European dairy farmers are discovering that traditional market cycles no longer apply—and the implications reach far beyond the Netherlands

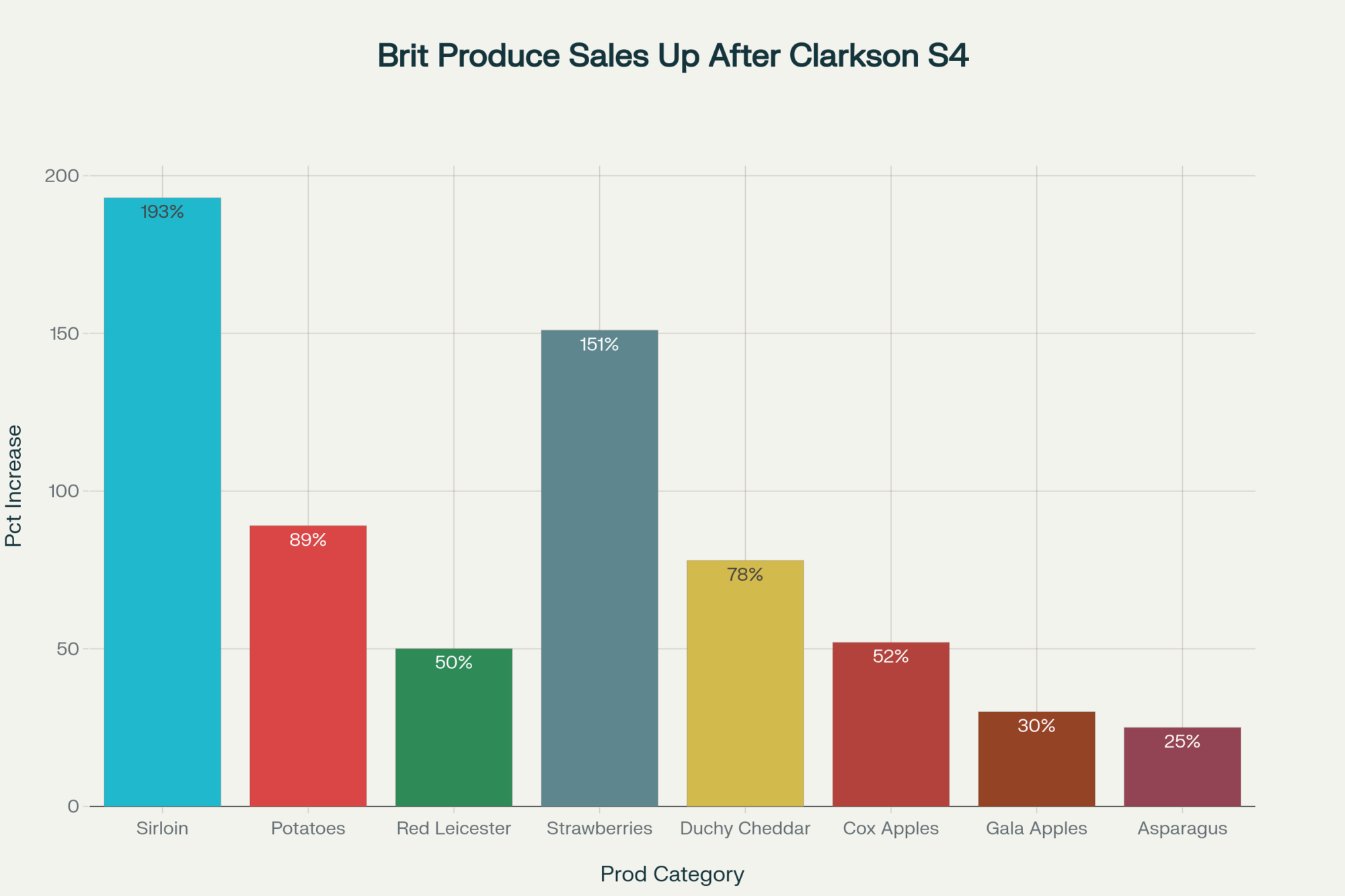

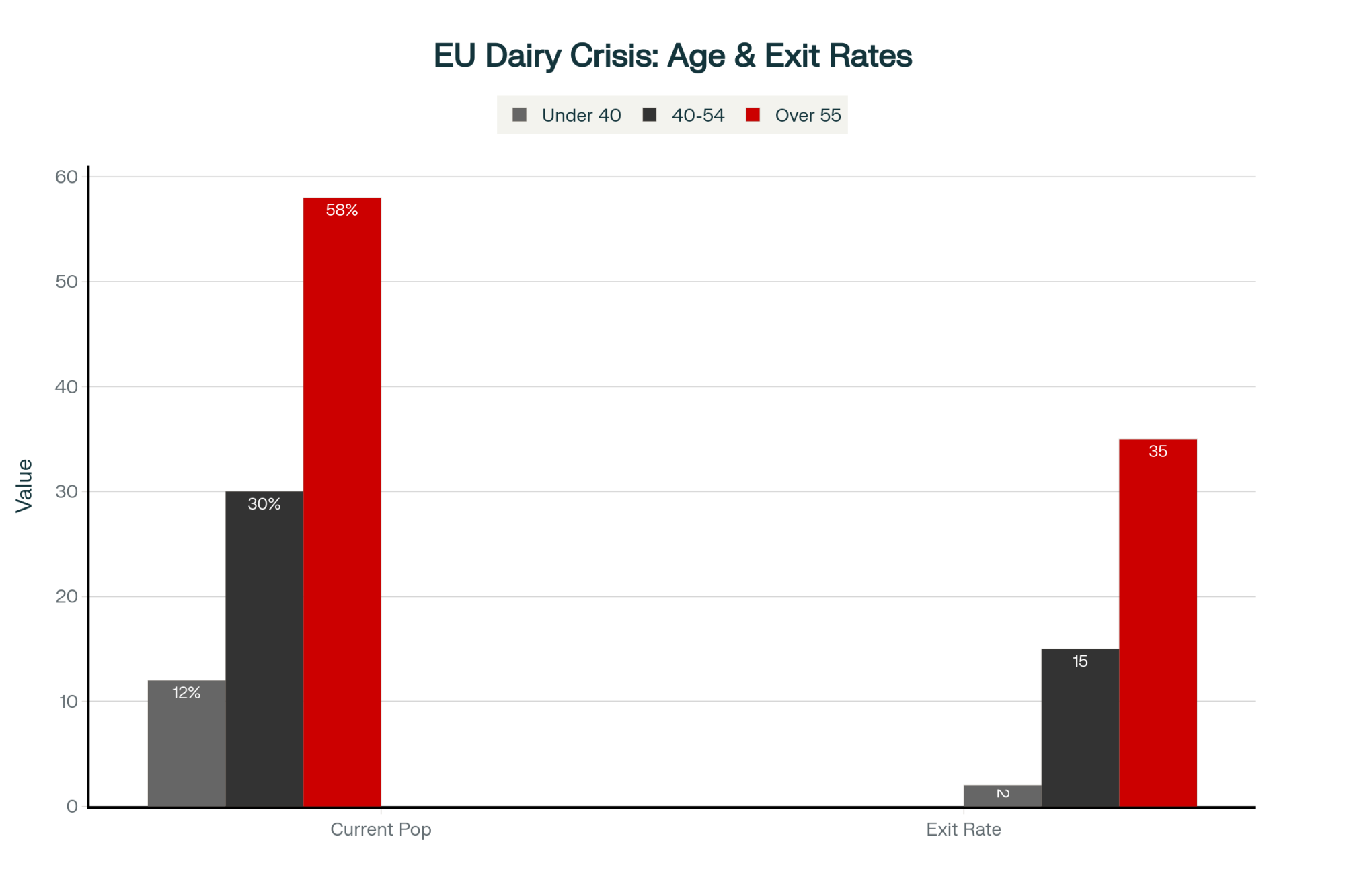

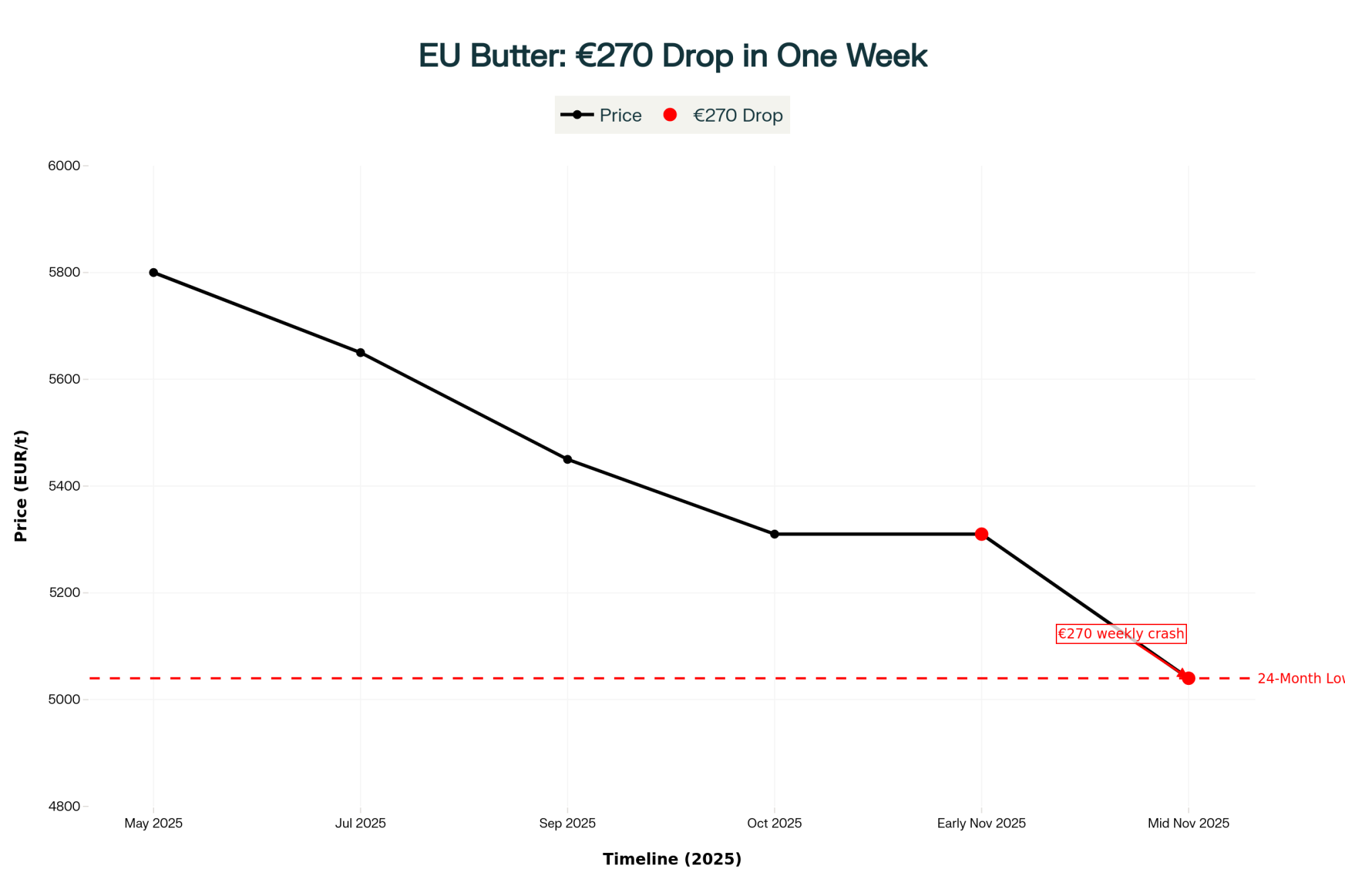

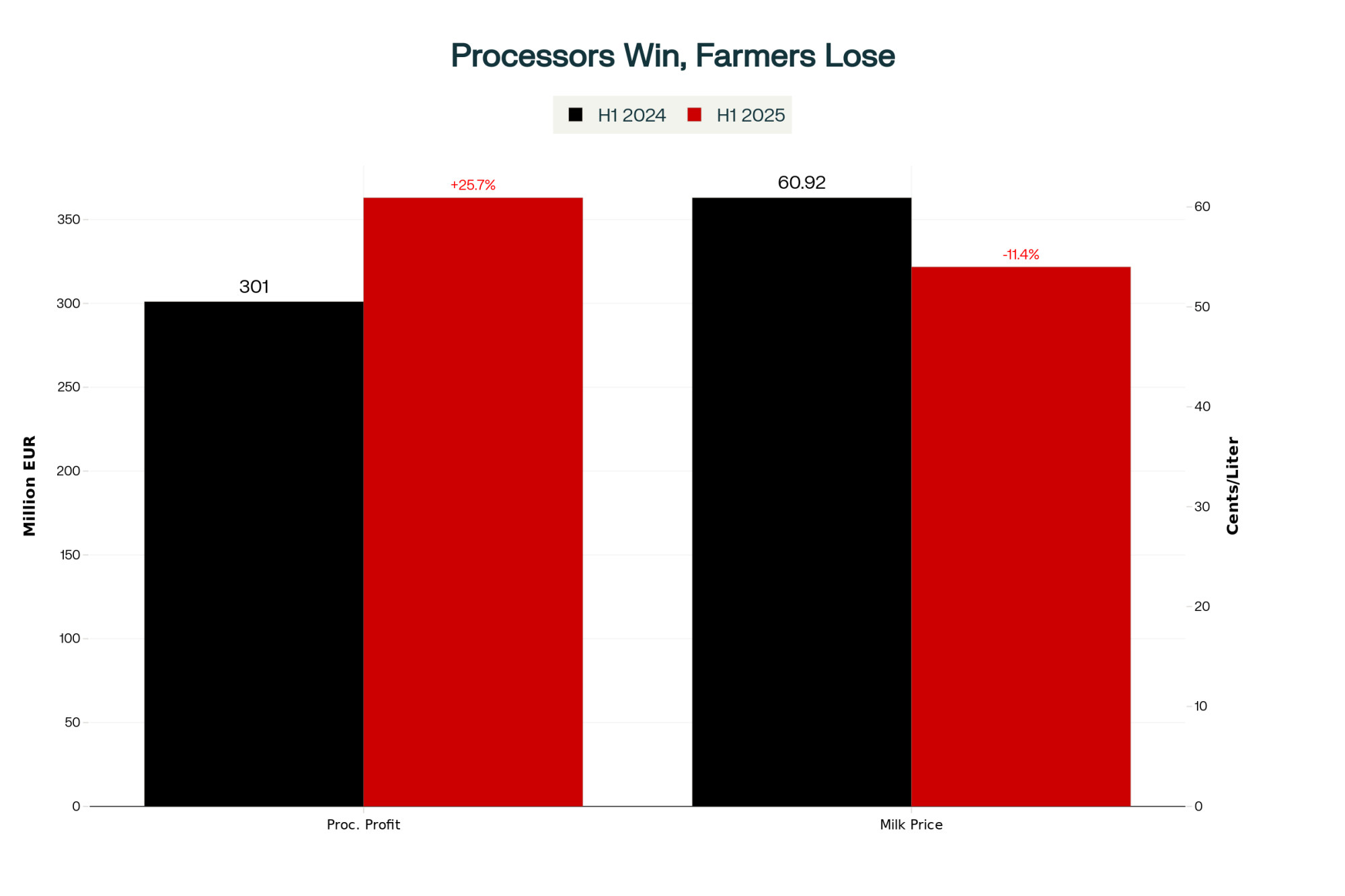

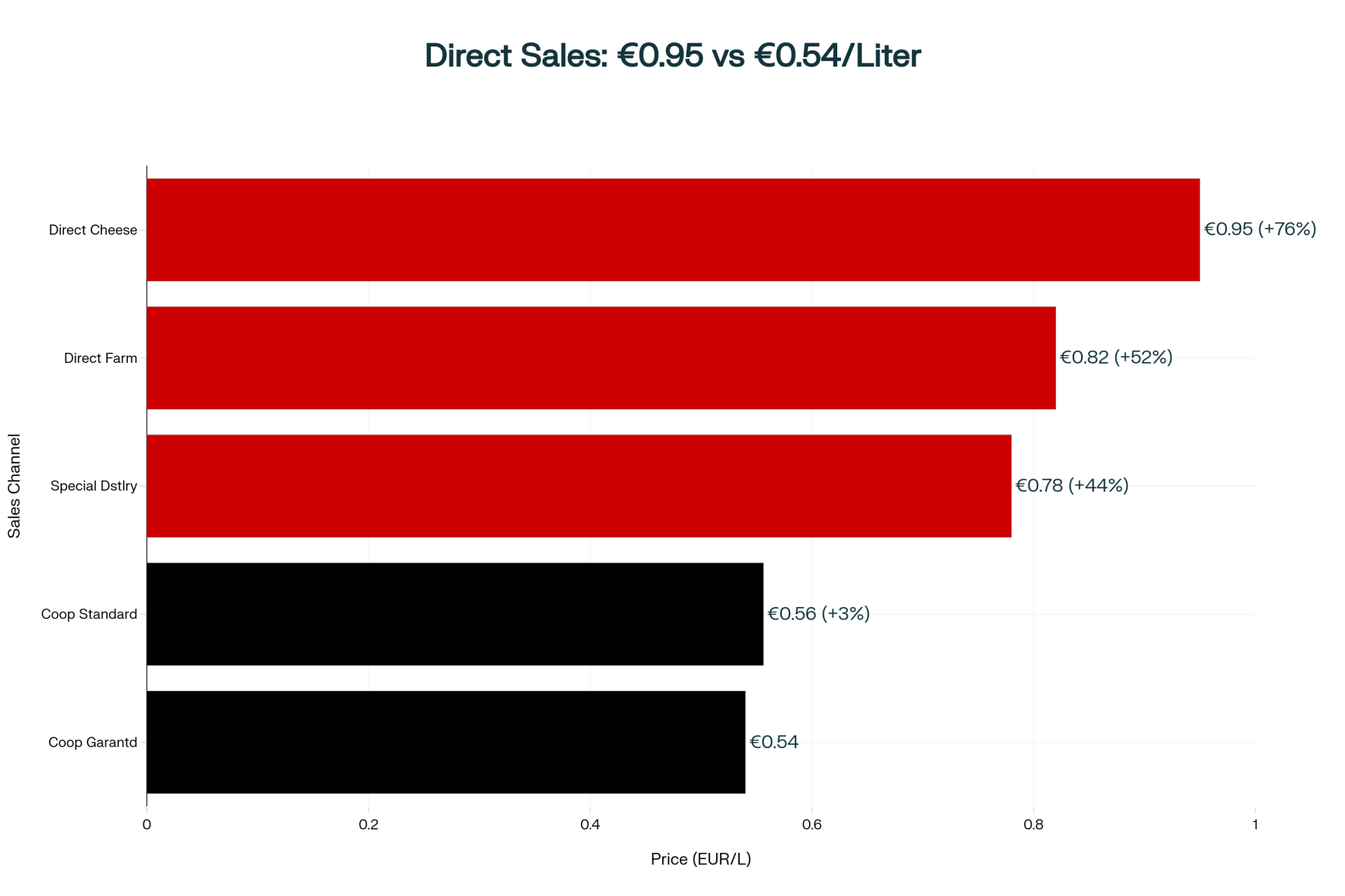

EXECUTIVE SUMMARY: When butter prices dropped by €270 in one week while processors reported 25% profit growth, it confirmed what many farmers suspected: the game has fundamentally changed. European cooperatives now profit from processing cheap milk rather than serving members, while retail algorithms lock in permanent price suppression—the recovery isn’t coming. With the Netherlands buying out farms for €1 million each and Germany losing eight operations a day, this isn’t a crisis; it’s a restructuring. Yet farmers capturing €0.95/liter through direct sales prove success is possible—just different than before. Smart operators are adapting now through specialty contracts, solar revenue, or value-added production, because after May 2027, government support ends, and today’s options disappear. The same patterns are emerging from Wisconsin to New Zealand, making this Europe’s story today, but everyone’s tomorrow.

You know, when butter prices in the Netherlands dropped €270 per tonne in a single week this November—hitting €5,040, the lowest we’ve seen in two years—the phone lines lit up across dairy country. Had a Dutch producer near Utrecht tell me something that really stuck: “This isn’t like 2015. Back then, we knew it would bounce back. Now? Nobody’s sure what normal looks like anymore.”

He’s right. The European Dairy Association’s November report shows this was the steepest drop they’ve recorded since they began monitoring weekly prices in 2018. But here’s what’s got everyone talking over morning coffee—processors like FrieslandCampina are reporting strong profits while our milk checks keep getting smaller. That disconnect… well, we need to understand what’s really happening here.

“This isn’t like 2015. Back then, we knew it would bounce back. Now? Nobody’s sure what normal looks like anymore.”

— Dutch dairy farmer near Utrecht

What we’re seeing across Europe right now—this mix of cooperative changes, retail evolution, and policy shifts—it’s creating something genuinely new. And I think these patterns offer insights for all of us, whether you’re milking in Wisconsin’s rolling hills or managing pastures down in New Zealand.

KEY FACTS AT A GLANCE

The Market Situation:

- €270/tonne butter price drop in one week (November 2025)

- €5,040/tonne current price—24-month low

- 56,500-tonne European butter surplus H1 2025

The Financial Picture:

- FrieslandCampina: 25.7% profit increase H1 2025

- Same period: 5.92 cent/liter milk price cut for farmers

- US butter: €4,246/tonne vs. European: €5,100-5,500/tonne

The Demographics:

- 12% of EU farmers are under 40 years old

- 58% over 55 years old

- Germany is losing 2,800 farms annually

The Policy Framework:

- €32 billion Dutch nitrogen reduction program

- €1 million average transition support per farm

- 70% nitrogen reduction targets in 131 areas by 2030

The Numbers Tell a Story We Can’t Ignore

So here’s what’s interesting—and the scale is pretty remarkable when you dig into it. The Agriculture and Horticulture Development Board’s latest assessment shows that European butter production alone created a 56,500-tonne surplus in the first half of 2025. That breaks down to 37,500 tonnes from increased production, 6,500 from exports drying up, and another 12,500 from higher imports. We aren’t talking minor fluctuations here.

What really gets me is how the processors are doing. FrieslandCampina’s July report showed their profits jumped 25.7% in the first half of 2025—we’re talking €301 million to €363 million. Then October rolls around, and they announce a 5.92-cent-per-liter cut to November milk prices. That’s… that’s one of the biggest monthly drops I’ve seen in years.

Dr. Alfons Oude Lansink over at Wageningen put it perfectly when talking to Dairy Global recently. He said we’re seeing processor profitability completely decouple from what farmers are getting paid. The old assumption—that cooperative success meant member success—well, that’s being challenged in ways we haven’t seen before.

And the international price gap? Man, that’s something else. Vesper’s August analysis has European butter at €5,100-5,500 per tonne, while the USDA shows American butter at €4,246 per tonne. That’s a $1.26-per-pound difference. Usually, these gaps close within months, right? This one’s been hanging around nearly a year now. Makes you think we’re dealing with something more permanent than temporary market hiccups.

How Our Cooperatives Changed While We Weren’t Looking

I’ve been watching cooperatives for over twenty years, and what’s happened recently… it’s remarkable how fast things shifted. Remember when cooperatives were basically just marketing organizations for our milk? That model—the one many of us grew up with—has morphed into something way more complex.

Take FrieslandCampina. Their 2024 annual report shows they’re processing 19 billion kilograms of milk across 30 countries. Think about that scale for a minute. It requires management structures that would’ve been unimaginable when most of us started farming. There’s now multiple layers between your morning milking and the boardroom decisions that affect your milk check.

Jan Willem Straatsma—farms 140 cows near Leeuwarden and serves on the Members’ Council—he told me something that really resonates: “We still have voting rights, but the distance between my morning milking and boardroom decisions has grown considerably.” I think that captures what a lot of us are feeling, doesn’t it?

What’s really shifted in these modern cooperatives:

- They’re pouring money into processing assets—FrieslandCampina spent over €500 million on capital expenditure in 2024 alone

- Member equity requirements? Up about 40% over the past decade, according to Rabobank’s analysis

- Governance now includes folks who, let’s be honest, probably haven’t mucked out a stall in their lives

- Payment formulas have gotten so complex that neighbors with nearly identical operations can have vastly different milk checks

The guaranteed price system—€55.63 per 100kg in the first half of 2025—sure, it provides some stability. But when butter tanks while cheese holds steady, cooperatives have to make allocation decisions. And understanding how those decisions get made… that’s becoming crucial for all of us.

The Retail Game Has Completely Changed

Here’s something that might surprise folks back home: German grocery retail has consolidated to where just four groups control between 65.9% and 85% of the market. We’re talking Edeka, Rewe, Aldi, and Schwarz Group—they run Lidl and Kaufland. The German Federal Statistical Office confirmed these numbers for 2025, and honestly, the implications are huge.

But what’s really wild is how technology’s changed pricing. Had a procurement manager from one of these chains explain it to me recently—didn’t want his name used, understandably. He said their systems constantly scan competitor prices, and when one store drops butter to €1.59, the others match within hours. All automatic. The computers handle the routine stuff while humans oversee strategic decisions.

“Our systems continuously monitor competitor pricing. When one retailer adjusts butter to €1.59, others typically match within hours.”

— German retail procurement manager

This creates what the academics call price convergence. Studies of German retail markets found butter prices across major chains vary by less than 2% on any given day. That’s… that’s basically identical pricing achieved through algorithms, not people sitting down together.

What’s this mean for us? Well, I was working with some Bavarian producers recently, and we calculated that retailers are selling butter at €1.59 per 250g while the actual milk cost for butter production runs about €11.50 per kilogram. That’s an €8 per kilo loss they’re taking.

Professor Hermann Simon at Cologne’s Retail Research Institute explained it pretty clearly—butter’s just the hook. Gets customers in the door. Then they make margins of 40-70% on everything else in the cart. So basically, our product is subsidizing their profit model. Tough pill to swallow, isn’t it?

Policy Changes That Are Reshaping Everything

The Netherlands’ nitrogen rules—probably the biggest agricultural policy shift we’ve seen in Europe in decades. Government documentation outlines requirements for a 70% reduction in 131 areas near protected sites by 2030. And folks, these aren’t minor tweaks we’re talking about.

The money behind it is substantial, I’ll give them that. Parliament confirmed €32 billion for the program, with €25 billion specifically for farm transitions. Works out to roughly a million euros per farm for those taking the exit package. Real money.

Met a producer near Zwolle recently who’s taking the buyout. He’s 58, son’s an engineer in Amsterdam. His logic was pretty straightforward: “Continuing would mean over €300,000 in compliance investments. The transition support lets me retire with dignity.” Hard to argue with that, you know?

The ripple effects are everywhere:

- Lely can’t keep up with demand for their Sphere systems—€180,000 to 250,000 installed, and they’re backordered

- Feed companies pushing additives like Bovaer—runs about €50 per cow annually, but cuts emissions 30%

- Land prices have gone crazy—saw a hectare near Utrecht sell for €140,000, triple its agricultural value

And demographics make it all worse. Eurostat’s latest census shows only 12% of EU farmers are under 40, while 58% are over 55. Germany’s losing about 2,800 farms a year, according to their Agriculture Ministry. That’s eight operations calling it quits every single day.

What’s Happening Elsewhere

Similar patterns are popping up globally, though the details vary. Understanding these helps put our own challenges in perspective.

The American Situation

USDA’s January report documented 1,420 dairy farms closing in 2024—that’s 5% of all operations. What’s interesting is these weren’t just small farms. Average herd size was 280 cows, way above the 180-cow national average. Seems like pressure’s hitting operations across the board.

Dairy Farmers of America, which handles about 30% of U.S. milk, is facing its own issues. Court documents from Vermont show that DFA began sending more member milk to its own processing plants after buying Dean Foods. Jumped from 50% in 2019 to 66% by 2021.

Dr. Marin Bozic from Minnesota testified before Congress about this, saying that when cooperatives own processing assets, their economics benefit from lower milk procurement costs. Creates real tension with member interests. That hits home for cooperative members everywhere, doesn’t it?

Had a Minnesota producer tell me recently they’re seeing the same disconnect—cooperative doing well while members struggle. “We’re basically funding their expansion while our margins shrink,” he said. Sound familiar?

New Zealand’s Big Move

Fonterra is selling their consumer brands to Lactalis for NZ$3.2 billion—that’s huge. Works out to about NZ$1,950 per farmer-shareholder. Meaningful money, but it’s also a fundamental strategy shift.

Alan Bollard, former Reserve Bank Governor, wrote in the Herald that it shows cooperative structures can’t compete with multinational capital in value-added markets. Sobering thought, but it reflects what many cooperatives are wrestling with.

The implications? Fonterra focuses on ingredients, while Lactalis—a private French company—focuses on premium brands. That’s a big shift in who captures value.

Australia’s Retail Challenge

The Competition Commission’s recent inquiry shows Coles and Woolworths expanding beyond retail into processing. Combined 65% market share plus direct farm sourcing creates unique dynamics.

Professor Frank Zumbo from the Dairy Products Federation notes that when retailers control processing and shelf space, traditional bargaining just disappears. We’re seeing this pattern everywhere now.

Strategies That Are Actually Working

Despite all these challenges—and they’re real—I’m seeing folks find viable paths forward. Not every approach works for everyone, but understanding what’s working helps us all.

[Visual suggestion: Infographic showing labor savings with robotic systems]

Going Direct to Consumers

Visited a 65-cow operation near Cologne that switched to farmstead cheese three years back. They invested €420,000 in equipment and aging rooms—a big risk. But now they’re getting €28 per kilo for their Gouda through direct sales and restaurants.

The farmer showed me his books—they’re showing about €0.95 per liter, compared to €0.54 through traditional channels. “Building customers took two years,” he said, “and my wife handles marketing full-time. It’s really a different business entirely.”

“I’d rather be profitable at 60 cows than losing money at 600.”

— Successful small-scale producer

What makes direct marketing work:

- Location matters: Need to be within 40km of population centers

- Capital requirements: €300,000-500,000 minimum—banks won’t touch these projects without collateral

- Marketing skills: Quality alone won’t sell cheese—you need marketing

- Regulations: EU hygiene requirements are mandatory and expensive

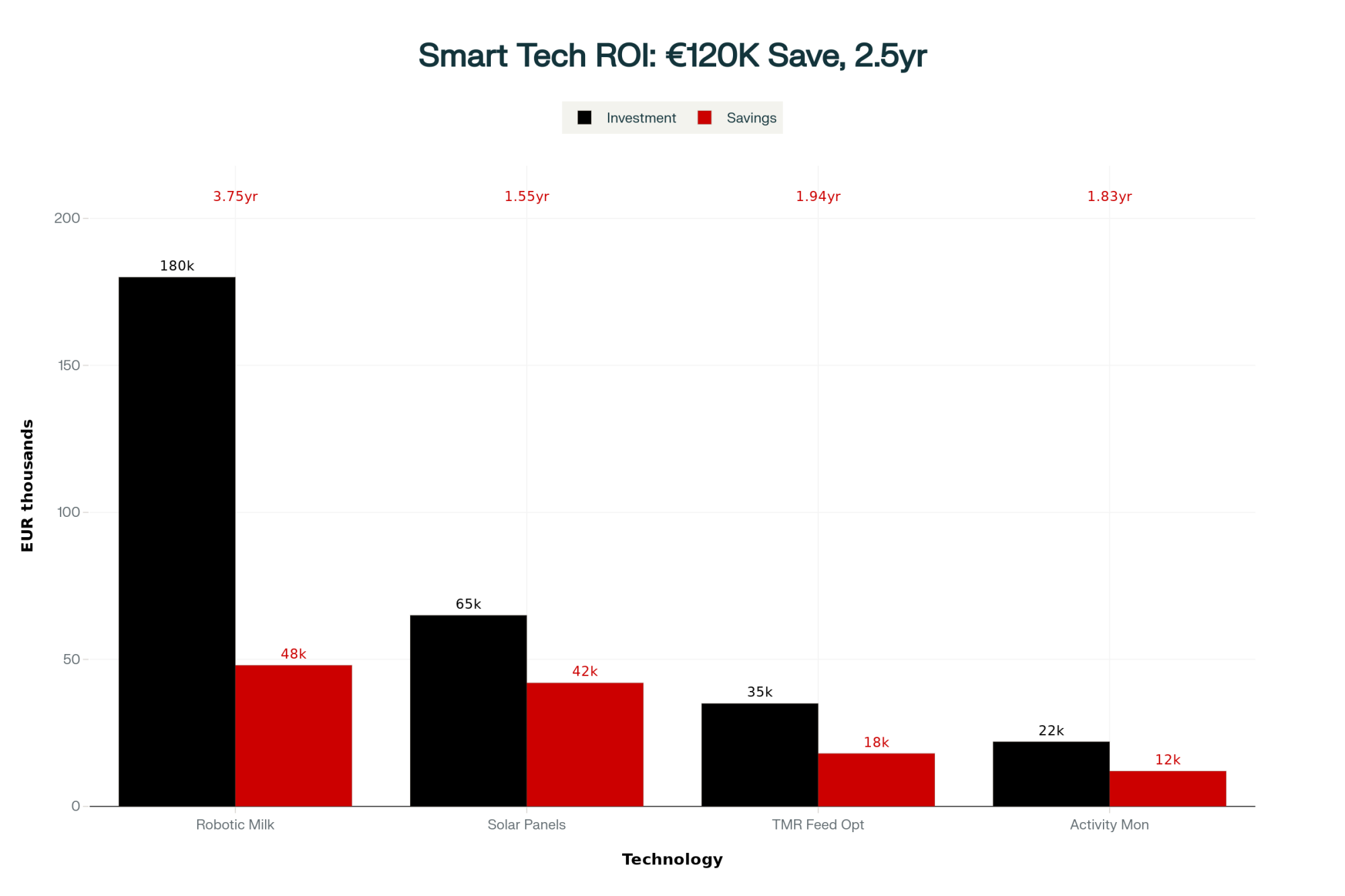

Smart Technology Choices

A 200-cow operation in northern Germany cut costs by 22% by carefully adopting technology. Nothing flashy—just practical improvements.

Their approach:

- Used robots: €180,000 for two DeLaval units, eliminated one full-time position

- Feed optimization: TMR mixer with sensors cut feed costs by 12%

- Solar income: €42,000 annually from barn-roof panels

“Every percentage point matters when margins are this tight,” the manager told me. “Can’t control milk prices, but we can control costs.”

Seeing similar success in the States. A Wisconsin friend installed used robots for about $165,000, with the same labor savings. California dairy added solar across their barns—covers all electricity plus $35,000 extra annually. And up in Idaho, a 300-cow operation retrofitted their parlor with activity monitors and automated sort gates for under $80,000—cut breeding costs by 25% and improved pregnancy rates. These aren’t revolutionary—just practical adaptations that work.

Creative Revenue Streams

The innovation I’m seeing is really encouraging. Bavarian operation raising 120 replacement heifers annually at €3,200 each—better margins than milk, less volatility.

Successful diversification approaches:

- Custom heifer raising: Five-year contracts provide stability that commodity markets never offer

- Solar leasing: €1,100 per hectare annually, minimal labor

- Specialty contracts: Amsterdam farm getting €0.78/liter for distillery milk—44% premium

In Vermont, a farm partnered with a local creamery for cultured butter—high-end restaurants pay $0.85 per liter equivalent. The Ohio operation makes $120,000 from agritourism while maintaining 150 cows. Shows innovation isn’t always about scale.

Making Sense of the Path Forward

After all these conversations and analysis, several things are becoming clear.

Markets have fundamentally shifted. The structural changes—retail consolidation, pricing algorithms, cooperative evolution—created new equilibrium points. Planning based on old cycles won’t work anymore.

Scale doesn’t guarantee success. I’ve seen all sizes struggle and succeed. It’s about positioning and differentiation. Like one farmer said, “I’d rather be profitable at 60 cows than losing money at 600.”

Cooperative engagement matters now. Can’t be passive members anymore. Either engage actively or develop alternatives.

Compliance is permanent. Whether it’s nitrogen, water quality, or animal welfare, these requirements aren’t going away. Early adoption usually costs less than fighting it.

Demographics create opportunity. With 60% of European farmers over 55, lots of assets will change hands. Prepared operators can build good operations—just avoid the debt traps that hurt previous generations.

The Critical 18-Month Window

What I’m seeing suggests we’re in a crucial period through May 2027 where decisions really matter.

Government programs are funded, cooperative equity’s stable, land markets haven’t crashed, and interest rates are elevated but manageable. But this could all shift quickly as more people make decisions.

For that typical 55-year-old with 80 cows and €2 million debt—and I meet lots in this situation—the math’s pretty clear. At €0.54/liter milk and €0.52 costs, including debt, you’re barely breaking even. Without succession plans or premium markets, continuing might cost more than transitioning.

Financial advisor who specializes in dairy told me recently: “I don’t tell people what to do, but I make sure they understand their real numbers. Emotions are understandable, but math doesn’t lie.”

WHAT THIS MEANS FOR YOUR OPERATION

Under 100 Cows:

- Focus on being different—direct sales, specialty products beat commodity competition

- Technology should cut labor, not boost production

- Consider partnerships for resources and market access

100-500 Cows (The Squeeze Zone):

- Too small for mega-efficiency, too large for niche marketing

- Make strategic choices: scale up with clear planning or pivot to value-added

- Get involved in your cooperative—you need to influence decisions

Over 500 Cows:

- Efficiency is everything—every percentage point counts

- Diversify into energy or services for stable revenue

- Succession planning is critical—the next generation needs a clear profitability path

The Industry Keeps Evolving

This €270 drop in butter prices isn’t just volatility—it shows fundamental changes reshaping dairy globally. Success requires different thinking than what built our industry.

Resilient operations share traits: diversified revenue streams, strong customer relationships, smart technology use, and—crucially—realistic assessment paired with decisive action.

Not everyone will make it through. We need to acknowledge that. But those who recognize the new reality early and adapt, they’ll find opportunities. Just different ones than we’re used to.

“Farming isn’t just about producing milk. It’s about making decisions that protect your family’s future. Sometimes that means knowing when to change course.”

— Dutch farmer preparing for transition

Standing in that Dutch farmer’s parlor last week, watching him prepare for his final season after decades of dedication, his pragmatism struck me. “Farming’s more than milk production,” he said thoughtfully. “It’s stewarding family resources. Sometimes wisdom means recognizing when things have fundamentally changed.”

And you know what? That might be the key insight here. Success isn’t just about perseverance anymore. Sometimes it’s recognizing when the rules changed and having the courage to adapt—whether that’s innovation, diversification, or transition.

What’s happening in European dairy right now… it’s not doom and gloom, but it’s not false hope either. It’s just reality: an industry transforming where old strategies don’t guarantee old outcomes. For those willing to see clearly and act decisively, that clarity becomes an advantage.

What matters is honest evaluation. Not wishful thinking, not catastrophizing, just a realistic assessment of where we are and where we’re headed. That’s how we make decisions that serve our operations and families.

The industry’s changing. We can change with it or get left behind. As always, the choice is ours.

KEY TAKEAWAYS:

- The old dairy economics are dead: When processors profit from your losses, the game has fundamentally changed

- Your cooperative isn’t your partner anymore: They profit from cheap milk, not member success—act accordingly

- Success formula flipped: Small + specialized beats large + commodity (€0.95/L direct vs €0.54 commodity proves it)

- 18 months until options vanish: Government support, buyout programs, and stable markets end May 2027

- Only three strategies work now: Go direct to consumers, cut costs with technology, or exit strategically—waiting isn’t a strategy

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Decide or Decline: 2025 and the Future of Mid-Size Dairies – Provides a critical survival roadmap for the “squeeze zone” operations (100-500 cows) identified in this article, offering specific financial benchmarks and debt-to-asset ratios needed to navigate the current restructuring.

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – Expands on the diversification strategies mentioned above, delivering the actual math behind beef-on-dairy premiums and renewable energy contracts that are stabilizing revenue for progressive producers.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – breaks down the ROI of the labor-saving technology discussed in this piece, offering case studies and data on how automation is lowering breakeven costs for family-scale operations.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!