She’s milking 110 lbs. Ketones perfect. Appetite strong. She’s also lost 40% of her muscle and won’t breed back. You just can’t see it yet.

EXECUTIVE SUMMARY: While you’re watching ketones and body condition, your best cows are quietly losing up to 40% of their muscle—and you can’t see it happening. Fat bounces back by 90 days in milk. Muscle doesn’t recover until 240-270 days, if at all. That gap explains a lot: the silent ovaries, the infections that won’t clear, the early culls you blamed on bad luck. Worse, Purdue research shows your highest-genetic cows mobilize the hardest—we may have spent 40 years breeding cows programmed to destroy themselves for peak milk. Rumen-protected amino acids and late-lactation nutrition buffer the damage—but don’t fix the genetics. The real question: are we willing to weight DPR, Livability, and persistency heavily enough to breed cows that last 4-5 lactations instead of 2.5?

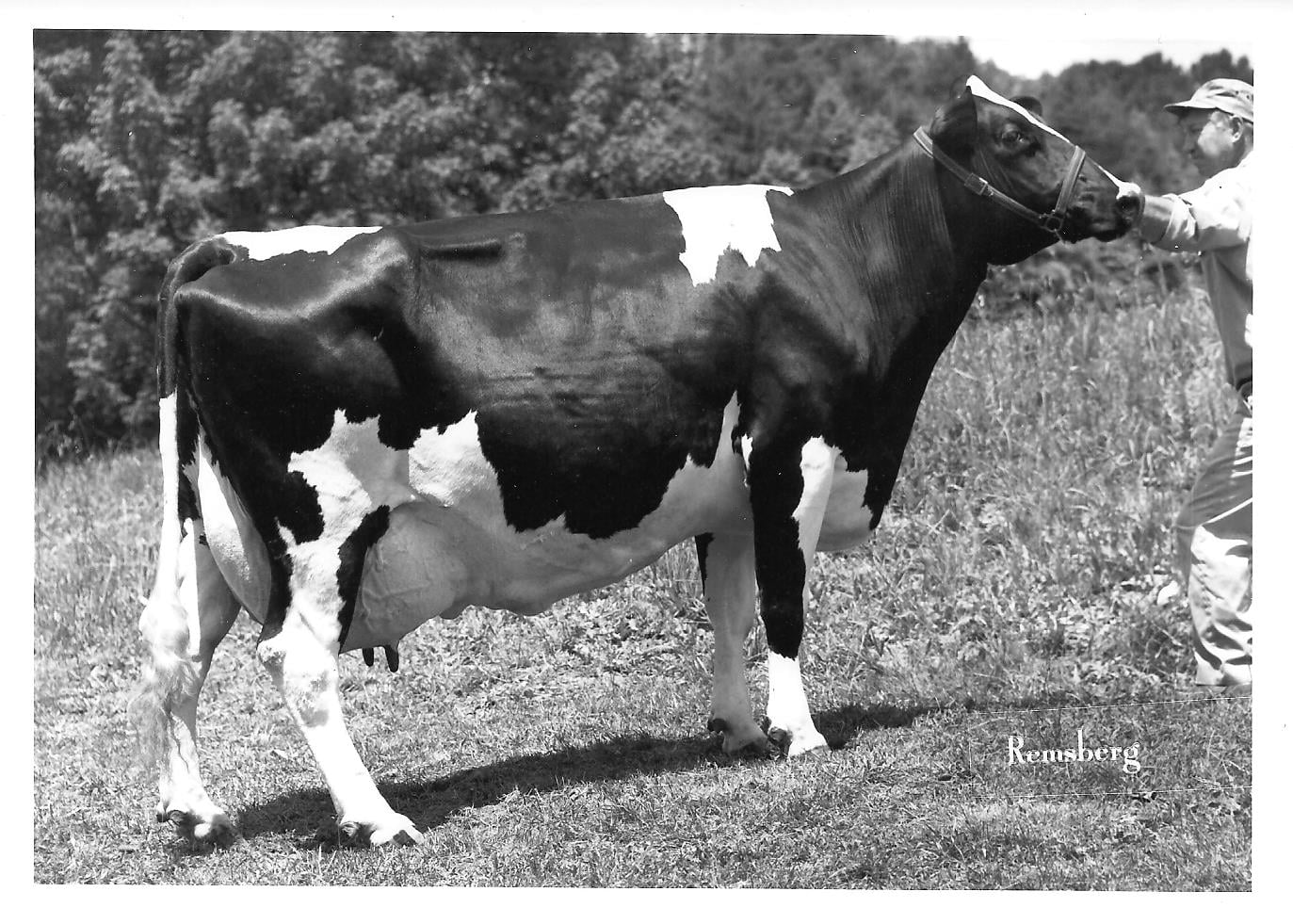

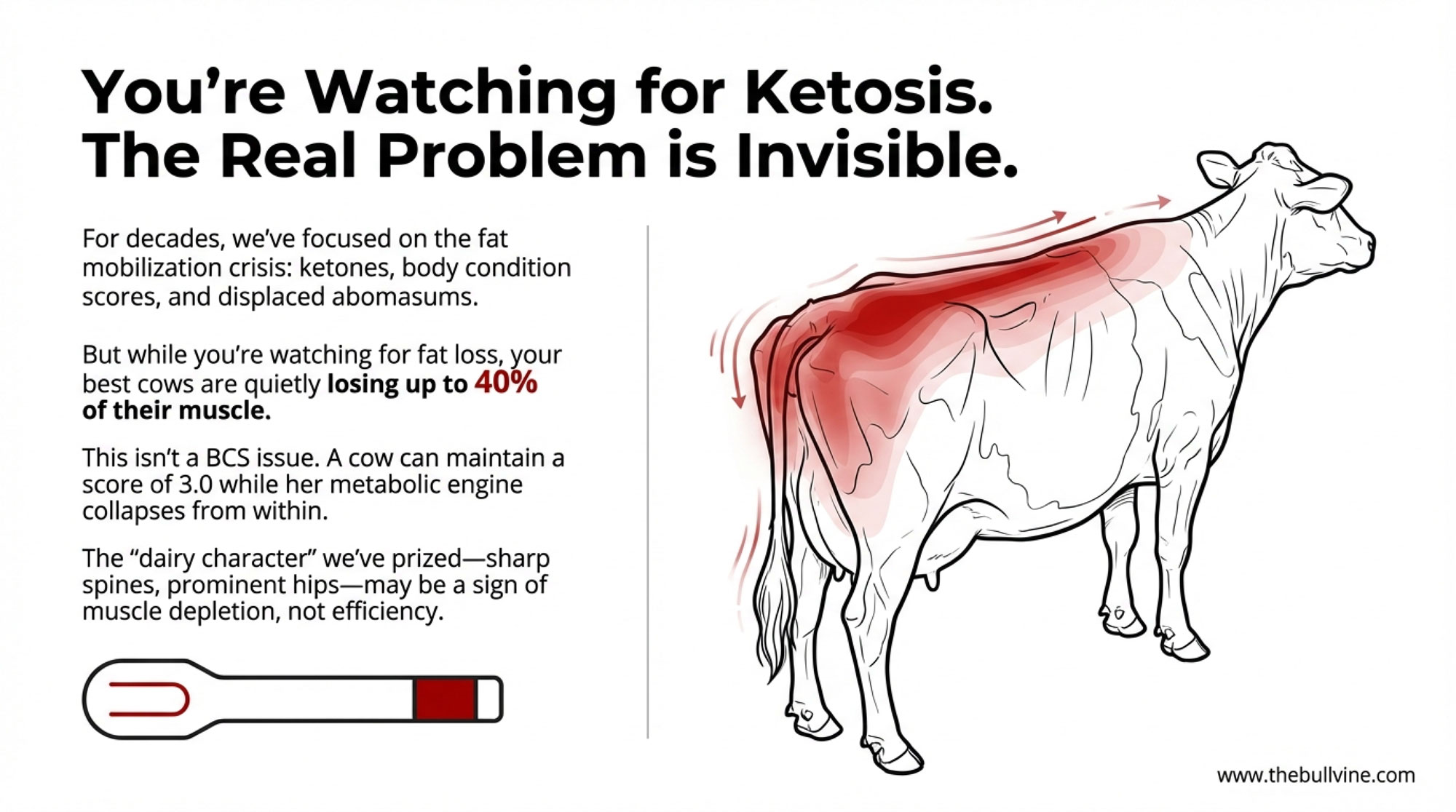

New research reveals that high-producing cows can lose up to 40% of their muscle depth in early lactation. The uncomfortable question: have decades of selection created cows genetically programmed to cannibalize themselves?

If you’ve spent any time around transition cows, you know the routine. Monitor ketones. Watch body condition. Keep an eye on feed intake. Over the past couple of decades, we’ve gotten pretty good at spotting the fat mobilization crisis—you know, the ketotic cow with acetone breath and a twisted stomach brewing.

But here’s what’s been hiding in plain sight: while we’ve been laser-focused on fat, our cows have been quietly drawing down something else entirely. Their muscle.

Recent work coming out of Purdue University, led by Dr. Jackie Boerman and her team, has documented something that should give us all pause. According to their research database, high-yielding cows routinely mobilize 30% to 35% of their longissimus dorsi muscle depth—that’s your ribeye area—within the first 60 days of lactation. And in some cases, cows can lose up to 40% of that muscle depth during this window.

Here’s the part that should make every breeder uncomfortable: unlike fat, which starts coming back around 60-90 days in milk, muscle mass often doesn’t rebuild until 240-270 days in milk. Sometimes not at all.

And the cows doing this most aggressively? Your highest genetic merit animals.

Let that sink in for a minute.

The Breeding Question Nobody Wants to Ask

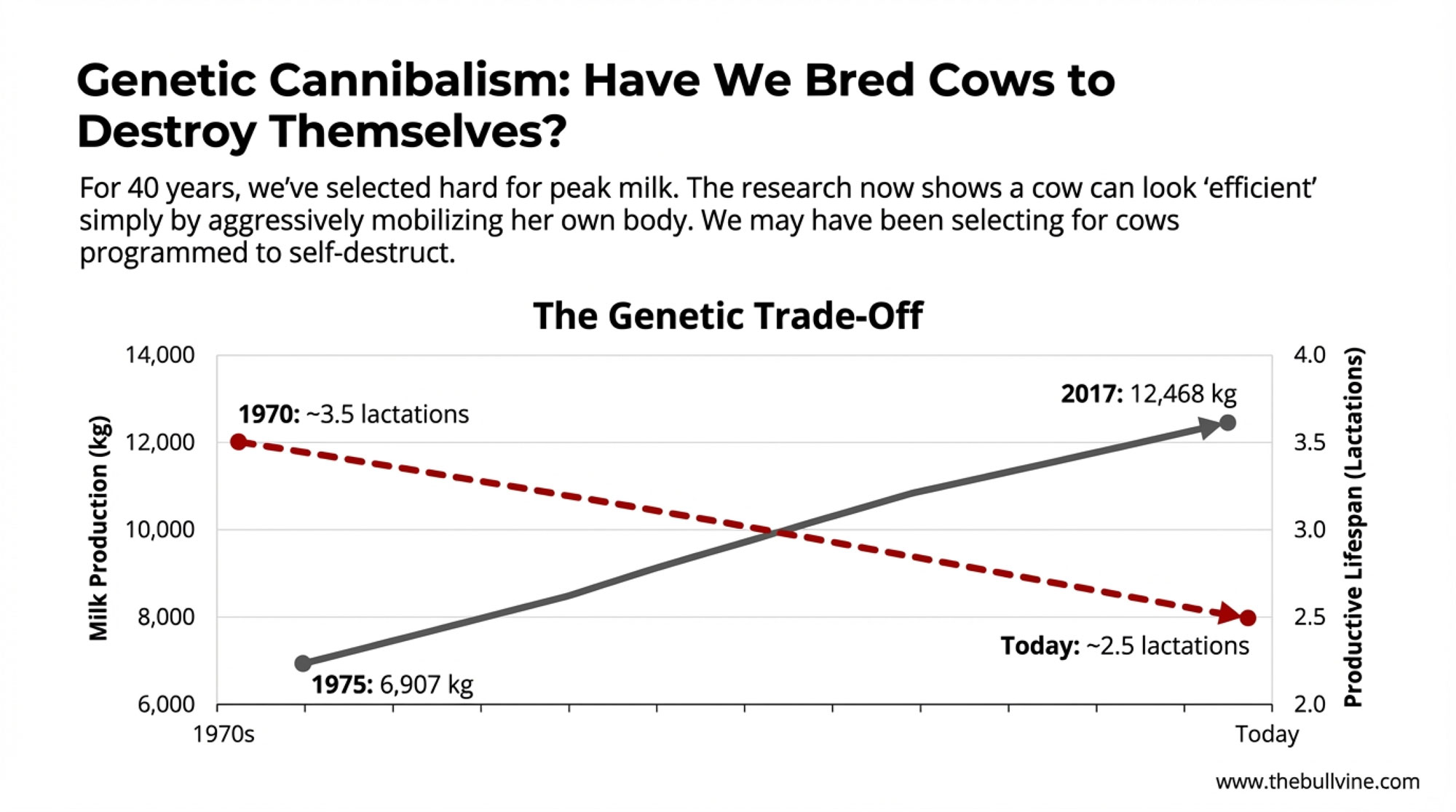

Let’s cut to the chase here. We’ve been selecting hard for peak milk yield and feed efficiency for decades—really since the early 1980s when the Holstein boom took off. Both traits have value. Nobody’s disputing that.

But here’s the uncomfortable reality the research is now exposing: a cow can score high on “efficiency” simply by aggressively mobilizing her own body tissue. She looks efficient on paper because her own reserves aren’t counted as an input.

Think about what that means. We may have spent 40 years selecting for cows willing to destroy themselves to make milk.

The data from Lactanet tells the story pretty clearly. The average Canadian Holstein cow born in 1975 produced 6,907 kg of milk. By 2017, that number had climbed to 12,468 kg. That’s remarkable genetic progress by any measure. But here’s the flip side—productive lifespan has moved in the opposite direction, declining from about 3.5 lactations in 1970 to somewhere between 2.5 and 3.0 today, according to research compiled by Lohmann Breeders.

Now, to be fair, some exceptional operations have achieved 4+ lactation averages even with high-production genetics—but they’re the exception rather than the rule, and they’ve typically invested heavily in the nutritional and management strategies we’ll discuss later. For most herds, the inverse relationship between genetic milk potential and productive lifespan remains stubbornly real.

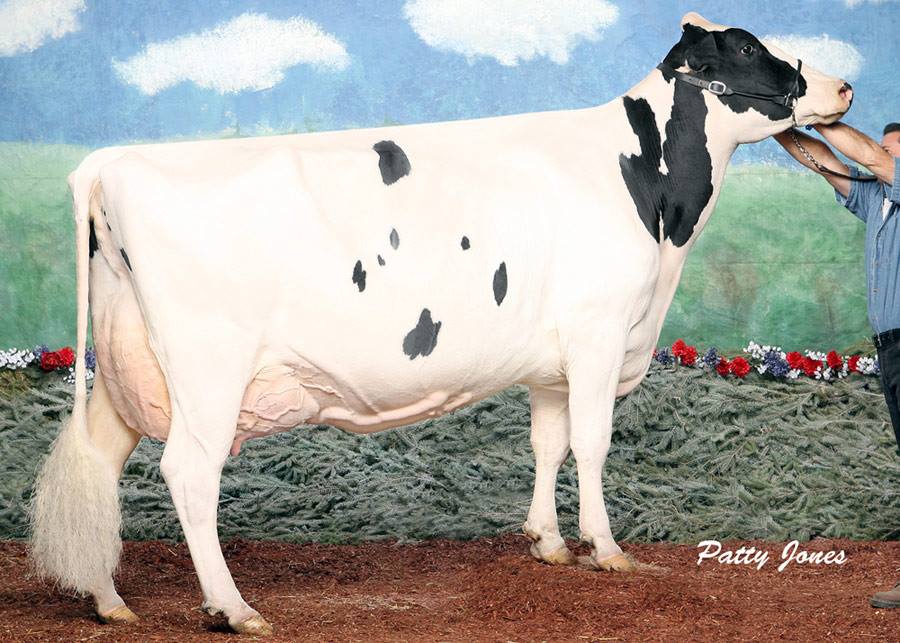

Studies published in Animals comparing “high muscle” cows (greater than 5cm longissimus dorsi depth at calving) with “low muscle” cows found something that should stop breeders in their tracks. High-muscle cows—your genetically superior animals with the capacity for massive production—actually begin mobilizing before calving even happens. They lose more total muscle in absolute terms. They produce significantly more milk in early lactation. And then they crash harder reproductively.

The cows with lighter frames? More metabolically conservative. Lower peaks, but they hold together longer.

Dr. Kent Weigel, who chairs the Department of Animal & Dairy Sciences at the University of Wisconsin-Madison and has worked extensively on dairy cattle selection indexes, has noted that traits such as Daughter Pregnancy Rate and Livability serve as indirect proxies for metabolic robustness. A cow with high DPR maintained her reproductive function while producing milk. A cow with high Livability survived multiple lactations, which require maintaining body reserves over time.

It’s worth noting that Scandinavian breeding programs recognized this connection earlier than most. Countries like Sweden and Denmark have emphasized health, fertility, and longevity traits in their selection indexes for decades—and their herds show it in productive lifespan numbers that consistently exceed North American averages.

Here’s the call to action for those of us making breeding decisions: If you’re still selecting primarily on milk and type while treating DPR and Livability as afterthoughts, you may be actively breeding for metabolic fragility. Every 500 pounds of additional milk potential means nothing if that cow burns out after 2.5 lactations—which is exactly where the U.S. average sits.

The cow of 2030 needs to look different than the cow we’ve been chasing. A bit more substance. A bit less extreme “dairy character.” Flatter lactation curves. And 4-5 profitable lactations instead of a spectacular peak followed by an infertility cull.

It’s achievable. Some of the herds are already there. The question is whether the rest of us are willing to shift our thinking.

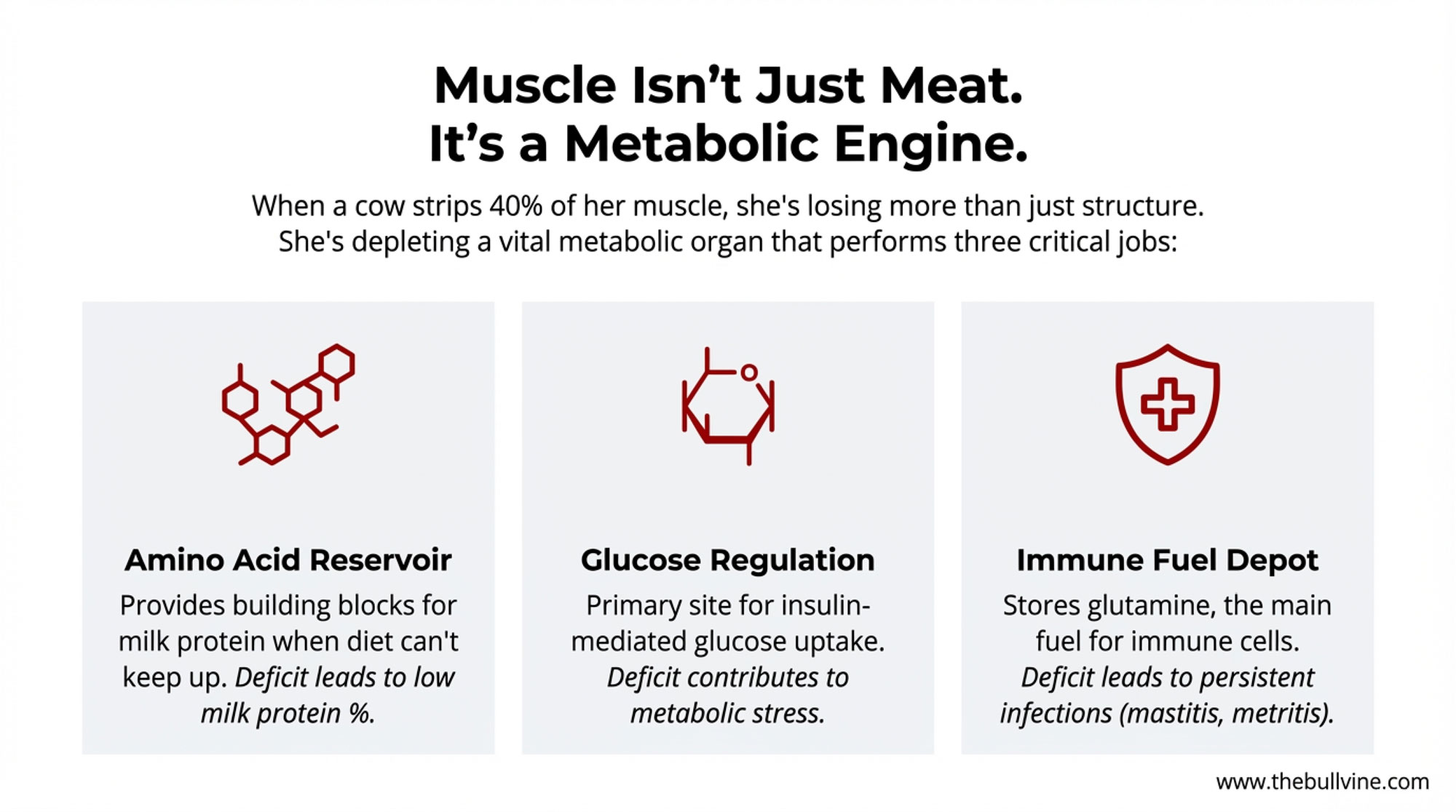

Why Muscle Matters More Than Most Realize

For a long time—and I was guilty of this too—we’ve thought about skeletal muscle as structural tissue. Important for getting the cow from the freestall to the feed bunk, sure, but not really central to the metabolic challenges of early lactation. That thinking is outdated.

What’s becoming clear from recent research is that muscle tissue pulls triple duty during lactation. It serves as the cow’s amino acid reservoir, providing the building blocks for milk protein synthesis when dietary intake can’t keep pace with demand. It’s also the primary site for insulin-mediated glucose uptake, which matters enormously during that naturally insulin-resistant state after calving. And here’s something that often surprises people: muscle stores glutamine—the primary fuel source for immune cells fighting infection.

Dr. Boerman put it well in a recent presentation at the American Dairy Science Association annual meeting—she essentially said we need to stop thinking about muscle as “meat” and start thinking about it as a metabolic organ. It’s not just structural. It’s actively regulating the cow’s entire metabolic response to lactation.

When a cow strips 40% of that organ in 60 days, you can imagine what follows.

What Body Condition Scoring Actually Misses

Here’s something worth considering, and you may have noticed this yourself if you’ve been paying close attention: our standard monitoring tools weren’t designed to catch muscle loss.

Body Condition Scoring primarily measures subcutaneous fat cover. That’s what it was built to do, and it does that job reasonably well. But a cow can maintain an acceptable BCS of 3.0 while losing significant muscle mass underneath. The visual “dairy character” many of us associate with high production—those sharp spines, prominent hip bones, angular frames—may sometimes reflect muscle depletion rather than optimal metabolic efficiency.

I’ve been thinking about this a lot lately. We may have been confusing a coping mechanism with a desirable trait for decades.

Tools that actually measure muscle status:

Research teams are using ultrasound imaging of the longissimus dorsi at the 12th/13th ribs to track changes in muscle depth over time. Blood biomarkers like 3-methylhistidine indicate active muscle breakdown, while creatinine levels reflect total muscle mass. Even milk protein percentage—when it drops below 2.9-3.0% in early lactation—can signal amino acid deficiency and excessive tissue mobilization.

These tools remain primarily in research settings for now, though some veterinary practices are beginning to explore on-farm ultrasound protocols. That’s worth watching.

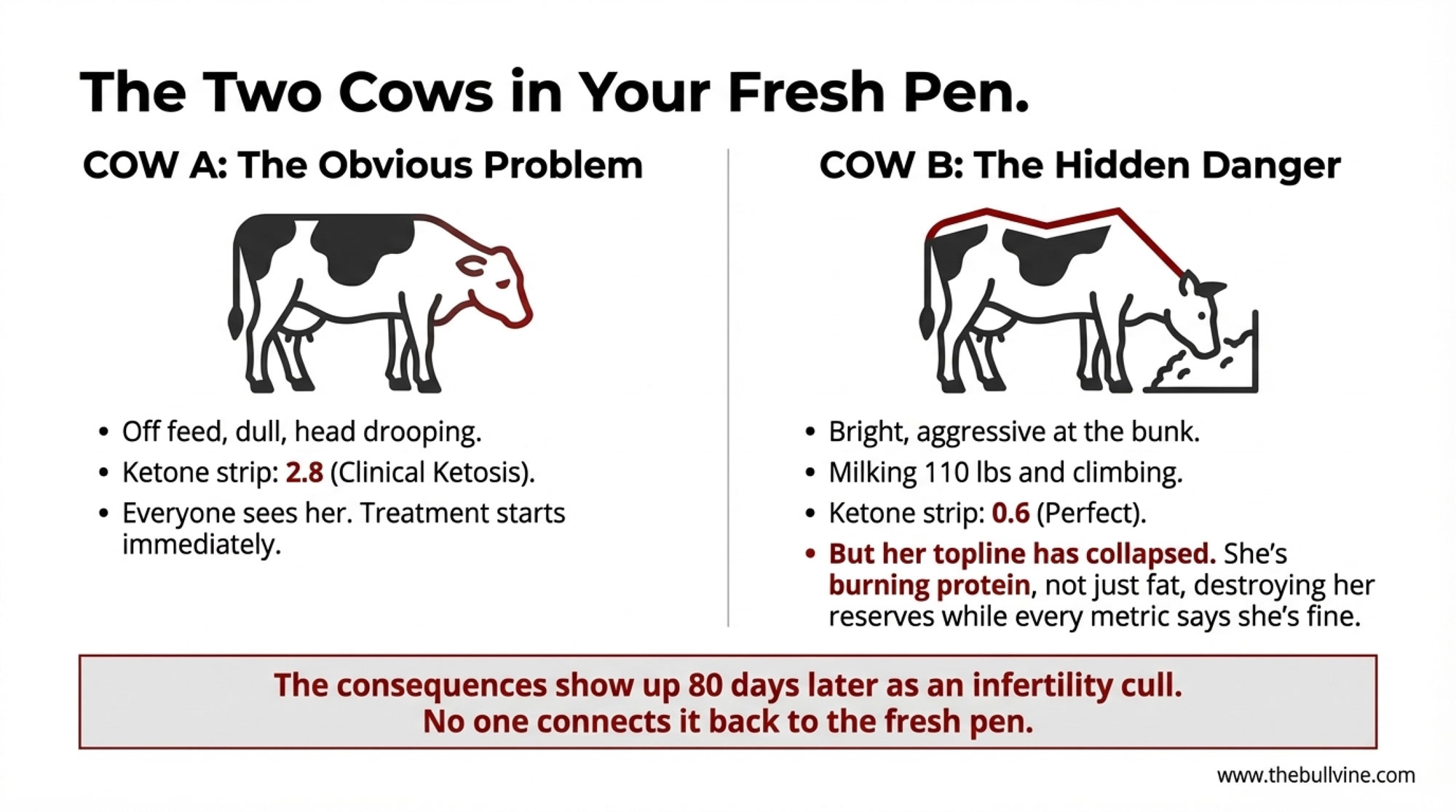

Two Cows, Two Outcomes: A Fresh Pen Scenario

Let me paint a picture that might feel familiar.

You walk into your fresh pen, 6 AM. Two cows calved about 20 days ago and are now penned side by side.

Cow A is obvious. She’s off feed, dull, and head drooping. Her ketone strip reads 2.8. Clinical ketosis, maybe a DA brewing. Everyone notices her. Treatment starts immediately. This cow is asking for help.

Cow B looks like your star. She’s bright, aggressive at the bunk, already milking 110 pounds, and climbing. Ketone strip reads 0.6, perfect. She appears to be crushing it.

But look closer at her topline. Three weeks ago, there was a firm shelf of muscle along her spine. Today, your fingers slide right down the side. The shelf has collapsed. Her ribs are more visible, her frame more angular.

She’s not showing ketosis because she’s burning protein, not just fat. Muscle catabolism produces glucose precursors that actually prevent ketone formation. She’s destroying her metabolic reserves while every standard metric says she’s fine.

| Monitoring Metric | Cow A – Clinical Ketosis (Everyone Notices) | Cow B – Hidden Muscle Crisis (Looks Perfect) |

|---|---|---|

| Ketones (mmol/L) | 2.8 (HIGH) | 0.6 (normal) |

| Body Condition Score | 2.5 | 3.0 |

| Milk Yield (lbs/day) | 75 | 110 |

| Milk Protein % | 3.2 | 2.8 (red text) |

| Muscle Depth (cm) | 4.8 | 3.2 (40% loss) (red text) |

| Reproductive Status at 100 DIM | Normal cycle expected | No cycle – infertility cull (red text) |

The consequences show up 80-100 days later when she fails to cycle and gets flagged as an infertility cull. And nobody connects it back to the fresh pen—or to the genetics that programmed her to spend herself this way.

Signs Worth Watching For in Fresh Cows

- Milk protein percentage dropping below 2.9% in the first 30 DIM

- Topline softening along the spine despite adequate body condition scores

- High-producing cows failing to show heat by 80-100 DIM

- Persistent low-grade infections (mastitis, metritis) that won’t fully clear

- Angular appearance developing more rapidly than expected post-calving

- Strong peak production followed by a steep, early decline

The Fertility and Immune Connection

This is where the research gets really practical, and honestly, it’s the part that convinced me this topic deserves more attention than it’s been getting.

Work published in the journal Animals back in 2022—a study by Schäff and colleagues that tracked 500 lactations across three commercial UK herds—found that cows experiencing excessive muscle tissue mobilization took significantly longer to resume ovarian cyclicity and had extended intervals to first service. Moderate muscle loss—around 1.5 to 5mm reduction in muscle diameter—was actually associated with optimal reproductive outcomes. It’s the excessive losses, more than 8mm reduction, that correlated with delayed return to fertility.

From a physiological standpoint, reproduction is what biologists call a “luxury” function. When a cow’s body is under severe metabolic stress, the signal is clear: conditions aren’t ideal for supporting a pregnancy.

The immune connection matters too. Immune cells are voracious consumers of glutamine—they use it as fuel to replicate and mount an immune response. Skeletal muscle is the body’s primary site for glutamine storage. When a fresh cow mobilizes muscle too aggressively, she may run short of glutamine for her immune system while the mammary gland simultaneously demands it for milk protein synthesis. Research published in the Journal of Dairy Science found that glutamine supplementation during the transition period improved immune cell function and reduced infection severity.

The practical takeaway: Cows leaving the herd for “infertility” may not have inherent reproductive problems at all. Their bodies have simply entered protein-conservation mode. And stubborn SCC problems or persistent metritis? The ration’s amino acid balance—and the cow’s genetic programming for tissue mobilization—may be part of the picture.

Every cow that fails to breed back at 100 DIM is a decision point—fix her nutrition, change her genetics, or make beef-on-dairy work for you. With week-old beef crosses commanding premium prices and replacement heifers running $2,600-3,000+, that infertility cull calculation has shifted. But here’s the thing: relying on beef-on-dairy to bail out your reproduction program isn’t a long-term strategy. It’s a symptom that something upstream needs fixing.

| Financial Metric (500-Cow Dairy) | Current Reality: 2.5 Avg Lactations | Achievable: 4.0 Avg Lactations | Your Farm’s Opportunity |

|---|---|---|---|

| Annual Replacement Rate | 40% | 25% | -15 percentage points |

| Cows Replaced per Year | 200 | 125 | -75 cows |

| Annual Replacement Cost | $560,000 | $350,000 | -$210,000/year |

| 5-Year Replacement Cost | $2,800,000 | $1,750,000 | -$1,050,000 |

| Reproduction Culls (5 years) | 250 cows | 100 cows | -150 fewer culls |

| Lost/Gained Milk Revenue | -$600,000 (lost) | +$990,000 (gained) | $1,590,000 swing |

| TOTAL 5-YEAR IMPACT | $3,400,000 (total cost) | $760,000 (net cost) | $2,640,000 SAVED |

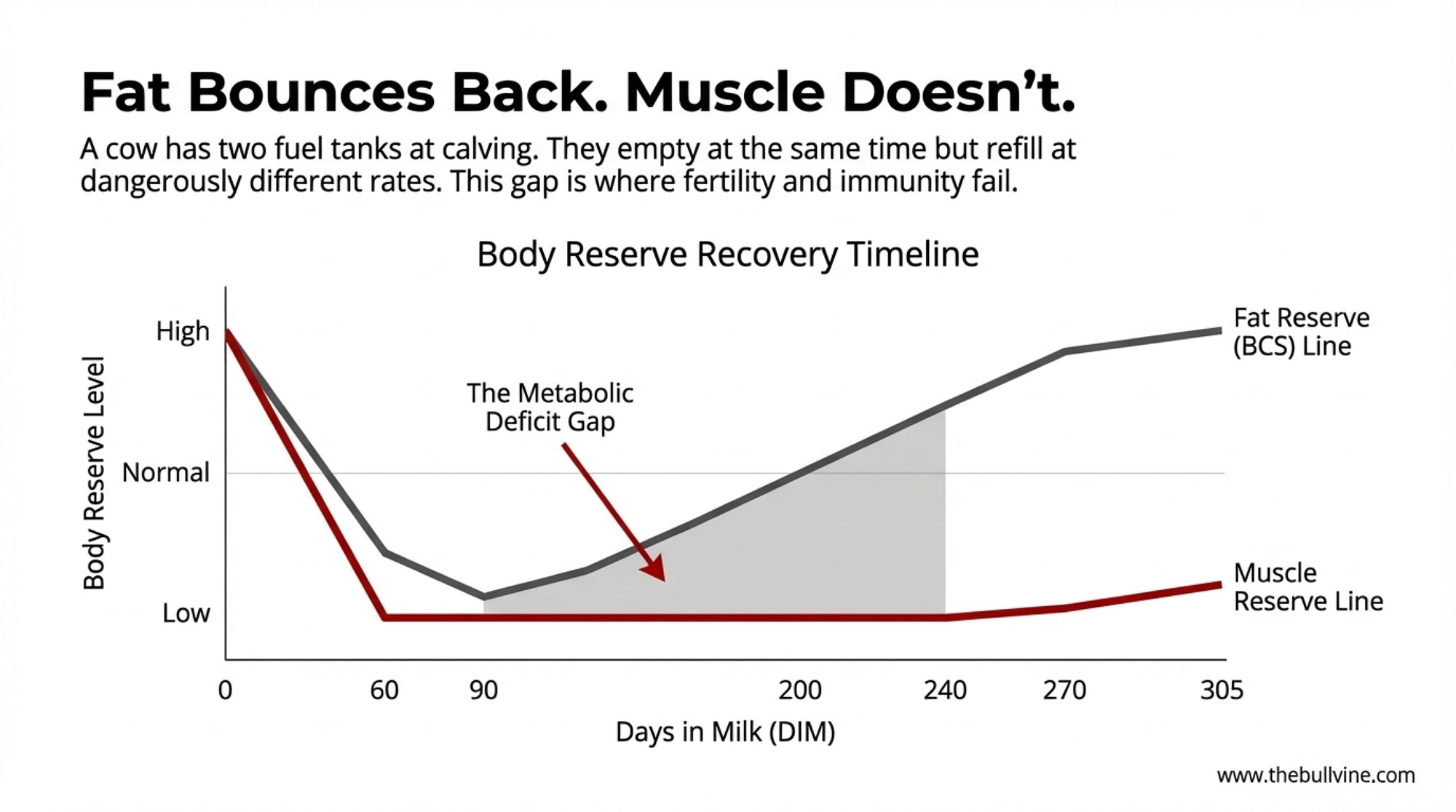

The Recovery Timeline: Fat vs. Muscle

This is what keeps nutritionists up at night. At calving, your cow has both a fat reserve and a muscle reserve. Both start depleting immediately—but their recovery paths couldn’t be more different.

| Timeline | Fat Reserve | Muscle Reserve |

| Days 0-60 | Heavy mobilization | Heavy mobilization (30-40% loss) |

| Days 60-90 | Hits nadir, starts recovering | Still depleted, no recovery |

| Days 90-200 | Continues rebuilding; BCS improves | Remains at nadir; cow looks healthy, but chassis is stripped |

| Days 240-270 | Fully recovered | Finally begins meaningful recovery |

| Day 305 | Normal | Many cows still haven’t returned to pre-calving depth |

If a cow enters each successive dry period with less metabolic reserve than before, you’re looking at a cumulative deficit that compounds across lactations. That’s not just a nutrition problem. That may be a genetic trajectory toward early culling.

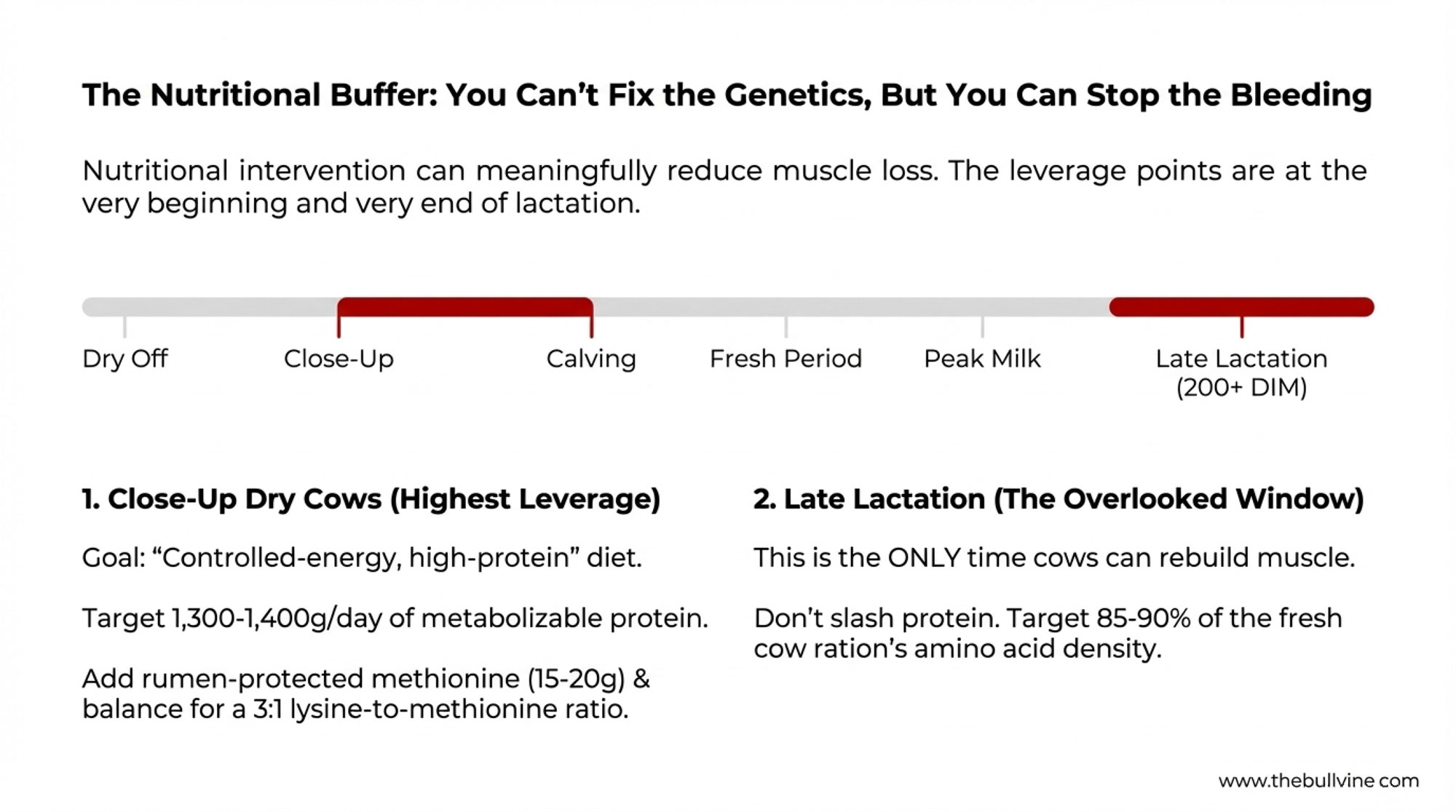

Nutritional Strategies That Buy Time

The encouraging news in all of this: nutritional intervention can meaningfully reduce muscle mobilization. It won’t change the underlying genetics, but it can buffer against the damage.

Close-Up Dry Cow Nutrition (21 Days Pre-Calving)

This is your highest-leverage intervention point. What happens in these three weeks before calving sets the trajectory for everything that follows.

The goal is a “controlled-energy, high-protein” approach. You want a high-fiber, high-bulk diet that keeps the rumen full and prevents over-conditioning. But—and this is critical—you also want a high metabolizable protein supply, not just crude protein.

Rumen-protected amino acids, particularly methionine and lysine at a 3:1 lysine-to-methionine ratio (a target well-established in the research literature, including foundational work by Dr. Chuck Schwab at the University of New Hampshire), give the cow a “labile protein reserve” she can draw on immediately post-calving. Think of it as preloading her checking account so she doesn’t have to raid her savings account.

| Component | Typical Close-Up | Muscle-Supportive Close-Up |

| Crude Protein | 14% | 14% |

| Metabolizable Protein | 1,000-1,100g/day | 1,300-1,400g/day |

| Rumen-Protected Methionine | 0g | 15-20g |

| Rumen-Protected Lysine | Variable | Balanced to a 3:1 ratio |

| Energy Density | Often too high | Controlled (0.65-0.68 Mcal/lb NEL) |

Fresh Cow Adjustments

If you’re seeing signs of excessive muscle mobilization in your fresh pen, here are some starting points:

Add rumen-protected methionine. Target 15-20 grams per cow daily. This is typically the first-limiting amino acid and has a meaningful impact on reducing tissue mobilization.

Increase rumen-undegradable protein (RUP) sources. Blood meal, heat-treated soybean meal, or commercial bypass protein blends provide amino acids that reach the small intestine directly.

Include glucogenic precursors. Propylene glycol, calcium propionate, or well-processed corn provide glucose precursors that reduce the need for the cow to convert her own amino acids into glucose.

Late Lactation: The Overlooked Rebuilding Window

Here’s where many herds have an opportunity, and I’ll admit I’ve been guilty of overlooking this myself in the past.

The 200 DIM to dry-off window is really the only opportunity your cows have to rebuild muscle before the next lactation. If you’re putting late-lactation cows on minimal rations to reduce costs, you may be setting them up to fail next time around.

Target at least 85-90% of your fresh cow ration’s amino acid density in late lactation, even as energy drops. The cow doesn’t need as many calories at 250 DIM, but she still needs the building blocks to rebuild tissue.

Questions Worth Asking Your Nutritionist

- “What’s our close-up ration’s metabolizable protein supply—not just crude protein percentage?”

- “Are we meeting the 3:1 lysine-to-methionine ratio in our fresh cow diet?”

- “What’s our fresh pen average milk protein percentage at 30 DIM?”

- “What bypass protein sources are we using, and what’s our RUP percentage?”

- “How does our late-lactation ration compare to our fresh cow ration on amino acid density?”

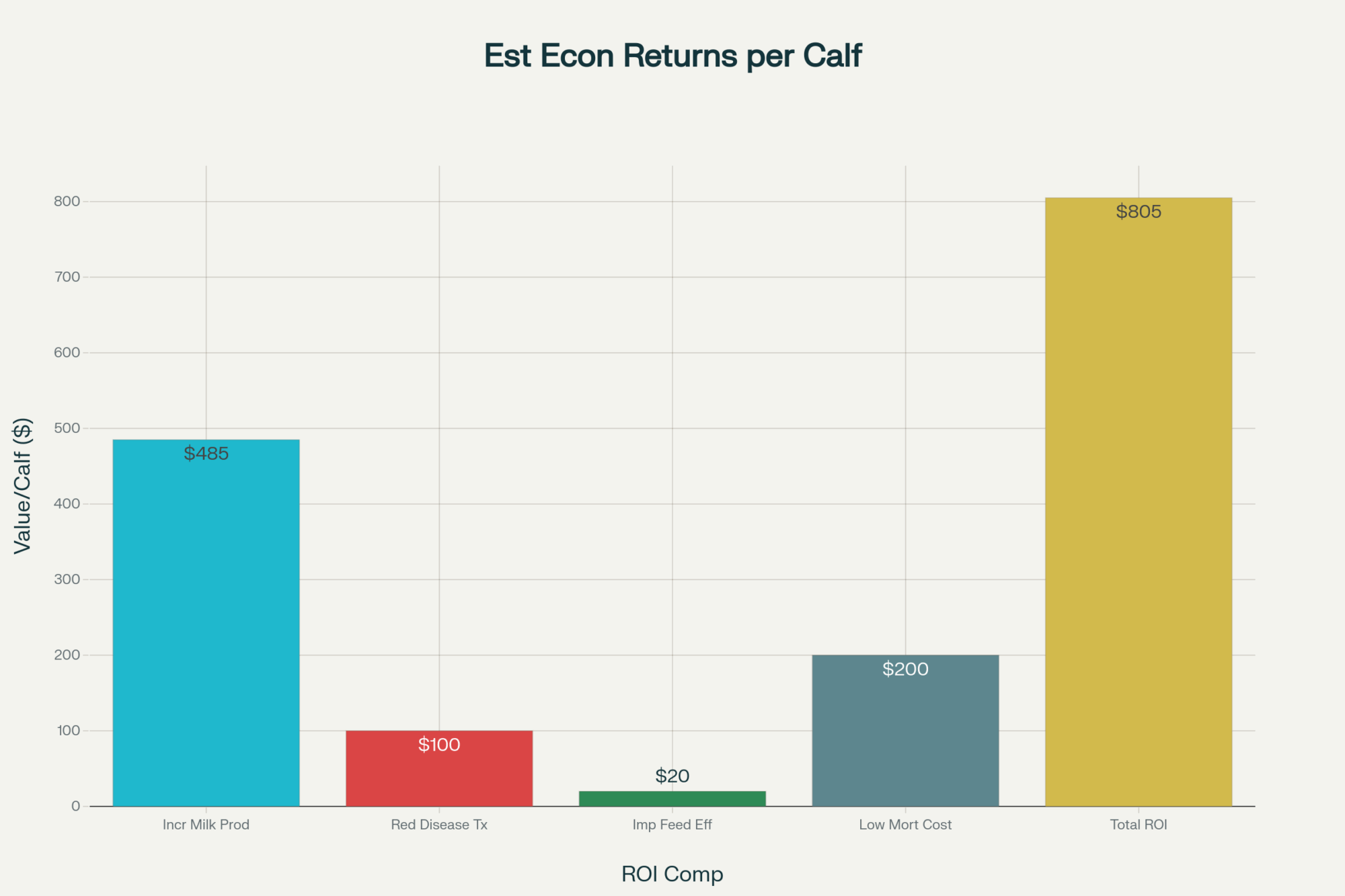

The Economics

Yes, this adds cost. Here’s the math.

The Investment (Fresh Period, 0-30 DIM):

- Rumen-protected methionine: $0.30-0.36 per cow/day

- Propylene glycol or glucose support: $0.40 per cow/day

- Bypass protein premium: $0.15 per cow/day

- Total: roughly $0.85 per cow/day ($25 per cow for 30 days)

The Potential Returns:

Fertility: University of Kentucky research indicates each day open beyond 100 DIM costs somewhere in the $2-5 range, though this varies significantly by herd. One fewer cycle open—21 days—often pays back the investment multiple times over.

Reduced culling: Replacement heifers are running $2,600-3,000+ according to USDA 2025 data, with premium animals fetching $4,000+ at auction. Preventing even a few infertility culls on a 500-cow dairy can dramatically change the economics.

Milk protein: Here’s where the market is shifting in ways that make this conversation even more relevant. With GLP-1 weight-loss drugs like Ozempic and Wegovy driving consumer demand toward high-protein dairy products, protein premiums are strengthening. Whey protein isolate hit record prices above $8.50 per pound in late 2024, and that demand is trickling back to the farm gate. In component-pricing markets, Wisconsin producers shipping 3.4% protein are capturing roughly $0.40-0.50 more per hundredweight than their 3.0% neighbors—and that gap adds up fast across a year’s production. Cows that can maintain milk protein above 3.0% while preserving body reserves become doubly valuable—they’re capturing today’s premiums while staying in the herd long enough to keep doing it.

With FMMO modernization now finalized—USDA’s January 2025 rule updates skim milk composition factors to 3.3% protein effective December 2025, up from the 3.1% standard that’s been in place since 2000—the cows that can maintain 3.2%+ protein while staying fertile become strategic assets. The new formula better reflects current milk composition and amplifies the protein’s relative value at the farm gate.

The Big Math: What 2.5 vs. 4.0 Lactations Actually Costs

Let’s run the numbers for a 500-cow dairy over five years. This is the calculation that changes how you think about breeding decisions.

Scenario A: 2.5 Average Lactations (Current U.S. Average)

- Annual replacement rate: 40% (200 cows/year)

- Replacement heifer cost: $2,800 average

- Annual replacement cost: $560,000

- 5-year replacement cost: $2,800,000

- Cows culled for reproduction failure (est. 25% of culls): 250 cows over 5 years

- Lost production from early exits: ~12,000 lbs/cow potential × 250 cows = 3 million lbs

- At $20/cwt: $600,000 in lost milk revenue

Scenario B: 4.0 Average Lactations (Achievable with intervention)

- Annual replacement rate: 25% (125 cows/year)

- Replacement heifer cost: $2,800 average

- Annual replacement cost: $350,000

- 5-year replacement cost: $1,750,000

- Reproduction culls reduced by 60%: 100 cows over 5 years

- Additional lactations captured: 150 cows × 1.5 extra lactations × 22,000 lbs = 4.95 million lbs

- At $20/cwt: $990,000 in additional milk revenue

The 5-Year Difference:

- Replacement cost savings: $1,050,000

- Additional milk revenue: $990,000 (conservative)

- Total advantage: Over $2 million per 500 cows over 5 years

That’s $400,000 per year—or $800 per cow annually—that separates the 2.5-lactation herd from the 4.0-lactation herd. And this doesn’t include reduced veterinary costs, fewer fertility treatments, better genetic progress from keeping your best cows longer, or the component premiums from cows that maintain protein percentage.

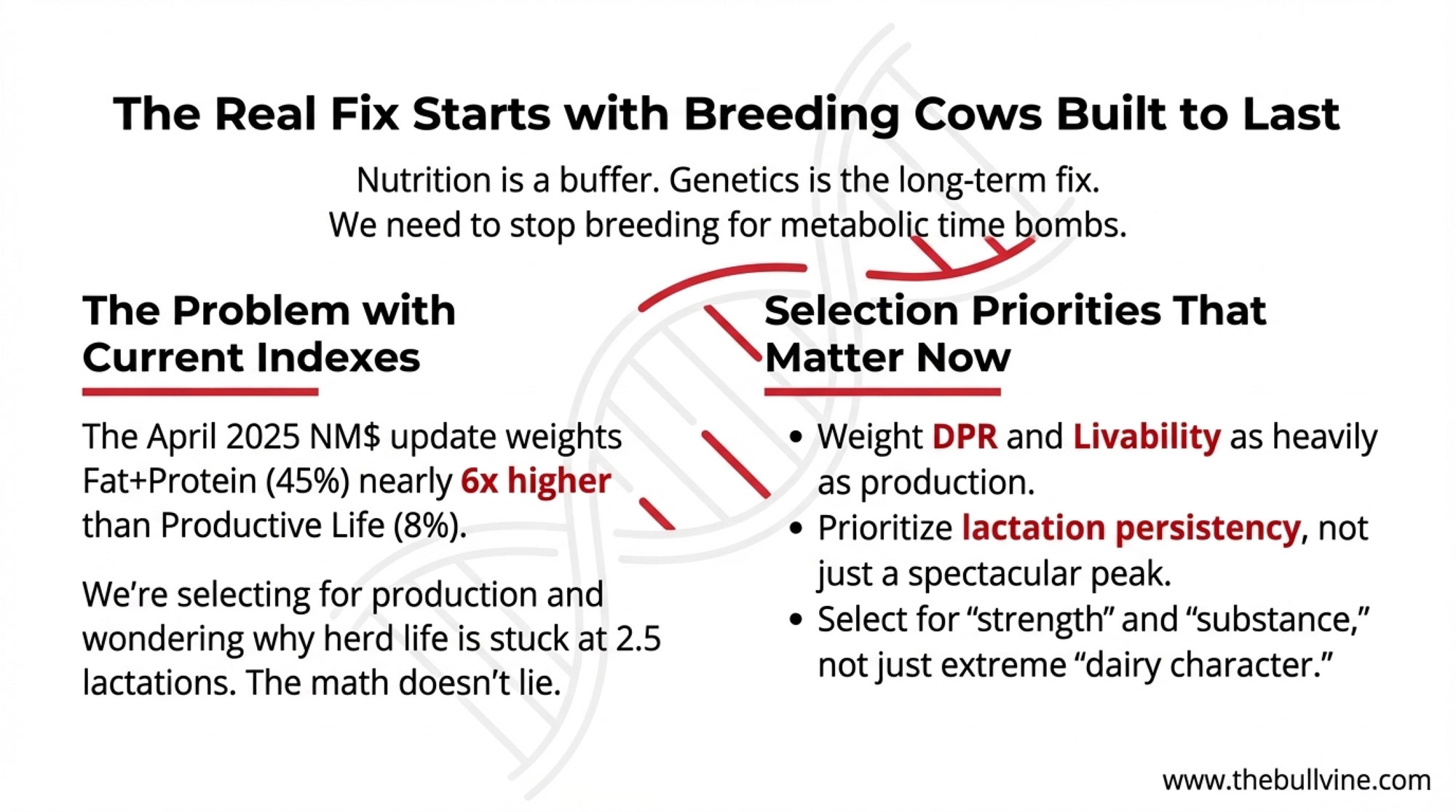

The Breeder’s Dilemma

Here’s where we need to be honest with ourselves about what we’re doing with our mating decisions.

Nutrition can buffer against aggressive tissue mobilization. Good management can catch problems earlier. But neither changes the fundamental genetic programming that’s telling your highest-merit cows to destroy themselves for peak production.

Research from Dairy Global has documented this connection pretty clearly: “Long-term genetic selection for high-yielding cows with increased productivity and calving intervals showed to increase susceptibility to metabolic diseases, including mastitis and lameness.” And work from the University of Melbourne found a negative association between thermotolerance and production traits—another dimension of the same problem.

A hard look at current index construction:

The April 2025 Net Merit revision tells an interesting story about industry priorities. According to CDCB, the updated NM$ assigns 31.8% to fat and 13.0% to protein—roughly 45% to production components. Productive Life, meanwhile, dropped from 11.0% to just 8.0%. Feed Saved increased to 17.8%, which sounds good until you remember that “efficiency” can be achieved by aggressive tissue mobilization.

That ratio may need recalibration if research on muscle mobilization and genetic predisposition holds true. We’re weighting production nearly six times heavier than the cow’s ability to stay in the herd—and wondering why average herd life sits at 2.5 lactations. The math doesn’t lie.

Selection considerations that matter now:

- Weight DPR and Livability heavily, even if it means accepting modestly lower predicted milk

- Look at lactation persistency, not just peak yield—a cow that peaks at 110 and holds 95 beats one that peaks at 140 and crashes

- Consider “strength” traits in type evaluation—chest width and loin strength reflect metabolic capacity, not just appearance

- Question whether 2.5 lactations is acceptable when genetics exist for 4-5

The question isn’t whether we can keep propping up metabolically fragile cows with expensive interventions. The question is whether we should be breeding them in the first place.

The Bottom Line

None of this changes the fundamentals of transition cow management. Fat mobilization and ketosis prevention remain critically important. But addressing only half of the metabolic equation has contributed to the fertility challenges, cull rates, and shortened productive lives that frustrate operations everywhere.

The research is telling us something uncomfortable: we may have optimized for the wrong things. Peak milk and extreme dairy character came at a cost we’re only now measuring—in muscle depth, immune function, fertility, and herd life.

What’s encouraging is that the tools are available. Nutritional interventions exist. Better genetic selection criteria are documented. Some herds are already proving that 4+ lactation averages are achievable. The knowledge is in the literature and is increasingly being applied in the field.

The cows are telling us something with their disappearing toplines and their silent ovaries. The data is confirming what they’ve been communicating for years.

The genetics we choose next will determine whether we keep selecting for metabolic time bombs—or start breeding cows built to last.

That choice is ours.

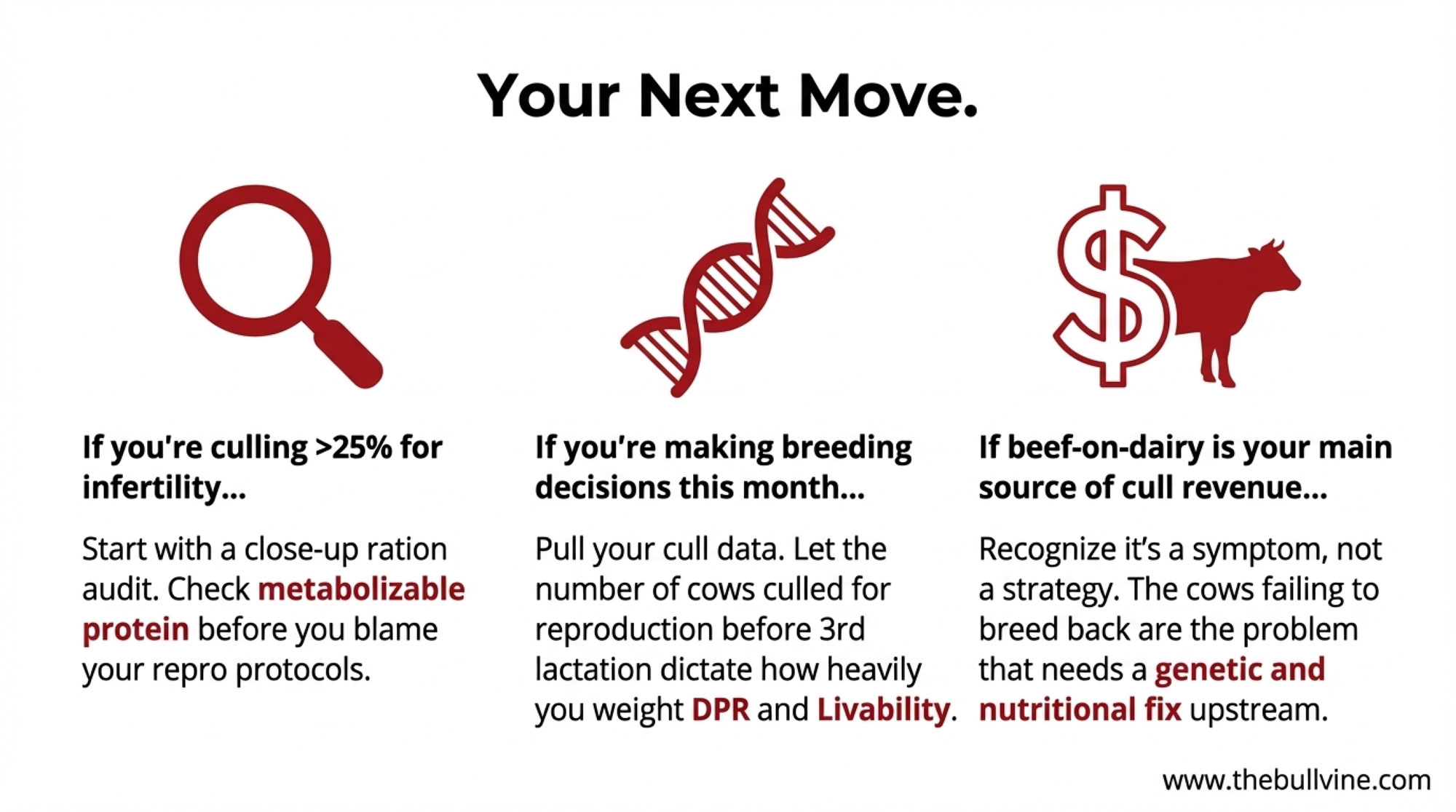

Where to Start Based on Your Situation

- If you’re culling 25%+ for infertility, Start with a close-up ration protein audit. Check the metabolizable protein supply and amino acid balance before blaming reproduction protocols.

- If you’re a 1,000+ cow operation: Consider piloting an ultrasound monitoring protocol with your vet on a subset of fresh cows. Track muscle depth at calving and 60 DIM to quantify what’s actually happening in your herd.

- If you’re making breeding decisions this month: Pull your last 12 months of cull data. Calculate what percentage is left for reproduction failure before the third lactation. That number should inform how heavily you weight DPR and Livability going forward.

- If beef-on-dairy is bailing out your cull revenue: That’s fine for now—but recognize it’s a symptom, not a solution. The cows generating those beef-cross premiums are the same ones failing to breed back. Fix the upstream problem.

For more information on transition cow protein metabolism, see Dr. Jackie Boerman’s research publications through Purdue University’s Department of Animal Sciences, or contact your regional dairy extension specialist.

KEY TAKEAWAYS

- 40% muscle loss in 60 days—invisible to standard monitoring. Your fresh cows are cannibalizing muscle, while ketones and BCS read normal

- Fat bounces back. Muscle doesn’t. Fat recovers by 90 DIM; muscle takes 240-270 days. That’s 8 months of hidden metabolic deficit

- Your highest-genetic cows mobilize hardest. The same genetics driving 110-lb peaks are programming aggressive self-destruction

- Nutrition buffers the damage but doesn’t fix it. Rumen-protected methionine (15-20g/day) and late-lactation amino acids buy time; genetics determines the trajectory

- The real lever is breeding. Weight DPR, Livability, and persistency now—or keep replacing cows every 2.5 lactations

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The 15:1 ROI Protocol: How Anti-Inflammatory Treatment is Cutting Transition Disease in Half – Gain a precise, low-cost method to stop inflammation from hijacking your fresh cows’ energy. This tactical guide reveals how a $10 investment protects your high-genetic animals while delivering an incredible 15:1 return.

- Squeezed Out? A 12-Month Decision Guide for 300-1,000 Cow Dairies – Arms you with a strategic roadmap to survive the collision of record heifer costs and shifting processing capacity. It exposes why standing still drains 8% of equity annually and delivers clear survival paths for mid-sized operations.

- The $4.78 Spread: Why Protein Premiums Won’t Last Past 2027 – Exposes how GLP-1 drugs like Ozempic are rewriting global protein demand and component values. This forward-looking brief reveals the disruptive forces that will dictate which genetics remain profitable as market premiums shift beyond 2027.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!