$30M in premiums, parachute semen, Trans Ova, and your next milk contract: this is who really keeps your dairy barn lights on—and who quietly turns them off.

Here’s what’s really going on behind the milk cheque you get every month: you’re either a price taker on your own, or you’re part of a community that can actually move the number.

In 1973, New England dairy farmers negotiated about $30 million in premiums in less than two years—and we’re still living with the lessons from that fight. This isn’t just about co‑op politics—it’s about which barns still have their lights on ten years from now.

With replacement heifers selling in the $3,500–$4,000 range in several U.S. and Canadian markets through 2024–2025 (according to university extension market summaries and major regional auctions) and top beef‑cross calves occasionally approaching four figures in hot beef markets, the margin for error keeps shrinking. According to 2024 USDA dairy cooperative statistics, co‑ops still market approximately 80% of U.S. milk, which means your bargaining power lives or dies with how those co‑ops behave—and whether you show up to shape them.

From a vo‑ag classroom in Connecticut to parachute semen drops in Indiana and ET labs in Iowa, here’s what three very different dairy stories can teach you about milk contracts, genetics, and who you want beside you when the road gets rough.

The Kid in the Vo‑Ag Room Who Refused to Stay a Price Taker

Picture an old vocational agriculture classroom in Connecticut, decades before anyone talked about genomics or robots.

A farm kid who’s already milked and scraped before daylight walks in and sits down at a desk that’s seen better years. His vo‑ag teacher pulls out an economics book and, instead of another day on rations or crop rotations, tells him, “Make sure you read all you can about economics, because there’s only one thing certain in the world, and that’s change.”

The kid was Louis Longo. He’d go on to milk cows, build a 350‑head herd, help organize milk cooperatives across New England, negotiate roughly $30 million in premiums in less than two years, and spend a lot of years trying to make sure younger producers didn’t have to learn the same lessons the hard way.

Louis wasn’t some ag‑policy nerd in a blazer. He was a tired kid milking about 20 cows by hand before and after school on his father’s small farm, then cleaning the stable with a wheelbarrow and shovel. That was “vacuum and gutter‑chain” money they didn’t have yet. It was just sweat and stubbornness.

By 19, he was married and building his first house. By 22, he’d started in the dairy business for himself with roughly those same 20 cows, still milking by hand, still scraping by.

In that vo‑ag room after chores, his instructor closed the door and started talking about more than breeding seasons and soil tests. They talked about who set milk prices. Why farmers always seemed to be on the wrong side of the desk. Why it felt like every bill went up while the milk cheque never quite caught up.

“I noticed that farmers were very disorganized,” Louis said in his 2005 National Dairy Shrine Pioneer interview. “They had no bargaining power. They were price takers rather than price makers.”

If you’ve ever opened a milk statement you didn’t write, full of basis changes and differentials you never agreed to, you know exactly what that feels like. That’s being a price taker.

The only difference for Louis was that someone put the right words and the right questions in his head early—and kept pushing him to learn the math behind the cheque.

That’s the first lesson in this whole piece: the people who quietly shove a book across the table and say “you’re going to need this” can change the next 40 years of milk pricing in their region, without ever standing in front of a microphone.

The Family Behind the Person in the Spotlight

By the time Louis had a few years under his belt, that little 20‑cow operation had turned into about 350 head.

That’s a completely different scale of responsibility—more cows, more staff, more eyes on you when decisions go sideways.

And he wasn’t just milking.

“I was lucky that I had the family that would run the farm,” he said. “My sons were home on the farm. I had a gravel operation—I had someone running that. I had a milk-hauling business, and I had a person run it. So I had good help.”

He and his first wife raised six kids. Later, he became stepfather to more.

He described how nine out of ten in that combined family ended up going to college: an attorney, a computer scientist, a psychologist in a Scottish hospital, two sons with dairy science and ag‑economics degrees, and stepchildren in environmental management and international business.

That didn’t just happen because the milk cheque was good. It happened because a family quietly carried a lot of the day‑to‑day, so he could spend nights in meetings and days on the road organizing farmers. It happened because there was enough shared belief that the bigger fight—the one about bargaining power and premiums—was worth missing suppers and sleep for.

Why This Matters at Home

You see this over and over in dairy.

Every time someone becomes “the co‑op person” or “the genetics person” or “the industry guy” who gets quoted, a spouse is doing extra chores, kids jumping in early on the parlor or calf barn, employees and international workers covering more hours, and maybe a banker who’s willing to be patient while time and energy go toward something that doesn’t pay off for a while.

If you’re that person, you know the guilt that comes with every meeting you don’t milk for. If you live with that person, you know the feeling of watching the pickup drive away again while you pull your boots on a little earlier.

That’s community too. It just happens first inside the same four walls.

When a Candy Company’s Farm Became a Test of Loyalty

Now let’s jump not to a barn but to a brand most Americans once knew from the candy aisle.

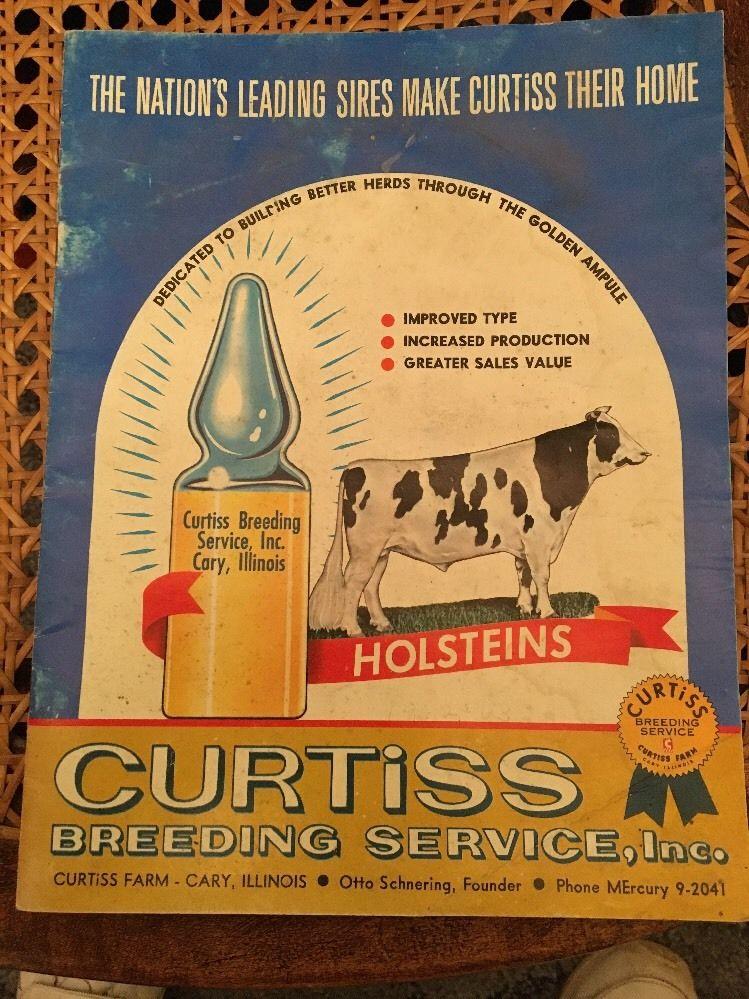

The Curtis Candy Company—think Baby Ruth and Butterfinger—didn’t just make sweets. They had a serious farm division in Cary, Illinois. They ran beef cattle and dairy herds, purebred sheep, hogs, potatoes for chips, and they showed at a very high level. In one year, Curtis cattle even managed to take grand champion in every dairy breed at a major show.

AI was still fairly new. Curtis Breeding Service was one of the early artificial insemination arms attached to that broader farm and company.

Then, founder A. S. “Otto” Schnering died, and the candy side of the company was eventually sold to Standard Brands. Curtis Breeding went with it. That’s the kind of corporate shift that usually ends with local history boxed up and sold off.

Except for one clause.

When the candy company was sold, Otto’s wife, Dorothy, insisted on an option to buy the AI center back within six months. She took it.

“When she sold the candy company and the AI center was a part of the candy company, she maintained an option to buy it back within six months,” remembered longtime Curtis man Bob Boese in his 1988 National Dairy Shrine interview. “When the six months expired, she did buy back the business, became president of the AI corporation, and it was an independent company under her leadership.”

At a time when women in agribusiness leadership were basically invisible in the headlines, Dorothy stepped in as president of an AI company because she believed in the work, the people, and the community around it. The lab staff, techs, office team, and farm clients kept showing up because she did.

Years later, the National Dairy Shrine would hang Dorothy and Otto’s Pioneer portraits side by side, recognizing how closely their work and impact were intertwined. People who worked with them understood the message: this story and this impact belonged to both of them and to the whole team that kept the doors open.

That stubbornly independent decision to hold on to a small AI business, rather than let it disappear inside a candy merger, is the same kind of entrepreneurial risk you see later when people like Dr. David Faber bet on ET and IVF in Sioux Center.

If you run a genetics program today—whether you’re flushing, doing IVF, or just making careful A.I. and beef‑on‑dairydecisions—there’s a straight line from that moment to your semen tank. And behind that line is a woman who decided a small AI outfit in Illinois wasn’t going to disappear into a corporate spreadsheet.

From Sioux Center to the World: The Genetic ROI That Started Local

Fast‑forward to Sioux Center, Iowa, in 1980.

Interest rates were high. A lot of farms were hanging on by their fingernails. Advanced reproduction was still a weird idea in most dairy barns—something you heard about at a meeting, not something you actually did.

In that environment, veterinarian Dr. David Faber and a small group of partners launched Trans Ova Genetics. They didn’t start out as the global ET/IVF powerhouse you know from catalogues today. They started with hands‑on embryo transfer, helping local and regional breeders multiply the impact of their top cows rather than spreading their genetic chips thin.

Over the next four decades, Trans Ova grew from that one Iowa base into a multi‑location company offering ET, in vitro fertilization, sexed semen implementation, genetic preservation, beef‑on‑dairy support, and even cloning. They’ve worked with everything from elite show cows and high‑ranking genomic heifers to commercial beef‑on‑dairy programs trying to squeeze more value out of every pregnancy.

For some breeders, ET and IVF turned a once‑in‑a‑lifetime cow into 15 or 20 daughters instead of two or three—if the market and the math justified it. For others today, a well‑run IVF program on a high‑genomic heifer can pay back several times the upfront cost when the embryos or resulting calves are marketed well, but the actual return depends heavily on the genetics, demand, and execution on your farm.

If you’ve ever put embryos in recipients, shipped pregnancies, or watched a flush from the parlor office cameras on your phone, you’re living with the ripple effects of that decision to start small in Sioux Center and scale carefully from there.

What’s interesting here isn’t just the tech. It’s the community logic behind it.

Trans Ova didn’t grow because they had a clever logo. They grew because:

- Producers trusted them with their best cows’ genetics.

- Staff stuck around through the years when protocols didn’t always work, and results were inconsistent.

- Local communities tolerated—and eventually embraced—the weirdness of tanks, labs, and trucks coming and going at all hours.

That’s the same pattern you see on successful farms that lean hard into genomic testing, ET/IVF, and beef‑on‑dairy today. If your community and team aren’t behind you, your genetic ROI is just numbers in a spreadsheet. If they are, those numbers turn into sale‑topping calves, stronger herds, better marketing leverage, and real dollars.

Parachutes, Pigeons, and the Cost of Not Shrugging

Now for the part everyone remembers.

“In the early days, liquid semen only had one day shelf life,” Bob Boese explained in that 1988 interview. Stored at about forty degrees Fahrenheit, that was it. “So we had to get the package to these folks all over the country by the next day.”

There was no UPS store on the corner. No Amazon hub building down the road.

Curtis used trains, buses, and trucks. Then they tried airplanes.

“One type of thing we did was have a small plane go over the Indiana distributors for a trial run and drop out the semen in parachutes,” Bob said. Technicians would lay out white sheets in their yards as targets. The pilot would circle, aim, and drop.

You can already see where this is going.

One day, the pilot spotted a white shape that looked like a sheet target and made the drop. It wasn’t a target. It was a clothesline full of fresh laundry.

If you’ve ever been the one whose clean barn clothes get nailed by a manure spreader, you can imagine the language. They were probably more frustrated than amused in the moment, but they adjusted the protocol and kept looking for better ways.

Then came the pigeons.

In the late 1940s, the Japanese government and a university wanted U.S. dairy genetics for herds on Hokkaido, the northern island. The challenge was getting semen from Tokyo to those northern herds before its one‑day shelf life expired.

Curtis collected from top bulls—Dandy, George, Masterpiece, names from another era—diluted the semen, packed it in ice in small thermoses, and shipped it by air to Tokyo. There, technicians attached the thermoses to homing pigeons, which then flew back to their base on Hokkaido. Once the birds returned, local staff removed the thermoses and inseminated cows. Conception rates were “fair,” as Bob put it—and honestly, fair was a minor miracle given the logistics.

Parachutes into backyards. Pigeons with thermoses. None of that is in the semen handling manual you give a new AI tech today.

But here’s the point: at no stage did that crew shrug and say, “Well, that’s just how it is. Guess we can’t get it done.” They kept trying, and they did it together.

We love to talk about innovation in terms of robots, rumen monitors, high‑oleic soybean diets, and IVF labs. The real pattern is this: a group of people in farms, labs, and offices refusing to accept “good enough” when they know something better is possible.

And that mindset is just as important to your bottom line as SCC, butterfat performance, and pregnancy rate.

When Dairy Cooperatives Chased Nickels and Lost the Dollar

Let’s go back to Louis and that economics book.

Those late‑night meetings grew into real, structured action. Local groups like the Connecticut Milk Producers Association, United Farmers of Rhode Island, and Modern Milk of Connecticut began working more closely together. They merged and organized into larger outfits, such as Consolidated Milk Producers, and coordinated with New England Milk Producers and United Farmers of New England.

It wasn’t smooth. It never is.

If you’ve ever sat through a co‑op or board meeting, you know exactly how quickly the room can split over hauling rates, blend prices, component pricing, or base allocation. Some nights, people drove home in silence and wondered if any of it was worth it.

Then 1973 hit, and the math finally landed on paper.

“In 1973, we negotiated premiums in the New England market that amounted to $30 million,” Louis said. “We did negotiate $30 million in 22 months for dairy farmers.”

Thirty million, spread across thousands of cheques, in less than two years. In 1973 New England dollars.

To put that in today’s mindset: even a 50‑cent/cwt premium over 22 months adds up fast. On a 100‑cow herd shipping around 90 pounds per cow per day, that’s in the neighbourhood of $8,000–$10,000 a year in extra revenue—enough to fix the roof instead of letting it leak, or buy the next round of heifers instead of putting it off again.

Across a region, that kind of premium level changes how lenders view dairy, how confident families feel about keeping kids in the business, and whether barns are reinvested in or quietly run down.

That win was only possible because producers used the legal breathing room created by the Capper‑Volstead Act. Passed in 1922, Capper‑Volstead gives agricultural producers a limited antitrust exemption to form cooperatives and jointly process, handle, and market their products, as long as those co‑ops are democratically controlled and run for the benefit of members. According to 2024 USDA data, dairy co‑ops still market approximately 80% of U.S. milk—which means those structures still sit right between you and the marketplace.

Without the Capper‑Volstead Act, many farmers who organized as Louis did would have been treated as illegal price‑fixers. With it, they were finally in a position to negotiate, not just beg.

But then comes the punch in the gut.

“You know the sad thing about it was that we lost the premiums,” Louis said. “Not because of handlers not willing to pay or consumers worrying about it. We lost it because farmers went out for nickels and gave up the idea of getting a dollar for 100. They were the ones that broke the premium.”

If you’ve watched a strong pool or co‑op slowly weaken while individual members chase slightly better private deals, you know exactly what he’s talking about.

The Nickels vs Dollars Trade‑Off

Here’s a simple way to frame the decision most of us are staring at in 2025–26. This is where a lot of herds get tripped up:

| Decision | Short‑Term Gain | Long‑Term Cost | Community Impact |

| Private contract | +$0.20–0.50/cwt for 12–24 months (in many current U.S. contracts) | Weakens regional bargaining; pool shrinks; harder to win premiums | Erodes the “safety net” for the next generation |

| Co‑op/pool loyalty | Slower, more stable gains | Requires political patience; premiums may come in waves | Preserves the region’s ability to demand premiums |

It’s never as simple as “greed.” When milk is ugly, heifers are expensive, interest rates are up, and you’ve got a broken gearbox in the mixer, that extra nickel or dime looks like the only lifeline you’ve got. Processor contracts, component premiums, and “special programs” can look like smart moves when you’re only thinking about your yard.

But let’s be honest: the math Louis learned in that vo‑ag room is still true. A bunch of farms jumping for nickels can cost everyone dollars over time.

Today, it shows up in different clothing:

- Private processor programs that offer short‑term premiums but weaken the pool.

- Contracts that look great on paper until basis shifts or depooling rules kick in.

- Deals that reward volume while punishing the neighbours who can’t or won’t scale.

In a lot of U.S. regions right now, it’s not unusual to see a 30–50 cent/cwt spread between a basic contract and a special program—at least for a year or two—if you qualify. That looks tempting in a bad month, but it changes the room when co‑ops try to negotiate the next decade.

On the Canadian side, you can see the same dynamic when short‑term quota trades and side‑deals start to chip away at local stability—specific impacts vary by province and processor, but the point is the same: short‑term moves can weaken long‑term stability.

On paper, each decision might be defensible. On the road, when enough people do it at once, your community loses the power to negotiate anything better the next time around.

I’m not saying “never chase a better contract.” I am saying this: if you’re betting your survival on solo deals while assuming the co‑op, pool, or quota system will always be there in the background, you’re kidding yourself.

Every time you look at a new milk contract or program, ask two questions: What does this do for my cash flow today? And what does it do to my community’s bargaining power tomorrow?

If the first answer is “helps a bit” and the second answer is “hurts a lot,” you’re living Louis’s story from the wrong side.

What Community Looks Like in a 2026 Barn

Community doesn’t just live in co‑op halls and board minutes.

These days, it also lives in the blue light off a phone screen at midnight in a tired kitchen.

Over the last few years, the same pattern has shown up again and again in women‑in‑ag and farmer support groups—a second‑generation daughter juggling frozen pipelines, kids in bed, and a stack of succession paperwork her dad never finished, typing some version of, “I don’t know if I can keep this farm going.” The names and details change, but the knot in the stomach is the same.

In many of those threads, people jump in from tractors, kitchen tables, and calf barns with replies that sound a lot like: “If you need help with chores, I can come for a morning,” or “Here are a couple of advisors who actually understand farm succession,” or “We lost Dad a few years ago too—if you need to talk, reach out.”

They’re not all on the same milk truck. They don’t all ship to the same processor or belong to the same co‑op. Some are on 60‑cow tie‑stalls. Some are on 1,700‑cow freestalls with robots and fresh‑cow pens dialed in like clockwork. Some have off‑farm jobs, and daycare runs on top of it.

But they’ve become, whether they meant to or not, a community that can make it a little easier for someone to take one more step, rather than quietly shut the doors.

No, an online group doesn’t replace a local neighbour with a tractor and a manure spreader. It doesn’t fix milk price or cure depression. It doesn’t sign your loan renewal for you.

But on a Tuesday night in February, when your barn feels like the last place on earth you want to be, knowing someone else gets it might be enough to get you out there for the next milking.

And for all of us who grew up in old‑school farm communities, the offline version is just as important:

- The neighbour who shows up with a skid steer and a pump when there’s water in your basement or smoke in your barn.

- The vet who is already behind but squeezes you in because they know you’re out of your depth with that fresh cow.

- The nutritionist who doesn’t just push more pricey products but helps you rework a ration around what you can actually afford.

- The group at coffee who notice you haven’t been in for a while and call to check in.

That’s all “soft” stuff until you realize how directly it ties into hard outcomes: how fast you bounce back from a barn fire, a disease outbreak, a contract change, a health crisis, a bad run of luck.

Herd strategy isn’t just your mating plan, your feed program, and your expansion dreams. It’s also your people plan. Who can you call when the road gets rough? Who can call you?

Quiet Heroes: The People Who Keep It All Stitched Together

Behind every Dairy Shrine awards program, every big show banner, every sale topper, and every “industry leader” profile, there’s a small army of people who never get mentioned in the first paragraph.

In Louis’s case, it was a vo‑ag teacher who stayed late and pushed economics books on a kid who smelled like the barn. It was a spouse who took on the home front so he could make meetings. It was the sons who came back to the farm, and the staff who kept the gravel and milk-hauling businesses running.

In Dorothy’s case, it was the lab staff who showed up day after day through ownership changes, the technicians who carried semen tanks down icy barn lanes when AI was still controversial, and the office staff who held it all together behind the scenes while she figured out how to be a president in a space that wasn’t built for her.

In the Trans Ova story, it’s the embryologists who spent long days and nights refining protocols, the vets and techs who left at 3 a.m. to make flush schedules work, and the farm clients who trusted them with their best genetics when ET was still considered a risky luxury.

In your own story, it’s probably:

- The employee who’s been with you longer than your last two parlors.

- The international worker who’s missed every Christmas at home for years but keeps the fresh cow pen running like clockwork.

- The 4‑H leader or Junior Holstein advisor who took your kid seriously when they were still showing a grade calf on the wrong halter.

- The banker or Farm Credit officer who was blunt but fair when things got tight.

- The spouse who has to be both co‑manager and sounding board when milk price and family stress collide.

A lot of those people will never sit in front of a microphone or see their name on a plaque. But if you pull them out of the story, the rest of it falls apart pretty fast.

That’s where this piece starts to shift from “nice stories” to strategy.

If you’re mapping out where your farm needs to be in five or ten years—what the herd looks like, what the labour plan is, how much automation makes sense, how much land you can afford to own or rent, whether you stay in the pool or chase private deals—you’re kidding yourself if you think you can do any of that without a strong community around you.

You need people who’ll tell you when an idea is stupid. You need people who’ll show up when you’ve bitten off too much. You need people who’ll drag you to a meeting when you’d rather stay home—and you need to be that person for someone else sometimes.

What This Means for Your Operation

I know what you’re thinking: “This all sounds nice, but I’ve got fresh cows, a lame heifer, a broken scraper, and a banker calling on Friday.”

Fair.

So let’s bring it down to ground level. Here’s what “community as strategy” can look like in the next seven days, without blowing up your schedule. You can literally print this next part and tape it to the fridge:

- Make one real check‑in.

Not a Facebook like. Not a quick “hey” across the sale barn. Pick one neighbour, one online friend, or one family member you haven’t heard from much and send a real message: “How are you holding up?” If you’re feeling brave, call. You’d be surprised how often the answer isn’t “fine.” - Take one younger person along.

If you’re going to a co‑op meeting, milk board session, breed association gathering, or a bull proof review night, invite a younger farmer, an employee, or your own kid to ride along. On the way there, explain what’s actually on the agenda in plain language. On the way back, ask what they heard. It’s the cheapest succession planning you’ll ever do. - Drag your own paperwork into the light.

If your succession plan is “I’ll get to it someday,” don’t wait until your kids are staring at a pile of half‑filled forms after a funeral. Call your accountant, lawyer, or lender and book a time. Even if all you do this week is email them, “We need to talk about a plan,” that’s movement. - Go to one meeting you’ve been avoiding.

Maybe you’re burned out on co‑op politics. Maybe you’re sick of listening to the same three people talk. Go anyway—once. Sit in the back if you want. But don’t let the future of your milk cheque be decided entirely by people you’re not in the room with. - Say “yes” once before you do the math.

When someone asks for help moving heifers, hauling a showstring, coaching a judging team, or talking to their teenager about whether there’s a path into the business, say yes at least once before you start counting how many hours it’ll cost you. Those yeses don’t show up on a balance sheet, but they do show up in who answers the phone when it’s your turn to ask. - Write down your “lights.”

It’s simple, but it works. On a scrap of paper at the kitchen table, list the people who showed up the last time things were rough—after a barn issue, a health scare, a price crash, a family blow‑up. Look at that list. Ask yourself two questions: “Do they know how much that meant?” and “Who doesn’t have a list like this right now?” That’s where you start. - Pull out your last 12 months of milk cheques.

Calculate: How much of your revenue came from co‑op or pool premiums vs private add‑ons? Are you leaning too hard on short‑term deals? This is one of those numbers most people never look at—until it’s too late.

None of this fixes your feed bill or magically makes Class III and Class IV prices behave. But taken together, these are the habits that build the kind of community Louis, Dorothy, Bob, and David depended on—often without realizing it at the time.

And those communities, in turn, are the ones that have a shot at negotiating better contracts, making smarter genetics bets, and keeping enough barns open to matter when processors and policymakers look at a map.

The Bottom Line

In that Connecticut vo‑ag room, a teacher closed the door after school and slid an economics book toward a tired kid who smelled like the barn. He had no way of knowing that the kid would end up helping organize farmers across a region, negotiating tens of millions in premiums, writing “The Business Side of Dairying” for 12 years in Hoard’s Dairyman, or seeing his book used in ag programs across 177 countries.

In Illinois, a widow made sure a small AI center had a buy‑back clause, then stepped into the president’s office when the time came, because she believed her people and her breeders deserved better than being written off as a rounding error in a candy merger.

In Sioux Center, a vet and a handful of partners put their reputations on the line to start an embryo business, even though most neighbours thought the whole thing sounded like science fiction.

Around all of them—then and now—are neighbours, spouses, kids, employees, vets, nutritionists, lenders, teachers, 4‑H leaders, Junior Holstein volunteers, and late‑night online friends who have all helped, in a hundred quiet ways, to keep barn lights on when the road turned rough.

Not every town responds like this. Not every co‑op holds together. Not every online group is safe. Not every farm chooses the long game when money’s tight.

But if you look around your own road, there are probably already more lights on than you think—people who’ve shown up before and will again, if you give them the chance.

The next time you’re staring at a new milk contract, a genomic test bill, or an ET proposal, remember that those decisions land very differently in a barn that’s surrounded by lights than in one that’s standing alone.

Here’s the real question for you, sitting at your own kitchen table:

Which decisions you’re making right now are dimming those lights? Who are the lights on your road?

And if you can’t name them—or you haven’t been one of those lights for someone else yet—that’s your real to‑do list.

Key Takeaways

- $30M lesson still applies: New England farmers won $30 million in premiums in 22 months (1973)—then lost them when individuals chased private deals over pool loyalty.

- Co‑ops still control the market: USDA 2024 data confirms co‑ops market ~80% of U.S. milk; your contract choice shapes your region’s leverage for the next decade.

- Genetic ROI needs community: Trans Ova, Curtis Breeding, and early AI pioneers succeeded because trusted teams stuck with them through inconsistent results and long odds.

- Two questions for every contract: What does this do for my cash flow today? What does it do to my community’s bargaining power tomorrow?

- Community is strategy, not sentiment: The producers who survive tight margins are the ones with neighbours, staff, and advisors who show up when things break.

Executive Summary:

This piece takes you from a $30 million co‑op premium win in 1973 New England to today’s milk contracts, genomics, and beef‑on‑dairy decisions, using the real stories of Louis Longo, Dorothy Schnering, Curtis Breeding, and Trans Ova. It shows how Capper‑Volstead, co‑op structure, and producer discipline turned disorganized price takers into price makers—and how chasing short‑term private deals can quietly unwind that leverage. USDA data from 2024 confirms co‑ops still market around 80% of U.S. milk, so your choice between private contracts and pool loyalty isn’t just about your next cheque; it shapes your region’s ability to negotiate premiums for the next decade. Along the way, the article uses parachute semen, pigeon‑delivered AI, and the rise of ET/IVF at Trans Ova to highlight how community and calculated genetic ROI bets have always separated survivors from the rest. You’ll walk away with a clear “nickels vs dollars” framework, two questions to run every new milk contract through, and a 7‑day, kitchen‑table checklist for strengthening the people around your herd so your barn lights don’t go out alone.

Editor’s Note: Historical material in this article is drawn from National Dairy Shrine Pioneer interview transcripts (Louis Longo, 2005; Robert Boese, 1988) and publicly available company and institutional records. Current market figures (heifer prices, calf values, contract spreads) reflect ranges reported in 2024–2025 university extension market summaries and regional auction data; actual prices vary significantly by region, genetics, and market conditions. Co‑op market share data is from the 2024 USDA dairy cooperative statistics. National averages may not reflect your specific region, management system, or market. If your experience differs or you have case studies to share, we welcome producer feedback for future coverage. Contact: editors@thebullvine.com

Continue the Story

- Don Bennink: A Visionary Who Redefined the Dairy Industry – Don walks a similar path to Louis Longo, proving the point that a multi-decade legacy isn’t just built on great cows, but on a relentless focus on economic math and the courage to lead alone.

- CURTIS CANDY COMPANY: Sweet Success in the Dairy Industry – This narrative dives into the world Dorothy Schnering fought to preserve, showing how a candy giant’s farm division became the unlikely cradle for the genetic tools that eventually transformed every modern dairy barn.

- Trans Ova Genetics – 40 Years of Bovine Reproductive Technology Leadership – Carrying forward the spirit of the Sioux Center pioneers, this story explores the evolution of advanced reproduction from risky science fiction into the everyday engine that keeps today’s most competitive herds sustainable.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.