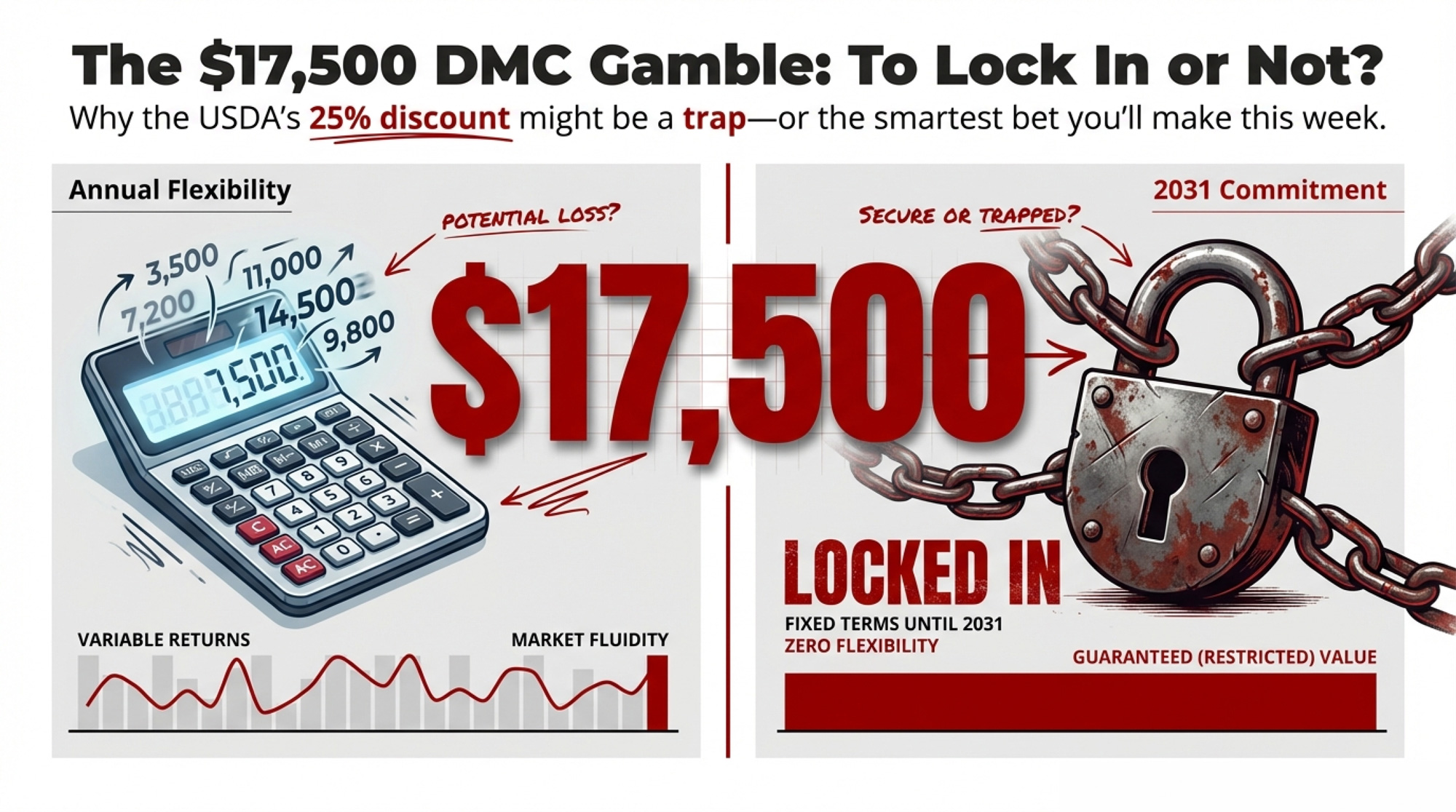

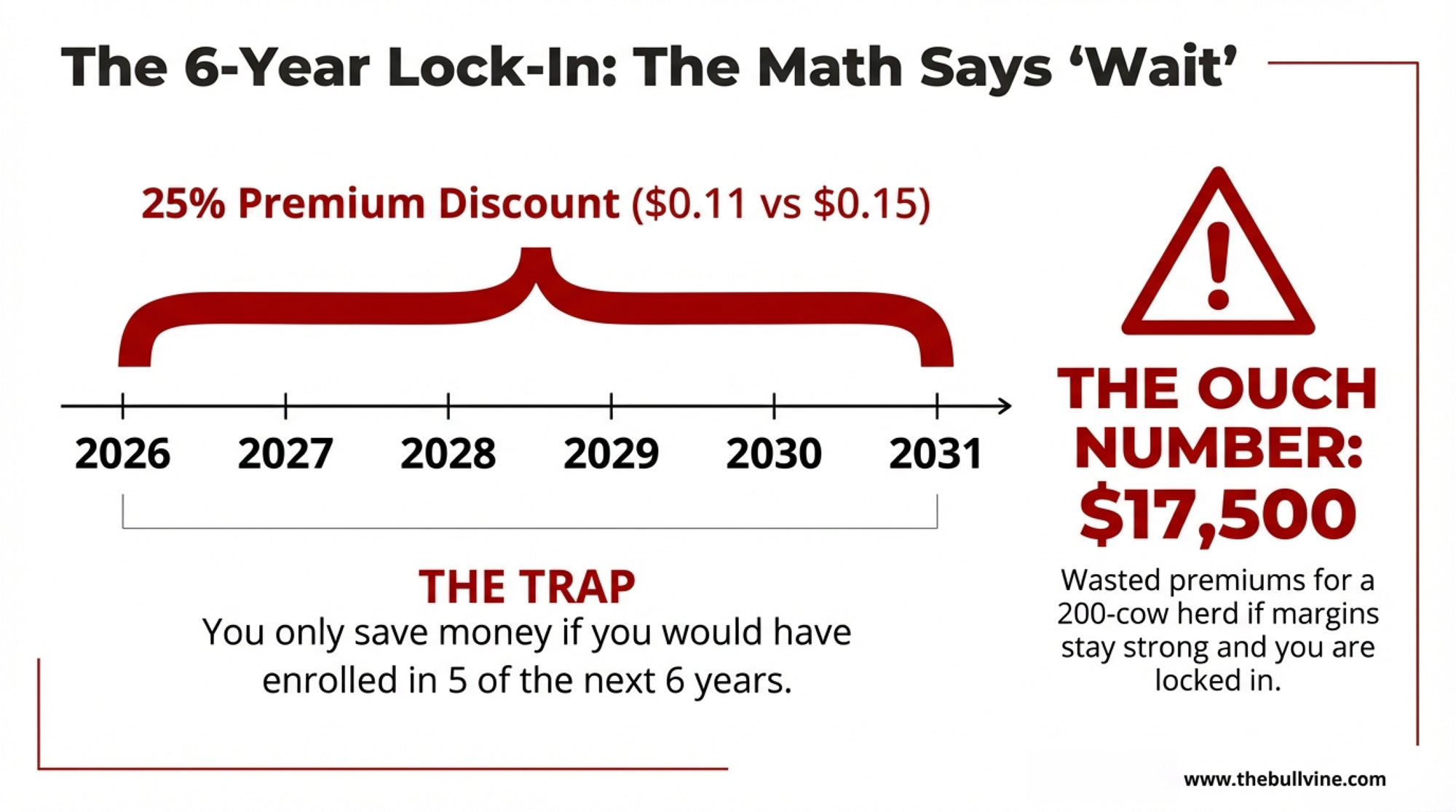

USDA’s 25% premium discount only pays off if margins stay compressed five of the next six years. That’s never happened.

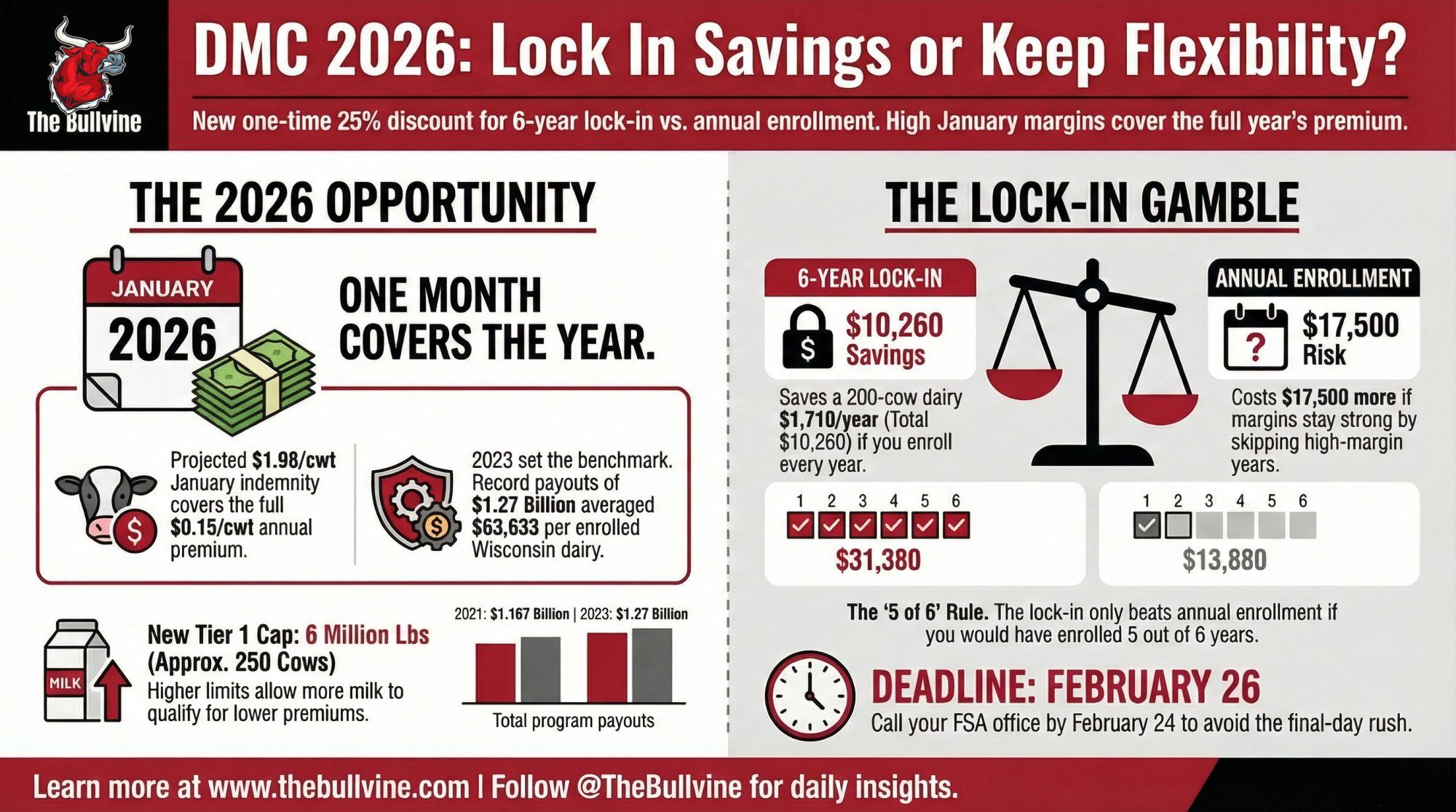

Executive Summary: Wisconsin dairies are a week from the 2026 Dairy Margin Coverage deadline, and 68% still aren’t enrolled even though January’s projected DMC margin of $7.52/cwt would generate about $1,564 per million pounds — enough to cover a full year of Tier 1 premiums at $9.50. The article breaks down how the new 6‑year lock‑in, with its 25% premium discount, only comes out ahead if you’d enroll in at least five of the next six years, and how locking in anyway can turn into a $17,500 premium drag for a 200‑cow herd when margins stay strong in four of those years. ⚡ But that analysis comes with an important caveat: at $0.15/cwt, the enrollment hurdle is low enough that a rational producer looking at futures would likely have enrolled in most years — which makes the lock‑in more defensible than it first appears. The article walks through full barn math for 200‑ and 500‑cow operations, shows how the 6‑million‑pound Tier 1 cap leaves half the milk on a 500‑cow herd uncovered, and puts 2023’s record $1.27 billion in DMC payouts — $63,633 per enrolled Wisconsin dairy — in context as the benchmark for what this program delivers when margins compress. Instead of generic advice, you get four specific paths — annual DMC, 6‑year lock‑in, lower‑tier coverage, or skipping DMC and leaning on DRP/LGM for the rest of your milk — with clear trade‑offs spelled out for each. The playbook is simple: pull your 2021–2023 milk marketings, run the USDA DMC calculator with your actual cwt, and call FSA by February 24, so you know exactly what you’re betting before you sign a contract that runs through 2031.

January 2026 Class III settled at $14.59/cwt — the weakest month since early 2024. And as of February 17, roughly 3,500 Wisconsin dairy operations still hadn’t enrolled in Dairy Margin Coverage for 2026. Katie Detra at Wisconsin’s Farm Service Agency shared that just 1,616 producers had completed DMC signup — only 31.5% of the state’s 5,116 licensed dairy farms. The deadline is February 26.

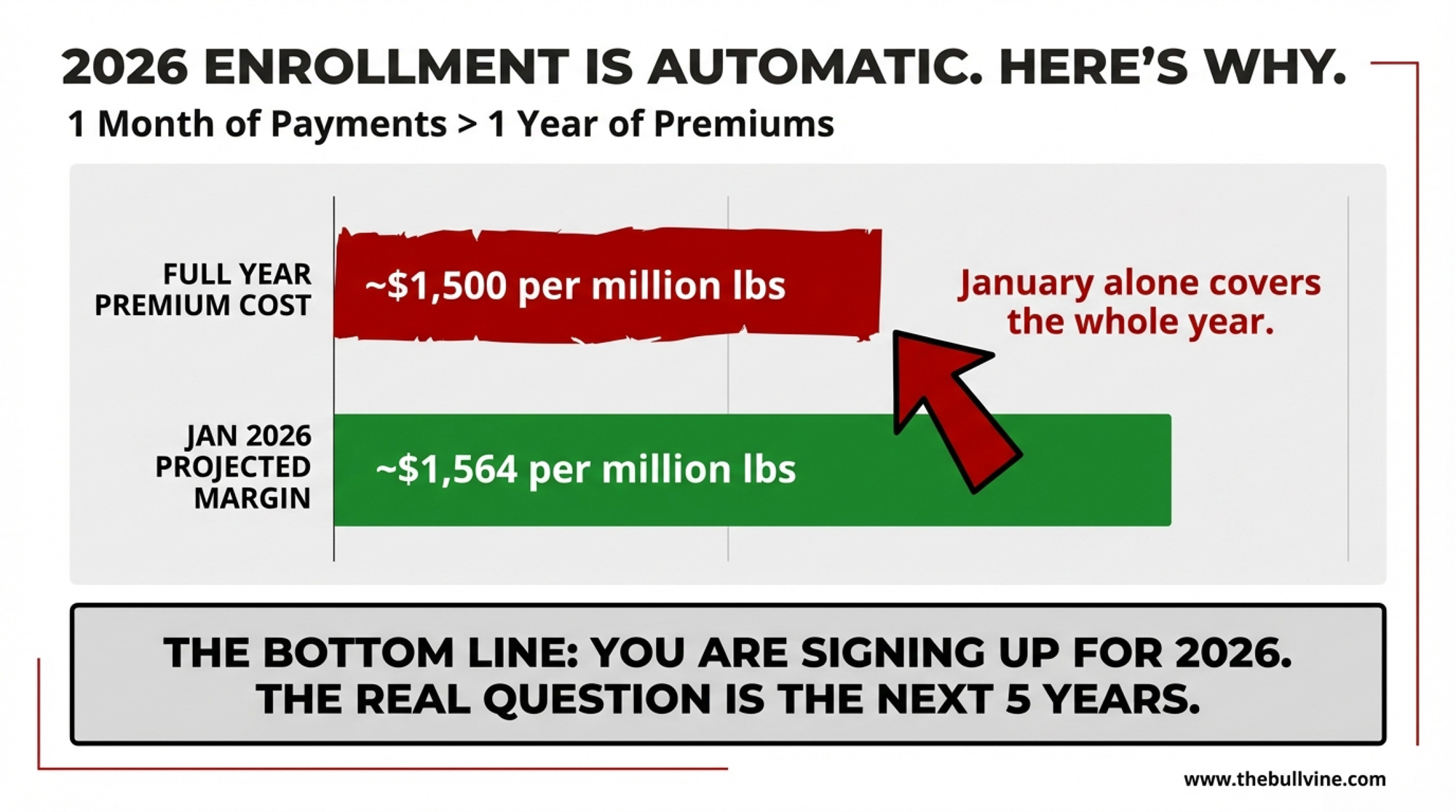

DMC doesn’t use Class III directly. The program’s margin formula takes the national All-Milk price and subtracts a standardized feed cost. But the pressure is running in the same direction. As of February 2, the Center for Dairy Excellence projected the January 2026 DMC margin at $7.52/cwt. At $9.50 coverage, that’s a $1.98/cwt indemnity — and CDE noted that January alone would produce “about $1,564 on a million pounds of production covered under Tier 1, which would cover premium costs” for the entire year.

One month’s payment covers your annual premium. For 2026, the enrollment decision is close to automatic. The six-year lock-in checkbox sitting next to it on the form? That’s a different conversation entirely—and nobody’s walking producers through the math.

From 80% to 31% — What Happened in Wisconsin?

Here’s the part that doesn’t add up. As of early 2024, 80 percent of Wisconsin dairy farmers were enrolled in DMC — the highest participation rate in the country, per Wisconsin Farm Bureau Federation. WFBF President Brad Olson called it “a critical farm safety net program during tough times.”

Fair warning on the comparison: that 80% figure was a final-year enrollment count. The current 31.5% is a mid-signup snapshot with six days left. Deadline rushes always close the gap. But even so, the pace is way off.

Some of the lag is structural. Wisconsin lost 545 dairy operations between January 2024 and today — down from 5,661 to 5,116. Some of those lost farms were DMC enrollees. Others are mid-transition, selling cows or passing the herd to the next generation, and a six-year commitment is the last thing they want. Still others have built hedging programs around Dairy Revenue Protection and see DMC as redundant on their first 6 million pounds.

But the margin picture has shifted underneath all of them. December 2025’s DMC margin came in at $9.42/cwt — just barely triggering the year’s first and only payment, a thin $0.08/cwt. That was the warm-up act. CDE’s January 14 outlook projects the full-year 2026 average margin at $8.51/cwt, starting at $7.37 in January and not climbing above $9.50 until November. If that forecast holds, ten months trigger payments — a total net indemnity of $8,300 per million pounds of Tier 1 covered production, after premiums but before sequestration.

Katie Burgess, director of risk management at Ever.Ag, projected “payouts of more than $1 per hundredweight for January through April, and then some smaller payments for May through July as well.” Mike North, also at Ever.Ag, as been blunt with producers: just “get it.”

They’re right about 2026. The harder question is whether you should lock your elections through 2031.

What 2023 Should Remind Every Producer About DMC

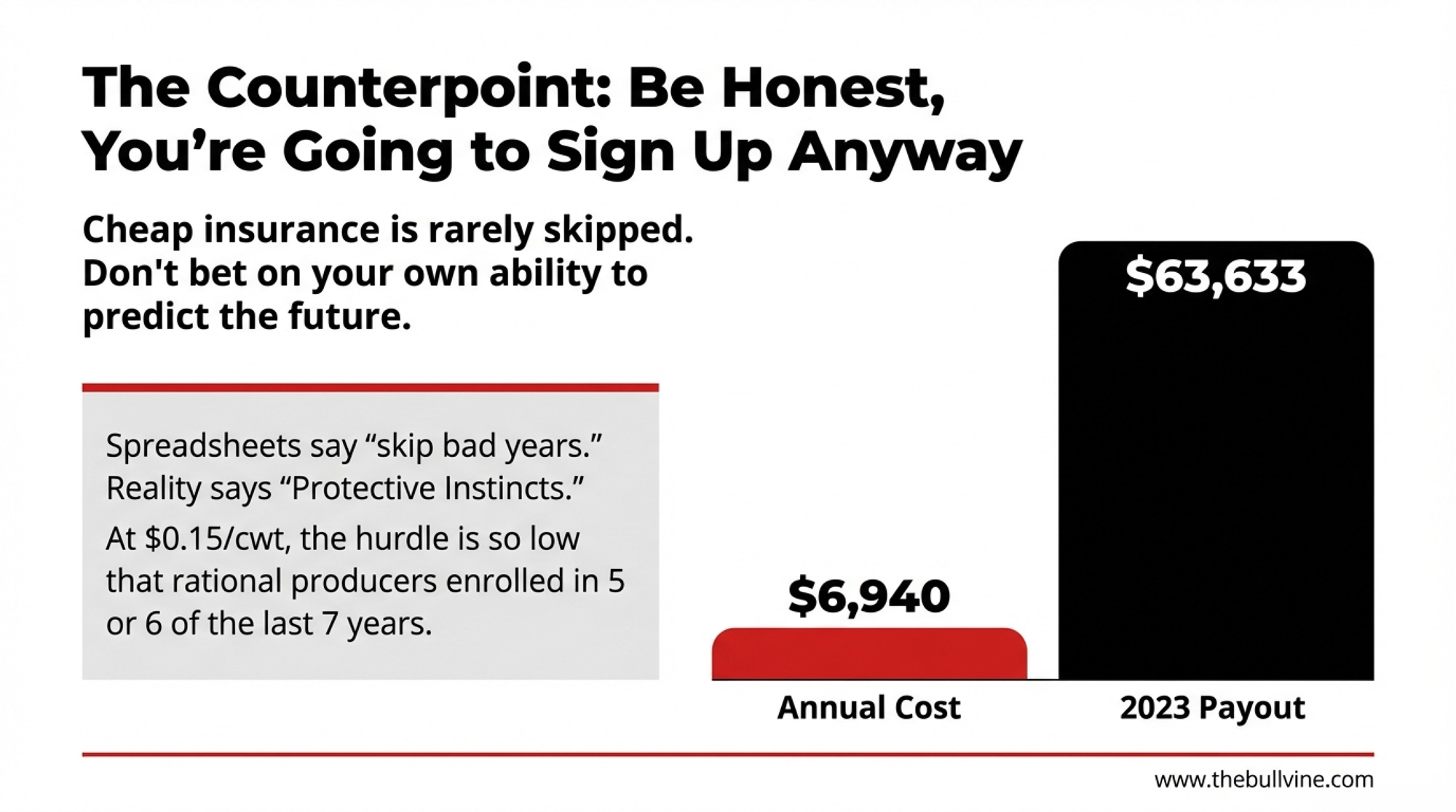

Before digging into the lock-in math, it’s worth anchoring on what DMC actually delivers when margins compress hard — because the numbers aren’t theoretical.

In 2023, DMC triggered payments in 11 of 12 months at $9.The 50 coverage. At the level of average enrolled dairy, received indemnity payments of $2.80/cwt per month. Through the first nine months alone, total program payouts reached $1.27 billion — surpassing the previous annual record of $1.187 billion set in 2021. Wisconsin led all states at $272.2 million, averaging $63,633 per enrolled operation.

July 2023 hit the floor: a $3.52/cwt margin, the lowest in DMC history. At $9.50 coverage, that was a $5.98/cwt indemnity in a single month.

Put that in barn math for a 200-cow herd at 95% Tier 1: one month at $5.98/cwt on 3,800 covered cwt = roughly $22,724 from one month of milk. The annual premium was about $6,840. One July check covered three years of premiums.

Here’s the full payout history at $9.50 Tier 1 coverage:

| Year | Months Triggered | Total Payouts | Avg Per Enrolled Dairy |

| 2019 | 7 of 12 | $451.6M | $19,306 |

| 2020 | 5 of 12 | $234.0M | $17,324 |

| 2021 | 11 of 12 | $1.187B | $62,214 |

| 2022 | 2 of 12 | $83.7M | $4,656 |

| 2023 | 11 of 12 | $1.27B+ | $74,553 |

| 2024 | ~5 of 12 | $36.9M est. | $2,356 est. |

| 2025 | 1 of 12 | Minimal | ~$0.08/cwt (Dec only) |

Two things jump out. First, the big-payment years are massive — 2021 and 2023 alone combined for roughly $2.46 billion in indemnities. A single year of compression can dwarf a decade of premiums. Second, the non-payment years (2022, 2024, 2025) are real. At $0.15/cwt, you’re not losing much in those years — but you are paying premiums for coverage that didn’t trigger.

That second point matters for the lock-in question. More on that below.

What Changed Under the New Law

The One Big Beautiful Bill Act, signed July 4, 2025, reauthorized DMC through 2031 with three changes that shift the math.

Tier 1 coverage went from 5 million to 6 million pounds. A 250-cow herd shipping 24,000 lbs/cow now fits entirely inside Tier 1. Every operation gets a fresh production history based on the highest annual marketings from 2021, 2022, or 2023. And the new wrinkle: lock your elections for all six years and get a 25% premium discount.

FSA program manager Doug Kilgore confirmed this lock-in is a one-time election — available only during 2026 enrollment. Skip it now, and it’s gone for the life of the program.

Sandy Chalmers, Wisconsin’s FSA State Executive Director, outlined the base case on February 17: “At $0.15 per hundredweight for $9.50 coverage, risk protection through Dairy Margin Coverage is a cost-effective tool to manage risk and provide added financial security for your operations.”

At fifteen cents a hundredweight, she’s right. That’s the easy part.

How Much Does DMC Actually Pay a 200‑Cow Dairy?

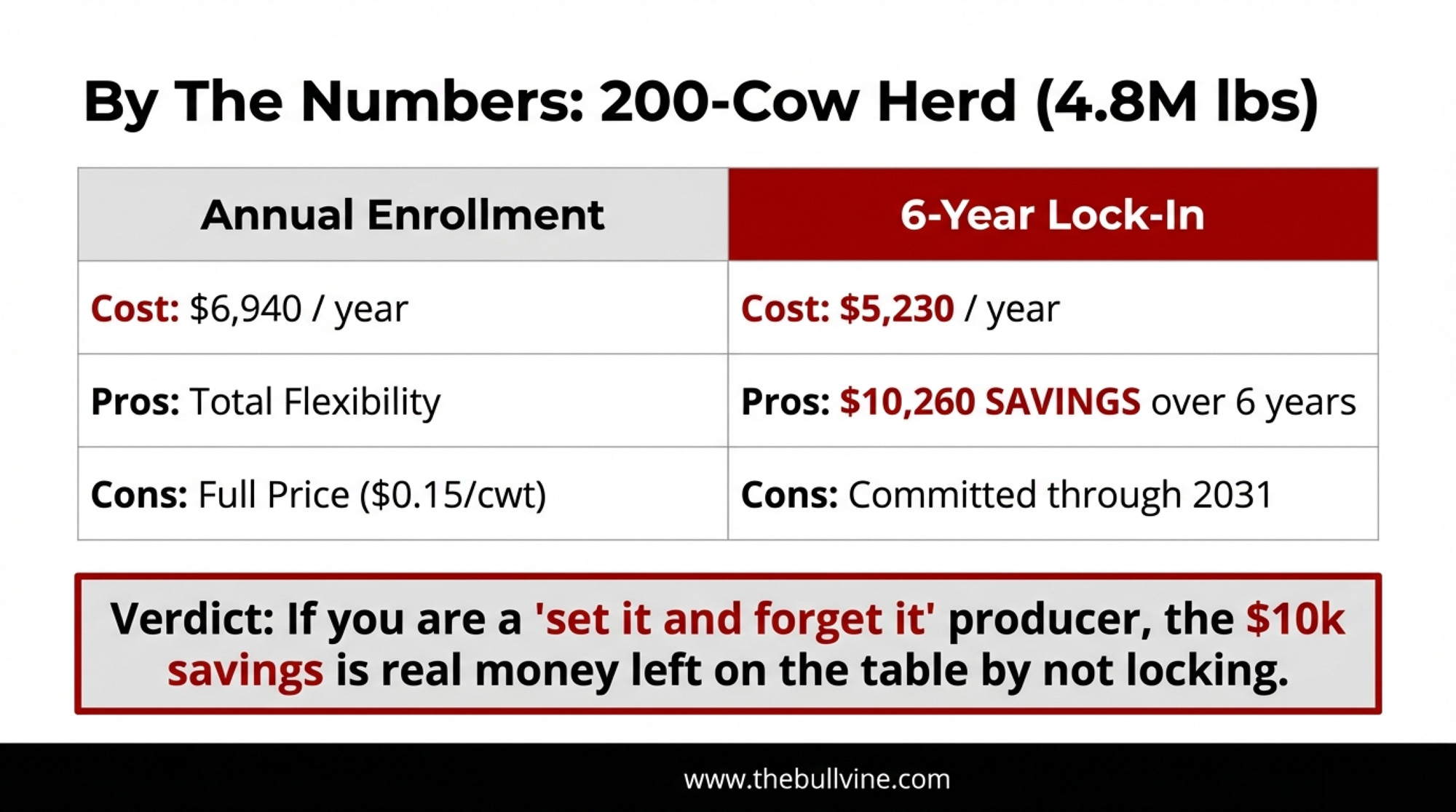

A 200-cow operation averaging 24,000 lbs/cow ships 4.8 million pounds — comfortably inside the 6-million-pound Tier 1 cap. At $9.50 coverage and 95% enrollment, the premium is $0.15/cwt.

Annual enrollment:

- 4,800,000 lbs × 95% = 4,560,000 lbs = 45,600 cwt covered

- 45,600 cwt × $0.15 = $6,840 + $100 admin fee = $6,940/year

- You choose each year whether to re-enroll.

Six-year lock-in:

- 45,600 cwt × $0.1125 (25% discount) = $5,130 + $100 = $5,230/year

- Locked through 2031. No exit.

Annual savings from the lock-in: $1,710/year, or $10,260 over six years.

Now look at January alone. CDE’s $1.98/cwt projected indemnity on that 200-cow herd: 3,800 cwt of monthly covered production × $1.98 = roughly $7,524 on one month’s milk. That single payment exceeds the entire annual premium.

If margins track CDE’s January 14 forecast for the full year, total net indemnity on 4.56 million covered pounds would land around $37,800 for 2026. That’s a projection, not a guarantee — forecasts shift month to month. But it shows the scale of what’s sitting on the table.

And on a 500‑Cow Operation?

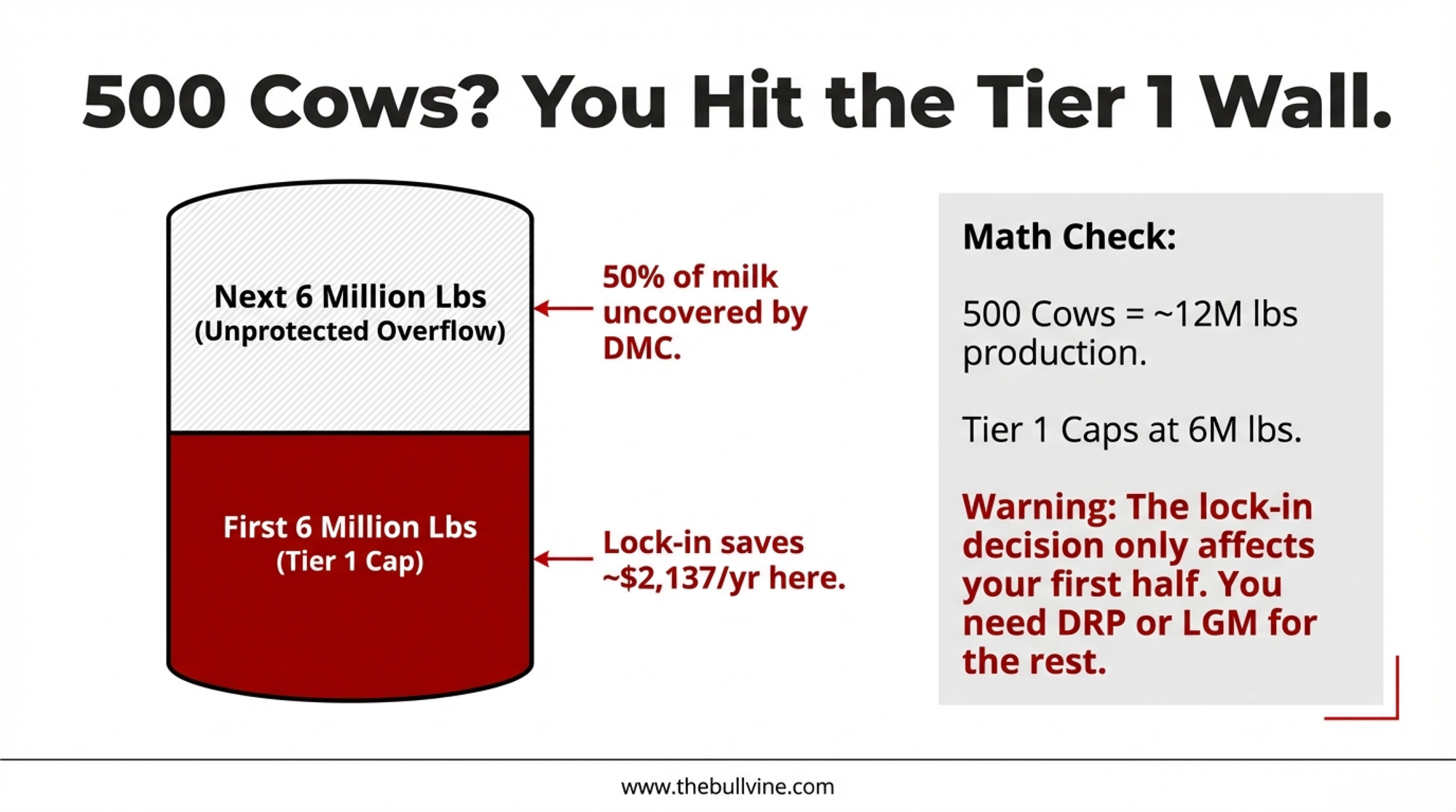

Scale up, but know where the wall is. A 500-cow dairy at 24,000 lbs/cow produces 12 million pounds. Tier 1 caps at 6 million. Half of your milk is unprotected.

Annual: 57,000 cwt × $0.15 = $8,550 + $100 = $8,650/year

Lock-in: 57,000 cwt × $0.1125 = $6,412.50 + $100 = $6,512.50/year — saving $2,137.50/year

January’s projected indemnity: 4,750 monthly cwt × $1.98 = $9,405. One month covers the premium. Scale CDE’s full-year projection the same way — $8,300 per million covered pounds × 5.7 million — and you’re looking at roughly$47,310 in net indemnity for 2026 on the Tier 1 portion alone.

But the other 6 million pounds? Nothing. Tier 2 premiums jump to a maximum of $8.00 coverage with rates running dramatically higher — that’s why most advisors treat DMC as a Tier 1 play and layer DRP on top for the rest.

William Loux, senior vice president of global economic affairs at the National Milk Producers Federation, put it this way: “The uncertainty in dairy markets is not going away anytime soon. So DMC, DRP — these are great programs to utilize.”

Should You Lock In DMC for 6 Years?

This is where the 25% discount starts to get complicated. Leonard Polzin, dairy markets and policy specialist at UW–Madison Extension, ran the margin history, and his numbers frame the decision.

The lock-in only beats annual enrollment if you’d sign up in at least 5 of the 6 years. Here’s what that looks like for a 200-cow dairy:

| Scenario | Lock-In Cost (6 yrs) | Annual Cost | Differencefor |

| Enroll all 6 years | $31,380 | $41,640 | Lock-in saves $10,260 |

| Enroll 5 of 6 | $31,380 | $34,700 | Lock-in saves $3,320 |

| Enroll 3 of 6 | $31,380 | $20,820 | Annual savings are $10,560 |

| Enroll 2 of 6 | $31,380 | $13,880 | Annual saves $17,500 |

That bottom row. You’ve paid $17,500 in premiums for coverage that barely triggered.

So how often do margins actually compress for five or six straight years? Polzin checked. From 2019 through 2025, 39 of 84 months fell below $9.50. Payment runs averaged 4.88 months. Non-payment runs averaged 4.33 months. As his analysis notes, “margins tend to move in episodes rather than in isolated one-month shocks” — and “the relevant risk is frequently the duration of tight margins and the associated working-capital strain, not only whether a single-month payment occurs.”

The margin oscillates. It doesn’t stack up in neat multi-year compression streaks.

But Here’s the Honest Counterpoint: What Did Futures Show at Decision Time?

The table above assumes you’d skip enrollment in years when margins ended up running above $9.50. That’s hindsight. You don’t have hindsight at enrollment time — you have futures.

And here’s what producers actually knew at each deadline:

| Enrollment Year | Deadline Window | Market Signal at Signup | Would a Rational Producer Enroll? | Actual Result |

| 2019 | Early 2019 | Tight margins expected | Yes | 7 months triggered; $19,306/op |

| 2020 | Late 2019 | Uncertain; premium cheap | Probably | 5 months; $17,324/op |

| 2021 | Early 2021 | Feed costs rising | Yes | 11 months; $62,214/op |

| 2022 | Late 2021 | Milk recovering, feed high | Uncertain — but $0.15/cwt is cheap insurance | 2 months; $4,656/op |

| 2023 | Extended to January 31, 2023 | FSA Administrator: “early projections indicate payments are likely for the first eight months” | Absolutely | 11 months; $74,553/op |

| 2024 | February 28 – April 29, 2024 | Jan margin hit $8.48, first payment triggered before enrollment opened | Probably | ~5 months; $2,356/op |

| 2025 | January 29 – March 31, 2025 | Futures projected ~$12.50/cwt average margins | Maybe skip — but premium is just $0.15/cwt | 1 month; ~$0.08/cwt |

At $0.15/cwt, the enrollment hurdle is remarkably low. A 200-cow herd pays $6,940 for a full year of $9.50 coverage. In 2023, that $6,940 returned roughly $63,000. Even in the weakest year on record — 2022 — the premium amounted to about $1.44/cow/year. Most producers would enroll on cheap-insurance logic alone in all but the most obviously strong-margin years.

Look at that column honestly: a rational producer reviewing futures at each enrollment deadline would likely have enrolled in five or six of the last seven years. Only 2025 gave a clear “skip” signal — and even then, some producers enrolled because the premium was effectively a rounding error against downside protection.

That changes the lock-in math. If you’re the kind of operator who enrolls most years anyway — and the historical enrollment rate of 73–80% of eligible dairies suggests most producers are — the lock-in’s $10,260 in savings over six years is real money you’d leave on the table by staying annual.

The lock-in loses when you’re disciplined enough actually to skip enrollment in good-margin years. Polzin’s data shows that the years 2022, 2024, and 2025 all had weak or zero payouts. But the question isn’t whether good-margin years exist. It’s whether you’d actually sit out when the premium is $0.15/cwt and the downside is missing a 2023-style year.

Loux captured the tension: “It’s good that DMC is paying out, but it’s almost always better for prices, and better for dairy farmers, if they don’t.”

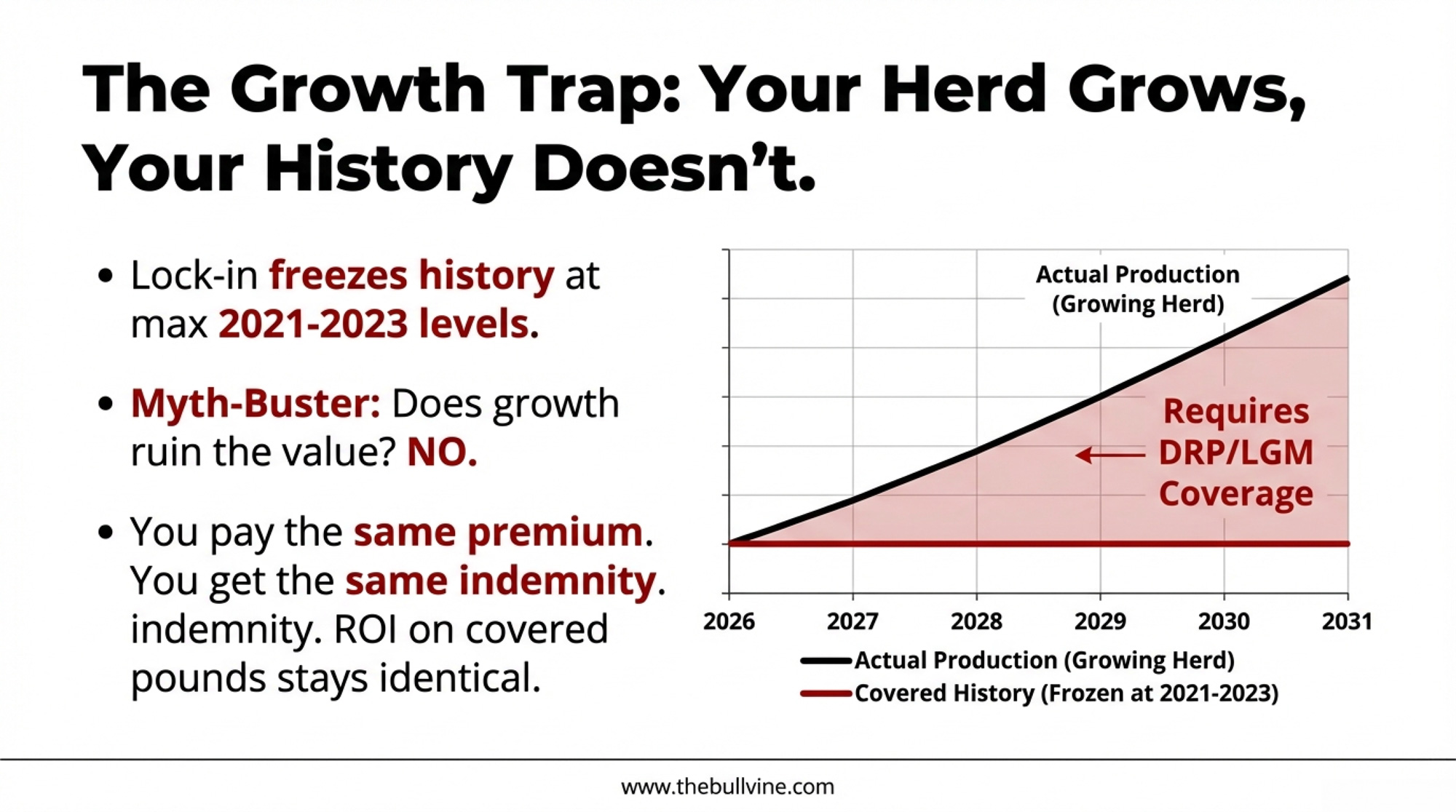

What Happens When Your Herd Outgrows Your History?

Lock in for six years, and your production history freezes at your best year between 2021 and 2023. Your herd doesn’t.

Say your best history year was 170 cows. You’re milking 200 now. That history — 4,080,000 lbs at 95% enrollment — gives you 3,876,000 covered pounds. Here’s the part that trips people up: the dollars don’t change as you grow. The premium stays the same. The indemnity payment stays the same. You’re buying coverage on a fixed number of pounds — same check out, same check in, regardless of what’s happening with your actual herd size.

What does change is the share of your total production that has margin protection underneath it:

| Year | Actual Production | Covered Lbs | % Covered | Annual Premium | Indemnity per $1/cwt Trigger |

| 2026 | 4,800,000 (200 cows) | 3,876,000 | 80.8% | $5,914 | $38,760 |

| 2028 | 5,198,000 (217 cows) | 3,876,000 | 74.6% | $5,914 | $38,760 |

| 2031 | 5,845,000 (244 cows) | 3,876,000 | 66.3% | $5,914 | $38,760 |

Notice the last two columns — they’re identical every row. The DMC math on your covered pounds doesn’t erode. You pay the same premium. You get the same indemnity. The ROI on the covered portion is unchanged whether you’re milking 200 cows or 244.

The real issue is what’s growing outside that coverage. By 2031, a third of your actual production has zero margin protection. That milk generates revenue in good months and unprotected losses in bad ones. It’s not that DMC got worse — it’s that your unprotected exposure got bigger, and you need to manage it separately.

For a 500-cow herd, this gap exists from day one. You’re producing 12 million pounds and covering 6 million — half your milk is already outside DMC, regardless of herd growth.

The practical question isn’t “is my DMC eroding?” — it’s “what am I doing about the growing share of milk that DMC was never designed to cover?” That’s where DRP, LGM, or self-insurance need to enter the conversation. Kilgore confirmed: locked-in operations must pay premiums annually and certify they’re commercially marketing milk every year. There’s no pause button and no off-ramp — but the coverage you’re paying for delivers the same dollar protection it always did.

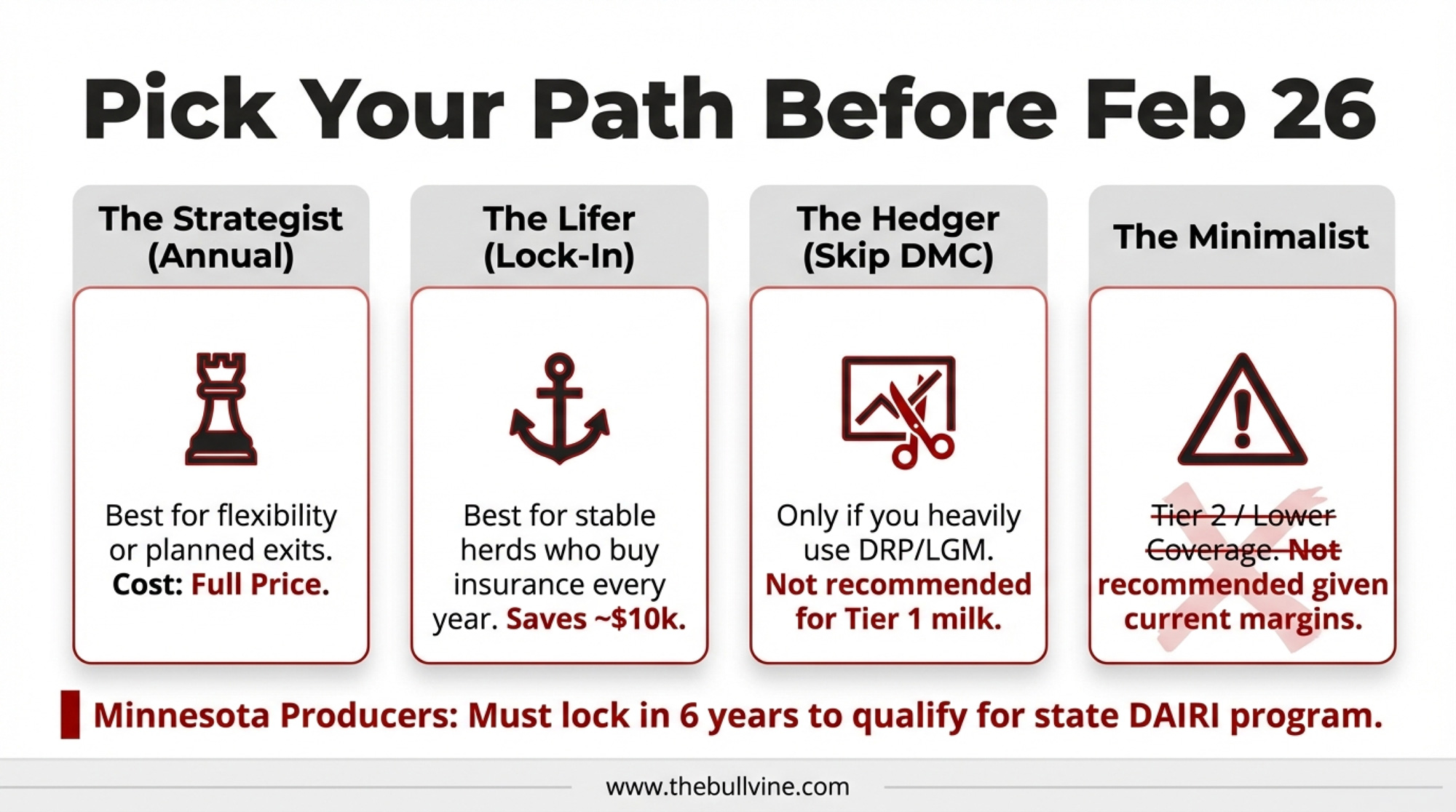

Four Paths Before February 26

Path 1: Annual enrollment at $9.50, Tier 1. No lock-in. Best for growing herds, operations expecting margin recovery within 2–3 years, or anyone facing a major change before 2031. Cost: $6,940/year (200-cow) or $8,650/year (500-cow), paid only in the years you choose. You sacrifice $1,710–$2,137/year in premium savings. You keep full flexibility.

Path 2: The stable-herd lock-in. Fits operations that closely match their 2021–2023 history, plan to milk through 2031, and would realistically enroll most years anyway, which the enrollment history suggests is most producers. Savings: $10,260–$12,825 total. But it can’t be reversed. Premiums are due by September each year, regardless of conditions. If 2028 turns out to be a $12 margin year, you’re still writing that check. ⚡

Think you’ll weigh the lock-in decision next year? You won’t have the option. This election is only available during the 2026 enrollment. Miss it, and it’s gone permanently.

Path 3: Enroll at a lower coverage tier. Dropping from $9.50 to $8.00 cuts your Tier 1 premium and reduces your exposure if margins recover faster than expected. But it also slashes your indemnity in the months that matter most. Run both scenarios at dmc.dairymarkets.org with your actual production numbers before deciding.

Path 4: Skip DMC entirely. Only makes sense if you’re running active DRP or LGM hedging and are comfortable walking away from the cheapest margin protection available on your first 6 million pounds. Note: operations with unpaid 2025 premiums can’t get a 2026 contract until the balance clears.

Minnesota producers — one more variable. Your state’s DAIRI program requires a 6-year DMC commitment to qualify for state-level dairy assistance. That alone could tip the math.

What This Means for Your Operation

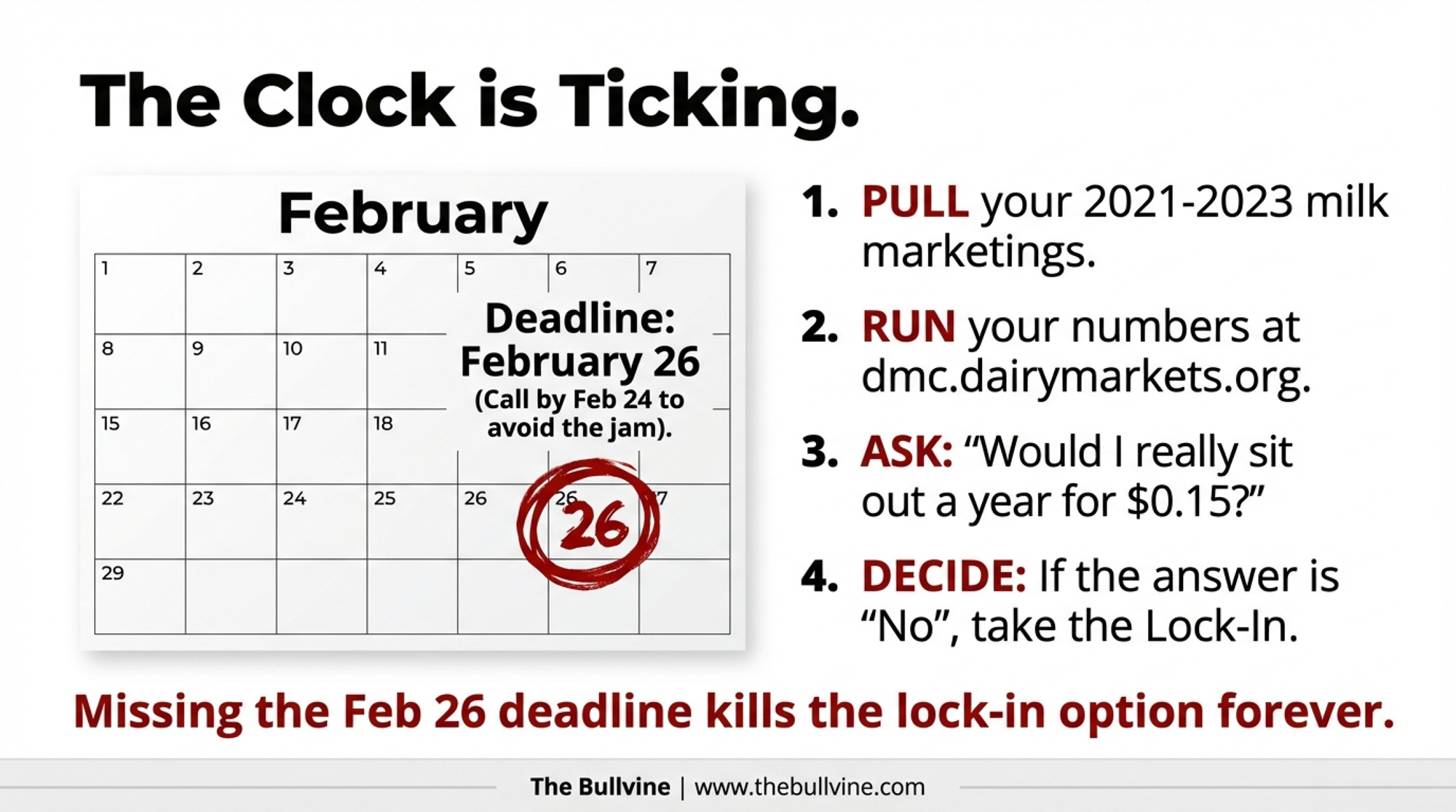

- Pull your 2021–2023 milk marketings now. Your production history is the highest of those three years. If it sits well below current output, know that your DMC coverage on those pounds still delivers the same dollar protection — but you’ll need DRP or LGM for the uncovered portion. ⚡

- Run the USDA DMC decision tool with your actual numbers: dmc.dairymarkets.org. Polzin’s full historical margin analysis is at UW–Madison’s farm management site.

- Be honest about your enrollment behavior. How many of the last seven years would you have enrolled? Not in hindsight — looking at what futures showed at each enrollment deadline. At $0.15/cwt, most producers enrolled in five or six of seven. If that’s you, the lock-in’s $10,260 in savings is real. If you’re disciplined enough to skip when futures signal strong margins, annual gives you that optionality.

- Remember what 2023 delivered. Wisconsin dairies enrolled in the program averaged $63,633 in indemnity payments. Those that weren’t? Zero. At $0.15/cwt, the annual cost of not being covered in a compression year dwarfs a decade of premiums.

- Call your local FSA office by February 24—not the 26th. Phone lines jam on deadline day. Paperwork takes longer than you expect. Find your office at farmers.gov/service-locator.

- DMC payments are taxable income and are subject to a 5.7% sequestration, per OMB’s FY2026 report. On a $1.98/cwt January indemnity, that shaves roughly $0.11/cwt before the check hits your account. Plan with your accountant.

- Within 3–5 years of a transition? A six-year commitment may outlast your timeline. Annual enrollment preserves every option.

Key Takeaways

- If you’d realistically enroll most years anyway — and at $0.15/cwt, the enrollment history suggests most producers would — the lock-in saves $10,260 on a 200-cow herd. The 25% discount represents genuine savings if your enrollment behavior aligns with historical norms.

- If you’re disciplined enough to skip enrollment when futures signal strong margins, annual enrollment preserves that optionality. Polzin’s data shows margins ran above $9.50 for all or most of 2022, 2024, and 2025 — skipping those years saves more than the lock-in discount.

- Growing herds don’t lose DMC value on covered pounds — same premium, same indemnity, same ROI. But the uncovered share of your total production continues to grow each year. If current production exceeds your 2021–2023 high by more than 15%, layer DRP or LGM on the exposed portion now.

- If your debt-service coverage ratio sits below 1.3, the lock-in’s predictable cost may matter more to your lender than flexibility. Have that conversation before the 26th.

- The six-year election disappears after 2026 enrollment. Annual is the default. After February 26, the option is permanently gone.

The Bottom Line

Pull your milk statements. Plug your numbers into the USDA calculator — yours, not the ones in this article. And before you check that lock-in box, answer one question honestly: in the last seven years, how many times would you have sat out enrollment at $0.15/cwt?

If the answer is one or two, the lock-in probably makes sense. If you’d have skipped three or more annual wins.

Make the call before February 24. When January’s official DMC margin drops, you’ll know exactly what your decision was worth.

We’ll have that scorecard next month.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- GT Thompson’s 2026 Farm Bill Math: DMC Pays Your 200‑Cow Dairy $1,800, Make Allowances Cut $42,240 – a 23 to 1 Hit – Arms you with the brutal math behind the 2026 Farm Bill, exposing why a small DMC win can’t mask massive make-allowance hits. It breaks down the 23-to-1 revenue gap to protect your real-world bottom line.

- The 90-Day Reckoning: What Your Milk Check Is Really Saying About 2026 – Delivers a strategic playbook for the upcoming consolidation period by revealing structural shifts in 2026 budgets. It helps you calculate your true “red line” to keep you solvent and liquid while peers face the exit.

- Genetic Correlations Upended: Why Sticking with Old Breeding Indices Could Cost Your Dairy $486 Per Cow – And What the Data Really Proves – Exposes the $486 profit gap hiding in your nitrogen tank, revealing how the 2025 genetic base change rewards component-focused herds. It turns your breeding strategy into a high-performance margin lever for the next decade.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!