Only 11% of dairies under 300 cows are profitable. But three paths still work—if you move in the next 18 months.

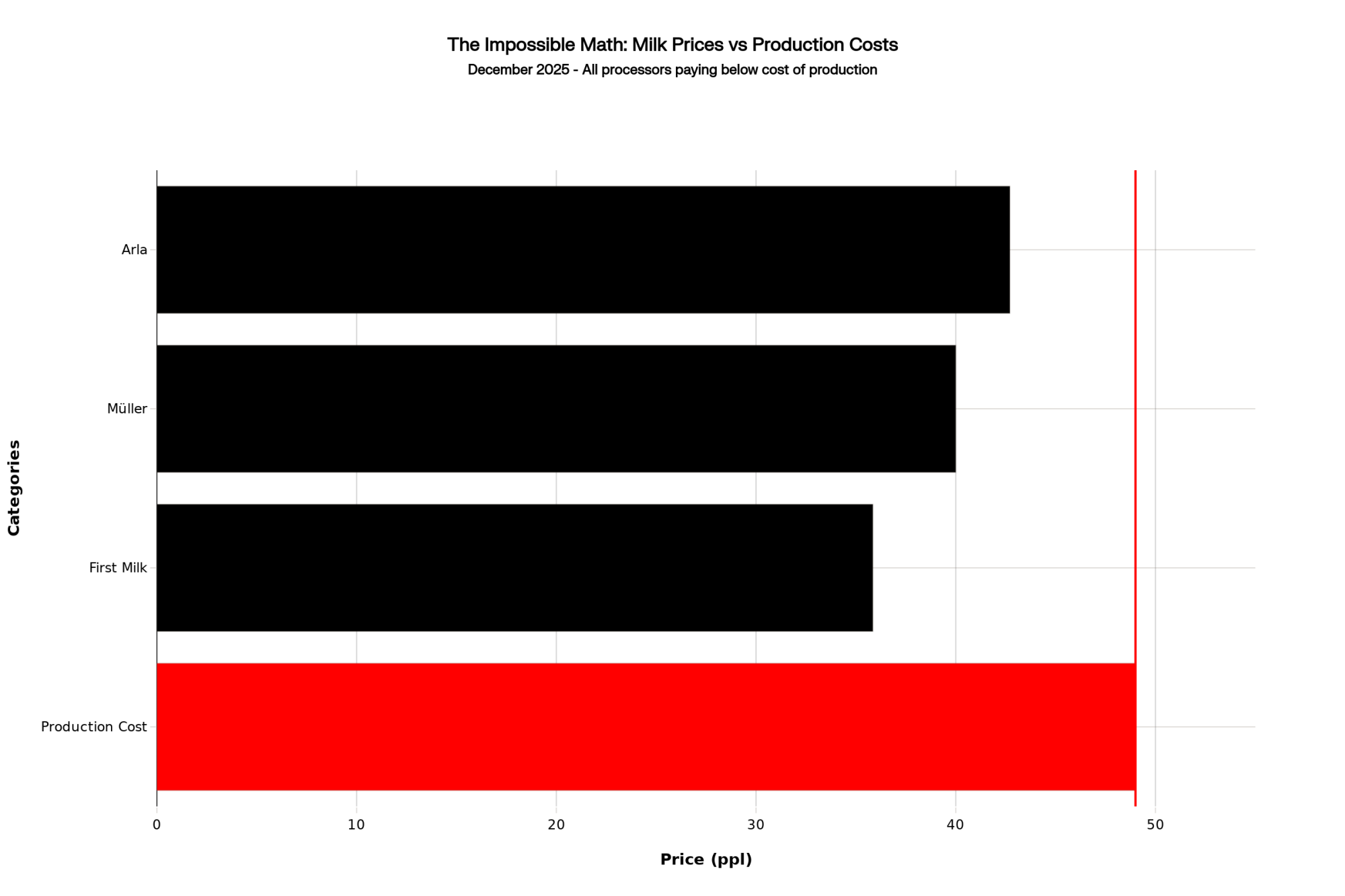

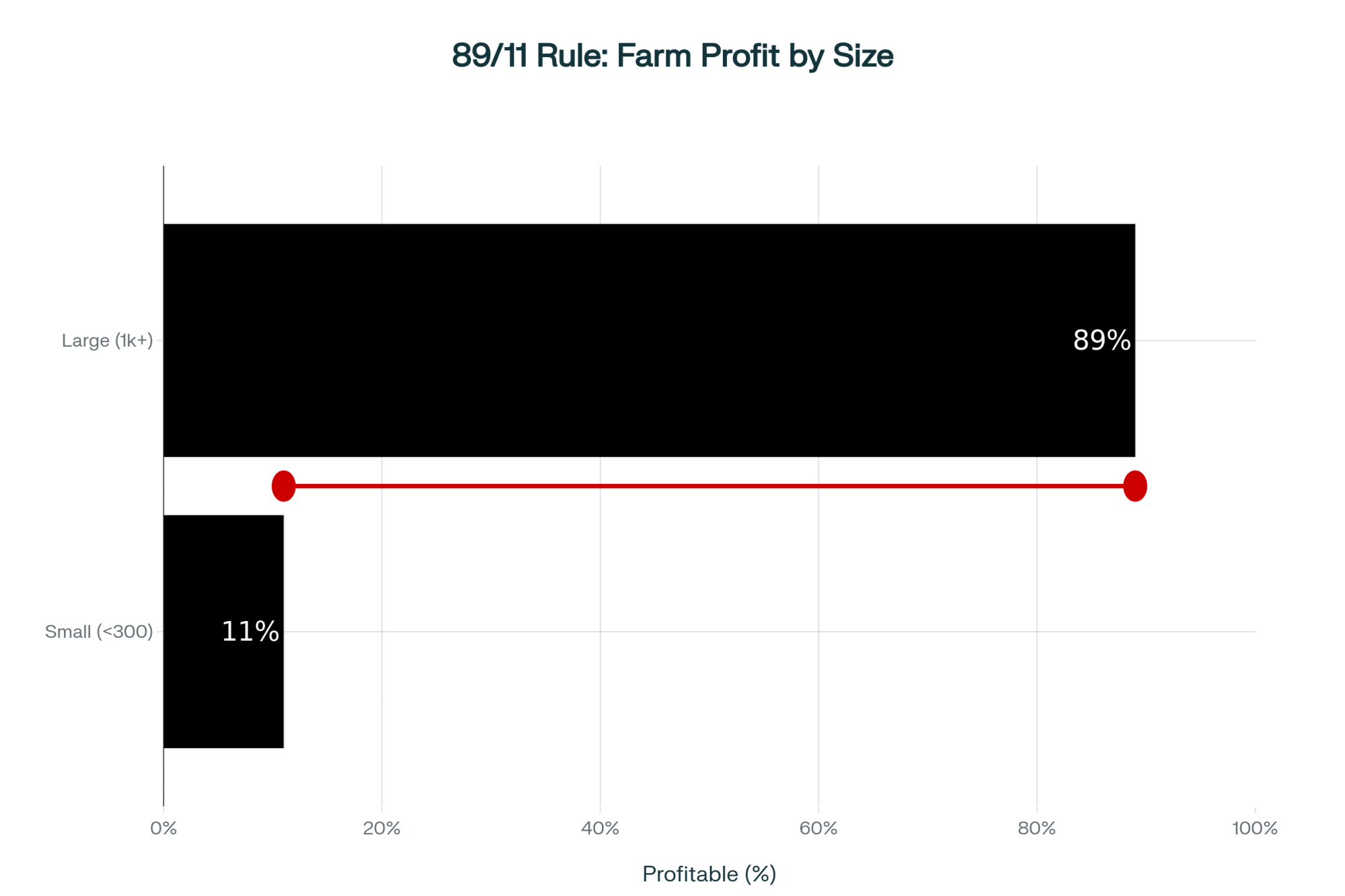

EXECUTIVE SUMMARY: Lactalis cutting 270 dairy farms while investing $11 billion in processing isn’t a contradiction—it’s the clearest signal yet that commodity milk is finished and component quality now rules everything. The stark reality: 89% of dairies over 1,000 cows are profitable while only 11% under 300 cows make money, and this isn’t about management skill—it’s structural economics you can’t overcome with hard work alone. Three converging crises (interest rates doubling to 8%, heifer inventory at 20-year lows, and labor costs up 73%) have compressed what was once a gradual 5-year industry shift into an urgent 18-month decision window. Every dairy faces three paths: invest $6.75-10.25 million to scale beyond 1,000 cows, transition to premium markets (organic/specialty) despite 3-year losses, or exit strategically while you can still preserve family wealth. Real farmers are already choosing—a Minnesota couple successfully scaled to 1,100 cows, Vermont neighbors transitioned to organic, and a Wisconsin family preserved $2.1 million through strategic sale. The difference between 3.6% and 4.2% butterfat is now worth $529,000 annually for a 500-cow operation, making component performance literally the difference between survival and closure. Your window to control this decision closes in 18 months—after that, circumstances decide for you.

You know, when Lactalis—the world’s largest dairy processor—announces they’re cutting 450 million liters and ending contracts with 270 French farmers, we should probably pay attention. I’ve been digging into this, talking with producers, looking at the numbers… and what’s interesting is this isn’t just another market cycle. We’re seeing something bigger here, something that’s going to affect all of us, whether we’re milking 50 cows or 5,000.

What I’ve found is that the traditional commodity dairy model—you know, the one most of us grew up with—it’s changing faster than anyone expected. And the timeline to adapt? Well, that’s gotten surprisingly short.

Understanding Why Processors Are Making These Moves

So here’s what caught my attention in Lactalis’s 2024 financials: €30.3 billion in revenue, but only 1.2% net profit margins. That’s down from 1.45% the year before. Now compare that to their premium products—the yogurt division they bought from General Mills is generating 15-20% operating margins. Premium cheese? Consistently 8-12% margins.

Lactalis’s supply director explained in their October statement that the valuation of excess milk is often very low and subject to market volatility—language that really reflects how processors are viewing commodity markets these days. When a processor that size essentially says commodity milk isn’t worth the trouble… well, that’s not just complaining, is it?

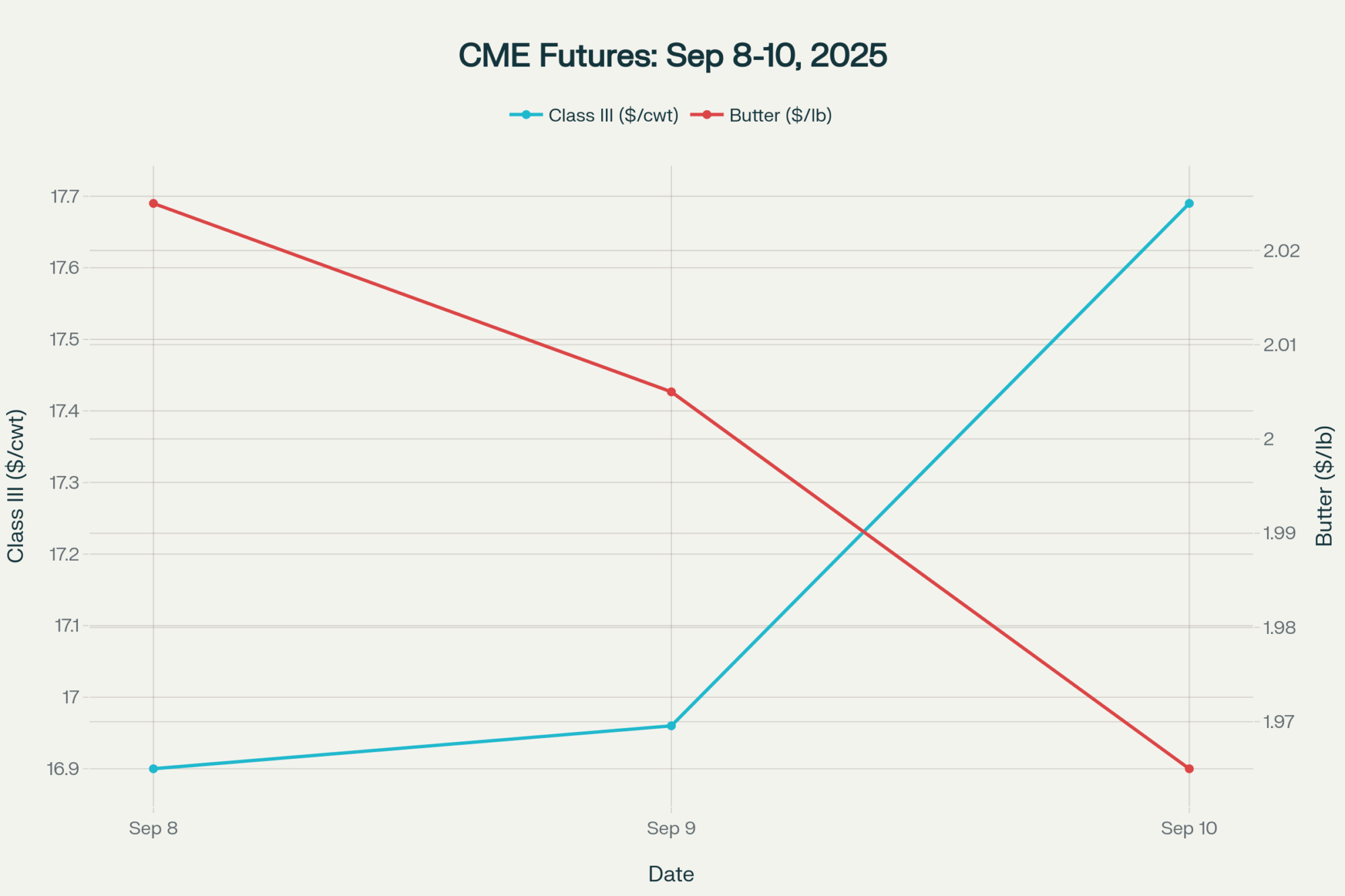

FrieslandCampina’s been going through similar challenges. They’ve talked about timing mismatches—buying milk at one price, processing it, then having to sell into a lower market. That kind of volatility makes it really tough to plan, and shareholders don’t like uncertainty.

The Component Game Has Changed Everything

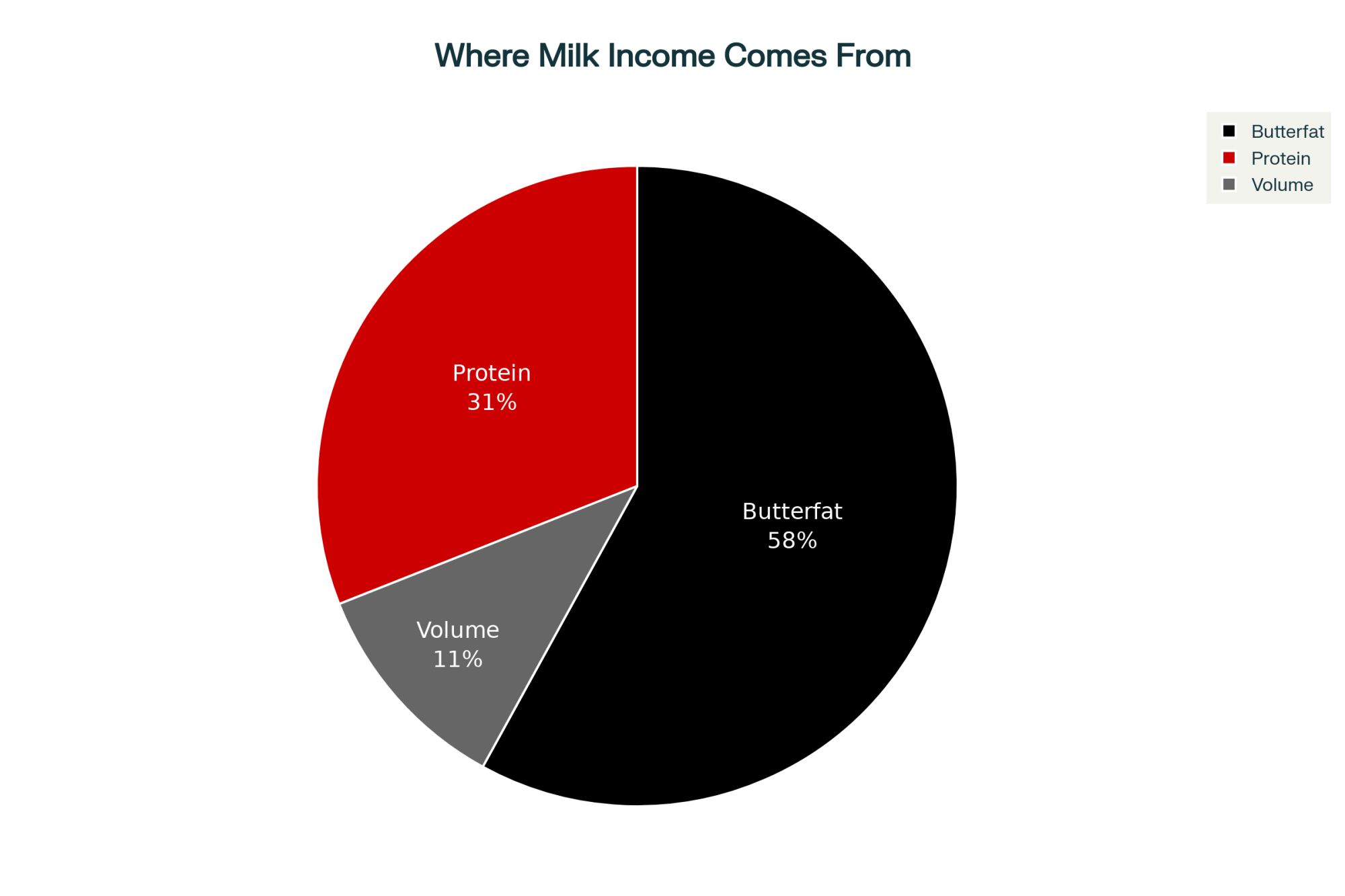

I was talking with a Wisconsin producer last week—he’s running 650 cows near Fond du Lac—and he helped me understand just how much components have shifted the whole economics of dairy farming. USDA data from November shows butterfat now represents 58% of your milk check value, and protein adds another 31%. Think about that… 89% of your income comes from components, not volume.

His neighbors who consistently hit 4.23% butterfat compared to the regional average of 3.69%? They’re capturing about $4.60 more per hundredweight. For a 500-cow operation producing 23,000 pounds per cow annually, that works out to roughly $529,000 in additional revenue—though your actual numbers will vary with production levels and regional premiums, of course.

Cornell’s latest farm business data shows some interesting patterns:

- The big operations—1,000+ cows—they’re hitting 4.0-4.3% butterfat with 3.3-3.5% protein pretty consistently

- Mid-sized farms, say 300-500 cows, generally average 3.6-3.8% butterfat, 3.0-3.1% protein

- And here’s what’s telling: large farms maintain about 2% daily variation in components while smaller operations see 5-10% swings

Now, getting those high components isn’t just about genetics. You need systematic management—a good nutritionist runs $80,000 to $120,000 a year, based on what I’m hearing. Feed testing programs add another $15,000 to $25,000. Those precision feeding systems? Dealers are quoting $250,000 to $500,000, depending on what you need.

The math gets tough for smaller operations. When you spread the combined cost of nutritionist, vet services, and consultants across a thousand-cow operation, it might come to $0.08-0.12 per hundredweight. But for a 200-cow farm? You’re looking at $0.40-$0.60 per hundredweight for the same level of professional support. That’s a huge competitive disadvantage.

Three Things Hitting Us All at Once

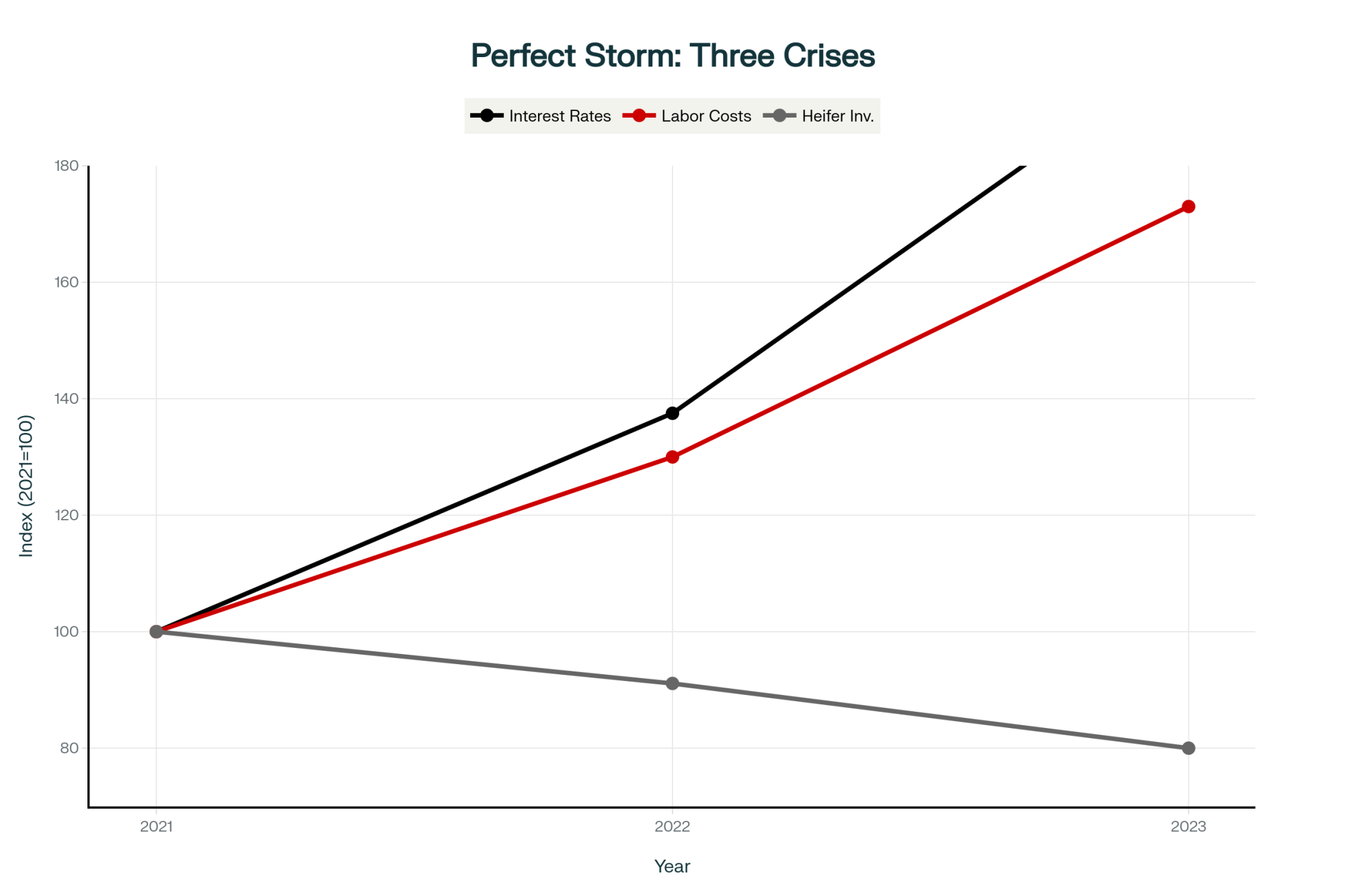

Cornell’s dairy economics team has been documenting what they’re calling a compressed decision timeline, and I think they’re onto something. Three things have converged, forcing us to make decisions faster than we’re used to.

Interest Rates Hit Like a Hammer

Federal Reserve data shows operating loan rates doubled—went from about 4% in 2021 to over 8% by late 2023. Haven’t seen rates like that in 20 years. A lender in Pennsylvania told me that operations that were barely profitable at 4% are now losing $3,000 to $5,000 monthly.

The Illinois farm management folks found that farms carrying significant debt saw interest costs per tillable acre jump from $33 to $60 in three years. That’s 82% more in fixed costs, and you can’t pass that along to your milk buyer.

What really concerns me is the Q3 2024 ag lending data—operating loan volumes are up over 30% for the third quarter in a row. A Wisconsin banker friend put it best: “This isn’t growth borrowing, it’s survival borrowing.”

The Heifer Shortage Nobody Saw Coming

CoBank’s August report lays out a fascinating situation—dairy heifer inventory’s at a 20-year low just when we need expansion for all this new processing capacity.

Here’s how we got here: the breeding data shows beef semen sales to dairy farms tripled from 2.5 million units in 2017 to 7.2 million by 2020. Last year? 7.9 million of the 9.7 million total units were beef semen.

Can’t blame anyone really. When beef calves were bringing $1,000 to $1,500 last October, while it costs $2,200 to $2,500 to raise a heifer worth maybe $1,600… the math was obvious. Problem is, we all did the same math at the same time.

CoBank thinks we’ll lose another 800,000 head before things turn around in 2027. An Idaho producer told me he’s been offered $3,200 for breeding-age heifers—if he had any. “Five years ago at $1,400, I had too many,” he said. “Now I can’t find them at any price.”

Labor Is Getting Impossible

Texas A&M’s 2024 research shows that immigrant workers make up 51% of dairy labor and milk 79% of our cows. Their models suggest losing that workforce would cut U.S. milk production by 48.4 billion pounds annually. That’s not a typo.

And it’s not just finding workers—it’s affording them. USDA data shows dairy wages went from $11.54 an hour in 2015 to $18-20 by 2024. A large operations manager in New Mexico told me they’re at $28 an hour when you factor in housing, benefits, and recruitment. “And we still can’t stay fully staffed,” he added.

Three Producers Who Found Their Way Through

Despite all these challenges, I’ve met several operations that have successfully navigating this transition. Let me share what they did differently.

Smart Scaling in Minnesota

There’s a couple in central Minnesota who expanded from 350 to 1,100 cows between 2019 and 2023. They saw their co-op’s base program would limit growth for mid-sized farms, so they moved early. Got financing at 3.5% before rates spiked, used sexed semen exclusively for three years to build internally, and partnered with an experienced Venezuelan family.

What’s smart is they expanded in phases over four years—each phase had to cash flow before they moved to the next. They’re now shipping butterfat at 4.1% consistently and have signed a five-year contract with a cheese plant 40 miles away. Their breakeven’s around $17.50 per hundredweight, so they’ve got a cushion even when markets get tough.

Going Organic in Vermont

A Vermont family with 480 cows went organic in 2021—right when everyone said that market was full. Key thing? They got Organic Valley’s commitment in writing before starting the transition. They lost $210,000 over three years, but off-farm income and some timber sales bridged the gap.

Today, they’re netting $3.80 per hundredweight after all costs. “We focused on keeping cows healthy and production steady rather than trying to expand during transition,” the son told me. They maintained 92% of conventional production throughout the transition—well above the 85% average.

Making the Tough Call in Wisconsin

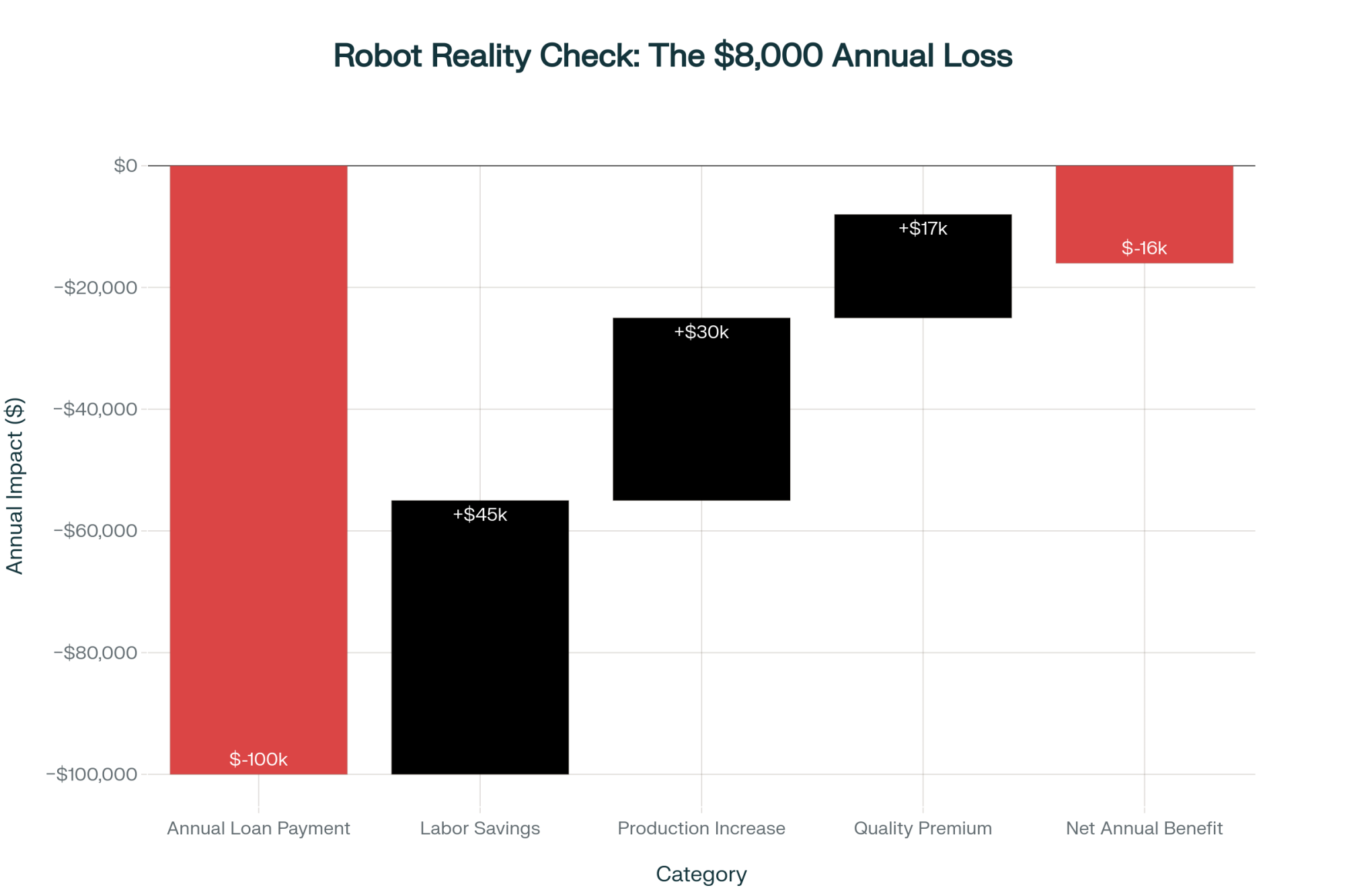

This one’s harder to talk about. A couple near Eau Claire sold their 280-cow operation in March 2024 after recognizing they were in what economists call the 18-month window—sustained losses with limited options. At 58, with kids established off-farm, expanding to a competitive scale meant $6 million in new debt.

They sold into a strong cull market, leased the cropland to a neighbor, and kept the house and 40 acres. The husband’s now using his 30 years of experience as a co-op field rep. “I sleep better, my wife’s happier, and financially we’re ahead,” he told me. They preserved about $2.1 million in equity that probably would’ve disappeared if they’d hung on another year.

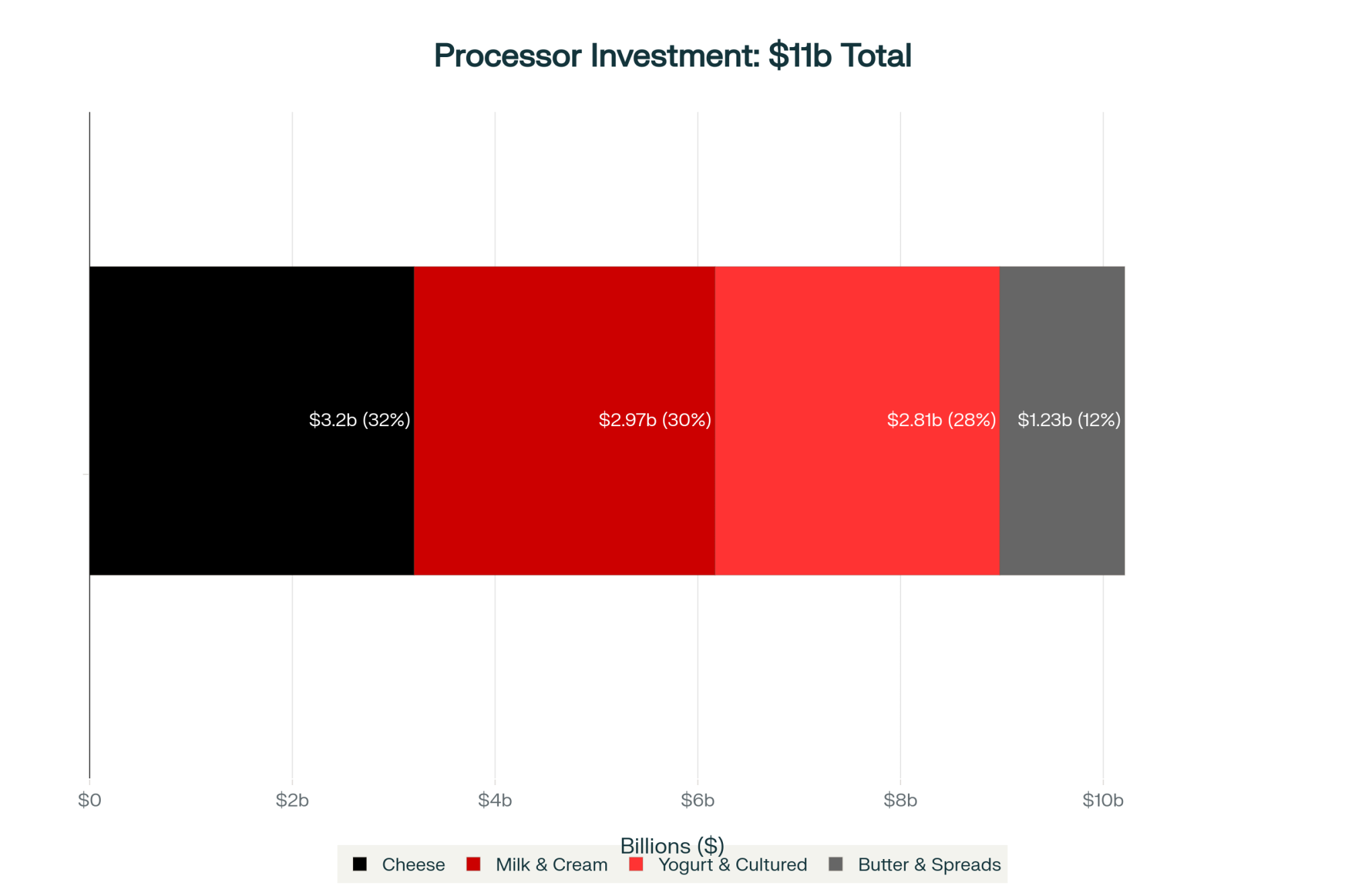

Where All This New Processing Investment Is Going

IDFA announced $11 billion in new processing capacity, and where that money’s going tells you everything about industry direction. Their October breakdown shows:

- Cheese gets $3.2 billion—32% of everything

- Milk and cream processing: $2.97 billion—30%

- Yogurt and cultured products: $2.81 billion—28%

- Butter and spreads: $1.23 billion—12%

Three new cheese plants in the Texas Panhandle need 20 million pounds of milk daily by mid-2025. But these aren’t commodity operations—they’re component extraction facilities making mozzarella for export while capturing valuable whey proteins.

What they’re NOT building? Commodity powder plants or basic fluid bottling. A processing engineer in Wisconsin explained it well: “We’re maximizing value from every component now. Just removing water to make powder doesn’t cut it anymore.”

And here’s something else—up in the Northeast, a couple of smaller specialty cheese operations just expanded. They’re not huge, but they’re finding success focusing on local markets and agritourism. Different model entirely from the big Texas plants, but it shows there’s more than one way forward. Out in California’s Central Valley, I’m seeing similar patterns with artisan operations carving out niches even as the big players consolidate.

The Cooperative Evolution We Need to Talk About

This is uncomfortable for many of us, but cooperatives have changed dramatically since DFA was formed in 1998 through regional mergers. They now control 30% of U.S. milk production, and after buying 44 Dean Foods plants in 2020, they’re both the biggest milk marketer AND processor.

A former board member explained how this creates tension: “When your co-op owns processing plants, optimizing those facilities becomes as important as your milk check—sometimes more important.”

Base-excess programs show this complexity. Cornell’s research indicates these programs typically use your best three consecutive months over three years as “base.” Milk over that? You might pay penalties of $5 to $13.30 per hundredweight.

A Vermont producer shared his frustration: “We wanted to add 50 cows to get more efficient, but overbase penalties would’ve killed any benefit. We’re locked at the current size.”

Meanwhile, operations that were already large when base programs started? They’re fine. It’s the 300-cow farms trying to grow to 500 that get squeezed.

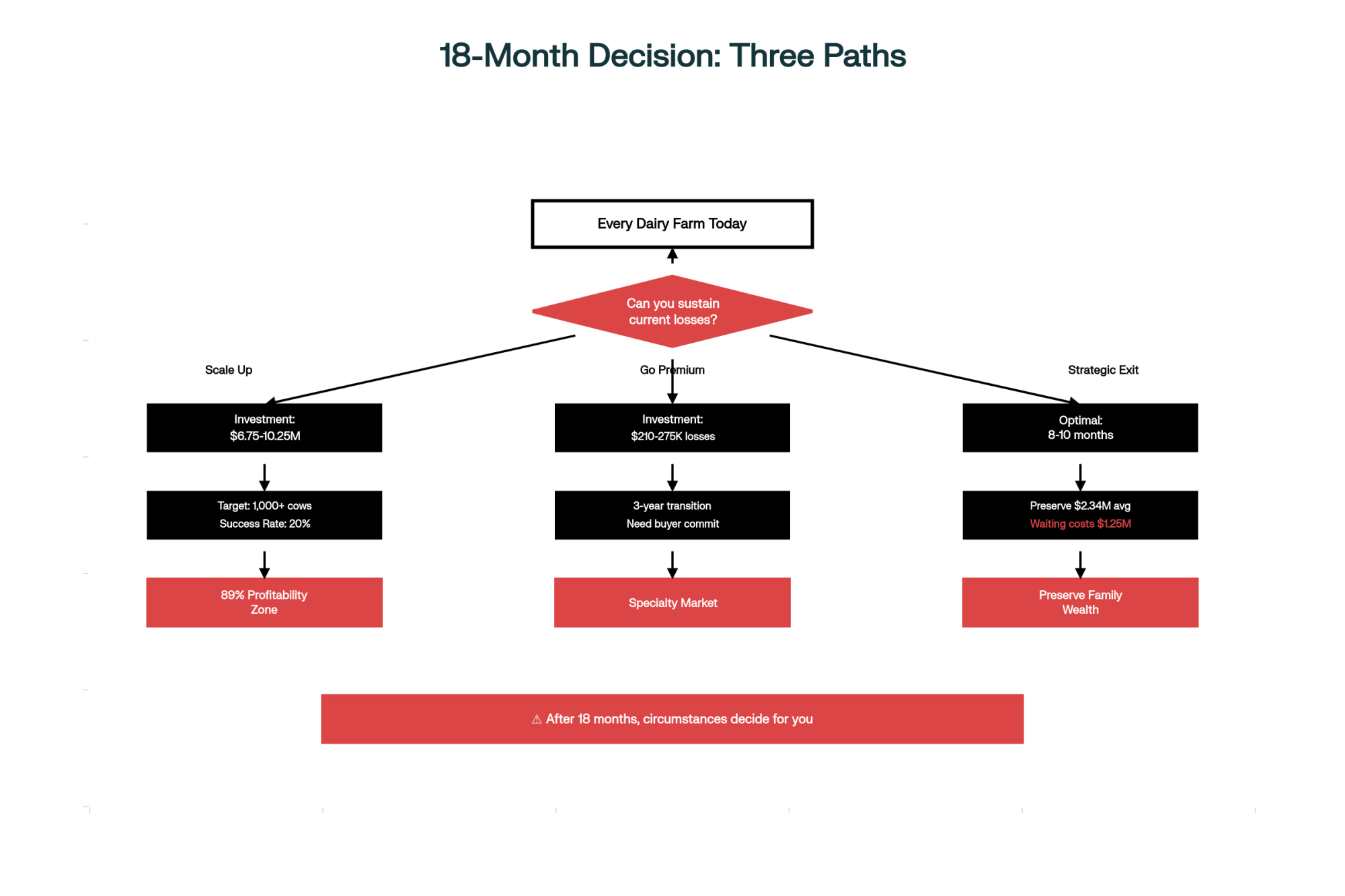

Your Three Paths Forward—Let’s Look at Real Numbers

Path Comparison at a Glance

| Factor | Scale Up | Go Premium | Strategic Exit |

| Investment | $6.75-10.25M | $210-275K losses | Preserve equity |

| Timeline | 4-5 years | 3-year transition | 8-10 months optimal |

| Success Rate | ~20% | Varies by market | 100% if timed right |

| Key Risk | Debt burden | Market saturation | Waiting too long |

Extension economists from Cornell and Wisconsin show that farms with sustained losses typically face critical decisions within 12-18 months. So what are your actual options?

Path 1: Scale Up to Compete

Investment Required: $6.75-10.25 million total

- Buildings and infrastructure: $3.5-5.0 million

- Cattle at current prices: $2.25-3.0 million

- Feed base expansion: $500,000-1.5 million

- Working capital: $500,000-750,000

Success Rate: According to lending industry estimates, about 20% achieve projected returns. Key Factor: Usually need family money for unexpected challenges. Financing Options: USDA FSA offers beginning farmer programs and guaranteed operating loans through participating lenders, though eligibility and terms vary by operation and region. Some states also have specific dairy expansion programs worth exploring.

Path 2: Find Your Premium Market

Organic Transition Example:

- Typical losses: $210,000-275,000 over 3 years

- Pay organic feed prices (30-50% higher) while getting conventional prices

- Need written buyer commitment before starting

- Must maintain 85%+ production through transition

Potential Returns: $2.45/cwt net (vs. -$5.29 for conventional, based on USDA 2023 data). Reality Check: Most regions aren’t currently seeking new organic production. Alternative Options: Consider grassfed certification, A2A2 markets, or local/regional branding

Path 3: Strategic Exit While You Can

Timing Matters—Example for 300-cow operation with $2M debt:

Exit at 8-10 months:

- Assets bring ~$4.65 million

- After $2M debt and costs ($230,000-390,000): $2.26-2.42 million preserved

Forced sale at 16-18 months:

- Assets bring ~$3.4 million (discounted)

- After everything: $650,000-970,000 retained

The difference: Over $1.4 million in family wealth

The Technology Wave is Coming Fast

I attended the Protein Industries Summit in Chicago last month, and what I heard was eye-opening. McKinsey’s early 2025 biotech analysis shows precision fermentation has already hit cost parity for certain dairy proteins. Boston Consulting thinks these proteins will be five times cheaper than ours by 2030.

Here’s what’s already happening—Perfect Day’s animal-free whey is in Ben & Jerry’s ice cream right now. Not someday. Today. Fonterra’s partnerships with Superbrewed Food and Nourish Ingredients show where big players are heading. Fonterra indicated in its August 2024 announcements that ingredients from these technologies can be used alongside traditional dairy products. Translation: they’re building systems that can use proteins from cows or fermentation tanks—whatever’s cheaper.

And it’s not just startups anymore. I’m seeing major food companies quietly building fermentation capacity. They’re hedging their bets, preparing for a world where they can source proteins from multiple streams.

How This Hits Different Regions

This transformation affects regions differently, and understanding your local dynamics matters.

California: UC Davis research shows farms with less than 22% quota coverage pay more into the system than they get back. “We’re subsidizing the big quota holders,” a Tulare County producer told me.

Southeast: Maintains higher Class I fluid use—over 60% according to Federal Orders—which provides some buffer since processors need consistent daily deliveries. But even there, consolidation pressure is building.

Upper Midwest: All about cheese, so components rule everything. Wisconsin processors consistently tell me 4% butterfat is their practical minimum for preferred suppliers.

Plains States: Seeing aggressive expansion with new processing, but these plants want a minimum of 50,000+ pounds daily per farm. Can’t deliver that volume? You won’t get a contract.

Pacific Northwest: Interesting developments with smaller operations finding niches in farmstead cheese and direct marketing. Not for everyone, but it’s working for some.

Northeast: Beyond the specialty cheese operations, there’s also growth in agritourism and on-farm processing. Entirely different economics, but viable for the right location.

Western States: Water rights and environmental regulations adding another layer of complexity to expansion decisions.

Questions to Ask Yourself Right Now

Before you make any big decisions, honestly assess:

- Are you covering all costs, including family living?

- Can you achieve 4%+ butterfat consistently?

- Do you have succession lined up?

- What’s your debt-to-asset ratio?

- Could you survive another year like 2023?

- What would happen if you lost two key employees tomorrow?

- Is your processor investing in commodity or specialty capacity?

- Are there emerging environmental regulations that could affect you?

What This All Means for Your Planning

After looking at all this, here’s what I think matters most:

Component performance isn’t negotiable anymore. The difference between 3.6% and 4.2% butterfat can mean hundreds of thousands annually for a 500-cow operation. That fundamentally changes farm economics.

That 12-18 month window Cornell documented? It’s real. Interest rates, heifer availability, and labor costs compressed what used to be a multi-year adjustment into a much shorter period. Within the next 12-18 months—essentially by mid-2026, based on the timeline Cornell economists have documented—many operations will have made their choice, voluntarily or not.

Scale economics show clear breaks. USDA data showing 89% profitability for 1,000+ cow operations versus 11% for under 300 cows… that’s not about who’s a better manager. It’s structural advantages smaller operations can’t overcome.

Your processor’s strategy matters more than ever. If they’re investing in commodity powder, you’ve got time. If they’re building component extraction or specialty facilities, that tells you something different.

Technology adoption keeps accelerating. The Good Food Institute tracked $840 million in precision fermentation investment last year. Alternative proteins are moving from the experimental to the commercial stage faster than most of us expected.

Risk management tools—like Dairy Margin Coverage and Dairy Revenue Protection—might buy you time but won’t change the fundamental economics. They’re Band-Aids, not cures.

The Bottom Line

What Lactalis is doing—cutting 450 million liters while investing in premium capacity—makes sense when you understand their strategy. They’re consolidating relationships with farms that can deliver consistent, high-component milk at scale while preparing for fermentation-derived proteins.

The Minnesota couple who scaled smart, the Vermont family succeeding in organic, the Wisconsin couple who preserved wealth through planned exit—they all made different choices. But they shared a realistic assessment of where things are heading and made decisions accordingly.

For those of us still figuring out our path, an honest assessment of where we fit in this evolving structure is critical. Whether that means pursuing scale, finding premium markets, or planning transition, the key is making informed decisions while we still have options.

And if you’re wondering about the next generation—I talked with several young farmers recently. The ones succeeding are incredibly sharp, using technology in ways we never imagined, and they’re not afraid to try completely different models. That gives me hope, even as things change.

The dairy industry will keep producing milk—consumers guarantee that. But who produces it, how it’s valued, and what matters most? That’s changing fundamentally. Understanding where your operation fits in that transformation might be the most important analysis you do this year.

Because waiting for things to “go back to normal”? Well, I think we all know that ship has sailed.

The Bullvine provides ongoing analysis and resources at www.thebullvine.com. Cornell’s Dairy Markets and Policy program and Wisconsin’s Center for Dairy Profitability offer valuable planning tools. The producer experiences shared here reflect confidential discussions, with identifying details modified for privacy.

KEY TAKEAWAYS

- You Have 18 Months to Decide: Cornell economists confirm sustained losses trigger forced decisions within this window—control your choice now or lose that option forever

- Three Paths Still Work: Scale to 1,000+ cows ($6.75-10.25M investment, 20% success rate) | Go premium (organic/A2/grassfed, 3-year transition) | Exit strategically (preserves $1.4M more than waiting)

- Components = Survival: The 0.6% butterfat difference between average and top herds is worth $529,000/year, and processors are making this gap the entry requirement

- The 89/11 Rule: 89% of 1,000+ cow dairies profit while only 11% under 300 cows survive—this is structural economics, not management quality

- Processors Already Chose: They’re investing $11B in component extraction while cutting commodity suppliers—understand their strategy to predict your future

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Seizing the Moment: Maximizing Milk Solids Output Through Strategic Nutrition and Genetics – This guide provides the tactical “how-to” for the main article’s “what.” It details precise nutritional strategies, feed supplements, and grazing management techniques for maximizing butterfat and protein, directly linking daily management to component-driven profits.

- US Dairy Market in 2025: Butterfat Boom & Price Volatility – How Farmers Can Protect Profits – This market analysis provides a “Dairy Farmer Survival Checklist” for navigating the component economy. It demonstrates how to use risk management tools like DRP, lock in feed costs, and make strategic culling decisions to protect your operation from volatility.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – This piece explains the why behind the component surge: genomics. It details how millions of cattle tests have revolutionized breeding, permanently shifting the industry’s genetic base and enabling the high-component cows that processors now demand.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!