Cornell study shows 150-cow dairies outearning 500-cow operations by $100K. The secret? It’s not what you think.

Cornell data reveals a $100,000 performance gap that has nothing to do with size. Here’s the 3-phase plan to capture it.

You know that feeling when you’re driving past one of those massive new dairy facilities? All that shiny equipment, those huge freestall barns stretching as far as you can see… makes you wonder sometimes about where smaller operations fit in all this, doesn’t it?

But here’s what’s really fascinating—and Cornell’s 2023 Dairy Farm Business Summary has been documenting this for years now—the profit differences between well-run and poorly-run farms of the same size are actually bigger than the differences between small and large operations.

“The profit differences between well-run and poorly-run farms of the same size are actually bigger than the differences between small and large operations.”

Think about that for a minute. We spend so much time worrying about scale, but what Cornell’s latest benchmarking data shows is that a really well-managed 150-cow dairy in the top quartile can generate significantly better returns per cow than a 500-cow operation that’s struggling with management. Same milk prices, same basic input costs, completely different bottom lines.

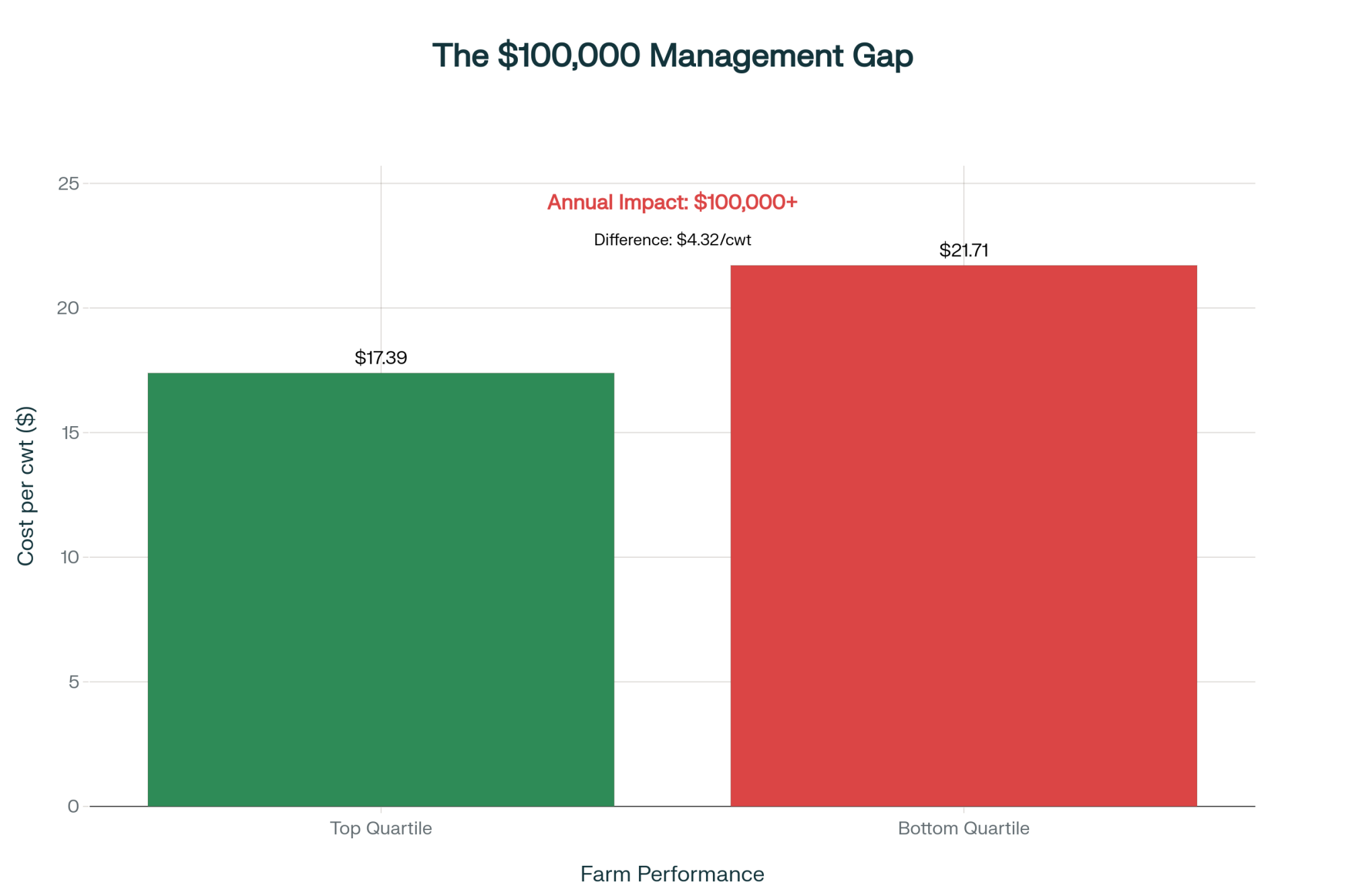

The numbers really spell it out. Top performers were hitting around $17.39 per hundredweight in operating costs. Bottom performers? They were running $21.71. On a 150-cow herd producing 24,000 pounds per cow annually… well, you can do the math. That’s over $100,000 difference we’re talking about. And that has nothing to do with how many cows you’re milking.

YOUR 3-PHASE ROADMAP TO SMALL DAIRY SUCCESS

Phase 1: Fix Your Foundation (Years 0-2)

- Achieve operating costs below $18/cwt

- Build working capital to 40% of expenses

- Get labor efficiency above 50 cows/worker

- Annual improvement potential: $50,000-100,000

Phase 2: Capture Easy Wins (Years 2-4)

- Component optimization: $20,000-30,000/year

- Quality premiums (SCC): $15,000-25,000/year

- Beef-on-dairy genetics if appropriate

- Total annual value: $35,000-65,000

Phase 3: Strategic Transformation (Years 4-7)

- Organic certification: $165,000-470,000/year potential

- Direct sales infrastructure: Variable returns

- Major technology adoption

- Choose ONE major transformation at a time

Critical Success Factor: Never skip phases. Foundation must be solid before pursuing transformation.

Small Dairy Farm Management: The Real Story Behind Consolidation

Looking at the USDA National Agricultural Statistics Service data, it’s stark. We’ve gone from 39,303 dairy operations in 2017 down to 24,082 in 2024. That’s… that’s a lot of farms gone.

But when you actually dig into who’s leaving—and the 2022 Census of Agriculture really shows this clearly—the average dairy farmer is now 58 years old. Somewhere between 40 and 45% don’t have anybody lined up to take over.

“That’s not business failure, is it? That’s retirement.”

I was talking to a producer near me last week who’s selling out next spring. He’s 64, his back’s giving him trouble, and his kids have established careers elsewhere. He actually had a pretty good year financially. But when you can barely get out of bed some mornings and your daughter’s doing well as a nurse practitioner with actual weekends off… the decision kind of makes itself.

There’s also the land value situation to consider. Out in California’s Central Valley, I heard about a 300-cow operation sitting on 40 acres near Modesto. With water costs skyrocketing and developers offering several million for the land… can you really blame them for taking it? Same thing’s happening in Pennsylvania, upstate New York, anywhere near growing communities.

What’s encouraging for those planning to stay is seeing how different successful models are emerging. Vermont’s Agency of Agriculture organic sector data show that smaller organic operations, typically 100 to 200 cows, are achieving solid profitability. Meanwhile, USDA Economic Research Service research indicates conventional operations generally need much larger scale—often over 2,000 cows—to hit similar per-cow returns.

So it’s not that small, can’t work. It’s so that small has to work differently.

The $100,000 Management Difference: Where Excellence Shows Up

When you look at benchmarking data from Cornell Pro-Dairy, Wisconsin’s Center for Dairy Profitability, and Minnesota’s FINBIN system—the pattern’s consistent. Top-performing farms are running operating costs in that $17-18 per hundredweight range. Bottom performers? They’re up at $21-22, sometimes higher.

That $4-5 difference per hundredweight—on a 150-cow operation, we’re talking serious money that has nothing to do with scale.

Labor Efficiency Makes or Breaks You

The benchmarking programs consistently show top operations getting 50-plus cows per full-time worker. Struggling farms? They’re down around 35-40.

I know a farm in Pennsylvania—150 cows, really efficient setup, running with 2.5 people total. Another operation nearby, same size, needs 4.5 people. At today’s wage rates… finding good help isn’t getting cheaper, as we all know… that difference alone can save or cost you $75,000 annually.

“We restructured our workflows last year,” one producer told me recently. “Went from 4.5 people down to 3 just by fixing bottlenecks in our parlor routine. Saved us $75,000 annually.”

Feed Efficiency: Not What You’d Expect

Here’s what’s interesting about feed costs. Looking at various state data, top farms aren’t necessarily spending less on feed per hundredweight. Often it’s about the same—around $9.60. But their income over feed cost? Way higher.

They’re not feeding cheaper. They’re feeding smarter. Better forage quality from optimal harvest timing. More precise ration formulation based on actual testing instead of guesswork. Walking those bunks twice daily, making adjustments based on what you see. Keeping waters clean, stalls comfortable, catching that fresh cow that’s a little off before she crashes.

It’s consistency. Every single day. Even when you’re tired.

Robotic Milking Economics: The Truth Nobody Wants to Hear

Let’s have an honest conversation about robots. Everyone’s got an opinion—they’re either the future or a complete waste. Truth is somewhere in the middle.

Wisconsin Extension and Minnesota Extension have done thorough economic analyses. For a 200-cow operation, you’re looking at close to a million dollars all in. The robots themselves run $250,000 to $300,000 each; you need about three for 200 cows, plus barn modifications, software, training… it adds up fast.

Annual operating costs? Figure $40,000 to $60,000 between maintenance contracts, parts, and electricity. When you run realistic payback calculations—not the dealer’s sunny projections—you’re often looking at 20-plus years. Sometimes 25 or 30.

Yet farms keep installing them. And many swear by them.

Here’s why: it’s not about immediate payback. Statistics Canada’s latest agricultural census data and university research consistently show farms with automated milking are significantly more likely to have younger family members interested in taking over.

“The financial payback is marginal at best. But my 24-year-old son, who was planning to leave farming? He’s now fully engaged. My daughter, studying ag business, sees a future here. What’s that worth?”

For older farmers—and let’s be honest, we’re not getting any younger—reduced physical demands can mean farming another decade versus selling. One Wisconsin producer was ready to quit at 55 because his knees were shot. Installed robots, now he’s 62 and planning to continue until 70.

Premium Market Access for Small Dairies: Reality Check

| Strategy | Investment | Time to ROI | Annual Return | Risk Level | Accessibility |

| Component Premiums | Minimal | Immediate | $20K-$30K | Low | High |

| Organic Certification | $150K-$300K | 3+ years | $165K-$470K | High | Limited |

| Direct Sales | $150K-$300K | 3-5 years | Variable | Med-High | Medium |

Everyone talks about capturing premiums like it’s simple. Go organic! Sell direct! Problem solved!

Not quite.

Organic Transition: A Three-Year Marathon

Federal organic standards require three years for land transition. During that entire time, you’re paying organic feed prices—USDA Agricultural Marketing Service reports show 30-50% higher—while receiving conventional milk prices.

Extension studies from Penn State and Cornell suggest you need $150,000 to $300,000 in extra working capital to survive the transition. Even after certification? Organic Valley and Horizon maintain regional quotas. NODPA producer surveys show many new organic farms only receive premium prices on partial production initially.

“It’s a marathon where you’re not sure the finish line exists until you cross it,” as one Vermont producer who completed the transition described it.

Direct Sales Infrastructure: Major Investment Required

Direct sales can work—retail prices obviously exceed farm gate values. But infrastructure costs are substantial.

Meeting health department requirements, installing pasteurization equipment, bottling lines, developing HACCP plans… Penn State Extension and Cornell Small Farms Program estimate $150,000 to $300,000 minimum for compliant facilities.

Building a customer base takes time, too. Most operations report 3-5 years to achieve meaningful volume. “Year one, we sold 50 gallons weekly and questioned our sanity,” a New York producer now moving 30% of production direct told me. “Year five, we’re at 500 gallons and hiring staff.”

Component Premiums: The Accessible Opportunity

Here’s what’s realistic for most operations—component premiums. Major processors are paying real money for high-protein, high-butterfat milk.

Current typical Northeast processor premiums (October 2025):

- Chobani (Rome, NY): $0.75-$1.25/cwt for 3.3%+ protein

- DFA: $0.50-$1.00/cwt for consistent 3.25%+ protein

- Upstate Niagara: $0.40-$0.80/cwt for SCC under 100,000

- Various cooperatives: $0.30-$1.50/cwt for butterfat over 3.8%

Getting from 3.0% to 3.3% protein through genetics and nutrition management generates $20,000-30,000 annually for a 150-cow herd. That’s achievable for pretty much any operation willing to focus on it.

Why Community Connections Generate Real Returns

I know sponsoring the 4-H livestock auction feels like charity. But the USDA Economic Research Service and Colorado State research documents that local food spending generates 1.8-2.6 times its value in local economic activity.

More directly, those connections pay off unexpectedly. When you need harvest help, and neighbors show up. When you’re expanding and the town supports your zoning request. When you need workers and people recommend their kids.

“Half our township board had either bought beef from us or had kids in 4-H projects we supported,” a Midwest producer told me about his manure storage permit. “That permit sailed through.”

Farms with strong community ties consistently report better employee retention, stronger bank relationships, and higher grant success rates. When regulations change, connected farms get flexibility. Isolated operations get compliance notices.

Your Strategic Path Forward

Looking at successful operations that have really turned things around, there’s a clear pattern.

First, they fix fundamentals. Labor efficiency, operating costs, and working capital. This alone can improve cash flow by tens of thousands annually.

Then they capture accessible wins. Component bonuses, quality premiums, maybe beef-on-dairy genetics. Things requiring minimal capital but adding meaningful revenue.

Only after achieving operational excellence and financial stability do they tackle major transformations—organic transition, direct sales, robotics. By then, they have management skills and a financial cushion to handle it.

The farms that fail? They jump straight to transformation, thinking it’ll save them without fixing underlying problems. Doesn’t work that way.

Making the Tough Exit Decision

Not everyone can make this work long-term. That’s okay.

If you’re consistently unable to cover costs. If you’re approaching retirement without succession. If health is failing and stress is overwhelming…

I’ve seen too many burn through equity trying to save something unsaveable. There’s no shame in selling with equity intact. That’s smart business, not failure.

“At first it felt like giving up,” a respected producer who sold at 62 told me. “Now, doing some consulting, enjoying grandkids—I realize it was my smartest business decision.”

The Bottom Line for Small Dairy Success

The industry is consolidating—24,082 farms now versus 39,303 in 2017. Those numbers are real.

But consolidation doesn’t mean small farms are doomed. What’s happening is sorting. Farms with strategies matching their capabilities thrive. Those competing on the wrong metrics struggle.

Your 150-cow dairy trying to beat a 5,000-cow operation on commodity cost per hundredweight? That’s like your local hardware store trying to beat Home Depot on lumber prices. Won’t work.

But competing on quality, flexibility, specialized products, customer relationships, and community connection? Different game entirely. Winnable game. Cornell’s data proves it. Wisconsin’s successful small farms demonstrate it. Vermont’s thriving organic dairies live it daily.

The question isn’t whether small dairies can survive. Plenty are doing better than surviving. The question is whether you’ll play the game that fits your size and situation.

“Good management at any size beats poor management at every size.”

Because ultimately—and this is what all the research confirms—management quality and strategic fit matter far more than scale.

That’s something we can all work on, regardless of herd size.

Key Takeaways:

- THE PROFIT TRUTH: Management quality drives a $100,000+ annual profit gap between same-sized dairies—Cornell data proves top 150-cow operations consistently outearn bottom-performing 500-cow dairies

- THE EFFICIENCY EDGE: Before buying robots, hit these benchmarks: 50+ cows/worker (saves $75K), operating costs under $18/cwt, and 40% working capital reserves—most farms can achieve this without major investment

- THE SMART MONEY PATH: Follow this exact sequence or fail: Fix fundamentals first (Year 0-2), capture component premiums second ($20-30K/year), only then pursue transformation (organic/robots/direct sales)

- THE PREMIUM REALITY: Component premiums pay faster than going organic: Getting to 3.3% protein adds $20-30K annually with minimal investment vs. a 3-year organic transition requiring $150-300K working capital

- THE COMMUNITY ROI: Your 4-H sponsorship isn’t charity—it’s strategy: Farms with strong community connections report 3.8-year employee retention (vs. 11-month average) and 23% lower borrowing costs

Executive Summary:

Cornell’s 2023 data definitively proves what progressive dairy farmers have long suspected: management excellence beats scale every time, with well-run 150-cow operations outearning poorly-managed 500-cow dairies by over $100,000 annually. The critical difference lies not in technology or size but in achieving operational benchmarks—top performers hit $17.39/cwt operating costs and 50+ cows per worker, while bottom quartile farms struggle at $21.71/cwt and 35-40 cows per worker. This comprehensive analysis reveals a proven three-phase strategy where successful small dairies first fix fundamentals (saving $50-100K), then capture accessible premiums like component bonuses ($20-30K), before attempting any transformation, such as organic transition or robotics. While the industry has consolidated from 39,303 to 24,082 farms since 2017, this largely reflects the reality that 40-45% of aging farmers lack successors, not the failure of small-scale dairy economics. The path forward is clear: compete on management quality, specialized products, and community relationships—not commodity volume. For the 150-cow dairy willing to execute this strategy, the opportunity hasn’t just survived consolidation; it’s actually grown stronger.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The 10 Commandments of Dairy Farming: Expert Tips for Sustainable Success – This guide provides a tactical framework for mastering the fundamentals discussed in Phase 1. It details actionable best practices in animal welfare and nutrition that directly translate to lower operating costs and higher efficiency, forming the bedrock of profitability.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong– For producers focused on strategy, this analysis unpacks the economic forces driving the component-driven market. It provides crucial insights into policy shifts and market volatility, helping you position your operation to capture the premiums the main article identifies.

- The Robot Revolution: Transforming Organic Dairy Farms with Smart Tech in 2025 – Exploring a Phase 3 transformation, this article offers a focused case study on technology adoption within the high-value organic sector. It demonstrates how to weigh the true ROI of automation, balancing innovation with the core values of a specialized market.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!