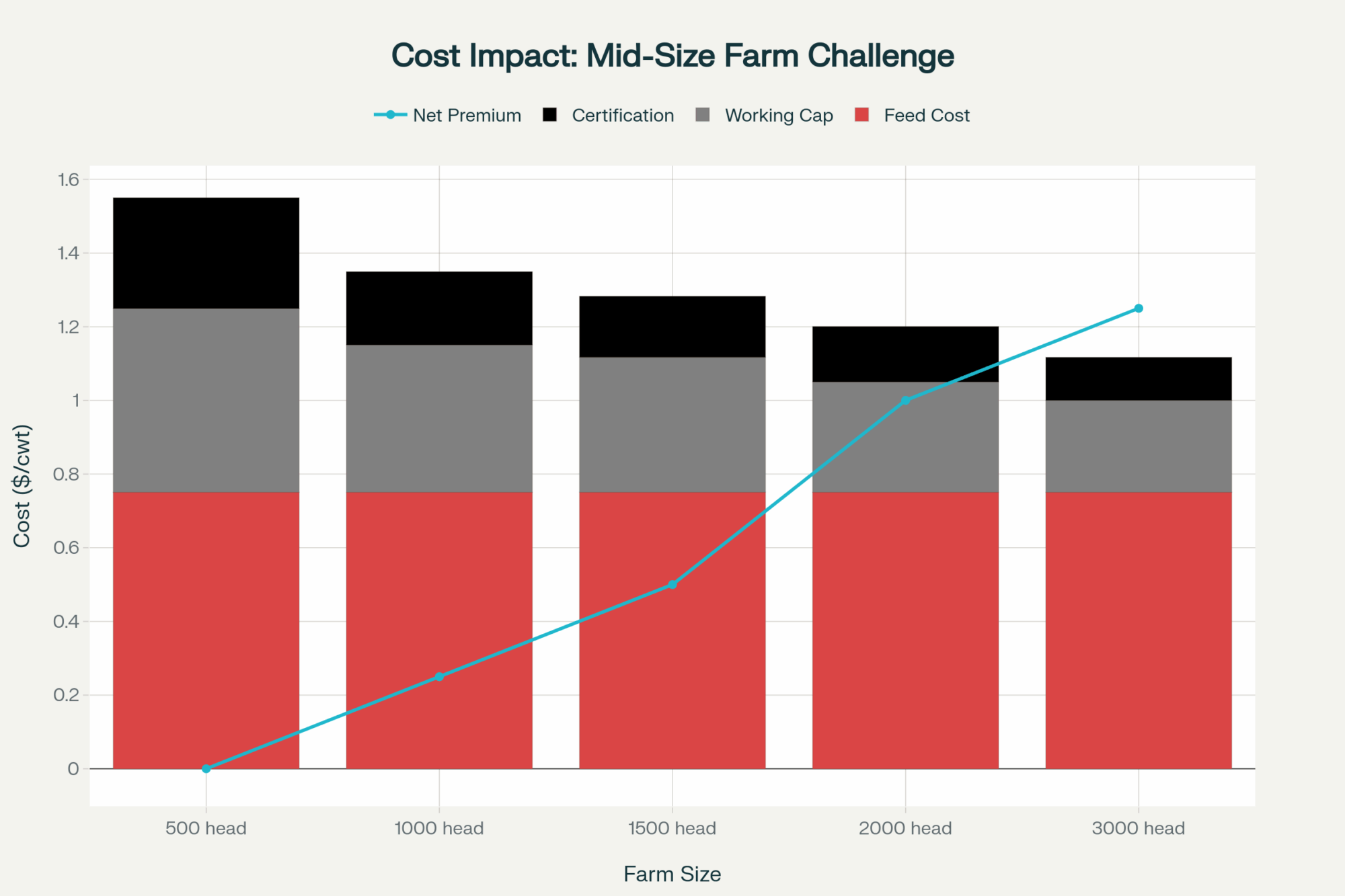

Why does this matter? Fixed costs for export certification, enhanced testing protocols, and documentation systems need to be spread across your total volume. A 2,000-head operation can absorb these costs much more efficiently. Basic math, but the impact on your bottom line is profound.

Then there’s the component specifications. Export buyers consistently want butterfat above 4.2% and protein exceeding 3.3%. Jersey herds naturally tend to hit these levels more easily—that’s just breed characteristics at work. Holstein operations often require significant ration adjustments or long-term genetic selection strategies. And changing your herd’s component profile… that’s not something that happens overnight.

New Zealand’s Built-In Advantages

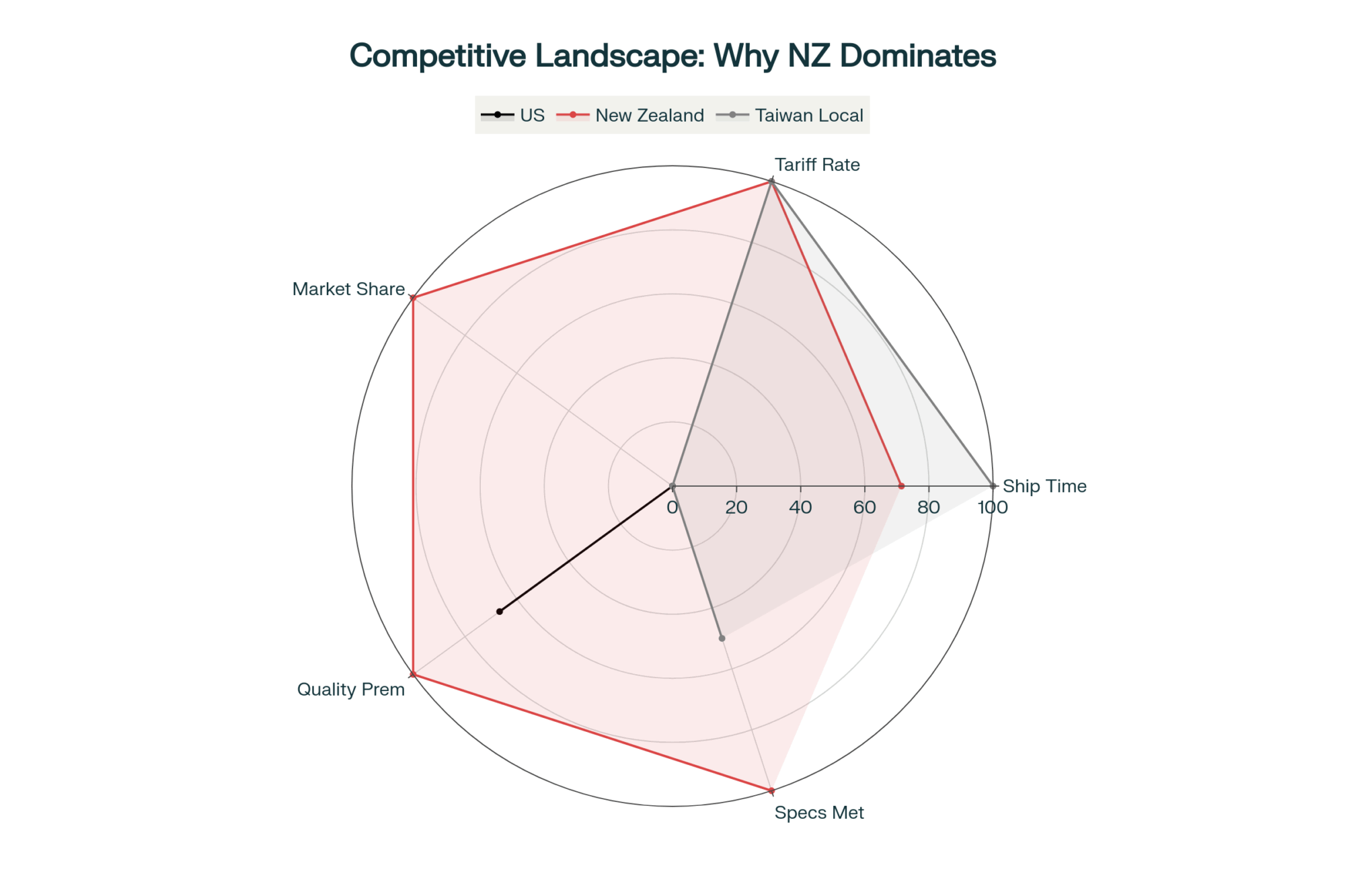

Here’s something that really shifts the competitive landscape: New Zealand achieved complete tariff elimination with Taiwan through their Economic Cooperation Agreement. Meanwhile, we’re still facing duties ranging from 15% to 20%, depending on the item being shipped. That’s documented in Taiwan’s customs schedules and various trade analyses.

Think about what this means practically. New Zealand can deliver to Taiwan in under a week from their ports. From our West Coast? We’re looking at a minimum of three to four weeks. When you combine zero tariffs with shorter shipping times and lower freight costs, their delivered price advantage becomes significant.

Trade data shows New Zealand already captures the largest share of Taiwan’s dairy imports, and with these structural advantages locked in through trade agreements, that position seems secure. Though U.S. dairy often commands quality premiums that can partially offset some disadvantages, particularly for specialized products where our consistency really shines.

Cash Flow and Operational Realities

One aspect that is not discussed enough is the impact of exports on working capital. Domestic milk payments typically arrive in your account within two to three weeks. But export contracts? Industry-standard terms typically run 60 to 90 days, sometimes longer.

For operations already managing tight cash flow—and let’s be honest, that describes many of us these days—that extended payment period creates real challenges. You’re still paying feed bills monthly, covering payroll every two weeks, but waiting two to three months for that milk check. The premium might look good on paper, but cash flow is what keeps the lights on.

Export-qualified milk typically receives priority scheduling for pickup to ensure that quality specifications are maintained. Makes perfect sense from a logistics standpoint, right? But farms not participating in export programs might see their pickup windows shift to less optimal times. Your milk sits in the tank longer, potentially affecting domestic quality premiums. Small things add up.

Community and Consolidation Impacts

What university extension programs have documented—and what many of us are seeing firsthand—is how consolidation patterns affect entire rural economies. Each mid-sized dairy operation supports a whole network of local businesses, including veterinary practices, feed suppliers, equipment dealers, local banks, and schools.

When smaller operations exit and their production is absorbed by larger farms (often located in different areas), the economic activity shifts accordingly. The local vet might lose enough business to cut back hours. The equipment dealer might close their satellite location. School enrollment drops. These ripple effects are real and lasting.

This isn’t an argument against efficiency—we all need to stay competitive. However, it’s worth understanding these broader impacts as we consider how export opportunities might accelerate existing trends.

Alternative Strategies for Premium Capture

Not every premium opportunity requires access to export markets. What’s encouraging is seeing different approaches work across various regions.

Institutional buyers—such as hospitals, schools, and corporate food service operations—have increasingly paid premiums for locally sourced dairy products. These arrangements often involve simpler logistics and much faster payment terms than export programs. When you factor in reduced complexity and faster cash flow, the net return can be comparable or even better.

Value-added production continues to show promise as well. Small-scale processing—whether it’s farmstead cheese, yogurt, or bottled milk—can capture retail premiums that rival export opportunities. Yes, it requires learning new skills and developing marketing channels. But you maintain control over your product and pricing in ways commodity markets never allow.

Producer collaborations are gaining traction, where multiple farms pool resources to meet export volume requirements while sharing certification costs. When economics get divided among several operations, they become more manageable—though it requires significant coordination and trust among participants.

Examining operations in Texas and Idaho, where large-scale dairies already predominate, we’re seeing interesting hybrid approaches. Some are partnering with smaller neighbors to aggregate volume while maintaining individual farm identity for certain premium markets. It’s a model worth watching.

The Cooperative Perspective—And Your Role in It

You know, cooperatives face genuine challenges here. They need to stay competitive in global markets while serving members ranging from 50 to 5,000 cows. Export program development represents one path toward accessing growing markets and potentially improving returns for all members.

Cooperative governance increasingly reflects the perspectives of larger operations. Not through conspiracy—it’s a practical reality. Larger farms typically have more resources to participate in leadership, attend meetings, and serve on committees. That naturally influences how programs get structured and priorities get set.

However, here’s the thing: if you’re not satisfied with how your cooperative is managing export opportunities or any other programs, sitting on the sidelines won’t make a difference. When’s the last time you attended your co-op’s annual meeting? Reviewed the board election slate? Actually read those governance proposals?

The question we should be asking our cooperatives: Can you develop tiered programs that recognize different member capabilities? Some co-ops are already experimenting with this—offering different service levels and cost structures based on volume and participation. If your cooperative isn’t exploring these options, bring it up at the next member meeting. Get it on the board’s agenda. Find other members who share your concerns and present a unified voice.

Your cooperative is only as responsive as its members are engaged. If export programs feel designed for operations three times your size, that’s feedback your board needs to hear—repeatedly and from multiple members.

Making the Right Decision for Your Operation

So, where does all this leave us with the Taiwan opportunity? The market is real, the demand is growing, and for operations with appropriate capabilities, the returns could be meaningful.

If you’re running a business with over 2,000 employees and strong component genetics, along with solid banking relationships, these export programs may align well with your business model. The premiums can justify the investment, and accessing growing Asian markets provides important diversification.

However, if you’re managing a mid-sized operation—particularly one already facing margin pressure—the requirements create hurdles that may be difficult to overcome profitably. And that’s okay. Not every opportunity needs to be your opportunity.

What seems to be working for many mid-size operations is focusing on regional markets. Building relationships with local institutions. Exploring value-added possibilities. Finding niche markets that value specific attributes—whether that’s grass-fed, local, family farm, or sustainable practices. These strategies might not generate headlines, but they’re delivering solid returns.

Looking Ahead

This Taiwan MOU illuminates broader dynamics in today’s dairy industry. Opportunities are increasingly differentiated by capability and resources, and understanding where your operation fits—along with what alternatives exist—is becoming crucial for long-term success.

Recent volatility has taught us that resilience comes from matching strategy to capabilities. Large operations might find their advantage in export markets and global supply chains. Mid-size farms often succeed through regional focus and differentiation. Smaller operations increasingly thrive through direct marketing and value-added strategies.

The most successful producers share common traits. They honestly assess their strengths and limitations. They understand market requirements thoroughly. They choose strategies aligned with their operational realities rather than chasing every opportunity that comes along.

As we head into another year of uncertainty, with milk prices volatile and input costs unpredictable, these strategic choices matter more than ever. The Taiwan opportunity offers a valuable perspective for examining our individual positions and options.

What’s working in your region? Because ultimately, that’s what makes our industry strong—sharing knowledge, learning from each other’s experiences, and finding paths forward that work for our individual operations while strengthening the broader dairy community. The Taiwan MOU is just one piece of a much larger puzzle we’re all working to solve together.

Key Takeaways:

- Component and cash flow impacts: Achieving 4.2% butterfat and 3.3% protein specifications often requires feed cost increases of $0.50-1.00/cwt, while 60-90 day export payment terms versus 15-20 day domestic payments can strain working capital by $40,000-60,000 for mid-size operations

- Regional alternatives delivering results: Direct institutional sales to hospitals and schools are capturing $0.50-1.00/cwt premiums with simpler logistics, while producer collaborations pooling volume among 6-8 farms are successfully accessing export premiums through shared certification costs

- Cooperative engagement opportunity: Members should actively push boards to develop tiered export programs, recognizing different scales—attend meetings, join committees, and build coalitions, because governance increasingly reflects large-farm perspectives unless smaller operations organize

- Strategic decision framework: Match your operation’s strengths to appropriate markets: 2,000+ head farms can justify export infrastructure, 500-1,000 head operations often maximize returns through regional differentiation, while smaller dairies thrive with direct marketing and value-added strategies

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- US Dairy Market in 2025: Butterfat Boom & Price Volatility – How Farmers Can Protect Profits – This article provides critical strategic context on the domestic market, revealing how a “butterfat tsunami” and price volatility impact milk checks. It offers actionable strategies for managing risk and protecting profit floors, a vital complement to the export discussion.

- Boosting Dairy Farm Profits: 7 Effective Strategies to Enhance Cash Flow – Beyond export requirements, this piece delivers concrete, tactical advice for improving on-farm profitability. It reveals proven methods for optimizing milking parlor efficiency, diversifying revenue streams, and managing feed costs to enhance working capital and operational resilience.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – This article demonstrates how technology can address the challenges highlighted in the main piece, from improving component levels to reducing labor costs. It provides a clear ROI-focused framework for adopting modern solutions like precision feeding and AI health monitoring.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!