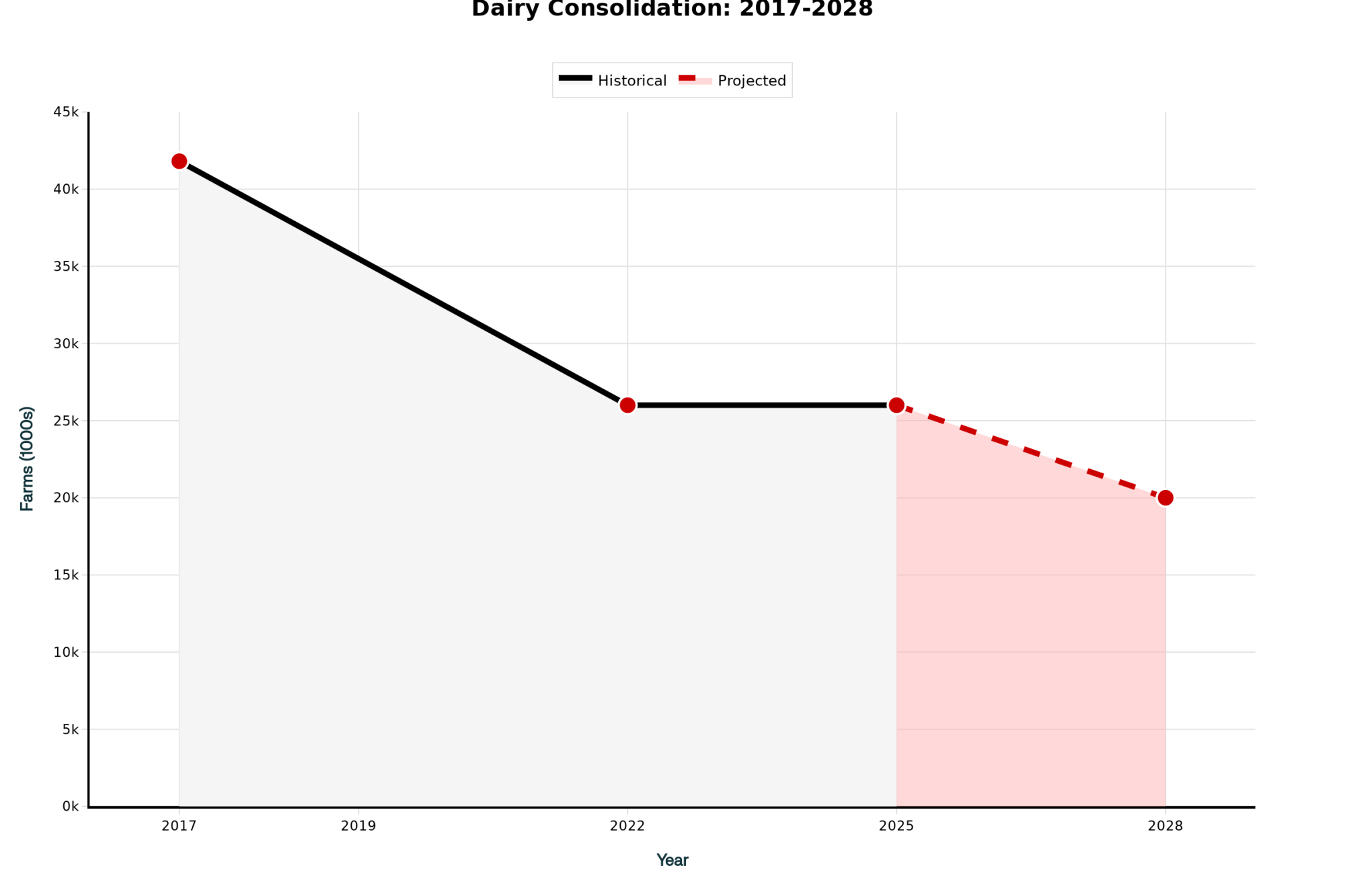

26,000 dairy farms are expected to drop to 20,000 by 2028. Which side of that line are you on? Four numbers will tell you

Executive Summary: With milk stuck below $14/cwt through 2026 while global production rises 3-6%, this isn’t a downturn—it’s a restructuring. Five permanent changes (beef-on-dairy heifer shortage, China’s self-sufficiency, technology cost gaps, fixed-cost production traps, and processor overcapacity) mean the old recovery playbook is dead. Right now, mega-dairies operate at $13.80/cwt, niche producers capture $8-12 premiums, but mid-sized farms (500-1,500 cows) hemorrhage cash at $18-21/cwt. I’ve developed a four-number framework—true cost per cwt, liquidity runway, competitive investment ratio, and niche premium potential—that reveals your best path forward in minutes. Calculate these this week to determine whether you should expand, pivot to premium markets, or execute a strategic exit while you control the terms. The industry will shrink from 26,000 to 20,000 farms by 2028, but producers who act decisively in the next 90 days can still position themselves to thrive.

You know, I was checking the CME futures board this morning—Class IV milk sitting below $14/cwt all the way through February 2026—and it really got me thinking about what we’re all dealing with right now. Here’s what’s interesting: while we’re staring at these terrible prices, the production reports from early October show New Zealand’s up 3% year-over-year, Ireland’s pumping out nearly 6% more milk, and Belgium’s somehow surging 6.5%.

You’d think somebody would cut back, right? But they can’t. And that’s what makes this whole situation fundamentally different from anything we’ve weathered before.

The Five Structural Changes We’re All Navigating Together

The Beef-on-Dairy Shift That’s Bigger Than We Realized

So here’s something that’s really caught my attention—and I think most of us have been surprised by how big this has gotten. The National Association of Animal Breeders’ latest sales data shows beef semen sales to dairy operations jumped almost 18% last year alone. What started as a way to manage margins has become something much more structural.

I was talking with a producer in central Wisconsin last week—third-generation operation, really sharp guy—and he walked me through his breeding decisions. With those week-old beef-cross calves bringing $800 to $1,200 at regional auctions (I saw some exceptional ones hit $1,400 at Dairyland), and compare that to the $3,200 to $4,500 it costs to raise a replacement heifer to breeding age… well, the math’s pretty clear. Penn State Extension’s budgets back this up, though honestly, if you’re in an area with higher feed costs, you might be looking at even more.

What’s particularly worth noting is how this revenue stream—often covering 12-16% of total farm income—has become essential for cash flow, especially for making those monthly debt service payments. But here’s the thing that’s really starting to bite: once you commit to this breeding strategy, you’re locked in for at least 30 months. That’s just biology—you can’t speed up getting a heifer from conception to first lactation.

I was chatting with one of CoBank’s dairy economists at a meeting recently, and they’re suggesting the US dairy heifer inventory could shrink by 700,000 to 800,000 head through 2027. Even if milk prices doubled tomorrow—and let’s be honest, we all know they won’t—we simply can’t produce replacement heifers any faster than nature allows.

China’s Role Has Completely Changed

Remember how China always seemed to bail us out? You probably know this pattern—2009, 2015… we’d get oversupplied, prices would tank, and then Chinese demand would gradually soak up the excess. Well, that playbook’s done, and we need to accept it.

The China Dairy Industry Association’s data shows their per capita consumption dropped from 14.4 kg in 2021 to 12.4 kg in 2022, and from what I’m hearing from folks in the export business, it hasn’t bounced back. Meanwhile—and this is what’s really changed the game—their domestic production hit nearly 42 million tonnes in 2023. They actually exceeded their own government targets.

Looking at the customs data from August, whole milk powder imports into China were down over 30% year-over-year, while skim milk powder imports were down about 23%. I’ve noticed many of us still talk about Chinese demand “recovering,” but honestly? They’re dealing with their own oversupply while facing declining birth rates and changing dietary preferences among younger consumers. That safety valve we used to count on… it’s gone.

The Technology Gap That’s Becoming a Canyon

Farm Size | Cows | Robot Investment | Annual Debt Service | Production Gain | Labor Savings | Net Annual Benefit | ROI at $20 | ROI at $14 |

|---|---|---|---|---|---|---|---|---|

| Mega-Dairy | 3,800 | $2.7M (12 robots) | $220K | +$684K | +$840K | +$1,304K | ✓ PROFITABLE | ✓ PROFITABLE |

| Mid-Size (TRAP) | 500 | $900K (4 robots) | $85K | +$90K | +$280K | +$285K | ✓ Barely profitable | ✗ LOSES MONEY |

| Small Farm | 180 | $450K (2 robots) | $43K | +$32K | +$140K | +$129K | ✗ Marginal | ✗ UNPROFITABLE |

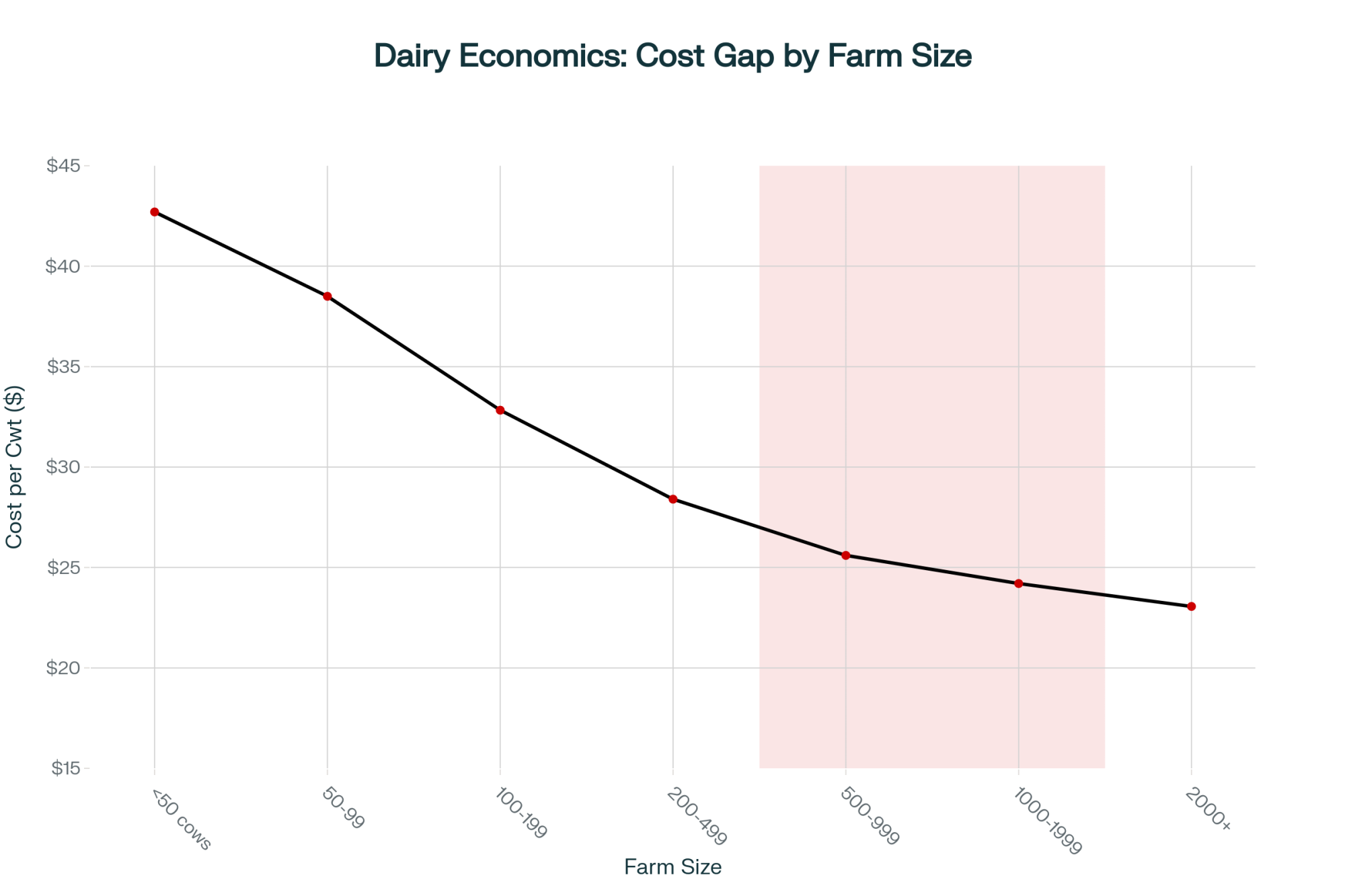

You probably already know this, but that USDA Economic Research Service report—”Profits, Costs, and the Changing Structure of Dairy Farming”—really lays it all out. Farms with 2,000+ cows are running total production costs around $23/cwt. Smaller operations with 100-199 cows? They’re looking at $32-33/cwt. That’s a $10 gap, and here’s the thing: technology is making it wider, not narrower.

My neighbor just got quotes for a robotic milking system—both DeLaval and Lely are quoting $180,000 to $230,000 per unit right now. For his 500-cow operation, he’s looking at a minimum of $900,000 for the robots alone, plus another $200,000 for barn modifications. At current Farm Credit rates—which are running 7.5-8.5% for most of us with decent credit—that’s $85,000 to $90,000 annually just in debt service.

Now, the big dairies installing these systems are seeing real gains—8-10 pounds more milk per cow daily, plus labor savings of $60,000 to $80,000 annually per robot. But here’s what nobody wants to say out loud at the co-op meetings: the return on investment only works at scale. University of Minnesota Extension did this analysis showing robots can be profitable at $20 milk but lose significant money at $15. And where are prices heading?

A producer out in California shared something interesting with me last month—they’ve got 3,800 cows, and went fully robotic two years ago. “Best decision we ever made,” he said, “but only because we had the volume to spread those fixed costs. My neighbor with 600 cows? Same robots would bankrupt him at these prices.”

Why We Keep Milking Even When We’re Losing Money

This one puzzles a lot of people outside the industry, but if you’ve been doing this a while, you get it. Cornell’s Program on Dairy Markets and Policy explained it really well in one of their recent webinars—pasture-based systems like those in New Zealand and Ireland have completely different cost structures than our confinement operations here in the States.

DairyNZ’s economic surveys show their typical operation has variable costs around NZ$4.50 per kilogram of milk solids—that works out to roughly $7/cwt for us—but fixed costs that come to about $12/cwt. Think about that for a minute. When milk drops to $12/cwt, if they stop milking, they still owe that $12 in fixed costs, but lose the $5 that’s at least helping cover some of it. So they keep milking, even at a loss.

Irish producers are in the same boat. Teagasc’s reports show that Irish dairy farmers invested over €2.2 billion in expansion after the abolition of quotas in 2015. Those loans don’t just disappear when milk prices crash. The Central Bank of Ireland’s latest data shows 64% of Irish dairy farms carrying debt averaging over €117,000. You can’t just turn that off.

Processing Plants Running Half Empty

Here’s something that doesn’t get enough attention, but it’s affecting all of us. The International Dairy Foods Association has been tracking this—US processors have invested billions in new plant capacity over the last few years, expecting the kind of production growth we saw in the 2010s. But USDA’s Milk Production reports show we’re growing at maybe 0.4-0.5% annually. They built for 2-3% growth.

I was talking with a cheese plant manager in Wisconsin last month—won’t name names, but you’d know the company—and he put it pretty bluntly: “We’ve got a $45 million plant running at 60% capacity. We need milk, but we can’t pay farmers enough to make them profitable because Walmart won’t pay us more for cheese.”

That’s creating this weird dynamic where processors actually benefit from low farmgate prices as long as they can maintain their retail contracts. It’s not some conspiracy—it’s just economics playing out in a way that hurts us at the farm level.

Looking Back: Why This Isn’t Like 2009 or 2015

It’s worth looking at how we got here, because understanding the differences helps explain why the old recovery patterns won’t work this time…

2009 was actually pretty straightforward. Lehman Brothers collapsed, credit markets froze, and people stopped buying. Class III went from $20 to $9 in six months. But once the economy recovered, so did we. By 2011, we were setting price records again.

2015 was about oversupply. The EU eliminated quotas on March 31st after 31 years. European production jumped 6% almost overnight. Russia banned imports. China had too much inventory. But eventually producers cut back, China started buying again, and markets found their balance within 18 months.

This time? We’ve got five structural changes all hitting at once. The beef-on-dairy heifer shortage that’s locked in for years. China is becoming self-sufficient rather than our backstop. Technology is creating cost gaps that can’t be bridged. Fixed costs that prevent production cuts. And processors built for growth that isn’t happening. There’s no single fix because these aren’t temporary problems—they’re permanent changes to how the industry works.

Seven Leading Indicators That’ll Signal the Turn

If you want to know when this market really turns—and I mean actually turns, not just bounces around—here’s what I’m keeping an eye on:

Weekly dairy cow slaughter – USDA reports every Thursday

Looking for sustained rates 15-25% above year-ago levels for 8+ weeks. Currently running 5-8% below average. When slaughter spikes above 65,000 head weekly, that’s capitulation.

CME spot whey prices

Holding at 71-72¢ while cheese crashed from $2.20 to $1.70/lb. Breaking above 75¢ signals genuine demand recovery.

Cold storage inventories

October cheese shipments totaled 1.48 billion pounds, up 5.2% year-over-year. Need two consecutive months of meaningful drawdowns.

Export volumes

Need 8-12% year-over-year growth to signal international demand strength. Currently flat to slightly positive.

Heifer inventory reports

July 2026 USDA report will be critical—looking for the first stabilization since 2021.

Futures curve shape

Currently in contango. Shift to backwardation signals near-term tightness.

Chapter 12 bankruptcy rates

Up substantially in Q1 2025. Peak usual coincides with the market bottom.

Three Types of Operations Emerging from This

Based on what I’m seeing across the country—and USDA’s Census of Agriculture data backs this up—here’s how I think this shakes out by 2028:

The Big Operations Will Get Bigger

These operations with 5,000 to 25,000 cows aren’t just surviving—they’re actively expanding. I visited a 7,500-cow dairy near Amarillo recently that’s running all-in costs at $13.80/cwt. They’re buying herds from struggling neighbors at 60-70 cents on the dollar and integrating them pretty seamlessly.

With private equity backing and professional management teams—and look, I know how we all feel about that, but it’s the reality—these operations will probably control over half of US milk production within three years. They’re not the enemy; they’re just adapting to the economic reality we’re all facing.

Premium Niche Players Will Do Just Fine

The October Organic Dairy Market News shows organic certification still pays an $8-12/cwt premium over conventional. A friend of mine in Vermont—she’s got 95 cows, beautiful grass-fed operation—is getting $45-48/cwt selling directly to consumers through her on-farm store and a handful of local restaurants.

These operations compete on story and quality, not efficiency. If you’ve got the right location, marketing skills, and family commitment to make it work, this can be really successful. But let’s be realistic—it’s maybe 1,500 to 2,500 farms nationally that can pull this off.

I know a family in Pennsylvania—180 cows—who transitioned to organic three years ago. The husband told me over coffee last month: “We’re netting more on 180 organic than we ever did on 350 conventional. But man, those three transition years nearly broke us financially and emotionally, and my wife’s at farmers markets every Saturday and Wednesday year-round. It’s a complete lifestyle change.”

The Middle Is Really Struggling

This is hard to say, but if you’re running 500-1,500 cows producing commodity milk, the math is really challenging. Farm Credit’s benchmarking across multiple regions shows operations this size averaging $18-21/cwt in total costs. You’re $5-7 above the mega-dairies but can’t access the premiums that niche markets provide.

Between 2017 and 2022, USDA census data shows we lost 15,866 dairy farms while milk production increased by 5%. And honestly, that trend seems to be accelerating rather than slowing down.

Your Four-Number Reality Check

“We’ve got a $45 million plant running at 60% capacity. We need milk, but we can’t pay farmers enough to make them profitable because Walmart won’t pay us more for cheese.” – Wisconsin cheese plant manager

Look, I know nobody wants to do this kind of analysis when things are tough, but you really need to sit down—pour yourself a coffee—and work through these four calculations honestly:

1. Your True All-In Cost Per Hundredweight

Include everything—cash costs, debt service, family living draws, depreciation, and opportunity cost of your labor.

- Under $16/cwt: You might make it work with expansion or efficiency gains

- $16-18/cwt: You’re marginal—evaluate all options

- $18-21/cwt: Need a transition plan within 12 months

- Over $21/cwt: Everyday costs you equity

2. How Many Months of Runway Do You Have?

Available cash and credit divided by the monthly losses at $14 milk.

- 6+ months: Time to be strategic

- 3-6 months: Decide within 30 days

- Under 3 months: Crisis mode—act immediately

3. What Would It Take to Get Competitive?

Investment required to reach $15/cwt divided by available capital.

- Under 2.0: Expansion might work

- 2.0-3.0: Pretty risky

- Over 3.0: Expansion won’t save you

4. Could You Make a Niche Work?

Net premium after transition costs. The Northeast Organic Dairy Producers Alliance shows $3-7/cwt additional cost during transition.

- Premium covers 40%+: Strong pivot candidate

- 25-40%: Possible with passion

- Under 25%: Math doesn’t work

Your 90-Day Action Plan

Based on where you fall in those calculations:

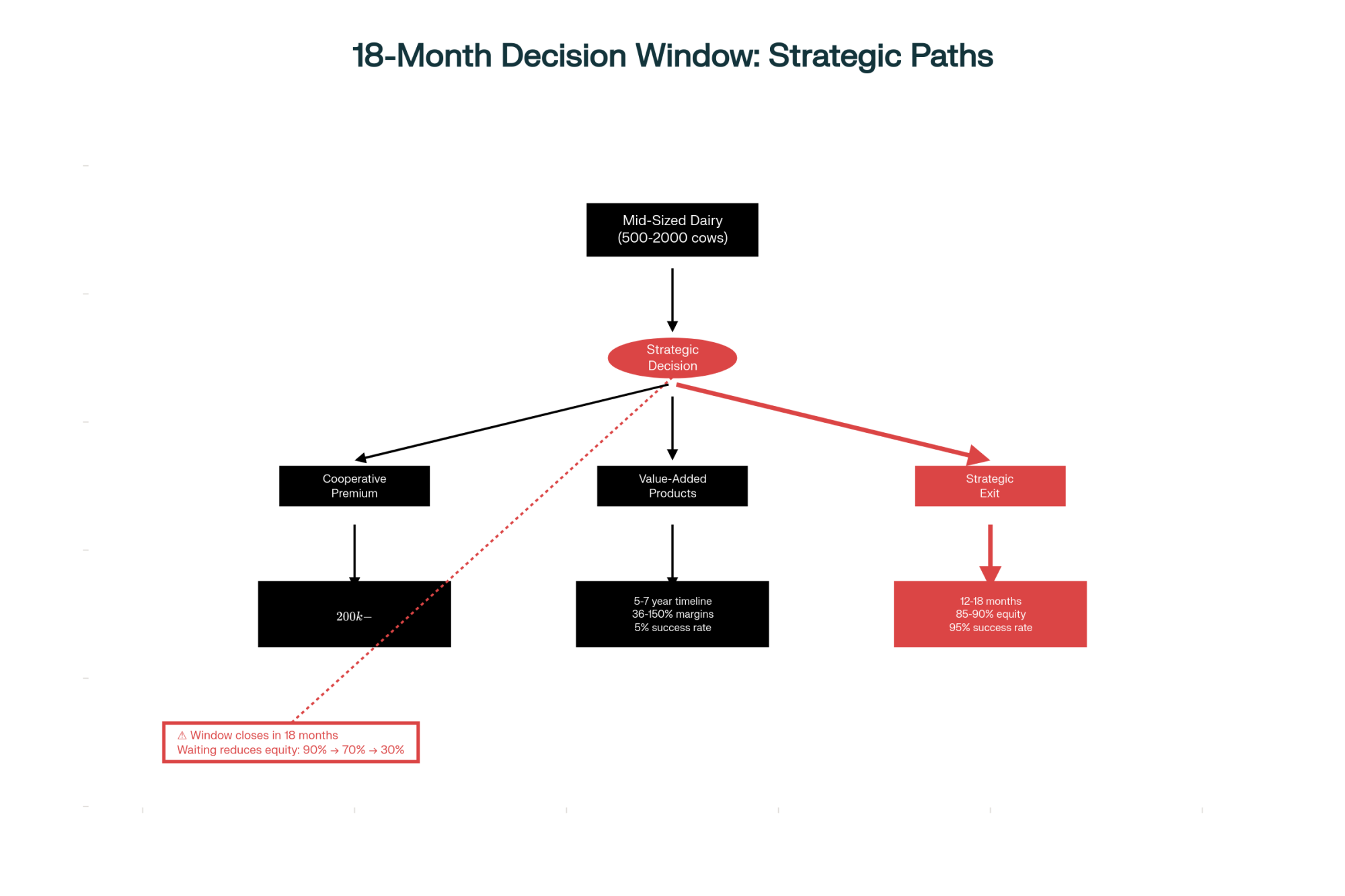

If You’re a Survivor (costs under $17/cwt, 6+ months liquidity):

Lock in feed costs now. Get maximum Dairy Revenue Protection. Model expansion scenarios. Position for Q2 2026 asset opportunities.

If You’re Facing an Exit (costs $18-22/cwt, limited liquidity):

Consult an attorney confidentially. Get a professional appraisal. Gauge neighbor interest discreetly. Act before banks force decisions.

If You’re Considering a Niche (strong local market, family commitment):

Start organic certification now (36-month process). Test farmers markets. Run realistic equipment costs. Ensure family buy-in.

If You’re in Crisis (under 3 months liquidity):

Call an attorney today. Cull aggressively for cash. List sellable assets. Understand personal versus farm-only debt.

The Reality We’re Facing

What makes this downturn different is that all the traditional recovery mechanisms have changed. China’s not coming to rescue us from oversupply. The advantages of technology are growing, not shrinking. Fixed costs mean producers keep producing even when they’re losing money. And processing overcapacity creates all kinds of weird incentives that work against us.

The industry that emerges by 2028 will probably have 20,000 to 22,000 farms, down from about 26,000 today. Maybe 800 mega-dairies will produce 60% of our milk. Another 2,000 or so niche operations will serve premium markets. And the middle—those 500-1,500 cow operations that have been the backbone of dairy for generations—most of them will be gone.

If you’re in that middle tier, you’ve got maybe 90 days to make a strategic decision while you still have some control over the outcome. Calculate those four numbers. Be honest with yourself about what they tell you. Make your move.

Because by March, the producers who waited will wish they’d acted sooner. And I really don’t want you to be one of them. We’ve all worked too hard, sacrificed too much, to let this restructuring take everything from us.

Look, there’s still opportunity in this industry. But it’s going to look different than what most of us grew up with. Understanding that—and adapting to it while you still have options—that’s what’s going to separate those who thrive from those who just survive.

Stay strong, make smart decisions, and remember—there’s no shame in strategic change. There’s only shame in letting pride destroy what you’ve built.

Key Takeaways:

- Your survival depends on four numbers: Calculate your true all-in cost/cwt, months of liquidity at $14 milk, investment needed to hit $15/cwt, and net premium from going niche—this week

- The cost gap is unbridgeable: Mega-dairies operate at $13.80/cwt, small organic farms capture $45-48/cwt, but mid-size operations bleed cash at $18-21/cwt with no fix

- Five permanent changes killed recovery: 72% beef-on-dairy locked through 2027, China down 30% on imports, tech ROI only at 2,000+ cows, fixed costs prevent production cuts, processors 40% overcapacity

- 90 days to choose your path: Expand to 2,500+ cows, transition to premium niche, or execute strategic exit—after March, banks choose for you

- 20,000 farms by 2028 (down from 26,000 today), but producers who act now can position themselves on the winning side

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – This article provides immediate, tactical strategies for improving your “Four-Number” reality check, revealing how producers are adding six figures in revenue by optimizing beef-on-dairy sales, cutting feed shrink, and leveraging low-cost energy efficiencies.

- US Dairy Market in 2025: Butterfat Boom & Price Volatility – How Farmers Can Protect Profits – While the main article focuses on cost per cwt, this strategic analysis explores the revenue side, demonstrating how to navigate the “component economy” and protect profits by breeding for butterfat and protein, not just volume.

- U.S. Dairy Genetic Evaluations Set for Historic Reset in April 2025 – This piece details the innovative genetic tools that answer the main article’s strategic challenges, showing how to use the new Net Merit $ (NM$) index to breed more feed-efficient, high-value cows and escape the “struggling middle” trap.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!