Just as we have learned with the Rebels versus the Republic in Star Wars, the Stud wars are far from over. However, instead of clones we have Genomic Sires versus Proven Sires and large A.I. companies versus smaller organizations. The April 2014 genetic evaluations have seen the gap between the haves and have nots decrease. Many of the larger studs that had in the past not focused on Genomic sires greatly increased their genomic offerings and some of the smaller studs greatly increased their niche market offerings. Stud Wars, like Star Wars, thrive on new releases, talent, unexpected changes and rivalries.

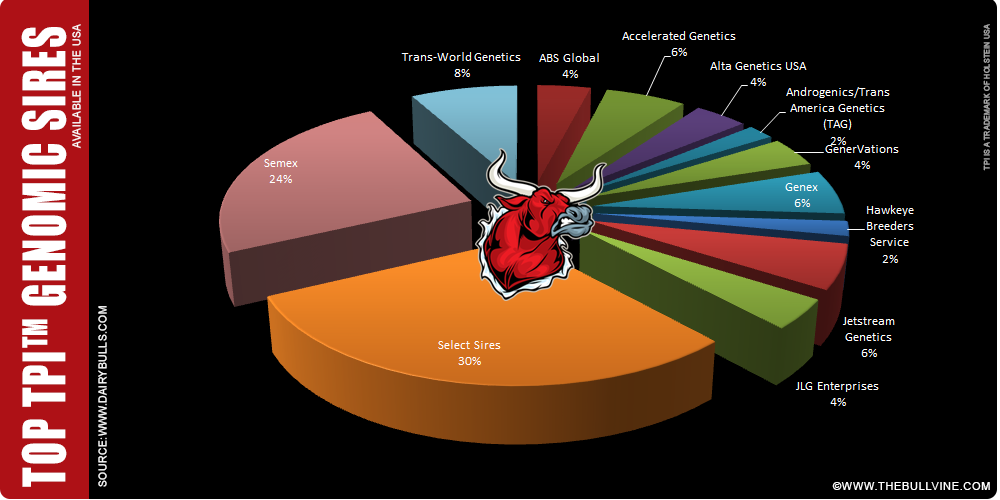

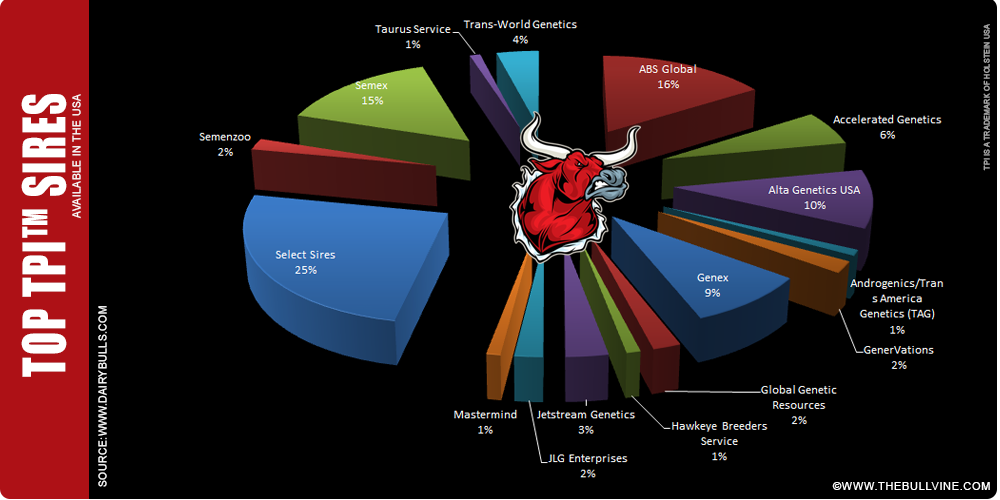

TPI

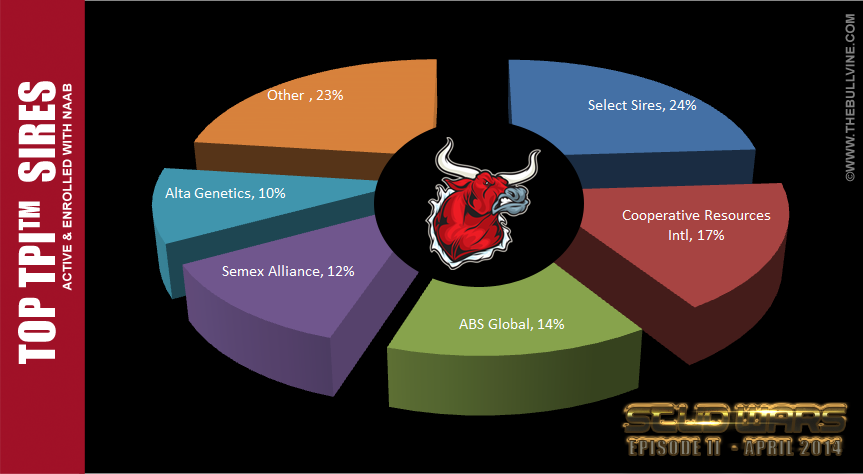

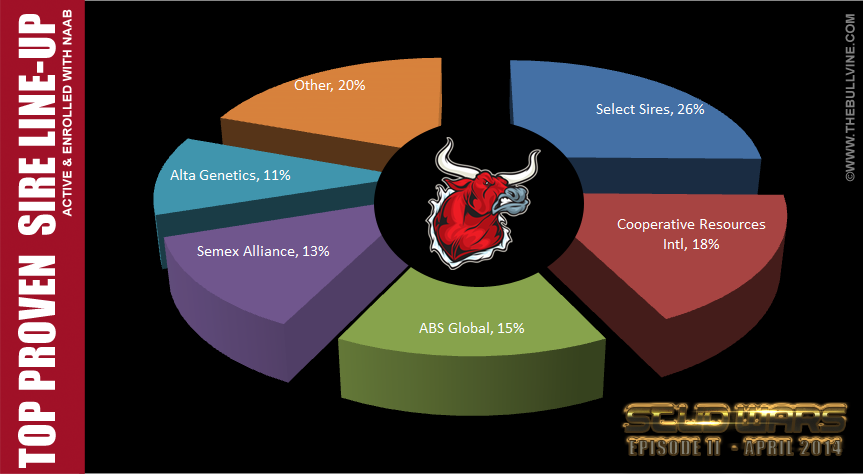

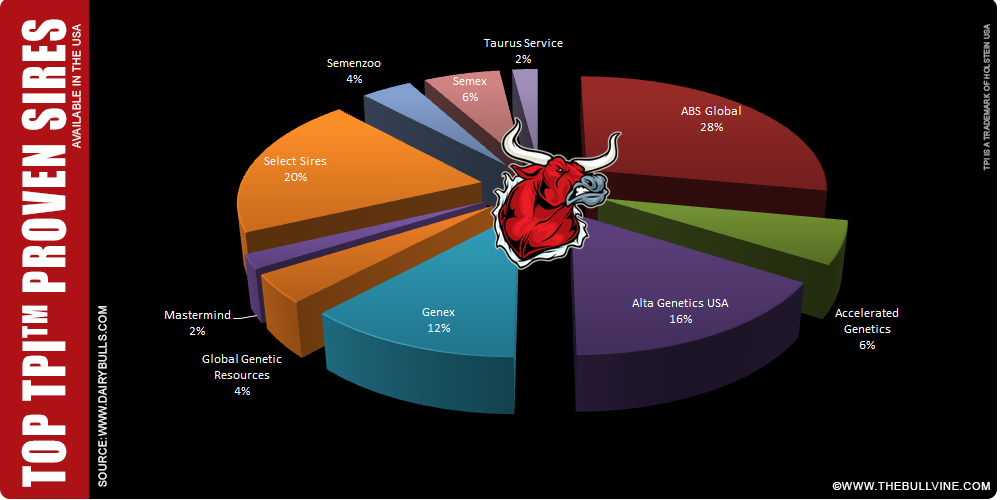

As we found in our initial stud wars (Stud Wars – The Battle for A.I. Supremacy), market share of the pre-genomic era correlates very highly with the big five being ABS, Select Sires, Alta Genetics, Accelerated Genetics and CRI. Since the last proof run, Select Sires has taken over the top spot with two more sires entering the top 50, and CRI has doubled the number of proven sires they had in the top 50 TPI to move into the #2 Spot. Former #1 holder ABS Global has dropped from 14 sires to 11 in the top 50 TPI and now holds the #3 position. A sign of the time is the way Accelerated has dropped market share.

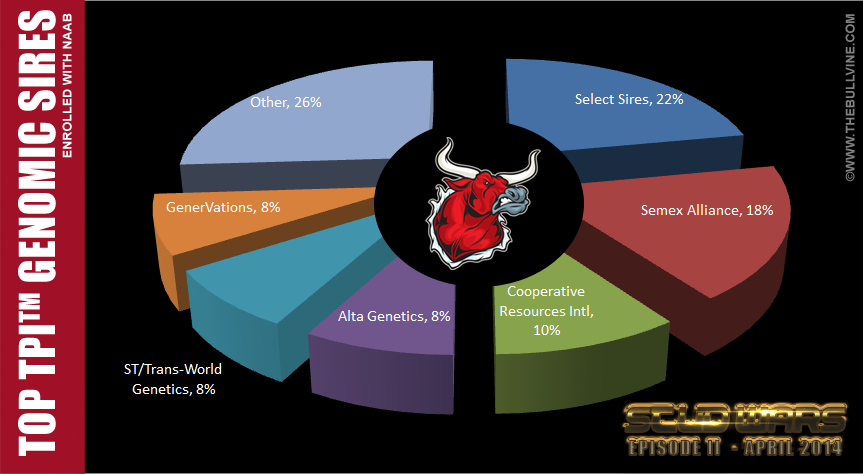

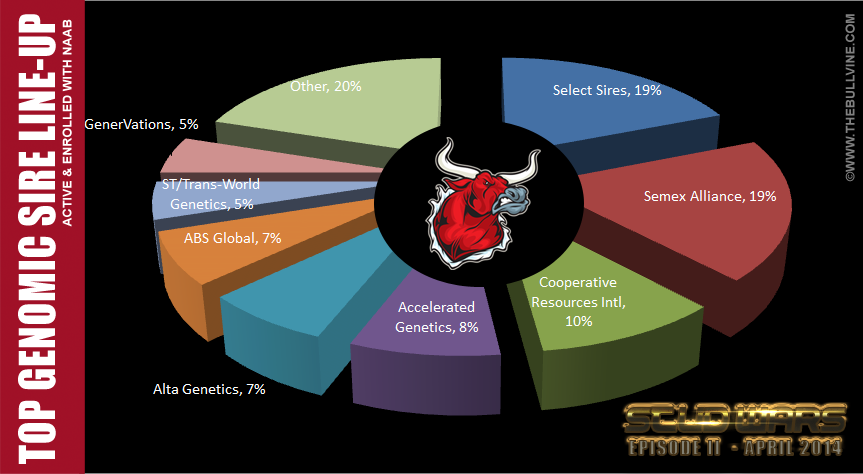

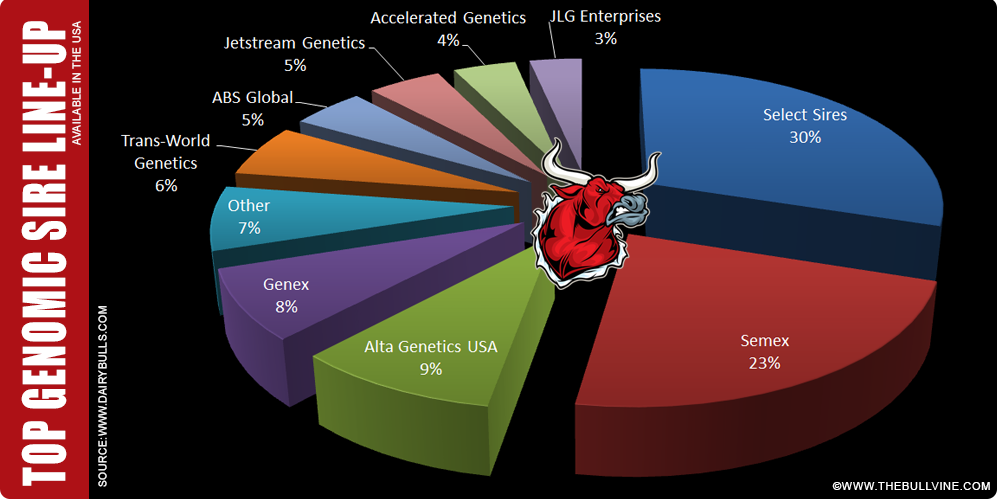

Both our previous gTPI leaders from December 2013 have dropped but still hold the #1, Select Sires, and #2 Semex spots on our list. Making a significant jump on the list is CRI who now holds the #3 spot on the list with 5 sires in the top 50 gTPI. Also seeing an increase is Alta Genetics who now has 4 sires in the top 50 gTPI.

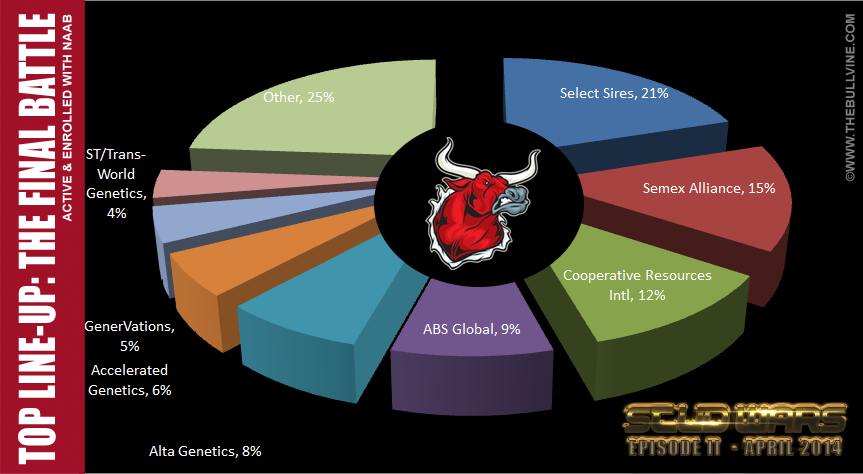

Select Sires continues to lead the way with top TPI offerings both Genomic and Proven. Making a jump into the #2 spot, thanks to an increase in their top TPI proven sires, is CRI. They are followed by Semex who continues to have a strong Genomic TPI offering. .

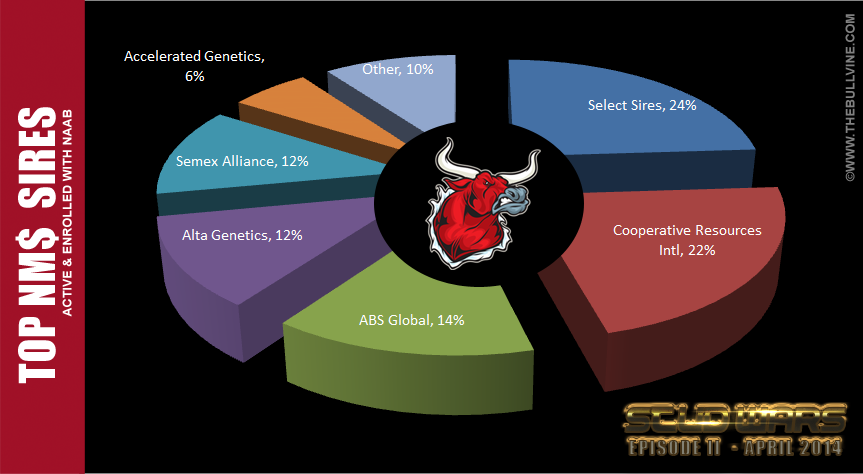

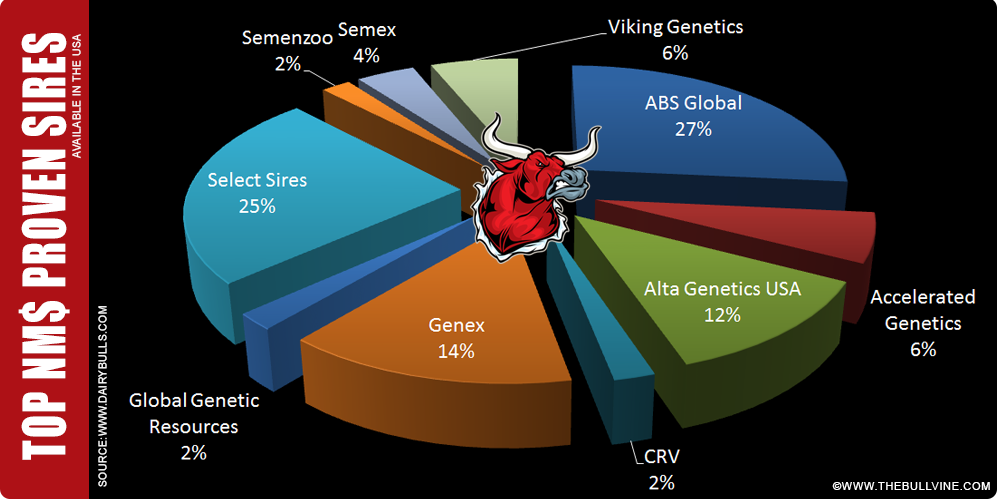

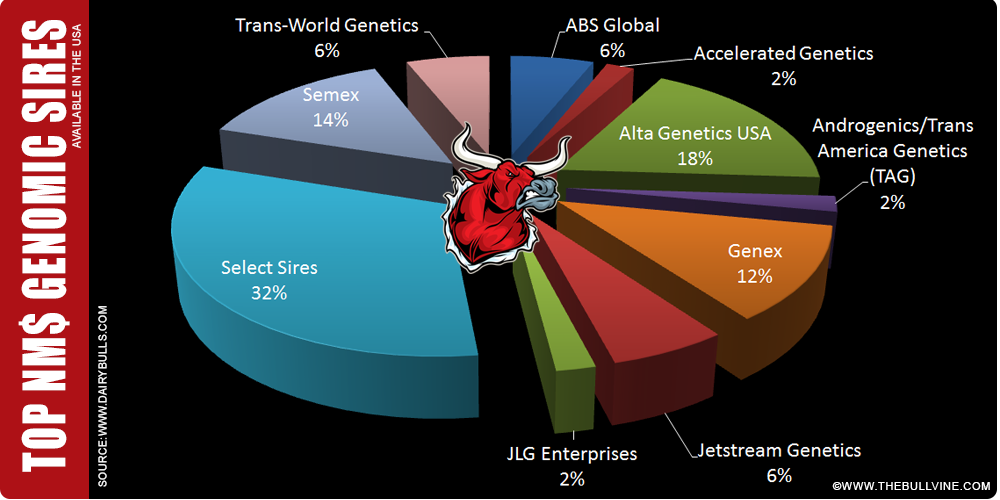

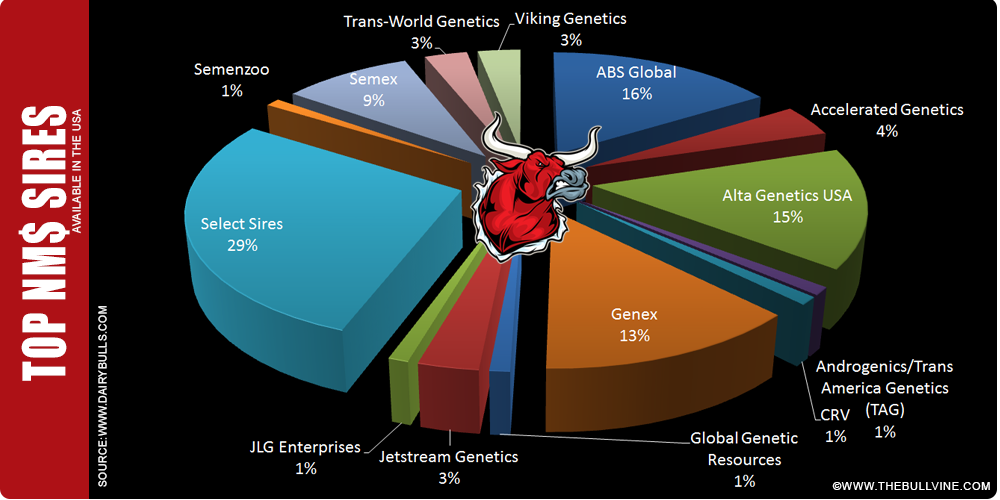

NM$

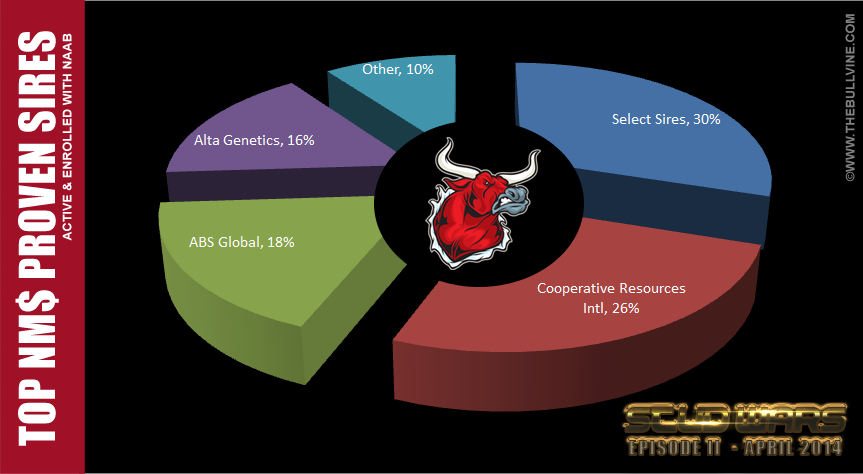

It is no surprise that, for the larger AI centers, the focus on the commercial producer market continues to dominate the proven NM$ list. Select Sires moves into the #1 position with the two additional sires in the top list, with CRI moving into the #2 position, almost doubling the number of top 50 NM$ sires they have to offer. Dropping significantly was ABS Global who now finds themselves in the #3 position with 5 fewer sires in the top 50 NM$ list.

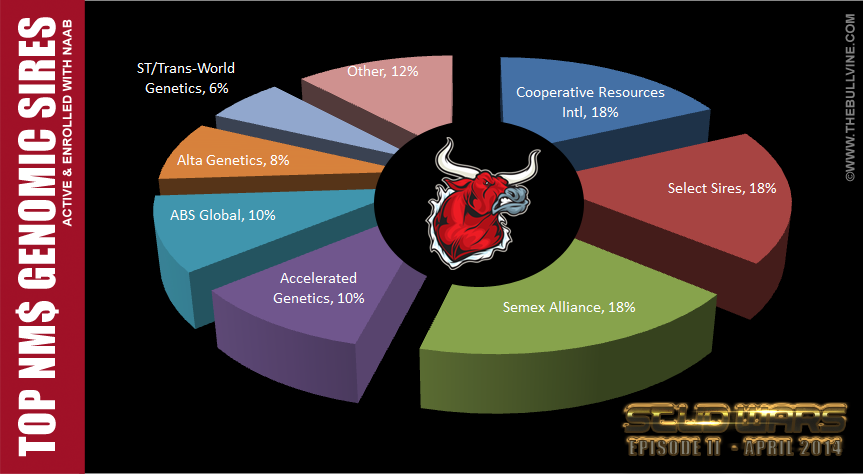

A list that was dominated last round by Select Sires who had 32% of the top sires, now finds them tied with CRI and Semex – all with 18% each. Also seeing a significant drop in top gNM$ sires is Alta Genetics who went from 9 last round to just 4 this round.

On the strength of their strong proven and genomic NM$ offering, Select Sires retains the strongest NM$ offering in the US. Thanks to a significant investment in Genomic sires CRI now find themselves with the 2nd strongest NM$ offering.

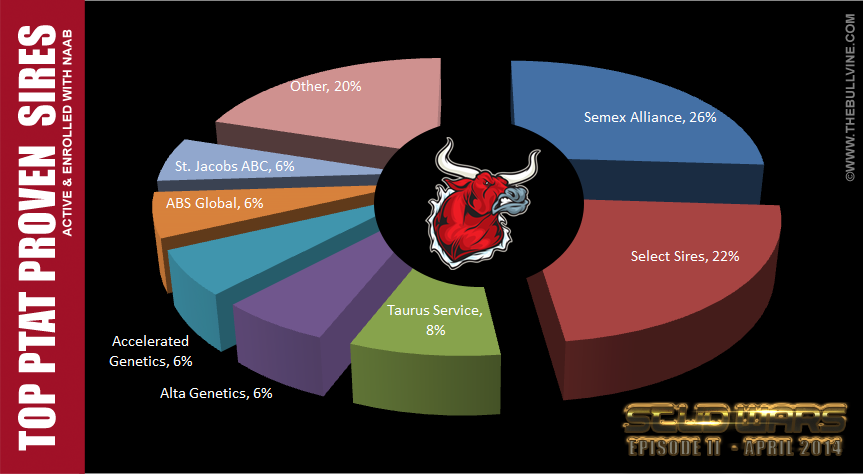

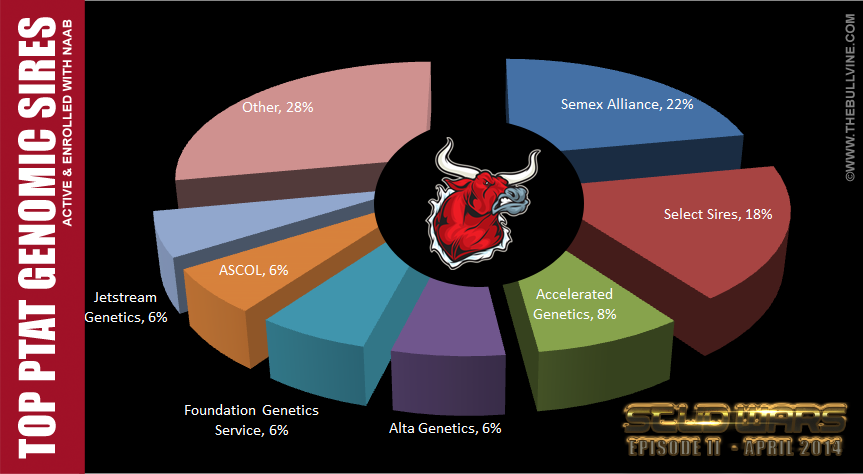

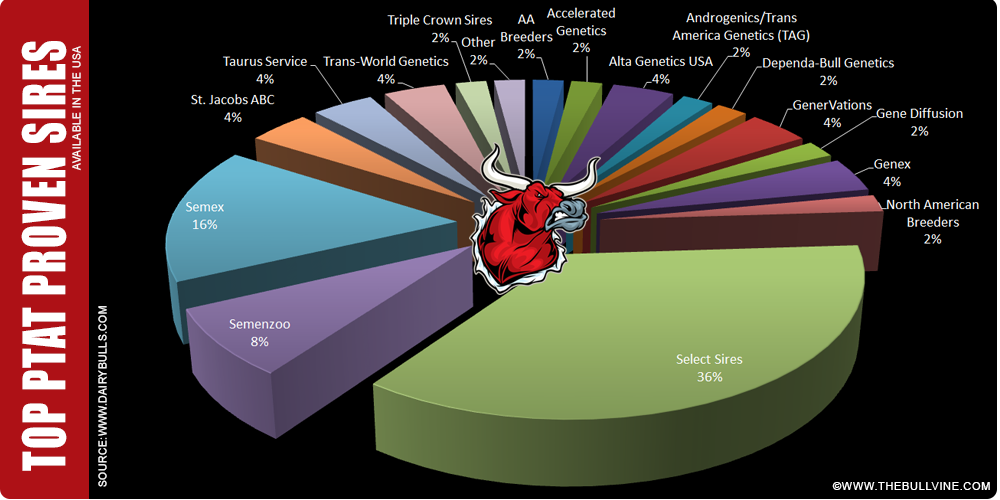

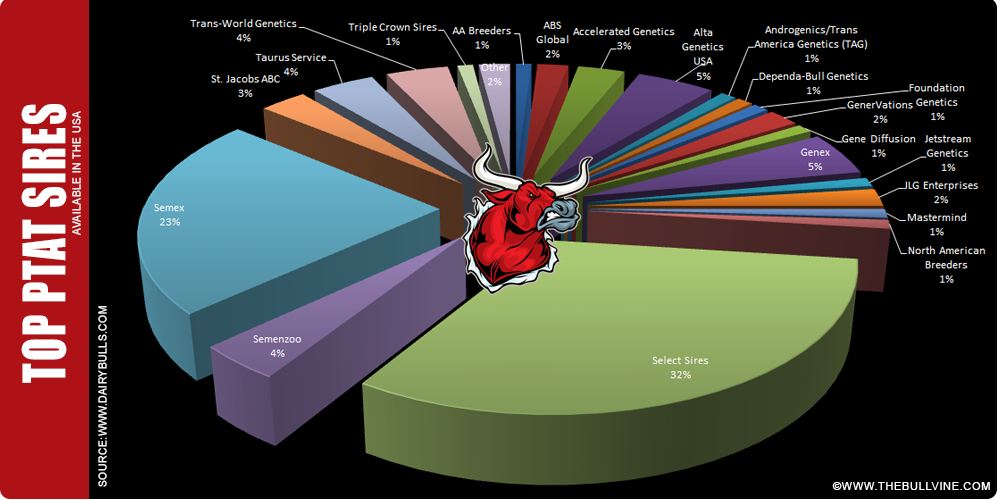

PTAT

Probably one of the most significant changes of this proof round is Semex moving into the strongest type proven sire offering in the world, with 5 more proven sires moving into the top 50 PTAT. Former #1 Select Sires goes from having 18 sires in the top 50 to 11 and holds the #2 spot.

When it comes to the top 50 Genomic PTAT sires, Semex and Select Sires still top the list, but both have seen significant declines in totals. Many small A.I. studs now find themselves with 1 to 3 sires in the top 50.

On the strength of a greatly improved proven type sire line up, Semex now find themselves on top of the overall PTAT list, followed by Select Sires. However the ever increasing trend continues where more and more smaller AI organizations have a top 50 PTAT proven or genomic sire.

Polled

As we continue to see trends change in the industry, we see the sire line-ups in key markets are also starting to change. Nowhere is it more evident than in the polled trend. With that in mind, we decided to add two key niche markets to our stud wars analysis: (1) polled TPI sires and (2) Red type sires. For both of these lists we are using the top 50 proven or genomic sires.

Not surprising DairyBullsOnline.com the Polled specialists lead the list. Followed by Select Sires and GenerVations.

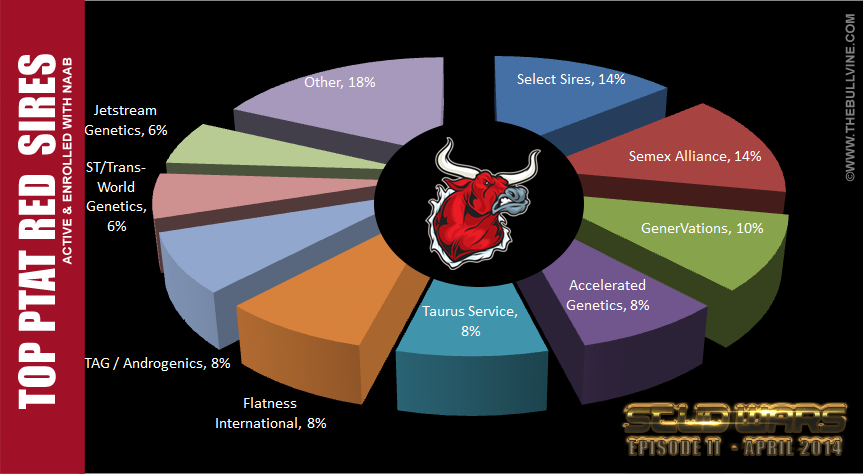

PTAT R&W SIRES

As we saw in the overall PTAT list, Semex and Select Sires continue to lead the way in type offerings. Also similar to the B&W PTAT lists, we find a number of smaller studs also offering 1-4 of the top red and white sires.

The Bullvine Bottom Line

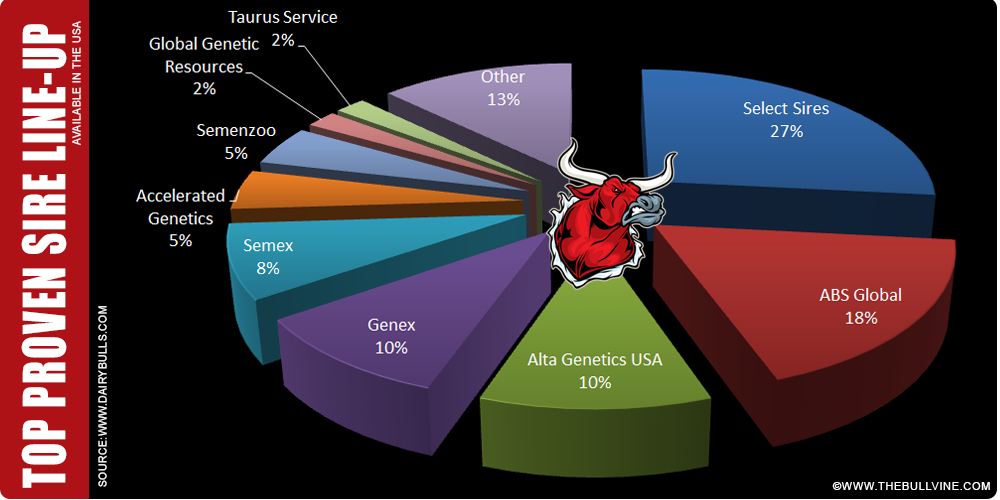

Holding strong with the best proven sire line-up is Select Sires. Seeing a significant increase and moving into the 2nd strongest proven sire line-up position is CRI. They rise on the strength of their significant increase in top NM$ proven sires. Also seeing an increase and moving into the #3 position is ABS Global. Semex finds themselves with 15 less proven sires on our top lists and drops from the #2 position in December to the #4 position currently.

Tied at the top genomic for genomic sires are Select Sires and Semex. These are the same two studs that ranked #1 and #2 last round. Moving up 2 spots from last round is CRI, powered by a significant investment in top gNM$ sires. Also making a strong showing is the Sexing Technologies / Trans-World Genetics partnership powered by their agreement with the EDG group, who own many of the top genomic females in the world.

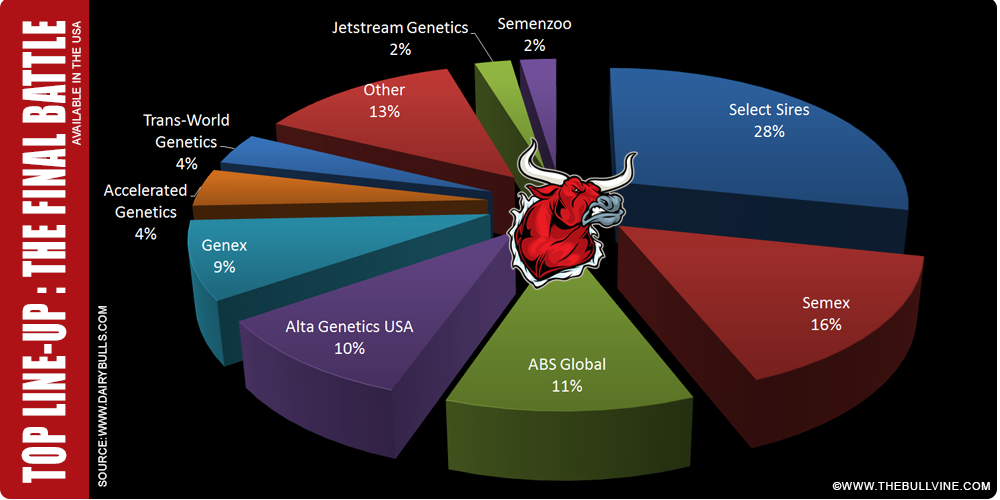

Retaining the title of as the strongest overall sire line-up is Select Sires, though it should be noted that Select went from 28% of the top sires in December 2013 to 21% this time. Holding steady with increases in their proven sire line-up and slight decreases in their genomic sire line-up, Semex comes in as the 2nd strongest sire line-up. Moving up to the #3 sire line-up with significant improvements in their proven TPI sire line-up as well as genomic offerings is CRI. ABS Global and Alta Genetics round out the top 5.

Join us in staying tuned to the next order of business in the expanding universe of the Stud Wars.

For complete genetic evaluations from around the world click here.

Get original “Bullvine” content sent straight to your email inbox for free.