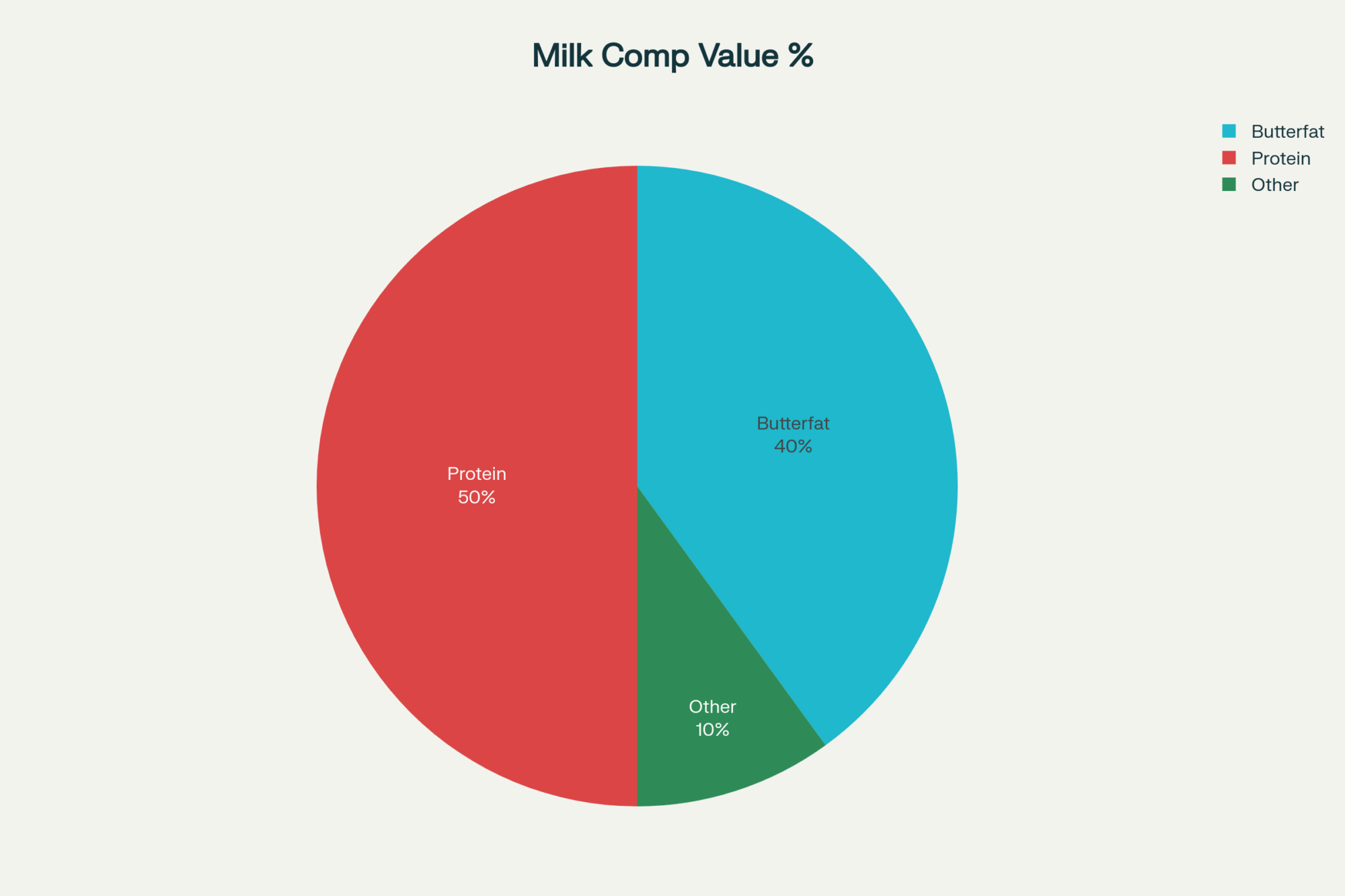

Your grandfather chased butterfat. Your kids will chase protein. The switch happens on December 1. Miss it and you’re playing catch-up forever.

EXECUTIVE SUMMARY: The pharmaceutical industry just rewrote dairy economics: 30 million Americans on GLP-1 weight-loss drugs can’t digest traditional cheese but desperately need protein, ending 20 years of butterfat dominance. December 1st brings Federal Milk Marketing Order reforms requiring a 3.3% minimum protein—a threshold that will trigger deductions for unprepared farms. Three proven strategies offer paths forward: amino acid optimization (generating $38,000+ within 60 days), Jersey crossbreeding (worth $850-1,100 per cow annually), or direct processor contracts (securing $270,000+ yearly for a 650-cow operation). The split is already visible—early adapters report record profits while operations with 55%+ debt-to-asset ratios and sub-3.2% protein face elimination. December 15 marks the strategic decision deadline before January’s bank reviews. This isn’t a temporary market disruption but a permanent shift where protein premiums of $1.40-1.75/cwt will separate survivors from statistics. The market has spoken: adapt to protein economics or exit on your terms before the choice gets made for you.

I was reviewing the latest milk check when something struck me. The numbers looked familiar enough, but there’s a fundamental shift happening underneath—one that started, surprisingly enough, in pharmaceutical boardrooms rather than our dairy barns.

When Eli Lilly announced last month that its GLP-1 drug, tirzepatide, became the world’s bestselling medicine, with over $10 billion in third-quarter sales alone, most of us probably didn’t pay much attention. But here’s what’s interesting: this pharmaceutical success story is about to reshape how we think about milk components, and it’s happening faster than most producers realize.

According to Gallup’s health tracking released in October, 12.4% of American adults are now using injectable GLP-1 medications for weight loss. That’s more than double the 5.8% from February 2024. And the Trump administration’s recent negotiations with Eli Lilly and Novo Nordisk to reduce prices from around $1,000 monthly to $350 for injectables through Medicare and certain insurance programs—with oral versions potentially hitting $150 once the FDA approves them—well, that’s when adoption really takes off.

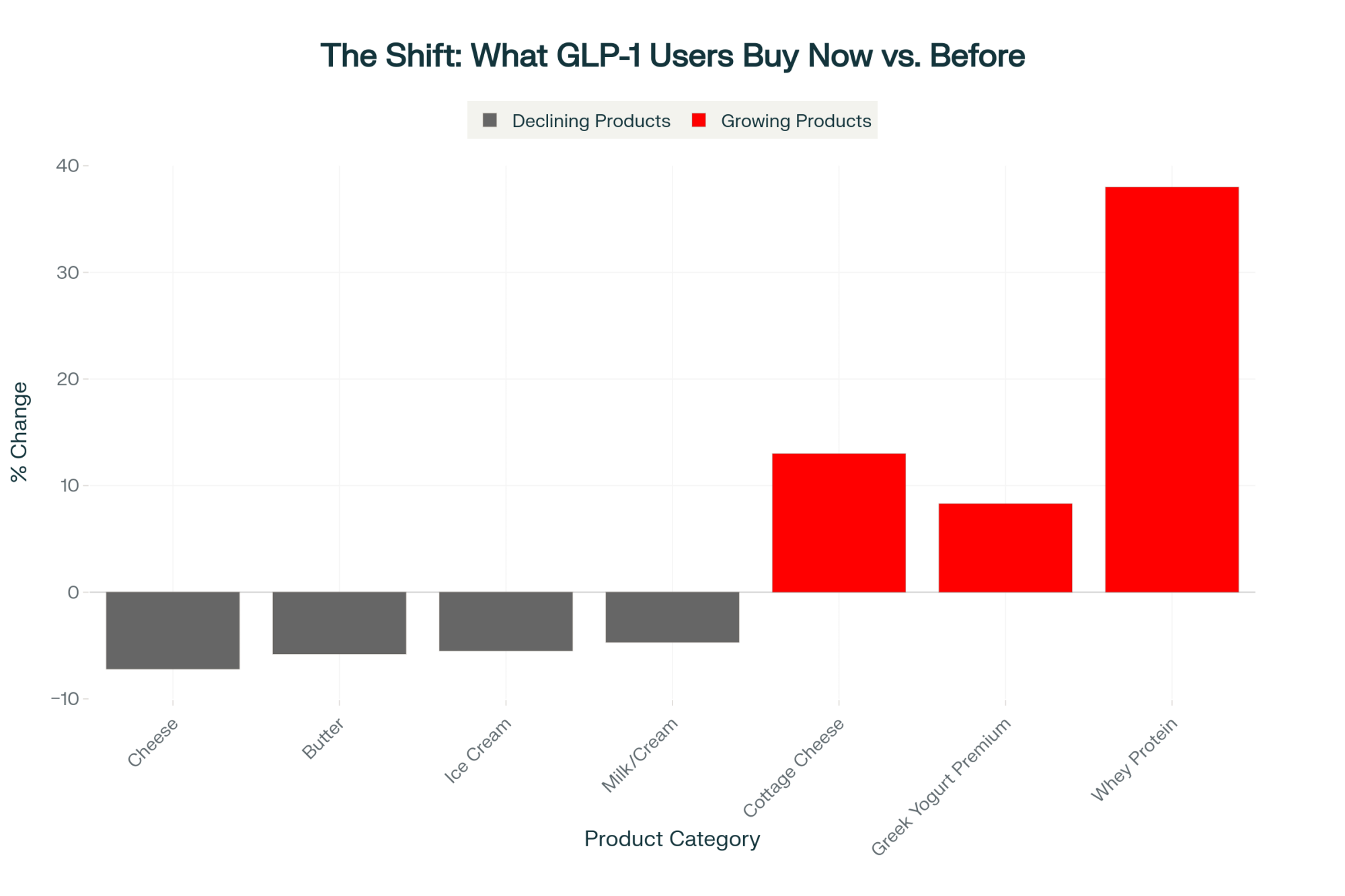

Dave Richards from IFF Consumer Insights shared something fascinating from their September 2025 report: households using these medications are fundamentally changing how they consume dairy. The implications reach far beyond individual shopping carts.

Why Protein Is Suddenly Everything

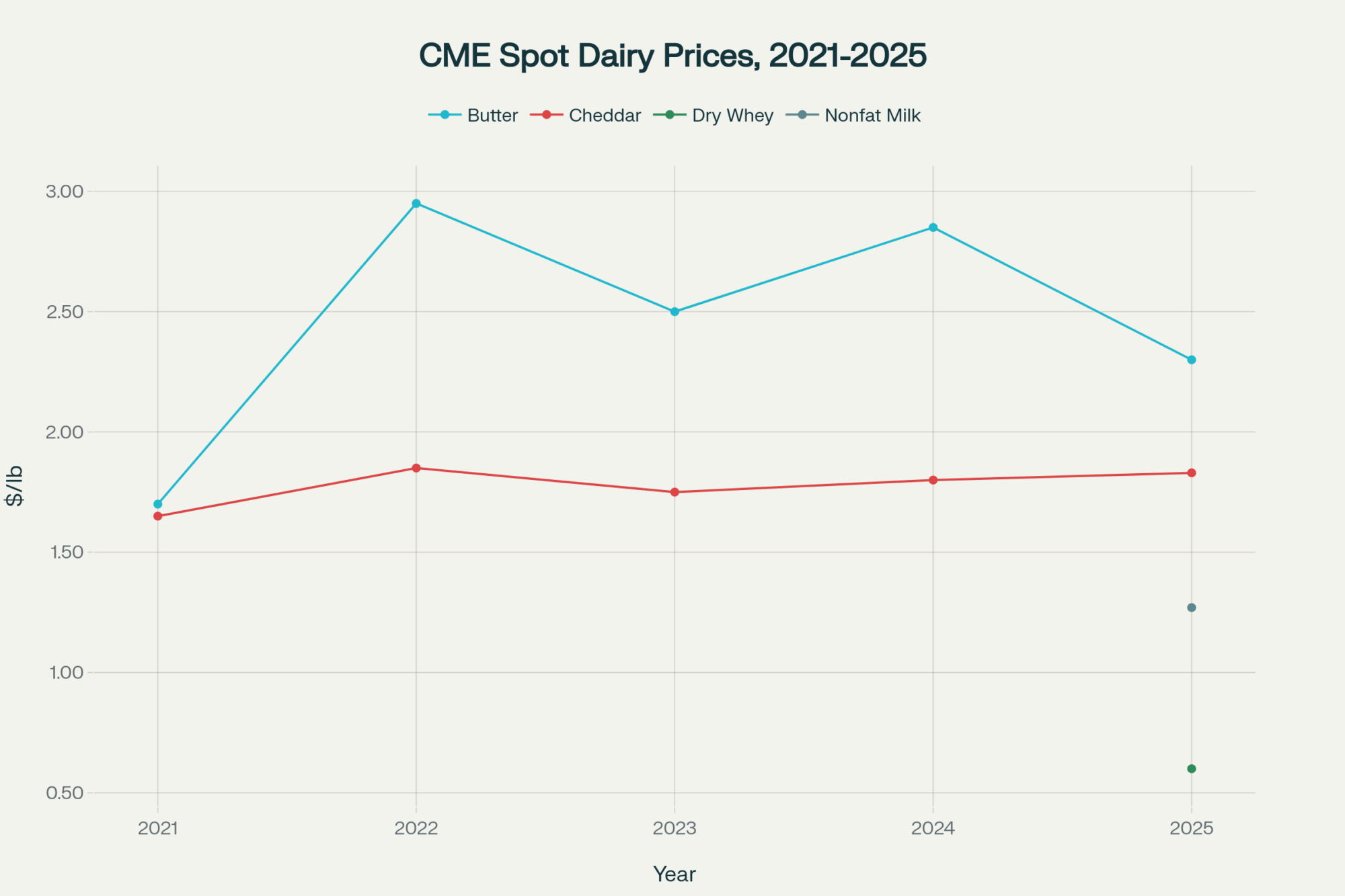

The timing here is remarkable. Come December 1st—we’re talking 19 days from now—Federal Milk Marketing Order reforms kick in. The baseline protein standard jumps from 3.1% to 3.3%. If you’re shipping below that threshold, you’ll see deductions starting with your January milk check. Meanwhile, CME spot dry whey hit $0.75 per pound this week, marking an 11-month high according to the Daily Dairy Report.

Tom Henderson, who runs 600 cows near Eau Claire, Wisconsin, put it perfectly when we talked last week. “We’ve been chasing butterfat for twenty years,” he said, looking at his component premiums tracking sheet that goes back to 2008. “Now my co-op’s offering $1.40 per hundredweight premium for anything above 3.4% protein. That’s more than I’ve ever seen for fat premiums, even in the good years.”

What farmers are finding is that this isn’t just a U.S. phenomenon. The Canadian Dairy Commission announced in September that four western provinces—British Columbia, Alberta, Saskatchewan, and Manitoba—will shift their component pricing ratios come April 2026. They’re dropping butterfat’s payment weight from 85% to 70% while increasing protein from 10% to 25%. That’s a fundamental acknowledgment that the market has changed.

Looking at today’s futures tells the whole story. November Class III milk (your cheese milk) trades at $17.16 per hundredweight. Class IV (butter-powder)? $13.63. That $3.53 spread reveals exactly what processors value now.

You know, I’ve been watching robotic milking systems for years, and what’s interesting is how they might actually help with this protein push. A producer near Watertown, New York, told me his robots let him feed different groups more precisely—his high-protein genetics get exactly what they need, when they need it. “The robots don’t just milk,” he said. “They’re data collection points for component optimization.”

Timeline Watch: Critical Dates Approaching

- Now through November 30: Last chance for nutrition adjustments to impact December protein tests

- December 1: FMMO protein baseline increases to 3.3%

- January 15: First milk check with potential deductions arrives

- January 31: Banks finalize credit reviews based on new component economics

Understanding the GLP-1 Effect on Dairy Consumption

Dr. Sarah Martinez, from UC Davis’s nutrition research program, has been studying the effects of GLP-1 since 2023. What she’s discovered explains a lot. These medications dramatically slow gastric emptying—food stays in the stomach much longer. While that’s great for feeling full, it creates real problems with high-fat foods.

Her research, published in the Journal of Clinical Endocrinology this September, shows that GLP-1 users experience increased discomfort with foods containing more than 20% fat. Think about that—cheddar cheese is 33% fat. Low-fat cottage cheese? Just 4%. The difference becomes physically uncomfortable for these consumers.

“My patients tell me they can’t even look at a grilled cheese sandwich anymore,” Dr. Robert Chen told me. He’s an endocrinologist at Mayo Clinic who’s prescribed GLP-1s to over 800 patients since 2022. “But they’re desperate for protein to prevent muscle loss during weight loss. We recommend 1.0 to 1.5 grams per kilogram of body weight daily.”

The IFF tracking data confirms what doctors are seeing clinically. GLP-1 households show unmistakable consumption shifts:

Declining consumption:

- Cheese: down 7.2%

- Butter: down 5.8%

- Ice cream and whipped cream: down 5.5%

- Fluid milk and cream: down 4.7%

Growing consumption:

- Cottage cheese: up 13%

- Greek yogurt: up 2.4% overall (premium Greek up 8.3%)

- Whey protein beverages: up 38%

I’ve noticed something else, talking to grocery store managers from California to New York—the cottage cheese boom isn’t just about protein. It’s convenience. Single-serve containers that provide instant protein when appetite returns. No prep required.

What’s particularly telling is what’s happening in Europe. A dairy economist I know in the Netherlands mentioned their processors are already reformulating products for the “Ozempic generation”—lower fat, higher protein, smaller portions. They’re six months ahead of us on this trend.

Down in New Zealand, where grass-based systems dominate, they’re having different conversations. A producer I spoke with at a recent conference said they’re exploring supplementation strategies they never would’ve considered five years ago. “Grass milk’s great,” he said, “but grass alone won’t hit these protein targets.”

Three Strategies That Are Actually Working

| Strategy | Speed to Result | Annual Impact | Investment | Risk Level | Timeline |

| Nutrition Optimization | 60 days | $38,000 | $3,500/month | Low | Start immediately |

| Jersey Crossbreeding | 18-30 months | $850-1,100/cow | $18-35/breeding | Medium | Heifers freshen in 24-30 mo |

| Processor Contracts | Immediate | $270,000+ (650 cows) | Relationship mgmt | Low | Lock in 30 days |

I’ve been talking to producers across different regions, and what’s fascinating is how operations are approaching this challenge. The smartest ones? They’re doing all three of these simultaneously.

Strategy 1: Fast-Track Nutrition (60-75 Day Results)

Mike Johannsen runs a nutrition consulting firm in Madison, working with about 40 dairy operations. “Forget dumping more crude protein in the ration,” he told me at World Dairy Expo. “That’s expensive and usually makes things worse.”

According to Johannsen, what works is precision amino acid balancing. Keep metabolizable protein at requirement levels but optimize the profile: lysine at 7.2-7.5% of metabolizable protein, methionine at 2.4-2.5%, maintaining that crucial 3:1 ratio.

A 480-cow operation near Fond du Lac documented everything for me. Started September at 3.12% protein. By late November, they’re expecting 3.28%. That translates to $38,000 additional annual revenue at current premiums. And here’s the kicker—they actually reduced crude protein by 1.5 percentage points and cut feed costs twelve cents per hundredweight.

Current market pricing for rumen-protected amino acids ranges from $8 to $ 12 per pound for lysine and $6 to $ 9 for methionine. For a 500-cow operation, you’re looking at roughly $3,500 monthly. But the documented returns are $3-5 for every dollar invested when you balance it right.

I talked to a producer near Modesto, California, who’s seeing similar results. “The heat stress out here makes protein optimization even more critical,” she explained. “We’re hitting 3.35% protein consistently now, up from 3.08% in July.”

What’s interesting about seasonal patterns—spring grass tends to be lower in metabolizable protein than people think. A nutritionist in Vermont told me that May and June are actually their toughest months for meeting protein targets in pasture-based systems. “Fresh grass looks great, but the protein’s all degradable. We need to supplement even on pasture.”

Strategy 2: The Genetics Play (18-30 Month Payoff)

This one’s controversial, I know. But the University of Minnesota’s 20-year crossbreeding study, which wrapped up in 2023 under Dr. Les Hansen, makes you think. Jersey × Holstein F1 crossbreds produce milk with 4.0-4.3% protein versus purebred Holstein’s 3.1-3.2%. Yes, they produce 3,000-4,000 pounds less milk annually, but their net income matches or beats purebreds due to better fertility (4-17 fewer days open), lower replacement costs, and those protein premiums.

Amy Steinberg, a genetic consultant working across Minnesota and Wisconsin, breaks it down simply. “This isn’t about converting your whole herd to Jerseys,” she explains. “Use Jersey AI on your bottom 40% ranked for protein genetics. Keep your top 30% pure Holstein with sexed semen for replacements.”

Jersey semen costs $18-35 per unit—same ballpark as decent Holstein genetics. Those F1 heifers will freshen at 24-30 months with 4%+ protein. At today’s premiums, each F1 cow could generate $850-1,100 extra annually just from protein.

I watched a breeding at a third-generation farm near Shawano last week. The producer laughed, “Grandpa would roll over seeing Jersey semen in our tank. But grandpa wasn’t dealing with GLP-1 drugs and protein premiums.”

Even producers in Texas are exploring this. One 2,000-cow operation near Stephenville told me they’re crossbreeding their bottom third. “The heat tolerance of the F1s is a bonus we didn’t expect,” the manager said. “They’re handling 105-degree days better than our Holsteins.”

Strategy 3: Direct Processor Deals (Immediate Impact)

Several producers aren’t waiting for their co-ops to act. One Green Bay area producer—let’s call him Steve—just locked a three-year contract with a regional yogurt manufacturer. He guarantees 95% of production at 3.8-4.2% protein, 3.7-4.0% butterfat, and somatic cells under 200,000. In return? $1.50 per hundredweight premium over base. That’s $270,000 extra annually on 650 cows.

The processor gets consistent milk that they can standardize products around. Steve gets price stability while neighbors scramble. Both win.

A Northeast producer near Lancaster, Pennsylvania, negotiated something similar with a specialty cheese maker. “They wanted consistent components for their aged products,” he explained. “We’re getting $1.65 over base for hitting their targets.”

Quick Math: Your Three Options

- Nutrition route: $3,500/month cost, $3-5 return per dollar, results in 60 days

- Genetics route: $18-35 per breeding, $850-1,100 annual premium per F1, results in 18-30 months

- Processor contracts: $1.00-1.75/cwt premiums, 3-year stability, starts immediately

The Calendar Is Not Your Friend

Looking at what’s coming, the window for positioning is narrower than most realize:

December 1, 2025: FMMO protein baseline shifts. Below 3.3%? Deductions start.

January 15-31, 2026: Annual bank reviews. Mark Stevens from Farm Credit Services of Southern Wisconsin tells me they’re already identifying operations with debt-to-asset ratios over 60% and protein under 3.2%. “We’re not trying to force exits,” he emphasizes. “But farms without component improvement plans raise viability questions.”

April 1, 2026: Canadian pricing shifts take effect, influencing cross-border dynamics.

2026-2027: New processing capacity from Lactalis, Leprino, others comes online. Competition for high-protein milk intensifies.

March 2027: FDA expected to approve oral GLP-1s based on current trials. When pills cost $150 instead of $1,000 for shots, adoption explodes.

Who’s Most Vulnerable Right Now

Let’s be honest about who needs to act immediately. Based on what lenders and co-op reps are telling me, here’s the danger profile:

- 500-1,500 cow operations shipping commodity milk

- Testing 3.0-3.2% protein currently

- Debt-to-asset ratio over 55%

- Production costs $18-21 per hundredweight

- Milk price averaging $13.50-14.50

If this describes your operation, December’s protein shift could eliminate your remaining margin. You’ve got 60 days to make nutrition changes, or you need to start planning an exit that preserves equity.

Dr. Chris Wolf, Cornell’s dairy economist, sees a clear split developing. “Operations that pivot to high-protein, quality milk will find opportunities. Those locked into commodity production with high debt face significant challenges.”

What worries me is the middle group—farms that could adapt but are waiting to see what happens. Every week of delay is a week competitors lock contracts and implement changes.

The Community Impact We Can’t Ignore

What really keeps me up at night is what happens when 20-30% of farms in a region exit within two years.

Wisconsin has lost thousands of dairy farms over recent decades while maintaining stable production, according to USDA data. Fewer families, smaller tax bases, struggling Main Streets. Rick Peterson from Crawford County’s economic development office showed me projections—losing 25% more farms by 2027 means $400,000-600,000 less for schools annually. The hospital might close its birthing unit. Main Street loses another third of its businesses.

“Each farm exit eliminates five to seven related jobs,” Peterson explains. Feed dealers, mechanics, accountants—it cascades through the community.

I drove through Richland County last month. Three dairy farms for sale in ten miles. The café owner told me business is down 20% this year. “When farms go, everything follows,” she said quietly.

But I also visited Tillamook County, Oregon, where processors and producers worked together on component premiums early. They’ve maintained farm numbers better than most. “We saw this coming and acted collectively,” a local co-op board member explained. “Not everyone can do that, but it made the difference here.”

What Success Looks Like in 2030

But it’s not all challenging news. Producers who execute this transition well achieve remarkable improvements.

Jim Bradley, a dairy nutritionist and economist consulting for Upper Midwest banks, helped me model a typical 500-cow operation. Starting point: 3.10% protein, $13.90 milk, 62% debt-to-asset. By 2030, with proper execution:

- Protein reaches 4.05% through nutrition and F1 genetics

- Milk price hits $17.00/cwt with premiums

- Net income grows from $127,000 to $495,000 annually

- Debt-to-asset improves to 38%

“This isn’t speculation,” Bradley insists. “These projections reflect actual results from operations that started transitioning in early 2024.”

A Vermont producer who started his transition 18 months ago confirms this. “We’re already seeing $180,000 more annually just from protein premiums. The genetics haven’t even kicked in yet.”

Your Action Plan for the Next 30 Days

After dozens of conversations with producers from California to Vermont, here’s what separates those who’ll thrive from those who’ll struggle:

Make your strategic decision by December 15: Pivot to capture premiums or plan a strategic exit? Both are valid. Waiting to see isn’t.

If pivoting:

Call your nutritionist this week. Amino acid balancing can boost protein 0.15-0.25% within 60 days, often reducing feed costs. Budget $0.03-0.08 per hundredweight for protected amino acids.

Rank cows by protein genetics. Bottom 40% get Jersey AI. Top 30% get sexed semen for replacements. Middle tier? Consider beef semen—those calves bring $800-1,200 versus $50 for Holstein bulls.

Meet with three processors before November 30. Your current handler plus alternatives. Bring component data and projections. Producers securing $1.40-1.75/cwt premiums are negotiating now, not during the crisis.

Talk to your lender before January reviews. Present your plan. Show market understanding. Lenders support strategic direction, question apparent oblivion.

If exiting:

Engage transition specialists immediately. Strategic exits preserve 70-80% equity. Forced liquidations preserve 40-50%. The difference determines retirement versus bankruptcy. The National Farm Transition Network has advisors who can help.

The Choice Facing Each of Us

This transformation is happening now—in bulk tanks, processing plants, and lending offices across dairy country. The convergence of GLP-1 adoption, FMMO reforms, and processor consolidation creates unprecedented challenges and significant opportunities for those positioned to capitalize on them.

The strategic window measures in weeks, not years. Producers who make informed decisions by December 15 and execute systematically will likely view November 2025 as the month they secured their future. Those who delay may remember it as the moment when opportunity passed by.

Ironically, dairy products perfectly match GLP-1 users’ nutritional needs—quality protein in digestible formats. But capturing this requires acknowledging that successful strategies from the past twenty years won’t work for the next five.

The market has clearly stated its protein priorities. Whether you’re milking 50 cows in Vermont or 5,000 in New Mexico, the question isn’t whether to adapt, but whether you’ll adapt quickly enough to capture premiums before they become the new baseline.

In our rapidly evolving industry, decisive action—even if imperfect—often beats waiting for complete information that never materializes. This might be one of those moments where the cost of inaction exceeds the risk of imperfect action.

For implementation guidance on protein optimization or transition planning, consult your regional extension dairy specialist or agricultural lender familiar with current market dynamics. Time-sensitive conditions make professional consultation advisable.

KEY TAKEAWAYS

- Protein is now king: GLP-1 drugs affecting 30M Americans killed butterfat’s 20-year reign—protein premiums hit $1.40-1.75/cwt while Class IV milk trades $3.53 below Class III

- December 15 = Decision Day: Make your strategic choice before December 1st’s 3.3% protein requirement triggers deductions and January’s bank reviews force your hand

- Three paths to profit: Fast nutrition fix ($38K return, 60 days) | Jersey crossbreeding ($1,100/cow/year, 18-30 months) | Direct processor deals ($270K+/year, immediate)

- The survival line: Farms below 3.2% protein with >55% debt face elimination—but strategic exits now preserve 70-80% equity versus 40% in forced liquidation

- First-mover advantage expires soon: Producers securing premium contracts today will be selling commodity milk to those same processors in 2027

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Complete Guide to Amino Acids for Dairy Farmers: Improving Your Livestock’s Health and Productivity – This guide provides the tactical 6-step plan for implementing the amino acid balancing mentioned in Strategy 1. It details precisely how to optimize lysine and methionine to boost milk protein percentage, often while cutting overall feed costs.

- The $11 Billion Gap: Where Processing Investment Meets Producer Reality – This strategic analysis breaks down the December 1st FMMO reforms. It explains exactly how the new 3.3% protein baseline will create deductions and premiums, revealing the hard economics driving the $11 billion processing investment.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – This article reveals the technology behind the ‘Genetics Play.’ It details how the 2025 genetic base reset and new Net Merit$ (NM$) formulas are re-weighting component values, creating a massive ROI for breeding for protein and fat.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!