China’s 42.7% EU dairy tariff? Don’t celebrate yet. NZ ships duty-free with 51% market share—and China built their herd with genetics we sold them.

Executive Summary: China’s 21.9%–42.7% tariffs on EU dairy, announced December 22, 2025, are being called an opportunity for American exporters—but the market math doesn’t add up. New Zealand ships to China duty-free and holds 51% of the import market share. The U.S. exports primarily whey (95%), not the specialty cheeses being tariffed, limiting substitution potential. Most significant: China expanded domestic production to 43 million tonnes using genetics purchased from Western suppliers, including the U.S. For producers, this isn’t a moment to expect export rallies—it’s a signal to assess your processor’s export exposure, stress-test finances assuming flat Class III prices, and focus on what you control: components, efficiency, and diversification strategies like beef-on-dairy.

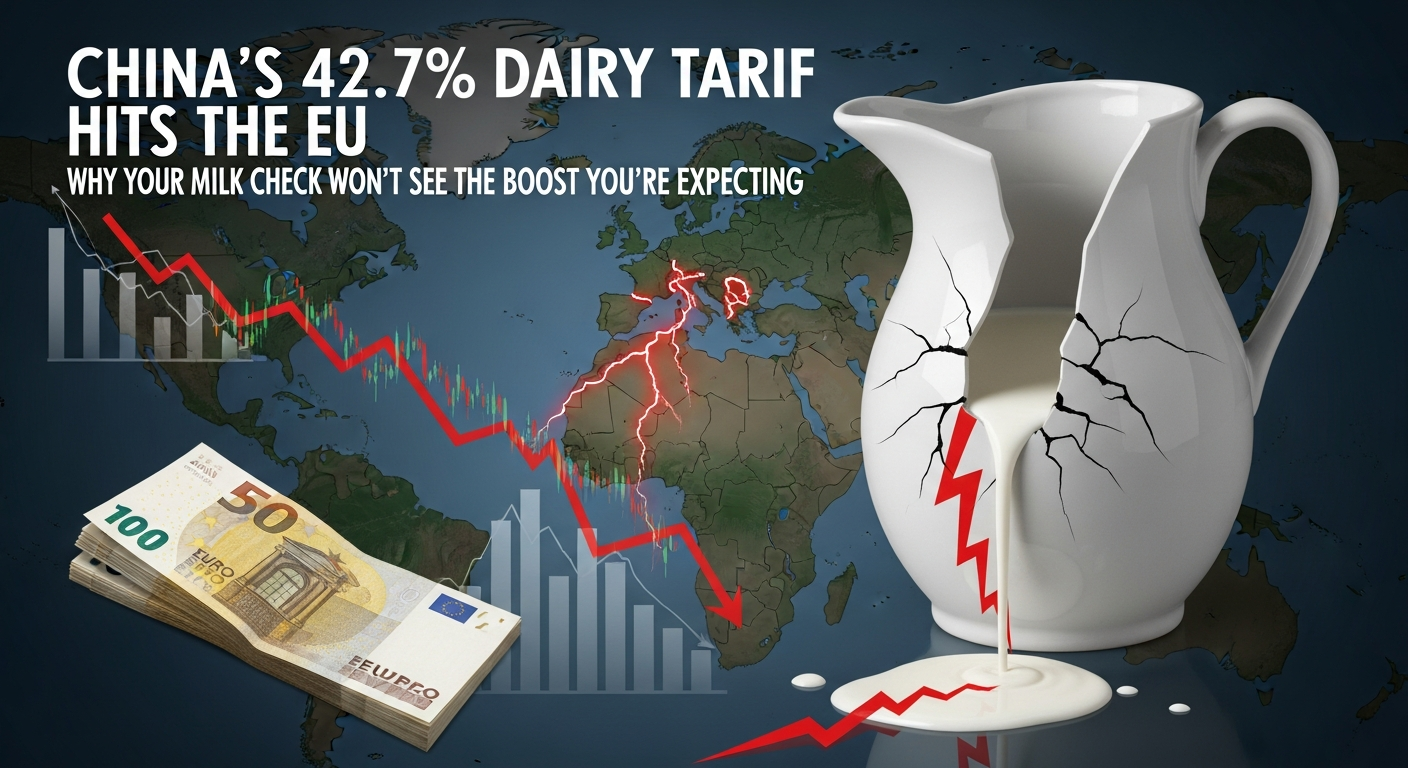

You know, I’ve been watching trade disputes affect dairy farmers for two decades now, and what happened today feels different. When China announced provisional tariffs of up to 42.7% on European Union dairy imports—a decision Reuters confirmed this morning—the industry press releases started flying within hours. “Opportunity for U.S. producers.” “Market share available.” “Ready to step into the gap.”

Those statements reflect genuine optimism. But there’s more context here that deserves attention. Context that can help you make better decisions about your operation, regardless of how this dispute plays out.

Grab a coffee—this one’s got some layers to it.

How Electric Vehicles Became a Dairy Problem

Back in August 2024—August 21st specifically, according to China’s Ministry of Commerce—Beijing announced it would investigate European dairy imports for alleged subsidies. The timing wasn’t coincidental. When the EU finalized tariffs of up to 45.3% on Chinese EVs that October, China had already begun its response.

Rather than targeting European cars directly, Beijing identified politically sensitive export categories: brandy, pork, and dairy. Smart strategy, honestly.

“It is highly frustrating that again, dairy seems to be used as a political pawn in a wider trade dispute between the EU and China regarding electric vehicles,” Conor Mulvihill, director of Dairy Industry Ireland, told reporters. Irish dairy exports to China topped €385 million in 2024, according to Bord Bia figures, and that revenue is now at risk.

The tariff structure ranges from 21.9% for cooperative companies up to the full 42.7% for non-cooperative ones, according to China’s Ministry of Commerce.

Assessing the Opportunity—Multiple Perspectives

Here’s where we need to think carefully. A Midwest processor I spoke with last week was measured:

“There might be some incremental business here, but anyone expecting a flood of new orders is probably going to be disappointed.” — Midwest dairy processor

The International Dairy Foods Association has offered a more optimistic view, noting U.S. exporters are ready to step into opportunities created by trade actions affecting competitors.

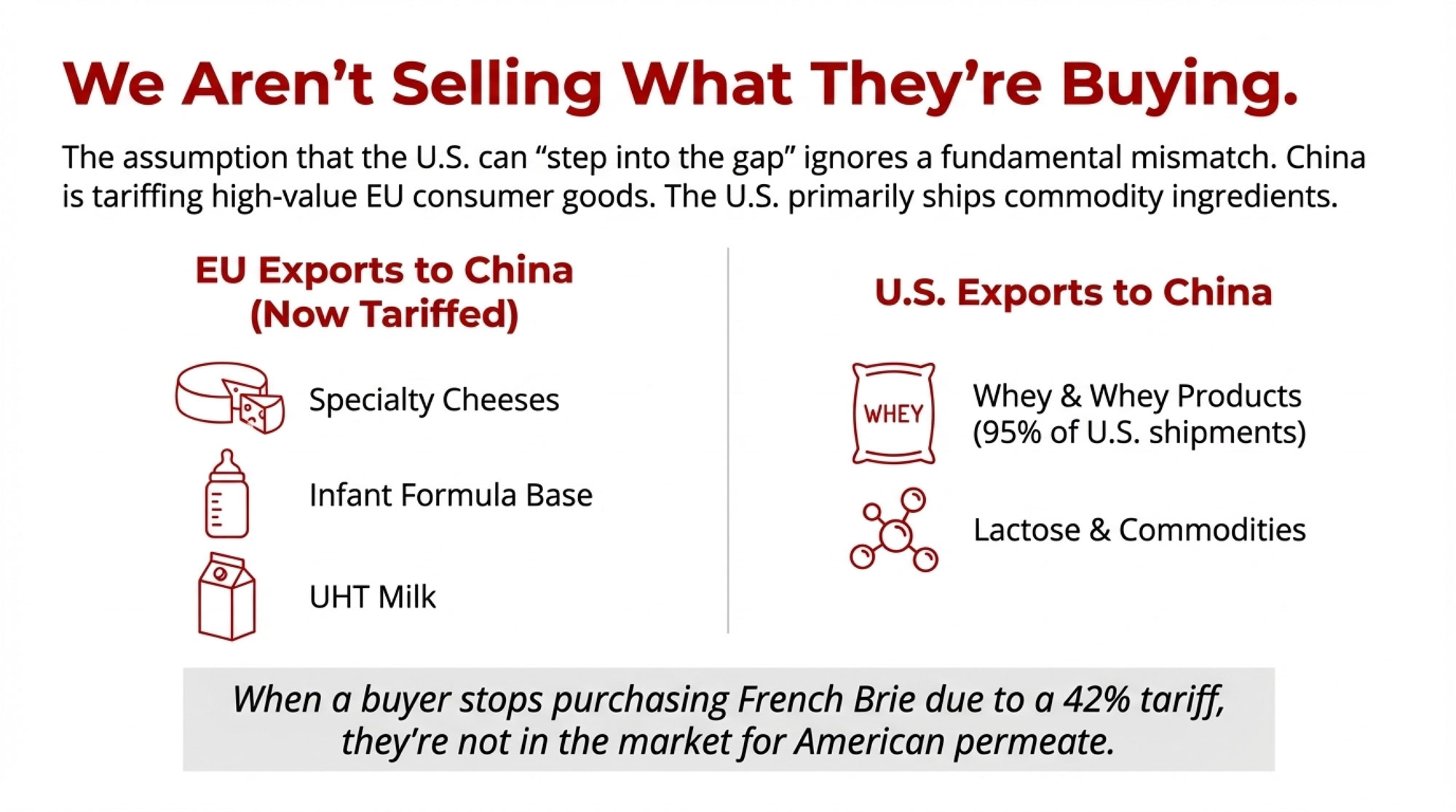

But here’s what many producers don’t appreciate: the U.S. and EU don’t sell the same products to China.

According to the UK’s Agriculture and Horticulture Development Board, around 95% of U.S. dairy exports to China consist of whey and whey products—commodity ingredients for food processing and animal feed. The EU sends specialty cheeses, infant formula base, and UHT milk. Premium consumer products.

So when a Chinese buyer stops purchasing French Brie because of a 42% tariff, they’re not necessarily in the market for American permeate. Different products, different purposes.

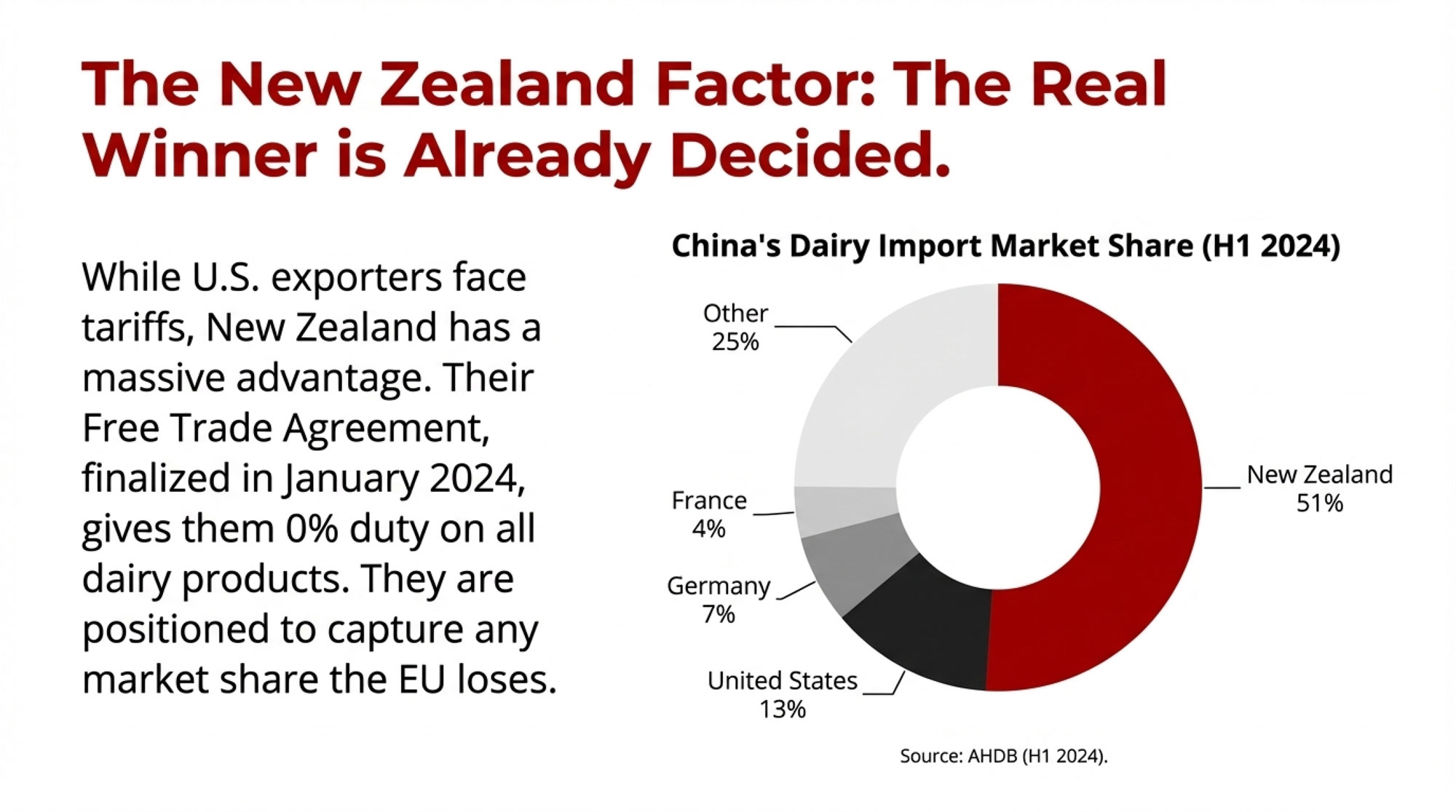

The New Zealand Factor

The AHDB reported that New Zealand controlled approximately 51% of China’s dairy import market in H1 2024—up from 42% in 2023. And thanks to their Free Trade Agreement, Kiwi dairy now enters China completely duty-free as of January 2024.

New Zealand’s Trade Minister Todd McClay confirmed it directly: all safeguard duties on milk powder have been eliminated.

China Market Access at a Glance

| Exporter | Tariff Status (Dec. 2025) | Market Position | Key Products |

| European Union | 21.9%–42.7% provisional duties | Germany 7%, France 4% of imports | Specialty cheese, infant formula |

| United States | Existing MFN + retaliatory tariffs | ~13% share; second-largest supplier | Whey (95%), lactose, commodities |

| New Zealand | 0% (duty-free) | ~51% share; largest supplier | Whole milk powder, butter, cheese |

Sources: China Ministry of Commerce; AHDB (H1 2024); Dairy Global

When European cheese gets more expensive, who captures that demand? New Zealand—and they’ve been working this market for decades.

Understanding China’s Domestic Situation

China’s tariffs serve multiple purposes. Yes, retaliation. But also breathing room for a domestic industry facing challenges.

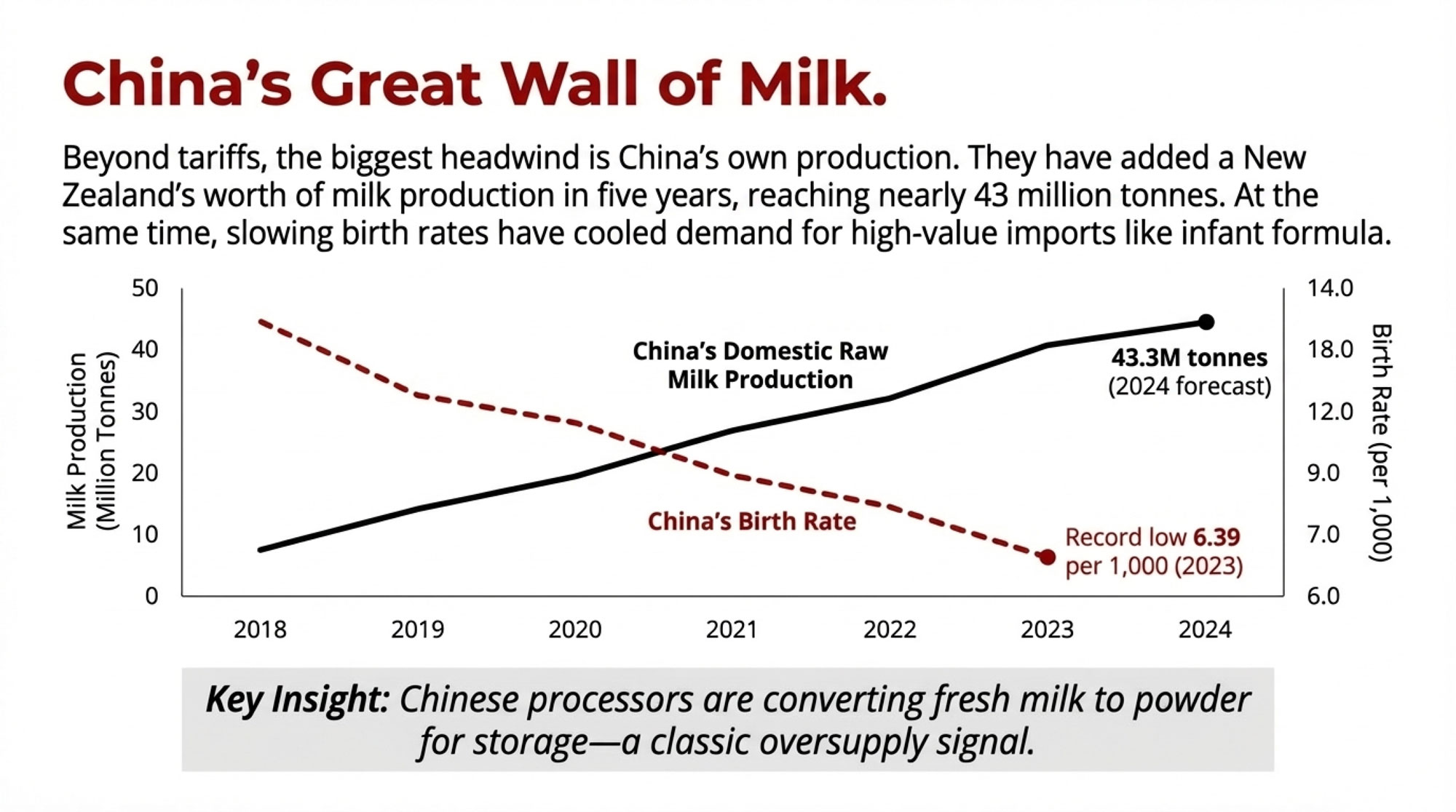

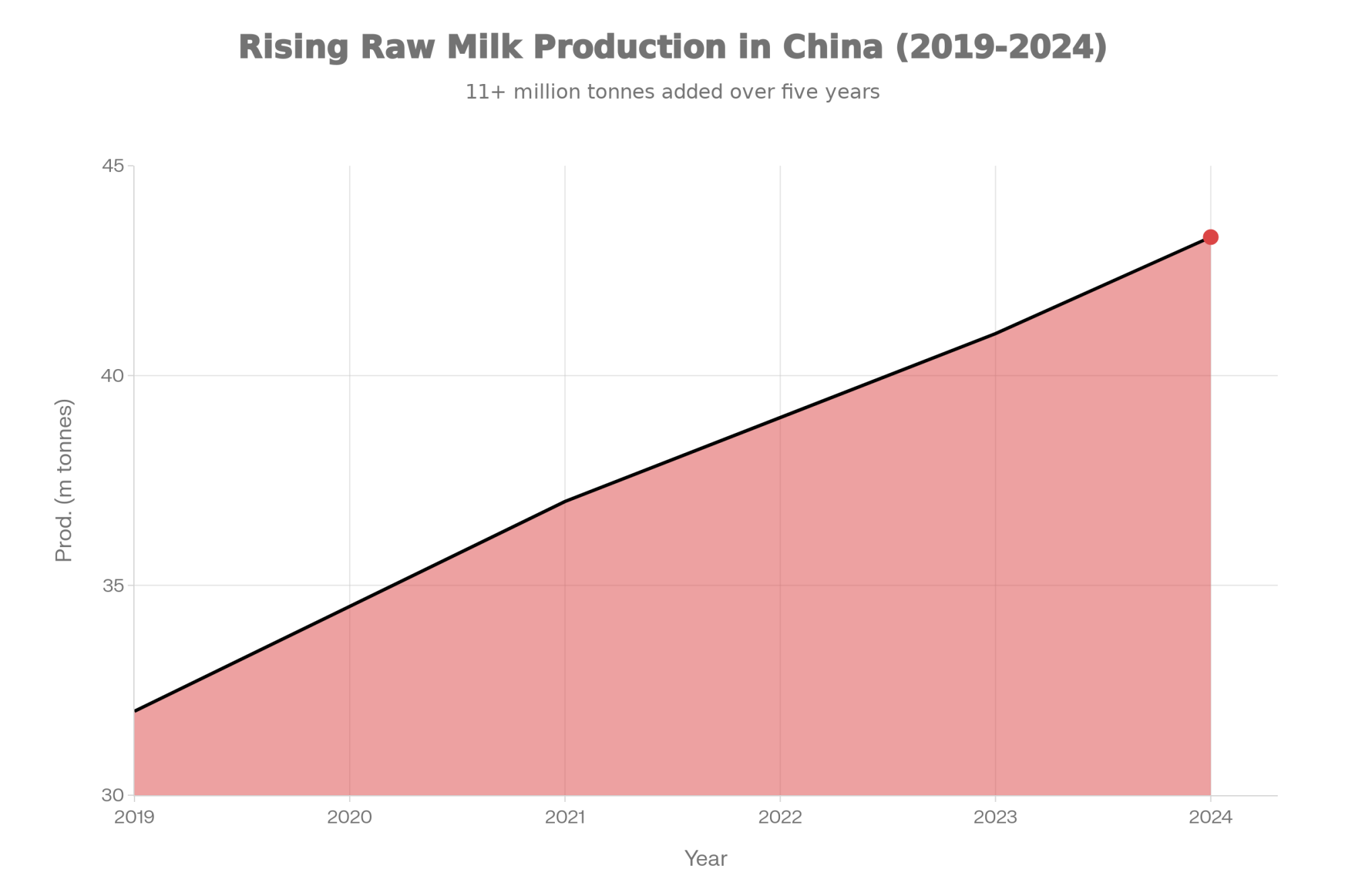

According to the USDA’s November 2024 report, Chinese raw milk production reached approximately 41-42 million tonnes. Rabobank forecasts 43.3 million tonnes for 2024. China has essentially added a New Zealand’s worth of production inside their own borders over five years.

Meanwhile, demand has slowed. China’s birth rate dropped to a record low of 6.39 per 1,000 in 2023, continuing a multi-decade decline. Fewer babies means less infant formula demand—one of the highest-value import categories.

Chinese processors are converting fresh milk to powder for storage. If you’ve been in dairy long enough, you recognize that as a classic oversupply signal.

The Genetic Paradox: Did We Export Our Own Market?

For Bullvine readers who understand breeding, this is worth sitting with.

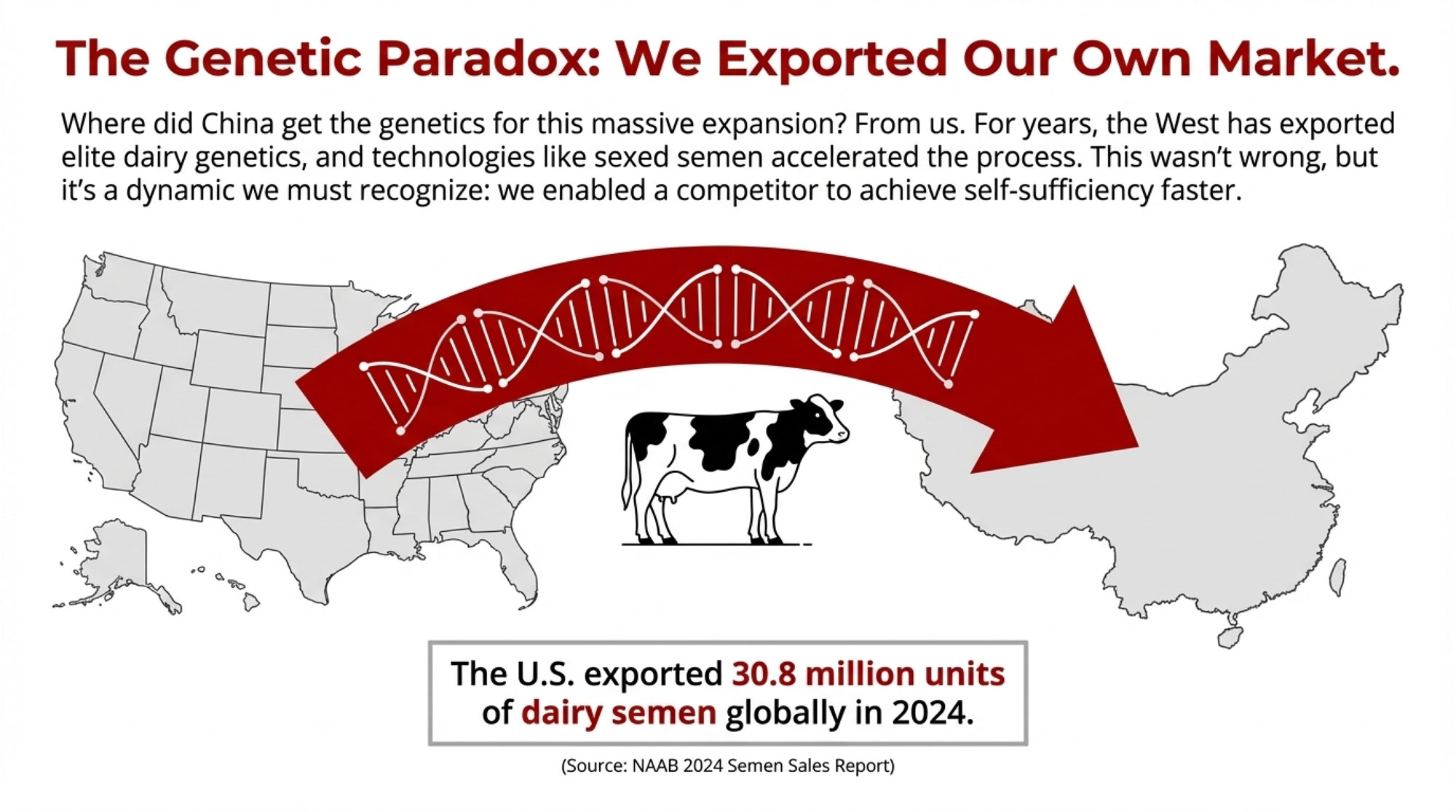

Where did China get the cows for this expansion? From us.

According to the NAAB 2024 Semen Sales Report, the U.S. exported 30.8 million units of dairy semen globally—up 1.6 million from 2023. China has historically been a top destination. Sexed semen technology accelerated the process considerably, allowing Chinese operations to rapidly multiply their female inventory using genetics that took Western breeders generations to develop.

This was normal commercial activity—nobody did anything wrong. But the dynamic is worth recognizing. The better our genetics got, the faster we enabled competitors to catch up.

The Southeast Asia Pivot

With China’s import appetite moderating, U.S. trade organizations are developing alternative markets. IDFA’s Michael Dykes notes these efforts promise improved access in growing Southeast Asian markets.

Current trade values show the scale challenge: Malaysia ~$118 million, Vietnam ~$127 million, Thailand ~$87 million in U.S. dairy sales according to USDA data. Growing markets, but building presence takes years.

“We’re excited about Southeast Asia, but we’re also realistic. Each country has different food safety standards, different labeling requirements. This isn’t switching customers—it’s building relationships from scratch.” — Wisconsin cheese exporter

New Zealand has been working these markets for decades with established relationships and geographic proximity. The Southeast Asia pivot is a real strategy—it’s also a multi-year project.

Processing Capacity: The Math That Hits Your Milk Check

Here’s where this gets personal for producers, even those who never think about exports.

According to IDFA’s October 2025 report, U.S. processors are investing more than $11 billion in new capacity across 19 states, with projects coming online between 2025 and early 2028. This investment assumed continued production growth and export demand.

Modern cheese plants generally need 85-95% utilization to hit economic targets. When volume drops, fixed costs per pound climb fast.

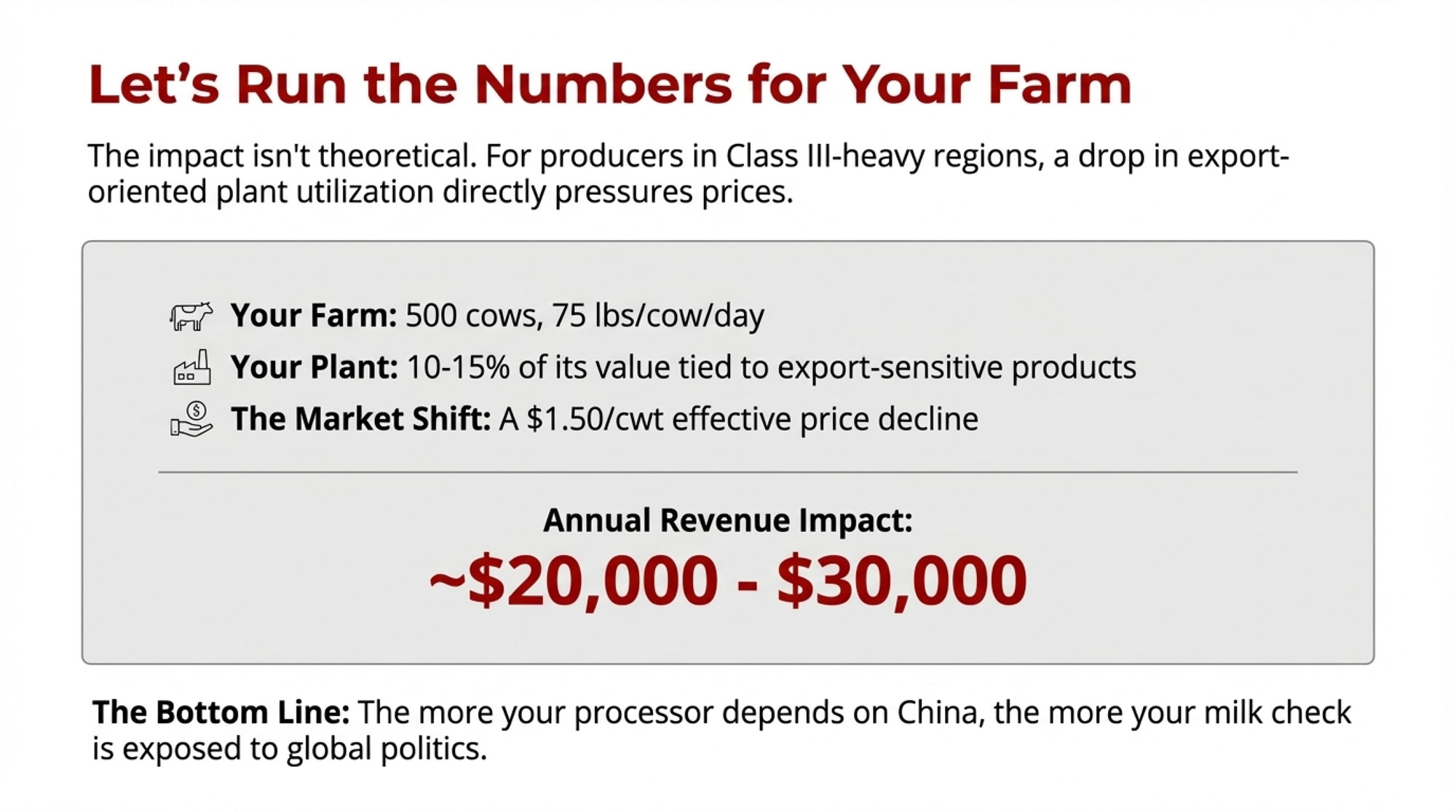

Let’s run some numbers. For a 500-cow dairy averaging 75 lbs/cow/day, you’re shipping roughly 13.7 million pounds annually. Now, not all of that is equally exposed to export market volatility—it depends on your plant’s product mix. But if 10-15% of your production value ties to export-sensitive products like whey going to China, a $1.50/cwt effective price decline on your total check translates to roughly $20,000-30,000 in annual revenue impact. For operations more heavily exposed, multiply accordingly.

| Herd Size | Annual Production (cwt) | Revenue Loss @ $1.50/cwt | Revenue Loss @ $2.50/cwt |

|---|---|---|---|

| 250 cows | 68,438 | $102,657 | $171,095 |

| 500 cows | 136,875 | $205,313 | $342,188 |

| 750 cows | 205,313 | $307,969 | $513,282 |

| 1,000 cows | 273,750 | $410,625 | $684,375 |

Here’s a specific scenario: If you’re an Upper Midwest producer shipping to a plant that sends 40% of its whey to China, and Chinese buyers shift to duty-free New Zealand sources, your plant’s utilization could drop. Even if your milk still gets processed, reduced efficiency often shows up in basis adjustments, component premiums, or year-end patronage dividends.

For producers in Class III-heavy federal order regions—such as Wisconsin, Minnesota, and the Upper Midwest—these dynamics matter more. When export-oriented cheese plants face utilization challenges, it pressures Class III specifically.

5 Signs Your Co-op May Be Too Export-Dependent

- More than 30% of plant output goes to export markets (especially single-country concentration)

- Whey or lactose represents a significant revenue stream with heavy China exposure

- No active diversification into Southeast Asian or Mexican markets is underway

- Recent capital investments were justified primarily by “growing Asian demand.”

- Member communications emphasize export opportunities without discussing contingencies

If three or more apply, it’s time to ask harder questions at your next member meeting.

| Warning Sign | Risk Threshold | Question to Ask Your Co-op |

|---|---|---|

| Export concentration | >30% of output to export markets | “What percentage of our plant’s production goes to export, and to which countries specifically?” |

| China-specific exposure | >20% of whey/lactose revenue from China | “How much of our whey revenue depends on Chinese buyers, and what’s our backup plan?” |

| Market diversification | <3 active export regions | “Are we building relationships in Southeast Asia and Mexico, or concentrated in East Asia?” |

| Capital investment rationale | “Asian growth” as primary justification | “Were recent expansions underwritten by export growth assumptions? What if those don’t materialize?” |

| Communication transparency | Export opportunities mentioned without contingencies | “What’s our plan if China’s self-sufficiency push continues reducing import demand over the next 3-5 years?” |

Practical Considerations for Your Operation

3 Questions to Ask Your Co-op Today

- Exposure: “What percentage of our plant’s output is tied to Chinese markets or other export-dependent products?”

- Diversification: “Do we have active sales relationships in Malaysia, Vietnam, or Mexico—or are we concentrated in East Asia?”

- Contingency: “What’s our plan if China’s self-sufficiency push continues reducing import demand?”

The breakeven question: At what export exposure does this tariff situation materially affect your milk check? Based on typical plant economics, producers shipping to facilities with export concentrations of 25-30% or more—particularly to China—face meaningful price risk if trade dynamics shift.

Component focus: Markets increasingly reward milk components over fluid volume. Breeding and feeding strategies that emphasize component density—managing your TMR for butterfat performance, making genetic selections that improve protein yields—can improve returns even when prices are flat.

Diversification strategies: The beef-on-dairy trend represents a rational response to moderating replacement heifer needs and provides revenue diversification independent of dairy market conditions.

Financial positioning: Planning for flat-to-modest milk prices provides a more stable foundation than relying on export-driven rallies. Programs like Dairy Revenue Protection exist precisely for this uncertainty.

The Labeling Dimension

China is establishing cheese naming standards, potentially aligning with European Geographical Indication protections. The EU is pursuing similar provisions throughout Southeast Asia.

The implication: American cheeses using names like Parmesan or Feta could face market access challenges regardless of tariffs. The long-term response involves building identity around distinctly American varieties—Wisconsin Original, California Dry Jack, and Vermont Creamery styles.

Your Next Moves

Final determinations are expected by February 2026. CNBC noted Beijing significantly reduced preliminary pork tariffs in final rulings, so flexibility remains possible. But regardless of how this dispute resolves, the underlying dynamics aren’t changing.

Here’s what to do now:

- Assess your exposure. Ask your co-op directly what percentage of plant output goes to export markets—especially China. If it’s above 25-30%, you have meaningful trade risk.

- Run your own numbers. Calculate what a $1.50-2.50/cwt Class III decline would mean for your operation annually. Know your vulnerability before it materializes.

- Evaluate your processor’s diversification. Are they actively building relationships in Southeast Asia and Mexico, or are they concentrated in markets facing structural headwinds?

- Double down on components. Regardless of trade outcomes, butterfat and protein premiums reward operational excellence. That’s within your control.

- Stress-test your finances. Model flat prices for 18-24 months. If that scenario creates problems, address leverage and cash reserves now while milk checks are decent.

The producers I see positioning themselves well are treating export markets as valuable but variable—additional revenue opportunity rather than baseline assumptions. They’re asking good questions and planning for multiple scenarios.

That’s the kind of thinking that builds durable farm businesses.

Key Takeaways:

- New Zealand wins this one: Duty-free access plus 51% market share means Kiwi dairy—not American—captures displaced EU demand

- Product mismatch limits upside: We export whey to China (95% of shipments); they’re tariffing specialty cheeses we don’t sell

- The genetics paradox: China reached 43M tonnes domestic production using genetics we sold them—we enabled our own competition

- Know your exposure number: If your co-op sends 25%+ of output to export markets, trade volatility hits your milk check directly

- Control beats hope: Component premiums, operational efficiency, and beef-on-dairy diversification outperform waiting for export rallies

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- China Promised 100%. Delivered 2.7%. Here’s Your 48-Hour Defense Plan. – Gain a 3-step tactical framework for vetting trade headlines and insulating your cash flow. This defense plan reveals how to model for zero-revenue scenarios and verify your margin protection before trade volatility erases your bottom line.

- 2025’s $21 Milk Reality: The 18-Month Window to Transform Your Dairy Before Consolidation Decides for You – Expose the structural shifts reshaping the global landscape before consolidation chooses your path for you. This strategic roadmap delivers a blueprint for restructuring your business model, ensuring your operation remains a leader in the high-stakes 2030 market.

- Biology Repriced Dairy: $4,000 Heifers Created a 90-Day Window When You Have Leverage, Not Processors– Weaponize your replacement inventory by understanding the rare leverage created by the current heifer shortage. This analysis breaks down how biological constraints have temporarily shifted power back to producers, arming you with the math to negotiate better terms.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.