Processors cut cheese time 56% with gene-edited cultures—your milk price depends on if yours adopts by 2026

EXECUTIVE SUMMARY: What farmers are discovering is that gene-edited bacterial cultures aren’t just making cheese 56% faster—they’re fundamentally reshaping which processors survive the next five years. University of Wisconsin-Madison trials documented 80% fewer phage-related shutdowns in facilities using these enhanced cultures, while processors report getting an extra vat through daily with the same equipment. The technology works by optimizing bacteria’s natural traits through CRISPR—no foreign DNA involved—creating what industry suppliers call “programmable” fermentation that adjusts to milk composition and market demands. Regional patterns are already emerging: California processors are partnering aggressively with UC Davis, while Wisconsin’s split between innovation leaders and traditional holdouts is evident. Meanwhile, mid-scale operations everywhere face a harsh reality—adapt, consolidate, or exit. For dairy farmers, this means fewer but potentially more stable processor relationships, with those starting implementation now having 75% better odds of success than those waiting until 2027. The window for positioning your farm advantageously is open today, but processors are making decisions right now that will determine market access for the next decade.

You know what’s got processors buzzing at every industry meeting these days? They’re getting an extra vat through daily with the same equipment, same crew—just different bacterial cultures. And when you dig into the research behind this, the implications for all of us are bigger than most folks realize.

The University of Wisconsin-Madison’s dairy extension documented a remarkable finding in their 2024 trials: facilities using gene-edited bacterial cultures experienced 80% fewer phage-related shutdowns. Meanwhile, Applied and Environmental Microbiology published data this August showing 56% faster fermentation times in controlled settings. This isn’t theoretical anymore—it’s happening in cheese plants right now, and it’s starting to reshape how processors think about capacity, efficiency, and even which farms they want to work with.

I’ve been following this development closely, speaking with everyone from small artisan cheesemakers to large co-ops that process thousands of tons daily. What’s becoming clear is we’re not just looking at another processing upgrade. This technology is fundamentally changing competitive dynamics in ways that’ll affect every farm shipping milk, regardless of size or location.

Making Sense of the Science

So what exactly makes these gene-edited cultures different from what processors have been using for decades?

Firstly, this isn’t like the old GMO controversies, where foreign DNA is introduced—and that distinction really matters. CRISPR technology, which FEMS Microbiology Letters explained well in their February 2024 issue, allows scientists to optimize traits that bacteria already possess. Think of it like… well, you know how we select for higher components in our herds? They’re doing something similar with bacteria, just at the genetic level. Same organism, better performance.

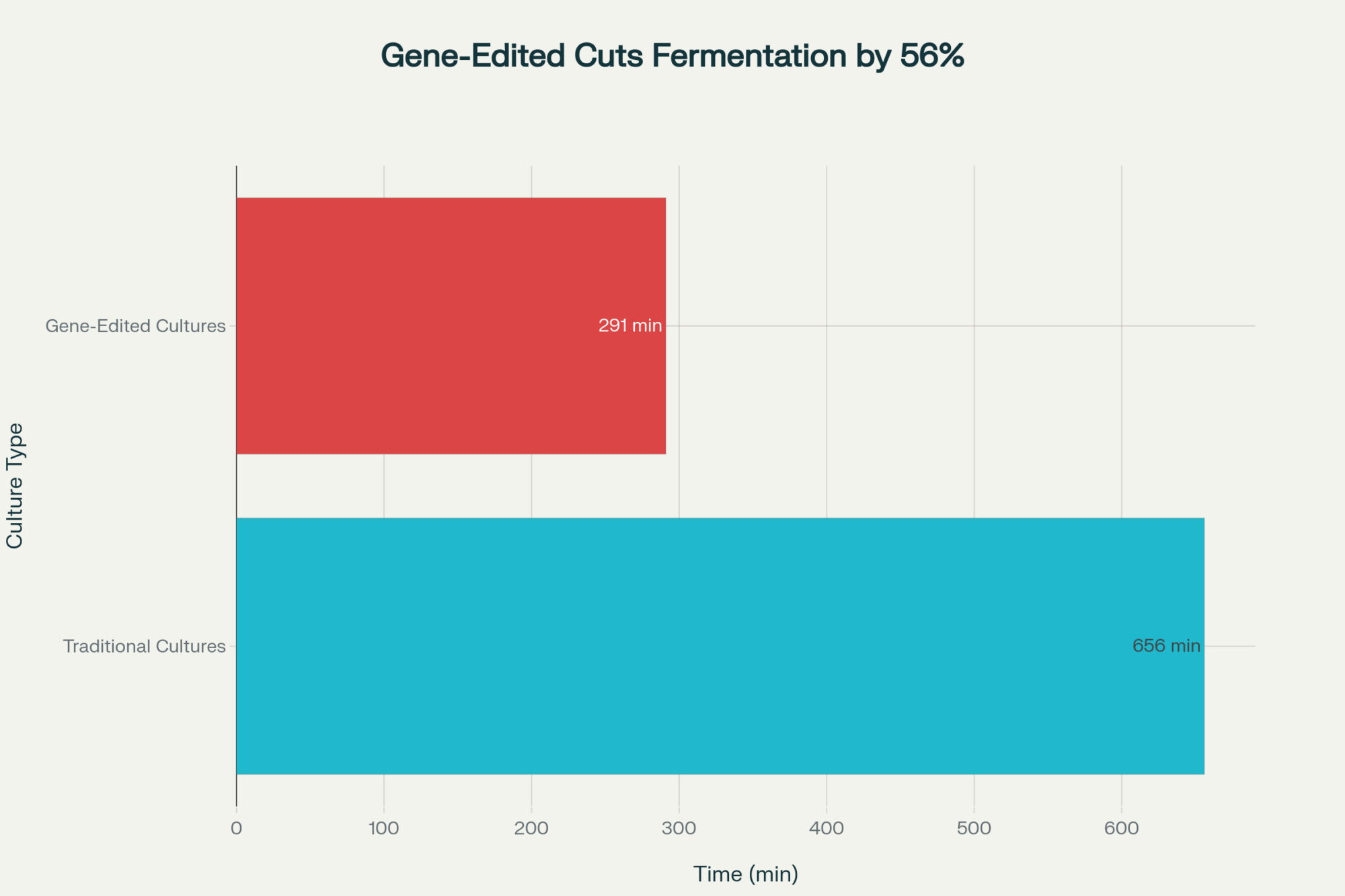

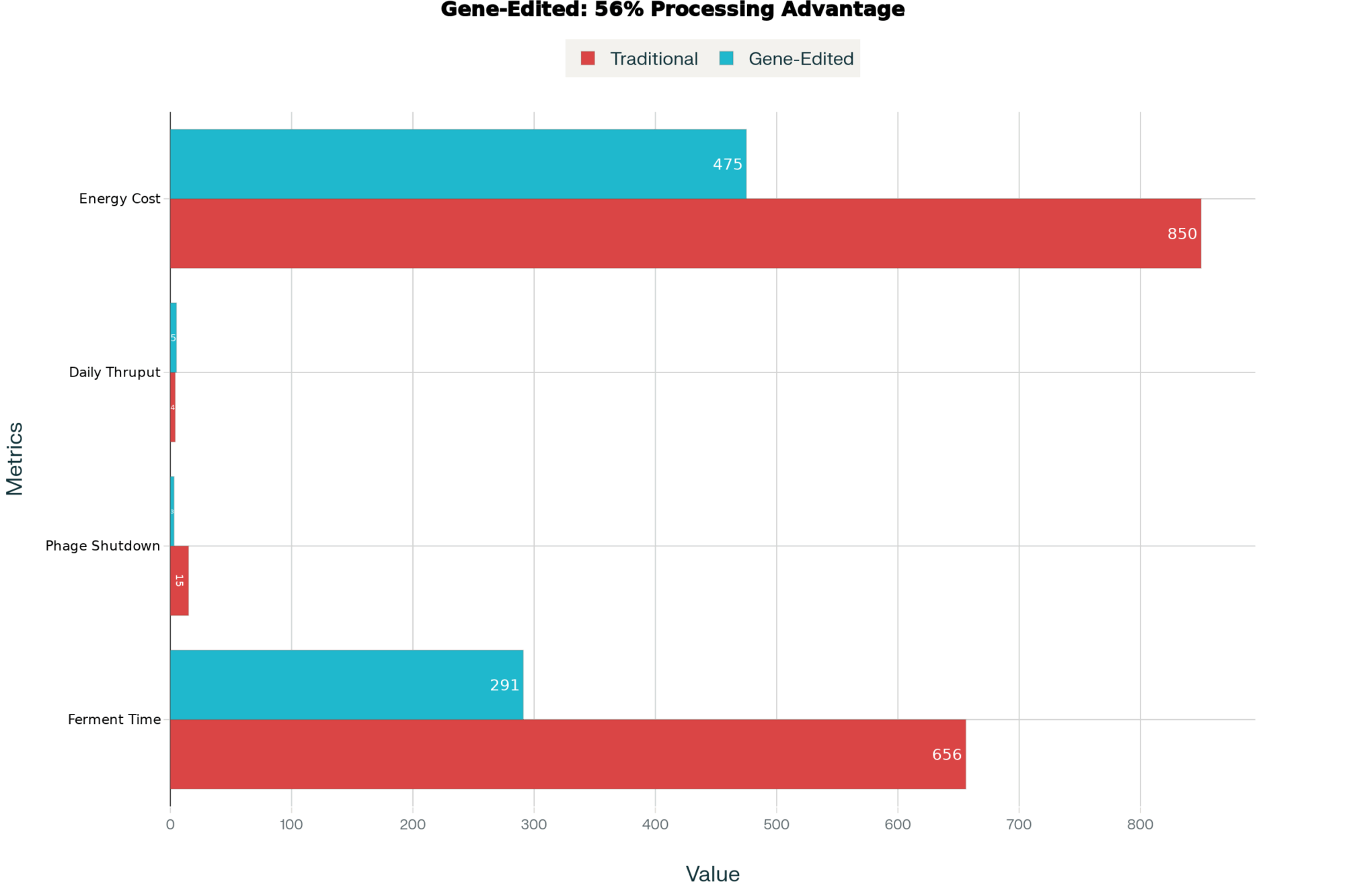

The University of Copenhagen published fascinating data on modified Streptococcus thermophilus strains that reach the target pH in 291 minutes, compared to the usual 656 minutes. Why should we care? Faster acidification enables processors to process more milk through existing equipment without the need to build new vats. That’s a game-changer for their economics—and eventually, for milk pricing.

The science behind it actually makes sense once you understand what they’re doing. By enhancing protease genes—basically the bacteria’s ability to break down casein—they’re making more nutrients available for bacterial growth. The bacteria perform better because they’re essentially getting a more balanced diet. Kind of reminds me of the difference we see in milk production when we nail the transition cow ration versus when we don’t quite get it right.

Processors across different scales are reporting consistent improvements:

- Throughput gains in the 20-30% range (imagine getting that from your existing parlor without adding a single stall)

- Dramatic drops in phage contamination losses

- Lower energy costs from shorter fermentation cycles

- Much more predictable results during the spring flush when components are bouncing around

Industry culture suppliers like Chr. Hansen and IFF (formerly DuPont) describe these as “programmable” cultures—meaning processors can adjust fermentation characteristics based on milk composition, product specs, even when electricity rates are lower. It’s giving them a level of control they’ve never had before.

Three-Speed Industry Emerging

What’s fascinating is watching how different processors are responding to this opportunity—or threat, depending on your perspective.

The Early Movers (Less Than 10%)

A small group of processors is not waiting for the FDA’s formal guidance, expected in 2026. They’re utilizing self-affirmed GRAS (Generally Recognized as Safe) status—a regulatory pathway that has been in existence since 1997, but is not widely recognized.

Examining the FDA GRAS Notice Database reveals an interesting story. Perfect Day’s precision fermentation whey protein was approved in March 2020. Remilk followed with beta-lactoglobulin in 2022. New Culture secured approval for animal-free casein this February. These precedents are creating pathways that traditional dairy processors could follow if they choose to.

The Squeezed Middle

Regional processors handling 200-800 tons daily are in a tough spot. They can’t match the massive investments of the big players—Fonterra just committed $500 million to biotechnology through their Ki Tua Innovation Fund this June. However, they’re also too large to pivot quickly, unlike specialty operations.

These mid-scale facilities are facing what you might call strategic compression. They lack both the capital for major innovation and the agility for rapid adaptation. Several processors I know are already exploring mergers, partnerships, or finding specialized niches. It’s not panic—it’s recognition that the competitive landscape is shifting fast.

Small Operations Finding Opportunities

Here’s what surprised me: artisan and small-scale processors are discovering real advantages through university partnerships. Wisconsin’s Center for Dairy Research, UC Davis, Cornell—they’re all running programs where small operations can access this technology without massive capital commitments.

Vermont cheesemakers working with their state university are combining traditional methods with modern science, and their customers—the ones paying $35 per pound for aged cheddar—seem to appreciate both the heritage and the innovation. This mirrors what we’ve seen with farmstead operations that embrace technology while maintaining their craft identity.

Five Critical Questions Every Farmer Should Ask Their Processor Today

| Question | Why It Matters | What to Listen For |

| “What’s your position on gene-edited starter cultures?” | Reveals strategic thinking and competitive awareness | Active exploration = stronger positioning; Wait-and-see = potential vulnerability |

| “How might this affect my component premiums?” | Could change payment structures significantly | Plans for adjusting premiums based on consistency vs. variation |

| “Are you considering consolidation or partnerships?” | Your market access depends on their survival | Transparency about strategic options vs. evasive responses |

| “What about organic certification?” | Critical for organic producers | Clear segregation plans and a committed organic strategy |

| “What’s your implementation timeline?” | Earlier adoption = better competitive position | Starting now = good odds; Planning for 2027+ = risky |

The Reality of Implementation

Based on what processors are actually experiencing, here’s how implementation typically unfolds—and it’s tougher than the sales pitches suggest.

Getting Everyone on Board (Months 1-3)

The biggest challenge isn’t technical—it’s organizational. Board members often confuse gene editing with GMO technology, even though gene editing does not involve the introduction of foreign DNA. It takes time to educate everyone on the differences and implications.

Processors typically spend three months on planning and education before making any commitments. University extension specialists often provide a crucial outside perspective during these discussions. What really matters is getting your quality team, operations staff, and salespeople all to understand what’s changing and why.

Running Pilots (Months 4-9)

This phase always takes longer than expected. You can’t just swap cultures like changing a barn cleaner belt. The entire fermentation profile changes, requiring new quality control protocols. Staff training takes months, not the weeks most processors budget for.

Customer communication during pilots requires real finesse. Some processors handle this brilliantly by being transparent without creating alarm. Others, however, create unnecessary market concerns that can take months to resolve.

Scaling to Full Production (Months 10-18+)

Converting an entire facility while maintaining production is like rebuilding your milking system while still milking twice a day. Technically possible, but it requires exceptional coordination and timing.

Common challenges include:

- Working capital needs that often exceed initial budgets substantially

- Customer education is becoming critical as implementation scales

- Competitors sometimes spreading concerns about the technology

- Supply chain coordination is becoming surprisingly complex

Regional Patterns Taking Shape

Different parts of the country are approaching this transformation in ways that reflect their unique situations.

California: Larger processors appear to be moving aggressively, often leveraging partnerships with UC Davis. Smaller operations are doubling down on organic and artisanal positioning—smart differentiation given their market dynamics.

Wisconsin: Shows interesting contrasts. Some cheese processors are pushing hard on innovation, while others maintain traditional approaches. The cooperative structure sometimes slows down decision-making, but it can provide resources once consensus is built.

Northeast: Fluid milk processors appear less engaged (which may prove shortsighted, given margin pressures), while specialty cheese operations are actively partnering with Cornell and the University of Vermont.

Southeast: Taking a measured approach overall, though some Greek yogurt processors are exploring applications where fermentation time directly impacts capacity utilization.

Upper Midwest: Watching Wisconsin closely while dealing with their own consolidation pressures. Several mid-sized processors in Minnesota and Iowa are forming informal groups to share information and potentially pool resources.

Idaho and Pacific Northwest: Larger operations are quietly evaluating options, particularly those supplying West Coast specialty cheese markets. The distance from major research universities is creating unique partnership challenges.

Understanding the Regulatory Landscape

The regulatory situation is more straightforward than many realize, although geography plays a significant role in determining it.

In the U.S., that self-affirmed GRAS pathway exists today. Companies can establish safety through independent expert panels without waiting for FDA pre-approval. The FDA’s formal guidance, expected in 2026, will provide an additional framework, but it isn’t required to move forward.

Europe operates completely differently. Their Novel Food regulations require 18-36 month approval processes, giving U.S. processors a significant head start in technology adoption and market positioning.

Canada and Mexico are monitoring U.S. developments and will likely follow with some delay, creating potential export opportunities for early-adopting U.S. processors.

The Economics That Matter

While specific numbers vary by facility, the patterns are clear. Processors report substantial reductions in phage-related losses—which have been an expensive hidden cost for decades. Combined with throughput improvements and energy savings, the economics can be compelling for successful implementers.

However, here’s what the technology suppliers often overlook: successful implementation requires much more than just purchasing new software. It demands supplier partnerships, comprehensive training, and careful market positioning. Miss any of these elements and those promising economics evaporate quickly.

One Midwest processor shared (off the record) that their implementation costs exceeded budget by 40%, largely due to extended timelines and unexpected customer education needs. They remain positive about the investment, but it took 18 months longer than planned to generate returns.

Looking Ahead: The 2030 Dairy Processing Landscape

Based on current adoption patterns, recent consolidation announcements, FrieslandCampina’s acquisition of MilcobelndCampina-Milcobel in January, and capital flowing into biotechnology, we’re heading toward a fundamentally different industry structure.

We’ll likely see three distinct operational tiers:

- Technology-enabled mega-processors are achieving efficiency levels we haven’t seen before

- Regional specialists using selective technology adoption for specific market positioning

- Artisan operations combining tradition with innovation for premium markets

The conventional middle market—characterized by moderate scale and traditional technology—faces the most pressure. Without technology advantages or premium positioning, these operations will struggle to compete.

For dairy farmers, this means:

- Fewer but potentially more stable processor relationships

- Greater importance of understanding your processor’s strategic position

- Need for contingency planning if your processor isn’t well-positioned

- Possible opportunities with processors who value a consistent, quality supply for their enhanced efficiency

What This Means for Different Farm Sizes

Large Operations (1,000+ cows): You’ve got negotiating power. Use it to understand your processor’s technology strategy and secure favorable contracts before consolidation reduces options.

Mid-Size Farms (200-1,000 cows): You’re in the sweet spot for processors who value consistent volume and quality. Build relationships with multiple processors now, before consolidation limits choices.

Small Farms (Under 200 cows): Consider forming partnerships with artisan processors that leverage university connections. Your flexibility and quality focus align well with premium market positioning.

Organic Producers: This technology does not directly apply to you, but consolidation affects everyone. Ensure your processor has clear segregation plans and a committed organic market strategy in place.

The Bottom Line for Your Farm

This isn’t some distant possibility—processors are making decisions right now that will determine their competitive position for the next decade. And their position directly affects your milk check and market access.

The technology demonstrably works. The economics can be strong for those who implement successfully. The regulatory pathways exist. What separates winners from losers increasingly comes down to execution capability and timing.

Have frank conversations with your processor about their plans and expectations. Their transparency—or lack of it—tells you something important about your own positioning needs. As the industry transforms, whether individual processors participate or not is a key consideration.

Looking back, 2025 will likely be remembered as a pivotal year, marking a significant turning point in history. The question is whether you recognized the signals and adapted accordingly, or got caught reacting to changes already underway.

This goes beyond bacteria making cheese faster. We’re watching competitive dynamics reshape our entire industry. And that reshaping is happening right now—today—regardless of whether we’re ready.

I’ve witnessed numerous changes during my years in the dairy industry. This one feels different—faster, more fundamental to processing economics. But here’s what I know for sure: dairy farmers who stay informed, ask tough questions, and keep their options open usually find their way through.

The key is understanding what’s happening, evaluating how it affects your specific operation, and making decisions based on your circumstances—not someone else’s. While technology may be reshaping dairy processing, good business judgment and strong relationships remain the most important factors.

And at the end of the day, processors still need quality milk from reliable farms. That hasn’t changed. What’s changing is which processors will be around to buy it, what they’ll pay, and what they’ll value most. Understanding those shifts—that’s what’ll separate the farms that thrive from those that just survive.

Keep asking questions. Keep building relationships. And, perhaps most importantly, continue to discuss with other farmers what they’re seeing and hearing. Because in times of change, our best resource has always been each other.

So here’s the real question: Will your operation be positioned to benefit from these changes, or will you find yourself scrambling to adapt when your processor announces their strategy? The window for proactive positioning is open now—but it won’t stay that way for long.

KEY TAKEAWAYS

- Processors using gene-edited cultures achieve 20-30% throughput gains without new equipment, fundamentally changing their economics—ask your processor about their technology timeline before consolidation limits your options

- Implementation takes 12-18 months and often exceeds budgets by 40%, but early adopters capture market advantages that become impossible to match—processors starting now have vastly better supplier access than those waiting for 2026 FDA guidance

- Regional dynamics vary significantly: California large processors lead adoption, Wisconsin shows cooperative resistance, the Northeast fluid processors lag dangerously—understand your region’s pattern to anticipate market changes

- Five critical questions determine your processor’s survival odds: their position on gene-edited cultures, impact on your premiums, consolidation plans, organic segregation strategy, and implementation timeline—transparent answers suggest stronger positioning

- Small farms under 200 cows can thrive through artisan processor partnerships leveraging university programs, while mid-size operations (200-1,000 cows) should build multiple processor relationships now before consolidation reduces choices

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Gene Editing in Dairy: When the Revolution Makes Sense—And When It’s Just Expensive Hype – This article provides a valuable producer-level guide, contrasting the hyped potential of gene editing with its practical reality. It reveals which applications offer clear ROI (like mastitis resistance) and which remain in the research phase, helping farmers make smarter investment decisions with their herds.

- The Economic Impact of Phage Contamination on Your Dairy—And The Technology That Could Cut It – This piece complements the main article by quantifying the “hidden” costs of phage-related shutdowns, a topic the main article only touches on. It provides a strategic framework for calculating the financial losses on your own farm, equipping you to have a data-driven conversation with your processor about solutions.

- Genomic Selection 2.0: The Blueprint for a More Profitable Dairy – This innovative article explores how advancements in genomic selection are already being used to “pre-screen” cow genetics for traits like heat tolerance and feed efficiency. It demonstrates how these existing technologies can be combined with gene-editing to create a comprehensive strategy for herd improvement and profitability.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!