Raising mediocre genetics into an $18 market is a $3,000 mistake walking on four legs. 8 GDT declines say it’s time to cull harder.

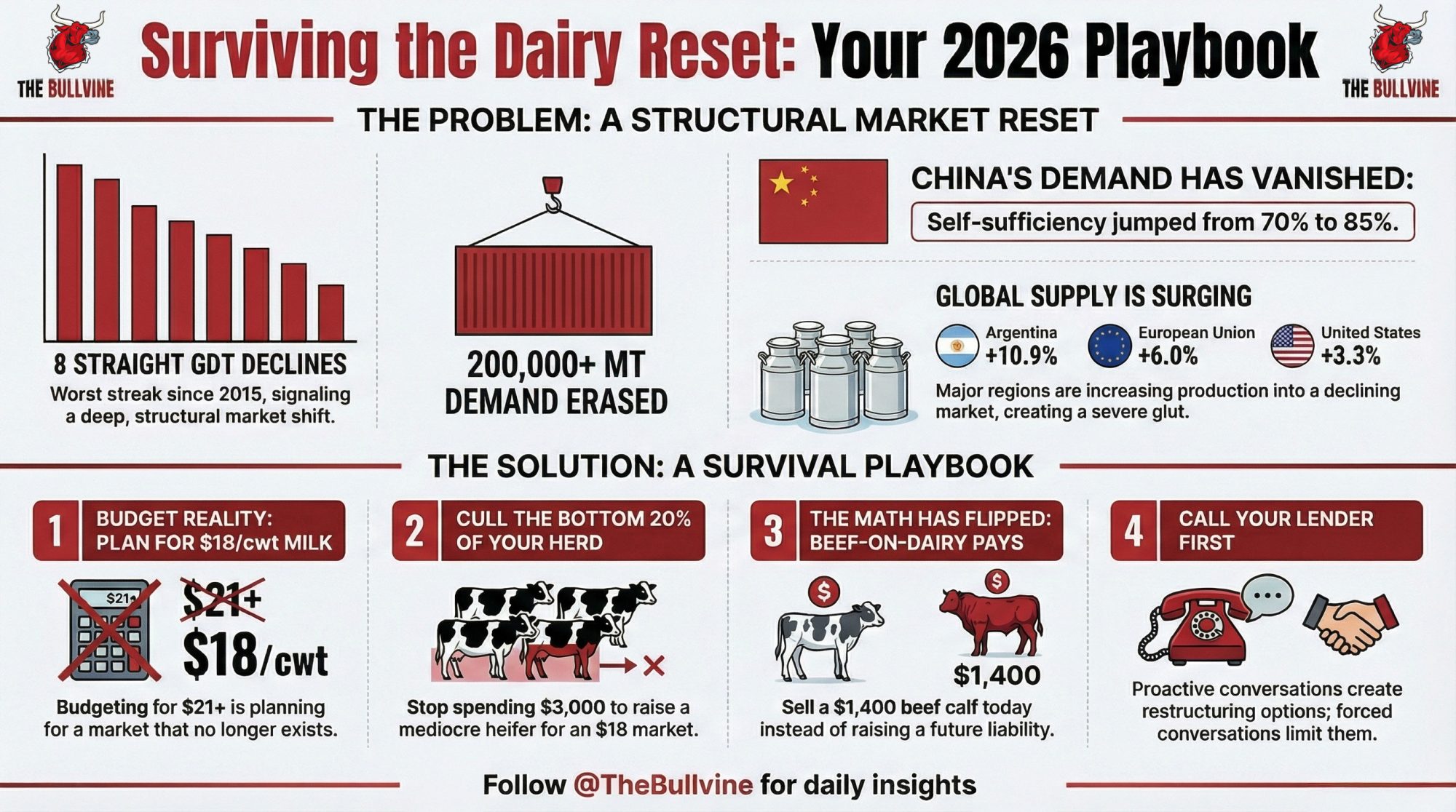

EXECUTIVE SUMMARY: Eight straight GDT declines—the worst streak since 2015—isn’t a cycle. It’s a structural reset. China’s self-sufficiency jumped from 70% to 85%, erasing 200,000+ metric tons of annual demand that isn’t returning. Production keeps accelerating everywhere: the US up 3.3%, the EU up 6%, Argentina up 10.9%. For operations still budgeting $21 milk, the math turns brutal fast—at $18/cwt, working capital burns in months, not years. The response demands ruthless clarity: cull the bottom 20% of your genetics, sell $1,000-1,400 beef-on-dairy calves instead of raising $3,000 replacement heifers, lock in price protection, and call your lender before covenants force the conversation. The dairies thriving in 2027 won’t be those that waited for recovery—they’ll be those that used 2026 to make the hard calls their competitors avoided.

Something shifted in global dairy markets this fall. Those of us watching the twice-monthly Global Dairy Trade auctions could sense it building, but the numbers from Event 393 on December 2nd brought it into sharp focus.

The damage in one auction:

- GDT Price Index: Down 4.3%

- Butter: Down 12.4% (the hardest hit)

- Whole Milk Powder: Down 2.4%

- Average price: US$3,507/MT (lowest in nearly two years)

- Streak: Eight consecutive declines—worst since 2015

For producers mapping out Q1 and Q2 of 2026—whether you’re managing a 200-cow operation in Vermont, running 3,000 head in the Central Valley, or navigating the unique economics of Southeast pasture-based systems—these results raise questions that deserve careful thought.

Is this a cyclical correction that resolves in a few months? Or does it reflect something more structural?

Here’s my read: eight consecutive declines with this breadth across product categories suggests supply-demand fundamentals that may take longer to rebalance than we’d like. That’s not cause for panic, but it is a reason for strategic action. The operations that navigate the next 12-18 months successfully will be those that understand what’s driving this weakness—and position accordingly.

The Supply Picture: Everyone’s Running Hot

The basic dynamic is pretty clear once you lay it out. Global milk production across major exporting regions is growing faster than demand can absorb. USDA Foreign Agricultural Service data and Rabobank’s quarterly analysis both point to this imbalance persisting through at least mid-2026.

What makes this period particularly concerning is the breadth. It’s not one region running hot while others moderate. Everyone’s pushing milk at the same time:

| Region | Growth Rate | Source |

| New Zealand | Season-to-date up 3.0% | Fonterra November Update |

| United States | August production up 3.3% (24 major states) | USDA Milk Production Report |

| European Union | September deliveries up 6.0% | AHDB Market Analysis |

| Argentina | Q1 2025 up 10.9% | USDA Attaché Reports |

Fonterra has already raised their collection forecast from 1,525 million kgMS to 1,545 million kgMS. The US herd continues expanding even as futures soften. You know how it goes—once you’ve invested in facilities, genetics, and labor, the economic pull favors keeping stalls occupied.

“This cycle, we’re seeing production accelerate into declining prices. That pattern—when it persists—typically indicates a longer adjustment period ahead.”

The China Shift: This Isn’t Cyclical

No factor shapes the global dairy trade outlook quite like China’s changing import patterns. For nearly a decade, China served as the primary growth engine for dairy exports worldwide. What’s shifted there helps explain everything we’re seeing at GDT.

The key numbers:

- Self-sufficiency: Climbed from ~70% (2020-2021) to ~85% (2025) per USDA and Rabobank estimates

- WMP imports: Dropped from 845,000 MT at peak to ~430,000 MT by 2023

- Missing demand: 200,000-240,000 MT annually that isn’t coming back soon

Rabobank’s Mary Ledman, its global dairy strategist, framed it clearly: China moved from about 70% self-sufficiency to roughly 85%, and that shift cascades through global trade flows. When China’s import demand contracts, it affects pricing for exporters worldwide.

What this means: Business planning built around a rapid return to peak Chinese imports probably warrants reconsideration. Beijing invested heavily in domestic processing capacity as a food security priority. Some analysts believe import demand could stabilize if domestic production growth slows—but for planning purposes, assuming reduced Chinese appetite persists seems prudent.

Where’s the Milk Going?

With China absorbing less, displaced volume is finding alternative homes—but at a cost:

Secondary markets are absorbing volume. The Middle East, Southeast Asia, and parts of Latin America have increased purchases at competitive pricing. But these markets are smaller and more price-sensitive. They take the milk—just at prices that drag everything down.

Product mix is shifting. EU processors are directing more milk toward cheese and whey rather than powder. This doesn’t eliminate surplus; it redistributes pressure across product streams.

Inventories are building. US nonfat dry milk stocks have grown through 2025, according to USDA Dairy Products data. The milk is moving, but it’s backing up. That overhang suppresses spot prices until stocks normalize.

Farm-Level Math: Where It Gets Real

For individual operations—particularly those carrying debt from recent expansions—extended margin compression creates genuine planning challenges.

Fonterra’s adjustment illustrates how GDT weakness hits farmgate: They narrowed their 2025/26 price range from NZ$9.00–$11.00/kgMS to NZ$9.00–$10.00/kgMS. For a farmer supplying 200,000 kgMS, that 50-cent midpoint reduction means roughly NZ$100,000 less this season.

US operations face a similar arithmetic:

- 500-cow dairy producing 25,000 lbs/cow annually

- Each $1/cwt change = approximately $125,000 in gross revenue impact

I recently spoke with a producer running about 450 cows in east-central Wisconsin—debt-to-asset ratio around 47%, which isn’t unusual for operations that expanded during 2021-2022. At $22/cwt, modest positive cash flow. At $18-19/cwt, he’s projecting monthly shortfalls of $35,000-45,000. Working capital covers roughly three months at that burn rate.

His approach? Running all projections at $18 now, not $21.

“I’d rather be surprised by better prices than caught short by worse ones.”

The timeline pressure: Working capital reserves on many operations cover 2-4 months of shortfalls. When those deplete, operating lines of credit come at higher rates—what was 6-7% might now cost 10-11%, further pressuring cash flow.

Practical Responses That Are Working

Across regions, proactive producers are responding with concrete adjustments. The specifics vary—feed costs differ between California and Wisconsin, Southeast operations face different heat-stress economics, and Northeast producers navigate distinct cooperative structures—but certain approaches work broadly.

Get Brutally Honest on Cash Flow

Run projections at $18.00/cwt, not $21-22. Answer these questions candidly:

- What’s the monthly cash flow at current prices through Q2 2026?

- How many months can you sustain negative cash flow before exhausting working capital?

- At what price does the operation return to breakeven?

Operations projecting shortfalls above $30,000-50,000/month should initiate lender conversations now—before covenant pressures force them.

Lock In Some Protection

Forward contracting and hedging deserve fresh attention:

- Forward contract 30-50% of near-term production through co-ops or direct processor contracts

- Put options on Class III or Class IV milk for downside floors with upside participation

- Dairy Margin Coverage enrollment at coverage levels matching your debt structure

Options protection typically costs $0.20-0.40/cwt. That’s insurance math—worth evaluating against your exposure.

Strategic Cost Management

Ration optimization remains the biggest lever. Maximize the number of components per pound of dry matter intake. With butterfat and protein premiums available through many marketing arrangements, component-focused feeding can partially offset lower base prices. Transition cow nutrition and fresh cow management remain areas where investment pays returns—you probably know this, but it bears repeating during tight margins.

Forward purchase feed ingredients at current favorable levels for 6-12 months.

Capital discipline—defer projects that don’t show clear payback within 12 months at $18/cwt.

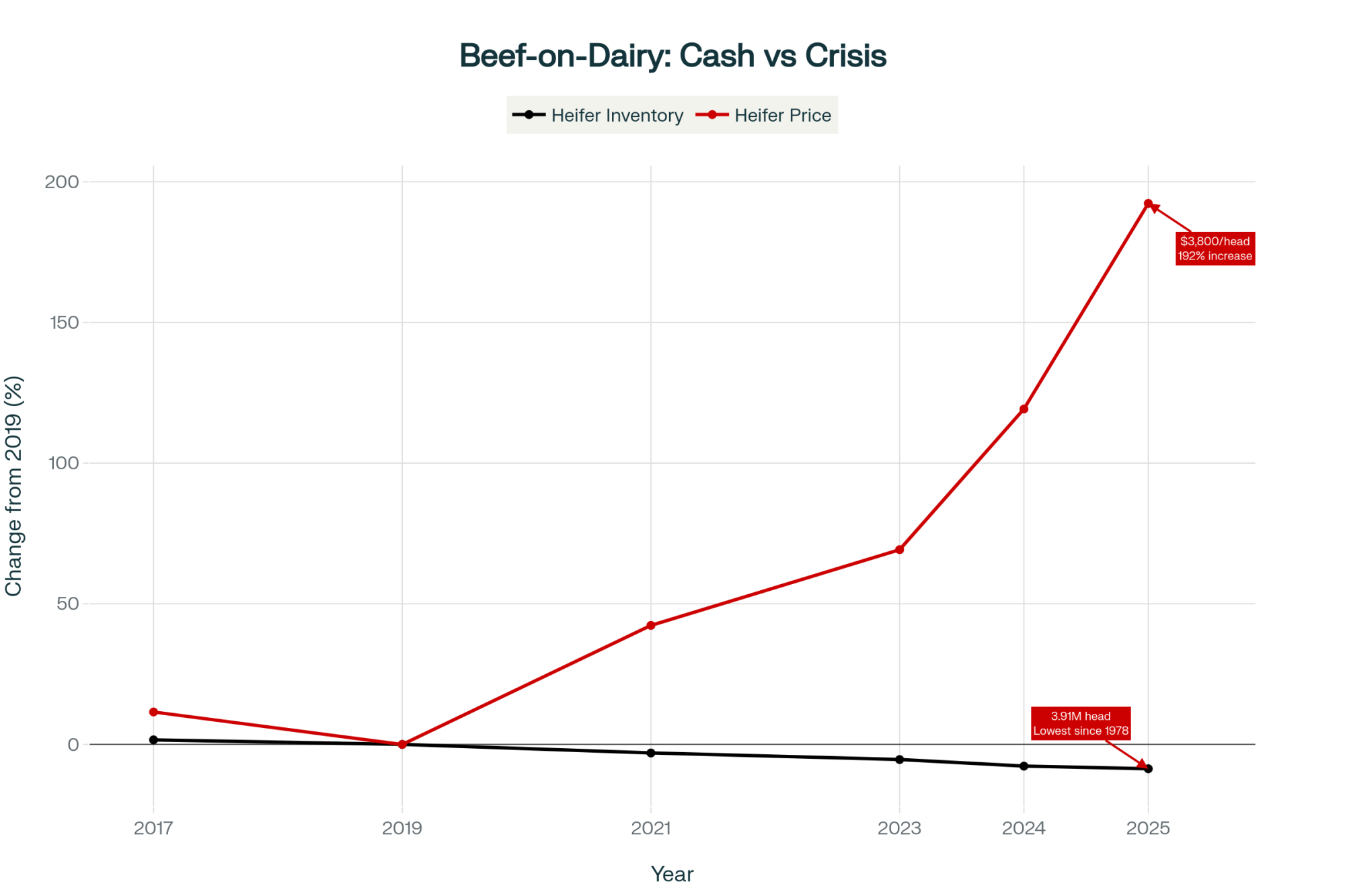

Ruthless Heifer Inventory Calibration

This is where genetics strategy meets financial survival.

Stop raising the bottom 20% of your genetics. Move from 110% of replacement needs to strictly 100%. Use beef-on-dairy crosses on everything that isn’t top-tier. In a market like this, raising a mediocre heifer is a luxury you cannot afford.

Downturns are the time to concentrate genetic investment. Focus sexed semen only on your elite animals. Let beef sires cover the rest. The operations that emerge strongest from price cycles are typically those that used the pressure to accelerate genetic progress—not those that kept feeding average genetics because “we’ve always raised our own replacements.”

Here’s what’s interesting about the economics right now. Dairy beef has become a meaningful revenue stream—according to Hoard’s Dairyman, dairy-beef crosses now represent 15-20% of national beef production. That $1,000-1,400 dairy-beef calf you’re selling at a few days old is worth far more than a replacement heifer you’ll spend $2,500-3,000 raising only to freshen into an $18 milk market. The math has completely flipped from where it was just a few years ago, when those calves were bringing $350-400.

Early Lender Engagement

For operations where projections suggest restructuring may be needed, earlier conversations produce better outcomes. Options farmers are exploring:

- Extending term debt amortization (10 → 15 years) to reduce annual payments

- Converting operating lines to term debt for covenant breathing room

- Adjusting payment timing to align with milk check cycles

- Providing additional collateral for better terms

Lenders prefer restructuring to foreclosure. But that preference is strongest when borrowers approach proactively—not when they’re already in technical default.

The Coordination Reality

Could coordinated production cuts accelerate rebalancing? Probably not.

US antitrust law restricts coordination on production or pricing. Cooperative structures require accepting all member milk. And even if one region cut output, others would expand to capture the opportunity—Argentina’s 10.9% Q1 surgeshows how fast capacity elsewhere fills gaps.

Historical precedent: During 2014-2016, US milk production actually grew despite severely compressed margins. Recovery came when demand improved—not from coordinated supply reduction. The survivors managed through individually: maintaining reserves, restructuring early, achieving efficiencies their neighbors didn’t.

Market rebalancing will occur through aggregated individual responses to economic pressure. That places the burden on each operation to assess its own position and act accordingly.

How the Next 18 Months Might Unfold

Here’s one informed perspective—not prediction:

Through Q1 2026: Current dynamics persist. Production growth continues despite weak prices, China maintains a reduced import posture, and inventories stay elevated. GDT likely stays below $3,500/MT, potentially testing $3,200-3,300.

By mid-2026: Margin compression forces more decisive responses. Some operations exit through individual financial pressure. Others restructure and emerge leaner. Consolidation accelerates.

Late 2026 into 2027: If sufficient capacity adjusts, supply comes into better balance. Prices recover—though likely to equilibrium levels reflecting China’s structurally lower imports and more consolidated global production.

The operations positioned well for 2027 won’t necessarily be the largest. They’ll be those that assessed their situations honestly now, made difficult decisions while options remained, and configured for a market that differs from 2021-2022.

The Bottom Line

This market weakness is structural, not cyclical. Eight consecutive GDT declines, plus China’s sustained import reduction, create headwinds that won’t resolve quickly.

Run your numbers at $18/cwt. Operations showing significant monthly negative cash flow face decisions within 6-12 months.

Talk to lenders before you have to. Proactive conversations yield better outcomes than forced ones.

Concentrate your genetic investment. Stop subsidizing mediocre genetics with expensive heifer development. Use beef-on-dairy aggressively—at $1,000+ per calf, the economics have never been better.

Protect some downside. Evaluate forward contracting and options based on your specific debt exposure.

Early action preserves options. Delayed response narrows them.

These are genuine challenges—and ones the industry has navigated before. The operations thriving when conditions improve will be those making informed decisions now: understanding what market signals indicate, assessing their position realistically, and acting while choices remain.

Your local extension dairy specialists and farm business management educators can provide perspective tailored to your specific circumstances. Run your numbers, have the conversations, and position your operation for whatever comes next.

We’ll continue tracking these developments. In the meantime—sharpen your pencil, sharpen your genetics, and sharpen your strategy.

Key Takeaways

- Stop waiting for recovery. China’s at 85% self-sufficient. That 200,000+ MT of vanished demand isn’t returning. This is the market now.

- Budget at $18. Today. At $21, you’re planning for a market that no longer exists. Run your numbers at $18 and see if your runway is months—or weeks.

- Cull the bottom 20%. Ruthlessly. A $1,400 beef calf at 3 days old beats a $3,000 heifer raised to freshen into $18 milk. That math has permanently flipped.

- Call your lender this week. Proactive conversations get restructuring options. Forced conversations get whatever terms are left.

- The 2027 winners are being decided now. They won’t be the biggest operations—they’ll be the ones that culled harder, budgeted tighter, and moved while competitors waited.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Transform Your Dairy Economics: How Beef-on-Dairy Crossbreeding Delivers 200% ROI – Reveals the specific ROI formulas progressive dairies use to validate beef-on-dairy programs, moving beyond simple calf premiums to calculate true feed efficiency gains and long-term herd profitability.

- Why Dairy Markets Can’t Self-Correct Anymore: The Hidden Forces Reshaping the Dairy Industry’s Future – Explains the structural “economic handcuffs”—from European cooperative obligations to energy revenue streams—that are preventing traditional supply corrections and keeping global production high despite low milk prices.

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – Provides a brutally honest assessment of automation ROI, demonstrating why management protocols matter more than machinery and how top operators achieve payback in 3.8 years while others struggle for a decade.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!