The consensus at USDEC’s Spring Board of Directors meeting was that U.S. dairy exports would continue to grow in 2023 but may not match last year’s lofty 5% increase.

After three straight years of breaking records, what’s next for U.S. dairy exports?

That was the overarching question at the U.S. Dairy Export Council’s Spring Board of Directors Meeting held March 27-29 in Washington, D.C.

USDEC President and CEO Krysta Harden captured the guarded optimism of the three-day meeting when she told attendees, “The long-term outlook for U.S. dairy exports is extremely bright. We are poised for continued growth.”

Looking ahead to the global dairy market, past performance does not guarantee future results.

U.S. supplier consistency a key to success

A growing reputation for reliability and an ample supply provided by U.S. farmers and dairy processors has helped get more milk and dairy products shipped across U.S. borders than ever before. That fact delivers hope because exports help everyone in the U.S. dairy industry and the local economies where they live.

USDEC member companies have demonstrated that exports are an integral part of their businesses, not an afterthought, overcoming COVID, a supply-chain crisis, a tilted trade policy playing field and other challenges.

“The message to our dairy customers around the world is that we will consistently meet their needs now and as their demand grows in the future,” said Harden in her address.

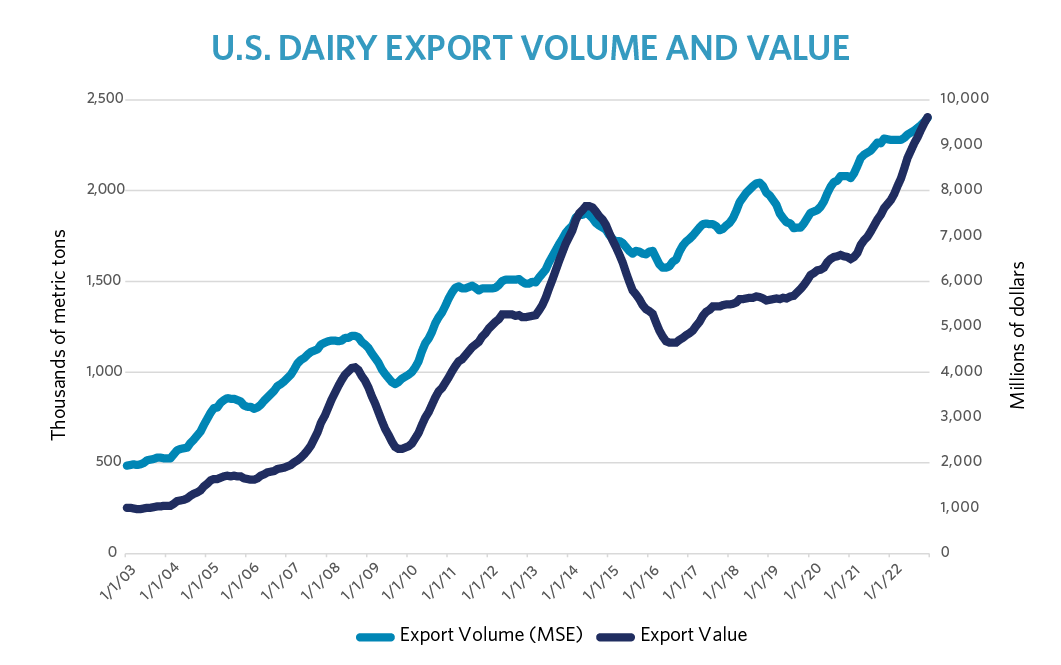

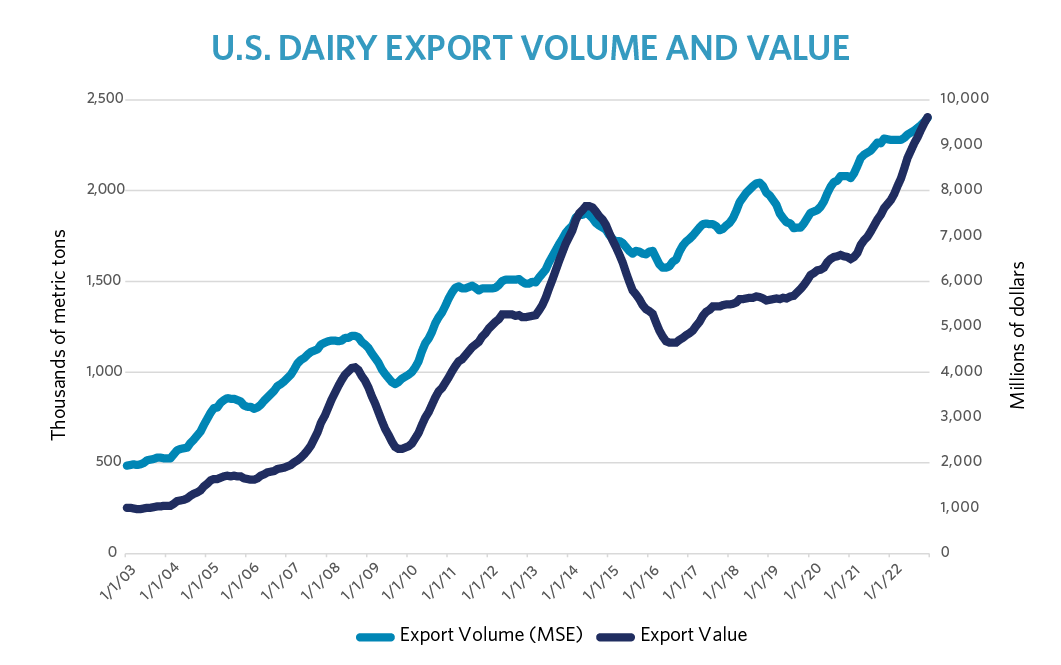

The long and steady growth of U.S. dairy exports

The trend toward more reliability and consistency is part of a long and steady international expansion of U.S. dairy, facilitated by USDEC, which was founded in 1985 by Dairy Management Inc. with dairy checkoff program funding. DMI remains USDEC’s parent organization, getting most of its budget through the dairy checkoff.

In 2022, the United States set new records for dairy export volume (2.4 million metric tons, milk solids equivalent), value ($9.6 billion) and percentage of U.S. milk production exported (18%)

In a Q&A session with USDEC members, Harden was asked if 2023 would yield another record for the percentage of U.S. milk production exported. Citing headwinds, including the “wild card” of China, Harden remained cautiously upbeat, saying, “We might not grow as much as we have been growing, but we’re hoping for a little bit more.”

Economists at the meeting (read below) expressed a similar outlook that growth will continue but slower.

Where would U.S. dairy be without exports?

What is clear, said Harden, is that the U.S. dairy industry needs exports and sees it as an engine for growth. “Where would we be without that 18% going to exports,” Harden asked rhetorically. “That would be a pretty big drain.”

The United States’ growth as a committed, consistent global dairy supplier delivering a portfolio of products suiting the needs of overseas buyers has driven U.S. dairy exports for decades, with USDEC there every step of the way.

In 2022 alone, USDEC staff traveled a combined 2.6 million air miles—the equivalent of five round-trip visits to the moon—for a broad array of activities aimed at building demand for U.S. exports and facilitating trade flows.

A high-level lineup of speakers delivers insights

While Harden’s remarks set the tone for the meeting, USDEC secured a list of high-level government officials and business executives to offer their expert opinions on dairy trade challenges and opportunities, from prospects for free trade agreements to geographic indications to dairy alternatives.

USDEC President and CEO Krysta Harden, left, with Rep. Dusty Johnson (R-SD) after a session addressing Congress’ outlook on agricultural issues.

The lineup included:

- U.S. Representative Dusty Johnson’s assessment of the political landscape for agricultural issues and the need for improved market access for exports.

- Scott Gottlieb, former Food and Drug Administration commissioner, on the FDA’s role in facilitating agricultural trade and his experiences leading the agency.

- Ambassador Doug McKalip, chief agricultural negotiator at the Office of the United States Trade Representative (USTR), and Alexis Taylor, undersecretary for trade and foreign agricultural affairs at USDA, about the 2023 agricultural trade landscape.

- A discussion about strengthening global connections with Michelangelo Margherita, head of trade section of the European Commission; Lloyd Day, deputy director general of the Inter-American Institute for Cooperation on Agriculture, and Ambassador Esteban Moctezuma, Ambassador Extraordinary and Plenipotentiary of Mexico to the United States of America.

- Tom Halverson, CEO of CoBank, providing a primer on globalization and deglobalization and ag’s role in feeding the world.

- James Caffyn, partner, Lever VC, on the evolution of plant-based and fermentation-derived dairy alternatives and how they relate to dairy.

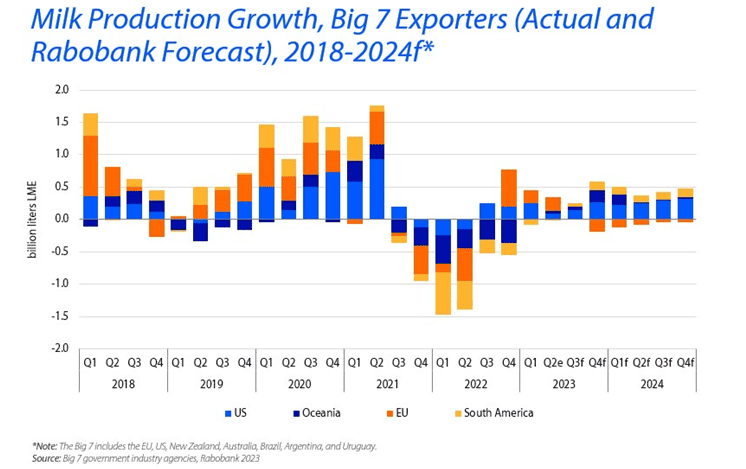

Challenges: Uncertain China demand, improved EU dairy supply

One session featured USDEC’s Economics team expressing differing opinions on their expectations for U.S. dairy export performance in 2023. One area that generated consensus was that U.S. dairy export volume growth in 2023 is unlikely to match 2022’s lofty 5% increase (milk solids equivalent or MSE).

U.S. dairy exporters face a series of challenges in 2023, including a weaker price environment, improved dairy supply out of the EU, uncertain Chinese demand and major questions about the global economy. That being said, William Loux, USDEC director, Economic Research and Analysis, expects solid demand for U.S. dairy ingredients in key growth markets, like nonfat dry milk/skim milk powder in Mexico and high-value whey in Japan, will still fuel a gain of more than 1.5% MSE.

In real-time audience polling, 58% of attendees sided with Loux, expecting U.S. MSE export growth to top 1.5% in 2023.

That’s the short term. Looking years into the future, the market dynamics that have helped carry U.S. dairy exports to this point remain favorable. A rising global population, growing middle class and the need for sustainable, affordable nutrition are expected to drive world dairy consumption, benefitting U.S. exports.

Fly-in conveys dairy priorities to Washington policymakers

Nine members of the USDEC Operating Committee conducted a Capitol Hill “fly-in” following the membership meeting for a day-and-a-half of meetings with congressional representatives and administration officials.

Participants included USDEC Chairman Larry Hancock; Vice Chair Alex Peterson; Pennsylvania dairy farmer Marilyn Hershey; Patti Smith, DairyAmerica; Jing Hagert, Milk Specialties Global; Greg Rodriguez, MCT Dairies; Sheryl Meshke, AMPI, Jeff Schwager, Sartori; and Alison Rosenblum, Tillamook County Creamery Association.

USDEC staff and members of USDEC’s Operating Committee met with Rep. Michelle Fischbach (center) during their visit to Capitol Hill to talk about dairy trade priorities.

Fly-in participants with FAS and AMS staff, including FAS Administrator Daniel Whitley (center front, left of Krysta Harden).

Accompanied by Harden, COO Martha Scott Poindexter and the USDEC Trade Policy team (Jaime Castaneda, Shawna Morris and Tony Rice), the group emphasized the need for increased funding for key FAS market development programs like the Market Access Program and for a larger U.S. government role in protecting common food names.

The group also touched on the significant role exports play in the health of the entire U.S. dairy supply chain, the U.S. economy and jobs.

Source: USDEC