83% of family dairies won’t survive to generation three. But farms boosting feed efficiency 15% through genomic testing are beating the odds.

You know that sinking feeling you get when you’re walking through a parlor that’s been sitting empty for months? The smell of old silage still lingering, phantom sounds of the vacuum pump… but knowing those stalls will never see fresh cows again?

I’ve been getting that feeling way too often lately. And not just about individual barns—I’m talking about our entire industry structure.

So there I was last month, finishing up evening chores with Tom on his third-generation operation in central Wisconsin. Solid 450-cow setup, decent butterfat numbers, the kind of place you’d expect to be milking cows forever. Then he drops this bombshell: “I might be the last one to milk on this land.”

The weight in that statement… it’s haunting more families than we’re willing to admit at those industry meetings.

Here’s what’s keeping me awake at night: the operations we’re losing aren’t the basket cases everyone expects. These are farms with respectable production records, decent equity positions, and respected names in their communities. They’re just… dissolving. Because they thought succession planning was something they’d handle “when the time comes.”

Spoiler alert: by then, it’s already too late.

Part 1: The Crisis

The Brutal Math Nobody Wants to Face

Let me hit you with some numbers that honestly made me double-check my calculator when I first saw them. According to recent work from Iowa State University, 83.5% of family dairies don’t make it to the third generation¹. Think about that for a second—we’re talking about failure rates that make the restaurant business look stable.

But here’s the kicker that really caught my attention: 71% of dairy farmers approaching retirement haven’t even identified a successor¹. And those who actually have succession plans? Only 20% believe they’ll work¹.

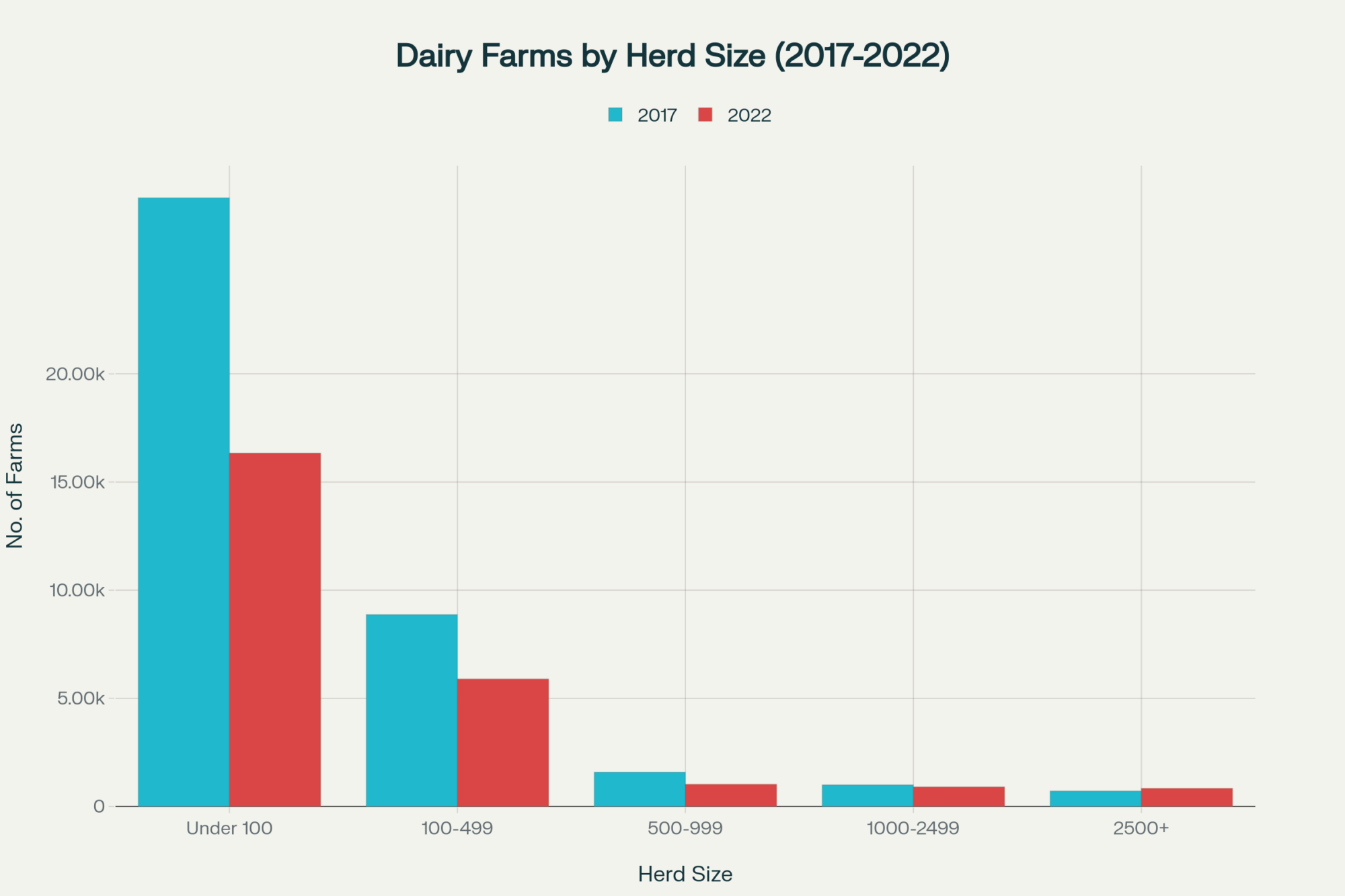

This isn’t some distant threat we can kick down the road, like those overdue invoices we’d rather not look at. The demographic avalanche is happening right now. Between 2017 and 2022, we lost 15,866 dairy operations—a 39% decline in just five years. Yet milk production actually increased 5% during that same period.

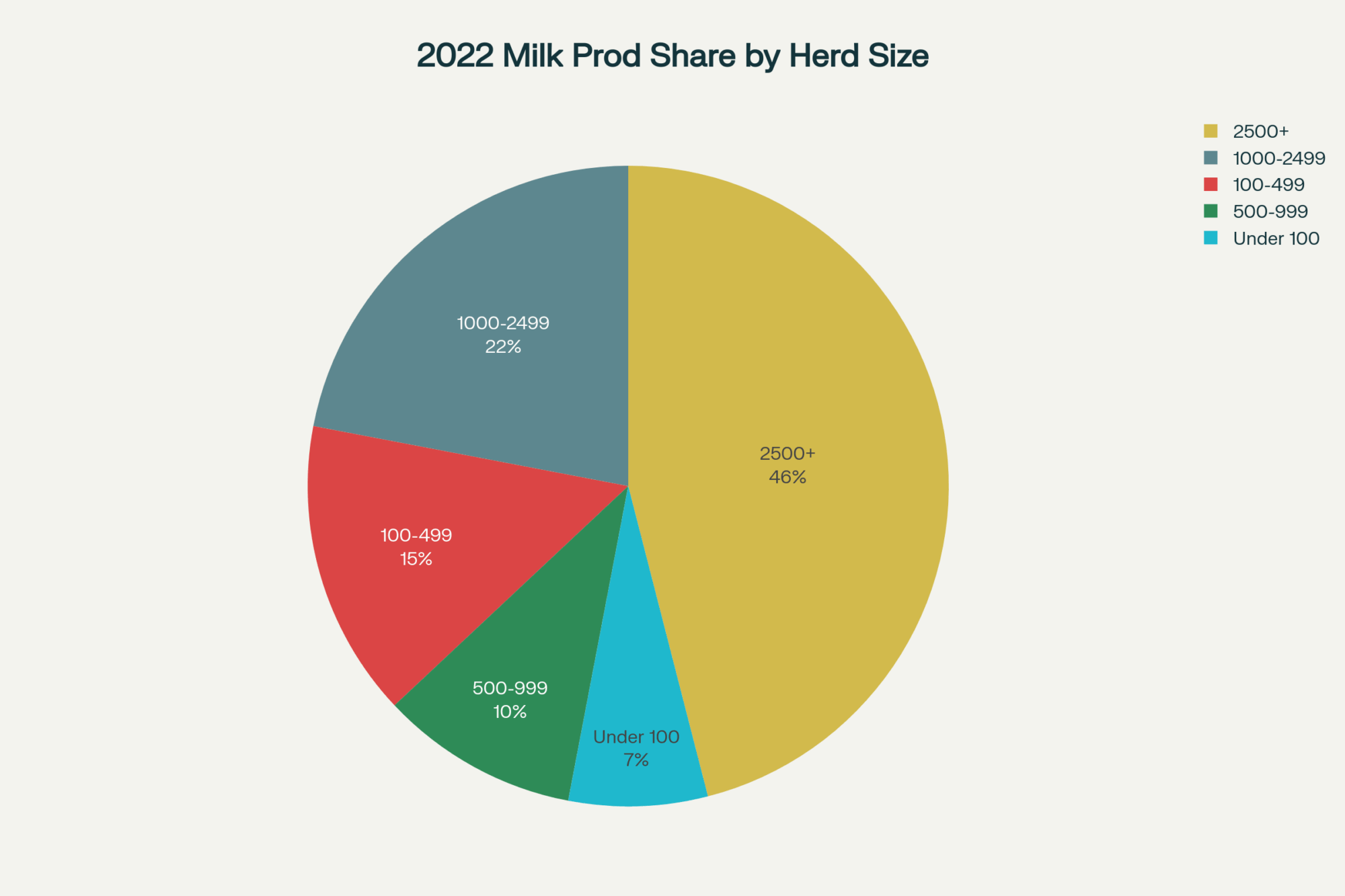

Know where all that production went? Those mega-dairies with 2,500+ cows that grew by 16.8% and now control 46% of national milk production. Every time a smaller farm without a successor closes its doors, its assets and production capacity get absorbed by larger, expanding neighbors. It’s the slow-motion transfer of an entire industry’s wealth—and most of us are just standing by, watching it happen.

What’s Really Happening in Our Parlors Right Now

The thing about demographics in dairy—they’re like watching a train wreck in slow motion where everyone can see what’s coming, but nobody seems able to stop it. You’ve probably noticed it at those recent industry meetings. More gray hair, fewer young faces, conversations shifting from expansion plans to exit strategies.

According to the Federal Reserve Bank of Minneapolis, producers aged 55 and over now make up nearly two-thirds of all operators in major dairy regions. That’s a massive jump from just 44% in 2002. Even more concerning? One-third are already 65 or older.

Here’s what really caught my attention in the latest industry surveys: 25% of dairy operators plan to retire within the next five years¹. Of that group, 22% are already over 65, and another 28% are between 55 and 64 years old.

The pipeline behind them? It’s not just weak—it’s practically nonexistent. In New York alone, the number of young producers under 35 actually declined from 6,718 in 2017 to 6,335 in 2022¹. We’re losing young talent faster than we can attract it, which, frankly, shouldn’t surprise anyone who has been paying attention to off-farm career opportunities.

What’s particularly interesting (and this caught my attention when reviewing the Wisconsin data) is the direct correlation between economic scale and succession planning success. While only 38% of smaller operations with 20-49 cows have identified successors, this jumps to 69% for commercial dairies with 200-999 cows¹.

Translation? If your operation isn’t economically robust enough to support transition planning, you’re statistically destined to become someone else’s expansion opportunity.

The $24 Trillion Wealth Transfer That’s Flying Under Everyone’s Radar

Let’s talk about numbers that should fundamentally change how you think about succession planning. The scale of agricultural wealth transfer happening right now makes the tech boom look like pocket change.

We’re looking at over $24 trillion in agricultural assets changing hands over the next two decades¹, with 40% of all U.S. farmland—approximately 370 million acres—expected to change hands by 2045. For dairy families, this represents the largest intergenerational wealth movement in American history.

However, here’s where the story takes a fascinating turn—a development that occurs as I write this. The estate tax situation that everyone’s been panicking about? It has been completely turned on its head.

The Estate Tax Plot Twist Nobody Saw Coming

For years, we’ve been discussing the looming “tax cliff,” where estate exemptions were set to drop from $13.99 million to approximately $7 million on January 1, 2026. Farm families have been scrambling to plan around this deadline, and advisors have been making bank on the fear…

Well, here’s the development that changes everything: President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025. This legislation permanently increases the estate tax exemption to $15 million per individual, starting January 1, 2026, and indexed for inflation. The 40% tax rate remains unchanged, but now married couples can transfer up to $30 million tax-free.

This is huge for dairy families. Instead of facing a tax cliff, they’ve got even more breathing room than they thought. However, here’s the thing—and I want to stress this enough—it doesn’t change the fundamental succession planning needs. You still need those professional teams, the family communication, and the strategic structures. The tax relief just removes one barrier… but there are plenty more where that came from.

Current Market Reality Check

The financial landscape we’re operating in right now is… honestly, it’s better than many expected going into 2025. USDA’s latest projections show All-Milk prices ranging from $21.60 to $22.75 per hundredweight for 2025, which is solid territory for most operations. Meanwhile, Class III futures are trading around $18.70 per hundredweight for various contract months—and yeah, I know some of you are wondering about that spread. Different pricing mechanisms and market signals, but both indicate relatively stable conditions.

Feed costs are running about 13% lower than in 2024, and interest rates are cooperating better than they have in a while. January 2025 milk production was up 0.1% with cow numbers at 9.365 million head—that’s 41,000 more than last year.

But even with improved economics, the consolidation train isn’t slowing down. Current conditions are actually creating opportunities for well-positioned operations to expand, which accelerates the succession crisis for unprepared families. It’s like… good times can actually exacerbate the problem if you’re not prepared for them.

Part 2: The Cause

Why Smart Operations Still Dissolve (The Psychology Nobody Discusses)

Here’s what really frustrates me about this whole situation… the families losing their operations aren’t the struggling ones everyone expects. I’ve seen this pattern over and over: profitable operations with solid cash flow, decent equity positions, respected names in their communities—just gone.

Because they thought succession planning was something they’d handle “when the time comes.”

The Mental Block That’s Killing Farms

The planning gap is so severe it’s almost criminal. Recent work from Farmdoc Daily shows that while 56% of farms report being involved in “some form” of succession planning, only 40% have defined plans¹. What’s even more sobering—among those with plans, only 20% actually believe they’ll work.

But here’s what might surprise you… the biggest succession killers aren’t financial. They’re psychological.

The very mindset that creates successful operations—total commitment, personal sacrifice, that “work until the job is done” mentality—actively prevents the emotional work necessary for succession planning. Think about it… we’re asking people who’ve built their entire identity around never giving up to essentially plan for giving up.

Take Sarah, a producer I know in Minnesota. Third-generation operation, 380 cows, solid margins year after year. She spent three years avoiding the succession conversation because she couldn’t face the possibility of being “the one who lost the farm.” That avoidance? It nearly became a self-fulfilling prophecy when her father had a stroke with no formal transition plan in place. They scrambled, got it figured out… but barely.

The Mental Health Crisis We Pretend Doesn’t Exist

The stress of succession planning isn’t just business pressure—it’s existential dread. Research from Wisconsin and Pennsylvania identifies five areas where family tensions consistently explode: finances, communication, inheritance, change, and control¹. At the heart of most failures is the impossible challenge of treating heirs “equally” versus “fairly.”

The mental health toll is both quantifiable and terrifying. Farmers experience suicide rates 3.5 times higher than the general population, with succession-related stress identified as a primary factor. More specific CDC data shows male farmers have suicide rates of 36.1 per 100,000, 1.6 times higher than all working males.

This hits close to home for a lot of us. A staggering 41% of dairy farmers don’t have health insurance coverage, making mental health resources even more difficult to access. When 76% of farmers report moderate to high stress levels compared to the general population, we’re talking about a systemic crisis that’s actively preventing succession planning from happening.

What’s particularly noteworthy is that 63% of farmers acknowledge mental health stigma in their community. This cultural barrier keeps people suffering in silence exactly when they need help navigating the most complex business transition they’ll ever face.

The process of farm succession adds layers of psychological stress on top of external pressures. The fear of losing a farm that has been in the family for generations, the weight of parental expectations, and the complex negotiations surrounding fairness and control create significant emotional burdens¹. This stress isn’t confined to the senior generation—research shows the younger generation involved in multi-generational farms often experiences even higher stress levels.

Here’s the cruel irony: The very state of mind induced by succession pressure prevents farmers from undertaking the emotionally taxing process of planning, creating a vicious cycle.

The Communication Breakdown That Destroys Everything

Here’s where things get really messy. Many farm families avoid discussing succession, often keeping their plans secret until a crisis, such as death or serious illness, forces the issue. This approach breeds resentment, misunderstanding, and conflict at the worst possible time.

A 2023 study by researchers from Purdue University found that a shocking 22% of farm owners who inherited their business ultimately felt the transfer was unsuccessful¹. The most cited reason? The process and outcome weren’t what they expected—clear evidence of long-term damage caused by poor communication and lack of shared vision.

I’ve watched families tear themselves apart over these discussions. Dad wants to treat all the kids equally, but equal division means the on-farm successor has to take on massive debt to buy out siblings. Non-farming kids often feel guilty about asking for their “share,” but they also don’t want to get left out. Mom’s caught in the middle trying to keep everyone happy…

It’s a recipe for disaster that plays out in conference rooms and kitchen tables across dairy country every single day.

The Generational Divide That’s Killing Transitions

What’s happening between generations right now… it goes way deeper than different opinions about technology adoption or work schedules. We’re seeing fundamental shifts in values, expectations, and definitions of success that can make or break transitions.

The thing about generational differences in dairy—they’re not just preferences, they’re deal-breakers if you don’t address them proactively.

The Technology Expectation Gap (This Is Getting Bigger)

Next-generation farmers don’t view precision agriculture and automation as optional upgrades—they see them as the expected foundation of competitive operations. They anticipate seamless data integration, automated decision-making, and precision nutrition management that previous generations might consider expensive luxuries.

I was on a farm in Minnesota last winter where the 28-year-old successor wanted to install a DeLaval VMS system. Cost? Around $180,000 per unit. The 58-year-old father kept saying, “We’ve milked cows for 40 years without robots.” The son’s response? “Dad, we’ve also struggled through margin squeezes for 40 years doing things the old way.”

Guess who won that argument?

For the next generation, technology adoption is driven by efficiency gains, labor shortage solutions, and—critically—achieving better work-life balance. The expectation is that technology should work seamlessly from the start; for Gen Z operators, if a new tool isn’t intuitive and effective on the first try, it gets abandoned quickly¹.

The Sustainability-Profitability Tension

Environmental stewardship represents another generational divide that’s becoming more pronounced. Younger farmers align philosophically with sustainable practices, viewing themselves as land stewards responsible for preserving resources for future generations. However, this alignment is quickly tempered by economic reality.

Farm Journal surveys show only 40% of young farmers would adopt sustainable practices without clear financial incentives¹. Only 27% view carbon markets as a viable means of income diversification. This highlights a critical “ROI of change” dilemma: the next generation is willing to adopt more sustainable practices, but the farm’s cash flow must support the transition.

I’ve seen this tension play out in succession discussions. The incoming generation wants cover crops, reduced tillage, maybe some grazing… but they also need to service transition debt and keep the operation profitable. Sometimes those goals conflict, at least in the short term.

Work-Life Balance: The Non-Negotiable That’s Changing Everything

Perhaps the most significant cultural shift is the expectation of work-life balance. The traditional ethos of farming as an all-consuming, 24/7 lifestyle—where personal time is secondary to farm needs—is being fundamentally challenged by the next generation.

This isn’t just a lifestyle preference—it has become a critical economic factor in succession decisions. The relentless, round-the-clock demands of dairy farming are significant deterrents for potential successors and a leading cause of burnout and mental health challenges. A farm that can’t offer a reasonable quality of life is effectively uncompetitive in the modern talent market, even when the potential employee is a family member.

I know producers who’ve lost successors not because the farm wasn’t profitable or the kid wasn’t interested… but because they couldn’t figure out how to make the operation run without requiring 80-hour weeks year-round. That’s a management problem, not a generational issue, but it’s one that succession planning must address head-on.

Part 3: The Toolkit for Success

Engineering a Successful Transition: What Actually Works

Here’s what separates the survivors from the statistics… successful succession isn’t about avoiding problems—it’s about systematically engineering solutions years before they’re needed. The families who beat these odds share characteristics that any operation can implement.

Asset Bifurcation—This Strategy Is Brilliant When Done Right

Instead of transferring the entire operation as one massive, debt-crushing transaction, smart families split their assets into two separate legal structures. The senior generation maintains an asset-holding company that owns land and major facilities, while the successor generation operates an operating company that runs daily dairy operations, leasing facilities from the holding company.

This structure achieves multiple objectives simultaneously: providing steady retirement income for parents through lease payments, significantly reducing capital requirements for successors, and offering opportunities for non-farming heirs to maintain ownership interests without interfering with day-to-day operations. It’s elegant, tax-efficient, and addresses the “equal versus fair” dilemma that often undermines most family transitions.

Canadian legal experts have been highlighting this approach through their Bar Association, calling it particularly effective for managing high capital requirements while providing secure retirement income. What’s interesting is how this model adapts to different scales… I’ve seen it work for 150-cow operations and 1,500-cow operations with similar success rates.

Technology-Enabled Succession Planning (This Is New Territory)

Here’s something fascinating… progressive operations are using technology investments to justify succession planning expenses and demonstrate long-term viability to potential successors. Recent analysis shows that farms achieving 30% milk production efficiency gains through precision agriculture and automated milking systems can justify transition investments by improving underlying profitability, which in turn services debt.

Genomic selection programs with 0.43 heritability for feed efficiency provide measurable ROI within 24-month breeding cycles, giving families concrete data to support succession decisions. When you can demonstrate to a successor that technology adoption directly improves margins and quality of life, the succession conversation becomes a lot easier.

Creative Financing Is Becoming Essential

Life insurance policies offer tax-free liquidity to cover estate taxes, ensuring that non-farming heirs receive fair inheritances without requiring asset sales. Revocable living trusts avoid probate complications while enabling gradual successor buyouts with manageable terms and conditions.

Lease-to-own agreements, seller financing, revenue-sharing structures—these address capital constraints that derail conventional transitions. The Farm Credit System has developed deep expertise in succession financing, offering specialized consulting services and loan products designed for intergenerational transfers that traditional banks often can’t match. They’re seeing this crisis firsthand through their lending portfolios and responding with tools most families don’t even know exist.

Professional Development That Actually Matters

The dairy industry has developed a robust ecosystem of high-level programs designed to equip the next generation with the skills needed to lead modern dairy businesses. These programs extend beyond technical farm management to encompass leadership, financial acumen, communication, and industry advocacy.

Holstein Foundation’s Young Dairy Leaders Institute (YDLI) is widely regarded as the premier national leadership program—an intensive, year-long program for young adults aged 22-45. Its curriculum focuses heavily on developing “soft skills” critical for success: interpersonal communication, team building, media training, and industry advocacy¹.

Cornell University’s Dairy Programs offer comprehensive suites catering to different development stages. The Junior and Beginning DAIRY LEADER programs provide high school students with early exposure to dairy careers. For established and aspiring managers, the Cornell Dairy Executive Program focuses on high-level strategic business planning, financial management, and human resources¹.

What’s interesting about these programs, though, is that they often attract the most progressive and motivated individuals from larger, more stable operations. This creates a risk that these efforts may primarily benefit farms already most likely to succeed, potentially widening the gap between well-prepared and unprepared operations.

Mentorship Programs That Transfer Real Knowledge

Formal education and workshops are essential, but they can’t replace the value of hands-on experience and tacit knowledge transfer—the intuitive, experience-based wisdom that’s crucial for successful farm management.

Dairy Grazing Apprenticeship (DGA) is a formal, two-year program registered as a National Apprenticeship. It pairs aspiring dairy farmers with experienced mentor graziers for full-time, on-farm employment and comprehensive training, providing a clear pathway to farm management and ownership¹.

The Canadian Cattle Young Leaders program has been particularly innovative, pairing 16 participants ages 18-35 with hand-picked mentors in specific areas of interest. Each participant receives a $3,000 budget (increased from $2,000 due to Cargill’s funding increase) to support learning opportunities, such as travel and industry events. The formal mentorship runs nine months, from November through July.

Building Your Support Network (You Can’t Do This Alone)

The difference between successful and failed transitions often comes down to the quality of professional support, rather than family dynamics or financial resources. You can’t DIY your way through modern succession planning… and frankly, trying to is one of the biggest mistakes I see families make.

The Kansas State 12-Step Model provides a proven framework that begins with identifying core values and individual goals before moving into technical analysis and formal planning. This model’s strength lies in insisting on building a shared vision foundation before tackling the legal and financial mechanics¹.

The most effective succession planning requires a coordinated team, comprising agricultural attorneys who handle legal structures and estate documents, farm-focused accountants who manage tax implications, and neutral facilitators who guide family conversations. The investment pays for itself by avoiding the mistakes that destroy transitions.

Alternative ownership models are gaining traction for farms without direct family successors. Community Land Trusts and Conservation Land Trusts separate prohibitive land costs from manageable operating businesses, creating opportunities for non-family successors while preserving agricultural use¹.

International Models We Should Be Copying

The challenge of farm succession isn’t unique to the United States. Other major agricultural nations are facing similar demographic pressures and have developed innovative policy responses that we could learn from —if we’re smart enough to pay attention.

Ireland’s Succession Planning Advice Grant directly subsidizes professional planning services, addressing cost and complexity barriers that prevent families from starting the process¹. This contrasts with the U.S. approach, which tends to provide support after a transition plan is already in motion, rather than catalyzing the creation of the plan itself.

New Zealand emphasizes extended “apprenticeship periods” for successors, with frameworks built on clear communication, shared vision, and systematic capability building¹. They’ve figured out something we’re still struggling with—successful transitions require years of preparation, not crisis-driven decisions.

These international examples demonstrate that proactive policy and a focus on the planning process, rather than the financial outcome, can lead to more successful transitions. The U.S. currently lacks federal policy that directly incentivizes the creation of a succession plan, representing a significant gap in our strategy to address this crisis.

Part 4: The Call to Action

Your 90-Day Emergency Action Plan

Here’s what the data reveals about your operation’s real succession odds… if you’re reading this without a formal, written succession plan that all family members understand and support, you’re statistically destined to join the 83.5% of families who lose everything they’ve built.

But the families who beat these odds share characteristics that any operation can implement. Here’s your roadmap.

Weeks 1-2: Emergency Assessment and Professional Team Building

Start with an honest family assessment of succession readiness. The most frequently cited barriers from Wisconsin surveys are having “no successor” (20% of respondents) and the “financial capacity of the dairy farm to allow more owners into the business” (1 )¹%)¹.

If you don’t have clear answers to these fundamental questions, that’s your starting point. Don’t overthink it—just get the conversation started.

Identify and engage that professional advisory team—agricultural attorney, farm-focused accountant, family business consultant. Schedule comprehensive asset valuation, including technology, genetics programs, and intangible assets. Modern dairy operations have complex value structures that go way beyond land and cows.

Weeks 3-6: Communication Framework Development

Implement structured family meeting protocols with professional facilitation if needed. Begin successor identification and development assessment. Address mental health resources and stress management strategies… because this process is going to be emotionally taxing for everyone involved.

This is where most families get stuck—the emotional work of succession planning. Remember, 22% of farm owners who inherited their business ultimately failed because the transition did not meet expectations. Poor communication and a lack of shared vision can cause long-term damage that may take generations to repair.

Weeks 7-12: Strategic Structure Design

Model asset bifurcation scenarios using current tax exemptions. Evaluate alternative financing and ownership structures. With the new permanent $15 million estate tax exemption, you’ve got more breathing room than expected, but you still need proper structure.

The window for proactive succession planning has actually expanded with recent legislative changes, but current economic conditions—All-Milk prices in the $21.60-$22.75 range for 2025, feed costs 13% lower than 2024, favorable interest rates—create opportunities that won’t exist indefinitely.

Regional Implementation Strategies

For Wisconsin Operations: Leverage the state’s succession planning resources while addressing the 49% successor identification gap¹. Focus on financial capacity assessment—can the operation support both generations during transition? Wisconsin’s deep cooperative infrastructure that provides advantages is a key strength, unlike regions that lack it.

For Upper Midwest Producers: With one-third of producers over 65, time is critical. Prioritize immediate succession conversations and assemble the professional team. Consider seasonal timing—many successful transitions begin with planning discussions during the winter months, when operational demands are lighter and you can focus on long-term thinking.

For All Regions: Recent regulatory changes add complexity but also create opportunities. FDA’s FSMA food traceability requirements have been extended to July 2028, giving operations more time to prepare compliance systems during transition periods—a 30-month extension from the original deadline that takes some pressure off families dealing with both succession and regulatory changes.

Where This All Leads (And Why It Matters to Your Operation)

Here’s what strikes me about this whole situation… we’re at an inflection point where the decisions made in the next 18 months will determine the structure of American dairy for the next 50 years. The families that recognize this and act accordingly will write the next chapter of our industry.

Those who wait for perfect conditions or hope that somebody else will solve it? They’re going to become footnotes in someone else’s expansion story.

The 16.5% of families who successfully navigate multi-generational transfers¹ aren’t lucky—they’re prepared. Really, really prepared. They start early, communicate openly, invest in professional guidance, and treat succession as a multi-year strategic process rather than a single transaction.

Current market conditions provide a unique window of opportunity. Milk prices are stable, feed costs are manageable, interest rates are cooperating, and estate tax relief provides more flexibility than anyone expected. But these conditions won’t last forever… and the demographic pressure isn’t going away.

Families who act decisively in 2025 can structure transitions that preserve wealth and maintain operational control. Those who delay? They’ll join the thousands of operations already absorbed by industry consolidation.

Your family’s legacy isn’t just about preserving what you’ve built—it’s about ensuring the next generation has the tools, resources, and strategic positioning to thrive in whatever dairy industry emerges from this demographic transition.

The choice is stark but manageable: begin comprehensive succession planning now, or risk your operation becoming an acquisition target for families who have already done so.

The question for your operation is simple: will you engineer your succession, or will market forces engineer it for you?

This analysis incorporates data from USDA reports, Iowa State University studies, Federal Reserve Bank analysis, and confidential industry surveys through July 2025. Market data confirmed through the USDA Agricultural Marketing Service, National Agricultural Statistics Service, and Economic Research Service publications.

KEY TAKEAWAYS

- Cut feed costs 20% while boosting production – Genomic testing with 0.43 heritability for feed efficiency delivers measurable ROI within 24 months. Start with your replacement heifers this breeding season—current market conditions give you the cash flow cushion to invest.

- Technology adoption = transition advantage – Farms implementing robotic milking and automated feeding see 25-35% labor cost reductions. That’s not just efficiency… that’s creating work-life balance that actually attracts successors instead of scaring them off.

- Data-driven decisions beat family drama – Operations using precision agriculture tools to demonstrate 15-20% productivity improvements have concrete numbers to justify transition investments. When you can show ROI on genomic breeding programs, succession planning shifts from emotional to financial.

- Scale smart, not just big – With milk production concentrated in larger operations (2,500+ cow farms now control 46% of national production), mid-size farms need genomic advantages to compete. Focus on genetic gains that improve your cost per hundredweight—that’s your survival strategy.

- Professional management = professional succession – Farms running like businesses with documented performance metrics, genomic breeding records, and efficiency tracking are the ones successfully transitioning. Start treating your operation like the multi-million dollar business it is.

EXECUTIVE SUMMARY

Look, we’ve been talking about succession planning for decades while farms keep disappearing around us. The real issue isn’t estate taxes or family meetings—it’s that too many operations aren’t profitable enough to be worth passing down. Recent data shows 71% of retiring farmers haven’t even named successors, but here’s what caught my attention: operations achieving 30% efficiency gains through precision management and genomic selection are actually attracting next-generation interest. With All-Milk prices steady around $22.75 and feed costs down 13% from last year, farms using genomic testing to improve feed efficiency are seeing $35K-45K annual savings on 200-cow operations. The Europeans figured this out years ago—you can’t preserve what isn’t viable. Time to make your operation so profitable that succession becomes inevitable, not optional.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 8 Steps to a Smooth Dairy Farm Succession Plan – Reveals practical strategies for implementing conditional sales, buy-sell agreements, and transparent family communication protocols that prevent the conflicts destroying 78% of family transitions.

- USDA’s 2025 Dairy Outlook: Market Shifts and Strategic Opportunities for Producers – Demonstrates how current milk prices at $22.75/cwt and tightening supply conditions create optimal timing windows for succession investments and strategic positioning decisions.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Identifies essential automation and AI tools delivering 20% yield increases that successors expect as operational foundations, bridging generational technology gaps.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!