This downturn feels different because it is. Four major exporters expanded at once, and $15 milk is testing every assumption. Here’s what the resilient dairies know.

EXECUTIVE SUMMARY: When producers say this downturn feels different, they’re right. For the first time, the U.S., EU, New Zealand, and Argentina all expanded production within the same window—creating a “wall of milk” that pushed July 2025 output to 19.0 billion pounds while Class III dropped from the $20s to around $15. Here’s what makes it unusual: exports are at record levels, confirming this is a supply squeeze, not a demand collapse. Dairy’s 24-month biological timeline means decisions that made complete sense at $22 milk are now delivering into a $15 market, with no quick reversal possible. Beef-on-dairy has added real value but also reduced the number of replacement heifers to 3.9 million head—the lowest since 1978—limiting culling flexibility when some operations need it most. The dairies navigating this effectively share common strategies: precision culling using income-over-feed-cost data, margin protection through DMC and Dairy Revenue Protection, and breeding for feed efficiency using traits like Feed Saved. This cycle will accelerate consolidation, but producers who know their numbers and deploy available tools will emerge stronger when markets rebalance.

As milk checks tightened through 2025, I kept hearing the same thing from producers across the country: “We’ve seen low prices before, but this one feels different.” And as many of you have probably sensed on your own operations, they’re right. This isn’t just one region working through a rough patch. The U.S., the European Union, New Zealand, and key South American exporters all pushed production higher within a fairly tight window. A lot of that milk is now competing for the same buyers at the same time.

What makes this cycle particularly challenging is that feed, labor, interest, and environmental compliance costs haven’t returned to the levels we saw a decade ago. That’s especially true in higher-cost regions like California and parts of Western Europe. So you’ve got more milk hitting the market, softer world prices, and cost structures that remain stubbornly elevated. That combination is creating what many are calling the “wall of milk.”

In this piece, we’ll walk through what farmers and analysts are learning about this cycle: how the 24-month expansion lag plays out in practice, how beef-on-dairy has delivered real benefits while also creating some unexpected ripple effects, why lenders and processors kept supporting growth even as signals shifted, how different regions are experiencing this downturn in very different ways, and what the operations navigating this well seem to have in common. The goal is to offer a clearer view of the bigger picture so the decisions you’re making—about cows, facilities, or risk management—are grounded in how this system actually works.

Why This Cycle Really Does Feel Different

Let’s start with the production numbers and work back toward the parlor.

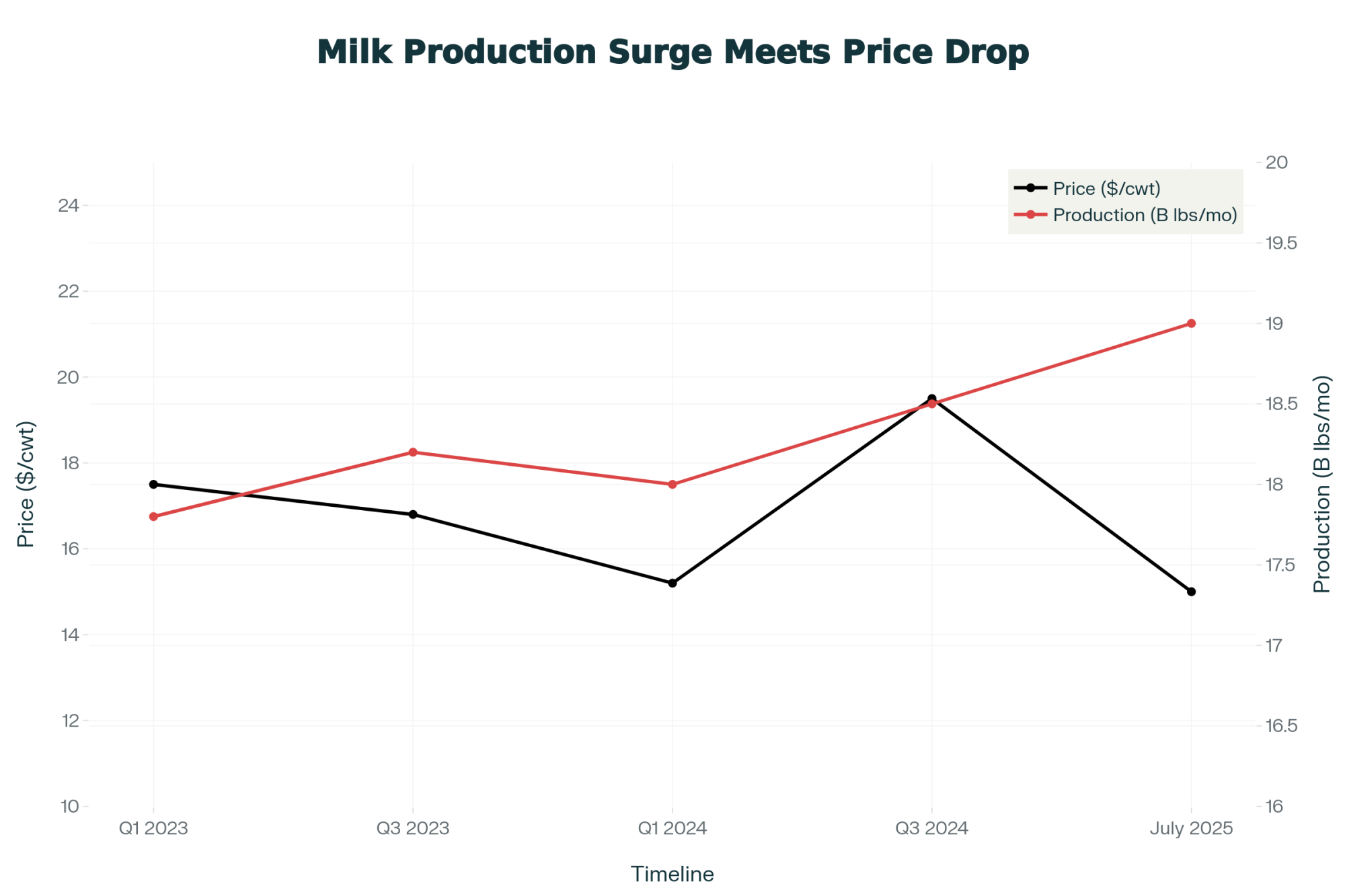

USDA’s Milk Production reports paint a stark picture:

- July 2025 Output (24 major states): 18.8 billion pounds initially, revised to 19.0 billion

- Year-Over-Year Growth: +4.2%—the strongest since 2021

- Total National Production: 19.6 billion pounds

- Cow Numbers: Approaching the highest levels seen in decades

On the infrastructure side, the industry has been busy. More than 50 new or expanded dairy plants—particularly cheese and powder facilities in the Upper Midwest, Texas, and the High Plains—have come online, representing roughly $8 billion in capital investment over the past several years.

Leonard Polzin, the Dairy Economist and Farm Management Outreach Specialist at UW-Madison Division of Extension, framed it well at the 2025 Wisconsin Agricultural Outlook Forum. He noted that the industry is seeing “a substantial increase in processing capacity,” with an estimated $8 billion in gross investment creating new demand for milk. The challenge, as he pointed out, is that policy uncertainties—including potential tariffs and questions about labor availability—could affect prices before that demand fully materializes.

The picture looks similar in other major producing regions:

- European Union: EU Milk Market Observatory data show deliveries climbing modestly in 2024, with product stocks building in early 2025 as cheese, butter, and powder production outpaced demand growth

- New Zealand: Fonterra’s 2025/26 season forecast shows milk solids volumes running several percent ahead of the prior year, with farmgate payouts around NZ$10 per kg of milksolids

- Argentina: Ministry data and Tridge reports show national milk output in early 2025 running 10.9% above the same period in 2024, with March posting gains of 15.9% year-over-year

Here’s where it gets interesting on the demand side. Exports have actually performed well:

- July 2025 U.S. Exports: 1.6 billion pounds (milk-fat basis)

- Year-Over-Year Export Growth: +53%—a record for any single month

- Yet Class III/IV Futures: Trading in the mid-teens through much of 2025, below full-cost breakeven for many conventional operations

The takeaway? World demand hasn’t collapsed. Exports are actually quite strong. But supply from multiple major exporting regions has grown faster than demand can absorb in the near term. That’s what makes this feel different from the regional downturns many of us have worked through before.

The 24-Month Expansion Timeline: When Biology Meets Economics

One of the lessons this cycle keeps reinforcing is how much dairy expansion is a commitment you can’t easily unwind. The biology and capital requirements simply don’t move on futures-market time.

Think back to 2023 and early 2024. Milk prices were strong, butterfat levels were excellent across many herds, and balance sheets looked healthier than they had in years. In that environment, deciding to add a pen, upgrade the parlor, or build out the dry cow facilities made a lot of sense. The numbers supported it.

Land-grant extension economists who model these decisions describe a fairly predictable timeline. In those first few months, you’re signing contracts, ordering equipment, and closing on financing. As one University of Wisconsin farm management publication notes, by the time the ink is dry, most of the financial risk is already committed—even though no extra milk has shipped yet.

Through months four to twelve, the facility goes up while you’re either buying bred heifers or ramping up your own replacement program with sexed semen. Cash is flowing out, but the additional milk revenue hasn’t started. Then in months thirteen through twenty-four, those heifers freshen, pens fill, and milk per stall climbs. The challenge is that the broader market—running on that same 18-24 month biological timeline—may have shifted considerably since you started.

Peter Vitaliano, who served as Vice President of Economic Policy and Market Research at the National Milk Producers Federation before retiring at the end of 2024, was already flagging concerns back in February 2024. He noted that “due to a number of factors, we’ll probably see a larger drop than usual” in dairy farm numbers, partly because USDA counts were likely collected before additional farms closed at the end of 2023 due to margin pressure. He added that any margin improvement wouldn’t “constitute anywhere near a full recovery from the financial stress that dairy farms, pretty much of all sizes, are experiencing.”

The 24-Month Trap in Action

I’ve been hearing about situations like this from lenders and consultants: a 900-cow Wisconsin operation signed expansion contracts in early 2024 for 300 additional stalls, with heifers due to freshen by mid-2025. By the time that barn was full, Class III had dropped from the low $20s to around $15.

The extra milk revenue is real, but so is the debt service. Over six months, the gap between projected and actual margins consumed roughly $180,000 in working capital that had been earmarked for feed prepays and equipment upgrades.

The family isn’t in crisis, but there’s no cushion left. They’re working with their lender on revised cash-flow projections and tightening culling criteria to protect equity.

Decisions that made complete sense at $22 milk are now playing out in a $15 world.

Beef-on-Dairy: Real Benefits with Some Unexpected Effects

Beef-on-dairy has been one of the more significant developments in recent years, and it’s delivered genuine value to many operations. At the same time, as it’s scaled across the industry, it’s also changed some dynamics that historically helped balance supply. What I’ve noticed talking with producers is that most understand the benefits clearly—but the systemic effects are only now becoming apparent.

Where the Value Has Been Clear

The research and market data are consistent on this: well-managed beef-on-dairy programs substantially increase calf value compared to straight dairy bull calves. Day-old beef-cross calves often fetch several hundred dollars more, and in program relationships where carcass performance is documented, they can approach native beef calf values.

With milk prices softening in the first half of 2025, beef has become a driver of dairy farm profitability through both cull cows and dairy-beef calves. For many operations, this revenue stream has made a meaningful difference in a tight-margin year.

Some Effects Worth Understanding

What’s become clearer over the past year is how beef-on-dairy interacts with culling decisions and replacement availability when prices fall.

Consider the culling dynamic. A few years ago, that seven- or eight-year-old cow with middling production and some foot issues—bred to a dairy bull and carrying a $50-100 calf—was an easier decision when milk prices dropped. Today, if she’s carrying a beef pregnancy that could bring four figures at calving, the economics pull toward keeping her “one more lactation.” Across a larger herd, those decisions on the bottom 15-20 percent of cows can add meaningful volume that wouldn’t have been in the tank in previous downturns.

| Culling Decision | Daily Milk Revenue | Daily Direct Costs | Daily Net Margin | Strategic Action |

|---|---|---|---|---|

| Keep Low Performer | $9.00 | $8.00 | $1.00 | Deferred culling |

| Replace with High Performer | $13.00 | $9.00 | $4.00 | Aggressive culling |

| Daily Margin Difference | +$4.00 | +$1.00 | +$3.00 | Per stall advantage |

| Impact Over 6 Months | – | – | $540 | Single cow (180 days) |

| Scale: 30 Cows in 600-Cow Herd | – | – | $16,200 | 30 decisions |

On the replacement side, the numbers tell a striking story:

- January 2025 USDA Cattle Report: Dairy replacement heifers over 500 pounds dropped to just 3.914 million head—the lowest since 1978

- Heifer-to-Cow Ratio: 41.9%, the smallest since 1991 (per CoBank lead dairy economist Corey Geiger)

- Primary Driver: More matings going to beef semen, fewer dairy heifer calves being raised

That pruning made sense when heifer-raising costs were high, and beef calves commanded strong premiums. But it also means some operations that would like to cull more aggressively now don’t have the springers available to maintain stall utilization.

And there’s a productivity element worth noting. Because the heifers that are raised tend to come from the top of the genetic pool—identified through genomic testing—they often bring stronger milk and component performance than the animals they replace. Leonard Polzin noted at the 2025 Wisconsin Ag Forum that “despite a 0.35 percent year-to-date decline in total milk production, calculated milk solids production increased by 1.35 percent.” The industry is meeting demand “more quickly than in the past,” even with somewhat fewer total gallons.

None of this suggests beef-on-dairy is problematic. It’s been valuable for many operations. The consideration is managing it as part of an overall herd and business strategy rather than simply as a breeding decision.

Understanding Why Growth Continued

A reasonable question producers ask is why banks, co-ops, and processors kept supporting expansion even as supply signals shifted. You know, it’s easy to look back and wonder what everyone was thinking. But looking at the incentive structures helps explain the pattern—and honestly, it makes more sense than it might first appear.

The Lender Perspective

Ag lenders work within risk models and regulatory frameworks that emphasize historical cash flow, current balance sheet strength, and collateral values. In 2022-2023, many dairy clients showed multiple years of positive returns and improved equity. Land values in dairy regions were firm. Cull cow and breeding stock values had recovered.

Farm finance research consistently shows that lenders lean heavily on these historical and collateral metrics rather than attempting to time commodity cycles. Add competitive pressure—banks and farm credit systems competing for the same well-run operations—and you can see how turning down an expansion with strong historical numbers often meant losing that relationship to a lender willing to proceed.

From the credit committee’s perspective at the time, financing expansion with their strongest clients appeared reasonable and well-supported by the available data. The depth of the 2025 correction wasn’t yet visible in those metrics.

The Processor View

For processors, the math centers on fixed costs and throughput. Depreciation, labor, and energy don’t decline proportionally when a plant runs below capacity. With billions invested in new cheese, powder, and specialty facilities over the past decade, plant managers face pressure to run at high utilization, spread fixed costs effectively, and maintain market share.

That creates incentives to encourage volume growth from existing shippers, sign new suppliers, and move cautiously on base-excess programs that might push producers toward competitors. Some buyers have implemented tiered pricing systems that discount over-base milk, but these tools are often adopted late in the cycle and rarely coordinate across an entire region.

The result is a system in which internal metrics rewarded growth and utilization, even as external data pointed to a building supply. That’s not a criticism—it’s recognizing how institutional incentives shape behavior.

Regional Variations: Same Prices, Different Realities

One aspect that gets lost in national averages is how differently the same price environment affects operations across locations. As many of us have seen firsthand, cost structure, regulatory environment, and market access all matter enormously.

California: Navigating Significant Headwinds

California operations face several overlapping pressures this cycle.

Water constraints continue tightening. Implementation of the Sustainable Groundwater Management Act and new dairy waste discharge requirements from the State Water Resources Control Board are limiting groundwater pumping and establishing stricter nitrate standards in parts of the Central Valley. Environmental compliance costs—for covered lagoons, digesters, and monitoring systems—continue adding capital and operating expenses. And labor costs, housing prices, and land values remain substantially higher than in most other dairy regions.

When Class IV prices are in the low teens and world butter and powder prices are soft, those structural costs make breakeven difficult, particularly for operations that recently invested in facility upgrades. Understandably, some families are evaluating whether another 20-year investment cycle makes sense in that regulatory and cost environment.

Upper Midwest: Cost Structure Advantages

Wisconsin and neighboring states present a different picture.

A November 2024 University of Wisconsin-Madison study found that dairy contributes about $52.8 billion annually to Wisconsin’s economy, with substantial value coming through processing rather than just farm-level milk sales. The region’s processing network has grown considerably, with cheese plant expansions and new facilities drawing milk from an expanding geography. Feed costs benefit from local production, and land and labor costs, while rising, remain below coastal levels.

Low Class III prices continue to pressure margins, and smaller operations face ongoing consolidation. But many Upper Midwest producers describe having a cost structure that provides a path through this downturn with good management, even if it’s not comfortable.

New Zealand: Low Costs, High Exposure

New Zealand’s pasture-based system delivers meaningful cost advantages—solids produced with less purchased feed and lower energy use in favorable seasons. The 2025/26 forecast payout around NZ$10 per kgMS suggests many operations are maintaining positive margins, though narrower than recent years.

The trade-off is exposure. New Zealand sells the vast majority of its production into export markets. Shifts in Chinese demand, Southeast Asian buying patterns, or currency movements translate quickly into payout adjustments. Low production costs provide resilience, but global market volatility is a constant factor.

Europe and South America: Policy and Economic Dynamics

EU production has edged modestly higher overall, but policy pressure to limit cow numbers in high-density areas for environmental reasons is influencing regional patterns. The bloc appears to be shifting toward cheese and higher-value products while moderating output of commodity powders and butter.

Argentina’s production surge—that 10.9 percent first-quarter increase—reflects improved weather and on-farm economics. But Argentine producers also navigate inflation, policy uncertainty, and volatile input costs that can shift margins dramatically in short periods.

The point is that $15 milk creates very different situations in Tulare, Green County, Canterbury, and Santa Fe. Regional context matters enormously.

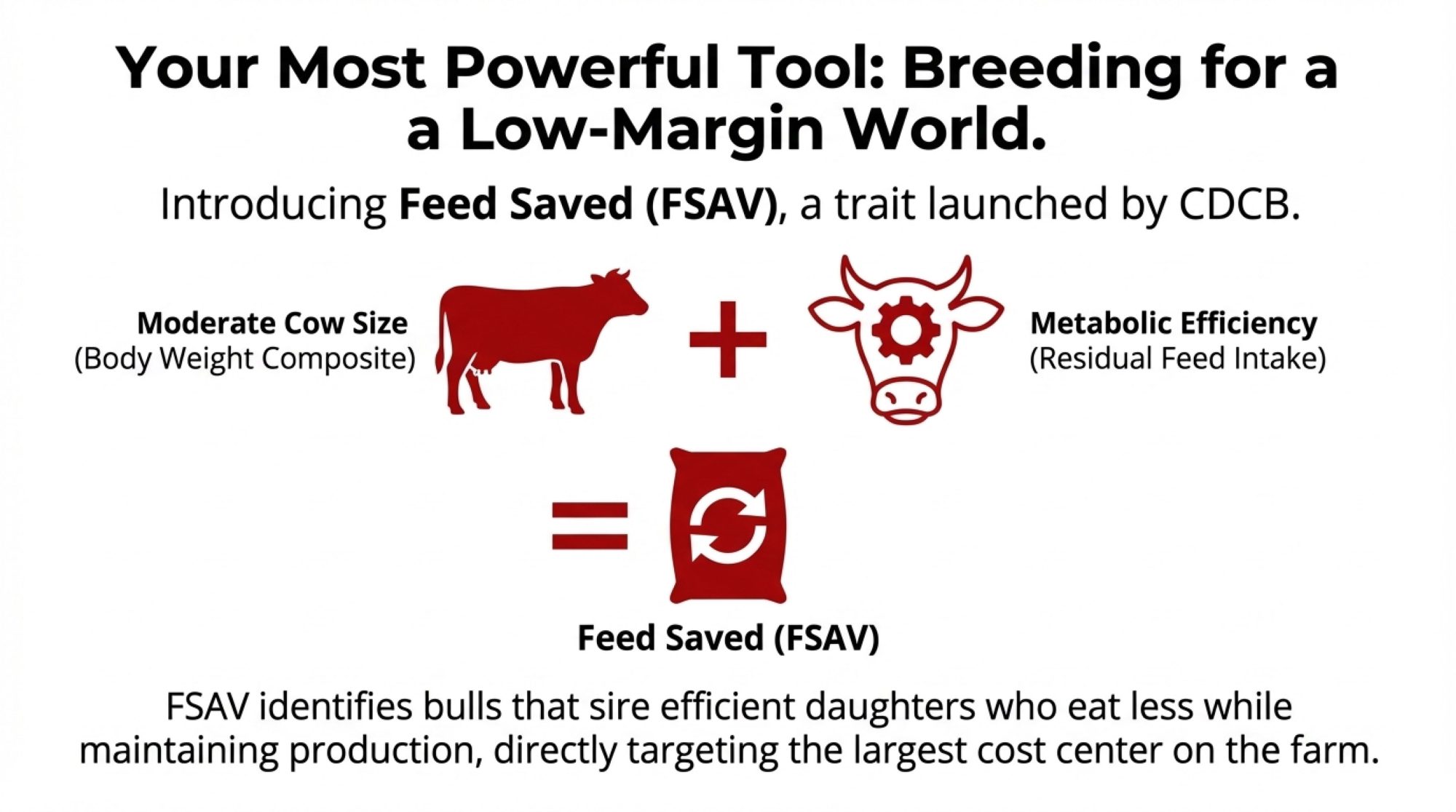

The Breeding Solution: Selecting for Feed Efficiency in a Low-Margin World

Here’s something that deserves more attention in these conversations: your genetic decisions today are one of the most powerful tools you have for navigating tight margins over the next decade. And there are now specific, measurable traits designed exactly for this environment.

Feed Saved: A Trait Built for This Moment

The Council on Dairy Cattle Breeding (CDCB) launched Feed Saved (FSAV) back in December 2020, and it’s become increasingly relevant as margins compress. The trait combines two components:

- Body Weight Composite (BWC): Selecting for moderate-sized cows that require less feed for maintenance

- Residual Feed Intake (RFI): Identifying cows that are metabolically more efficient—eating less than expected based on their production and body weight

According to Holstein USA’s April 2025 TPI formula update, every pound of feed saved returns approximately $0.13 per cow per lactation. That might sound modest, but across a 500-cow herd over multiple generations, the cumulative impact is substantial.

What’s particularly interesting is the research backing this. A November 2024 study published in Frontiers in Geneticsexamining genomic evaluation of RFI in U.S. Holsteins found that the difference between the most and least efficient first-lactation cows averaged 4.6 kg of dry matter intake per day—while producing similar amounts of milk. Over a 305-day lactation, that’s a significant difference in feed costs. The same study found even larger spreads in second-lactation animals.

How the Industry Is Weighting Efficiency

The April 2025 Net Merit update from CDCB reflects this shift. As Holstein Association USA’s TPI formula now shows:

- Production (including Feed Efficiency): 46% of total index weight

- Feed Efficiency $ Index: Combines production efficiency, lower maintenance costs from moderate body weight, and better feed conversion (RFI)

What’s encouraging is that research shows meaningful genetic variation in feed efficiency—the November 2024 Frontiers in Genetics study found RFI heritability in lactating U.S. Holsteins at approximately 0.43 (43%), indicating substantial potential for genetic progress through selection. That’s higher than many health and fertility traits, which means you can actually move the needle on this.

| Efficiency Metric | Daily Feed (lbs DM) | Annual Feed Cost @ $0.12/lb | Milk Production (lbs/day) | Breeding Strategy Impact |

|---|---|---|---|---|

| Standard Efficiency Cow | 55 | $2,409 | 85 | Baseline |

| High Efficiency Cow (Feed Saved) | 50 | $2,190 | 85 | RFI + Feed Saved traits |

| Annual Advantage per Cow | -5 lbs/day | $219 saved | Same output | Immediate selection |

| 500-Cow Herd Annual Impact | – | $109,500 | Same output | Herd-wide savings |

| 10-Year Genetic Improvement | – | $1,095,000 | Same output | Compound benefits |

Practical Application

For producers looking to incorporate feed efficiency into their breeding programs:

- Look for bulls with positive Feed Saved (FSAV) values in their genomic evaluations

- Consider Body Weight Composite alongside production traits—extreme frame size increases maintenance costs

- Balance feed efficiency with health and fertility traits; the most efficient cow isn’t profitable if she doesn’t breed back or stay healthy

- Work with your AI representative or genetics consultant to model how different selection emphases might affect your herd’s economics over 5-10 years

This isn’t about abandoning production goals. It’s about recognizing that in a low-margin environment, the cow that produces 85 pounds while eating 10% less feed may be more profitable than the cow producing 90 pounds at average efficiency.

What the More Resilient Operations Have in Common

Every downturn separates operations that preserve equity and position well for the recovery from those that don’t. Several patterns are emerging among farms navigating this cycle effectively—and what’s encouraging is that most of these are things within a producer’s control.

Making Culling Decisions with Better Data

Operations that are doing well are generally bringing greater precision to culling. That means tracking income over feed cost by pen or individual cow, using parlor data and feed records to identify animals that are not covering their direct costs, plus a reasonable share of overhead. It means using genomic information and reproductive performance to spot heifers and cows unlikely to generate positive returns. And it means connecting culling plans to realistic replacement availability rather than culling until pens feel empty and then scrambling for springers.

The math consultants’ walk-through is straightforward: a cow generating $9 in milk revenue and consuming $7 in feed, plus $1 in bedding, breeding, and health costs, clears $1 in labor, debt, and margin costs. Replace her with a fresher or higher-producing animal netting $4 daily above direct costs, and over six months, that stall contributes $720 more. Scale that to 30 similar decisions in a 600-cow herd, and the difference exceeds $20,000 in half a year. That kind of analysis is making some producers more willing to make uncomfortable culling decisions earlier.

Managing Margins Rather Than Guessing Prices

Another pattern is shifting from attempting to call price tops to protecting survivable margin ranges.

Dairy Margin Coverage continues providing value for eligible operations, particularly smaller herds. A 2025 Government Accountability Office review noted that USDA paid out nearly $2.7 billion more to DMC participants than it collected in premiums from 2019 through 2024—significant catastrophic protection.

More operations are using Dairy Revenue Protection to establish floors on portions of future production, sometimes combined with feed contracts that define at least a rough margin band. The approach isn’t about optimizing returns; it’s about narrowing the range of outcomes to avoid truly damaging quarters.

Suppose you haven’t explored these tools recently. In that case, your local FSA office or an extension dairy specialist can walk you through current enrollment options and help you model how different coverage levels might fit your operation’s risk profile.

Treating Beef-on-Dairy as a Managed Program

Operations that consistently achieve value from beef-on-dairy tend to approach it systematically rather than opportunistically. That means selecting sires with documented growth, feed efficiency, and carcass data—often aligned with specific feedlot or packer programs. It means coordinating with buyers on calving timing, health protocols, and genetics to capture available premiums. And it means maintaining enough high-merit dairy genetics to ensure replacement availability as conditions change.

This program approach doesn’t eliminate beef market volatility, but it improves the odds of consistent returns and preserves flexibility on the dairy side. If you’re looking to establish these relationships, many breed associations and AI companies now maintain lists of feedlots and packers actively seeking dairy-beef partnerships.

Continuous Focus on Feed Efficiency

Feed remains the largest expense for most operations, and in low-margin periods, every pound of dry matter needs to perform. The farms that manage well keep returning to fundamentals: grouping by lactation stage so rations match requirements, reducing shrink through bunker management and feed-handling practices, and monitoring feed efficiency as a core metric.

Relatively modest improvements—a tenth or two-tenths improvement in feed efficiency, a few percentage points less silage waste—can represent $0.50-1.00 per hundredweight in income over feed cost. Across millions of pounds of annual production, that compounds into meaningful dollars.

Looking Toward 2027-2028: Reasonable Expectations

Forecasting specific prices years out isn’t realistic, but we can identify directions based on current trends and policy trajectories. These are scenarios, not predictions—individual outcomes will vary considerably.

The consolidation pattern is well-documented. Lucas Fuess, Senior Dairy Analyst at Rabobank, noted in his analysis of the 2022 Census of Agriculture that the U.S. lost nearly 40 percent of its dairy farms between 2017 and 2022—from about 39,300 to around 24,000—while total production rose because “larger farms show lower production costs.” This downturn will likely accelerate that trend.

By the late 2020s, several developments seem probable:

The total number of licensed U.S. dairies may fall below 20,000, with an increasing share of national volume coming from herds milking several hundred to several thousand cows. Regional patterns may sharpen, with lower-cost areas—much of the Upper Midwest and Central Plains—holding or gaining share, while higher-cost, more regulated regions see gradual declines in cow numbers as families choose not to reinvest. Beef-on-dairy will likely remain prevalent but may stratify further between well-structured programs that capture consistent premiums and undifferentiated approaches that face greater volatility.

Globally, New Zealand will remain important in the powder and butterfat markets, while the EU continues to shift toward cheese and value-added products within environmental constraints.

The Bottom Line

These are the conversations I’m hearing producers have with their teams, advisers, and families. Every operation faces unique circumstances, and general advice only goes so far—but these questions seem to be helping people think through their situation:

- Where are you in your own expansion timeline? How many heifers are scheduled to freshen over the next 18-24 months? Do those numbers align with what your facilities, labor, feed base, and market access can profitably support at current price levels?

- Do you have clear visibility on cow-level economics? Which animals are covering feed plus a reasonable share of labor, debt, and overhead—and which aren’t? What would tightening culling criteria by 5-10 percent look like, and is your replacement pipeline ready for that?

- How much of your margin is protected versus hoped for? What portion of the next 12-24 months could you realistically put under DMC, DRP, or forward contracts? Have you had direct conversations with your lender about your risk management approach?

- Is your beef-on-dairy program intentional? Do you know what your calf buyers specifically want, and are you breeding to those specifications? Are you confident that your current approach will leave enough high-quality dairy replacements for the herd you want to be running in three years?

- Are your genetic criteria aligned with a low-margin reality? Are you selecting strictly for high production, or are you also prioritizing Feed Saved, moderate frame size through Body Weight Composite, and Residual Feed Intake to lower lifetime maintenance costs? In an environment where feed represents 50-60% of production costs, breeding decisions made today will shape your cost structure for the next decade.

- Are you making decisions for this week or for the next several years? Culling, breeding, feeding, capital allocation, and even family succession—are these being decided tactically or within a longer-term framework?

This cycle is demonstrating that individually sensible decisions—expanding when returns were strong, adding beef value to calves, filling new processing capacity—can produce collective oversupply when everyone responds to the same signals simultaneously. None of us individually controls global supply and demand. What each operation can control is understanding its position within the bigger picture, knowing its own numbers thoroughly, and using available tools—biological, genetic, and financial—to improve the odds of still being here, on your own terms, when conditions improve.

KEY TAKEAWAYS

- This is a global supply collision, not a demand problem. The U.S., EU, New Zealand, and Argentina all expanded at once—yet exports hit record highs. Pure oversupply.

- The 24-month trap is unforgiving. Decisions that made sense at $22 milk are now delivering into a $15 market. Biology doesn’t wait for prices to recover.

- Beef-on-dairy reshaped the culling equation. Replacement heifers dropped to 3.9 million—the lowest since 1978—limiting flexibility exactly when operations need it most.

- Resilient dairies share three priorities: precision culling based on income over feed cost, margin protection through DMC and DRP, and breeding for feed efficiency traits.

- Consolidation will accelerate—preparation separates outcomes. Producers who know their numbers and deploy available tools now will emerge stronger when markets turn.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The 90-Day Dairy Pivot: Converting Beef Windfalls into Next Year’s Survival – Reveals a tactical 90-day action plan for stacking cull cow revenues, beef-on-dairy premiums, and component bonuses to create the liquidity needed to bridge the gap between today’s costs and the next recovery cycle.

- The $11 Billion Reality Check: Why Dairy Processors Are Banking on Fewer, Bigger Farms – Analyzes why processors are accelerating capital investments despite low margins and how their shift toward exclusive supply contracts is permanently altering the competitive landscape for mid-sized operations.

- The Energy Efficient Dairy Cow: Leveraging Genetics and Nutrition for Sustainable Dairy Farming – Explores the specific genetic traits and nutritional strategies behind Feed Efficiency, providing the technical roadmap for breeding cows that maintain production while consuming significantly less dry matter.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!