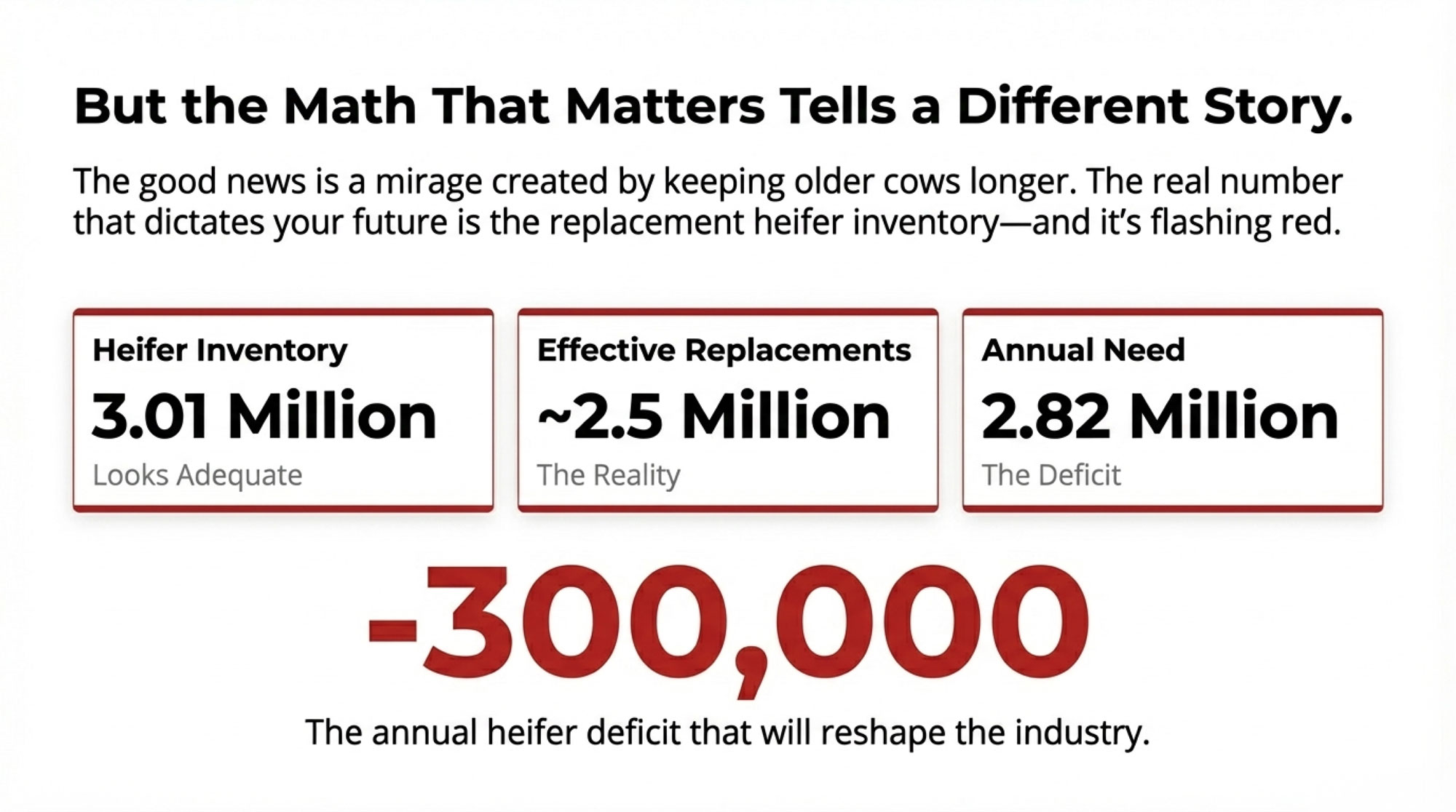

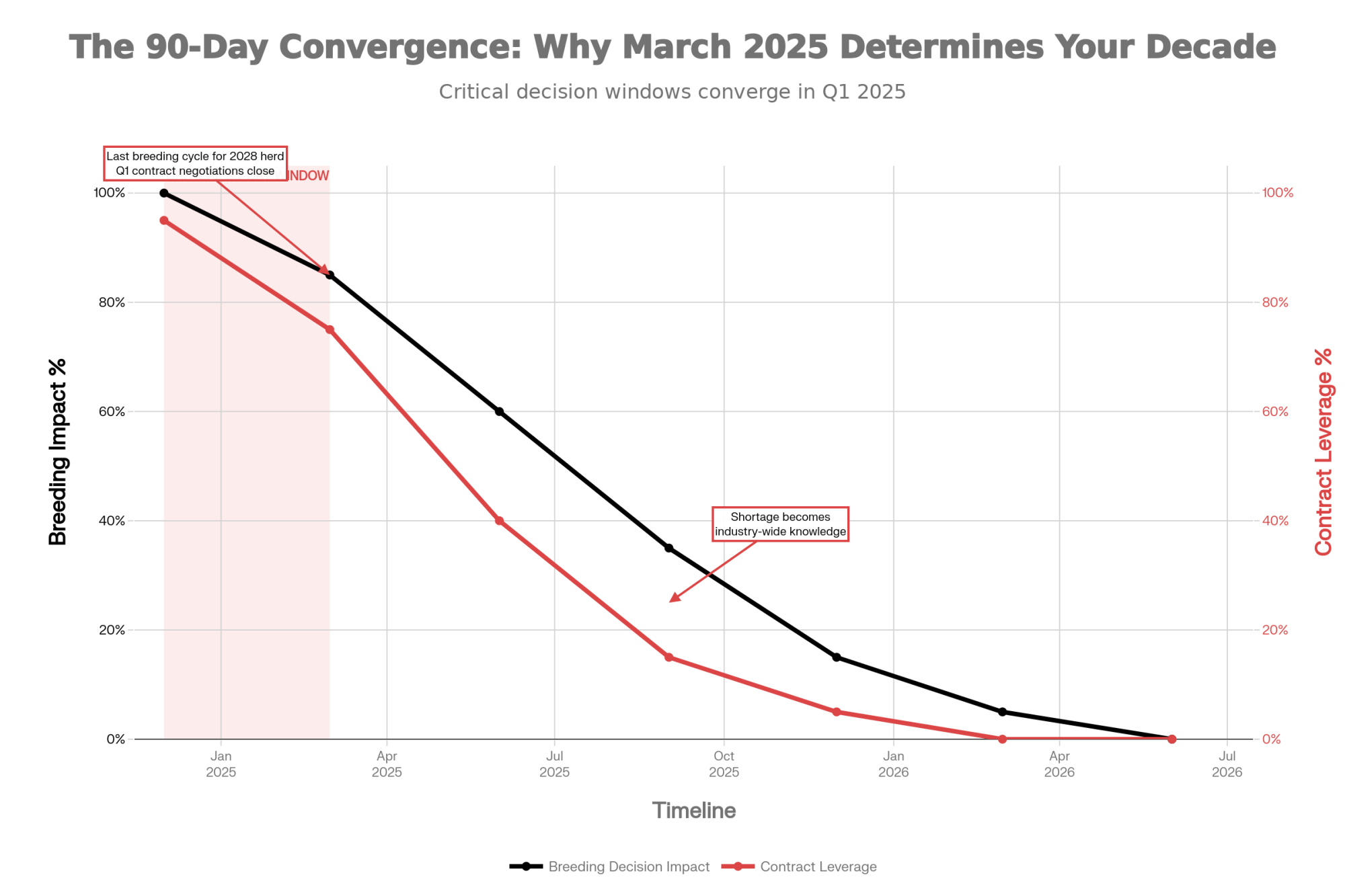

Here’s what USDA’s numbers aren’t saying: we’re producing 2% more milk by keeping older cows longer, not breeding better replacements. Heifer inventory: 3M. Effective after losses: 2.5M. Need: 2.8M. Q1 2025 contract negotiations may be your last window for leverage.

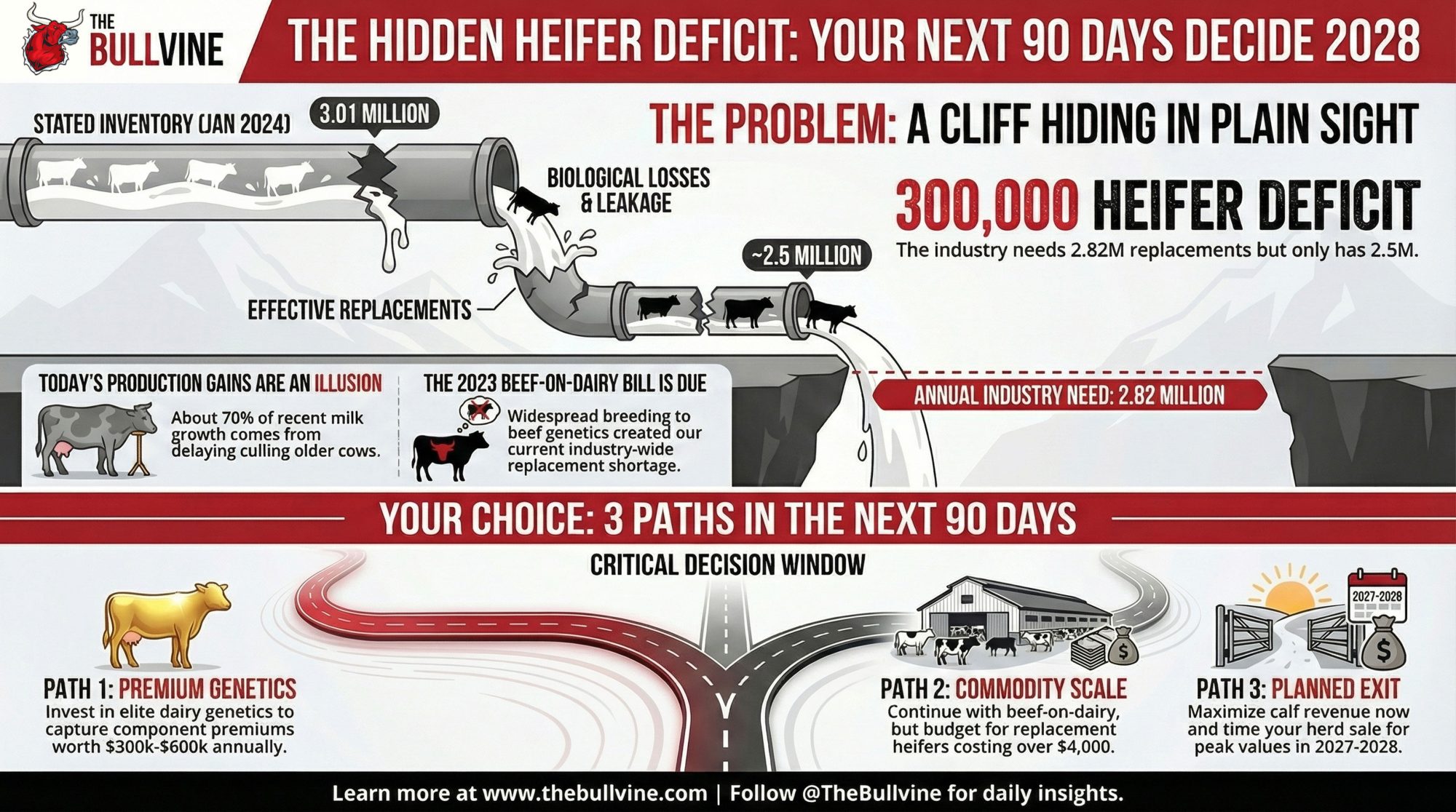

Executive Summary: The U.S. dairy industry’s 3 million replacement heifers look adequate—until you run the math. Biological losses reduce effective replacements to 2.5 million against 2.82 million needed, creating a 300,000-head deficit that determines who’s milking cows in 2028. This shortage traces directly to 2023’s margin crisis, when 50-60% of operations made individually rational decisions to breed beef genetics, creating a collective supply constraint. Recent production gains (+2% component-adjusted) mask this reality through delayed culling—essentially borrowing from future herd health to meet current demand. Producers face a critical 90-day convergence: breeding decisions made through March 2025 determine 2028 herds (a 30-month development cycle), while Q1 contract negotiations lock in multi-year positioning before processor leverage shifts mid-year. Three strategic paths remain viable—premium genetics targeting $300K-600K component premiums, commodity-scale operations, or planned exits that maximize 2027-2028 peak values—but only for farms committing to strategy before leverage evaporates. Delay means accepting substantially weaker competitive positioning.

The dairy production numbers coming out of USDA through fall 2024 have been encouraging—milk production trending up around 1% year-over-year, with component-adjusted growth looking even better at close to 2%. For those of us who’ve weathered some brutal margin pressure, volatile feed costs, and the ongoing industry consolidation, those figures feel like validation that our strategic shifts toward higher per-cow productivity and better component yields are finally paying dividends.

But there’s another number in those same USDA cattle inventory reports that tells a fundamentally different story about where we’re headed. And honestly, it’s the number that keeps me up at night more than any production statistic: we’re looking at around 3 million replacement heifers in the pipeline, and when you account for the biological realities of heifer development—the mortality, the breeding failures, the time lag—that number gets tight. Real tight.

Here’s what I mean by that.

The Fast Facts: Where We Stand Right Now

| Metric | Current Estimate | Required for Stability | Status |

| Total US Dairy Herd | 9.4 Million Cows | 9.4 Million Cows | Neutral |

| Replacement Heifer Inventory | 3.01 Million (Jan 2024) | 2.82 Million Minimum | Tight |

| Effective Replacements (After Losses) | ~2.5 Million | 2.82 Million | Deficit |

| Annual Heifer Mortality | 10-12% (300,000-360,000 head) | — | Critical Loss |

| Breeding Failures | 5-8% (150,000-240,000 head) | — | Critical Loss |

Source: USDA NASS Cattle Inventory (January 2024); Penn State Extension; University of Wisconsin dairy economists

The Replacement Math Most Folks Aren’t Running

Let’s walk through the fundamentals here, because this is where the whole story starts to come together.

The U.S. dairy herd sits at roughly 9.4 million cows right now—that’s straight from USDA’s latest numbers. And if you’ve been in this business for any length of time, you know the biological reality: you need to replace somewhere between 25 and 30% of your herd annually just to maintain stable numbers.

That’s not bad management. That’s just dairy farming.

Cows age out, reproductive issues happen, injuries occur, and diseases strike. Penn State Extension puts typical culling rates at 25-35% annually, and Wisconsin Extension says 28-32% is common. It’s simply the nature of keeping a productive milking herd.

So do the math with me here: maintaining 9.4 million cows means you need somewhere between 2.35 and 2.82 million replacement heifers every year. Not to grow. Not to expand into new markets or add another parlor. Just to stay even.

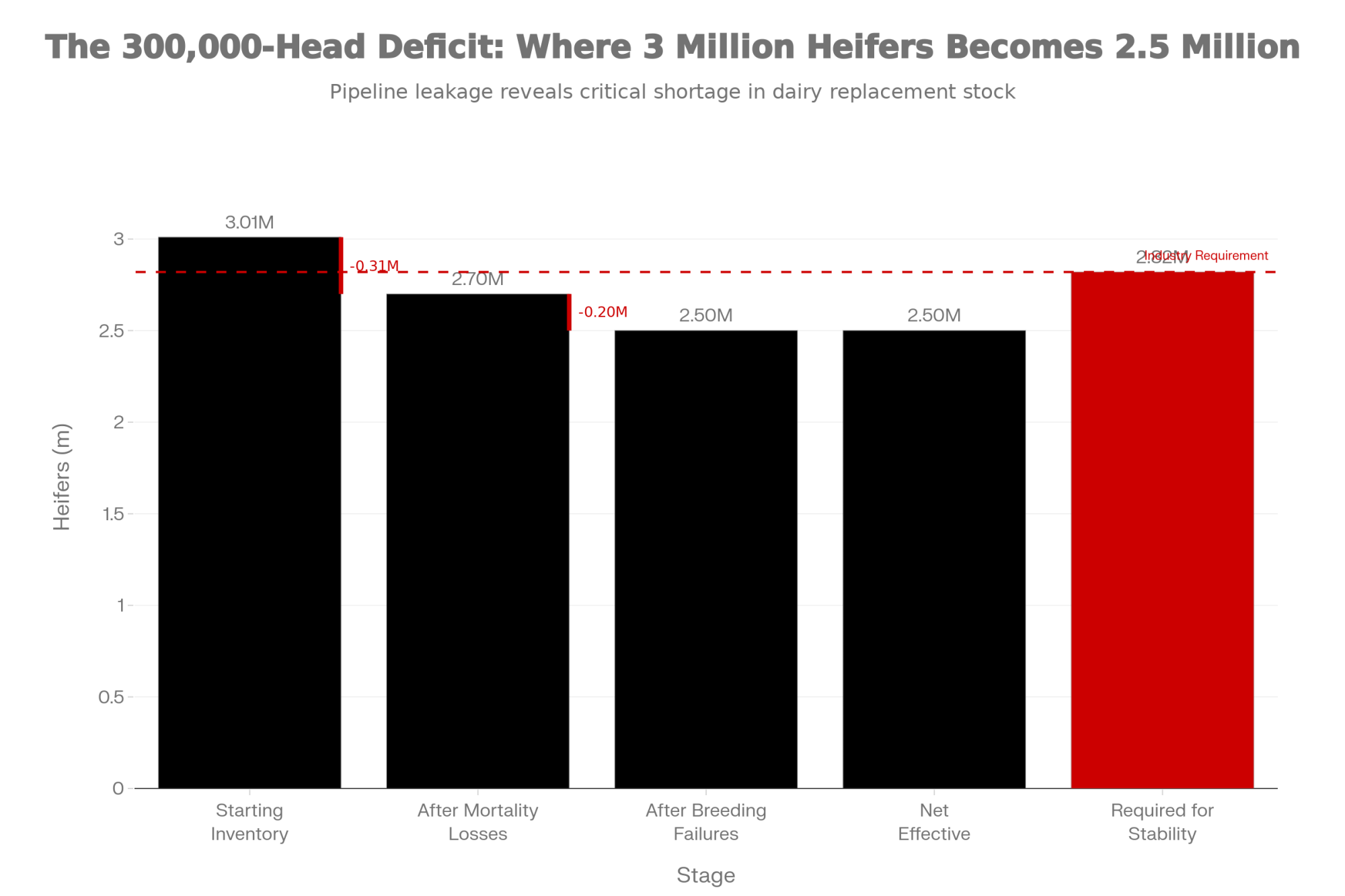

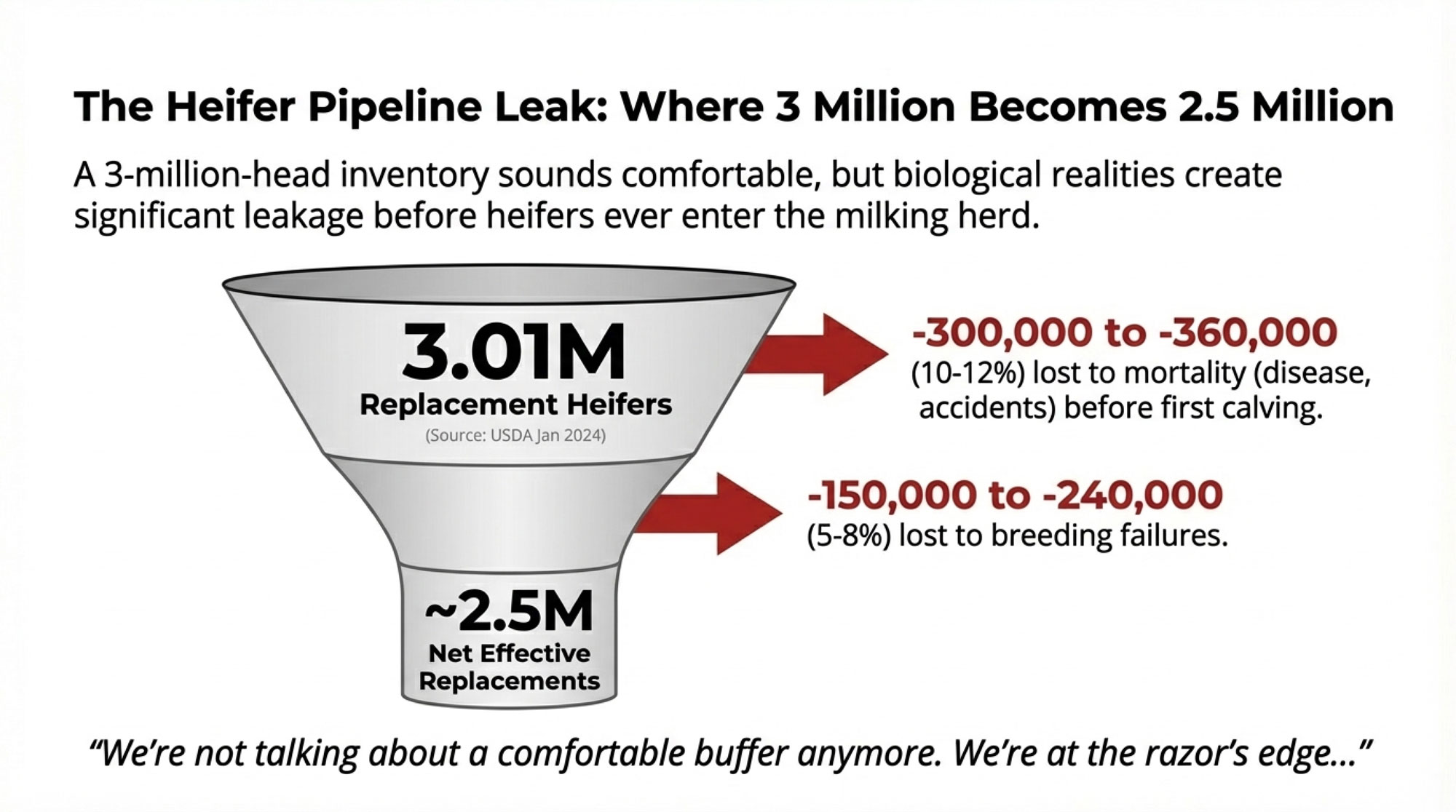

The Heifer Pipeline Leakage: Where 3 Million Becomes 2.5 Million

Now, looking at USDA’s January 2024 cattle inventory—the most recent complete data we’ve got—we’re seeing about 3.01 million dairy replacement heifers of all ages. That sounds comfortable at first glance. Maybe even pretty good compared to where we need to be.

But here’s where the biological constraints start biting us.

The Pipeline Breakdown:

- Starting inventory: 3.01 million replacement heifers (USDA Jan 2024)

- Minus mortality losses (10-12%): -300,000 to -360,000 heifers lost to disease, accidents, developmental issues before first calving

- Minus breeding failures (5-8%): -150,000 to -240,000 heifers that never successfully breed within acceptable timeframes

- Net effective replacements: ~2.5 million heifers actually entering milking herds

- Industry requirement: 2.35 to 2.82 million for herd maintenance

- Buffer remaining: Essentially zero

Research from Wisconsin, Penn State, Cornell—pretty much every land-grant university that studies this—consistently shows that 10-12% of heifers don’t make it to first calving. We lose them to scours as calves, respiratory disease as weanlings, accidents, and developmental issues. The USDA’s own National Animal Health Monitoring System studies peg pre-weaning mortality around 5%, with another 5 to 7% lost between weaning and first calving.

“We’re not talking about a comfortable buffer anymore. We’re at the razor’s edge, with very little room for regional variation, disease outbreaks, or any of the hundred other things that can go sideways in livestock production.”

Then you’ve got breeding failures. And this is where I think a lot of optimistic projections fall short. Heifer conception rates typically run 55 to 65% per service according to the research, and while most heifers get bred successfully within a couple of services, you’re still looking at 5 to 8% that never successfully breed within acceptable timeframes. That’s another 150,000 to 240,000 heifers gone from productive use.

The 2025-2026 Outlook Gets Tighter

And here’s what makes this particularly concerning: CoBank’s agricultural economists—folks who study dairy markets for a living—are projecting that the heifer pipeline will continue to drop through 2025 before we see any meaningful recovery. They’re not expecting things to turn around until late 2026 or even 2027.

When the January 2025 inventory numbers come out in a few weeks, most industry watchers I talk to expect to see that replacement heifer number down even further from where we were in 2024.

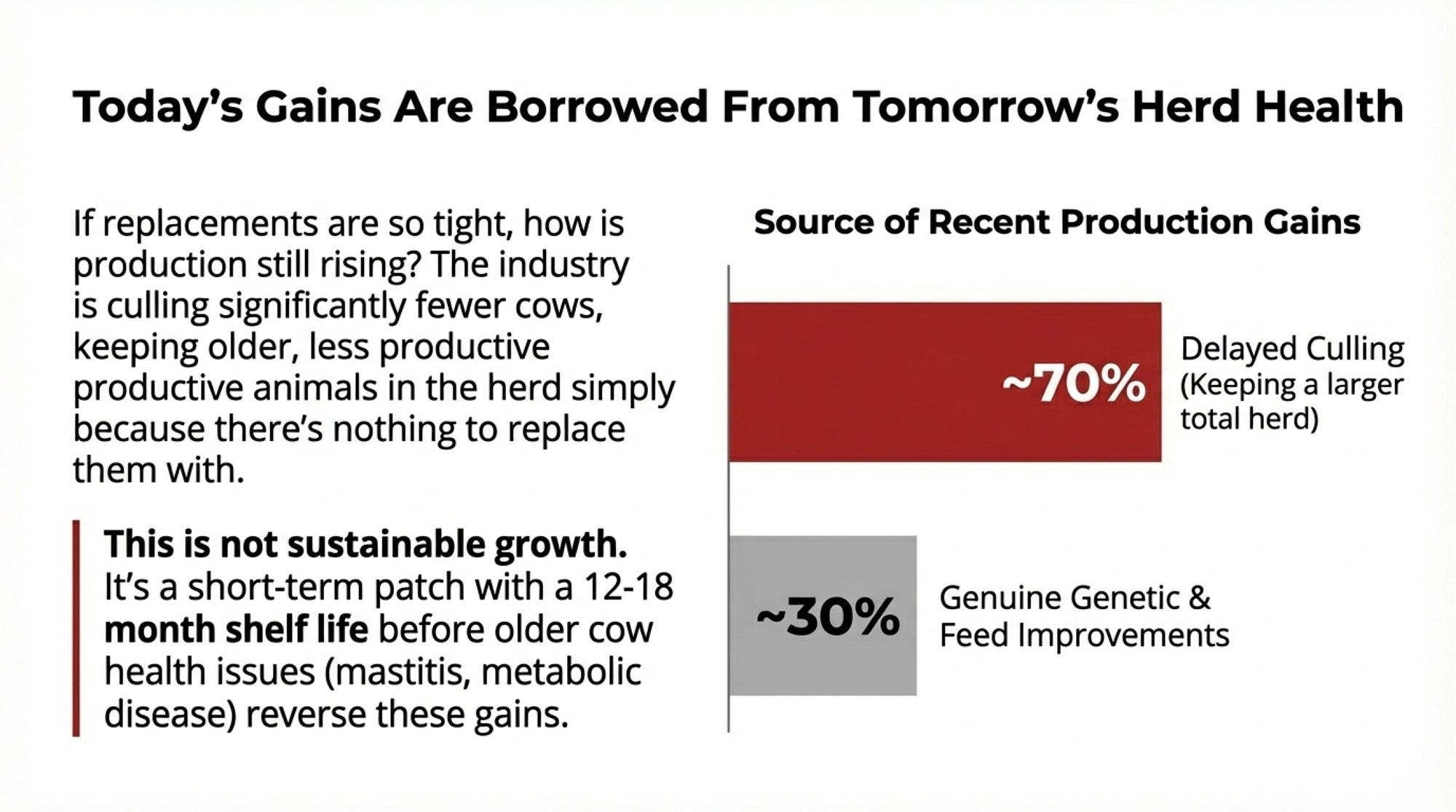

Where That Production Growth Really Came From

This brings us back to those encouraging production numbers, and I think it’s worth looking at what’s actually driving them. Because if the replacement heifer supply is this constrained, how are we still seeing production gains?

The answer—and you’ve probably noticed this on your own operation—is that we’re keeping older cows in production longer than we normally would. A lot longer, in some cases.

Delayed Culling: Borrowing From Tomorrow’s Herd Health

USDA’s data through 2024 shows dairy producers culled significantly fewer cows compared to 2023—we’re talking hundreds of thousands fewer culls across the industry. These are animals that, under normal circumstances, with adequate replacement availability, would’ve been sold or culled due to age, declining production, or health challenges. Instead, they’re staying in the barn because we simply don’t have enough young, high-producing replacements to take their place.

Dr. Marin Bozic—he’s a dairy economist many of you probably know from his market analysis work—has pointed out in his reports that this strategy has a definite shelf life. You can delay culling for a period, especially when milk prices justify keeping lower-producing cows. But eventually, and we’re seeing this now in some herds, the biological realities catch up. Older cows are more likely to develop metabolic disease, mastitis, and reproductive failure. Your herd’s overall efficiency starts degrading, and those production gains you achieved by maintaining more cows start reversing on you.

Production Gain Breakdown (Industry Analysis):

- Economists estimate ~30% from genuine improvements (better component genetics, genomic selection, improved feed efficiency)

- ~70% from delayed culling (maintaining larger total cow inventory by extending productive lives)

And that’s not sustainable growth. That’s borrowing from tomorrow’s herd health to hit today’s production targets.

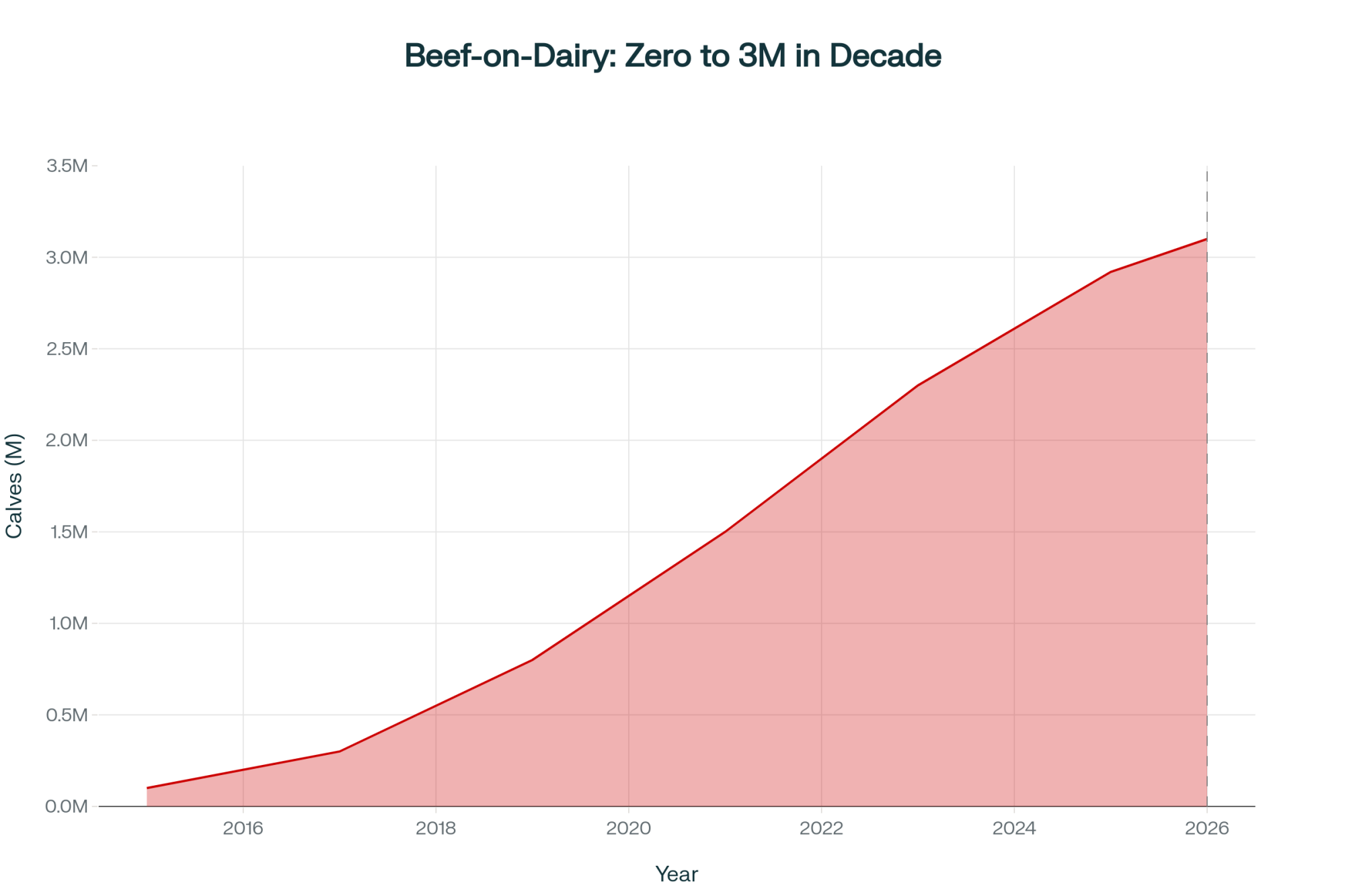

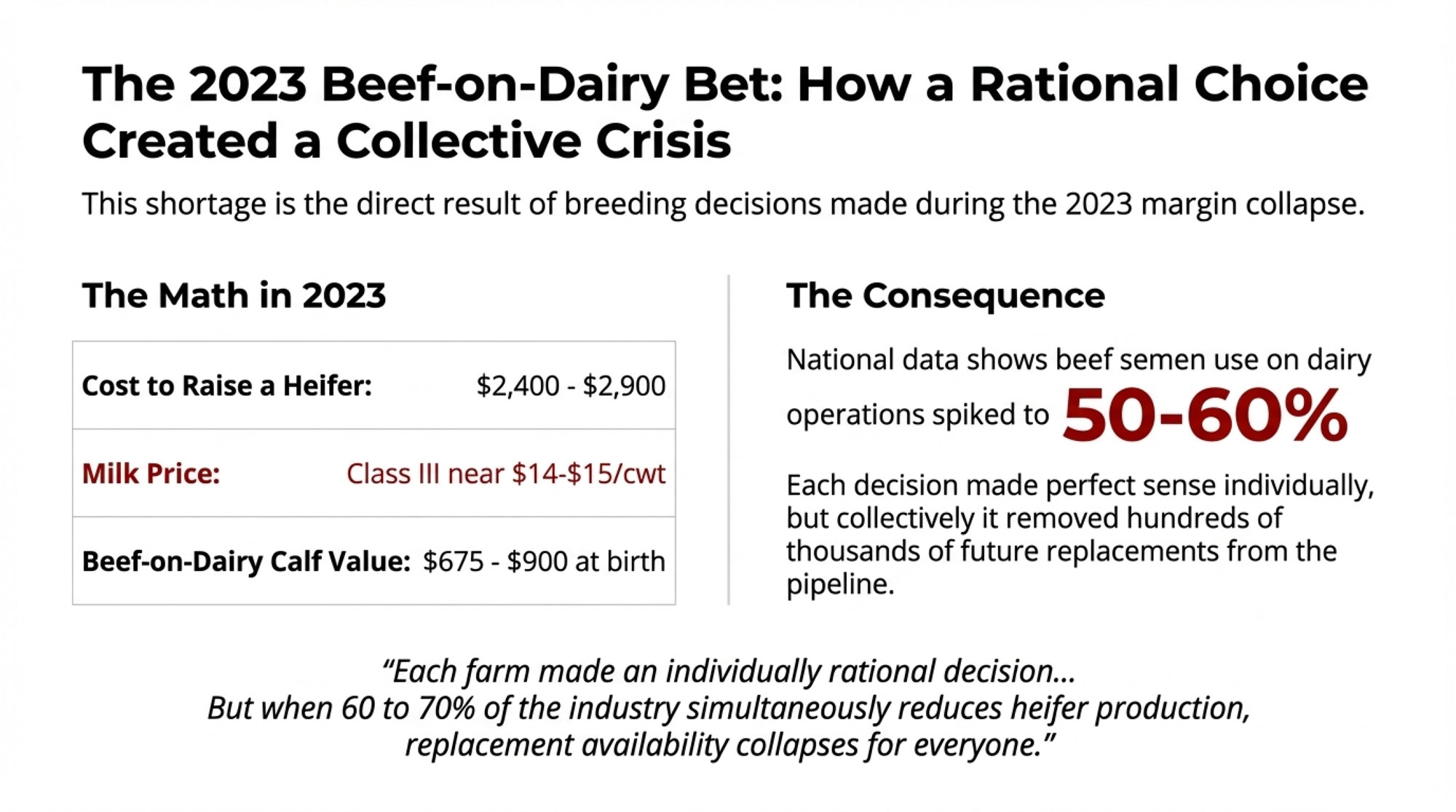

How We Got Here: The Beef-on-Dairy Decision

The heifer shortage we’re dealing with now didn’t just appear out of nowhere. It’s the direct consequence of the breeding decisions most of us made two to three years ago—decisions that made perfect economic sense at the time but created the industry-wide squeeze we’re feeling now.

When the Math Favored Beef Genetics

Do you remember where milk prices were in 2023? I mean, Class III hit lows near $14 to $15 per hundredweight in some months. Absolutely catastrophic margins for most operations. And at the same time, you’re looking at $2,400 to $2,900 to raise a replacement heifer from birth to first calving—that’s what the university budgets were showing. Penn State’s numbers, Wisconsin’s enterprise budgets, they all penciled out in that range.

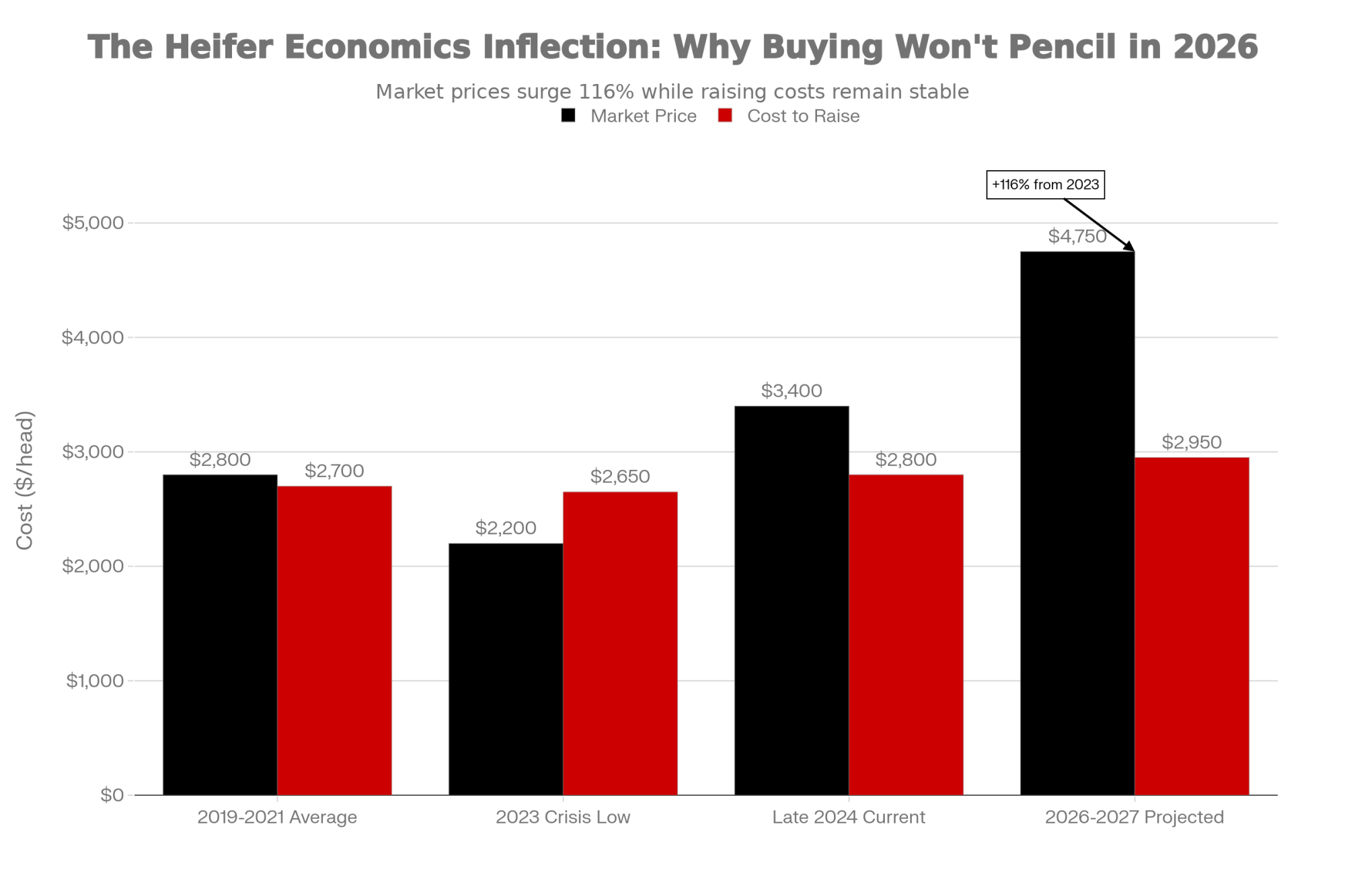

| Economic Factor | 2023 Crisis Period | Late 2024 Current | 2026-2027 Projected |

| Beef-Dairy Calf Sale Value | $675-900 per calf | $725-950 per calf | $800-1,100 per calf |

| Dairy Heifer Replacement Cost (2023) | $2,000-2,500 (buying cheaper) | — | — |

| Dairy Heifer Replacement Cost (2024) | — | $2,800-4,000 (buying costly) | $4,500-5,000 (prohibitive) |

| Cost to Raise Own Heifer | $2,400-2,650 | $2,700-2,900 | $2,850-3,100 |

| Annual Calf Revenue (500 cows, 75% beef) | $160K-180K | $165K-195K | $180K-220K |

Meanwhile, beef-on-dairy breeding was offering an attractive alternative that a lot of us took advantage of:

- Breed lower-ranking dairy cows to beef semen

- Sell calves for $675 to $900 within days of birth

- Buy replacement heifers from the market when needed at $2,000 to $2,500 (2023 pricing)

The math clearly favored beef-breeding, especially if you were watching cash flow. And it worked. Really well, actually, in the short term.

The Collective Impact Nobody Was Tracking

But here’s what happened at the industry level, and this is where nobody was really tracking the collective impact: National Association of Animal Breeders data through 2023 shows beef semen usage on dairy operations increased to somewhere around 50 to 60% of total breedings.

That’s a massive shift from historical patterns where we were breeding maybe 80 to 90% dairy genetics. Each one of those breeding decisions—multiply it across thousands of farms all making similar calls—meant one fewer potential replacement heifer entering the pipeline 30 months later.

“Each farm made an individually rational decision based on their economics. But when 60 to 70% of the industry simultaneously reduces heifer production, replacement availability collapses for everyone.”

The cumulative effect is what we’re seeing now. Hundreds of thousands of additional beef-on-dairy calves were produced compared to historical patterns. Those are animals that would’ve been dairy replacements, now permanently out of our genetic pipeline.

And what’s interesting—Penn State Extension folks have pointed this out in their recent analyses—is that this represents what economists call a tragedy of the commons. Each farm made an individually rational decision based on their economics. But when 60 to 70% of the industry simultaneously reduces heifer production, replacement availability collapses for everyone. Including the farms that kept breeding dairy genetics through the tight times.

The Regional Story: Why Some Areas Kept Breeding Dairy

Not everyone followed the beef-on-dairy path, though, and the regional variation tells you a lot about the structural factors at play here.

USDA’s state-level data shows Pennsylvania maintained or slightly increased replacement heifer inventory through 2024, while most of the country was reducing numbers. Wisconsin held relatively stable. Meanwhile, the big Western dairies in California, Texas, and Idaho saw significant heifer reductions.

Scale Makes the Difference

I’ve been talking with lenders, extension specialists, and economists across different regions, trying to understand what explains this split, and a few things have become pretty clear.

Farm scale makes a real difference. Pennsylvania’s dairy sector—according to their Center for Dairy Excellence reports—averages around 90 to 100 cows per farm. Compare that to the national average, which is pushing 350 to 380 cows.

Capital Requirements by Herd Size:

- 95-cow operation: $67,000 to $81,000 annually for heifer raising (manageable with multi-generational equity)

- 500-cow operation: $360,000 to $435,000 annually for adequate replacement raising (became nearly impossible during the 2023 margin collapse)

The Pasture Advantage

Geography matters, too, and folks sometimes overlook this. Regions with established pasture systems—Pennsylvania, upstate New York, parts of Wisconsin—have what turns out to be a substantial cost advantage for heifer raising.

Heifer Raising Cost Comparison:

- Pasture-based systems: ~$1,336 per head

- Confinement systems: ~$1,919 per head

- Cost advantage: 43% difference driven by reduced feed costs, lower facility investment, and less labor intensity

Source: Penn State Extension, University of Wisconsin, Cornell dairy management research

So Pennsylvania farmers could raise their own replacements for less than market purchase prices even when beef-breeding looked economically superior to everyone else. The pasture advantage is structural—it doesn’t go away when milk prices improve.

Custom Heifer Raising Infrastructure

Pennsylvania and Wisconsin also developed something most other regions just don’t have: sophisticated custom heifer-raising operations. These are specialized businesses that contract with dairy farmers to raise heifers through the non-productive phase. When cash got tight in 2023, being able to contract out heifer raising at $1,900 to $2,100 per animal provided flexibility that regions without this infrastructure simply couldn’t access.

Here’s an important point the Wisconsin specialists emphasize: this wasn’t necessarily Pennsylvania farmers being smarter or more strategic than everyone else. They had structural advantages—lower scale requirements, existing pasture systems, access to custom raising—that made maintaining dairy breeding economically feasible when others couldn’t justify it.

| Region/System | Cost per Head | Primary Cost Driver | Heifer Inventory Trend (2023-24) |

| Pennsylvania (Pasture) | $1,336 | Low feed costs | Stable/Up |

| Wisconsin (Pasture) | $1,425 | Pasture + custom raising | Stable |

| Midwest (Confinement) | $1,850 | Facility investment | Down 8-12% |

| Western US (Confinement) | $1,919 | Labor + facility costs | Down 15-18% |

| Texas/Southwest (Confinement) | $1,975 | Heat stress + facility | Down 12-15% |

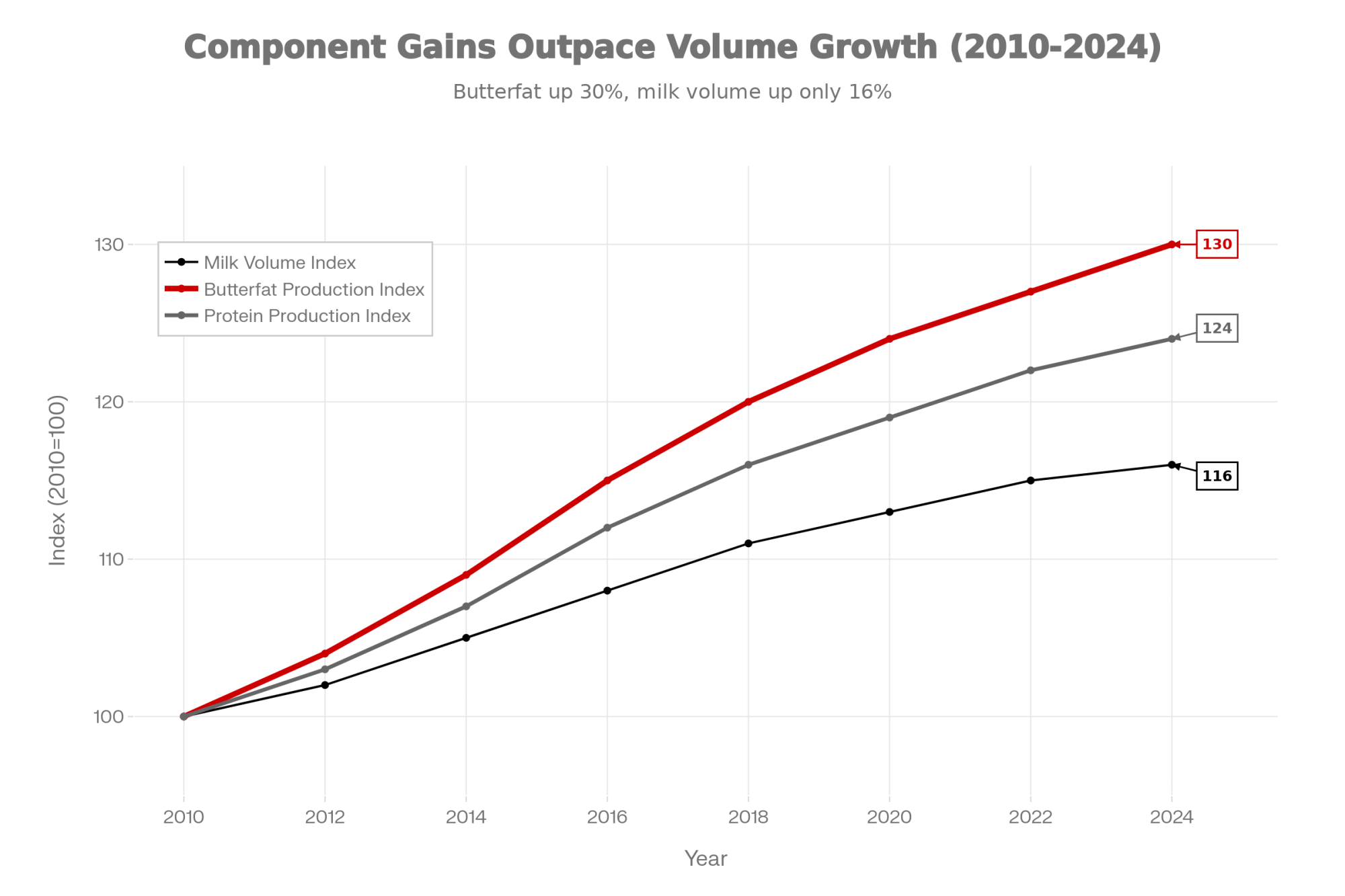

The Component Gains: Real Progress on a Narrowing Base

Those component numbers from USDA through 2024 deserve a closer look, especially given what’s happening with the genetic foundation underlying them.

The Impressive Gains Are Real

The gains are real. Absolutely real:

- Butterfat production: Up ~30% since 2010 (milk volume grew only 15-16%)

- Protein production: Up 23-24% over the same period

- Current national averages: ~4.2% butterfat, ~3.3% protein (both record territory)

The Council on Dairy Cattle Breeding’s 2024 genetic evaluations show substantial base changes in butterfat in Holsteins compared to just five years ago. This represents genuine genetic progress driven by genomic selection, improved breeding strategies, and the industry’s intense focus on component traits.

And that focus makes economic sense—Multiple Component Pricing puts roughly 90% of your milk check value on butterfat and protein rather than volume.

But the Genetic Base Is Narrowing

But here’s what concerns the geneticists when you talk to them about long-term sustainability: the genetic base enabling this progress is simultaneously contracting because of those beef-on-dairy breeding patterns we just discussed.

When 50 to 60% of your dairy breedings are going to beef genetics, you’re systematically removing potential dairy females from the breeding population. Those aren’t just your bottom-tier animals, either. They’re your “genetically lower-ranking” cows within each herd, sure, but they’re still above-average dairy cattle compared to historical standards.

Dr. Kent Weigel at Wisconsin—he’s published extensively on breeding strategies over the years—has noted in his research that maintaining genetic diversity while pursuing component gains requires balancing selection intensity with population size. What we’re seeing now, with maybe 30% of farms maintaining intensive dairy genetics while 70% breed primarily to beef, creates what he calls a “two-tier genetic system” that could persist for years.

“Population geneticists call this ‘peak selection intensity.’ You get temporary acceleration in the traits you’re selecting for because you’re working with a smaller, more intensely selected population. But that acceleration isn’t indefinitely sustainable.”

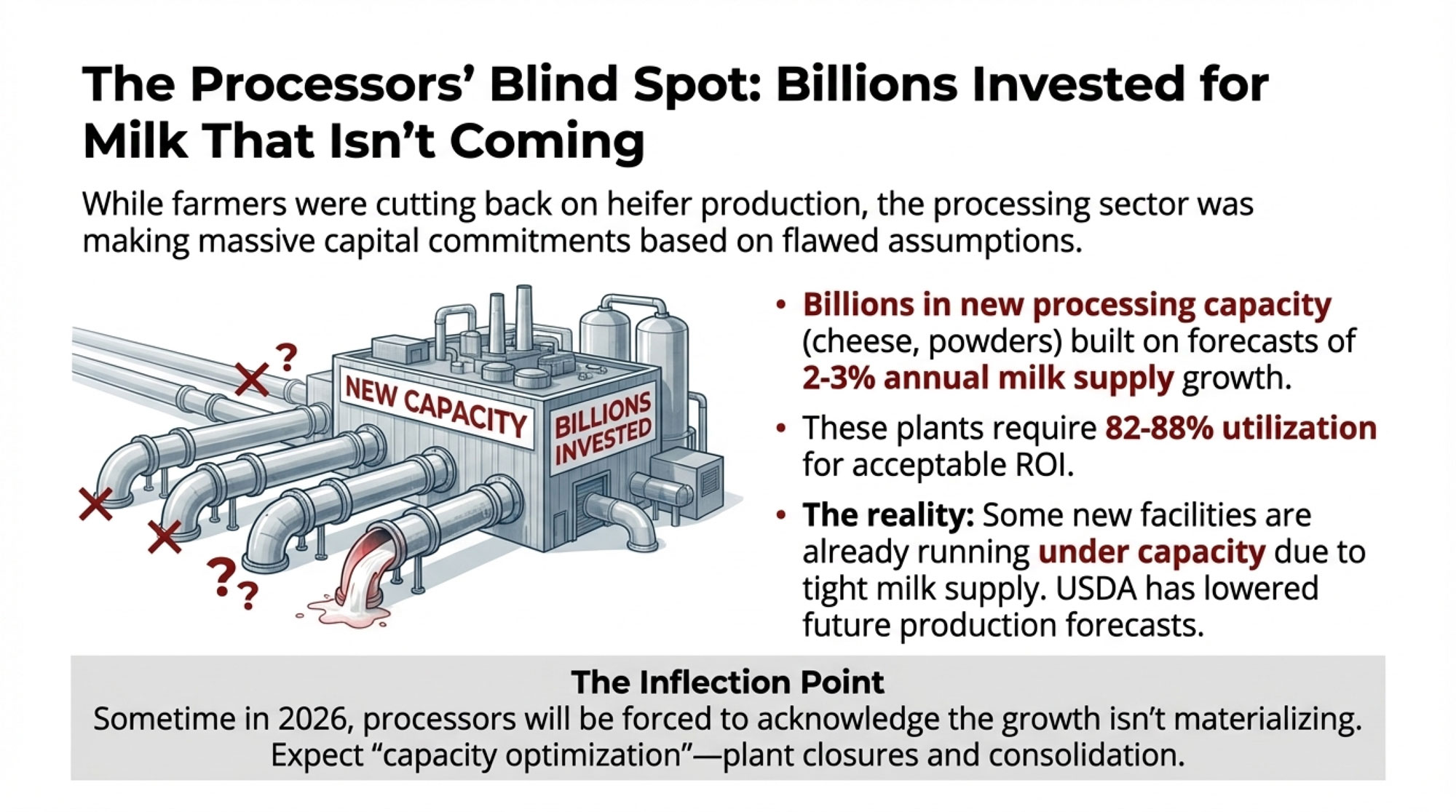

The Processing Side: What Happens When Plants Realize Growth Isn’t Coming

While we were all managing heifer inventories and breeding decisions based on individual farm economics, the processing sector was making massive capital commitments based on very different assumptions about future milk supply.

Billions Invested on 2-3% Growth Assumptions

Trade publications and industry reports through 2024 document several billion dollars in new dairy processing capacity either announced or under construction—most of it concentrated in cheese and milk powder production. You’ve got major projects in Kansas, Texas, Michigan, Wisconsin, and other core dairy regions.

These plants were financed through USDA Rural Development loans and private investment, based on forecasts of 2-3% annual growth in milk production. That’s been the historical assumption for feasibility studies.

Processing Plant Economics:

- Required utilization: 82-88% of design capacity for acceptable ROI

- Typical $500M cheese plant capacity: 1.8 billion pounds annually

- Below-target utilization impact: Fixed costs spread across lower volume = compressed profitability per pound

The 2026 Inflection Point

Current reality appears to be telling a different story, though this isn’t widely published data. Industry observers watching the processing sector suggest some newer facilities are running at lower utilization rates than their models projected, constrained by available milk supply in their procurement areas.

And USDA’s most recent forecasts, released in late 2024, lowered its milk production expectations going forward despite projecting continued per-cow yield improvements. That’s essentially an admission that herd-size constraints are binding.

So what happens when processors start realizing the milk growth they financed their expansions around isn’t materializing? Industry folks watching processor earnings calls and capital markets are suggesting we might see an inflection point sometime in 2026. When you get multiple quarters showing milk production growth in the 0 to 2% range rather than the 3 to 4% that plant economics require, processor guidance is going to feature some significant adjustments.

Some analysts are already anticipating what they’re calling “capacity optimization”—industry-speak for plant closures, consolidation, and scaled-back operations.

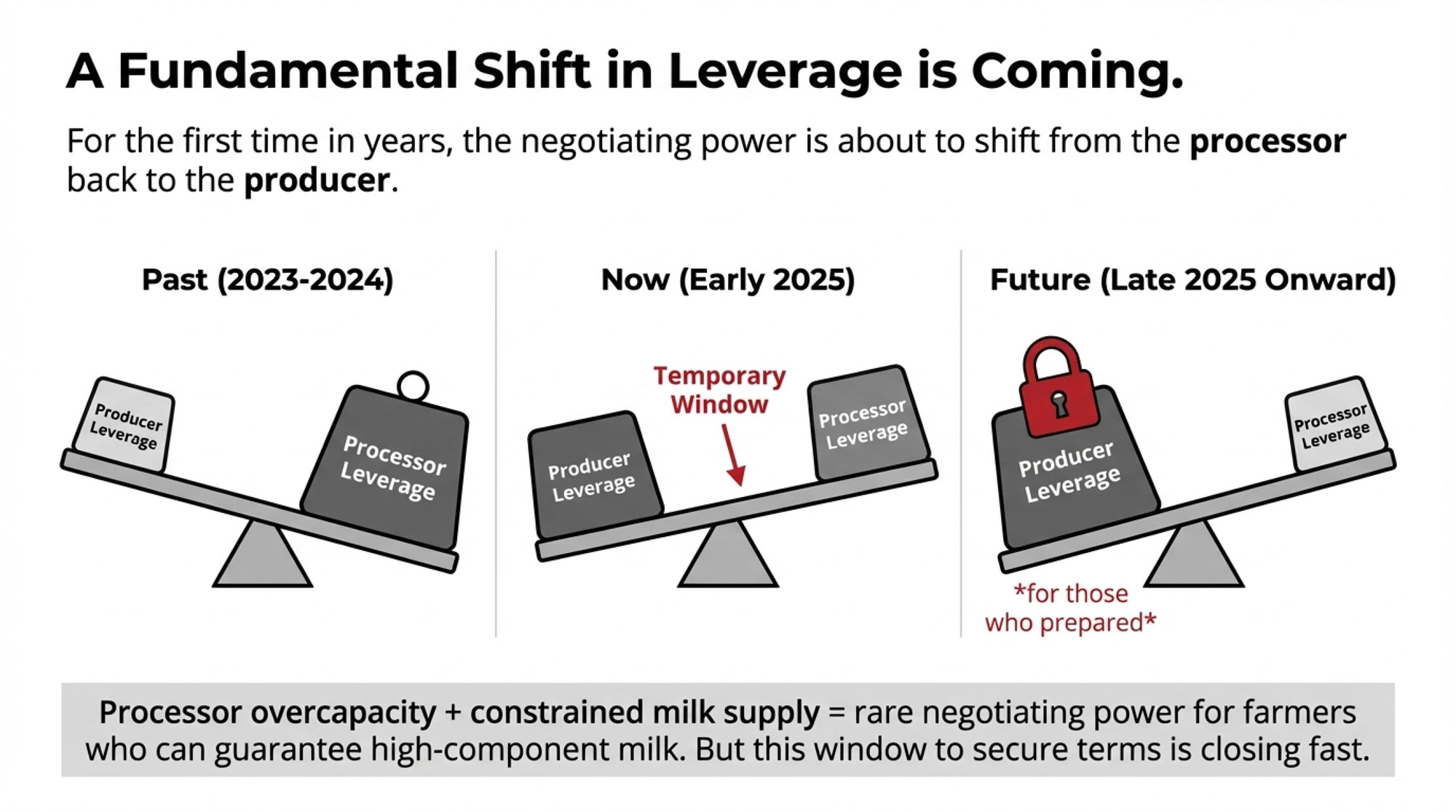

Your Strategic Window: The Next 90 Days Matter

For producers reading these market signals, we’re looking at a compressed timeline for some critical decisions.

Why 90 Days? The Biology and the Contracts

Here’s why the next 90 days—roughly late December 2024 through March 2025—are so critical:

The Biological Reality: The 30-month heifer development cycle means breeding decisions you make between now and spring 2025 determine which cows become the mothers of your 2028 replacement heifers. A heifer bred in January 2025 calves in October 2025, and her heifer calf (if you breed dairy genetics) doesn’t freshen until spring 2028.

The Contract Window: Milk contracts for 2025-2027 are currently being negotiated. Processors are offering multi-year deals with premium component pricing while they’re uncertain about future supply. That negotiating leverage shifts dramatically by mid-2025 when production data confirms the heifer shortage is constraining growth.

Three Viable Paths Forward

Let me walk through what I see as roughly three viable paths forward. Each requires some level of commitment in the next 90 days.

| Strategy | Annual Investment | Replacement Source | 2026-2028 Revenue Impact | Risk Level |

| Premium Genetic Positioning | $25K-35K (semen + testing) | Raise own (150-200/yr) | +$300K-600K (component premiums) | Medium (genetics execution) |

| Commodity Beef-on-Dairy | $0-5K (maintaining current) | Purchase market ($3,400-4,750) | Commodity pricing (no premium) | High (replacement cost escalation) |

| Planned Exit (Peak Value) | $2K-8K (maximize beef revenue) | Minimize/phase out | +$450K-750K (peak herd sale) | Low (planned timeline) |

Path 1: Premium Genetic Positioning

The Strategy:

- Shift 40-50% of fertile cows to sexed dairy semen

- Implement genomic testing to identify the top genetics

- Target 150-200 high-quality replacement heifers annually

The Investment:

- Annual cost: $25,000 to $35,000 for semen and testing

- Positions you for component premiums, analysts project could reach $5-10/cwt above commodity pricing in the coming years

- On a 500-cow operation producing 12 million pounds: potential $300,000 to $600,000 additional annual revenue using conservative mid-range premium estimates

Financial Checkup Action: Meet with your lender specifically to discuss the rising asset value of your heifer inventory (currently $2,800-4,000 per head and climbing). Many operations can leverage this increased equity to finance genomic testing programs and investments in sexed semen without taking on significant additional debt.

Path 2: Commodity Beef-on-Dairy Continuation

The Strategy:

- Maintain current breeding patterns (75-80% beef semen)

- Purchase replacements from the market as needed

- Compete on cost efficiency and operational scale

The Economics:

- Annual calf revenue: $160,000 to $180,000 based on current beef-dairy calf markets

- Replacement purchase costs: $2,800-4,000 per head (current market, up from $2,000-2,500 in 2023)

- Locks into commodity pricing structures without premium component access

- Best fit: larger operations (1,500+ cows) with structural cost advantages

Financial Checkup Action: Work with your lender to model the impact of rising replacement heifer costs on your cash flow. If replacements continue climbing to $4,500-5,000 per head (as some project for 2026-2027), calculate whether beef calf revenue still pencils out favorably versus raising your own.

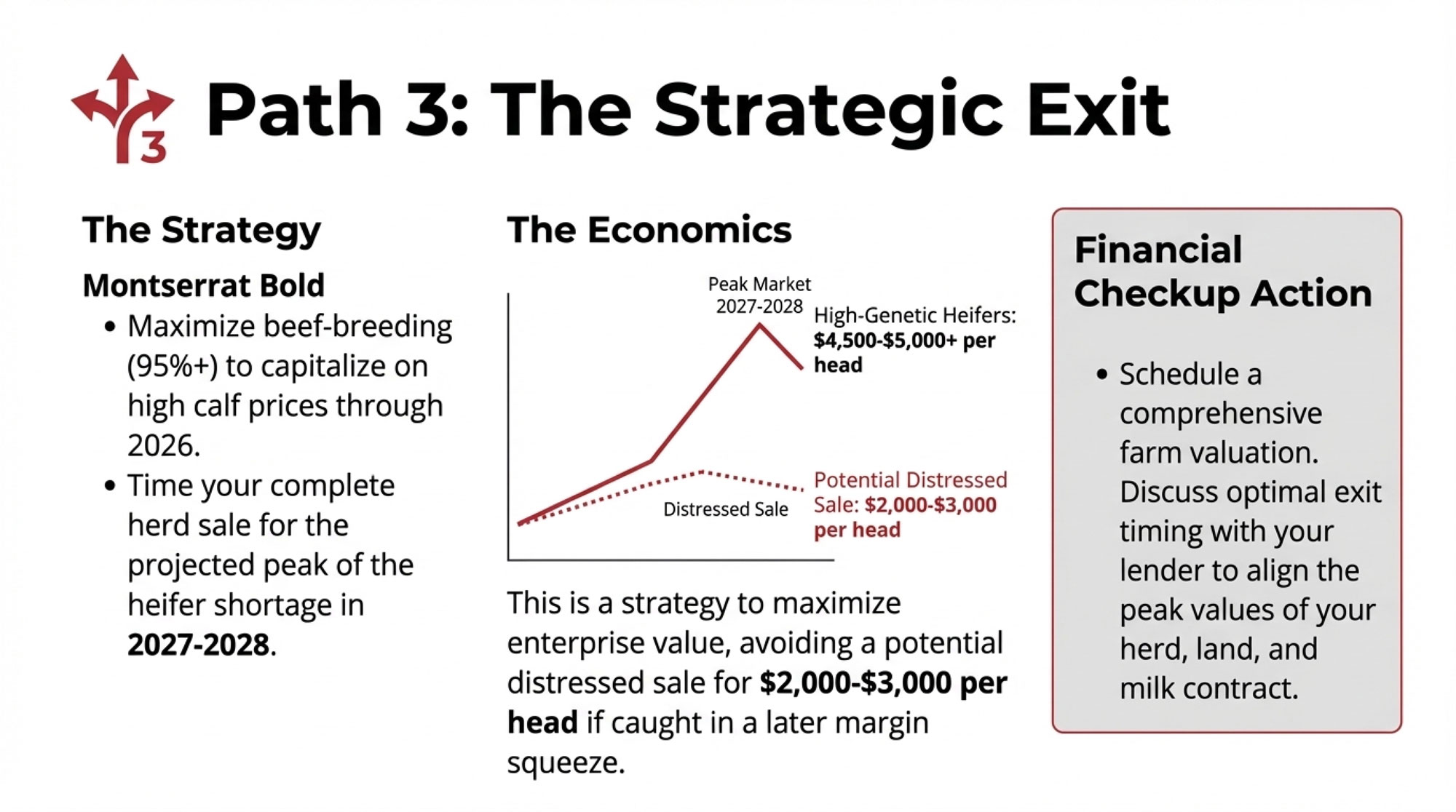

Path 3: Planned Exit Strategy

The Strategy:

- Maximize beef-breeding (95%+ beef semen) through 2025-2026

- Capitalize on elevated calf prices

- Time herd sale for 2027-2028, when heifer genetics values are projected to peak

The Economics:

- Current replacement heifer market: $2,800 to $4,000 per head, depending on genetics and stage

- Projected 2027-2028 peak: Potentially $4,500-5,000+ per head as shortage intensifies

- Compare to potential distressed sales if caught in a margin squeeze: $2,000-3,000 per head

- Capital redeployment options: service businesses for dairy farmers, land development, genetics operations, agritourism

Financial Checkup Action: Schedule a comprehensive farm valuation with your lender and discuss optimal exit timing. Your heifer inventory, land, facilities, and milk contract all have peak value windows. Understanding when those align—likely 2027-2028 based on market projections—helps you maximize enterprise value rather than being forced into a distressed sale.

The Contract Negotiation Window Is Open Now

Milk contract negotiations matter more right now than they have in years. Processors are offering multi-year contracts—3 to 5 years—with locked base pricing and component premium structures. These offers are driven by processor uncertainty about future milk availability. They’re trying to secure supply commitments before the shortage becomes industry-wide common knowledge and their negotiating leverage disappears.

What Producers Are Negotiating (Q4 2024 – Q1 2025):

- Base pricing: Contracts being offered in the $17.50 to $18.50 per hundredweight range

- Component premiums: $1.25 to $1.50 per hundredweight for high-testing milk (varies by processor)

- Liability caps: Negotiate caps at one year’s milk revenue or $2.5 million maximum (unlimited liability clauses are becoming standard; insurance runs $50,000+ annually for mid-size operations)

By mid-2026, when production data confirms the heifer shortage is constraining growth, that leverage shifts dramatically. Farms locking in favorable terms in early 2025 will have substantial advantages over those accepting spot pricing or shorter contracts six months later, when terms probably worsen.

| Contract Element | Q1 2025 Window (NOW) | Q3 2025 Projected | Advantage |

| Base Milk Price ($/cwt) | $17.50-18.50 | $16.80-17.80 | $0.70-1.00/cwt HIGHER |

| Component Premium ($/cwt) | $1.25-1.50 | $0.85-1.15 | $0.35-0.40/cwt HIGHER |

| Contract Length Available | 3-5 years | 1-2 years | 2-3 years LONGER |

| Liability Cap Terms | Negotiable ($2.5M cap) | Unlimited (standard) | Caps still possible |

| Processor Leverage | LOW – Need supply commitments | HIGH – Shortage confirmed | Producer has power NOW |

What This Means Going Forward

The biological reality here is pretty unforgiving. You can’t breed your way out of a heifer shortage retroactively. A heifer born today doesn’t freshen for 30 months. Decisions you make in the next 90 days determine your herd composition through 2027 and 2028. Operations waiting for “better conditions” or “clearer signals” will find their strategic options have narrowed substantially by mid-2025.

The Industry Is Bifurcating

The industry is splitting into distinct segments:

- Premium component producers accessing specialized markets

- Mega-dairies (1,500+ cows) competing on cost efficiency

- A shrinking middle ground (500-700 cows) with limited competitive advantages

Farms making intentional choices about which segment to compete in have better odds than those maintaining status quo operations, hoping market conditions improve on their own.

The Temporary Leverage Window

Processor dynamics are creating unusual leverage for producers right now, but it’s temporary. Processing overcapacity combined with a tight milk supply creates rare negotiating power for dairy farmers willing to commit supply. But that window is open for only a limited time. Multi-year contracts with component premiums locked at current rates may represent opportunities that won’t be available once market realities become widely understood.

Genetic Investment Pays Differently Now

Component pricing puts 90% of your milk check value on butterfat and protein. Farms maintaining or enhancing dairy genetics through this shortage period—even at higher short-term cost—are positioning for substantial premiums when processing demand exceeds available supply of high-component milk.

Resources to Help You Decide

If you’re working through these decisions, extension resources can help:

- Penn State Extension: Heifer raising cost calculators, enterprise budgets

- Wisconsin’s Center for Dairy Profitability: Genomic selection ROI tools, contract analysis templates

- Cornell’s dairy management program: Financial modeling for strategic path comparison

These tools are generally free or low-cost, and they’re worth using before you commit to a direction.

The Bottom Line

Recent production numbers tell an encouraging story about where the industry has been. But the heifer inventory numbers reveal something different about where we can realistically go. For those of us making decisions that’ll determine our operations’ viability through the rest of this decade, understanding that difference—and acting on it in the next few months—probably matters more than any single month’s production data.

Key Takeaways:

- The Math That Matters: 3M Heifers → 2.5M Actual Replacements — Mortality and breeding failures eliminate 500,000 head before production. Industry needs 2.82M to maintain the current herd. That 300K shortfall determines who’s still milking in 2028.

- The Beef-on-Dairy Bill Just Came Due — In 2023, 50-60% of farms made the rational call to breed beef genetics. That 30-month lag is now hitting—and we’re all competing for replacements that don’t exist.

- Current Production Is Borrowed From Future Herd Health — Today’s 2% gains come from delaying culls, not improving genetics. This strategy has 12-18 months before older cow health issues force the reversal you can’t afford.

- 90-Day Convergence: March 2025 Is Your Leverage Deadline — Breeding decisions now determine your 2028 herd composition. Contract negotiations now lock multi-year pricing. Both windows close when processors realize supply is tight—likely Q3 2025.

- Three Paths Forward, One Window to Choose — Premium genetics: target $300K-600K in component premiums. Commodity scale: maximize beef calf revenue, buy replacements. Strategic exit: time sale for 2027-2028 peak. Decision deadline: March 2025.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Beef on Dairy: The “Golden Goose” or a “Trojan Horse” for the Dairy Industry? – This breakdown delivers a cold-blooded look at the ROI of beef-cross programs. It arms you with the math to determine if short-term calf checks are worth the long-term risk of gutting your internal genetic pipeline.

- The Shifting Global Dairy Landscape: How to Position Your Farm for 2030 – Beyond the heifer pen, this analysis exposes the structural shifts in global demand and processor consolidation. It reveals how to secure your 2028 viability by aligning your farm’s output with the emerging requirements of the next decade.

- The Genomic Revolution: Are You Breeding Cows for 2025 or 2035? – This piece breaks down high-velocity genetic progress, showing you how to compress your generation interval. It delivers a strategy for using elite genetics to overcome the quantity shortage by maximizing the efficiency of every heifer that survives.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!