Your milk check received some help today, but your feed bill has just become critical.

EXECUTIVE SUMMARY: Alright, here’s the deal—feed costs just sucker-punched your milk check, and fancy butter rallies can’t hide it. Butter prices jumped 3.5¢ to $2.0850/lb, and cheddar blocks weren’t far behind, but September corn futures blew up by 62¢ to $4.45/bushel. That results in a $1.91 loss of margin per cow, per day, just like that. Margins? The milk-to-feed ratio plunged from 2.28 to 1.14—basically, we’re teetering on breakeven (or worse). Meanwhile, Europe and New Zealand are hustling hard—U.S. butter’s still a global bargain, but powder and cheese face tough competition. Global demand’s heating up, but your local profitability could freeze if you don’t hedge those feed costs now. Bottom line: The smart money’s already checking their coverage and running cash-flow stress tests. You should too—don’t wait for next week’s volatility to lock in anything you can on feed and milk.

KEY TAKEAWAYS

- Corn’s 62¢ spike just slammed margins by $1.91/cow/day.

Immediate play: Run your margin worksheet tonight. Figure out exactly what that does to your bottom line before you feed up tomorrow morning. - Margins are down—milk-to-feed ratio is 1.14, near 2008 crisis levels.

Smart move: Don’t just read about coverages and puts—call your broker or co-op feed guy before the market jumps again. - Butter’s 3.5¢ rally sounds sweet, but feed inflation eats it up.

Reset: Forward-contract fepossibleou can, and overlookignore lockian some floor on milk prices (those put options aren’t just for the risk-averse). - Global competition’s fierce—U.S. butter’s got the edge, but powder and cheese don’t.

Translation: Your local pricing power disappear quicklyh faglobal world buyers shop elsewhere. - Big gaps between blocks and barrels are signaling retail cheese demand, not foodservice strength.

Heads up: Realign your production mix if you can pivot fast—’tis the season for block-heavy orders.

Butter prices rallied a solid 3.5 cents to $2.0850/lb while cheese blocks gained 1.5 cents, providing much-needed support for dairy futures. However, September corn futures exploded 62 cents higher to $4.45/bushel in a single session – a move that slashes our calculated milk-to-feed ratio from 2.28 to just 1.14, dangerously close to breakeven territory.

Bottom line: Today’s corn spike just became the most critical number affecting your profitability. Our margin worksheet indicates that this corn move incurs an additional $1.91 per day in feed costs for the average operation per cow.

Today’s Price Action & Class Impact

| Product | Price | Daily Move | Weekly Δ | 30-Day Avg Trades* | Class Price Impact |

| Butter | $2.0850/lb | +3.50¢ | -14.3¢ | 8.2 trades | Class IV: +$0.12/cwt |

| Cheddar Blocks | $1.7750/lb | +1.50¢ | -3.1¢ | 6.8 trades | Class III: +$0.16/cwt |

| Cheddar Barrels | $1.7800/lb | -0.50¢ | -2.0¢ | 2.1 trades | Class III: -$0.05/cwt |

| NDM Grade A | $1.2600/lb | +0.50¢ | -0.6¢ | 12.4 trades | Class IV: +$0.05/cwt |

| Dry Whey | $0.5550/lb | +0.50¢ | -1.6¢ | 4.7 trades | Class III: +$0.05/cwt |

Net Class Impact: Class III equivalent: +$0.16/cwt | Class IV equivalent: +$0.17/cwt

*Source: CME Group Spot Call Data, 30-session rolling average

Class III/IV Equivalency Note: Calculations use standard CME formulas: Cheese = 9.87x + 0.0968, Butter = 1.2199x – 0.0179, NDM = 9.0675x – 0.0756, Whey = 1.17x.

Market Commentary

The ddemonstratedomplex showed genuine resilience today, despite being overshachaos in the dowed by the market chaos. Butter’s 3.5-cent rally represents a technical bounce off oversold conditions after this week’s brutal slide from $2.24. The move found support around $2.05—a level that has been held twice in the past month.

Cheese dynamics were telling. Blocks outperformed barrels by 2 cents, widening the spread to 5 cents – the largest gap in three weeks. This typically signals stronger retail demand (blocks) versus food service (barrels), which makes sense heading into the Labor Day weekend, when stockpiling is expected.

The real story was in the order flow. Dry whey closed with nine bids and zero offers—the strongest demand signal we’ve seen in weeks. Meanwhile, butter had no actual trades at the highs, despite the rally, suggesting that sellers weren’t panic-dumping, but buyers weren’t aggressively chasing either.

Critical Margin Math: The Feed Cost Crisis

Daily Feed Cost Impact Per Cow

Calculation Method: 16.5 lb milk/day, 24 lb corn/day, 5 lb SBM/day

- Corn cost: $1.91/cow/day (24 lb × $4.45 ÷ 56 lb/bu)

- Soybean meal: $0.71/cow/day (5 lb × $284.90 ÷ 2000 lb/ton)

- Total feed cost: $2.62/cow/day

Milk-to-Feed Ratio Analysis

- Previous ratio: 2.28 (acceptable range)

- Today’s ratio: 1.14 (critical – under 2.0 signals trouble)

- IOFC impact: -$66/cow/month

For a 500-cow operation, this represents a $33,000 monthly cash flow reduction if these feed levels hold.

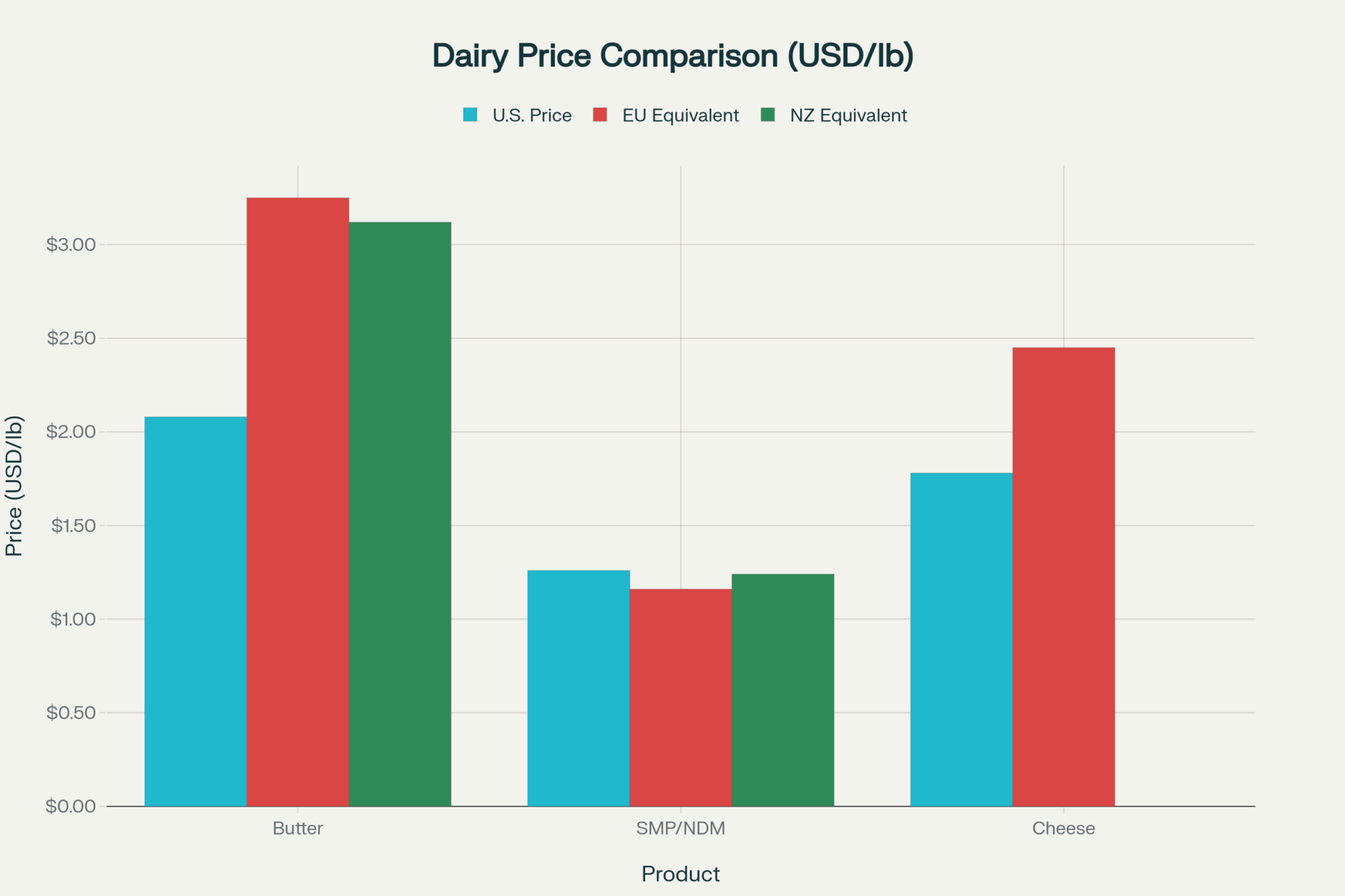

Global Market Competitiveness

USD/lb equivalent, EUR/USD: 1.08, NZD/USD: 0.59

| Product | U.S. Price | EU Equivalent* | NZ Equivalent** | Export Edge |

| Butter | $2.08 | $3.25 | $3.12 | Strong advantage |

| SMP/NDM | $1.26 | $1.16 | $1.24 | Slight EU advantage |

| Cheese | $1.78 | $2.45 | N/A | Highly competitive |

*EU prices converted from EEX futures at €2398/MT SMP, €6700/MT butter

**NZ prices from NZX futures are already quoted in USD/MT

Export Parity Summary: U.S. butter clears Middle East/North Africa with freight. NDM faces headwinds against the EU in Southeast Asia. Cheese dominates Mexico’s trade.

USDA Forecast Variance Analysis

Current vs Official Projections

USDA August 2025 Baseline (Published 8/11/25):

- 2025 milk production: 229.2 billion lbs (+900M from July forecast)

- Q4 2025 all-milk price: $22.00/cwt

- December Class III: $18.50/cwt forecast

Current Market Reality:

- December Class III futures: $17.75/cwt

- Gap: -$0.75/cwt (futures trading below USDA)

Feed Cost Reality Check: The USDA’s August forecast assumed an average corn price of $3.85 for Q4 2025. Today’s corn close at $4.45 represents a 60-cent premium to that assumption – enough to pressure USDA’s milk price forecasts lower in their September update.

Trading Floor Intelligence

Bid/Ask Analysis vs 30-Day Averages:

- Butter: 2 bids, three offers (avg: 1.8 bids, 2.1 offers) – above-average interest

- Whey: 9 bids, zero offers (avg: 4.2 bids, 1.8 offers) – exceptional demand

- Blocks: 3 bids, one offer (avg: 2.1 bids, 1.9 offers) – strong buyer interest

Volume Context: Today’s combined 16 trades across all products match the recent daily average, lending credibility to price moves. The complete absence of barrel trading (0 trades) alongside three trades in blocks suggests a clear preference for retail-focused products.

Late-Day Action: Butter’s gains accelerated in the final 10 minutes, often signaling that commercial end-users were covering weekend needs before the holiday.

What’s Really Driving These Markets

Domestic Demand: Retail cheese and butter loading ahead of Labor Day weekend is providing solid support. Food service demand remains steady but unspectacular – reflected in the block-barrel price divergence.

Export Pipeline:

- Mexico: Steady 15,000 MT/month cheese pace continues

- Southeast Asia: Strong NDM demand, particularly from the Philippines

- Middle East: Increasing butter interest due to competitive U.S. pricing

The Corn Market Shock: The 62-cent explosion likely stems from updated weather forecasts showing stress in key Iowa and Illinois growing regions. Early harvest reports are confirming yields below trend in several counties.

Regional Market Spotlight: Upper Midwest Under Pressure

Wisconsin/Minnesota producers face an immediate cash crunch. With corn harvest 2-3 weeks away, the futures explosion creates tough decisions: lock in expected crop at these elevated prices or gamble on a harvest-time retreat?

Local milk pricing: Processing plants report ample supplies as cooler late-August weather improves cow comfort. This abundance is preventing any significant local premiums despite the stronger cheese complex.

Immediate concerns: Many operations were counting on $3.80-$4.00 corn through the end of the year. Today’s move to $4.45 could force early culling decisions if sustained.

Actionable Intelligence: What to Do Right Now

Immediate Actions (Next 48 Hours):

- Feed Coverage Assessment: Calculate your uncovered corn needs for the period from March 2026 to March 2027. Consider pricing 25-50% of the remaining 2025 needs if you’re completely unhedged

- Milk Pricing Review: With Class III holding above $18.00, consider buying $17.50 put options for October-December to protect downside

- Cash Flow Stress Test: Model your operation with sustained $4.40+ corn using our worksheet below

Feed Cost Management Worksheet

Your Operation: _____ cows

- Daily corn cost: _____ lb/cow × $4.45 ÷ 56 = $_____ /cow/day

- Daily SBM cost: _____ lb/cow × $284.90 ÷ 2000 = $_____ /cow/day

- Total daily feed cost: $_____ /cow/day

- Monthly impact: $_____ × 30 × _____ cows = $_____ /month

Strategic Positioning by Region:

Wisconsin/Minnesota Operations:

- The soybean meal weakness (-$7.50) offers an opportunity to lock in protein costs

- Consider corn basis contracts if you’re growing your own feed

- Evaluate switching to higher-forage rations with your nutritionist

California Operations:

- Your higher baseline costs make you more vulnerable to this feed spike

- Focus on maximizing components – butterfat premiums are strong

- Consider forward-contracting more aggressively given tighter margins

Industry Intelligence & Regulatory Watch

Processing Capacity: Great Lakes Cooperative confirms their Michigan cheese expansion remains on schedule for Q2 2026, adding 180 million pounds of annual capacity to the region.

Trade Developments: USMCA review discussions continue with Mexico, our largest cheese customer, at 15,000 MT per month. No immediate concerns, but worth monitoring.

Regulatory Update: The FDA’s plant-based labeling guidance, expected before Thanksgiving, could impact dairy demand dynamics in 2026.

Tomorrow’s Watch List

- Weather: Updated crop condition reports due Tuesday could extend corn’s volatility

- International: New Zealand’s production update on Thursday will impact the global powder outlook

- Domestic: Weekly cold storage numbers on Friday will show if the butter rally has fundamental support

Bottom Line: Navigation Strategy

Today marks a significant shift from cautious optimism to proactive risk management. The dairy complex has proven its resilience, but the sudden surge in feed costs changes everything for producer profitability.

The mathematics are stark: Every $0.50 increase in corn per bushel cuts dairy margins by roughly $1.50-$2.00 per cow per day. Today’s 62-cent corn move effectively erased 2-3 months of improved milk pricing.

Your immediate focus must shift to:

- Securing feed cost protection for the next 6-9 months

- Establishing milk price floors using options rather than outright futures

- Stress-testing cash flows under sustained high-cost scenarios

The dairy markets have demonstrated their resilience when demand fundamentals remain solid. Your job now is to ensure your operation can weather the input cost storm until this feed price shock normalizes.

Let’s face it—waiting this out isn’t a strategy, it’s a gamble. Lock in what matters, test your cash flows, and stay nimble. Like always, the folks who move early are the ones who make it through the storm.

Learn More:

- Maximizing Income Over Feed Cost: A Dairy Producer’s Guide – This guide provides practical, on-farm strategies for optimizing your ration and management practices. It reveals methods for improving feed efficiency and protecting your bottom line when input costs, like corn, spike unexpectedly.

- The 2025 Dairy Outlook: Navigating Market Volatility and Seizing Opportunities – Move beyond today’s crisis with a strategic view of the entire year. This article analyzes the long-term market forces, global trends, and economic factors that will shape dairy profitability through 2025, helping you position your operation for future shocks.

- Precision Feeding: The Key to Unlocking Higher Margins and Sustainability – Discover how innovative technology can provide a long-term defense against market volatility. This piece demonstrates how to leverage data and automation for precise nutrient delivery, cutting waste and significantly reducing your operation’s exposure to volatile feed markets.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.