Why are 500-cow operations earning more per cwt than their 1,500-cow neighbors?

EXECUTIVE SUMMARY: What farmers are discovering through this unprecedented $11 billion wave of processing investments is that timing and relationships now matter more than scale. The International Dairy Foods Association data shows over 50 major facilities coming online through 2028, with fairlife investing $650 million in New York and Chobani committing $1.2 billion to their Rome plant. Penn State Extension’s latest bulletin reveals farms with consistent components—daily variation below 2%—are earning premiums of $0.50 to $1.50 per hundredweight, while Vermont’s St. Albans Cooperative reported average component premiums of $1.25/cwt in Q3 2025. Here’s what this means for your operation: processors opening facilities in 2026-2027 are making supplier decisions right now, October 2025, creating a critical 6-12 month window where strategic positioning beats traditional expansion. Recent USDA data showing protein levels climbing from 3.08% to 3.26% and butterfat from 3.70% to 4.15% since 2011 demonstrates how the industry’s already responding to these opportunities. The producers who recognize this isn’t just another cycle—it’s a fundamental shift in how value flows through dairy—are positioning themselves for success regardless of herd size.

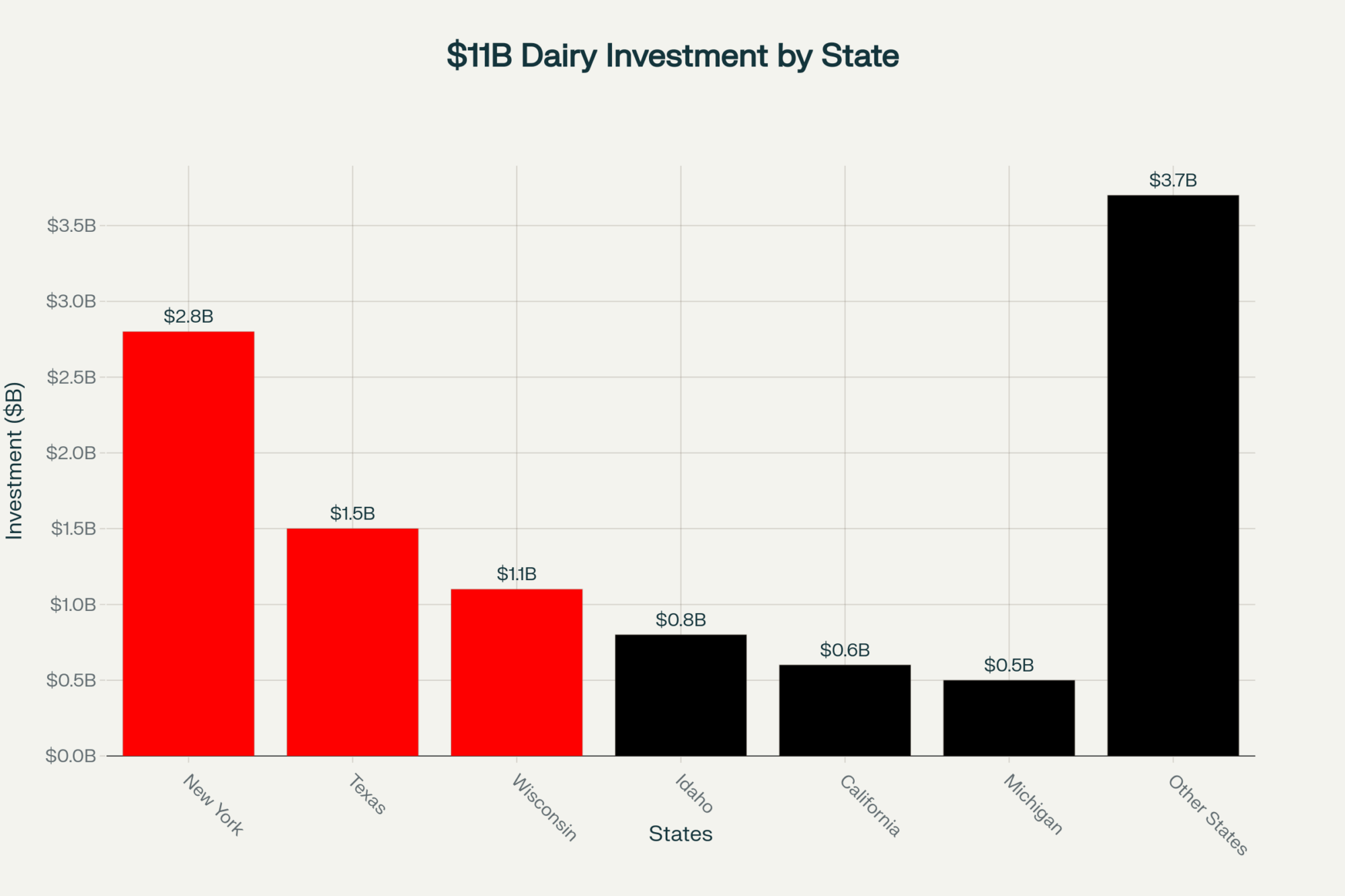

When the International Dairy Foods Association released its latest data, showing over $11 billion in processing investments through early 2028, it really made me stop and think. That’s not just another market cycle. That’s a fundamental shift in how our industry will work.

What caught my attention is where this money’s actually going. Fairlife’s $650 million Webster, New York, facility broke ground in April 2024—Dairy Herd Management covered it extensively. Then there’s Chobani committing $1.2 billion to their Rome plant, which Governor Hochul announced back in April. These aren’t incremental expansions, folks. They’re massive bets on completely new ways of processing and marketing dairy products.

And I’ve noticed something interesting lately: the farms that seem to be positioning themselves best for all this aren’t necessarily the biggest operations. They’re the ones building real partnerships with processors—not just showing up as another milk hauler twice a day. That’s a different mindset than what many of us grew up with.

Understanding Where the Investment Is Going

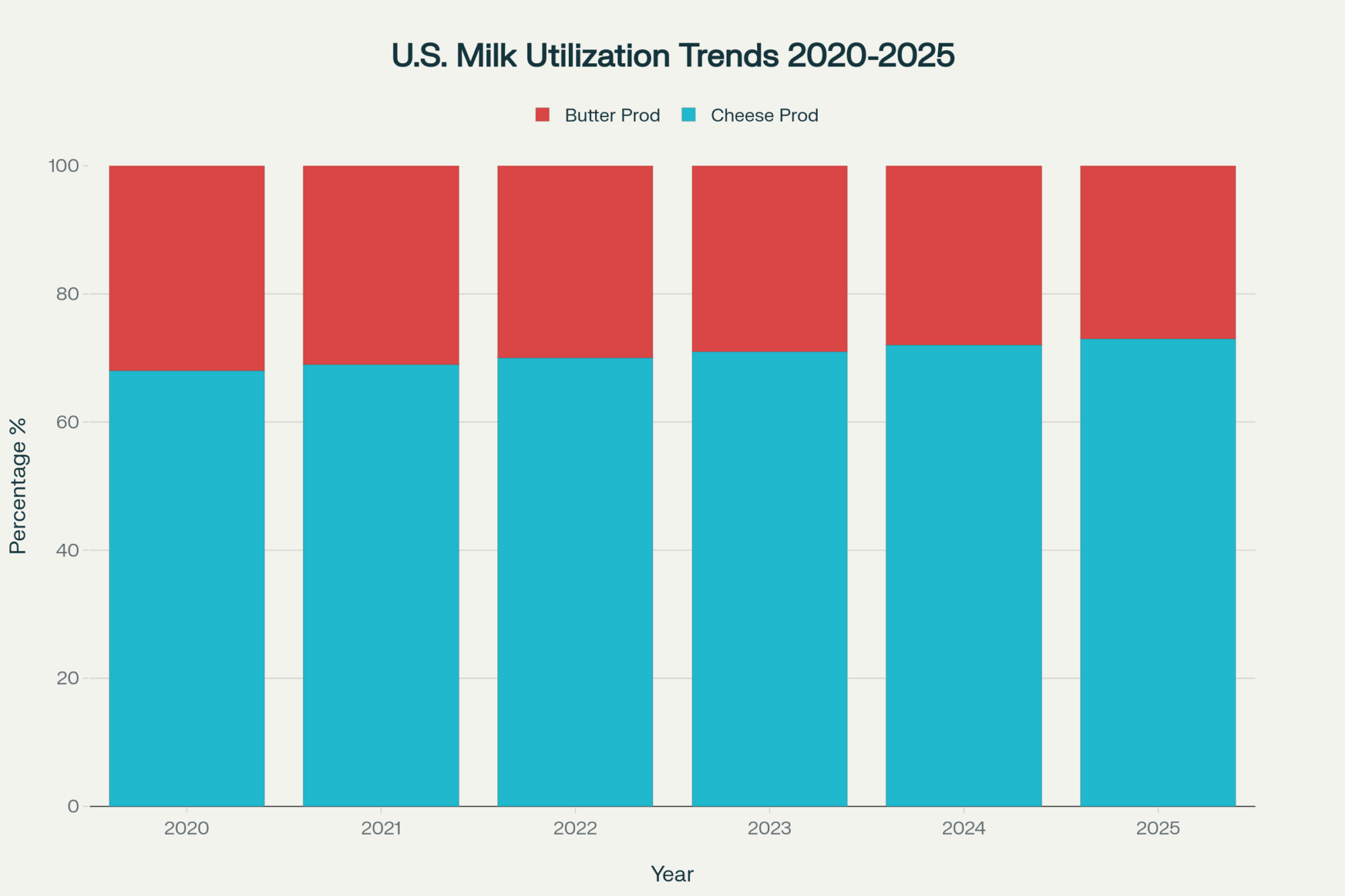

Looking at the IDFA breakdown, you can see some clear patterns emerging. Cheese facilities are attracting about $3.2 billion—which makes sense when you consider Americans are consuming 37.8 pounds per capita, according to the USDA’s Economic Research Service. That’s a lot of cheese, even by Wisconsin standards.

Milk and cream operations account for nearly $3 billion, while yogurt and cultured products draw another $2.8 billion. Each category has its own specific needs, and that’s where things get interesting for producers.

New York leads with $2.8 billion in total investment. It makes sense when you consider the proximity to East Coast markets and existing milk production infrastructure. Texas follows at $1.5 billion, anchored by Leprino Foods’ massive facility in Lubbock. Wisconsin adds $1.1 billion in capacity, which… well, nobody’s surprised there.

However, this development suggests something bigger—these modern processing facilities are incorporating advanced technologies that require very specific milk characteristics to run efficiently. We’re not talking about just hauling milk anymore. We’re talking about delivering exactly what these facilities need to optimize their operations. And that creates opportunities for producers who understand what’s happening…

Beyond Volume: Why Components Are King Now

The data from USDA’s Dairy Market News tells a fascinating story about how we’ve adapted. Federal order protein levels have increased from 3.08% in 2011 to 3.26% by 2023. Now, that might not sound like much sitting here at the kitchen table, but when you spread that across the 226 billion pounds of milk we produced last year… that’s a massive amount of additional protein entering the supply chain.

Butterfat’s even more dramatic. We’ve gone from 3.70% in 2011 to 4.15% by 2023. Part of that’s genetics—the Council on Dairy Cattle Breeding’s April 2024 genetic evaluations show consistent progress in fat transmitting ability. But it’s also management. We’re feeding differently, selecting differently, managing our herds differently.

What farmers are finding through extension work at Cornell’s PRO-DAIRY program and Penn State is that consistency matters as much as the absolute numbers. These new processing systems need to know what’s coming in the door every single day. Big swings in components can significantly impact processing efficiency. Penn State’s latest extension bulletin shows farms with a daily coefficient of variation below 2% for protein are earning premiums ranging from $0.50 to $1.50 per hundredweight, depending on the processor.

Vermont’s St. Albans Cooperative reported component premiums averaging $1.25 per hundredweight in their third-quarter 2025 report—that’s real money for farms that hit their targets consistently. Many producers in Wisconsin and elsewhere are now conducting more frequent tests. Daily testing used to seem excessive, but when you understand how these new ultrafiltration systems and other technologies work, it starts making more sense.

The Green Premium: Sustainability Programs That Actually Pay

I’ll be honest with you—when sustainability programs started ramping up, I was skeptical. We’ve all seen programs that promise a lot and deliver little. But the economics have shifted in ways I didn’t expect.

Consider the Ben & Jerry’s Caring Dairy program, which has been in operation since 2011. Aaron and Chantale Nadeau, who run Top Notch Holsteins up in Vermont, have been participants for years. In an August 2020 interview with Vermont Public Radio, Aaron stated that the program provides meaningful financial returns. That’s real money, not just feel-good corporate messaging.

The carbon credit side has also transitioned from theory to reality. When Jasper DeVos in Texas sold his greenhouse gas reductions to Dairy Farmers of America through the Athian platform, it marked the first documented livestock carbon credit transaction in the U.S. That opened a lot of eyes.

Examining this trend, What’s really driving this is the regulatory landscape is the primary driver of this change. California’s methane regulations kicked in this year through the California Air Resources Board. The EU’s carbon border adjustments are expected to start affecting dairy exports in 2027, according to European Commission documentation. Processors need compliant milk to maintain those markets. It’s that simple.

Your Zip Code Matters: Regional Dynamics in Play

Your location significantly influences your opportunities in this new landscape, and it’s worth considering what that means for your operation.

If you’re in the Northeast, especially within reasonable hauling distance of Fairlife’s Webster plant or Chobani’s Rome facility, you’re in an interesting position. That $2.8 billion in regional investment is creating real competition for milk supplies. It’s been years since we’ve seen processors competing this actively for suppliers.

Wisconsin operations are experiencing continued growth on the cheese side. Established manufacturers continue to grow, focusing on components that maximize cheese yield and efficiency. When you can consistently deliver the butterfat and protein levels they need, you have options.

Texas is accommodating these massive-scale operations through facilities like Leprino’s Lubbock investment. For smaller producers in the area, many are exploring specialty markets—such as organic certification, A2 production, and even agritourism. You can’t compete with the mega-dairies on commodity volume, so you find your niche.

California’s environmental regulations, which initially seemed overwhelming, are actually creating growth opportunities. Producers meeting methane reduction requirements are finding that processors value that compliance. Market access depends on it.

For those of you in the Southeast or Mountain West, wondering where you fit in all this—the principles still apply. Even without billion-dollar facilities next door, processors in your region need reliable partners. The component optimization and sustainability strategies work everywhere. Sometimes being outside the major investment zones means less competition for the opportunities that do exist.

The Clock Is Ticking: Why Timing Matters More Than Ever

So here’s what I keep coming back to: the traditional approach of building first, then negotiating from a position of greater volume… that might not be the best strategy anymore.

Consider the timeline. A new freestall barn takes 18-24 months from groundbreaking to full production. Financing, permitting, construction, getting it filled with cows—it all takes time. Meanwhile, processors are expected to open facilities in 2026 and 2027. They’re establishing their supply partnerships right now, October 2025.

Some producers are taking a different approach. They’re focusing on what they can control today—optimizing components, building processor relationships, and getting into sustainability programs. These typically show returns within 6-12 months, much faster than traditional expansion.

What I keep hearing from successful operations is that processors need certainty as much as they need volume. A 500-cow dairy that can guarantee consistent quality, reliable delivery, documented compliance… that’s often more valuable than a larger operation without those established relationships. It’s a different way of thinking about competitive advantage.

Comparing Processor and Farm Expansion Timelines

Processor Timeline

Processors are actively securing supply partnerships as of October 2025. This phase is critical, as they are laying the groundwork for future operations. Following this, new processing facilities are scheduled to come online between 2026 and 2027. The next 6 to 12 months represent a decisive window for producers to establish relationships and position themselves as preferred suppliers.

Farm Expansion Timeline

Expanding a farm operation is a lengthy process. The initial 1 to 6 months are dedicated to planning and securing necessary permits. Construction typically spans months 7 through 18. Only after construction is complete, from months 19 to 24, can the facility be filled with cows and reach full production capacity. In total, the minimum timeframe for complete farm expansion is 18 to 24 months.

Strategic Implications

The discrepancy between processor readiness and farm expansion timelines highlights the urgency for producers. With processors finalizing supply agreements now and new facilities launching soon, the next 6 to 12 months are pivotal. Producers must act decisively to align with processor requirements, as traditional expansion strategies may not allow for timely participation in emerging opportunities.

Your Action Plan: Resources That Actually Help

| Component Strategy | Premium Range per cwt | Annual Impact 500 Cows | Implementation Timeline |

|---|---|---|---|

| Daily Variation <2% | $0.50 – $1.50 | $75,000 – $225,000 | 30-60 days |

| Butterfat >4.30% | $0.25 – $0.75 | $37,500 – $112,500 | 6-12 months |

| Protein >3.35% | $0.20 – $0.60 | $30,000 – $90,000 | 3-9 months |

| Consistent Quality | $0.15 – $0.40 | $22,500 – $60,000 | 60-90 days |

| Sustainability Certified | $0.30 – $1.00 | $45,000 – $150,000 | 3-18 months |

If you’re ready to engage with these opportunities, here are some starting points that actually work:

For Carbon Credits:

- Athian: athian.ai or call 737-263-4839—they facilitated that first livestock carbon transaction

- Nori: marketplace.nori.com—focuses on soil carbon

- Indigo Ag: indigoag.com/for-growers/carbon

For Sustainability Programs:

- Ben & Jerry’s Caring Dairy: Contact your co-op if you’re in their supply shed

- Danone North America: danonenorthamerica.com/farmers

- Nestle’s Net Zero roadmap: nestle.com/sustainability/climate-change

For Component Optimization:

- Cornell PRO-DAIRY: prodairy.cals.cornell.edu (607-255-4478)

- Penn State Extension Dairy Team: extension.psu.edu/animals/dairy

- University of Wisconsin Dairy: fyi.extension.wisc.edu/dairy

Most major processors have farmer relations departments. Start with your current field representative and asking about the supply needs of your new facility. Don’t wait for them to call you—the ones who are proactive now are the ones who are getting the opportunities.

The Bottom Line: Being Indispensable Beats Being Bigger

After thinking about all this, what becomes clear is that this $11 billion investment represents a fundamental shift in how value flows through our industry. It’s not just about selling milk anymore. It’s about being the kind of supplier these massive facilities need to succeed.

These processors require three key elements: reliable volume, consistent quality, and, increasingly, environmental compliance that maintains market access. Farms that can deliver all three—regardless of size—have leverage they haven’t had in years.

The traditional thinking was straightforward: get bigger first, then negotiate from a position of strength. What’s working now is different. Become indispensable at your current size, then grow strategically. The infrastructure can wait if it needs to. The relationships can’t.

Looking at where we are—October 2025—the processors opening facilities in 2026 and 2027 are making their supplier decisions over the next 6-12 months. By next October, most of these opportunities will be committed. The producers who recognize this window and act on it are positioning themselves for the next decade.

Remember that $11 billion number we started with? It’s not just about processing capacity. It’s about reshaping how our entire industry works. The processors don’t just need our milk anymore—they need us as partners. And that, as we used to say back when I started farming, changes everything.

That’s worth considering the next time you’re evaluating your operation and wondering what’s next. Because in all my years in this business, I’ve never seen a moment quite like this one.

KEY TAKEAWAYS

- Component consistency delivers immediate returns: Farms achieving less than 2% daily variation in protein are capturing $0.50-$1.50/cwt premiums, potentially adding $75,000-225,000 annually for a 500-cow dairy producing 15 million pounds

- Strategic timing beats traditional expansion: With processors making supply decisions now for 2026-2027 facility openings, the 6-12 month returns from relationship building outpace the 18-24 months needed for barn construction and herd expansion

- Regional opportunities vary but principles remain: Whether you’re near New York’s $2.8 billion investment zone or operating in the Mountain West, processors need partners who deliver consistent quality, documented compliance, and reliable volume—creating leverage even for mid-sized operations

- Sustainability programs have moved from cost to revenue: Carbon credits through platforms like Athian plus programs like Ben & Jerry’s Caring Dairy are generating real income, with early adopters capturing value before compliance becomes mandatory in markets like California (2025) and EU exports (2027)

- Action window is narrowing: Contact your processor’s farmer relations department about new facility needs, optimize components through daily testing, and explore sustainability programs now—by October 2026, most premium partnership opportunities will be committed

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- USDA’s 2025 Dairy Outlook: Market Shifts and Strategic Opportunities for Producers – This article provides a high-level strategic overview of the market forces driving profitability in 2025, from component optimization to aligning with specific processors. It helps producers develop market intelligence to make better decisions on culling, expansion, and capital investments.

- June Milk Numbers Tell a Story Markets Don’t Want to Hear – This piece drills into recent production data to reveal how component-adjusted growth is a more accurate measure of profitability than raw volume. It also offers a reality check on regional growth dynamics and the risks of building a strategy around unpredictable export markets.

- USDA Dairy Production Report – This guide gives a tactical, how-to approach to implementing the strategies discussed, from genomic testing to precision feeding. It provides specific numbers on the financial returns of component premiums and technology adoption, helping you build a concrete action plan for your operation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!