NMPF asked USDA for exactly $148 million in dairy purchases last November. On February 19, USDA delivered — to the dollar. That’s not luck. That’s the advocacy pipeline working. Who benefits?

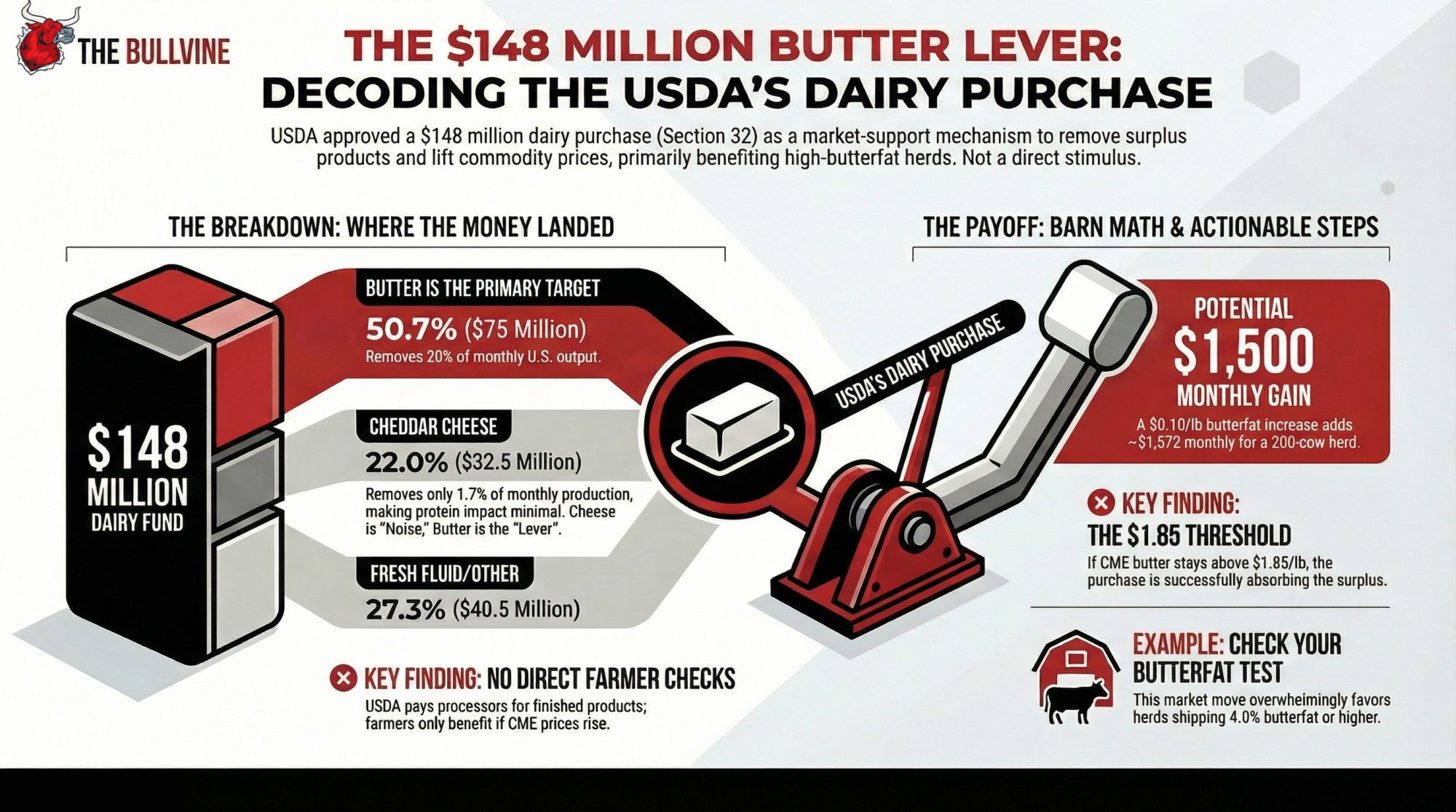

Executive Summary: USDA has approved $263 million in Section 32 food purchases, including $148 million for dairy — the exact figure NMPF asked for last November and the largest dairy round since the COVID programs. That money goes to processors for butter, cheese, and milk, not directly to farms, so any benefit shows up only if it lifts CME prices enough to move FMMO component values on your milk check. Butter is the main story: $75 million at current prices pulls roughly 40 million pounds — about 20% of a typical month of U.S. butter output — out of the commercial market, and CME butter already jumped $0.165/lb during the announcement week. The $32.5 million cheddar buy, by comparison, removes only about 1.7% of a month’s cheese production, so it’s unlikely to change protein checks on its own materially. For high‑butterfat herds, a sustained $0.10/lb increase in butterfat value can add more than $1,500/month per 200 cows, but only if the rally holds and your co‑op’s component premiums pass that value through. The article breaks down that barn math, compares this purchase to earlier Section 32 and COVID‑era interventions, and provides a 30/90/365‑day playbook so you can track CME butter, scrutinize your component statement, and adjust your risk‑management strategy in response to this one‑time demand boost.

$148 million. That’s the dairy industry’s share of USDA’s $263 million Section 32 purchase announced on February 19, 2026 — and it’s the exact figure the National Milk Producers Federation requested in a letter to USDA last November. Not one dollar more. Not one dollar less.

Every ag newswire ran the number. Secretary Brooke Rollins called it “delivering wholesome, real food to Americans while injecting critical dollars into local economies”. NMPF President and CEO Gregg Doud said the purchases “will provide important relief to producers who will benefit from the additional demand”. The International Dairy Foods Association applauded. Headlines everywhere.

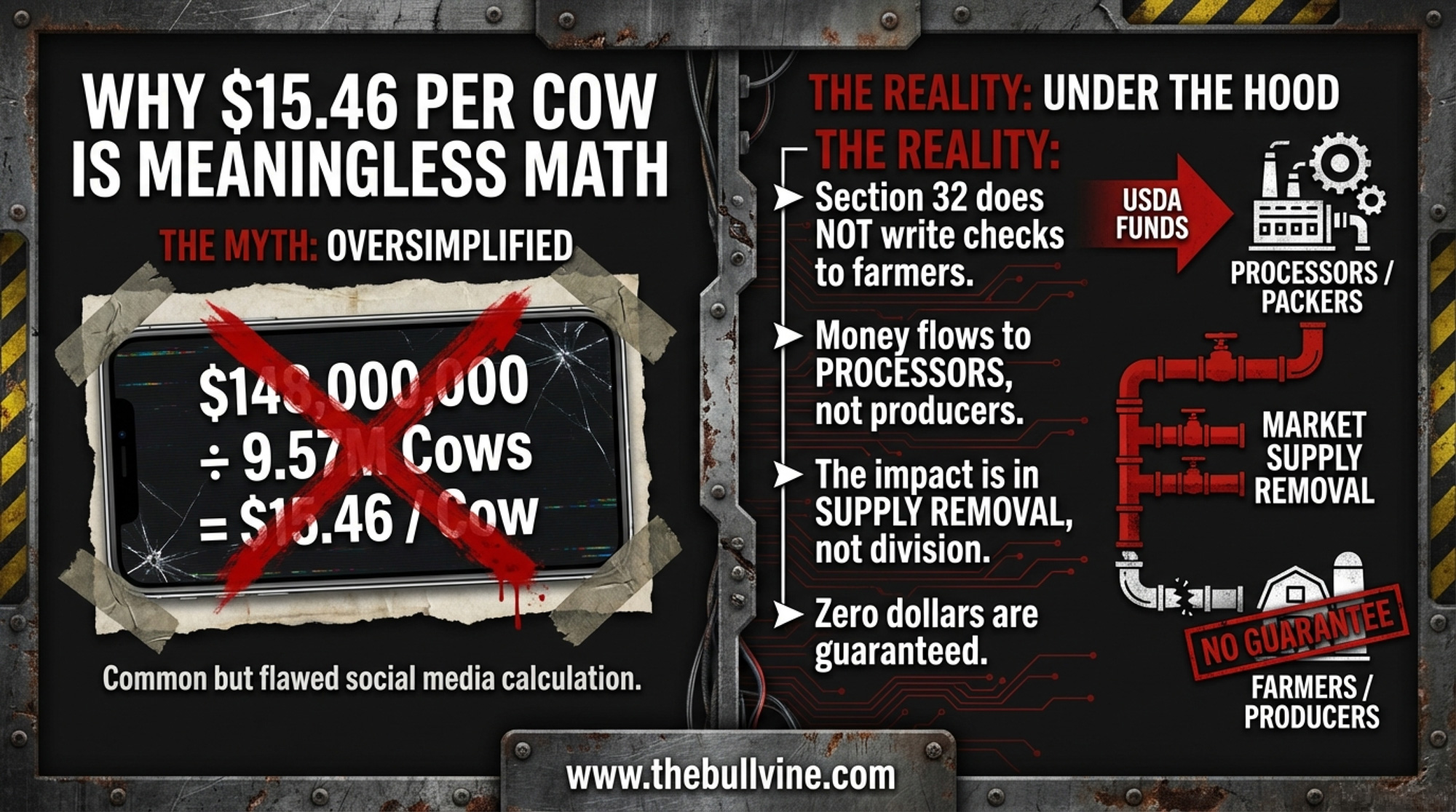

But here’s what nobody’s explaining: Section 32 doesn’t write checks to dairy farmers. It buys finished products from processors. Between that $148 million announcement and your milk check, there are five steps, at least three middlemen, and zero guaranteed dollars. Let’s walk through what this purchase actually buys, who actually gets paid, and what it could — could — mean for the price of your milk.

What USDA Is Actually Buying

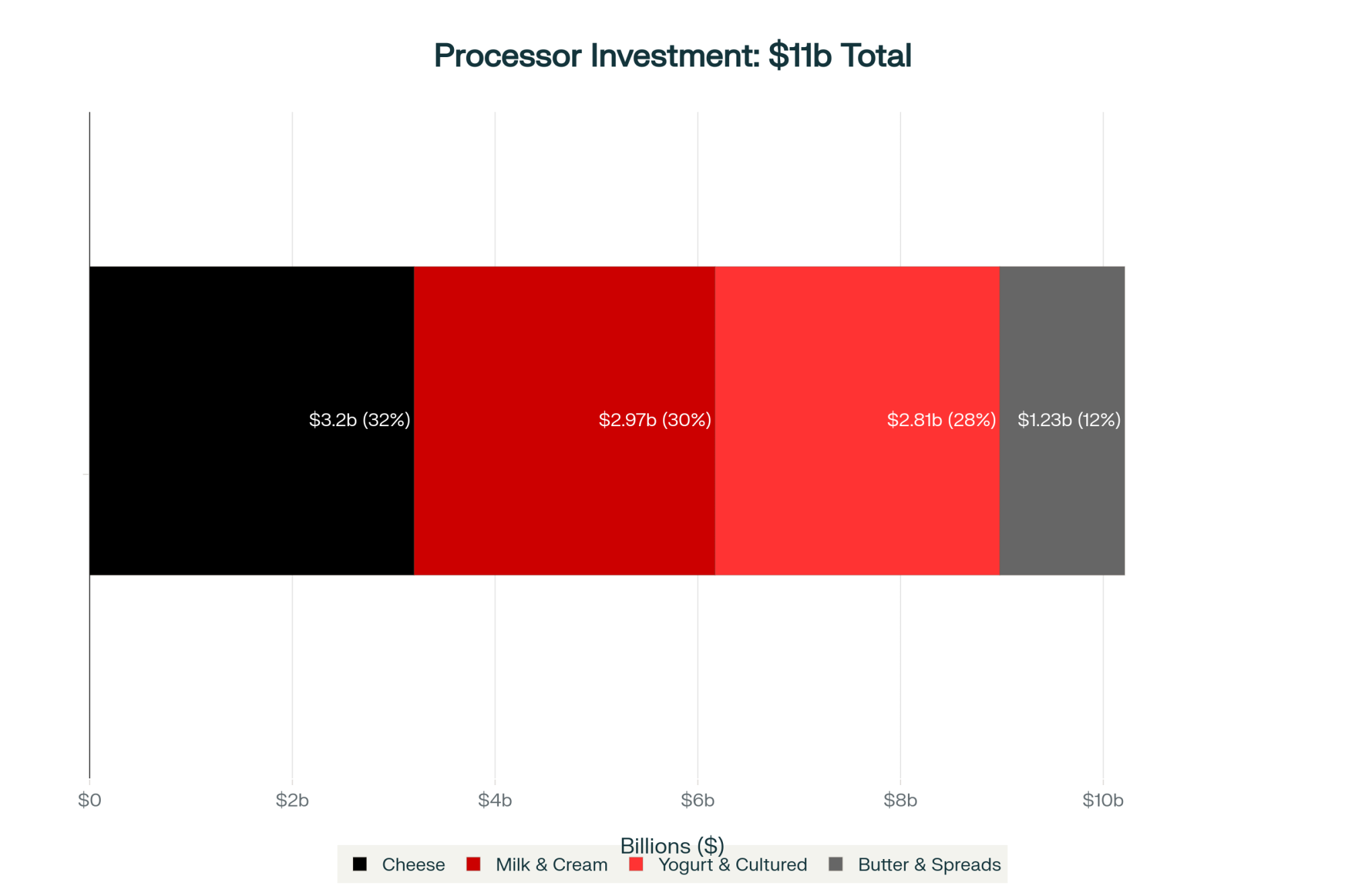

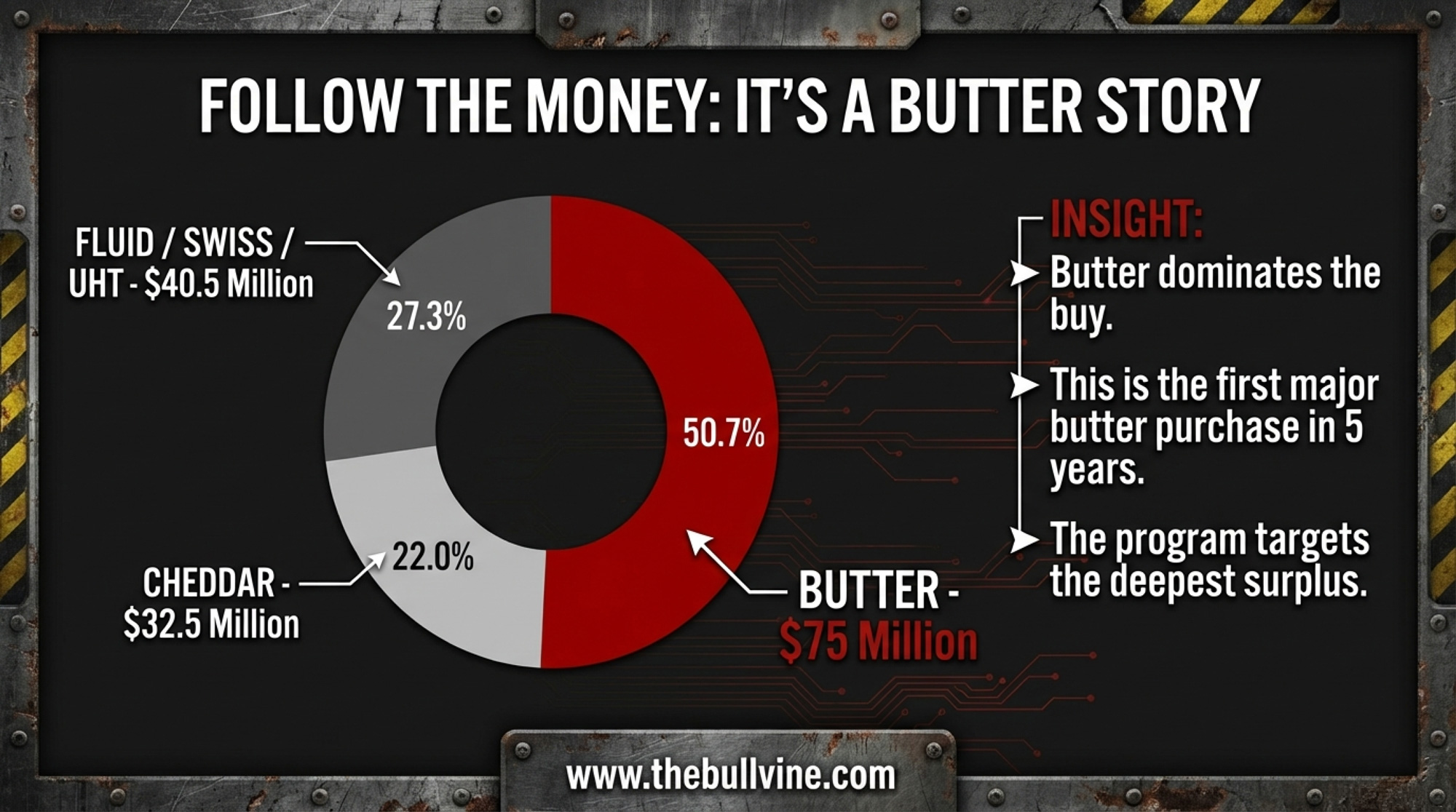

The $148 million breaks down into five commodity categories, and the allocation tells you exactly where USDA sees the deepest surplus problem:

- Butter: $75 million (50.7% of dairy total)

- Cheddar cheese: $32.5 million (22.0%)

- Fresh fluid milk: $20.5 million (13.9%)

- Swiss cheese: $10 million (6.8%)

- UHT (shelf-stable) milk: $10 million (6.8%)

Butter dominates. That’s not random — it’s where the price crash has been worst. NMPF specifically noted that these are “the first major butter purchases in five years.” The remaining $115 million in the broader announcement covers non-dairy commodities: dried beans ($25 million), split peas ($24 million), fresh pears ($15 million), walnuts ($15 million), lentils ($14 million), chickpeas ($12 million), and pecans ($10 million).

Dairy got the single largest allocation of any category. That matters.

How $148 Million Became the Number

This wasn’t a surprise. NMPF sent USDA a letter last November requesting exactly $148 million in dairy purchases. What followed, in NMPF’s own words, were “extensive conversations and further official communication with USDA”. When the announcement dropped on February 19, it matched the request to the dollar.

Gregg Doud — NMPF’s president and CEO since September 2023, a former Chief Agricultural Negotiator under President Trump’s first term, and a Kansas farm kid who still runs cattle — framed it as demand support: “Dairy farmers have shared in the struggles faced throughout the agricultural economy.”

That’s the advocacy pipeline working. NMPF identified the surplus problem, built the case with USDA, and delivered a specific ask. Whether you’re an NMPF member co-op shipper or not, this is what organized lobbying looks like when it produces results. The question is whether those results reach your bulk tank.

If you ship to an NMPF member co‑op, this is your dues at work; if you don’t, you’re still riding the same CME prices, just without the direct contract upside.

What Is a Section 32 Purchase and How Does It Work?

Section 32 of the Agricultural Adjustment Act of 1935 authorizes the USDA to buy surplus U.S.-produced agricultural products for two purposes: stabilize farm markets and supply food to federal nutrition assistance programs.

Here’s the mechanism, step by step:

- USDA’s Agricultural Marketing Service issues Purchase Program Announcements.

- Approved vendors — processors, not farmers — submit bids.

- USDA awards contracts to winning bidders.

- Processors deliver products to food banks and nutrition programs.

- The purchased volume exits the commercial market, reducing available supply.

That fifth step is where farm‑level impact starts, in theory. Removing surplus from the market tightens supply, which supports commodity prices on the CME, which flows through FMMO formulas into component pricing, which eventually — weeks to months later — appears on your milk check.

Five steps. None of them is “USDA writes a check to a dairy farmer.” This is a market-support mechanism, not a direct payment. That distinction matters.

The Per-Cow Reality Check: Why $15.46 Is a Meaningless Number

You’ll see this math on social media: $148 million ÷ 9.57 million U.S. dairy cows = $15.46 per cow. Sounds underwhelming, right?

It’s also completely irrelevant. Section 32 doesn’t distribute money per cow. It removes the product from the market. The $15.46 figure tells you nothing about the actual price-support effect, which depends on how much volume gets pulled, from which markets, at what prices, and how CME traders respond.

The per-cow math is a useful headline killer, though. And that’s the point: $148 million sounds massive until you spread it across the national herd. The real impact isn’t in the division. It’s in the market math.

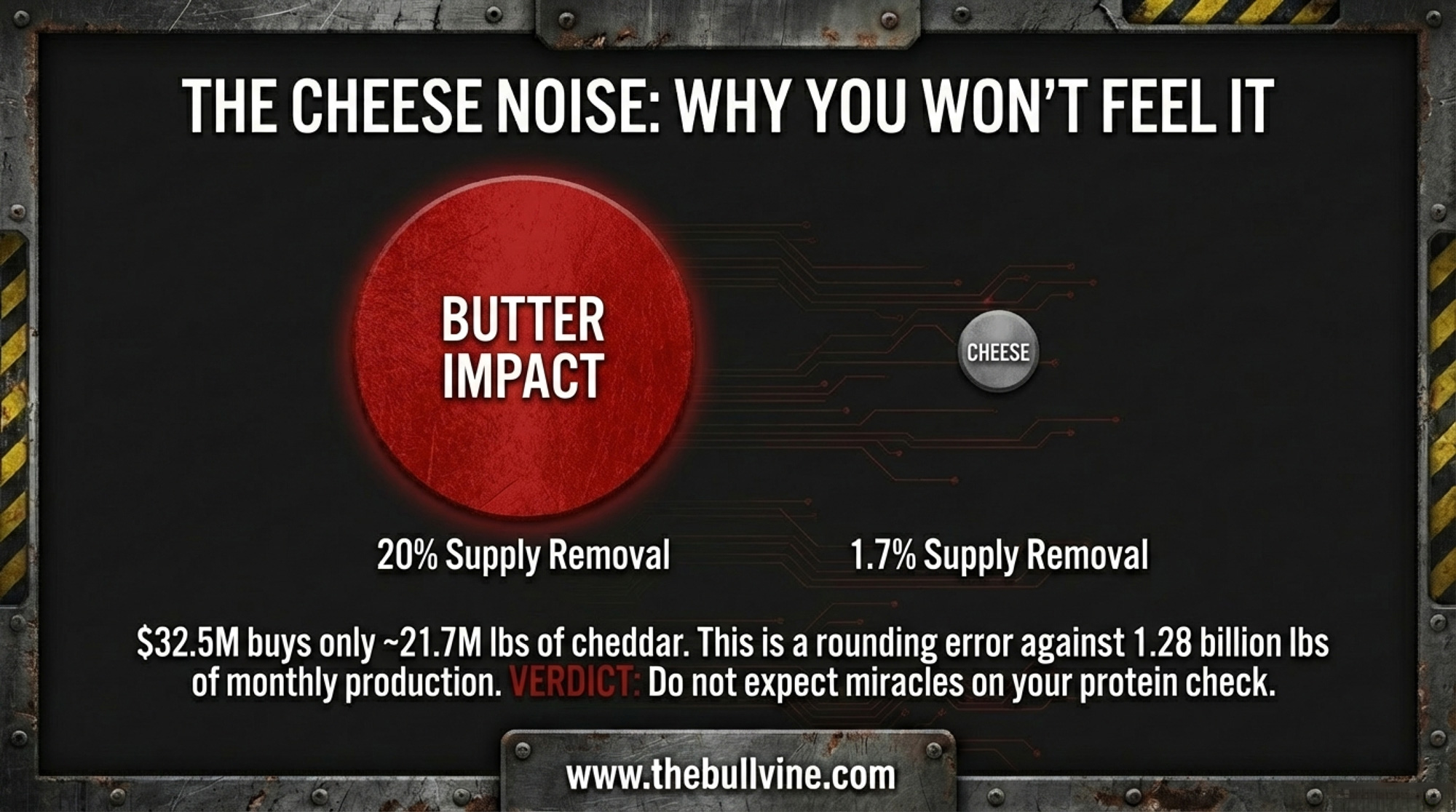

Butter vs. Cheese: One Big Lever, One Tiny One

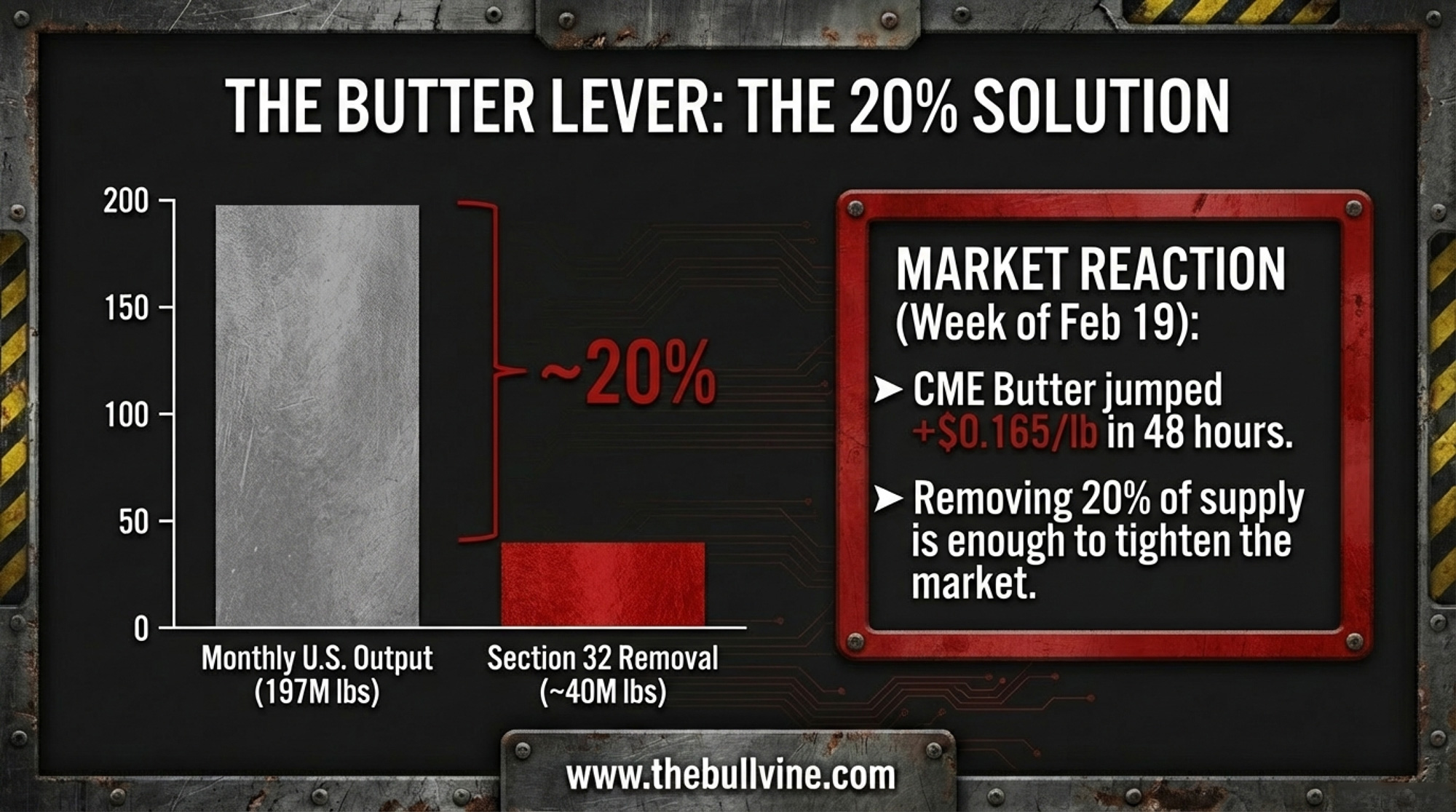

This is where the numbers get interesting. The $75 million butter purchase is the headline within the headline. Here’s why.

Butter math: At CME cash butter prices of $1.8700/lb on Friday, February 20, 2026, $75 million buys roughly 40 million pounds of butter. December 2025 U.S. butter production was 204 million pounds, according to USDA NASS’s Dairy Products report released on February 5, 2026. Full-year 2025 butter output hit 2.36 billion pounds — an average of about 197 million pounds per month. That $75 million purchase removes roughly 20% of one month’s productionfrom the commercial market.

| Metric | Butter | Cheddar Cheese |

|---|---|---|

| Purchase Amount | $75 million | $32.5 million |

| Pounds Purchased | ~40 million lbs | ~21.7 million lbs |

| Typical Monthly Production | ~197 million lbs | ~1.28 billion lbs |

| % of Monthly Output Removed | 20.3% | 1.7% |

| Likely CME Price Impact | $0.10–0.15/lb | $0.01–0.02/lb |

Twenty percent is significant. It’s not catastrophic-surplus territory, but it’s enough to tighten the market meaningfully — especially with butter already climbing. CME cash butter opened the announcement week at $1.7050 on Tuesday and closed Friday at $1.8700, a $0.165/lb gain in four trading sessions. That’s not all Section 32 — other factors are in play — but the timing is hard to ignore.

Cheese math: The $32.5 million cheddar purchase at roughly $1.50/lb buys about 21.7 million pounds. December 2025 total cheese production was 1.28 billion pounds. That’s barely 1.7% of one month’s output. Meaningful for cheddar specifically, but a rounding error for the broader cheese market.

The takeaway: If you’re a high-butterfat herd, this purchase tilts in your favor. If your income depends more on protein and cheese prices, the direct effect is minimal. Butter is the big lever here. Cheese is noise.

How Much Will This Actually Affect Milk Prices?

Now for the barn math that connects the announcement to your component statement.

Start with butter. If the Section 32 purchase contributes even $0.10/lb to sustained butter price support — and the $0.165/lb rally this week suggests that’s conservative — here’s what it means at the farm level:

The Class IV butterfat price is derived directly from CME butter. A $0.10/lb butter increase translates to roughly $0.10/lb on your butterfat component price. For a 200-cow herd shipping 23,000 lbs/cow/year at 4.1% butterfat:

- Monthly milk shipped: ~383,333 lbs

- Monthly butterfat lbs: ~15,717 lbs

- Value of $0.10/lb BF increase: ~$1,572/month, or $18,860 annualized

For a 400-cow herd at the same test? Double it: roughly $3,144/month.

That’s real money — if the butter rally holds and if your co-op’s component premiums reflect it. Two big ifs.

Now cheese. A $32.5 million purchase removing 1.7% of monthly production might support block prices by $0.01–0.02/lb at best. On your protein check, that’s almost invisible.

Bottom line: This purchase is a butterfat story. Your Class IV components — butterfat specifically — are where the action is. If your herd tests 3.6% fat, the impact is noticeably smaller than at 4.2%. Run it with your own numbers.

Why Now — and How Does This Compare?

Butter prices crashed from roughly $2.50/lb in mid-2025 to around $1.50/lb by January 2026 — a 40% decline in six months. CME cheese blocks were sitting at $1.45/lb before the announcement week. Global milk production — what analysts have called the “wall of milk” — has been pressuring commodity prices across the board.

NMPF called this the first major butter purchase in five years. That’s significant context. For comparison:

- 2020 COVID-era: USDA purchased roughly $1.33 billion in dairy products across multiple programs, including about $100 million/month in Section 32 alone. That removed an estimated 238 million pounds of cheese and 64 million pounds of butter over the year.

- 2020 Section 32 specifically: A $120 million cheese-and-butter purchase removed about 23 million pounds of cheese and 3.6 million pounds of butter per month.

- January 2026: USDA bought $80 million in specialty crops under Section 32 — no dairy in that round.

At $148 million, this is the largest single-round Section 32 dairy purchase outside of COVID emergency spending. It’s substantial. It’s also one-time, not recurring. The 2020 program ran for months. This is a single injection.

The Market Already Moved

Here’s what happened on the CME the week of the announcement:

| Commodity | Tue 2/17 | Wed 2/18 | Thu 2/19 (Announcement) | Fri 2/20 | Weekly Change |

| Butter ($/lb) | $1.7050 | $1.7050 | $1.7800 | $1.8700 | +$0.1650 |

| Blocks ($/lb) | $1.4500 | $1.5000 | $1.5100 | $1.4975 | +$0.0475 |

| Barrels ($/lb) | $1.4500 | $1.4700 | $1.4700 | $1.4900 | +$0.0400 |

| NFDM ($/lb) | $1.5900 | $1.5975 | $1.6225 | $1.6850 | +$0.0950 |

Butter jumped $0.075/lb on announcement day alone and added another $0.09 on Friday. That’s a two-day move of $0.165/lb — the kind of swing that moves component checks. Blocks and barrels gained modestly. NFDM surged nearly a dime on the week.

The market is pricing in the volume removal. Whether it holds through March and April — when the actual Purchase Program Announcements are issued, and contracts are awarded — is the open question.

What $148 Million in Section 32 Purchases Means for Your Component Check

- Check your butterfat test. This purchase overwhelmingly favors high-BF herds. At 4.0%+ test, the butter rally has meaningful upside for your Class IV components. At 3.5%, the effect is roughly half as large.

- Watch CME butter through March. If butter sustains above $1.85/lb through mid-March, the Section 32 volume removal is working as intended. If it fades back below $1.70, the purchase wasn’t enough to absorb the surplus.

- Don’t expect cheese miracles. The $32.5 million cheddar purchase is too small relative to monthly production (1.28 billion pounds in December alone ) to meaningfully move block or barrel prices. Your protein check won’t feel this.

- Know the timeline. USDA hasn’t issued the Purchase Program Announcements yet. Approved vendors still need to bid. Contracts need awarding. Product needs to ship. The actual volume won’t leave the commercial market for weeks, possibly months.

- Ask your co-op. Does your cooperative supply USDA commodity programs? If so, this purchase directly increases demand for your co-op’s output. If not, you’re relying entirely on the indirect price-support effect.

- Review your risk coverage. DRP (Dairy Revenue Protection) is available for purchase on any business day when prices are published on RMA’s website — there’s no fixed quarterly enrollment window. If butter holds its rally, Class IV DRP coverage premiums will rise as expected revenue increases. Locking in current premium levels sooner rather than later may make sense for Q2 and Q3 2026 quarters. Separately, DMC enrollment for 2026 closed February 26 — if you missed it, DRP is your remaining federal safety-net option.

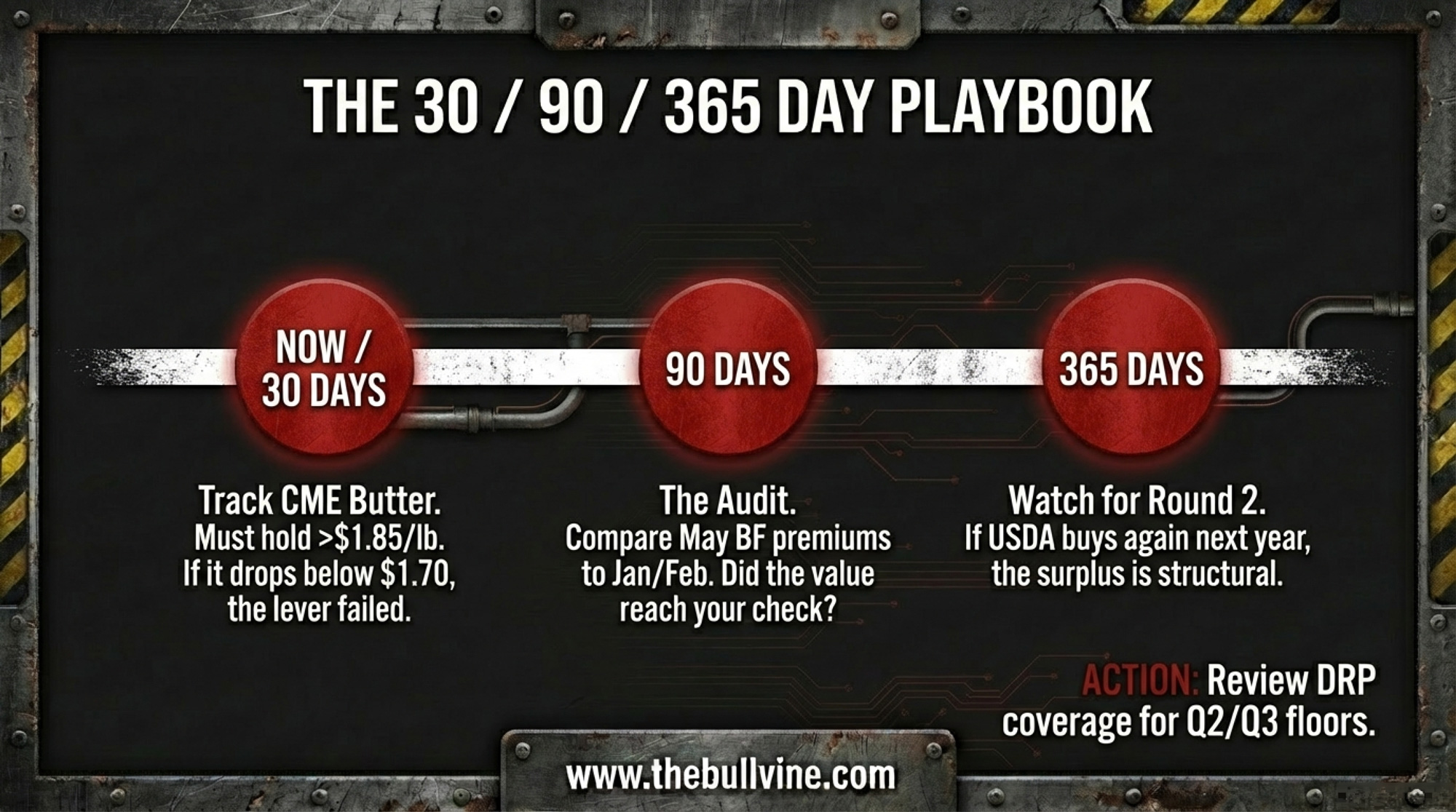

Your 30/90/365-Day Playbook

| Timeline | What to Track | Key Threshold | Action If Threshold Met/Missed |

|---|---|---|---|

| This Week | USDA AMS Purchase Program Announcement | Announcement posted | Read for delivery windows, product specs, quantity breakdowns |

| 30 Days | CME butter & cheese block prices | Butter holds above $1.85/lb | Price support working; below = surplus bigger than $75M can fix |

| 90 Days | Your co-op component statement (April/May) | BF premium reflects butter rally | If butter held but BF premium flat = question for co-op field rep |

| 365 Days | Total 2026 Section 32 dairy purchases vs. 2024/2025 | Second round announced | Signals structural surplus, not seasonal—NMPF pipeline now recurring |

This week: Read the USDA AMS Purchase Program Announcement when it posts. It will specify exact product forms, quantities, and delivery windows. That’s when you’ll know whether this is a 60-day buy or a 6-month program.

30 days: Track CME butter and cheese block prices. The $1.85/lb butter threshold is your marker. Above it, the purchase is supporting prices. Below it, the surplus is bigger than $75 million can fix.

90 days: Pull your co-op component statement for April or May. Compare your butterfat premium to January and February. If butter held above $1.85 through March and your BF premium didn’t move, that’s a question for your co-op field rep.

365 days: Compare the total 2026 Section 32 dairy purchases to 2025 and 2024. If USDA comes back for a second round, it signals the surplus problem is structural, not seasonal — and that NMPF’s advocacy pipeline is becoming a recurring feature of dairy price support.

Key Takeaways

- USDA’s $148 million dairy allocation under Section 32 is exactly what NMPF asked for last November and marks the largest non‑COVID dairy purchase in five years.

- None of that money arrives as a farm check — it pays processors, and the only way you see it is if it pushes CME prices high enough to lift FMMO component values on your milk check.

- Butter is where it bites: $75 million pulls roughly 40 million pounds — about 20% of a typical month of U.S. butter output —, and CME butter already moved $0.165/lb higher during the announcement week.

- The cheddar piece is small by comparison: $32.5 million removes only about 1.7% of a month’s cheese production, so don’t expect a big protein or Class III bump from this round alone.

- If your herd ships 4%‑plus butterfat, a sustained $0.10/lb increase in butterfat value can add more than $1,500/month per 200 cows, which makes watching butter hold above roughly $1.85/lb and checking how your co‑op adjusts component premiums a key decision point.

The Bottom Line

$148 million isn’t a rescue. It’s a market lever—and specifically, a butter lever. NMPF asked for it, USDA delivered it, and the CME responded with a $0.165/lb butter rally in 48 hours. Whether that holds depends on what happens when the actual contracts hit and the product starts moving.

Pull your last component statement. Find the butterfat line. Now add $0.10/lb and multiply by your monthly butterfat pounds. That’s the upside scenario from this purchase — not $148 million divided by your herd size, but butter price × your components × time.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Your Milk Check Just Split in Two: NDM’s Best Week Since 2007 Blows the Class IV Spread to $1.40 – Arms you with four immediate risk-management moves to protect your margin before the spring flush. This implementation guide breaks down exactly how to restructure your DRP weighting to capture the diverging values between cheese and powder.

- The Wall of Milk: Making Sense of 2025’s Global Dairy Crunch – Reveals the structural supply collision between the U.S., EU, and New Zealand that is currently capping your upside. This strategic analysis exposes the “biological trap” of beef-on-dairy and helps you position your operation for the next three years.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – Delivers a deep dive into the genomic surge that “pre-loaded” the national herd for record butterfat. It identifies the emerging genetic traits—from feed efficiency to methane indexes—that will determine which dairies remain competitive through the 2030s.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.