Your barn smells like manure before feed? That’s $150K in annual losses. Here’s the 4-step fix that costs just $20K.

Executive Summary: Walk into two dairy barns during a February blizzard: one owner scrambles with frozen pipes while the neighbor executes routine protocols—that’s the $100,000 winter divide. Reactive operations hemorrhage $110,000-163,000 annually through emergency repairs, production losses, and worker injuries, while systematic farms invest just $30,000-35,000 in prevention for a 300% return within 12 months. The transformation starts with three September decisions: body condition scoring ($800 saved per thin cow), winterizing the water system ($20,000 in prevented failures), and implementing ventilation protocols ($150,000 in avoided moisture damage). Implementation takes 2-3 years total, but farms report 75% less time spent on winter tasks despite more structured protocols. Bottom line: systematic winter management isn’t about working harder—it’s about deciding in September not to be a victim in February.

Picture two dairy barns on a February morning when it’s -5°F outside. In the first, workers are scrambling to thaw frozen waterers while the owner calculates emergency repair costs. In the second, morning protocols proceed smoothly—waterers functioning, ventilation balanced, production holding steady.

Both operations milk similar herd sizes. Both face identical weather. Yet their financial outcomes this winter will differ by tens of thousands of dollars.

The distinction? It comes down to management philosophy. One farm approaches winter as an annual emergency to endure. The other treats it as an operational challenge to manage systematically, starting preparations when the corn is still green in early September.

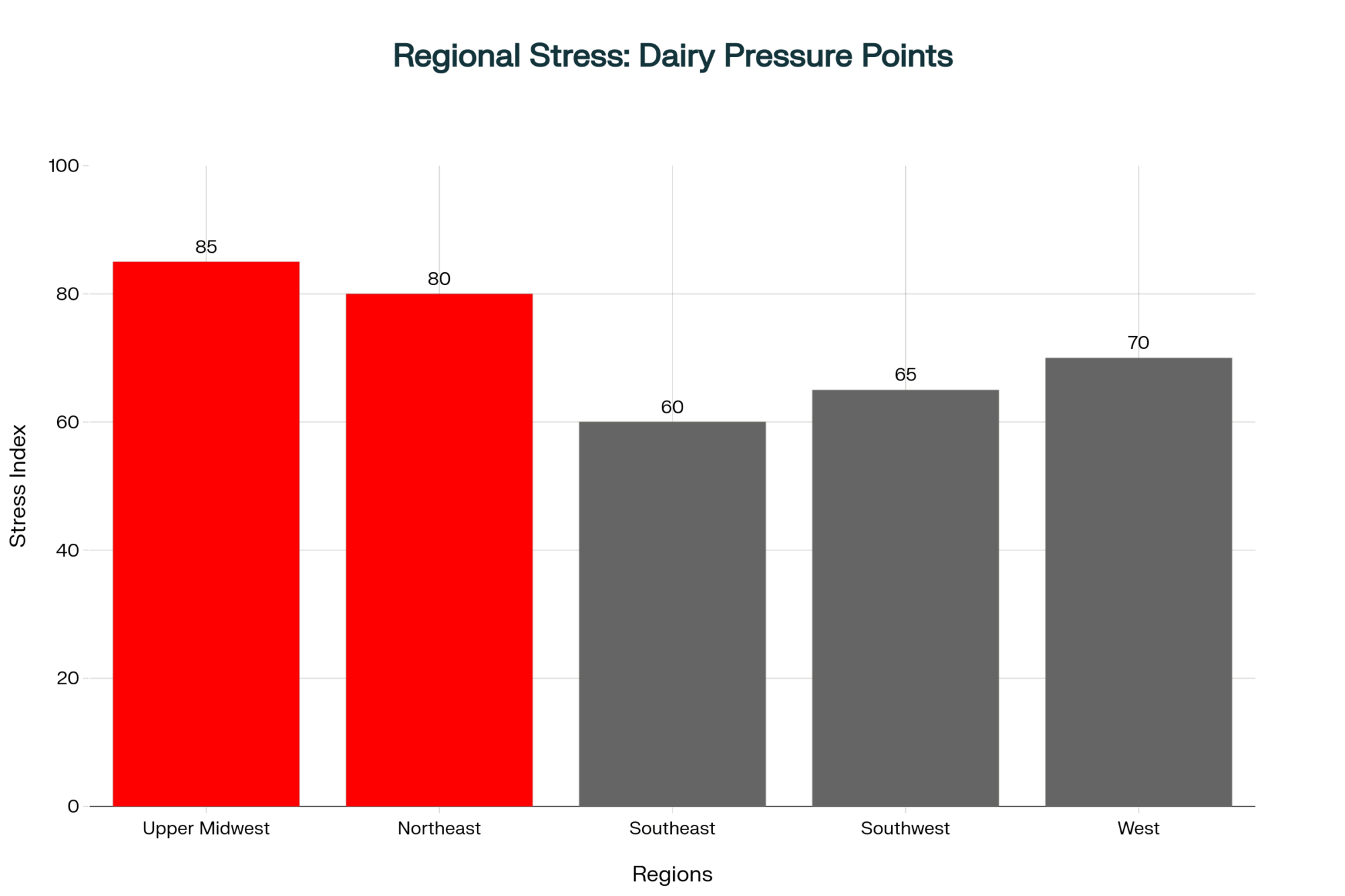

Having worked with dairy operations across North America—from the harsh winters of Wisconsin and Ontario to more moderate climates in California’s Central Valley—I’ve observed that the economic gap between reactive and systematic winter management often exceeds what many producers expect. Based on university extension research and documented producer experiences, a typical 200-cow operation can see differences approaching or exceeding $50,000 annually through avoided costs and maintained production.

Now, these specific protocols prove most critical for northern-tier operations facing severe winters. A dairy in Texas or Florida adapts these principles differently than one in Minnesota. But here’s what I find fascinating—the systematic approach delivers value whether you’re dealing with frozen water lines or heat stress. It’s really about mindset more than climate.

Understanding the True Economics of Winter Management

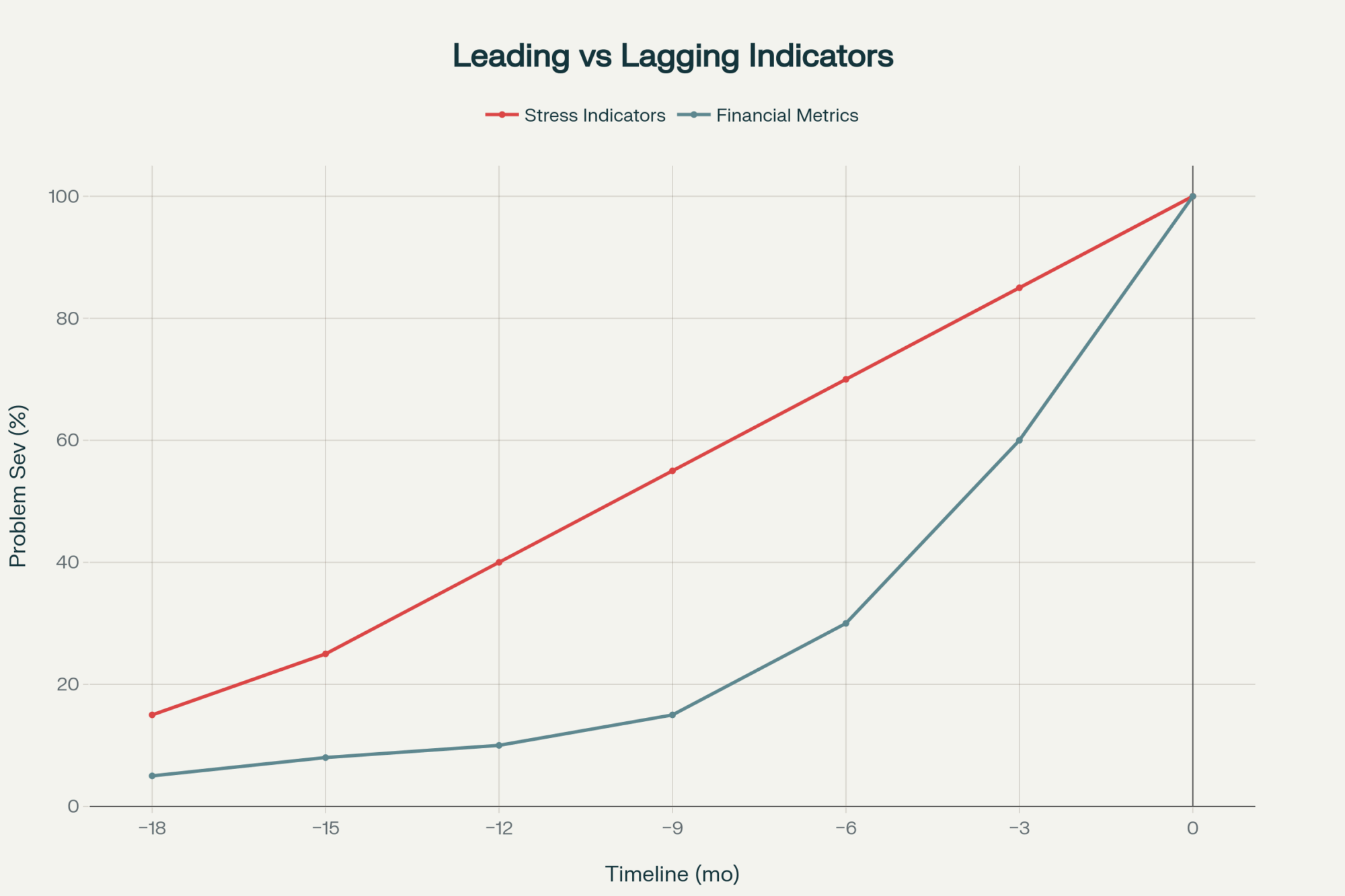

Most producers grasp that winter brings additional costs. What’s less understood is how those costs compound when approached reactively versus systematically.

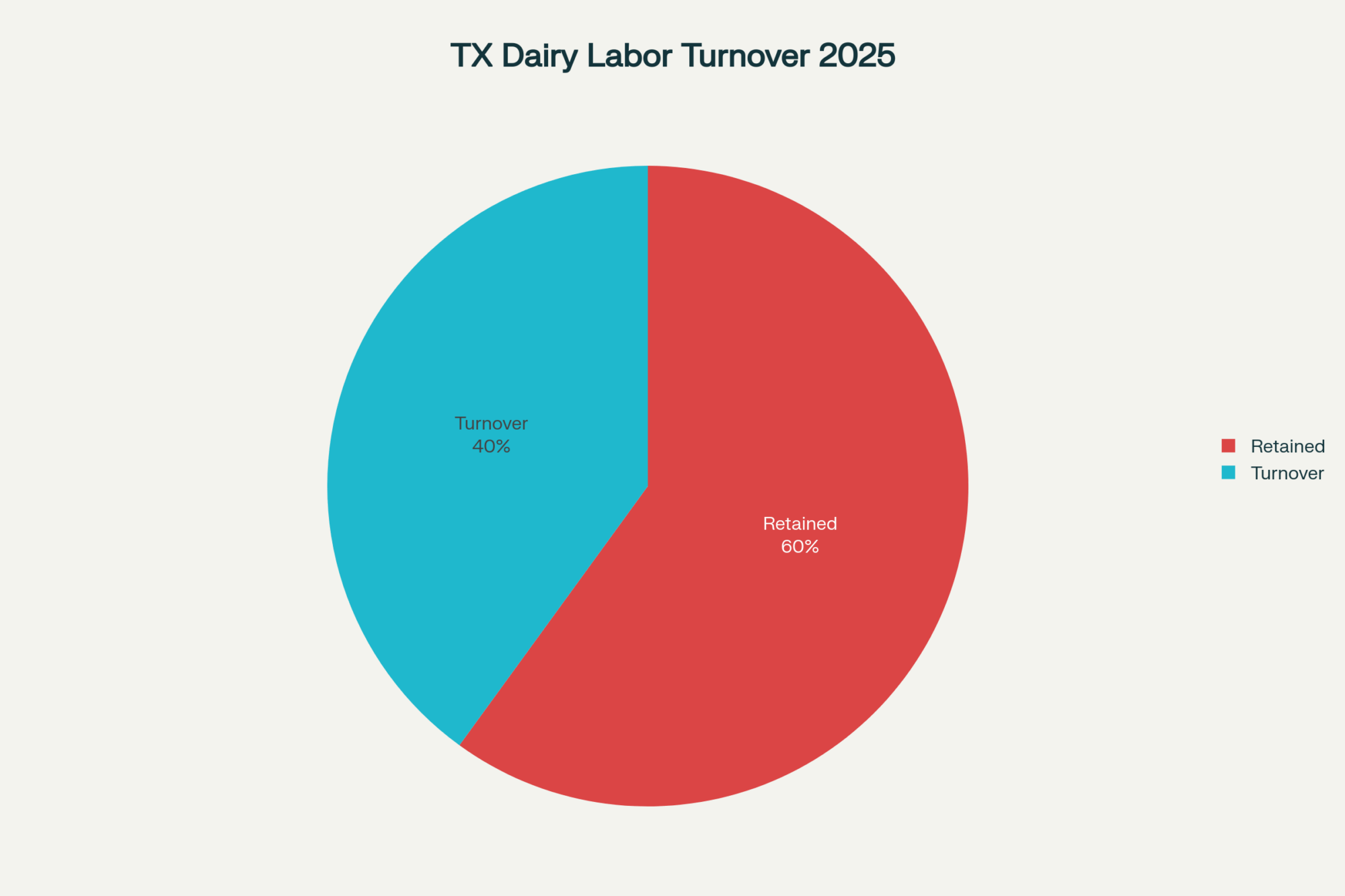

Looking at research from land-grant universities examining component costs reveals the fuller picture. Production losses from inadequate body condition management typically range from $25,000 to $30,000, according to work from Michigan State Extension’s dairy team. Worker injuries during cold-weather operations can reach $40,000 to $60,000 when you account for medical costs, lost productivity, and potential liability—these figures come from the National Institute for Occupational Safety and Health’s agricultural injury database. Emergency equipment repairs average between $20,000 and $35,000, according to Farm Credit’s operational cost surveys. Employee turnover stemming from difficult working conditions? That adds another $20,000 to $30,000, according to the Canadian Agricultural Human Resource Council’s workforce studies. And veterinary interventions for cold-stress-related issues add an additional $5,000 to $8,000, according to Cornell University’s veterinary economics research.

When we aggregate these components—using conservative estimates—a reactive 200-cow dairy potentially faces $110,000 to $163,000 in winter-related costs.

The systematic farms report spending roughly $30,000 to $35,000 annually on prevention to avoid the majority of these reactive costs. The net advantage often exceeds $50,000 annually, though exact figures vary based on operation size, existing infrastructure, and regional conditions.

Iowa State Extension’s dairy team has documented this pattern across dozens of operations in their management surveys. What farmers are finding is that implementing systematic protocols doesn’t mean working harder—it means approaching the challenge differently. While neighboring operations struggle with compressed margins, systematic farms maintain profitability through the winter months.

It’s worth noting that some smaller operations—particularly those with fewer than 50 cows and primarily family labor—successfully manage winter reactively. The stress and time costs remain substantial, but their lower overhead and flexibility can absorb the inefficiencies. There’s a 45-cow operation in Vermont I know that’s done it this way for three generations. It works for them. They accept the trade-offs.

I also know a 300-cow operation in upstate New York that deliberately chooses reactive management—they accept the higher costs as the price for operational flexibility. As the owner told me, “We know we’re leaving money on the table, but we value the ability to pivot quickly more than the cost savings.” For most commercial-scale operations, though? The economics strongly favor systematic approaches.

Body Condition Scoring: A September Decision with February Consequences

The evolving understanding of the impact of body condition on winter performance represents one of the most significant shifts in cold-weather dairy management. Research published in the Journal of Dairy Science, combined with feeding trials documented by Alberta Agriculture in their Winter Feeding Guidelines, demonstrates that a thin cow entering winter faces metabolic demands costing $500 to $800 more in feed, lost production, and health interventions compared to a properly conditioned cow.

Let me walk through the physiological mechanisms, because once you understand what’s happening inside that cow, the September decisions make a lot more sense.

A cow maintaining an optimal body condition score of 3.0 on the five-point scale sustains her lower critical temperature around 19°F. That’s based on research from the University of Nebraska’s beef and dairy extension program, confirmed by similar work from Manitoba Agriculture. When body condition drops to 2.0 to 2.5—and this happens constantly in herds pushing for maximum butterfat performance through summer—that threshold shifts dramatically upward to 32-33°F.

Think about what this means operationally: a 14-degree reduction in cold tolerance based solely on body reserves.

At 20°F—which many of us in the Midwest consider a mild winter day—that underconditioned cow requires approximately 24% additional energy simply for thermoregulation. But here’s where it gets worse. She’s simultaneously experiencing 5 to 10% reduced digestive efficiency as cold stress compromises rumen function and feed passage rates. Michigan State’s Department of Animal Science has documented this repeatedly in both research trials and farm observations.

The research consistently demonstrates that correcting poor body condition is impossible once winter arrives. Metabolic demands escalate while digestive capacity diminishes. You’re caught in a physiological trap that additional feed alone cannot overcome.

For a 200-cow herd where 20% of animals enter winter underconditioned—not uncommon in operations facing drought-stressed forages or those really pushing lactation curves through transition periods—the September body condition scoring decision carries $20,000 to $30,000 in winter cost implications.

A producer in central Wisconsin told me last year, “I never believed body condition mattered that much until I actually tracked the feed costs and health bills. Now I start thinking about winter body condition in July.” That’s the mindset shift we’re seeing.

Moisture Management: The Hidden Crisis in Barn Environment Control

Each mature dairy cow contributes 10 to 15 gallons (38-57 liters) of moisture to the barn environment daily through respiration, perspiration, and evaporation from waste—a figure documented by agricultural engineers at universities like Penn State and Wisconsin in their ventilation design guides. For a 200-cow barn, we’re talking over 3,000 gallons of water vapor requiring removal through ventilation systems every 24 hours.

The first time I shared that 3,000-gallon figure with a producer, he didn’t believe me. We actually set up collection tarps and measured condensation over 48 hours. The numbers don’t lie.

Research from Wisconsin’s School of Veterinary Medicine’s dairy housing recommendations reveals that when barn humidity exceeds 80%, airborne bacterial survival extends dramatically—from minutes under dry conditions to potentially months in humid environments. The specific mechanism involves moisture protecting bacteria from desiccation while providing a medium for reproduction.

What’s particularly interesting here is how this plays out differently across regions. In Georgia, where I consulted with a 400-cow operation last spring, their challenge isn’t cold—it’s managing 90% humidity during their wet winters. They use the exact same systematic ventilation approach we recommend up north, just for different reasons.

Dairy ventilation specialists across the Midwest have documented consistent operational impacts. Pneumonia incidence increases approximately 40% in high-humidity environments compared to properly ventilated barns. Hoof disease rates climb 25% as moisture softens hoof walls and promotes bacterial growth, particularly digital dermatitis. Milk production typically drops 10 to 15% as cows divert energy toward maintaining homeostasis in these suboptimal conditions.

For a 200-cow operation, when you combine lost production, increased disease treatment, infrastructure degradation from condensation, and elevated labor costs responding to health crises, inadequate moisture management can cost well over $150,000 annually, based on component cost analyses from multiple university studies.

The encouraging news? Solutions cost a fraction of the problem. Proper ventilation systems—prioritizing cold, dry conditions over warm, damp environments—require initial investments of $15,000 to $20,000 for retrofit installations, according to agricultural engineering estimates from the Midwest Plan Service. The return becomes apparent within the first winter season.

Looking ahead, as we see more variable weather patterns—like the extreme temperature swings experienced in recent years—moisture management will likely become even more critical. The operations getting this right now are positioning themselves for long-term success, regardless of what climate change throws at us.

Rethinking Barn Temperature: Why Heating Isn’t the Answer

A persistent misconception I encounter weekly involves the perceived need to heat dairy barns during winter. And I mean weekly—just yesterday, a producer from northern Minnesota called asking about heating options.

“I can’t afford to heat the barn and run ventilation simultaneously,” he said. He was spending $3,000 monthly trying to keep his freestall barn at 45°F.

This perspective overlooks fundamental bovine physiology that agricultural engineers have understood for decades.

Mature dairy cows generate approximately 4,800 BTU per hour each, according to calculations from the Ontario Ministry of Agriculture, Food and Rural Affairs (OMAFRA Publication 833) and confirmed by similar research from Midwest universities. Let’s put that in perspective. A 200-cow herd produces heat equivalent to nine 100,000 BTU furnaces operating continuously. The cows themselves are literally the heating system.

Michigan State Extension Bulletin E-3090 on dairy ventilation clearly emphasizes this principle. When you enter a barn where manure odor predominates over feed aromas, humidity levels are excessive, and ventilation is inadequate. The solution is to accept that cattle thrive at temperatures humans find uncomfortable rather than adding supplemental heat.

What we’re seeing on successful systematic operations from Vermont to Alberta are consistent principles. Keep barn temperatures as low as possible without causing equipment failures—typically, this means maintaining just above 32°F in areas with water lines. Keep ridge ventilation at maximum capacity throughout the winter months, aiming for a minimum of 4 to 8 air changes per hour. Provide workers with appropriate cold-weather clothing rather than attempting barn heating for human comfort. And always prioritize cold, dry conditions over warm, damp environments.

Research from Penn State Extension examining thermal comfort zones (documented in their Special Circular 397) confirms dairy cattle maintain productivity within a thermoneutral zone ranging from 41 to 77°F. Well-fed, dry-coated Holstein cows can tolerate temperatures approaching 5°F before requiring additional energy for thermoregulation beyond normal metabolic heat production.

These animals evolved for cold climates. They become stressed by heat, not cold. Your ventilation strategy should reflect bovine physiology, not human comfort preferences.

Even in warmer climates, these principles apply. That Georgia dairy I mentioned earlier? They use the same systematic ventilation approach—not for cold stress, but to manage humidity during their wet winters. The systematic mindset translates across latitudes.

Water System Management: Preventing the Costliest Winter Crisis

Among winter equipment failures, frozen water systems create the most immediate and severe consequences. Operations can lose $10,000 in 48 hours from one frozen water line. The cascade effect is remarkable—and remarkably expensive.

Research from New Mexico State University’s Cooperative Extension Service dairy management bulletin shows that cows deprived of water for 24 hours can lose over 10 pounds of daily milk production, with high producers experiencing even greater losses. For a 200-cow herd at current milk prices, this represents over $800 in lost revenue per day, before accounting for potential metabolic issues from dehydration.

A Wisconsin operation milking just over 4,000 cows across two sites experienced three major water system failures during the winter of 2018, before implementing systematic prevention measures. Each incident cost between $8,000 and $10,000 in repairs, production losses, and overtime labor. The owner told me, “That winter taught us prevention costs pennies compared to reaction.”

Metric | Preventive Approach | Reactive Approach | Difference |

|---|---|---|---|

| Initial Investment | $4,000-5,000 | $0 | – |

| Annual Maintenance | $1,000-1,500 | $0 | – |

| Average Annual Failures | $0 | $20,000-25,000 | $20K-25K savings |

| Revenue Loss Per Incident | $0 | $800/day | Crisis avoided |

| Milk Production Impact | None | 10+ lbs/cow/24hrs | Stable production |

| Emergency Response Time | Proactive | Hours-Days | No downtime |

| Total Annual Cost | $1,000-1,500 | $20,000-25,000 | $18.5K-23.5K savings |

| ROI Timeline | Immediate | N/A (loss) | 1,800%+ ROI |

Looking at systematic farms — from Vermont’s smaller operations to Alberta’s larger dairies —successful preventive protocols share common elements.

During October, they test every heating element under load for 24 to 48 hours, documenting wattage draw to establish performance baselines. The University of Minnesota Extension’s winter prep guidelines recommend replacing elements drawing 10% below specifications—they’re failing but haven’t quit yet. Critical operations install redundant heating systems on separate electrical circuits. One fails? The backup’s already running.

Throughout winter, these operations conduct twice-daily water system checks at a minimum, typically at 6 AM and 6 PM, with additional checks during extreme cold (below -10°F). They maintain temperature-triggered intervention protocols. Backup generator capacity specifically sized for water systems proves essential. And they prepare emergency water sources before they’re needed, not during a crisis.

This preventive approach requires initial investments of $4,000 to $5,000, then $1,000 to $1,500 annually for maintenance and monitoring. Compare this to Farm Credit Canada’s risk analysis, showing reactive farms averaging $20,000 to $25,000 in water system failures per winter. The return on investment is immediate and substantial.

Even producers who remain somewhat reactive in other areas tell me water system prevention is non-negotiable. As one put it, “Everything else can wait a few hours. Water can’t.”

WINTER PREPARATION CHECKLIST

September: Assessment & Planning □ Body condition score all animals (target BCS 3.0-3.5)

□ Schedule October equipment servicing

□ Secure winter fuel contracts

□ Evaluate feed inventory for winter needs

□ Review previous winter’s near-miss reports

October: Infrastructure Preparation □ Test all water heating elements under load (24-48 hours)

□ Service all equipment (tractors, generators, loaders)

□ Install heat tape and insulation (minimum R-3) on exposed pipes

□ Stockpile 2-week minimums (feed, bedding, supplies)

□ Check and repair barn ventilation systems

November: Systems & Training □ Full generator load testing (4+ hours continuous)

□ Emergency response drills with the entire team

□ Winter safety training (hypothermia recognition)

□ Final pre-winter facility walkthrough

□ Post emergency contact lists in multiple locations

December-February: Active Management □ Twice-daily water checks (6 AM, 6 PM minimum)

□ Temperature-based monitoring protocols

□ Weekly near-miss review meetings

□ Continuous system improvements

□ Document all incidents for next year’s planning

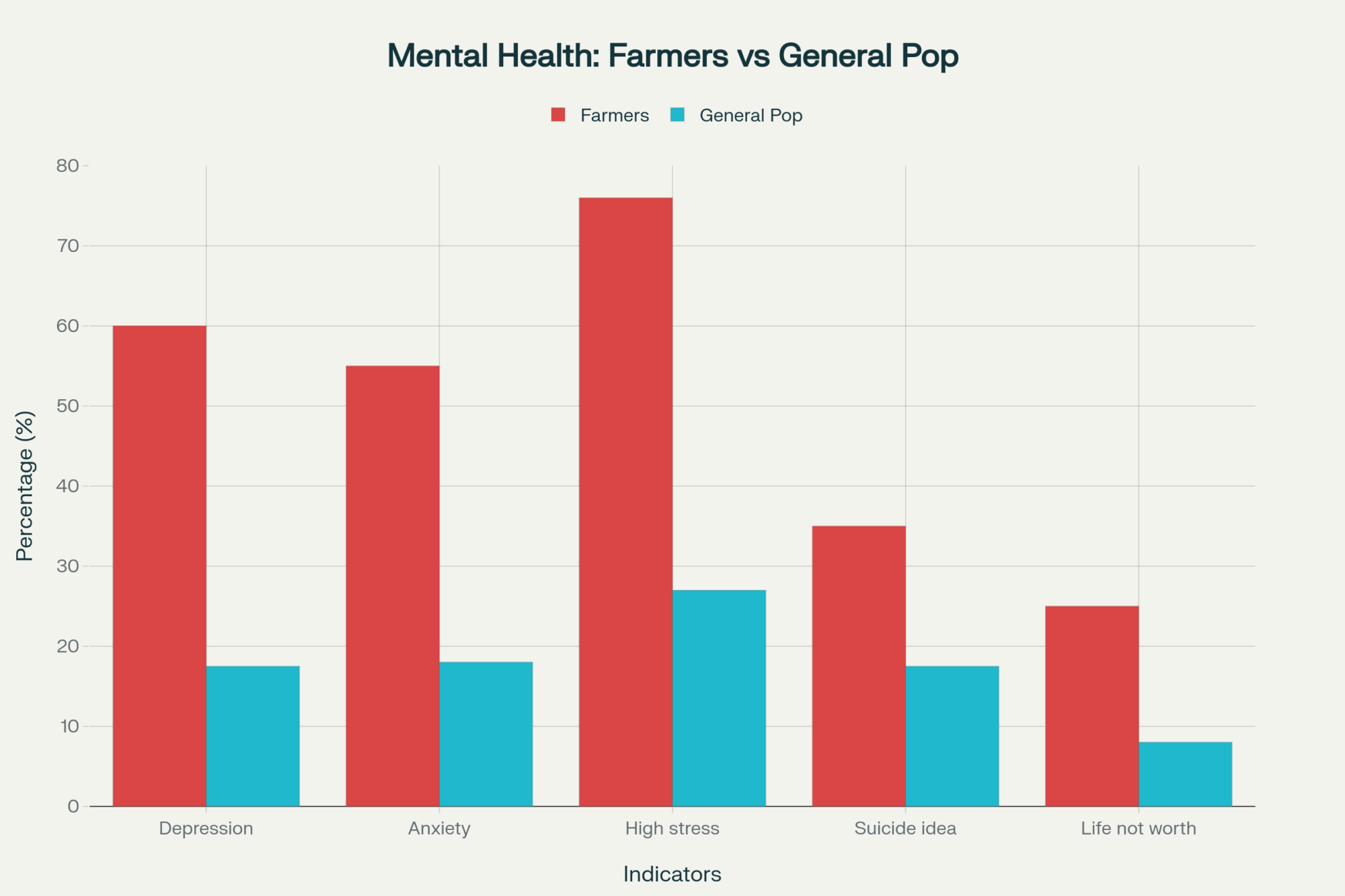

Developing Safety Culture: Beyond Compliance to Commitment

Near-miss reporting systems represent an underutilized opportunity in dairy operations. Construction industry research published in the Journal of Safety Research demonstrates that structured reporting reduces accidents by 64%. When agricultural operations implement similar systems—and precious few do—they report comparable improvements.

But here’s the challenge I see constantly: implementation requires genuine commitment from ownership. This cannot be delegated or treated as a compliance checkbox.

The process begins with the ownership making a public commitment to non-punitive reporting during a full-team meeting. Not a memo posted on the bulletin board, but a face-to-face conversation that establishes trust. You need clear distinctions between reportable mistakes and cardinal violations. Operating equipment while impaired? That’s a cardinal violation requiring disciplinary action. Forgetting to engage a safety guard? That’s a reportable near-miss requiring system improvement, not punishment.

Multiple reporting channels accommodate different comfort levels—paper forms in the break room, digital options through smartphones, and anonymous boxes for sensitive issues. The critical element involves responding within 24 to 48 hours. When employees observe reported near-misses generating rapid improvements rather than blame, trust develops quickly.

A Wisconsin operation with about 230 cows and six full-time employees transformed from experiencing 2 to 3 injuries annually to zero lost-time incidents over 2 years. They report saving approximately $30,000 annually in avoided injury costs. Their workers’ compensation premiums declined 22% at the last renewal.

The owner’s perspective is telling: “I was skeptical about non-punitive reporting. Seemed like giving people a pass for mistakes. But when we started fixing problems instead of finding fault, everything changed. Employees started telling us about issues we never knew existed.”

For a typical 200-cow operation employing eight workers, implementing comprehensive near-miss reporting costs approximately $4,000 to $5,000 annually. Based on USDA agricultural injury statistics, this investment could prevent $25,000 to $35,000 in injury-related costs.

This development suggests that as younger generations enter dairy management—often with safety training from agricultural programs—we’ll see accelerated adoption of these protocols.

Strategic Timeline: September Through February

Successful transformation from reactive to systematic management follows a predictable timeline. The key is starting early—in September, not November.

A Pennsylvania producer described his evolution perfectly: “We used to scramble every November, trying to prepare for winter that was already arriving. Now we start in September when it’s still 70 degrees and pleasant. Everything’s easier, cheaper, and more thorough.”

The breakdown of what this looks like operationally:

September becomes your assessment month. Body condition scoring takes one person approximately two days for a 200-cow herd. This establishes nutritional interventions for thin cows while there is still time for improvement. I recommend scoring on the same day each year—it creates a rhythm. Equipment servicing gets scheduled for October. Fuel supplies receive evaluation with winter delivery contracts secured.

October is infrastructure month. Every water heating element undergoes load testing. Not just checking if they turn on—actually measuring amperage draw. Tractors, skid loaders, and generators receive comprehensive servicing. Exposed water lines get winterized with heat tape and insulation. Operations stockpile two-week minimums of critical supplies.

November focuses on systems and people. Generators undergo full load testing—actually powering critical systems for several hours. Emergency response drills engage the entire team. What happens if we lose power for 48 hours? Winter safety training covers hypothermia recognition and emergency protocols.

December through February represents active management rather than crisis response. Daily protocols adjust based on temperature conditions. Above 20°F, standard checks. Below zero, hourly monitoring. Teams implement continuous improvements based on observations.

Farm Management Canada’s analysis comparing proactive versus reactive management reveals systematic farms investing $20,000 to $25,000 in preparation to avoid $60,000 to $70,000 in winter crisis costs—a net advantage often exceeding $40,000.

Overcoming Implementation Barriers

The primary obstacle to change isn’t financial or technical—it’s psychological. The Canadian Agricultural Human Resource Council’s survey indicates that over 75% of farmers report feeling overwhelmed and trapped in reactive patterns.

“I’m too busy fighting today’s fires to install prevention systems,” producers tell me constantly. But that reveals the fundamental paradox—the constant crisis management is exactly what prevents systematic improvement.

How do farms successfully break this cycle?

They start small, typically with water winterization due to clear, rapid returns. Success with one system builds confidence for expansion. A Vermont producer running 150 Jerseys told me, “Once we stopped having water crises, we realized how much time we’d been wasting. That motivated us to systematize other areas.”

Documentation proves critical. Track actual time and costs comparing reactive versus systematic management. When producers see they’re spending 40 hours monthly on emergencies versus 10 hours on prevention, the economics become undeniable.

Trust develops gradually through consistent actions. Near-miss reporting demonstrates a non-punitive culture when reports generate improvements rather than punishment. An employee on a Minnesota dairy told me, “When I reported a ladder problem and saw it fixed the next day with no questions asked, I started reporting everything that seemed unsafe.”

What I’ve noticed is that operations using farm management software and IoT sensors for monitoring find the transition to systematic management easier. The technology provides the data backbone that enables systematic approaches to be more manageable.

February’s Revealing Truth

Winter exposes operational realities that summer’s favorable conditions mask. February particularly reveals the difference between surviving and thriving.

After evaluating hundreds of operations, one indicator consistently distinguishes thriving farms: employee understanding. Ask any worker why they perform a specific task a certain way. If they can explain both the procedure and rationale, you’re observing systematic management in action.

Lactanet Canada’s performance indices reveal an interesting pattern that holds true across borders. The highest-scoring farms don’t necessarily achieve maximum per-cow production. Instead, they maintain remarkable consistency across all performance metrics—production, reproduction, health, and longevity.

Walking through a thriving February dairy reveals distinct characteristics. Body condition scores cluster tightly around 3.0-3.5. Waterers function reliably without daily crisis interventions. Barn temperature sits at 25°F when it’s -5°F outside—by design, not accident. Performance data appears where employees actually reference it. Equipment operates on maintenance schedules rather than emergency repair cycles.

What’s particularly noteworthy is that these outcomes occur regardless of which employees are working or the prevailing weather conditions. The system functions independent of individuals. That’s systematic management.

Practical Implementation for Your Operation

Looking at the evidence, the financial gap between reactive and systematic approaches can exceed $50,000 annually for a typical 200-cow dairy. Your specific figures will vary based on herd size, geographic location, existing infrastructure, and management capacity. But the direction remains consistent—systematic beats reactive.

Where should you start? Water system winterization offers the most immediate returns with visible results that build confidence. September body condition assessment determines February profitability—each underconditioned cow entering winter represents $500 to $800 in unrecoverable costs.

Understanding cows as heat generators rather than cold victims reshapes ventilation strategies. A quality insulated coverall costs $200 per employee. A sick cow from poor ventilation costs at least $300. The math is straightforward.

Cultural elements ultimately determine success. Near-miss reporting succeeds only with genuine trust and consistently non-punitive responses. When appropriately implemented—and it takes commitment—injury rates decline substantially.

Interestingly, systematic farms consistently report spending less total time on winter management despite more structured approaches. The perception of being “too busy to plan” often perpetuates reactive patterns.

Don’t attempt a comprehensive transformation immediately. Implement one system successfully this year. Document the results. Build momentum. While a complete, systematic transformation typically takes 2 to 3 years, returns begin within months.

Looking ahead, emerging technologies such as automated monitoring systems and IoT sensors will likely make systematic management even more accessible and cost-effective. The farms building these foundations now will be best positioned to leverage these advances.

The Bottom Line

As climate patterns become more variable and economic margins continue tightening, winter management approaches must evolve accordingly. Every operation faces a fundamental choice: continue accepting substantial reactive costs as inherent to dairy farming, or invest in systematic protocols that turn winter from a liability into a manageable operational period.

The systematic farms succeeding today don’t benefit from superior weather or advantageous genetics. They’ve shifted from treating winter as an annual surprise to approaching it as a manageable operational challenge.

A Wisconsin producer who transformed his 280-cow operation over three years captured this perfectly: “You’re not too busy to implement systematic management. You’re too busy because you haven’t implemented it yet.”

The decision is yours. This coming February will be here regardless of preparation levels. Will your operation be reacting to a crisis or executing established protocols?

The $50,000 question isn’t whether you can afford to systematize. It’s whether you can afford not to.

FINAL KEY TAKEAWAYS:

- The $100K bottom line: Systematic farms invest $30K in prevention to avoid the $130K reactive farms lose each winter—a 300% ROI starting year one

- Water winterization delivers instant returns: $200 heating element prevents $10,000 frozen pipe disaster—start here for immediate 500% ROI

- September body condition scoring saves $800 per cow: Thin cows need 24% more energy at 20°F, but can’t eat enough to compensate—fix condition before winter

- The nose knows: Smell manure before feed in your barn? That’s $150K in annual moisture damage—proper ventilation costs $20K once

- Less work, more profit: Systematic farms spend 75% less time on winter management while earning $50K+ more—because prevention takes minutes, crisis takes days

Resources for Winter Management Success

Body Condition Scoring: University of Wisconsin Extension Publication A3948

Ventilation Design: Penn State Extension Special Circular 397

Cold Stress Management: Michigan State Extension Bulletin E-3090

Water System Winterization: Ontario Ministry of Agriculture (OMAFRA) Publication 833

Safety Culture: Visit the National Safety Council’s agricultural division website (nsc.org) for templates

Economic Analysis Tools: Farm Management Canada’s risk assessment resources at fmc-gac.com

Weather Monitoring: NOAA’s agricultural weather portal at weather.gov/agriculture

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – This article details the specific ROI of the technologies that power systematic management, showing how AI and automation can slash feed costs by 15-25% and save up to $500 per cow in health costs.

- Dairy Profit Squeeze 2025: Why Your Margins Are About to Collapse (And What to Do About It) – Provides the urgent “why” for the main article’s strategies, exploring the market forces squeezing producer margins. It outlines aggressive, high-level financial tactics for protecting profitability beyond just seasonal preparedness.

- Winning the Workforce War: How Top Dairies Are Solving Labor Shortages in 2025 – A systematic winter plan is only as good as the team executing it. This article delivers tactical solutions for finding, training, and retaining the skilled labor needed to run advanced operational protocols.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!