A father. Two sons. Four coworkers. All dead from manure gas in minutes. The monitor that could have saved them? $200. Why does this keep happening?

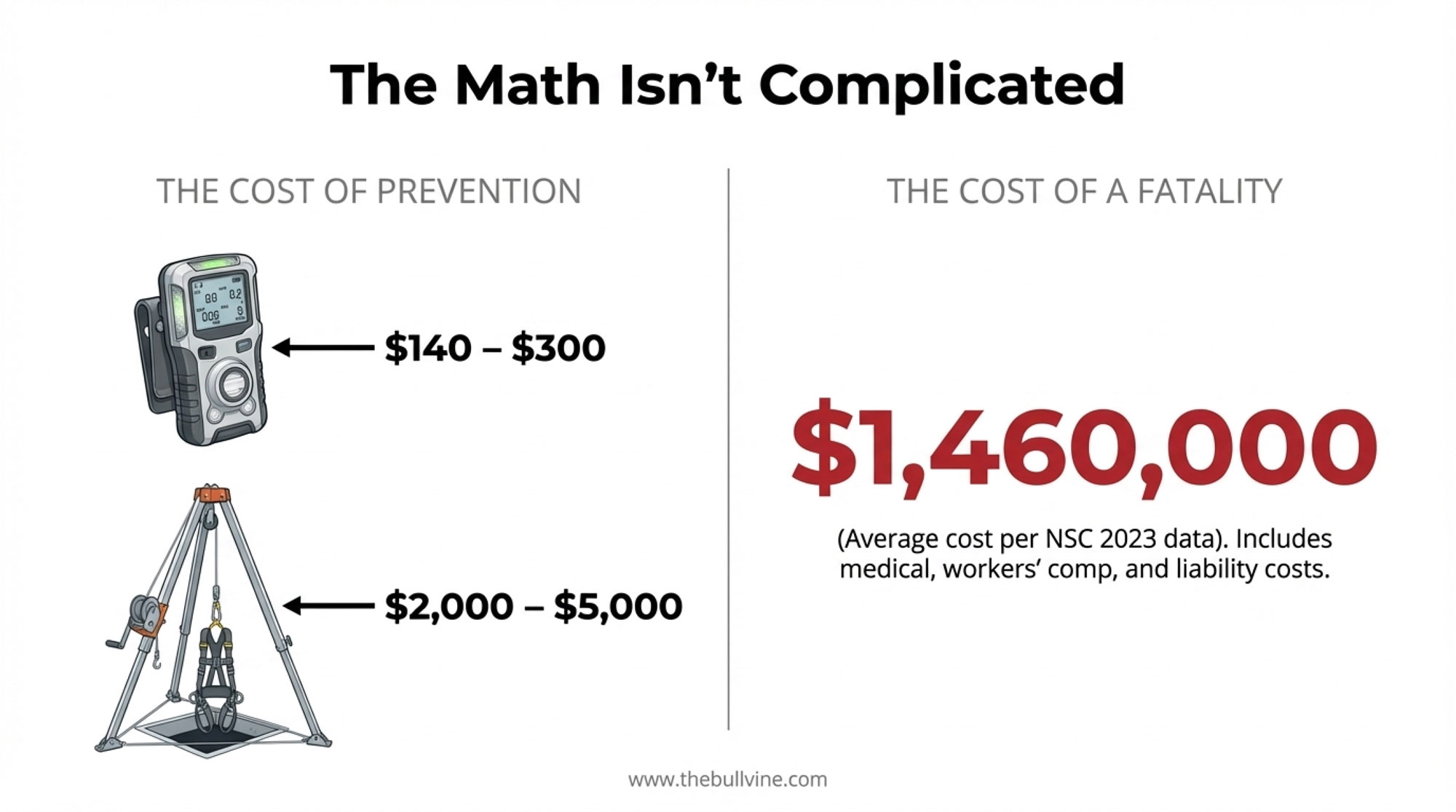

Executive Summary: In August 2025, manure gas killed six workers at a Colorado dairy in minutes—including a father and his two sons. Hydrogen sulfide can spike to deadly concentrations within the first hour of agitation, and at high levels, it paralyzes your sense of smell before you know you’re in trouble. The equipment that could have prevented this? Portable gas monitors cost $140 to $300. Retrieval systems that would have saved the coworkers who rushed in to help run $2,000 to $5,000. We’ve known about this hazard for decades, the technology is affordable, and we’re still losing families to something entirely preventable. This article covers what happened, what the science tells us, and five steps you can take this week to make sure your operation isn’t next.

You know, some stories just stop you cold. Among the six workers who died at Prospect Valley Dairy in Keenesburg, Colorado, on August 20, 2025, was 17-year-old Oscar Espinoza Leos, working alongside his father, Alejandro Espinoza Cruz, and his older brother Carlos Espinoza Prado. All three were lost that day. The Weld County Coroner’s October report confirmed what safety professionals had suspected from the beginning—acute hydrogen sulfide poisoning killed all six within minutes.

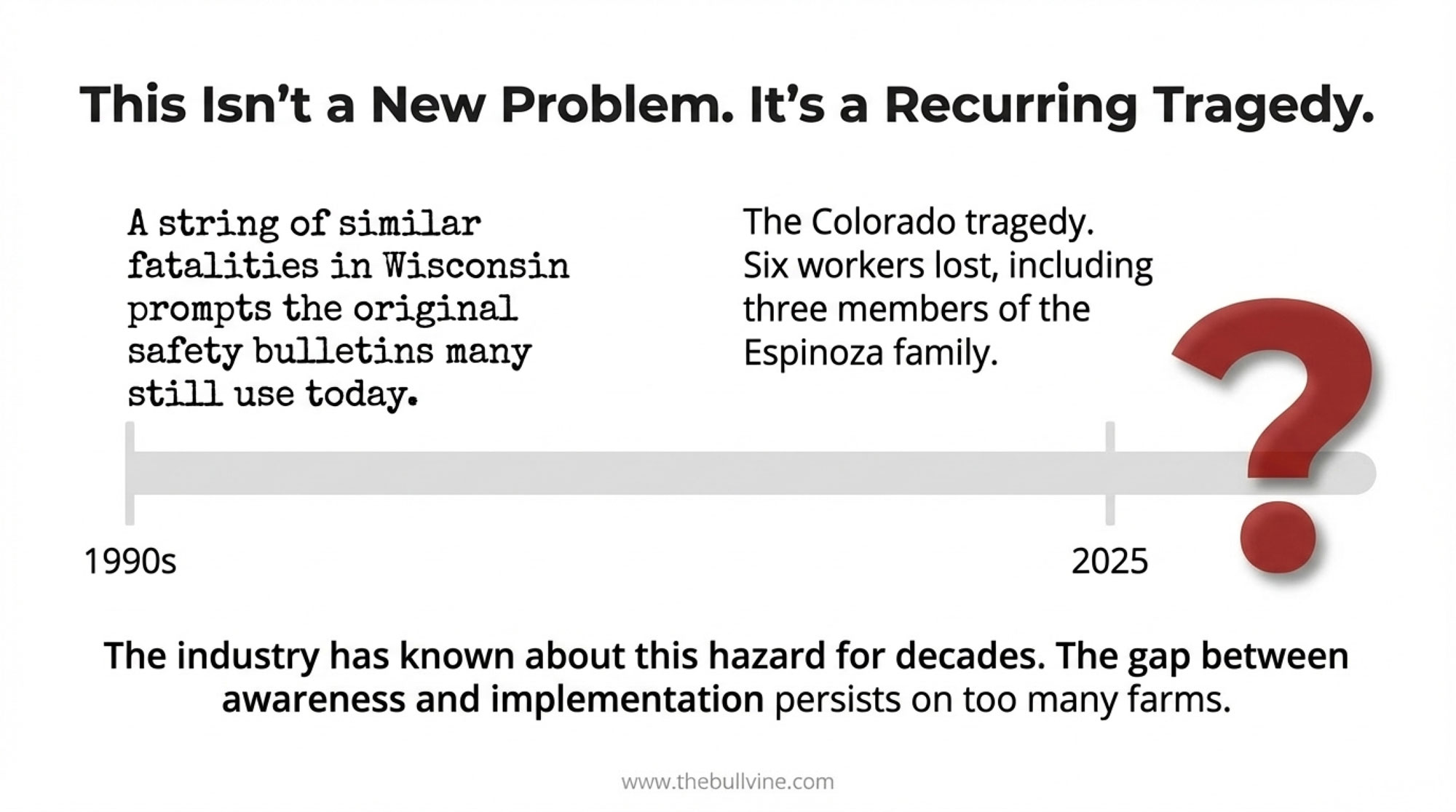

I’ve been in this industry long enough to remember similar incidents. The Wisconsin cases back in the 1990s. That string of fatalities across the Midwest that prompted the original extension bulletins, many of us still reference. And every time, the conversation that follows sounds remarkably similar: we know the hazard exists, we know the solutions exist, yet somehow the gap between awareness and implementation persists.

This isn’t about pointing fingers. It really isn’t. It’s about understanding what’s actually getting in the way—and learning from producers who’ve figured out how to close that gap on their own operations.

Understanding the Hazard: What Makes Hydrogen Sulfide Different

If you’ve worked around manure storage for any length of time, you’re familiar with that distinctive rotten-egg smell at low concentrations. That’s hydrogen sulfide—H₂S—produced naturally when manure breaks down in anaerobic conditions. Covered pits, deep storage facilities, pump stations, and, especially, freshly agitated slurry all create an oxygen-free environment where this gas accumulates.

| H₂S Concentration (ppm) | Effects on Humans | Time to Incapacitation | Action Required |

|---|---|---|---|

| <10 | Rotten egg odor detectable; no health effects | N/A | Normal operation; monitor if agitating |

| 10-100 | Eye irritation, respiratory distress, nausea | Minutes to hours | Evacuate area immediately; activate alarm |

| 100-400 | IDLH threshold; loss of smell, dizziness, confusion | 1-5 minutes | No entry without SCBA; treat as life-threatening |

| 400-700 | Rapid unconsciousness, respiratory arrest | 30-60 seconds | Death imminent; non-entry rescue only |

| 700+ | Immediate collapse, death within 1-2 breaths | <10 seconds | Unsurvivable without immediate extraction |

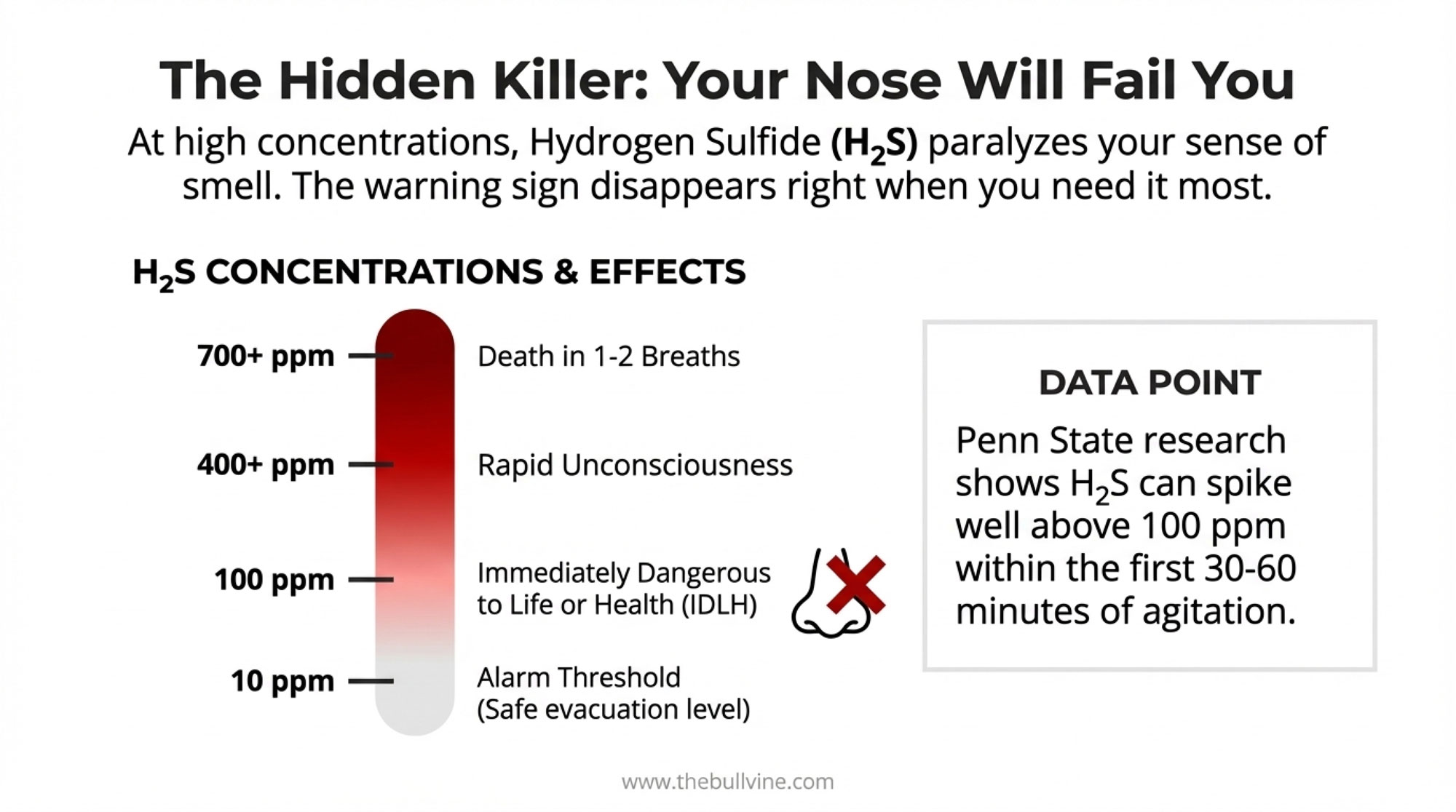

What makes hydrogen sulfide particularly dangerous—and this is something I don’t think gets emphasized enough in standard safety talks—is how it behaves at different concentrations. The CDC and NIOSH have established clear thresholds every producer should understand:

- 10 ppm → Recommended alarm threshold; evacuate the area

- 100 ppm → NIOSH “Immediately Dangerous to Life or Health” (IDLH)

- 400+ ppm → Rapid unconsciousness, often within seconds

- 700+ ppm → Death within one or two breaths

Here’s the part that catches people off guard: at high concentrations, H₂S paralyzes your sense of smell before you notice anything’s wrong. The warning sign disappears right when you need it most. So telling workers to “be careful” or “watch for the smell” doesn’t really account for how this hazard actually behaves.

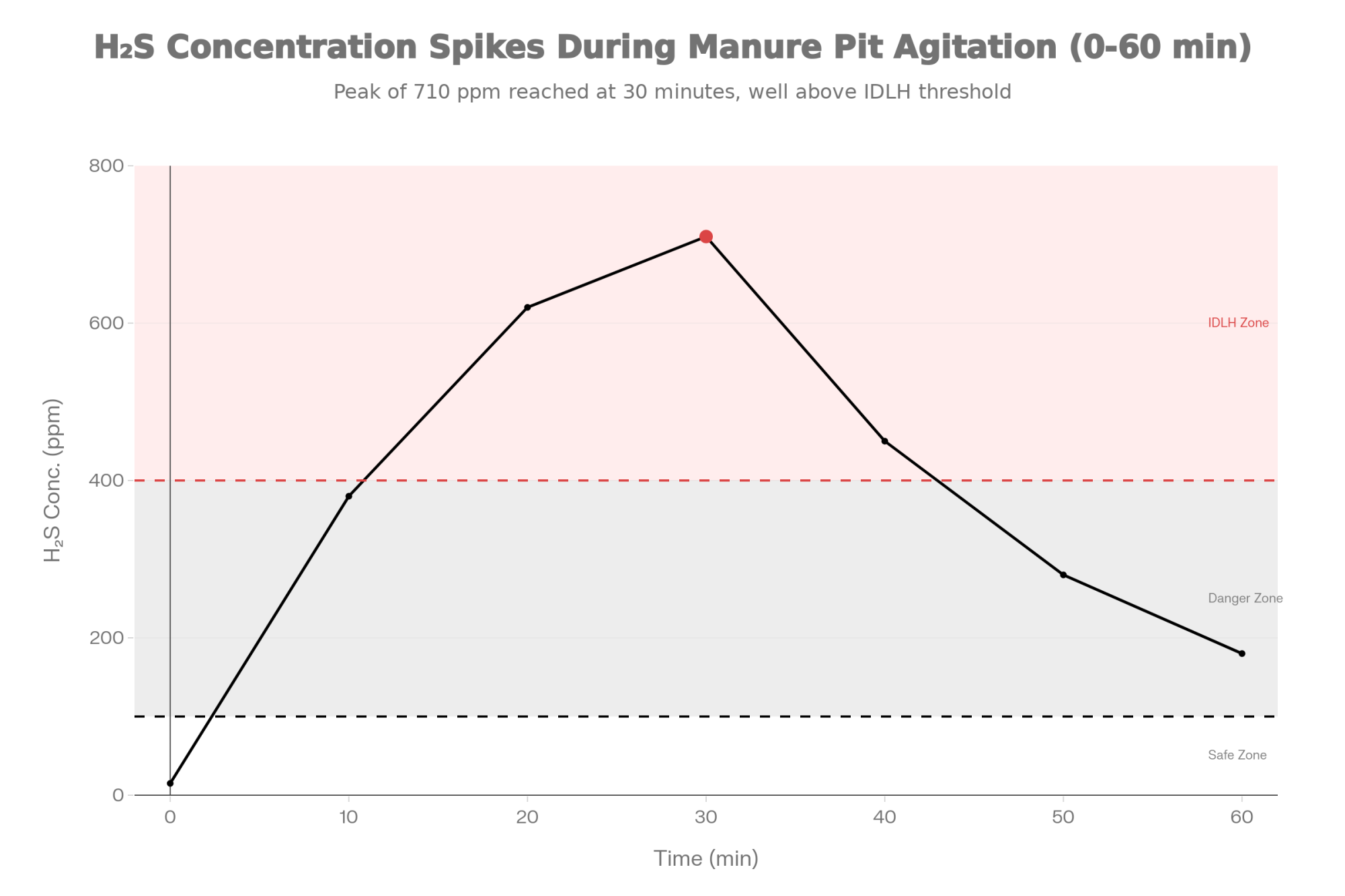

Research from Penn State’s Department of Agricultural and Biological Engineering has documented concentration spikes well above the 100 ppm danger threshold during the first 30-60 minutes of agitation, reaching levels immediately dangerous to life and health—especially on operations using gypsum bedding. The danger isn’t a gradual buildup that gives workers time to respond. It’s rapid spikes that can incapacitate someone before they even realize there’s a problem.

Penn State Extension specialists report that producers who’ve used monitors during agitation are consistently surprised by how quickly concentrations spike—often reaching several hundred ppm within the first 10-15 minutes. There’s something about watching those numbers climb in real time that makes the abstract hazard very, very concrete.

The Rescue Effect: Why Single Incidents Become Multiple Fatalities

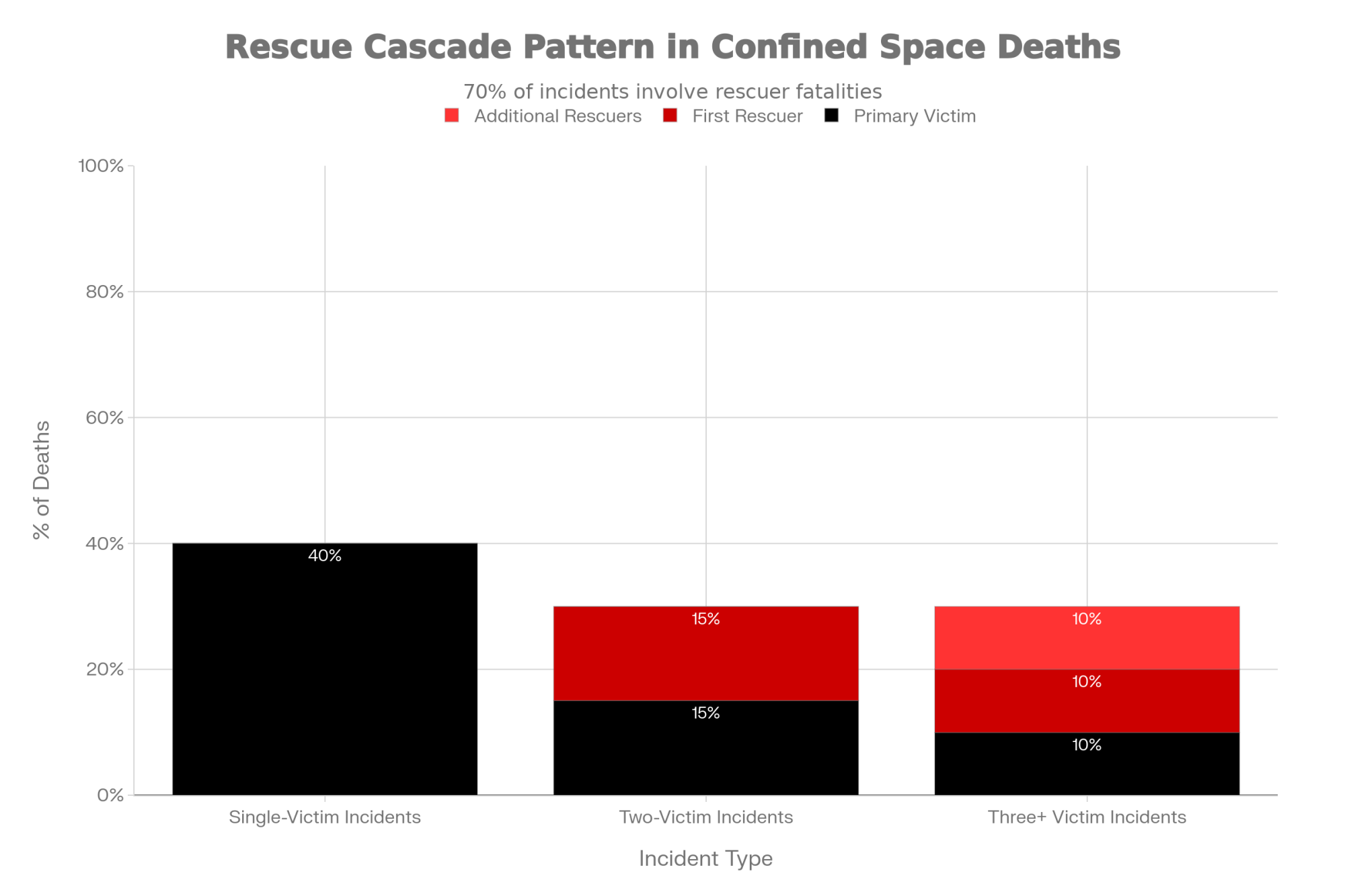

One pattern that appears to have occurred in Colorado—and this is something safety professionals have documented extensively over the years—is the “rescue effect” or “cascade phenomenon.”

According to NIOSH data, approximately 60 percent of confined-space fatalities are rescuers who enter to save others. Think about that for a moment.

| Incident Type | Primary Victim | First Rescuer | Additional Rescuers | Total |

| Single-Victim | 40% | 0% | 0% | 40% |

| Two-Victim | 15% | 15% | 0% | 30% |

| Three+ Victim | 10% | 10% | 10% | 30% |

A comprehensive study examining incidents from 1980-1989 documented 670 deaths in 585 confined space incidents during that period, with rescuers consistently dying at higher rates than initial victims when atmospheric hazards were involved.

The pattern is remarkably consistent:

- A worker is overcome and collapses

- Coworkers see someone in distress and rush to help

- Without respiratory protection or retrieval equipment, they’re overcome by the same hazard

- Others follow

Dan Neenan, who directs the National Educational Center for Agricultural Safety, frames it in terms that resonate with anyone who’s worked on a farm: “You see your coworker, your friend, maybe your family member go down, and every instinct you have says to help. That’s not a training problem you can solve by telling people to suppress their instincts.”

And that’s exactly right. That’s why the focus has to be on systems design rather than just awareness. You can’t train people not to care about each other—nor would you want to. The goal is providing tools that make safe rescue possible when that instinct kicks in.

Equipment Options: What’s Actually Available and What It Costs

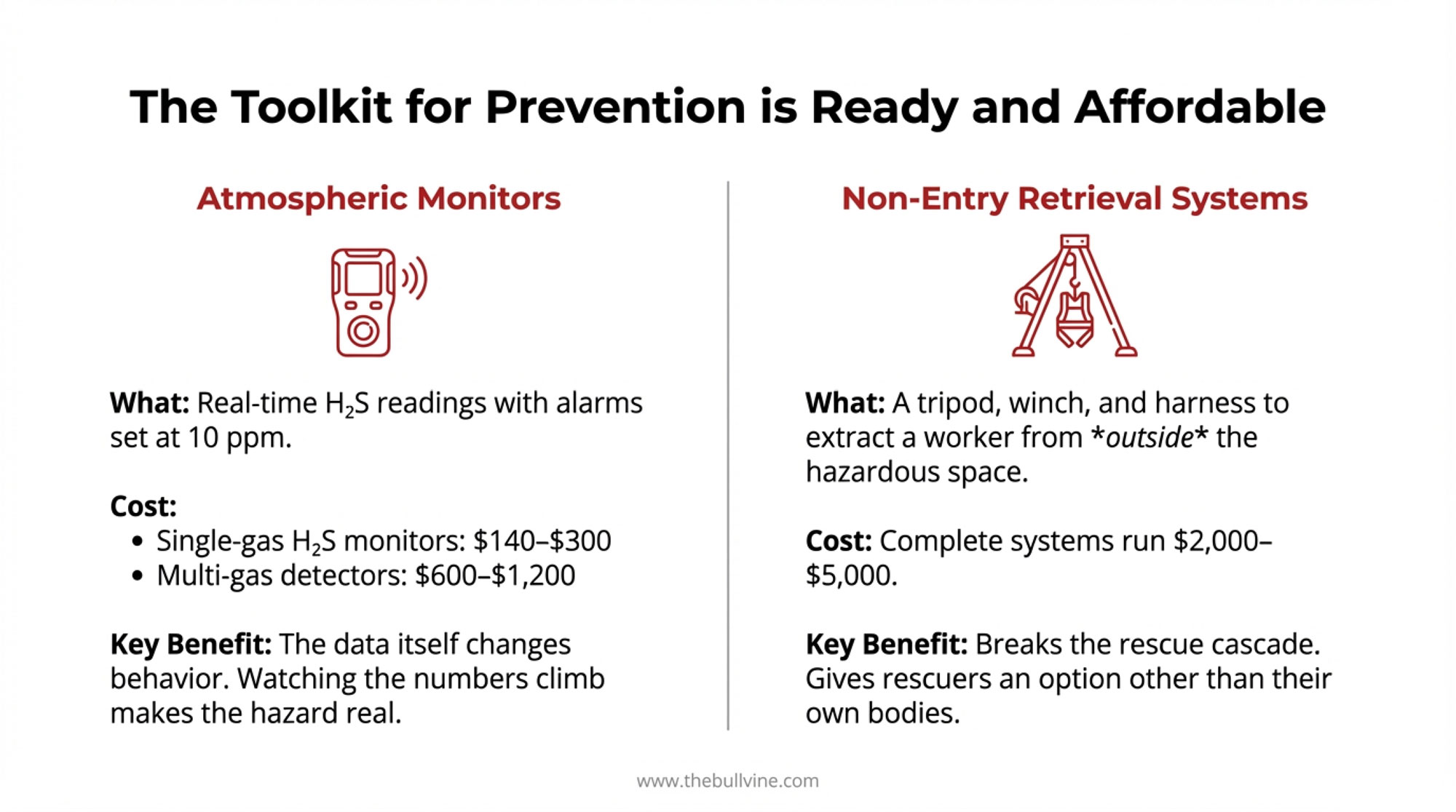

The good news here—and I think this deserves more attention than it typically gets—is that the technology for preventing these tragedies isn’t exotic or prohibitively expensive. We’re not talking about the kind of capital investment required for a new milking parlor or feed center.

Atmospheric Monitoring

Portable hydrogen sulfide monitors have come down significantly in price. Based on current distributor pricing from suppliers like Grainger and MSA Safety:

| Equipment Type | Cost Range |

| Single-gas H₂S monitors | $140–$300 |

| Multi-gas detectors (H₂S, methane, ammonia, O₂) | $600–$1,200 |

| Weekly rental options | $30–$50 |

These devices provide real-time concentration readings and can be programmed to alarm at 10 ppm—well below the danger zone.

What producers are finding is that the monitoring itself changes behavior. Once you actually see the numbers during agitation, you understand why the guidelines exist. The data itself is educational in a way that safety talks and warning signs just aren’t.

The practical side: monitors require regular calibration and bump-testing before each use. But honestly, these aren’t complicated maintenance items for anyone already managing activity meters, automatic calf feeders, or other technology that’s become standard in modern operations.

Retrieval Systems

Non-entry rescue equipment—designed to extract an incapacitated worker from outside the confined space—typically includes a tripod, mechanical winch, harness, and lifeline. Complete systems run $2,000 to $5,000, depending on configuration.

The concept is straightforward: when a worker wearing a harness connected to a retrieval line is overcome, an operator outside the space can mechanically extract them—without anyone else entering the hazardous atmosphere. This breaks the rescue cascade.

Dr. William Field at Purdue, who’s studied farm confined space incidents for over three decades, puts it simply: “It’s the difference between having an option and not having one. When the only tool available is your own body, that’s what people use. Give them equipment that works from outside, and the dynamics change completely.”

Cost-sharing options:

- Partner with neighboring farms to share retrieval equipment

- Connect with local fire departments to ensure rescue teams know about on-farm confined spaces

- Check with your cooperative about group purchasing programs

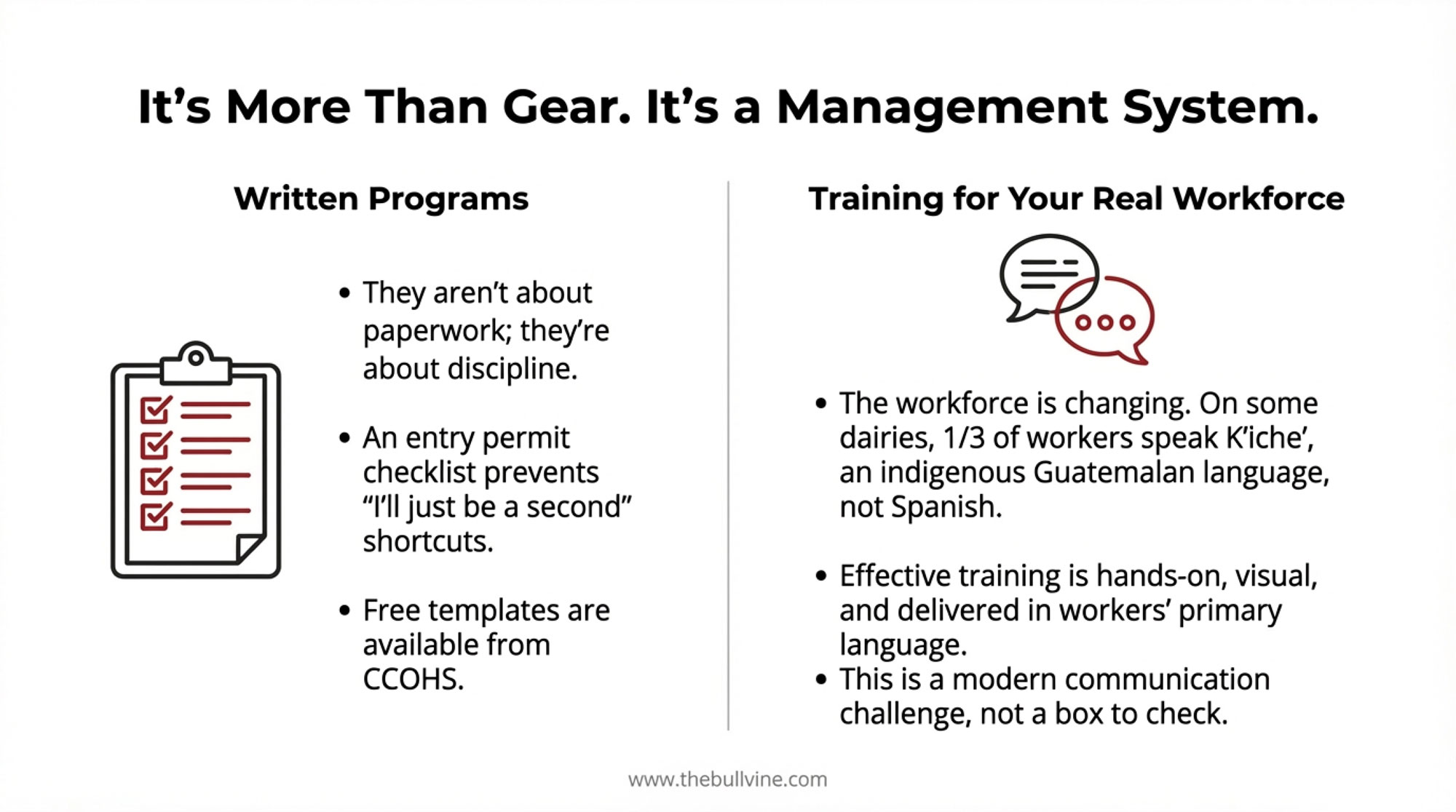

Written Programs and Documentation

Beyond equipment, effective confined space safety requires documented procedures. This is where some producers push back—and I get it. Nobody got into dairy farming because they love paperwork. But the discipline of a written program catches oversights that informal approaches miss.

The Canadian Centre for Occupational Health and Safety offers free, downloadable templates that work well for U.S. operations. A complete program covers:

- Hazard identification for all confined spaces

- Atmospheric testing protocols

- Entry permit systems

- Rescue procedures and emergency contacts

- Training documentation

The entry permit piece is worth emphasizing. Before anyone enters a confined space, a permit gets completed documenting atmospheric test results, equipment in place, and emergency procedures. It sounds like bureaucracy, but producers who use permits consistently tell me the checklist discipline is exactly what prevents the “I’ll just be a second” shortcuts that lead to trouble.

The Training Challenge: Reaching a Changing Workforce

Here’s something that doesn’t get enough attention in industry conversations about safety: the disconnect between how training is typically delivered and how many dairy workers actually learn.

Research from the Migrant Clinicians Network and studies published in Frontiers in Public Health have documented significant challenges:

- Language barriers consistently rank as a major safety issue among Latino dairy workers

- Formal safety training reaches fewer workers than most producers realize

- Most learning happens from coworkers rather than structured programs

The workforce reality has evolved faster than training infrastructure in many regions. Dr. Robert Hagevoort at New Mexico State University Extension has documented that, on many southwestern dairies, approximately one-third of workers now speak K’iche’, an indigenous Mayan language from Guatemala, as their primary language. Not Spanish. Not English. K’iche’.

As Dr. Hagevoort explained, during standard training, they were missing one out of every three employees.

What’s proving more effective:

- Training delivered in the workers’ primary language by fluent speakers

- Hands-on demonstration rather than written materials

- Assessment of actual comprehension, not just attendance

- Visual aids and practical exercises that don’t depend on literacy

- Repeated reinforcement across multiple sessions

New Mexico State actually developed voice-over translations for dairy safety training in K’iche’—work that required coordination with native speakers, since the language lacks a standardized written alphabet. It’s a model worth considering as workforce demographics continue shifting.

This isn’t just a southwestern issue. Operations in Wisconsin, Minnesota, and across the Northeast are navigating similar workforce transitions. The producers handling it best are treating communication as a core management challenge rather than a box to check.

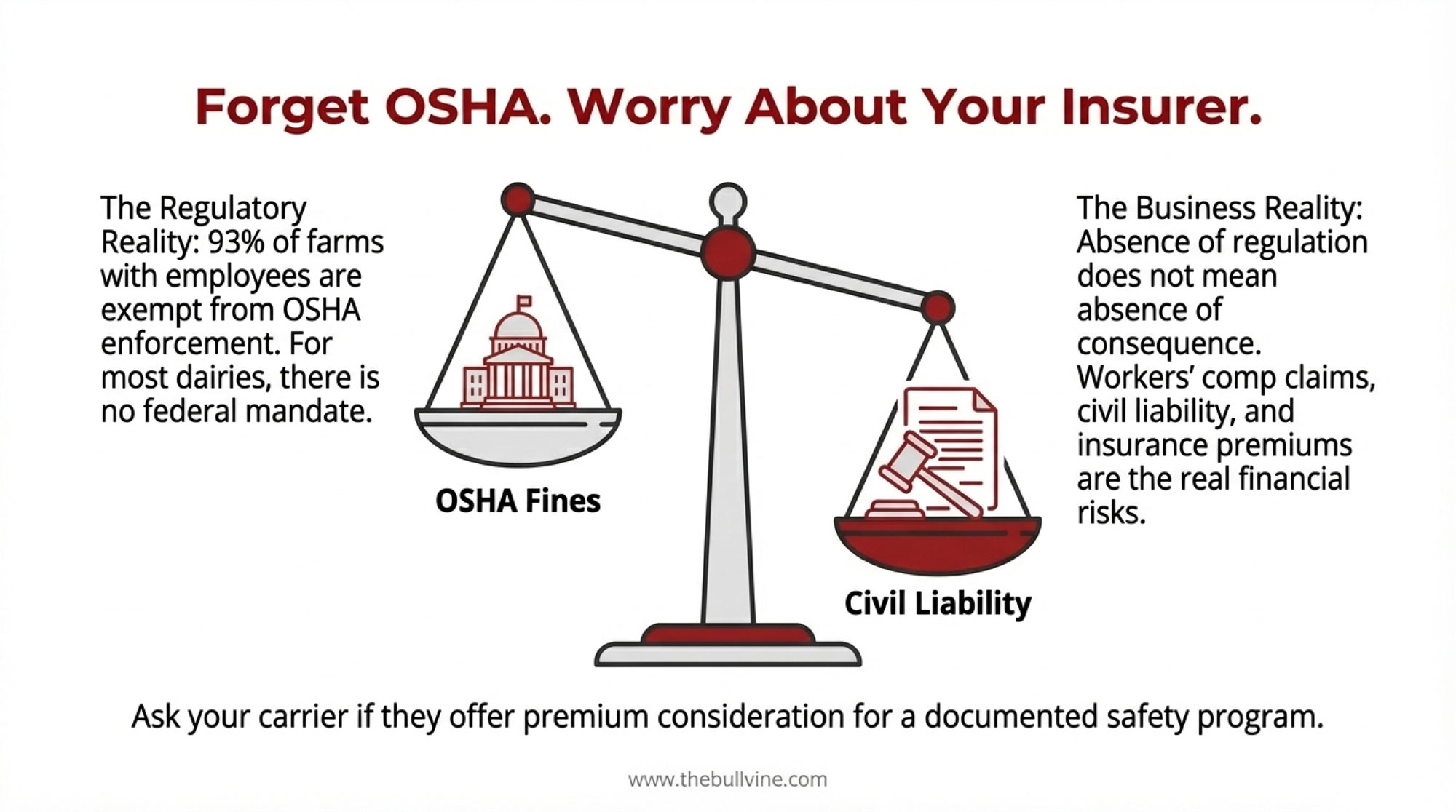

The Regulatory Reality: What You Need to Know

Let me give you the quick version on regulations, because this matters for your decision-making.

The federal picture:

- Farms with 10 or fewer non-family employees are largely exempt from OSHA enforcement (1976 appropriations rider, renewed annually)

- According to The Atlantic’s analysis, 93% of farms with outside employees meet this exemption

- OSHA can’t conduct routine inspections or issue citations on exempt operations—even after a fatality

State variations:

- California: Cal/OSHA covers all agricultural operations regardless of size

- Oregon & Washington: Active agricultural safety programs

- Most other states: Minimal agricultural-specific requirements

The bottom line: Most dairy operations face no federal regulatory requirement for confined space safety programs. But here’s the thing—absence of regulation doesn’t mean absence of consequences.

Workers’ compensation claims, civil liability exposure, and operational disruption from incidents can far exceed the costs of prevention. Some agricultural insurers are beginning to factor confined space protocols into premium calculations. It’s worth asking your carrier what documentation they consider.

One thing to watch: Legislative efforts to eliminate the small farm OSHA exemption continue. The most recent push in 2023 didn’t advance, but producers planning long-term should factor potential regulatory changes into their thinking.

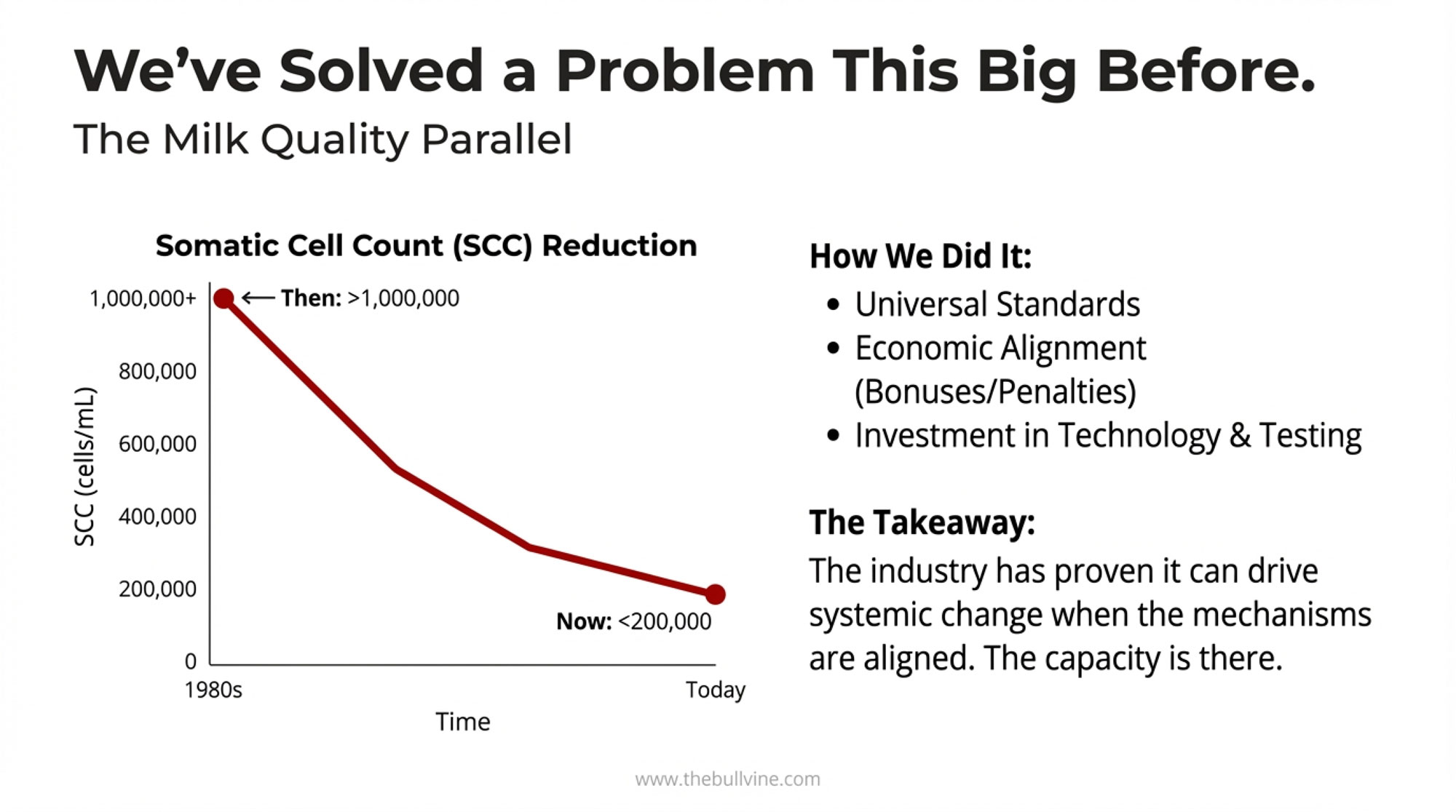

Learning from What’s Worked Before: The Milk Quality Parallel

Here’s a comparison I find useful—not to criticize anyone, but to understand what this industry is capable of.

The transformation: In the 1980s, bulk tank somatic cell counts routinely exceeded 1 million cells/mL. Today, many operations achieve counts below 200,000. That happened within the working memory of producers still active in the industry.

What made it work:

- Universal standards that applied to every farm

- Enforcement with real consequences (lose market access)

- Economic alignment (processor bonuses/penalties tied to SCC)

- Investment in testing infrastructure

The industry demonstrated it could drive systematic change when the mechanisms aligned. Safety presents different challenges—the “return” on prevention is invisible until something goes wrong. But the organizational capacity clearly exists.

Some producer groups and cooperatives are beginning to explore whether similar frameworks could work for worker safety. It’s early, but the conversation is happening in ways it wasn’t five years ago.

What Implementation Actually Looks Like

I’ve been asking around what comprehensive programs look like in practice—not the textbook version, but the operations that are actually doing them.

Pre-Agitation Protocols

- Test atmospheric conditions before any manure disturbance

- Establish “no-go” zones during the first 60-90 minutes (highest-risk window per Penn State research)

- Communicate clearly when agitation is occurring

- One Wisconsin operation uses a simple flag system: red flag up = stay clear of the pit area

Seasonal Timing

- Most northern operations schedule agitation during the spring and fall

- Warmer temperatures accelerate gas production

- With increasingly hot Midwest summers, some producers are being more cautious about late-spring timing

Equipment Deployment

- Gas monitors worn by workers near manure storage during agitation

- Retrieval systems set up before any planned entry

- Emergency response kits at confined space access points

Training Integration

- Safety briefings in workers’ primary languages

- Hands-on practice—not just showing equipment but having workers use it

- Regular drills, quarterly or more frequent

- One California producer: “The drills feel excessive until you need them. The first real scare we had, everyone knew exactly where to go.”

Documentation

- Entry permits are required before any confined space work

- Training records for all personnel

- Near-miss reporting to catch hazards before they become tragedies

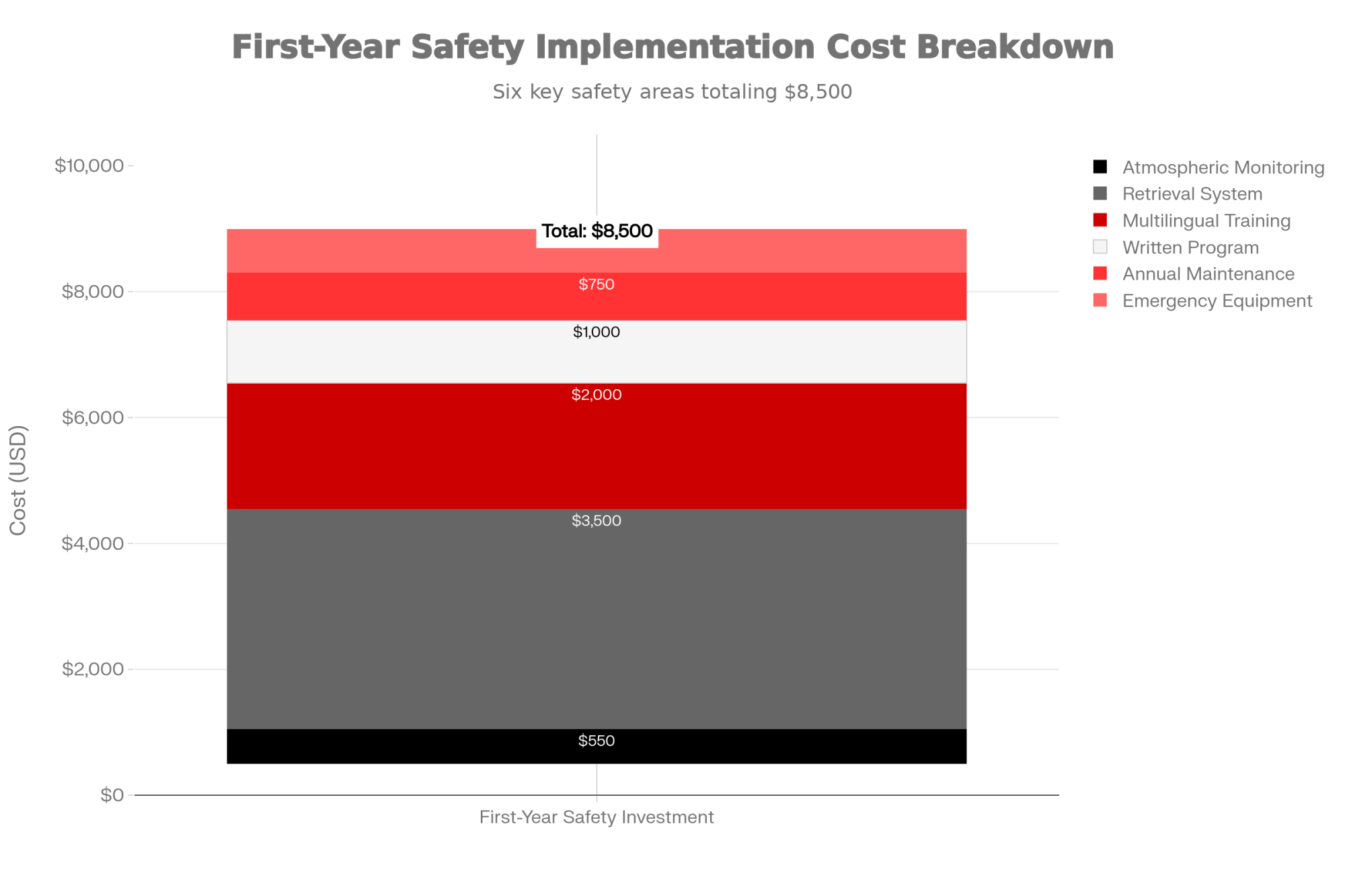

The Economics: Making Sense of the Numbers

First-year implementation costs:

| Item | Cost Range |

| Atmospheric monitoring | $300–$800 |

| Retrieval system | $2,000–$5,000 |

| Training (including multilingual) | $1,000–$3,000 |

| Written program development | $500–$1,500 (less with free templates) |

| Total first-year investment | $4,000–$10,000 |

| Annual maintenance/training | $500–$1,000 |

What incidents actually cost:

| Consequence | Cost Range |

| Medical expenses (serious H₂S exposure) | $50,000–$200,000 |

| Workers’ comp claim (fatality) | $500,000–$1.5 million |

| Civil liability settlements | $1–$5 million |

| Average workplace fatality (NSC 2023 data) | $1.46 million |

Research from the Institute for Work and Health in Ontario found ROI on safety investments ranging from 24% in manufacturing to over 100% in transportation when prevented incidents are factored in.

When you look at equipment costs comparable to routine operating expenses—less than a decent replacement heifer—the math starts to look different than many producers assume.

Regional Risk Factors to Consider

Risk levels aren’t uniform. Here’s what affects how much attention confined space protocols warrant for your specific operation:

| Risk Factor | Higher Risk Profile | Lower Risk Profile | Recommended Equipment | Estimated Investment |

|---|---|---|---|---|

| Climate | Southern states; hot, humid summers | Moderate temps; cooler regions | Multi-gas monitor, ventilation fans | $800-$1,500 |

| Storage Design | Below-grade covered pits, limited airflow | Above-ground, open-top, natural ventilation | H₂S monitor, retrieval tripod | $2,200-$5,300 |

| Bedding Type | Gypsum (high sulfur content) | Sand, sawdust, other low-sulfur | Continuous monitoring, rescue gear | $3,000-$6,000 |

| Workforce | High turnover, multilingual, seasonal | Stable, experienced, consistent | Multilingual training, frequent drills | $1,200-$3,000 annually |

| Emergency Access | Rural, 30+ min from hospital/rescue | Near town; rescue services <15 min | Full retrieval system, SCBA | $4,000-$7,500 |

Your Next Steps: Start This Week

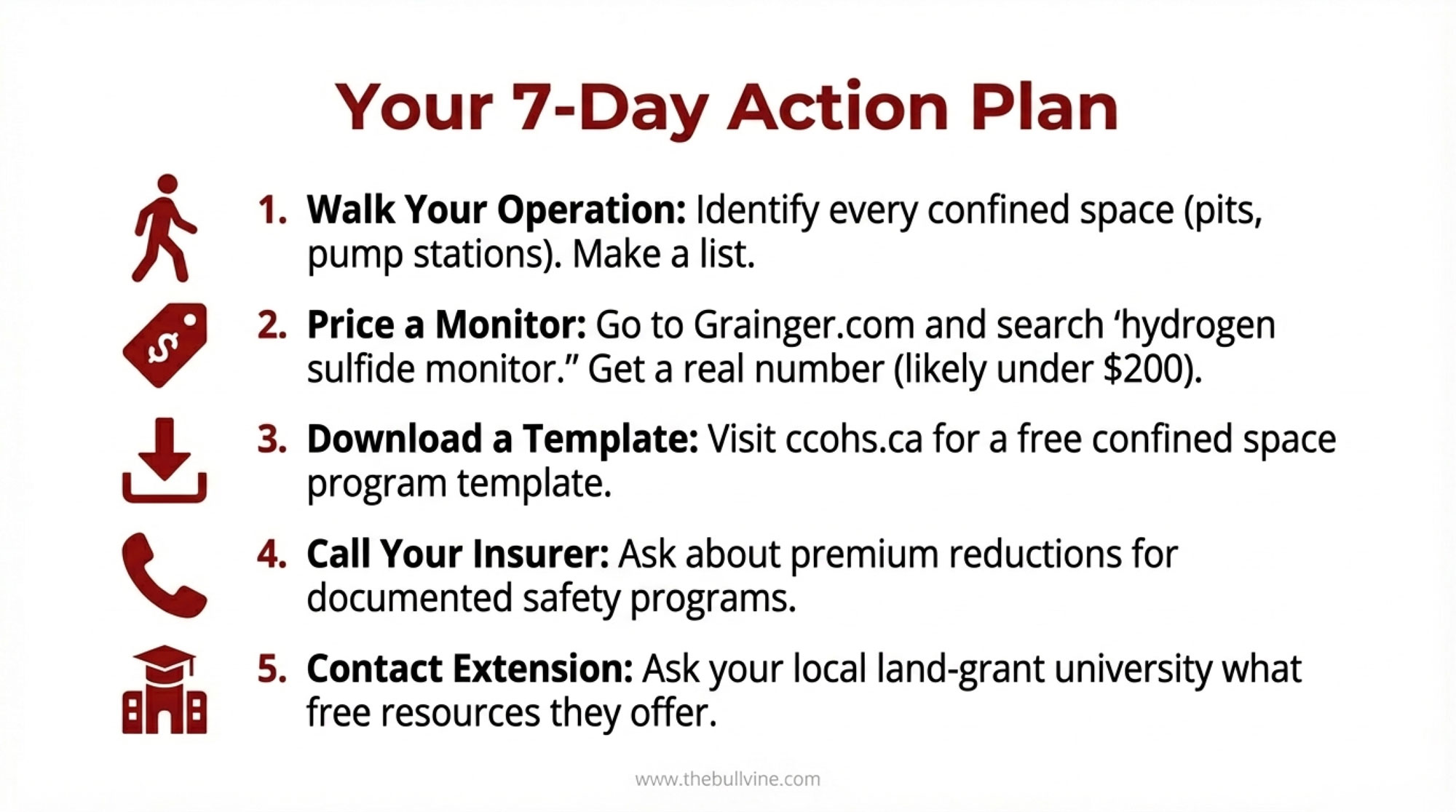

Don’t let this become another article you read and forget. Here are five things you can do in the next seven days:

1. Walk your operation tomorrow. Identify every manure pit, pump station, and storage facility where atmospheric hazards could develop. Make a list. You can’t manage what you haven’t identified.

2. Order a gas monitor this week. Go to Grainger.com or call your local safety equipment supplier. Get an actual quote for a single-gas H₂S monitor. Seeing a real number—likely under $200—changes the conversation.

3. Download a free template. Visit ccohs.ca and download their confined space program template. Even if you don’t implement it immediately, having it on your computer is a start.

4. Call your insurance carrier. Ask one question: “Do you offer any premium consideration for documented confined space safety programs?” The answer might surprise you—and might save you money.

5. Talk to your extension office. Call Penn State, Purdue, Wisconsin, or your state’s land-grant university extension. Ask what confined space resources they have available. Many offer free on-farm consultations you’ve probably never heard about.

The Bottom Line

The Colorado tragedy reminds us that the knowledge to prevent manure pit deaths has been available for decades. The technology is proven and increasingly affordable. The training methods are documented.

What remains is the work of translating awareness into action.

For the families of those six workers—including Alejandro Espinoza Cruz and his two sons Oscar and Carlos, who died together that August morning—that work needed to happen sooner.

For the rest of us, the tools and knowledge exist, and what happens next comes down to the choices we make in our own operations—starting this week.

Resources

Free Templates & Training Materials:

- CCOHS: Confined Space Program Templates → ccohs.ca

- Penn State Extension: Manure Storage Safety → extension.psu.edu

- Purdue Agricultural Safety: extension.purdue.edu

- UW-Extension Farm Safety: extension.wisc.edu

- National Ag Safety Database: nasdonline.org

Regulatory Information:

- OSHA Agricultural Standards: osha.gov

- State Plan Directory: osha.gov/stateplans

Equipment Suppliers:

- Grainger: grainger.com (search “hydrogen sulfide monitor”)

- MSA Safety: msasafety.com

- 3M Fall Protection: 3m.com

Key Takeaways

- A $200 monitor could have saved six lives—including a father and two sons who died together at a Colorado dairy in August 2025

- 60% of confined space deaths are would-be rescuers; you can’t train away the instinct to help, but you can equip for safe rescue

- H₂S kills your sense of smell before it kills you—at high concentrations, the warning sign vanishes when you need it most

- Peak danger: the first 60 minutes after agitation starts; establish no-go zones and test the air before anyone approaches

- Start this week: Identify your confined spaces, price a monitor (~$150), and download free CCOHS templates

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlock Peak Performance on Your Dairy Farm: Top Leadership Advice – reveals methods for building a communication-first culture that ensures safety protocols aren’t just written down but actively followed by every team member, bridging the gap between management expectations and employee reality.

- The Family Dairy Time Bomb: Why 83.5% of Operations Fail by the Third Generation – provides strategies for protecting your operation’s future, connecting the dots between family safety, risk management, and the long-term survival of multi-generational farms facing operational transitions.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – demonstrates how emerging monitoring systems and sensor technologies are moving beyond herd health to improve overall farm safety, offering automated solutions that reduce human exposure to hazardous environments.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.