Digesters: $100/cow. Beef crosses: $250/calf. Carbon credits: $28K. When milk becomes your SMALLEST revenue, you survive.

EXECUTIVE SUMMARY: Traditional dairy economics no longer exist—milk production rises 7.5% while prices crash 29% because half of the global supply doesn’t need milk profits anymore. Six structural forces —from European cooperatives locked into accepting all production to U.S. farms earning $100/cow from digesters —have permanently broken market self-correction mechanisms. This isn’t temporary: 40-50% of U.S. milk now comes from multi-revenue operations that profit even at $12/cwt, while conventional farms need $17/cwt to survive. The 2026-2027 shakeout will consolidate 25-40% of production into mega-dairies as thousands of single-revenue farms exit. But you can act now: implementing beef-on-dairy generates $15,000-20,000 annually with one phone call to your breeding tech—no loans, no construction. The divide is clear: farms with multiple revenue streams will thrive at prices that bankrupt traditional operations. Your survival depends on recognizing this transformation isn’t cyclical—it’s permanent.

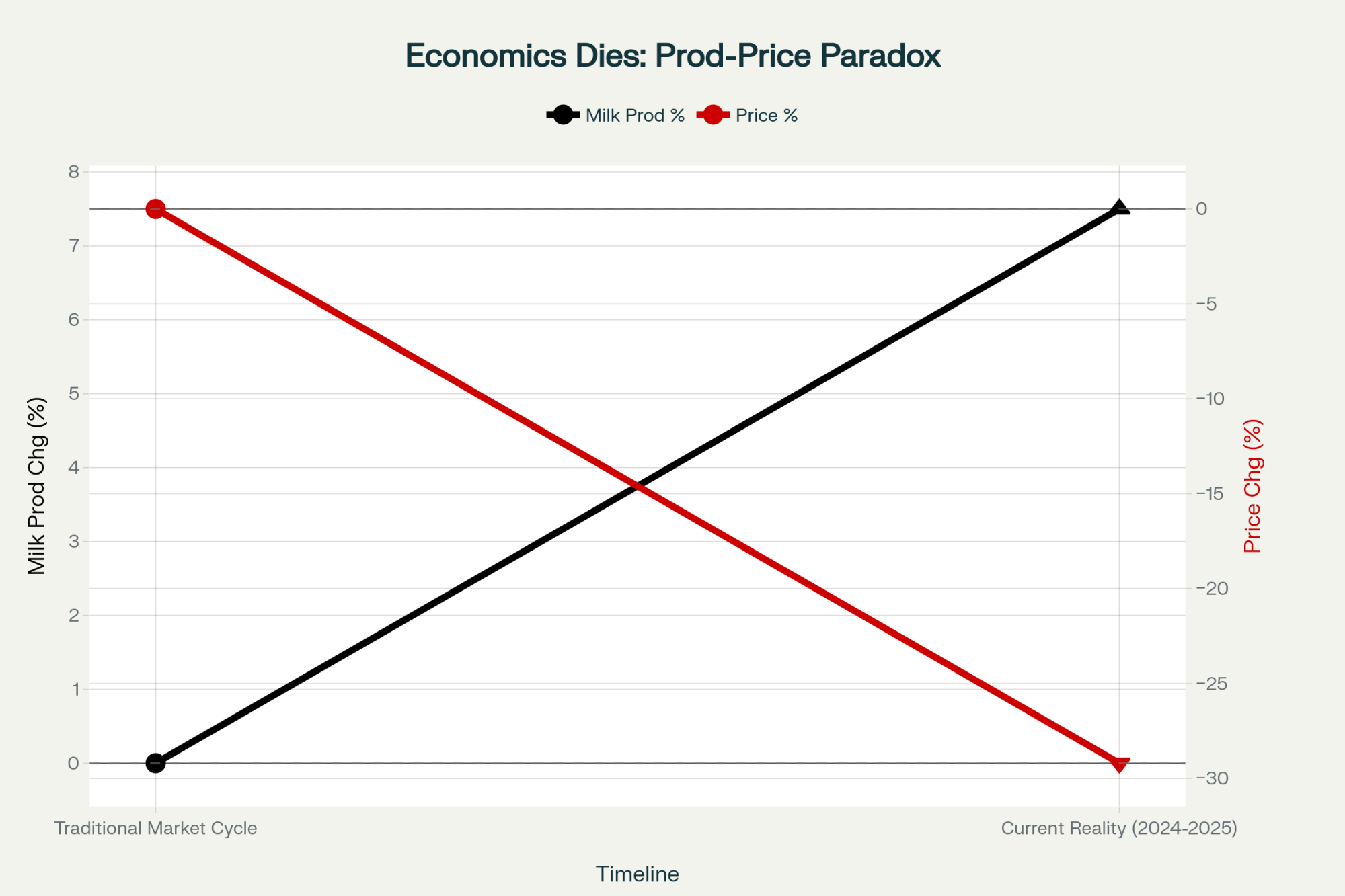

I recently reviewed the UK’s latest production figures from AHDB Dairy, and something remarkable stood out. Milk output increased 7.5% while butter prices declined 29.2% year-over-year. This pattern extends across Europe—Poland’s growing 5.7%, Italy expanding 3%. Meanwhile, European Commission data shows cheese prices down 33-37% across varieties.

What’s particularly noteworthy is how this contradicts everything we thought we knew about market dynamics. When prices fall by a third, producers should reduce output. Basic economics, right? Yet that’s not happening, and understanding these dynamics becomes essential for navigating what lies ahead.

My analysis of Global Dairy Trade auctions, European Energy Exchange futures, and USDA production reports reveals something striking: approximately half of the global milk supply now operates under economic principles different from those we traditionally understood. This shift affects every segment of our industry, from family farms to mega-dairies, from local cooperatives to multinational processors.

Six Structural Forces Reshaping Market Dynamics

Through extensive analysis of production patterns and discussions with industry professionals across multiple regions, I’ve identified six key factors preventing traditional market corrections. As many of us have observed, these aren’t temporary disruptions—they’re permanent structural changes.

1. Cooperative Frameworks and Supply Obligations

European cooperatives manage approximately 60% of the continent’s milk, according to data from the European Dairy Association. What’s interesting here is how these systems operate under unique structural constraints that essentially lock in production.

Within these frameworks, members maintain contractual obligations to deliver their full production, while cooperatives must accept all member milk regardless of market conditions. Think about operations like Dairygold in Ireland—when most members have committed their supply through formal agreements, the cooperative can’t refuse deliveries even when tanks are full and prices are in the basement.

This represents a significant structural difference from the flexibility many North American producers experience. I’ve noticed that producers in Wisconsin or California often don’t fully appreciate how these European constraints ripple through global markets.

2. Infrastructure Investment and Economic Lock-In

Modern dairy facilities require substantial capital that creates what I call “economic handcuffs.” Current robotic milking systems range from $150,000 to $250,000 per unit, according to Lely and DeLaval specifications. The University of Wisconsin Extension‘s latest facilities guide indicates modern freestall barns require $2,000-3,500 per cow space.

Do the math on a 200-cow operation—you’re looking at $2-3 million in specialized assets. And here’s what keeps me up at night: agricultural equipment values have declined significantly, with virtually no secondary market for used robotic milkers.

Cornell’s agricultural economics research demonstrates what we’re seeing firsthand—operations continue production as long as variable costs are covered, even when they’re bleeding red ink on total costs. It’s rational for the individual farm, but it perpetuates the oversupply problem.

3. Agricultural Support Programs and Income Stability

The European Union’s Common Agricultural Policy represents a €291.1 billion commitment from 2021-2027. What farmers are finding is that these payments, primarily based on land area rather than production, create income stability that’s independent of milk prices.

Research from Wageningen University indicates CAP payments constitute 30-40% of net farm income for many European operations. I’ve spoken with numerous Irish producers whose single farm payments—typically €15,000-20,000 annually—provide the cushion that keeps them milking when prices tank.

While these programs successfully maintain rural communities (and that’s important), they also reduce the supply response we traditionally expected during downturns.

4. Energy Production and Alternative Revenue Streams

This development changes everything about dairy economics. EPA’s AgSTAR program data shows methane digesters generate $80-100 per cow annually through renewable natural gas contracts. California Air Resources Board reports indicate some operations earn $2-3 per hundredweight from energy alone.

A senior consultant recently told me, “We’re approaching a point where milk becomes the co-product of energy production.” That might sound extreme, but look at the numbers…

California operations with 10-15 year renewable natural gas contracts can’t reduce cow numbers without breaching agreements worth millions. With over 200 digester projects operational or under construction, according to the California Department of Food and Agriculture, this fundamentally alters production incentives.

5. Environmental Compliance and Capital Lock-In

Environmental regulations create an interesting paradox. I recently spoke with a Vermont producer who invested approximately $275,000 in manure separation and phosphorus recovery to meet Required Agricultural Practices regulations.

“When you’ve invested that much in compliance infrastructure,” he explained, “continuing at marginal returns often makes more sense than exiting and losing everything.”

This becomes especially complex for operations with succession plans. Kids wanting to farm face tough choices between continuing marginally profitable operations or walking away from family legacies.

6. Beef-on-Dairy Programs: Accessible Revenue Diversification

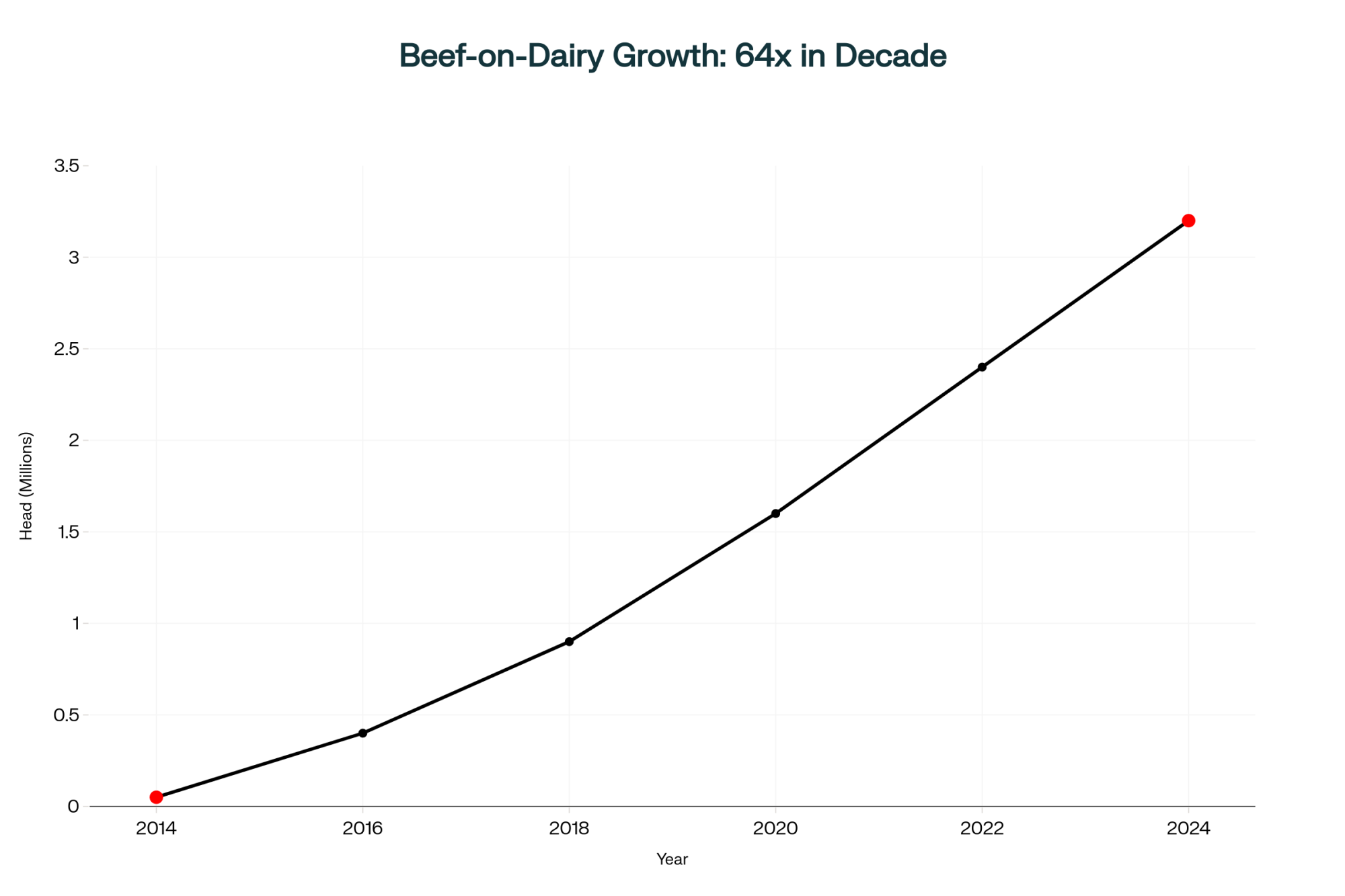

Here’s a revenue stream that deserves particular attention because it’s accessible to everyone. USDA Agricultural Marketing Service data from October shows beef-cross dairy calves commanding $200-300 premiums over Holstein bulls. Regional auctions report Angus-Holstein crosses averaging $450-500 while Holstein bulls struggle to hit $200.

Industry breeding data suggests 30-40% of U.S. operations now use beef semen for 20-50% of breedings, up from under 10% five years ago. A 100-cow dairy breeding 30 animals to beef genetics at a $250 premium generates $7,500additional revenue—roughly 50¢ per hundredweight across total production.

Penn State’s dairy genetics team has documented how these programs provide crucial diversification for operations of all sizes, making it a key survival strategy in the current market environment.

Understanding Multi-Revenue Economics

The transformation from single to multiple revenue streams represents a paradigm shift in how we think about dairy profitability.

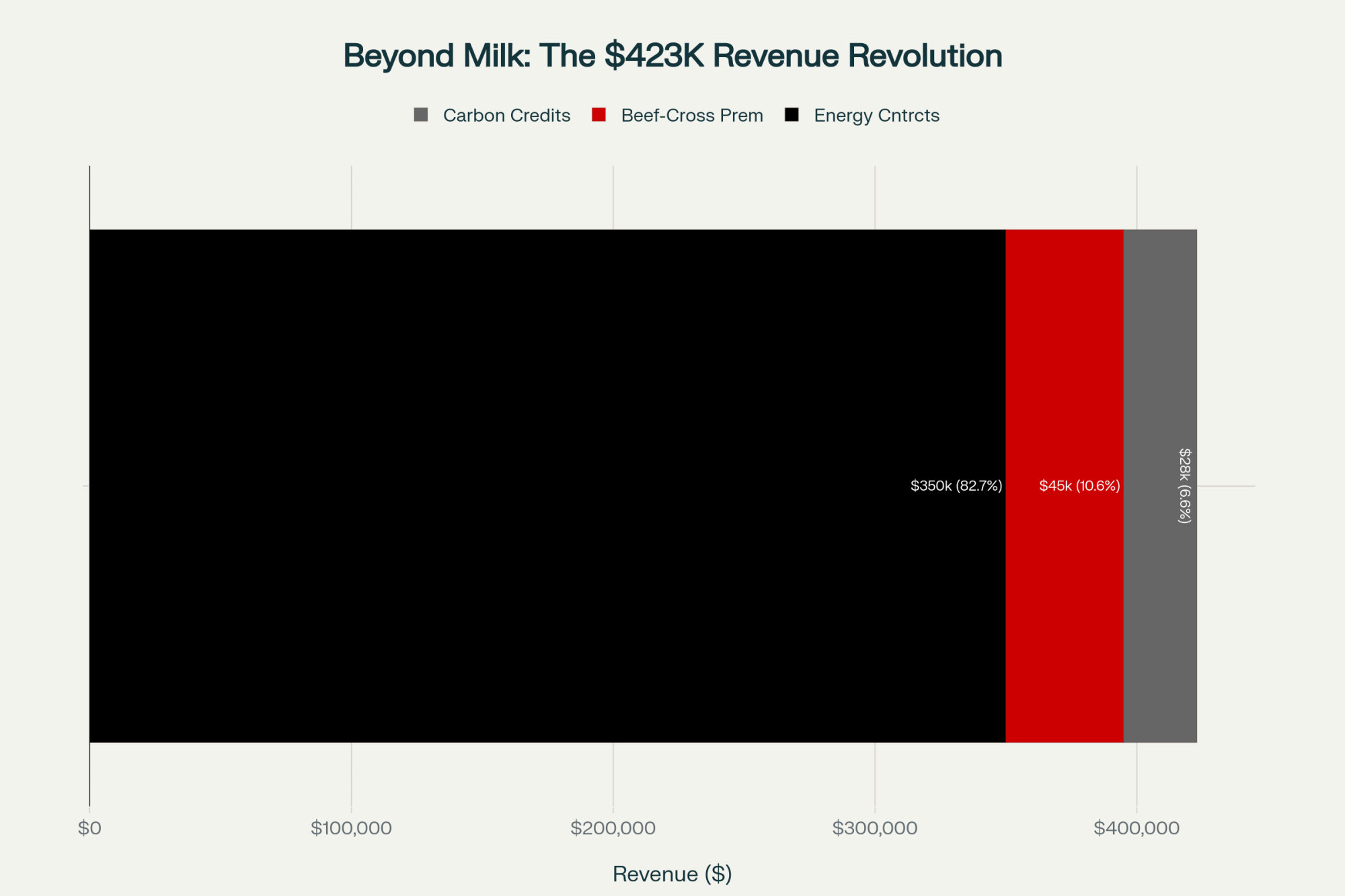

I recently analyzed a 3,500-cow California operation that illustrates this perfectly. Their annual alternative revenue includes:

- Energy contracts: $350,000

- Beef-cross premiums: $45,000

- Carbon credits: $28,000

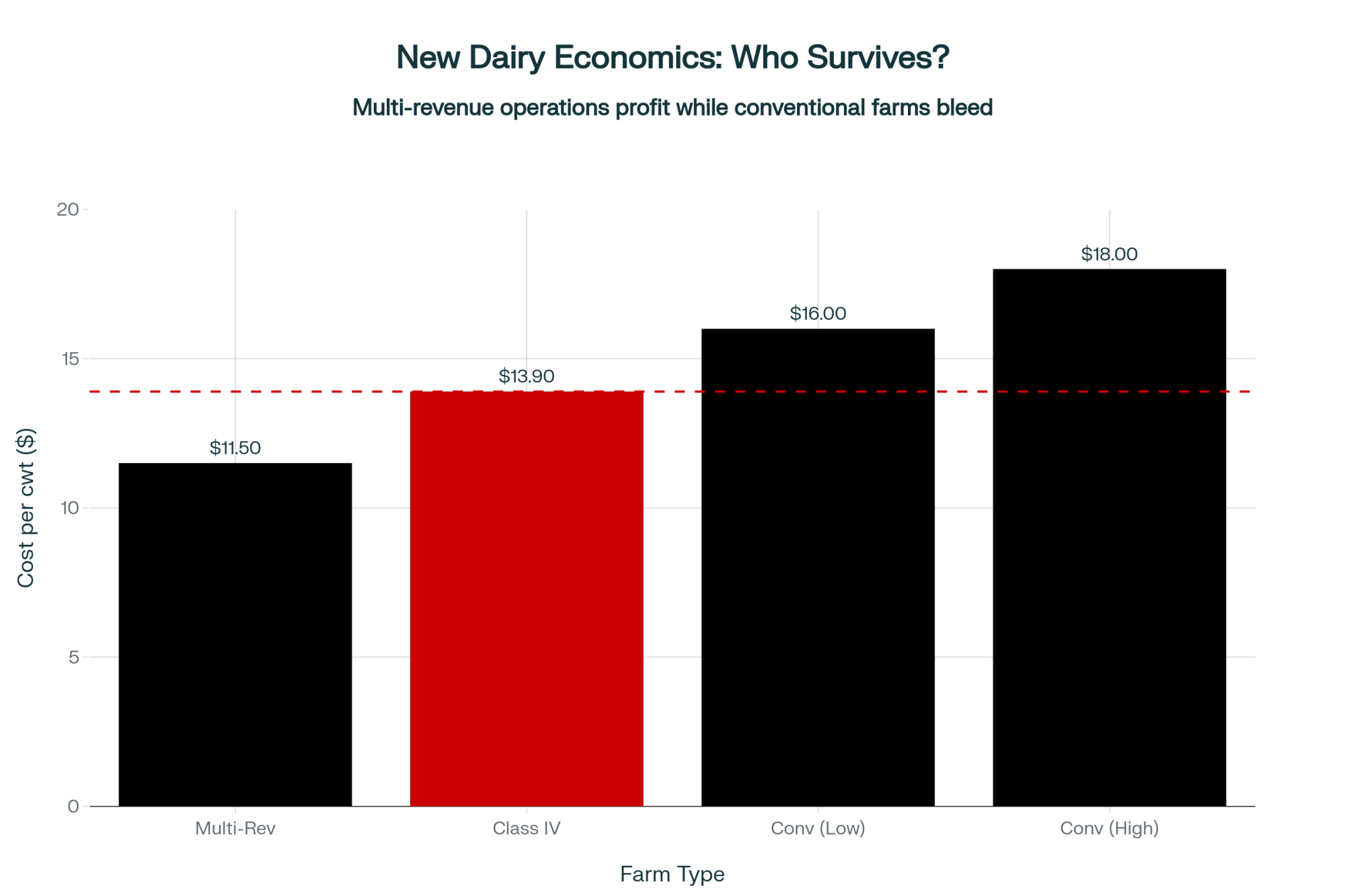

That’s over $400,000 in non-milk revenue, roughly $3 per hundredweight. Their effective break-even after all revenue streams? About $11.50/cwt. Meanwhile, University of California Cooperative Extension data shows conventional neighbors need $16-18/cwt just to cover costs.

With November’s CME Class IV at $13.90, multi-revenue operations maintain positive margins while single-revenue neighbors hemorrhage cash daily.

Scale of the Transformation

EPA’s AgSTAR database documents over 270 digesting operations covering approximately 10% of the national herd. The California Energy Commission reports $522 million in private investment in digester projects.

When we combine operations with digesters, beef programs, carbon credits, and solar leases, approximately 40-50% of U.S. milk production now comes from farms with significant non-milk revenue. Traditional supply response? It’s essentially dead.

Processor Adaptation Strategies

Processors aren’t sitting idle—they’re repositioning aggressively. The whey market tells the story.

The Whey Market Divergence

While CME Class IV futures languish at $13.90-14.00/cwt through March 2026, dry whey hit nine-month highs at 71¢/pound—16¢ above the March-September average according to USDA Dairy Market News.

Why this divergence? Three factors stand out:

First, clinical guidelines for GLP-1 medications like Ozempic recommend 1.2-1.5 grams of protein per kilogram body weight to preserve muscle during weight loss. Whey’s amino acid profile makes it ideal.

Second, the sports nutrition market will reach $27.6 billion by 2030, up from $15.6 billion in 2022, with whey representing 70% of protein supplement sales.

Third, technology breakthroughs—companies like Milk Specialties Global have developed clear, fruit-flavored protein beverages that expand beyond traditional shake consumers.

Strategic Processing Investments

The International Dairy Foods Association reports over $11 billion in new processing capacity through 2027. Valley Queen Cheese Factory’s South Dakota expansion illustrates the strategy—management emphasizes whey and lactose demand drives growth planning, not cheese.

These processors recognize that a predictable milk supply from multi-revenue farms justifies substantial investments in protein concentration. Cheese enables whey capture—the latter increasingly drives decisions.

Global Price Transmission Mechanisms

Recent GDT auctions showed whole milk powder down 0.5%, European powder fell 2% per CLAL monitoring, and U.S. nonfat dry milk hit 13-month lows at $1.1325 CME spot. Three different structures, identical direction.

How Arbitrage Enforces Price Discipline

Import buyers consistently report shifting purchases immediately when New Zealand, German, or Wisconsin prices show 5% differentials. The Global Dairy Trade platform, with hundreds of bidders trading 10 million metric tonsannually, creates transparent global price discovery.

Structural Supply Rigidity Everywhere

All major exporters demonstrate inflexibility:

- Fonterra must accept all shareholder milk (82% of New Zealand production)

- European cooperatives, plus CAP support, maintain production regardless of price

- U.S. operations with digester/beef revenue lock in production for years

When China’s imports grow just 6% versus the historical 15-20% (USDA Foreign Agricultural Service), no region possesses quick adjustment mechanisms.

Anticipated Market Evolution: 2026-2027

Based on financial indicators, here’s what I expect:

Q4 2025 – Q1 2026: Credit Market Adjustment

Financial institutions report rising delinquencies. Some require quarterly rather than annual production reports. American Farm Bureau data shows Chapter 12 bankruptcies increased 55% in 2024—that trend continues.

Q2-Q3 2026: Initial Consolidation

Credit-constrained operations begin exiting, but milk production doesn’t disappear—it consolidates. I’m seeing California Central Valley operations with 5,000+ cows buying neighboring 500-cow dairies as satellites.

Q4 2026 – Q2 2027: Structural Realignment

Analysis suggests Class IV stabilizes around $15.00/cwt—sufficient for multi-revenue operations but challenging for conventional single-revenue farms.

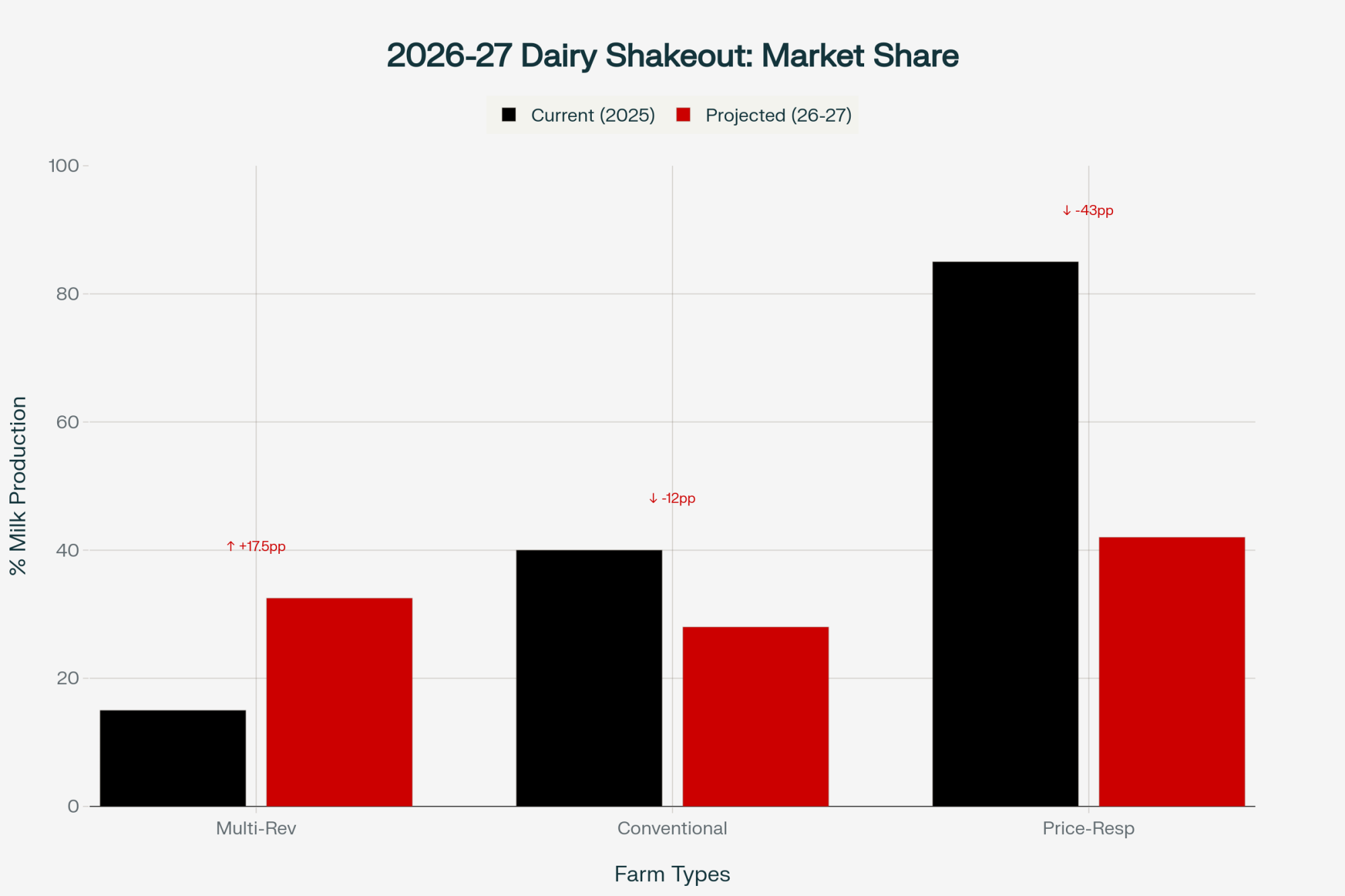

By mid-2027:

- Multi-revenue mega-dairies: 25-40% of supply (up from 15%)

- Conventional small farms: 26-30% (down from 40%)

- Price-responsive segment: Under 45% (down from 85%)

This represents permanent transformation, not cyclical adjustment.

Southeast Asian Trade: Realistic Assessment

October’s agreements with Malaysia, Cambodia, Thailand, and Vietnam generated optimism. Let’s examine the actual impact.

USDA data shows current exports to these nations total $335 million—just 4% of our $8.2 billion total. Mexico alone buys $2.47 billion.

Even assuming aggressive growth, additional exports might reach $150-200 million by 2027—roughly 750 million pounds milk equivalent. But U.S. production ranges from 6.8 to 9.1 billion pounds annually. Southeast Asia absorbs 8-11% of growth—helpful but not transformative.

These agreements benefit operations with scale, integrated processing, and West Coast proximity—not the Wisconsin 300-cow farm facing bankruptcy.

Strategic Guidance by Operation Type

Small-to-Medium Conventional (100-500 cows)

Post-crisis prices around $14.85/cwt for Class IV are likely to fall below your break-even. University of Minnesota’s FINBIN shows operations this size need $15.50-17.50/cwt.

Immediate action: Implement beef-on-dairy tomorrow. Breeding 30-40% to beef generates $150-250/calf premium. For 200 cows, that’s $15,000-20,000 annually. Call your breeding tech today.

Exit strategies: Chapter 12 provisions offer tax advantages when properly structured. Timing matters as provisions may change.

Expansion: Only viable with 40%+ equity. Reaching 1,500+ cows requires $3-5 million in capital.

Metric | Holstein Bull Calf | Beef-Cross Calf | Premium/Advantage |

|---|---|---|---|

| Market Value | $150-200 | $450-500 | $250-300 |

| Current Adoption | N/A | 30-40% of farms | Growing rapidly |

| Breeding % | 100% dairy | 20-50% beef | Strategic flexibility |

| Capital Required | $0 | $0 | Zero investment |

| Annual Revenue (100 cows, 30% beef) | N/A | $7,500-9,000 | Immediate impact |

| Per Cwt Benefit | N/A | +$0.50/cwt | Pure profit add-on |

Large Conventional (500-1,500 cows)

You’ll survive but face persistent margin pressure. Push beef-on-dairy toward 40-50% if heifer inventory allows. Lock processor relationships now. Watch for acquisition opportunities.

Near gas pipelines? Seriously evaluate digesters—the economics are compelling, especially with access to infrastructure.

Integrated and Mega-Dairy Operations

The next 24 months present strategic opportunities: favorable asset acquisitions, long-term processor contracts, and continued revenue diversification. Don’t overestimate Southeast Asian volumes—focus on operational efficiency and strategic positioning.

The Bottom Line

What we’re witnessing represents market evolution driven by technology and policy, not temporary failure. The emerging industry will be more concentrated, less price-responsive, and fundamentally different.

Traditional boom-bust cycles are giving way to persistent equilibrium at lower prices, with alternative revenue determining competitive advantage. I know this challenges everything many of us learned. The farm I grew up on wouldn’t survive today’s reality.

But early recognition creates options. Waiting for “normal” to return? That normal no longer exists.

Operations understanding these structural changes will define the next era. Those managing based solely on milk prices risk missing critical competitive factors.

Your strategic window remains open, but it won’t remain open indefinitely. Whether implementing beef-on-dairy, evaluating energy opportunities, or planning transitions, purposeful action becomes essential.

In this evolving dairy economy, standing still means falling behind. The fundamentals have shifted, and our strategies must evolve accordingly. While challenging, this transition creates opportunities for those prepared to adapt.

Together, we’ll navigate this transformation. But success requires understanding the forces at work and a willingness to embrace new models. The path forward demands both realism about challenges and optimism about opportunitiesfor those ready to evolve.

KEY TAKEAWAYS:

- Critical Market Intelligence Traditional dairy economics is dead: Half of global milk supply doesn’t need milk profits—digesters generate $100/cow, beef-on-dairy adds $250/calf, making $12/cwt profitable while you need $17/cwt

- Immediate opportunity: Implement beef-on-dairy tomorrow for $15,000-20,000 annual revenue with zero capital investment—just one call to your breeding tech

- Six permanent forces guarantee oversupply: European cooperatives must accept all milk, U.S. farms locked into 10-15 year energy contracts, and CAP subsidies cushion losses

- 2026-2027 consolidation inevitable: 25-40% of milk production shifting to multi-revenue mega-dairies as thousands of conventional farms exit at $15/cwt prices

- Your choice is binary: Develop multiple revenue streams now or exit within 24 months—waiting for market recovery means waiting for something that won’t happen

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Will Your Dairy Farm Survive the Next Decade? The Brutal Math of Consolidation – This strategic analysis digs into the math behind the consolidation wave. It reveals the cost-per-cow advantages of mega-dairies and the specific “scale or pivot” dilemma facing producers, reinforcing the main article’s 2026-2027 forecast.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – While the main article highlights the “economic handcuffs” of capital investment, this piece details the ROI. It quantifies the 60% labor savings and data advantages, explaining why producers are making the multi-million dollar investments that lock in production.

- Europe’s Strategic Dairy Revolution: Why Cutting Herds is Making Producers Rich – This article provides a powerful alternative tactic. Instead of just adding revenue, it demonstrates how to achieve profitability through strategic contraction, using precision culling and component optimization to boost per-cow margins and cut feed costs.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!