Inside the Minnesota families who asked for help before it was too late—and why their choice could change how you think about survival.

EXECUTIVE SUMMARY: Katie Elvehjem was ready to drive 95 miles per hour down a back road—anything to escape the pressure of cows calving, kids hungry, and a husband who couldn’t see she was drowning. Instead, she sent one email to a therapist. It saved her marriage. This article follows three Minnesota dairy families who made the call most farmers refuse to make: asking for help before the economics destroyed everything else. With Class III crashing toward $15 and margins at their lowest since 2012, the pressure is crushing—but nobody tracks how many farms fail because the marriage failed first. Free counseling exists. These families used it. And they discovered something the industry needs to hear: asking for help isn’t a sign of weakness. It’s the survival strategy that actually works.

I’ll never forget the moment I first read Katie Elvehjem’s story in Jenny Berg’s December reporting for the Star Tribune. Something in those words stopped me cold—not because it was dramatic, but because it was so achingly familiar. So ordinary. The kind of breaking point that happens in kitchens and barns across dairy country every single day, invisible until someone finally finds the courage to speak.

It was a Friday evening in spring 2024. Katie’s cows were calving—you know what that means, someone checking every few hours around the clock. Her children were clamoring for dinner, that hungry-tired kind that doesn’t negotiate or wait. Her husband Matt Laubach was out in their Glenwood fields, racing daylight to get seed in the ground before the weather turned.

But the thing eating at her most? Matt couldn’t seem to see she was drowning.

“I felt like driving 95 miles per hour down a road somewhere just to get out some steam,” Katie told the Star Tribune.

What happened next still gives me chills. Because Katie didn’t bolt. She didn’t give up. Instead, she did something that would have been unthinkable to her grandparents’ generation of Minnesota farmers.

She sent an email to a therapist.

Within a week, Katie and Matt were in couples counseling. And what happened in those sessions didn’t just save their marriage—it transformed how they run their farm, raise their children, and talk to each other at 2 AM during calving season.

This is a story about what breaks. But more importantly, it’s about what heals when people find the courage to reach out.

The Numbers We Never Talk About

Here’s something that keeps me awake at night.

The dairy industry obsesses over metrics. Milk prices per hundredweight. Feed costs. Margins. Herd size. Butterfat percentages. We track every data point with religious devotion—it’s just what we do.

But there’s a number nobody tracks: how many farms we’re losing not to bad genetics or brutal markets, but to marriages that couldn’t survive the business.

“This could get uglier and uglier,” Katie remembered thinking that spring evening, according to the Star Tribune. “And the thing that brought us together, our farm, could drive us apart.”

The courage it took to admit that fear out loud. To name the thing so many of us carry silently.

Katie isn’t alone. But what the crisis headlines miss—what moved me most in researching these stories—is that families are fighting back. And against every odd, they’re winning.

The Woman Who Understands

Monica McConkey grew up on a farm in northwestern Minnesota. She’s spent over 25 years walking alongside families in crisis, and since 2019, she’s served as an agricultural mental health counselor through a program funded by the Minnesota Legislature and administered by Region Five Development Commission.

When Katie’s email arrived, Monica knew exactly what she was seeing. A family at the breaking point—but not yet broken.

“In tough economic years like we’re in right now, there might have to be changes to lifestyle and spending,” Monica explained to the Star Tribune. “That’s hard, and those are hard conversations to have in marriage.”

Her prescription was deceptively simple: schedule one hour every week to talk about money. Put it on the calendar. Make it happen. Run the marriage a little more like a million-dollar company might run its board.

Katie and Matt started holding weekly financial meetings at their kitchen table. And I won’t pretend those first conversations were easy—they were brutal. Raw disagreements about whether to till the fields. Whether to sell the cattle. Whether they could afford another year of hoping prices would turn.

But somewhere along the way, something shifted. The meetings stopped feeling like surgery and started feeling like planning.

“After almost two years with Monica,” Katie told the Star Tribune, “our fights sound more like banter now.”

Both she and Matt now call their marriage “solid”—a word neither would have used that spring evening in 2024.

What gives me hope? Their 10-year-old daughter, Finley, has started joining those weekly meetings. Not to burden her with adult problems, but to show her what her parents had to learn the hard way: farming isn’t really about driving tractors anymore. It’s about having the conversations nobody wants to have—and coming out stronger.

“We have too much invested in one another,” Katie said.

Even now, she frames love in economic terms. But watching her stand in that pasture with Matt, debating the cattle sale that used to spark real fights—what Berg captured in her reporting is something different in the air. Something that looks like a partnership rebuilt from the ground up.

The Math That Nearly Broke Them

Let me paint you a picture of what Katie and Matt were carrying.

They run more than 1,200 acres near Glenwood in Pope County. They’re bringing in about a million dollars annually, which sounds impressive until you realize, as the Star Tribune documented, they’re hoping to scrape off maybe $50,000 in profit.

Katie raises beef cattle. With beef-on-dairy calves now commanding prices north of $1,300—some auctions topping $1,375 per hundredweight according to industry reports—and fed cattle prices pushing toward $230 per hundredweight in late 2025, that side of the operation might be what’s keeping them afloat.

But the milk market told a different story through 2024 and into 2025. Class III hit $18.20 in September, then crashed toward the mid-$15 range for early 2026. The Dairy Margin Coverage program calculated margins below $7 per hundredweight through much of 2023—the lowest since 2012.

So when Katie and Matt stand in their pasture in November, staring at what the Star Tribune described as “a quarter million dollars” worth of cattle, and Matt says, “Why don’t we just sell?”—it’s not really about the cows.

It never was.

“Matt sees these animals and just sees dollar signs,” Katie told the Star Tribune, stroking a white cow’s fur with a slight smile that suggested they’d had this argument before. Many times.

But here’s what’s different now: they can have that argument without it threatening everything else.

“Each debt, each purchase, and each business decision is more stressful with kids waiting in the wings,” Matt reflected. “A bad decision could both destroy a business built over three generations and deprive their kids of a chance to farm in the future.”

The weight of that responsibility used to crush them separately. Now they carry it together.

A Princeton Family’s Quiet Revolution

Two hours east of Glenwood, another family was fighting their own battle—a story also documented in Berg’s Star Tribune feature.

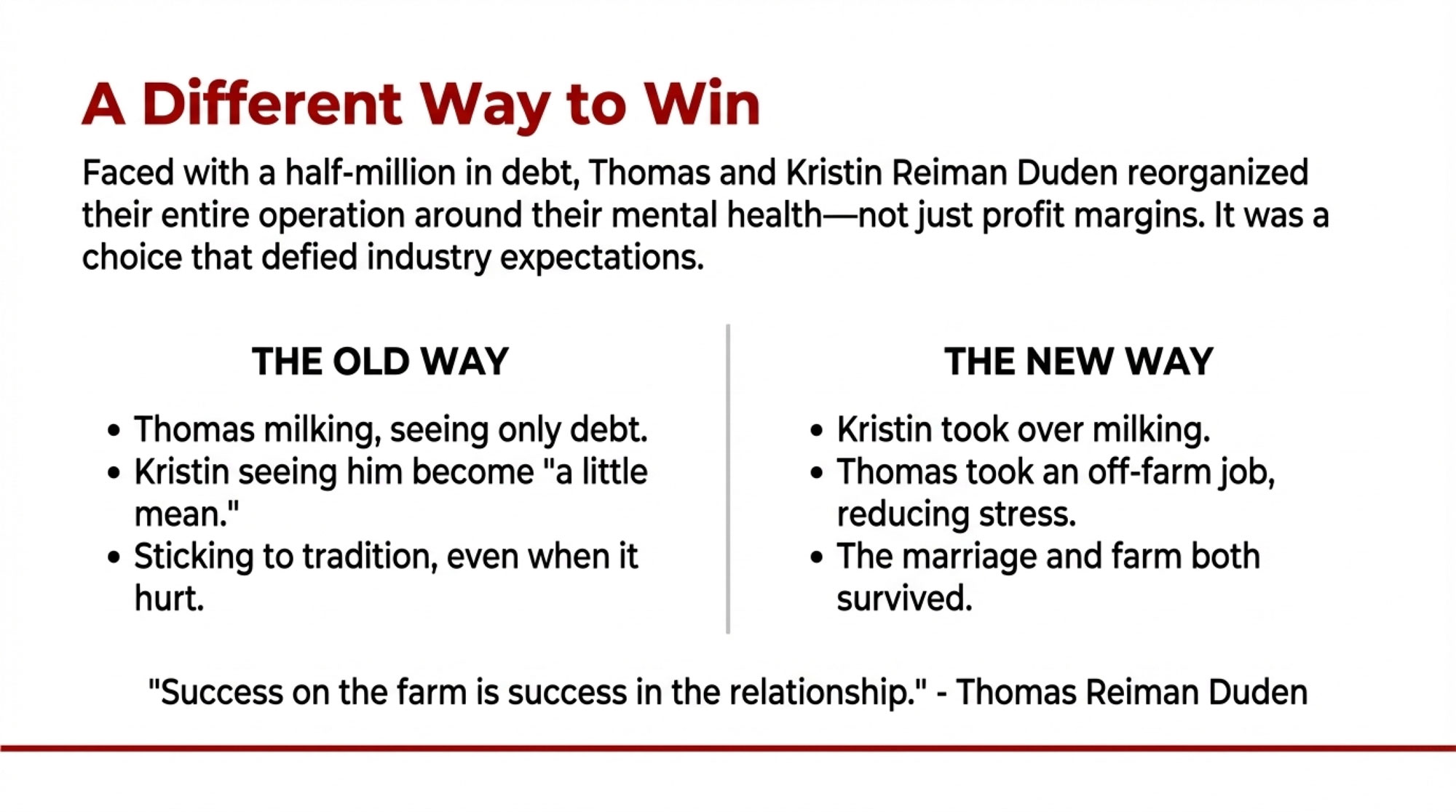

Thomas and Kristin Reiman Duden had taken over Kristin’s family dairy in Princeton, Minnesota, in 2017. About 40 cows—a small operation by today’s standards. The choice that year was stark: invest millions in expansion, or find another way forward.

They chose diversification. Bought tractors. Added a baler. Within two years, according to the Star Tribune, they owed about half a million dollars.

Thomas couldn’t bear to milk the cows anymore. Each time he walked into the barn, all he could see was money draining away. Kristin noticed him becoming dismissive—”a little mean,” as she described it to the Star Tribune. His moods darkened in ways that scared her.

Kristin was already in therapy—healing from what she described to the Star Tribune as a previous abusive marriage. One day, she asked Thomas to sit in on a session. Just for support.

What the counselors observed changed everything. They gently suggested Thomas might be “steeped in depression” himself—words that caught him completely off guard.

The moment of recognition. That he simply hadn’t seen what was happening inside himself. How many farmers reading this right now are living something they’ve stopped being able to recognize? How many spouses are watching it happen, not knowing how to break through?

Thomas and Kristin started couples counseling. They attended a couples retreat. There must have been nights when giving up seemed easier than restructuring everything they knew.

But then something remarkable happened.

They made a decision that defied every expectation the industry puts on farm families. They reorganized their entire operation around their mental health—not their profit margins.

Kristin took on milking—trudging out to the barn every 12 hours, finding in that rhythm a kind of grounding instead of drowning. Thomas took a job off the farm, training other farmers to use self-propelled sprayers.

In an industry where “real farmers” don’t take off-farm jobs—where stepping back from milking can feel like admitting failure—what Thomas and Kristin did was quietly revolutionary. They decided their marriage mattered more than how it looked to the neighbors.

The farm didn’t fail. The marriage didn’t fail. They found a different way to make both work.

“Success on the farm is success in the relationship,” Thomas told the Star Tribune.

It’s the kind of wisdom that only comes from nearly losing both—and choosing, every single day, not to let go.

What Farm Family Therapy Actually Looks Like

When a farmer calls Monica McConkey at (218) 280-7785, something remarkable happens: they don’t have to explain themselves.

They don’t have to translate what it means when the banker calls about the operating note. They don’t have to describe “spring fieldwork” or “calving season” or why taking a vacation is logistically impossible when you’re milking twice a day.

Monica grew up on a farm. She already knows.

The service is free and is funded through an appropriation from the Minnesota Legislature to the Region Five Development Commission. No insurance hoops. Phone, Zoom, or in-person. For as long as you need.

But what actually happens in those sessions? It’s not lying on a couch talking about your childhood. It’s practical. Strategic. Sometimes it’s as simple as scheduling that weekly financial meeting. Sometimes it’s harder: restructuring who does what, acknowledging depression that’s been hiding in plain sight, learning to fight in ways that don’t leave scars.

The couples who make it through often discover something unexpected: they’re still arguing over the same decisions, but now they’re on the same team.

That distinction—same team versus opposing sides—might be the difference between farms that survive this crisis and farms that don’t.

The Invisible Weight Farm Women Carry

A University of Georgia Extension study on farm wives documented something researchers call “emotional labor”—the invisible work that falls overwhelmingly on women in farm families. Being the eternal cheerleader. Tolerating stress-related irritability. Serving as a mediator when father and son clash over decisions.

One wife in the study captured it perfectly: “So my son has that stress of not filling his daddy’s shoes… So I have to kind of—be the mediator.”

Another described what farm families sacrifice: “Time is huge. The things that they miss… Everything. They miss everything… Everything.”

That word, repeated three times. Everything. Anyone who’s farmed knows exactly what she means.

But the Georgia researchers also found what helps. Faith and prayer. Talking with other farmers who “get it”—often at the fuel pump or seed store. Making creative use of limited time: grabbing a meal away from the farm, turning a drive to the parts store into “couples time.”

Small moments that don’t look like anything from the outside—but feel like oxygen when you’re drowning.

Echoes of the 1980s

Minnesota has been here before.

Bob Worth farms soybeans and corn near Lake Benton. When Berg interviewed him for the Star Tribune, he talked about 1986—the year his local bank told him he couldn’t get any more money.

That harvest, he couldn’t get out of bed. Fighting with his wife. Sleeping on the couch.

“There were times we were shaky,” he admitted.

But Bob and his wife made it through. Nearly four decades later, watching young families navigate similar pressures, he carries a weight of understanding few others can share.

“I feel for the young families,” he told the Star Tribune.

Emily Hansen, a Commercial Agriculture Educator with University of Illinois Extension, drew the parallel carefully in recent comments to Brownfield Ag News: “Comparing these economic times… to what happened back in the 80s, we’re not quite at that point, but everybody’s stressed right now.”

Greg Ibendahl from Kansas State University was more direct: today’s debt load is “similar to the run up to the 1980s farm crisis.” Land prices remain high, he noted, “but it wouldn’t take much to duplicate a 1980s situation where land prices would drop. So far, we haven’t seen that.”

The Federal Reserve’s agricultural credit report confirms the pattern—credit conditions have softened for eight straight quarters.

Here’s what the history books miss about the 1980s: the economy turned around in 1986, but rural communities took much longer to heal. The wounds don’t heal on the market’s timeline. They heal on the family’s timeline. Or they don’t heal at all.

The Relief Milker Who Gives Families Their Lives Back

I want to share one more story—one that’s circulated through Minnesota’s dairy community and captures something essential about what survival really looks like in this industry.

Michele Schroeder’s family dairy farm in Glenwood sold their cows in 2018-2019. Rock-bottom milk prices. Bulk tank needed replacement. The writing was on the wall.

The last night before the cows left, all five family members milked together. There were tears—some more than others. Who would have thought that years of working every day without a break, the stress of paying bills, dealing with bitter cold and extreme heat day in and day out would result in tears at the end?

But here’s what happened next. Instead of leaving dairy entirely, Michele became a relief milker for other farms—showing up so families can take the breaks she never got to take.

She regularly drives—sometimes 45 minutes or more, often in the dark—to milk someone else’s cows. In an industry that lost 58 dairy permits in a single month (November 2023, according to state data), she’s become a quiet lifeline for families trying to hang on.

That means a family gets to attend a kid’s game. Or just sleep. Or have a conversation that doesn’t end with someone walking away.

Her husband Jason joining the township board made a difference for their family—thinking and doing something completely different, a mental break from the constant weight of farming.

One farmer she milks for had a father who was dying of cancer. Every milking she covered meant the family could continue harvest while saying goodbye.

That’s what survival looks like. Not just hanging on yourself—but showing up so others can hang on too.

The Warning Signs Nobody Talks About

Agricultural mental health professionals and clinical research identify patterns that signal a farm family may need support:

- Arguments about farm decisions that circle back to the same unresolved tensions

- One partner feeling invisible, unheard, or carrying the emotional weight alone

- Avoiding financial conversations because they always end badly

- Physical exhaustion that doesn’t lift even after rest

- Irritability that’s becoming the default, not the exception

- Kids are starting to sense the tension, even when you think you’re hiding it

- Fantasies about just driving away—even for an hour

None of these make you broken. They make you human—a human carrying more than anyone should carry alone.

If you recognized yourself in that list, you’re not alone. You’re just at the point where Katie was when she sent that email instead of driving 95 miles per hour down a back road.

She made the harder choice. And it saved everything.

What Survival Really Looks Like

The industry will tell you we’re losing thousands of dairy farms each year. We’ll debate make allowances, milk pricing formulas, and export markets. But there’s a question underneath all the data that nobody seems willing to ask: How many of those farms are failing because the marriage failed first?

Katie and Matt are proof that it doesn’t have to end that way. They asked for help. They did the weekly meetings. They learned to argue on the same team. Their daughter is learning what it takes to run a business from a kitchen table in Glenwood—and she’s also learning that her parents love each other enough to fight for the marriage, not just the farm.

Their story proves it’s possible”. They restructured everything. Found new roles. They’re still milking 40 cows, still married, still showing that sometimes the unconventional choice is the only one that works.

Monica McConkey keeps answering her phone. So do Jennifer Vaughn in northern Minnesota and Tracie Rutherford-Self in the south. Relief milkers like Michele Schroeder keep showing up—often in the dark, often far from home—so another family can catch their breath.

Not every story ends this way. Some couples wait too long. Some farms can’t be saved even when the marriage survives. That’s the truth of it.

But Katie and Matt are proof that it’s possible. Thomas and Kristin are proof there’s more than one way through. And sometimes that’s enough—knowing it’s possible. Knowing you don’t have to figure it out alone.

This is what survival looks like. Not white-knuckling through alone. Not pretending everything’s fine when the kitchen-table conversations have gone silent. Not driving 95 miles per hour, hoping to outrun something that’ll be waiting when you get home.

Survival looks like sending that email. Making that call. Saying out loud, to someone who understands, “We need help.”

In an industry that prizes self-reliance, that’s not weakness. It’s a strategy. It’s deciding that staying afloat matters more than looking strong.

And for Katie, for Thomas and Kristin, for the families Michele milks for—it turned out to be the decision that saved everything else.

If You Need Help

Minnesota Farm & Rural Helpline: 833-600-2670 (free, confidential, 24/7)

Text: “FARMSTRESS” to 898211

Monica McConkey (Western MN): (218) 280-7785

Jennifer Vaughn (Northern MN): (218) 820-6626

Tracie Rutherford-Self (Southern MN): (507) 514-7057

988 Suicide & Crisis Lifeline (nationwide, 24/7)

For Canadian Producers: Contact your provincial farm stress line—every province has free, confidential support. In Ontario: 1-866-267-6255. In Alberta: 1-800-387-6030. In Manitoba: 1-866-367-3276.

You don’t have to explain what calving season means. You don’t have to justify why you can’t just “take a vacation.” You just have to reach out.

The farm can wait an hour. Your family can’t wait forever.

KEY TAKEAWAYS

- The metric nobody tracks: We obsess over milk prices and margins, but nobody counts how many farms fail because the marriage failed first—and it’s more than you think

- 95 mph or one email: Katie Elvehjem was ready to bolt. She sent an email to a therapist instead. Two years later, she and her husband call their marriage “solid.”

- Same team, not opposing sides: The couples who survive aren’t fighting less—they’re fighting together. Weekly financial meetings turned kitchen-table wars into planning sessions.

- Free help exists—use it: Monica McConkey: (218) 280-7785. Minnesota Farm & Rural Helpline: 833-600-2670. No insurance. No cost. No judgment. Just someone who gets it.

- Self-reliance is killing us: The families in this article did something the industry calls weakness. Turns out it was the smartest business decision they ever made.

This story draws on Jenny Berg’s deeply reported feature in the Star Tribune (December 2025), research from the University of Georgia Extension, Minnesota Department of Agriculture records, Federal Reserve agricultural credit data, and verified industry sources. The families profiled agreed to share their experiences publicly in hopes of helping others find the courage to reach out. If your story could help someone else, we want to hear from you: editor@thebullvine.com.

Learn More

- How Dairy Farmers Are Finally Breaking Free From the 365-Day Grind – and Finding More Time and Profit – Gain a blueprint for reclaiming your sanity by auditing labor distribution and implementing flexible milking schedules. This guide arms you with proven methods to cut the “365-day grind” while protecting your operation’s bottom line.

- The Wall of Milk: Making Sense of 2025’s Global Dairy Crunch – Secure your financial future with a survival roadmap that navigates the global “24-month trap.” This analysis exposes how biology-driven expansion is colliding with a $15 market and helps you position for the 2026 economic pivot.

- Beef-on-Dairy’s $6,215 Secret: Why 72% of Herds Are Playing It Wrong – Capture massive hidden premiums by mastering surgical beef-on-dairy genetics. This deep dive shatters the “shotgun” approach to breeding and reveals how genomic testing turns your bottom-tier cows into a high-margin primary profit center.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.