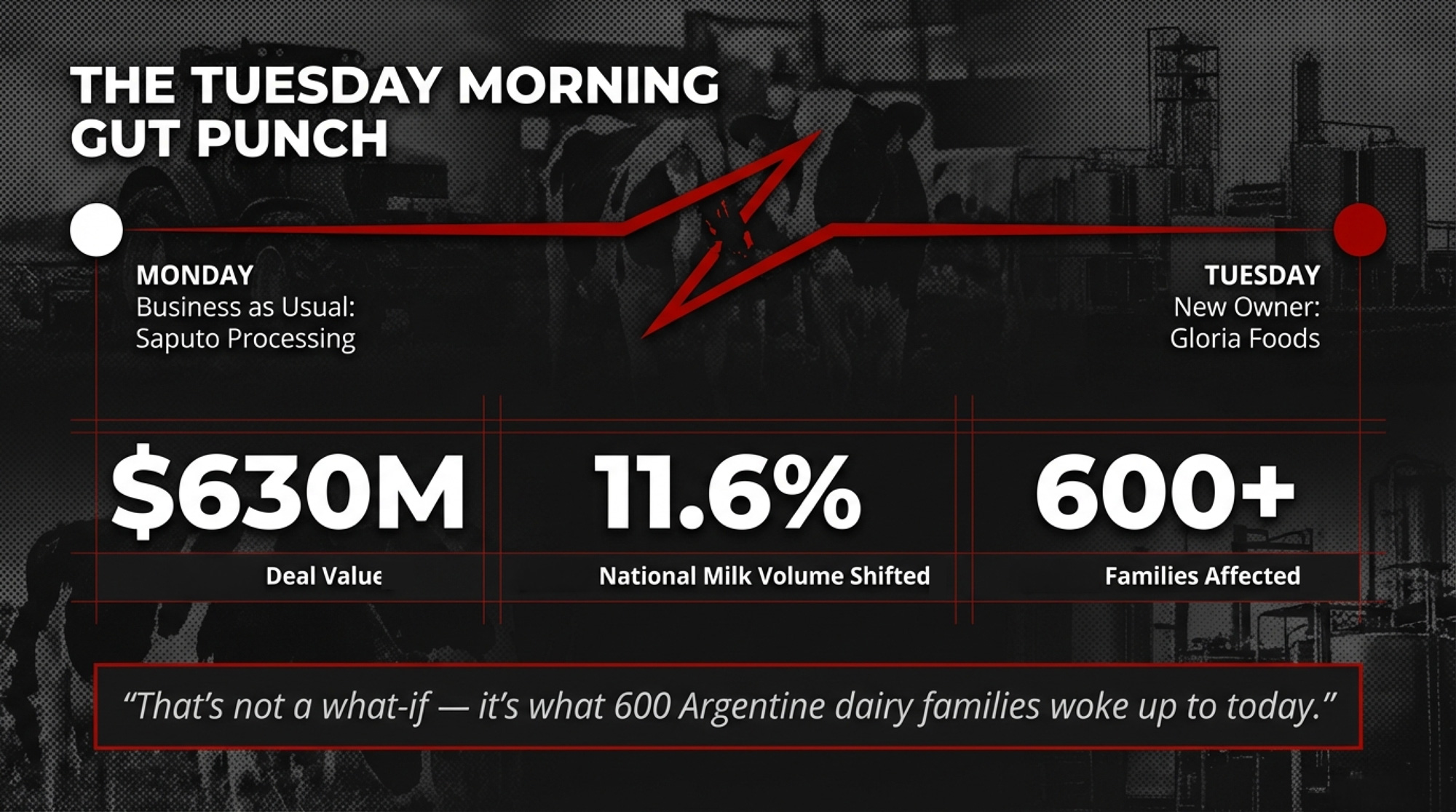

Your milk goes to one processor. Overnight, they sell 80% to a stranger. That’s not a what‑if — it’s what 600 Argentine dairy families woke up to today.

Executive Summary: Saputo is selling 80% of its Argentine dairy division to Peru’s Gloria Foods in a deal that values the business at C$855 million (about US$630 million), while keeping a 20% stake. Overnight, control of Argentina’s largest milk processor — 11.6% of the nation’s industrial milk and collections from more than 600 farms — shifts to a buyer that’s been sued for abusing its power with producers in Chile, fined in Colombia for adding whey to “whole” milk, and accused of monopolistic practices in Peru. Farmers shipping to Saputo’s Rafaela and Tío Pujio plants learned about the deal from a press release instead of a phone call, and they still don’t know if Gloria will keep their contracts, prices, and pickup schedules intact. They’re dealing with that gut punch in a sector where SanCor has just entered creditor protection and co‑ops’ share of Argentina’s milk has collapsed from roughly 34% to about 3%, leaving most producers tied closely to a single processor. Add in Gloria’s aggressive acquisition run and rising debt‑service costs at its Peruvian holding company, and you have a new owner that’s highly motivated to manage margins hard once the ink dries. This article walks you through what’s happening to those 600 Argentine dairy families — and gives you a concrete playbook to check whether your own processor contract would protect you if the company you ship to sold tomorrow without warning.

Saputo Inc. announced today that it’s selling 80% of its Argentine dairy division to Gloria Foods — the dairy arm of Peru’s Grupo Gloria — for an enterprise value of C$855 million. That works out to roughly US$630 million, including assumed debt, though Peruvian business media report the equity purchase price closer to US$500 million. Saputo expects net proceeds after tax of approximately C$543 million (US$400 million). The company keeps a 20% minority stake. The deal covers two processing plants, the La Paulina, Ricrem, and Molfino brands, and a milk collection network serving more than 600 dairy farms across Santa Fe and Córdoba provinces, according to Argentine agricultural media, including LA17 and Bichos de Campo.

This is what dairy processor consolidation risk looks like in practice. Those 600 families weren’t part of the conversation — and the company taking over has a record across Latin America that every producer, Argentine or not, ought to understand before this deal closes around mid-2026.

If you read nothing else this month, pair this with our recent piece on the four questions every dairy producer should ask about processor dependency. What’s happening in Argentina right now is a textbook case of what that audit is designed to prevent.

How Saputo Built Argentina’s Top Dairy Operation — Then Walked Away

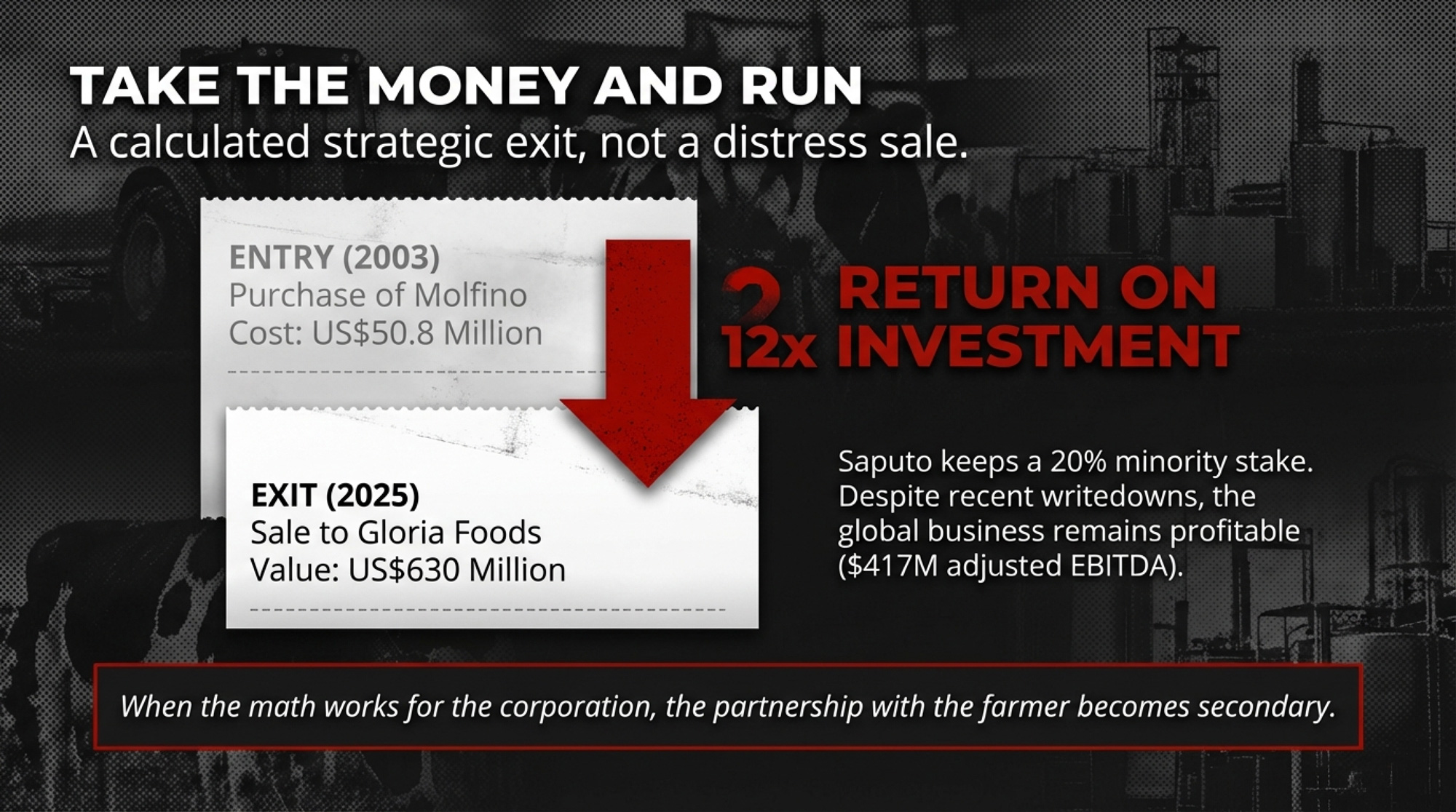

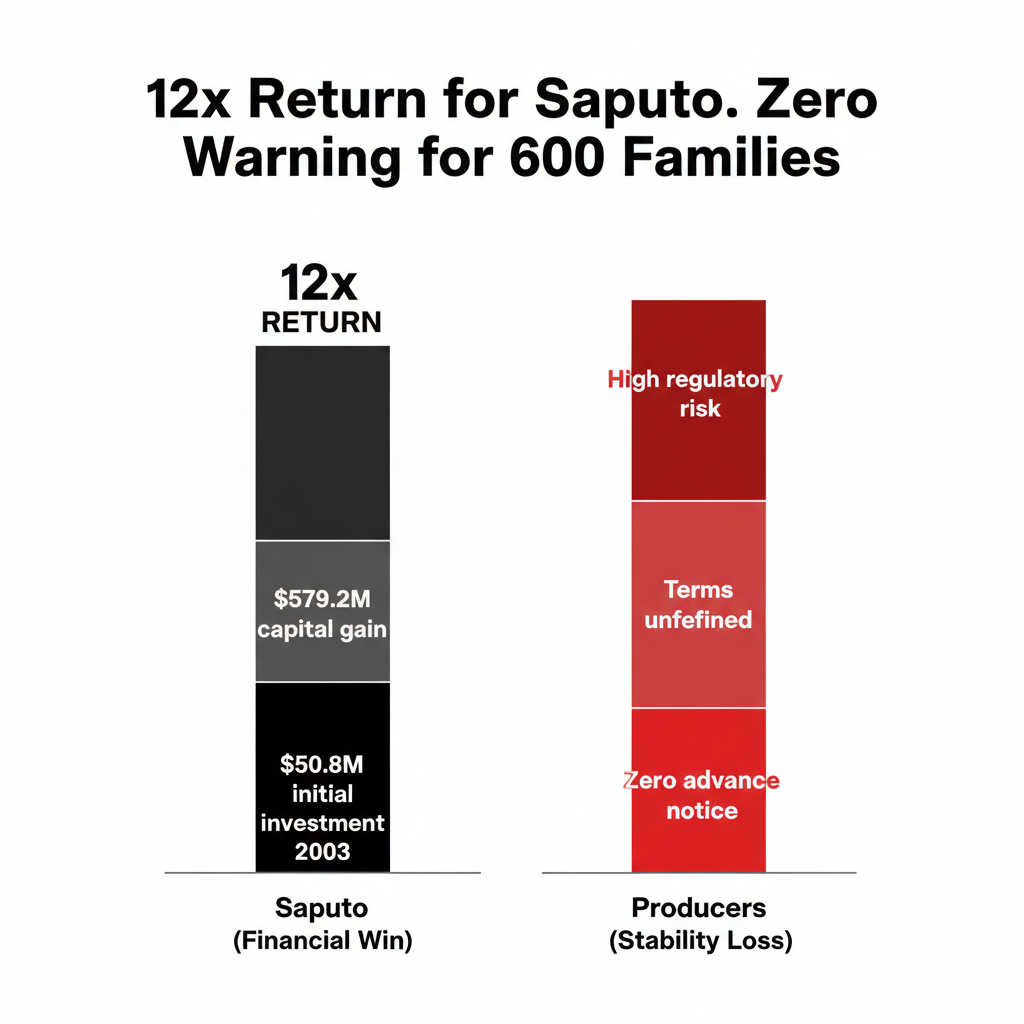

Saputo entered Argentina in November 2003 by acquiring Molfino Hermanos S.A. from Molinos Río de la Plata for US$50.8 million. At the time, Molfino was the country’s third-largest processor — two plants, roughly 850 employees, about US$90 million in annual revenue. Over 23 years, Saputo turned that into the country’s number-one operation.

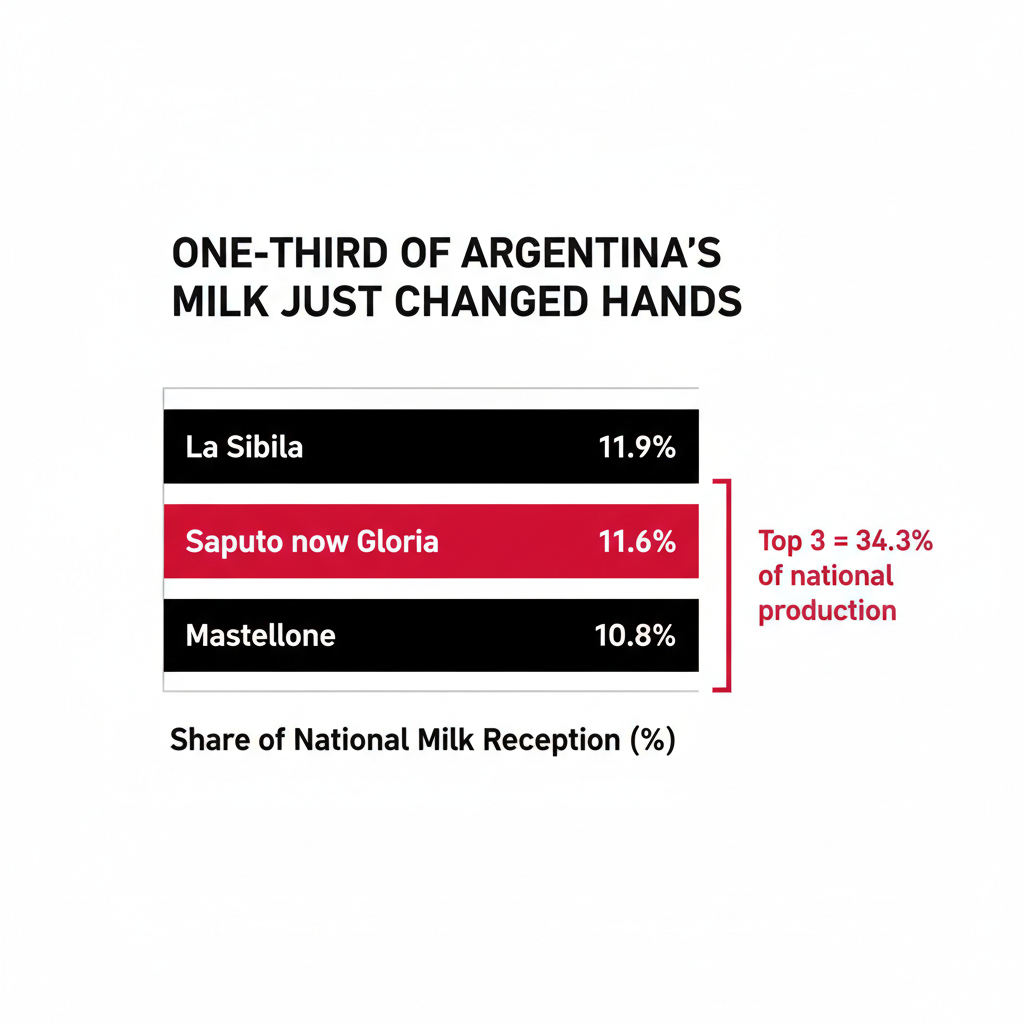

The OCLA 2023/24 industry ranking — based on reported and estimated daily milk reception by industrial processors, published annually — had Saputo processing an average of 3,650,288 liters per day, or 12.5% of national industrial milk volume. By the most recent OCLA 2024/25 ranking (published July 2025), that figure had dropped to 3.53 million liters daily, or 11.6% of the national total. Still number one, ahead of Mastellone (La Serenísima) at 3.15 million liters and 10.8%, but the decline hints at the pressures behind Saputo’s decision to sell. In the last four quarters, the Argentine operation generated approximately C$1.2 billion in revenue — about 7% of Saputo’s consolidated total.

When SanCor — once Argentina’s cooperative giant — entered a deep financial crisis beginning in 2017 (as SanCor put it in its February 2025 court filing), Saputo moved quickly. The company absorbed the freed-up milk supply and routinely offered prices better than competitors’. Producers followed the money. You would have too.

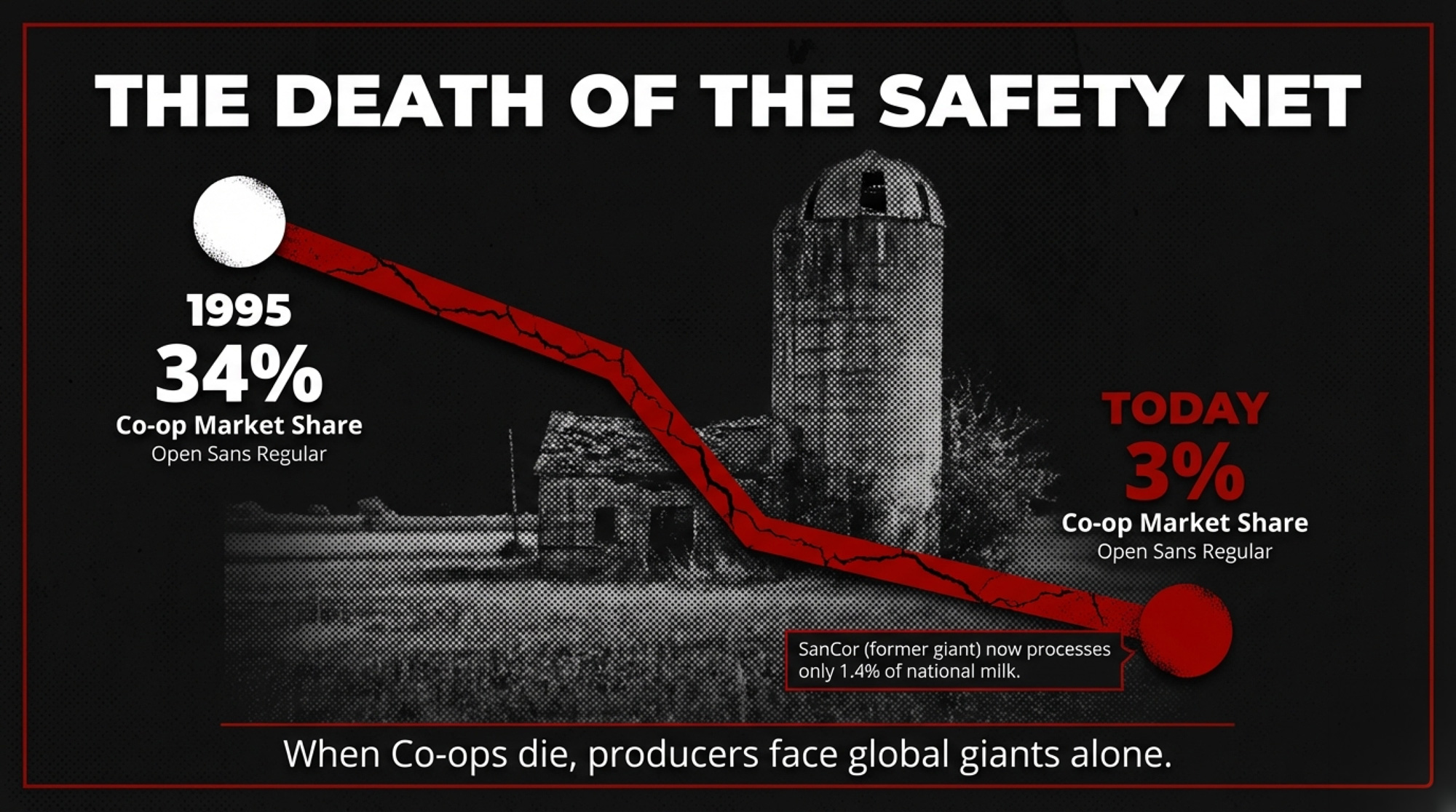

And then SanCor’s story got worse. On February 2, 2025 — just ten days before today’s Gloria announcement — SanCor formally filed for concurso preventivo de acreedores (creditor protection proceedings) at the Commercial Court in Rafaela, Santa Fe, carrying approximately US$400 million in debt. SanCor now processes just 409,163 liters daily, barely 1.4% of national production, down from its peak of 1.2 million. The region’s dairy infrastructure isn’t just shifting; it’s transforming. It’s being completely restructured.

Saputo’s dominance also created structural dependency. The practical effect was that Saputo’s price signals shaped the broader regional market — when the biggest buyer in the milkshed moved, everyone else followed. That arrangement works fine. Right up until the company at the center decides to leave.

CEO Carl Colizza’s press release language was corporate but clear: “This divestiture enhances our financial flexibility and supports targeted reinvestment in platforms that offer the highest growth opportunities.” Translation: take a roughly 12-fold return on a 23-year investment (US$630M enterprise value on a US$50.8M entry) and redeploy capital somewhere with fewer currency crises.

600 Families, No Advance Notice

Here’s what we know about how this landed on the ground. As of publication — hours after the announcement — there’s been no reported communication from Gloria Foods to Argentine producers. No new contract terms. No timeline for meetings. No word on whether existing payment schedules, quality premiums, or pickup logistics will change. Infocampo described the news as a “sacudón” — a jolt — to the Argentine dairy chain.

Several cooperatives sit squarely in Saputo’s milkshed. Cooperativa Tambera Central Unida in San Guillermo, Santa Fe — managed by Javier Clemente — delivers milk to five processing companies, including Saputo. Clemente has spoken publicly about producer autonomy in the region: “The one who decides where their production goes is the member, because the milk belongs to whoever produces it.” He made those remarks before the Gloria deal was announced. His cooperative is now directly affected, and whether that principle holds when a Peruvian conglomerate replaces a Canadian one is the question nobody can answer yet.

Cooperativa Agrícola Santa Rosa, also near San Guillermo and managed by Martín Guruceaga, works with approximately 60 farms across a 40-kilometer radius. Guruceaga has described the area simply as “una zona tambera” — a dairy zone where the community and the industry are one and the same. UNCOGA, a federation of nine cooperatives spanning central-west Santa Fe and central-east Córdoba, operates across the heart of Saputo’s collection territory.

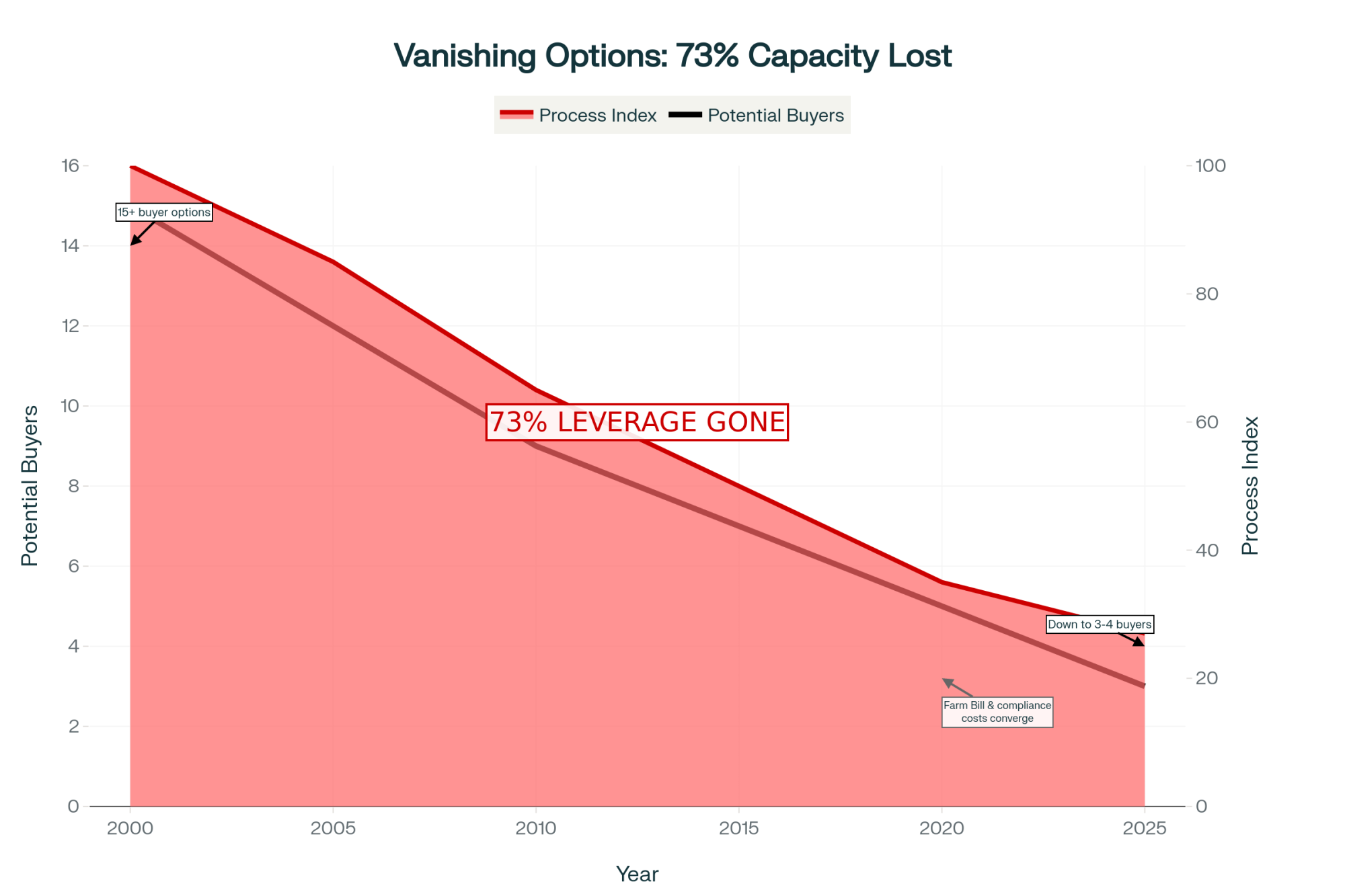

These cooperatives are the closest thing to a collective voice that affected producers have. But the cooperative system itself has been hollowed out. Cooperative share of Argentine milk reception dropped from 34% in 1995 to roughly 3%today, according to the OCLA 2024/25 industry ranking. That means most of those 600-plus farms negotiate individually with their processor. When that processor changes without warning, individual leverage is essentially zero.

“The dairy sector and the country will only grow when the producer grows, because the producer is the one who carries the activity in their blood.” — Daniel Oggero, APLA executive committee, El Litoral, July 2015

Oggero made that statement during a blockade of Saputo’s Rafaela plant by western Santa Fe dairy farmers protesting milk price cuts. Those words land differently today, when the producer’s voice in the transaction was exactly zero.

Why Saputo Sold — And What Gloria’s Track Record Shows

Understanding both sides of this deal matters if you’re trying to figure out what comes next.

Why Saputo left: This isn’t a distressed sale. Through FY26, Saputo’s efficiency program has been delivering: Q1 operating cash flow hit C$317 million (up 66% year-over-year), adjusted EBITDA reached C$417 million (up 12.7%), and the company has been buying back shares aggressively. Saputo reported net losses of C$250 million through the nine months ended December 2024, driven largely by writedowns and hyperinflation accounting adjustments tied to Argentina — but the underlying business is profitable and improving. Saputo chose to leave. That tells you how the company views Argentine risk-reward going forward.

Who Gloria is: Gloria Foods is the dairy platform of Grupo Gloria, a Peruvian conglomerate with more than 7,000 employees across Peru, Chile, Bolivia, Argentina, Colombia, and Ecuador. President Claudio Rodriguez called the Saputo acquisition “a milestone within the strategy of sustained growth in Latin America.” The expansion has been rapid: Soprole in Chile from Fonterra for approximately US$644 million (completed April 2023), Ecuajugos from Nestlé in Ecuador (2024), and now Saputo Argentina.

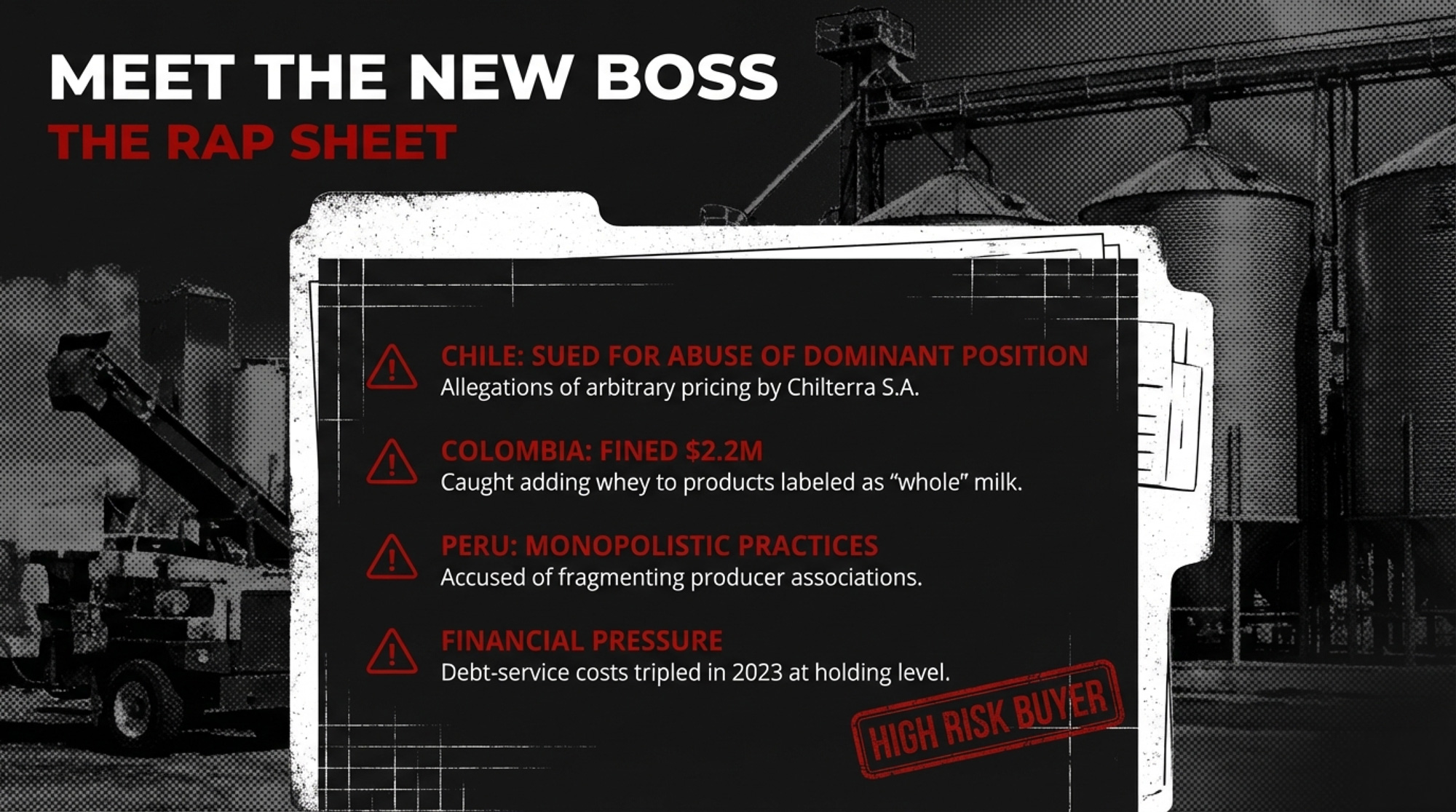

But that growth has come with a trail of regulatory actions and producer-relations disputes. Not one-offs. A pattern across multiple countries.

In Peru, former AGALEP (national dairy farmers’ association) president Javier Valera publicly described Gloria’s market behavior as monopolistic. His successor, Nivia Vargas, accused the company of offering infrastructure only to larger-volume farms — deliberately fragmenting producer associations and undermining collective bargaining. Gloria has also fought a Peruvian government decree requiring evaporated milk be made from fresh milk. AGALEP leadership says that regulation underpins demand from an estimated 450,000 Peruvian dairy farmers.

In Chile, Gloria’s subsidiary Prolesur faces a lawsuit admitted by the national competition tribunal (TDLC) on January 30, 2025. Plaintiff Chilterra S.A. alleged abuse of dominant position, specifically that Prolesur imposed “unjustified prices through arbitrary and unverifiable criteria”—a system plaintiff Ricardo Ríos described as designed to create total producer dependence.

In Colombia, the Superintendencia de Industria y Comercio fined Gloria, along with Lactalis, Hacienda San Mateo, and Sabanalac in February 2025 for adding whey protein (lactosuero) to products labeled as whole pasteurized milk. The basis: INVIMA laboratory studies from 2019–2020 detected elevated caseinomacropeptide levels — a marker indicating whey protein had been added to a product labeled as pure milk. Gloria’s penalty was US$2.2 million. The company has appealed.

| Country | Action / Dispute | Year | Status / Penalty |

|---|---|---|---|

| Peru | Former AGALEP president accused Gloria of monopolistic behavior; producers claim infrastructure access limited to large farms, fragmenting associations | Ongoing | No formal penalty; producer relations remain strained |

| Chile | Prolesur (Gloria subsidiary) sued for abuse of dominant position—”unjustified prices through arbitrary criteria” designed to create producer dependence | 2025 | Lawsuit admitted by TDLC competition tribunal Jan 2025; pending resolution |

| Colombia | Fined for adding whey protein to “whole” milk; INVIMA labs detected elevated caseinomacropeptide (adulteration marker) | 2025 | US$2.2 million fine; Gloria appealed |

| Puerto Rico | Exited market entirely after regulatory challenges made operations “unworkable” | 2025–26 | Complete market withdrawal |

Gloria reports investing approximately S/718 million — roughly US$190 million (S/ refers to Peruvian soles) — between 2012 and 2023 in a farmer development program. That figure comes from Gloria itself and hasn’t been independently audited, but the investment claim is on the record. In Puerto Rico, the company exited the market entirely in 2025–2026 after what it described as regulatory challenges that made operations unworkable.

Does any of this predict what happens in Argentina? Not necessarily. Different market, different regulations, different competitive dynamics. But the holding-level financial picture adds context. Holding Alimentario del Perú reported net losses of S/124.9 million (roughly US$33 million) in 2023 and S/62.2 million (~US$16 million) through nine months of 2024, according to Peruvian securities filings. Financial expenses surged from S/123.7 million in 2022 to S/399.5 million in 2023. A company whose debt-service costs tripled in one year is under pressure, even if the core dairy business is profitable.

Nobody’s saying assume the worst. But you’d be wise to ask very specific questions before closing day.

What This Means for Your Operation

This section is about dairy processor risk — and it applies whether you’re milking cows in Córdoba or Ontario or Wisconsin.

| Contract Protection | What It Does | Argentine Status | Your Action This Week |

|---|---|---|---|

| Ownership-change clause | Requires new buyer to honor existing contract terms or provides renegotiation window | Missing for most producers | Pull your supply agreement; search for “assignment,” “change of control,” or “transfer” clauses |

| Minimum notice period | Guarantees 30–90 days’ written notice before contract termination or major changes | Missing for most producers | Check termination section; if absent, negotiate 60-day minimum before any ownership transfer |

| Payment guarantee | Ensures payment terms (price, schedule, penalties) survive ownership change | Unknown—producers waiting for Gloria communication | Verify whether your agreement specifies payment continuity; if not, add it |

| Secondary buyer relationship | Diversifies risk by routing 10–30% of production to alternative processor | Not common in concentrated markets | Identify regional cheese makers or co-ops; formalize even small-volume backup contract |

| Collective bargaining vehicle | Cooperative or producer association negotiates on behalf of group | Exists (UNCOGA, cooperatives) but weakened by 3% co-op market share | Join or re-engage with local co-op; coordinate questions for new buyer through group |

| Regulatory review trigger | Large acquisitions require competition-authority approval, sometimes with producer-protection conditions | Pending—Argentine CNDC reviewing deal | Monitor CNDC decision; if conditions imposed, ensure enforcement mechanisms exist |

If you’re in Saputo’s Argentine collection zone: Your contract is the document that matters now. Does it include an ownership-change clause? A minimum notice period? A payment guarantee? If yes, those terms should carry over. If not — or if you don’t have a written agreement at all — you’re negotiating from scratch with a company you’ve never dealt with. Contact your cooperative this week. The latest SIGLEA data (December 2025) shows Argentine farm-gate milk prices averaging AR$476.60 per liter — up only about 8% year-over-year in nominal terms, while costs have continued to rise, putting margins under pressure. Any disruption in payment terms during a processor transition hits harder when margins are already thin.

If you’re a North American Saputo supplier: This looks like an emerging-market exit, not a signal about Saputo’s core North American business. The company is investing in U.S. capacity and showing improving domestic margins. Your situation is structurally different. But the underlying lesson is universal — if your supply agreement doesn’t survive a processor sale, you’re carrying the same risk these Argentine families just discovered. You just haven’t been tested yet.

If you sell to any dominant processor, anywhere: Here’s the math that matters. If one company handles more than 60% of your milk and your agreement has no ownership-change clause, you’re structurally identical to those 600 Argentine families. Geography doesn’t change that equation. What changes it is your contract.

The trend behind this deal — processor consolidation reshaping producer relationships globally — isn’t slowing down. In the past three years, Fonterra sold Soprole to Gloria, Nestlé sold Ecuador operations to Gloria, Savencia acquired Williner in Argentina, and Lactalis bought Dairy Partners Americas. Every transaction meant producers discovering, after the fact, that their buyer had changed.

Four Moves Before Closing Day

1. Pull your supply agreement and read it this week. Look for three things: the termination notice period, the ownership-change transfer provision, and the payment guarantee. If any are missing, that’s your negotiating priority before the new owner takes over. Not after.

2. Engage through your cooperative — and accept the trade-off. UNCOGA, Productores Unidos de Rafaela, and the San Guillermo cooperatives are the existing vehicles for collective action. A unified set of questions to Gloria about contracts, payment terms, and collection schedules carries more weight than 600 separate phone calls. Yes, coordinated engagement could be perceived as adversarial before the relationship starts. Move forward anyway. Silence is worse than friction.

3. Explore a second buyer relationship. Around Córdoba and Santa Fe, small and medium cheese makers (PyMEs queseras) have historically offered competitive raw-milk prices. Diversifying even a portion of production reduces concentration risk. The trade-off is real: approaching alternative buyers pre-closing could signal distrust to Gloria, and logistics with smaller processors are more complex. But having options is always the right strategy. And here’s your trigger — if Gloria hasn’t communicated directly with producers within 60 days of closing, that’s your signal to formalize a secondary buyer relationship. Not explore one. Formalize it.

4. Watch Gloria’s first 90 days after closing. Do they communicate directly with producers? Honor existing terms? Provide timeline certainty? Those are positive signals. Prolonged silence — producers still waiting for a phone call weeks after operational control transfers — tells a different story. What Gloria actually does will matter more than anything in a press release.

Three Signals Between Now and Mid-2026

Argentine regulatory review. This deal requires approval from Argentine authorities. At 11.6% of the national industrial milk volume, the competition authority (CNDC) could attach conditions. Any requirements imposed on Gloria regarding producer terms or pricing would be of enormous importance.

Gloria’s outreach to producers. The single most revealing signal. The company knows 600-plus families are waiting. Whether Gloria reaches out proactively or waits for producers to come to them will tell you which version of Gloria is showing up in Argentina.

Payment performance. SIGLEA reported Argentine farm-gate milk prices at AR$476.60 per liter in December 2025 — up only about 8% year-over-year in nominal terms, while production costs have continued climbing, according to OCLA. Gloria’s ability and willingness to maintain competitive pricing after closing will be the metric that matters most to every producer in the collection zone. Everything else is words on paper.

The broader context here — what processor consolidation means for producer survival — was one of the defining themes of 2025 dairy coverage.

Your Processor Risk Checklist

- Audit your contract this week. No ownership-change clause, no defined termination notice, no payment guarantee means you’re carrying processor risk whether you’re in Córdoba or Ontario, or Wisconsin.

- Know your single-buyer number. Over 60% of your milk to one processor without contractual protections? You’re in the same structural position as those Argentine families. The difference is timing — you can fix it before the press release drops.

- Research your processor’s parent company. Financial pressure at the holding level — like debt-service costs tripling in a year — eventually filters down to producer terms. This applies to your processor too.

- Don’t wait for the phone call. If you’re in Saputo’s Argentine collection zone: contact UNCOGA, your regional cooperative, or APLA (headquartered in Suardi, Santa Fe) this week. Ask collectively about contract continuity, payment schedules, and collection logistics. A coordinated ask is harder to ignore.

- For North American Saputo suppliers wondering if you’re next: The evidence points to an emerging-market exit driven by Argentine macro conditions, not a systemic pullback. Saputo’s domestic numbers are moving in the right direction. But read your contract. Know what survives a sale.

- If you know Argentine producers, share this. If you’ve toured dairy operations in Santa Fe or met producers from the Rafaela corridor at genetics events, connect them with this information. The more that circulates, the better everyone’s decisions get.

The Bottom Line

Guruceaga calls his part of Santa Fe “una zona tambera.” A dairy zone. It sounds simple until you sit with what it means: the cows and the community are the same thing. When the processor changes, the community changes with it.

The hardest part of what happened today isn’t the deal. It’s the sequence. A press release in Montreal. A wire story picked up in Lima. A notification on a phone in a milking parlor somewhere between Rafaela and Tío Pujio. And then the question that 600-plus families are asking right now — the same question every producer who depends on a single buyer should be asking before their turn comes:

Does my contract survive this?

If you don’t know the answer, you already know what to do this week.

Key Takeaways

- Saputo is selling 80% of its Argentine dairy division to Gloria Foods for a C$855 million (≈US$630 million) enterprise value, keeping a 20% minority stake.

- That puts Argentina’s largest processor — 11.6% of industrial milk and collections from 600‑plus farms — in the hands of a buyer that’s been sued for abuse of dominance in Chile, fined in Colombia over adulterated “whole” milk, and accused of monopolistic behavior in Peru.

- Farmers supplying Saputo’s Rafaela and Tío Pujio plants learned of the sale from the media, not from their processor, and, as of today, have no firm answer on whether Gloria will honor their current contracts, prices, or pickup schedules.

- With SanCor in creditor protection and co‑ops’ share of Argentina’s milk shrinking from roughly 34% to about 3%, most producers are now highly dependent on a single buyer when decisions like this drop.

- If more than 60% of your milk goes to one processor and your contract is silent on ownership changes, you’re carrying the same processor‑risk those 600 Argentine families just discovered — and you should be auditing that agreement this week, before your own “press‑release moment” arrives.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The $0.90/Cwt FMMO Hit: Reset Your Breakeven, DMC Coverage, and Heifer Strategy for 2026 – Arms you with a step-by-step math reset to dodge the $0.90/cwt margin hit from 2025 FMMO changes. This guide delivers immediate tactics to rebuild your breakeven before these structural price shifts quietly drain your farm’s equity.

- More Milk, Fewer Farms, $250K at Risk: The 2026 Numbers Every Dairy Needs to Run – Exposes the $250,000 annual margin gap facing mid-sized dairies and reveals how to position your operation for 2026’s “more milk, fewer farms” reality. This strategic analysis identifies the specific leverage points needed to survive increasing processor consolidation.

- From Udder to Pizza: Blockchain’s Dairy Revolution Hits the Table – Are You Ready to Ride the Wave? – Unlocks 15% export premiums by transforming your milk from a raw commodity into a traceable, high-value asset. This report reveals how blockchain technology builds the “audit-proof” proof of welfare that global buyers now use to select their preferred suppliers.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!