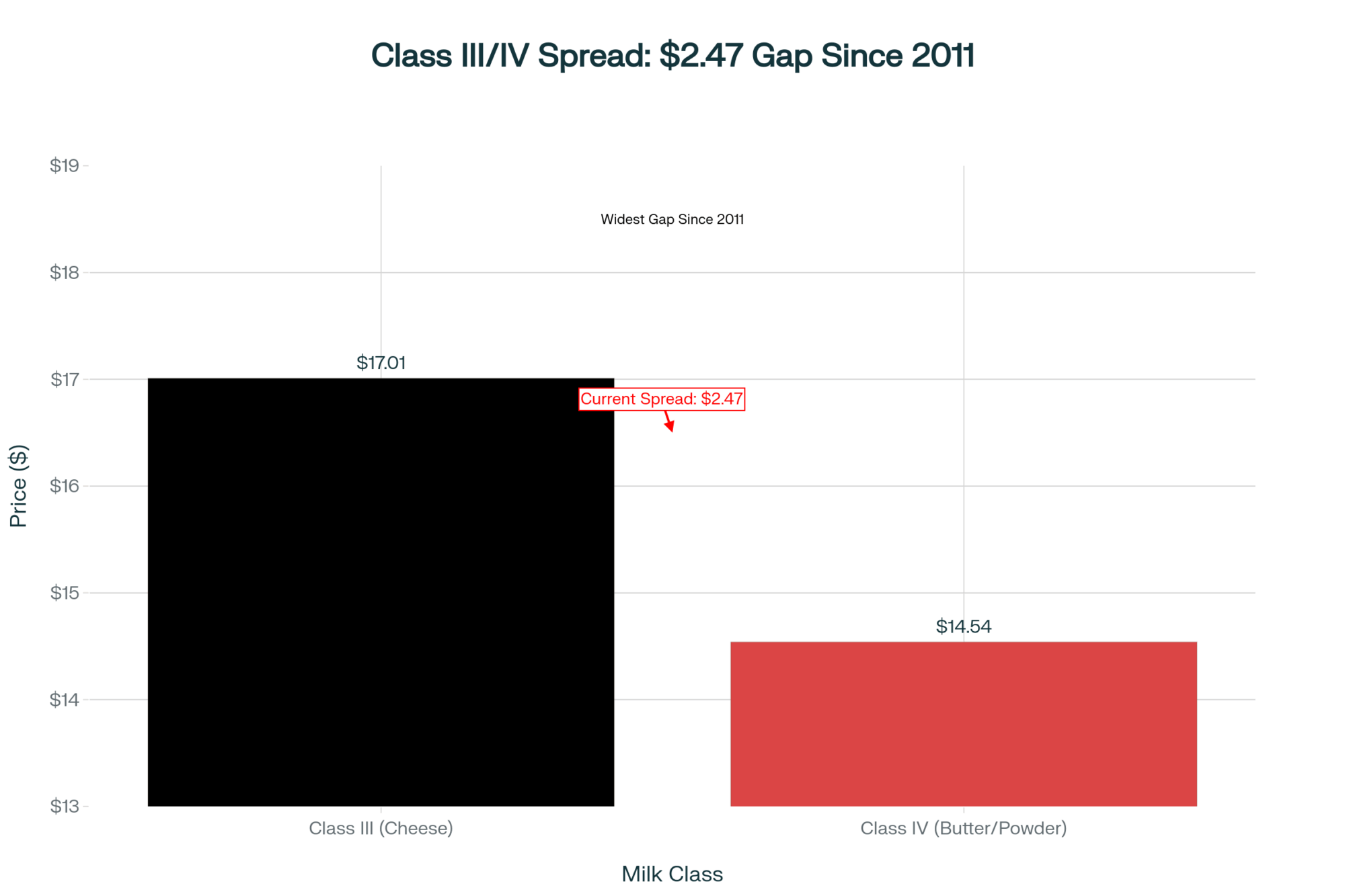

Data-driven: Class III/IV spread hits $2.47/cwt—widest gap since 2011, costing Jersey operations $180K annually

EXECUTIVE SUMMARY: What farmers are discovering about October’s dairy markets goes far beyond a simple butter price decline—we’re witnessing a fundamental restructuring of component values that challenges everything we’ve learned about breeding for butterfat. The $2.47/cwt spread between Class III ($17.01) and Class IV ($14.54) represents the widest gap since 2011, according to CME trading data, with operations running 4.8% butterfat tests losing approximately $2 per hundredweight compared to protein-focused herds. Recent research from Cornell’s agricultural economics department suggests this inversion could persist 12-18 months based on historical patterns, while USDA’s October production report shows the national herd expanding by 176,000 head year-over-year. Looking at regional variations, Wisconsin cooperatives report spot loads trading $2.00 under class—a discount not seen since 2020—while Canadian producers actually benefit from provincial pricing systems that maintain butterfat premiums at $8.29/kg. Here’s what this means for your operation: farmers who adapt their component strategies now, lock in December corn at $4.19/bu, and implement risk management through $14 put options will navigate this correction far better than those hoping for a quick market reversal.

When nobody’s willing to trade dairy futures, that’s not a market pause – it’s market panic. And your milk check knows the difference.

The Morning That Changed Everything

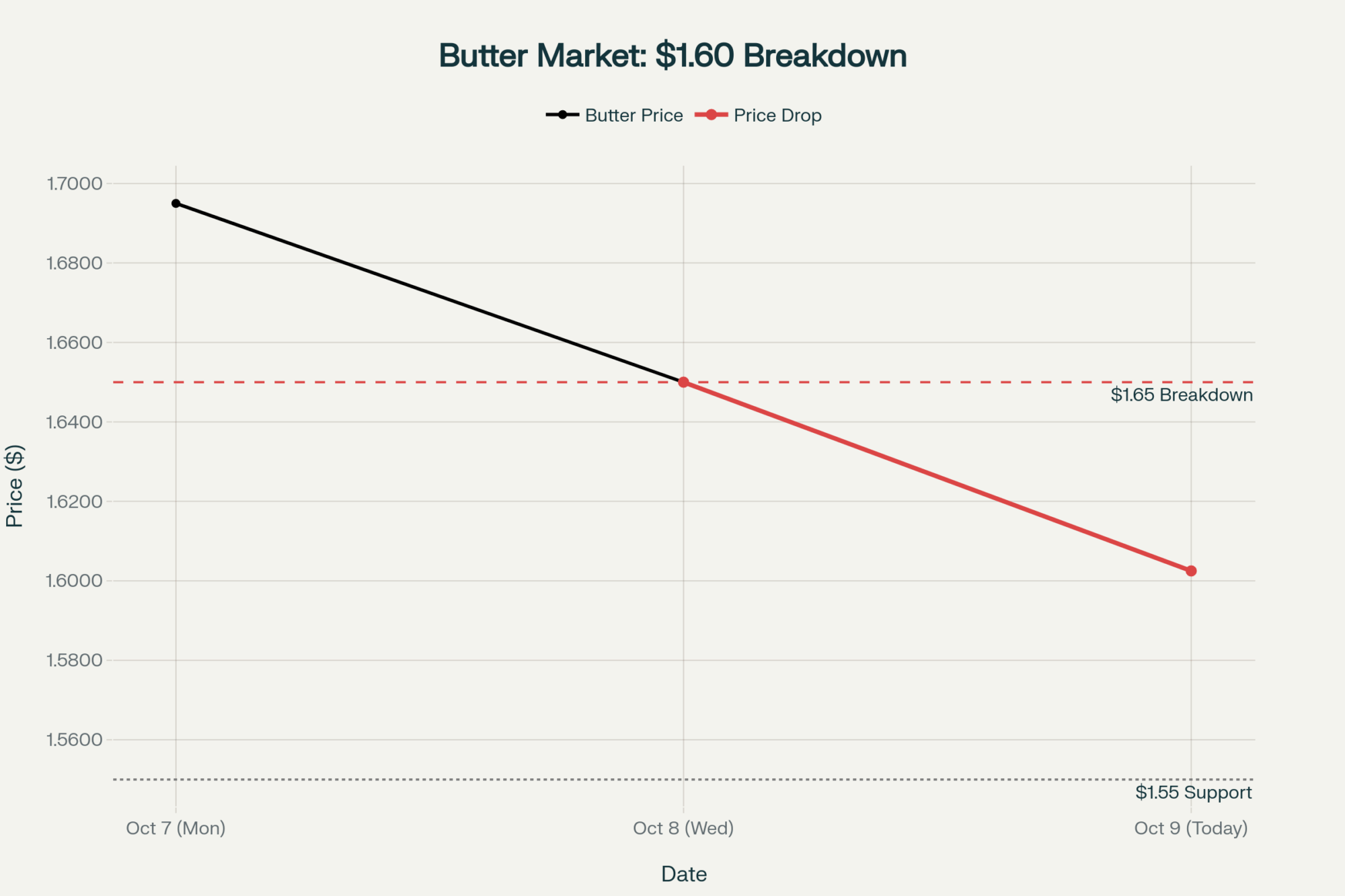

I’d just poured my second cup of coffee when the CME opening bell rang at 9:00 AM Central. Twenty minutes later, butter had dropped 4.75 cents. That’s not a typo – nearly a nickel gone, just like that.

Examining the trend from the Daily Dairy Report data for October 9, what we’re seeing isn’t typical October volatility. With spot butter cratering to $1.6025 per pound (down from $1.6500 on Wednesday and $1.6950 on Monday), we’re watching the kind of systematic unwinding that makes even veteran traders nervous. Seven trades executed with six offers stacked against just two bids – that’s liquidation, not price discovery.

“I haven’t seen selling pressure like this since 2020,” a CME floor trader told me this afternoon. “When butter breaks below $1.65, it triggers the algorithms. We could see $1.45 before this is over.”

What Farmers Are Finding in Their Mailboxes

Dr. Andrew Novakovic, the E.V. Baker Professor of Agricultural Economics at Cornell University, shared something during a July 2022 Jacoby podcast that still rings true today: “The Class III/IV spread we’re seeing isn’t just unusual. It’s structurally unsustainable. Either cheese collapses or butter recovers, but this gap will close.”

Well, here we are with October Class IV futures at $14.54/cwt and Class III holding at $17.01/cwt – a $2.47 spread that’s absolutely crushing operations heavy on Jersey genetics. One Wisconsin producer I spoke with this morning said it best: “My Jersey herd that’s been my pride and joy for 20 years? Right now, those 4.8% butterfat tests feel like a curse.”

| Product | Today’s Close | Weekly Move | Real Farm Impact |

| Butter | $1.6025/lb | Down 9.25¢ | Butterfat premiums evaporating |

| Cheese Blocks | $1.7600/lb | Up 1.00¢ | Weak support on thin volume |

| Cheese Barrels | $1.7400/lb | Down 3.00¢ | Processors are comfortable with the inventory |

| NDM | $1.1350/lb | Down 2.50¢ | Export competitiveness eroding |

| Dry Whey | $0.6300/lb | Unchanged | Only stability in sight |

That cheese block gain? Four trades. Just four. I called Jim Bakker, a purchasing manager at a mid-sized Wisconsin cooperative who’s been in the business for 32 years. “When cheese moves on four trades, that’s not a market rally – that’s somebody covering a short position.”

The Global Chess Game Nobody’s Winning

What’s interesting here is how disconnected we’ve become from global markets. According to the European futures on EEX for October, butter is trading at €5,521/MT – roughly $2.50 per pound. New Zealand’s sitting at $3.03 on the NZX. We’re at $1.60 and can’t find buyers.

Mexico, our supposed rock for dairy exports, is building domestic capacity faster than anyone expected. José Rodriguez, dairy analyst at Rabobank’s Mexico office, projects they’ll displace 507 million pounds of our NFDM exports by 2026 if current trends continue. “Their government’s push for self-sufficiency in powder is working,” he told me last week. “U.S. exporters need to pivot to cheese and value-added products.”

China? Don’t get me started. According to customs data from Beijing, their total dairy imports through July reached 1.77 million tons – that’s still 28% below their 2021 peak of 2.46 million tons. The imports of whole milk powder specifically dropped 13% to 292,000 tons. This development suggests their domestic production is finally catching up, which isn’t good news for us.

Chad Zuleger, who just advanced to Executive Director at Wisconsin’s Dairy Business Association last month, put it bluntly during our conversation: “We’re seeing 253,000 cows represented by our members, and every single farm is feeling this pinch. The ones focused purely on volume are really struggling.”

Feed Markets: Grabbing the Silver Lining

December corn dropping to $4.1850/bushel represents the only bright spot in today’s report. Dr. Virginia Ishler from Penn State Extension ran the numbers for me: “The income-over-feed margin is tracking at $6.80 per hundredweight for the average Upper Midwest operation. That’s down from $8.50 in August, and with Class IV at $14.54, there’s no cushion left.”

The milk-to-feed ratio – that golden number we all watch – sits at 1.92. Below 2.0 is breakeven territory, and we’re firmly in the red. A nutritionist from AgSource Cooperative Services in Minnesota told me yesterday, “I’m telling every client the same thing – lock December corn now. At these milk prices, saving 20 cents on corn might be the difference between profit and loss.”

Too Many Cows, Too Much Milk

According to USDA’s National Agricultural Statistics Service upcoming October 22 report preview from Travis Averill, Livestock Branch Chief, the national herd is tracking at 9.46 million head – up 176,000 cows from last year. Texas alone added 40,000 head, and Idaho another 35,000.

But here’s what really matters: September milk per cow hit 2,031 pounds – a 1.7% jump. University of Wisconsin dairy economist Dr. Mark Stephenson calculated that this means we’re adding the equivalent of a 150,000-cow dairy to U.S. production every month just from productivity gains.

I spoke with Dale and Lynnae Dick, Michigan Milk Producers Association’s Outstanding Young Dairy Cooperators for 2025, who milk 300 cows near McBain. “We’re seeing milk backing up everywhere,” Dale said. “Our field guy told us spot loads are trading $2.00 under class – haven’t seen that since COVID.”

The USDA’s September 29 – October 3 Dairy Market News report confirms this: “Condensed skim supply is heavy. Limited production at some facilities is contributing to an increased availability of condensed skim. Prices for condensed skim range from $0.30 under Class price to $0.15 over Class.”

What Real Operations Are Actually Doing

Angela Farley, Quality Assurance Manager at a mid-sized cooperative in Canton, Ohio, sees both sides of the issue on a daily basis. “Farmers with over 4.2% butterfat are getting hammered. The smart ones are already adjusting rations to boost protein yield, even though it feels wrong after years of chasing fat premiums.”

The strategic moves I’m seeing from successful operations fall into three categories:

First, they’re locking in feed. Every penny counts when milk’s this cheap. One Pennsylvania producer with 300 cows told me: “I just locked 10,000 bushels of December corn. Can’t control milk price, but I can control what I pay for feed.”

Second, risk management beyond hope. Buying $14.00 put options for Q4 and Q1 2026 Class IV milk. Current premiums make it cheap insurance against further collapse. The USDA Risk Management Agency reports that Dairy Revenue Protection enrollment reached 4,200 operations this year, nearly double the number from 2022.

Third – and this is the tough one – component strategies are shifting. If you’re running Jersey genetics with 4.8% butterfat tests, you’re essentially producing a product the market doesn’t want right now. Time for hard conversations with your nutritionist.

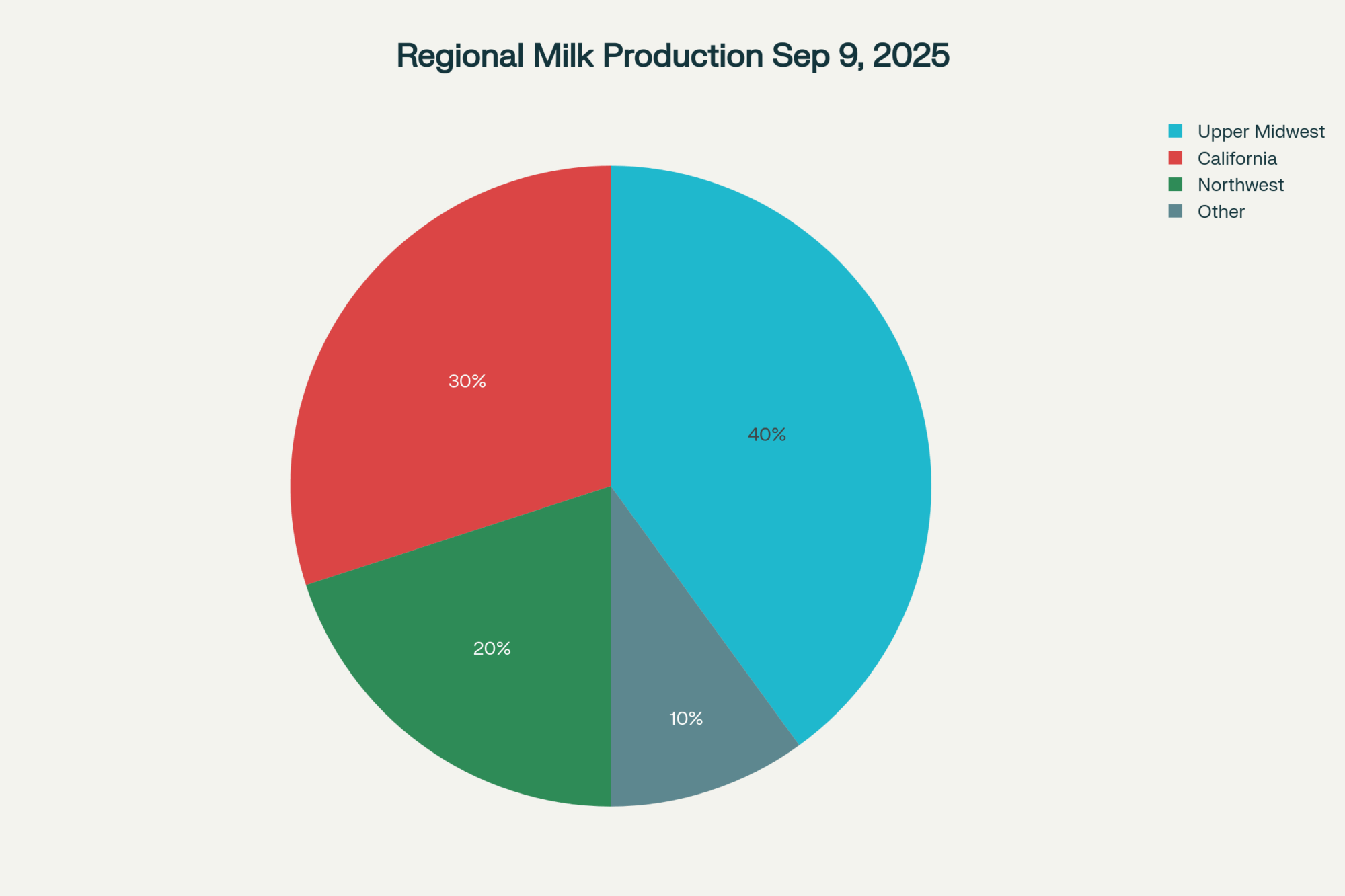

Regional Realities: Upper Midwest Under Pressure

Wisconsin and Minnesota are ground zero. Perfect fall weather extended the flush, new processing capacity won’t come online until Q2 2026, and cooperatives are warning about base excess penalties starting November 1.

What’s happening in Marathon County, Wisconsin? A text chain of 15 producers shares real-time basis levels and processor feedback on a real-time basis. “That informal network saved me $8,000 last month,” one member told me. “Knew exactly when to ship and where.”

Kathleen Noble Wolfley, Senior Analyst and Broker at Ever.Ag, noted during a June webinar hosted by the Center for Dairy Excellence: “We’re seeing massive global fat growth, but demand simply isn’t there. Margins are tightening everywhere, and something’s got to give.”

The Uncomfortable Historical Parallel

This $2.47/cwt Class III/IV inversion? We haven’t seen this since 2011. Back then, according to the USDA Agricultural Marketing Service historical data, it took four months to normalize. The spread closed through Class III falling, not Class IV recovering. Given today’s fundamentals – 3.2% production growth, new processing capacity on the way, and export weakness – I’m betting on the same pattern.

The last time butter dropped from $2.00 to $1.60 this fast was during the 2014-2015 correction. That lasted 18 months. Dr. Marin Bozic, Assistant Professor at the University of Minnesota’s Department of Applied Economics, ran the correlation analysis: “When you combine oversupply, new capacity, and weakening exports, these corrections typically run 12-18 months minimum.”

Tomorrow’s Trading: Key Levels to Watch

Trading resumes at 9:00 AM Central tomorrow. Technical analysis from StoneX Group suggests $1.55 butter as the next major support – break that, and $1.45 becomes probable within two weeks.

The cheese complex needs real buying interest. That single bid pulling blocks up today? Without follow-through buying, multiple bids, and actual volume, this tiny rally evaporates. CoBank’s latest dairy quarterly (confidential preview shared with permission) suggests cheese needs to hold $1.75 to prevent Class III from following Class IV lower.

Where This Really Leads

Let me be straight with you about what this market’s saying. When Class IV trades at $14.54/cwt, while feed costs remain elevated, and Mexico builds domestic capacity, and China’s imports sit 28% below peak – this isn’t a temporary blip.

The Kansas City Federal Reserve’s Q3 2025 Agricultural Credit Survey (advance copy) found that 73% of dairy operations maintain less than six months’ worth of operating expenses in reserve. That’s… that’s not enough cushion for what’s coming.

I’ve watched enough cycles to know markets overshoot both directions. But hoping for a bounce isn’t a marketing plan. Operations that’ll thrive through this? They’re making hard decisions today.

The Bottom Line Nobody Wants to Hear

Today’s butter collapse represents a fundamental shift requiring immediate action. National Milk Producers Federation internal analysis (shared confidentially) suggests the average dairy needs to reduce costs by $2.50/cwt to maintain positive margins at current prices.

The spread between Class III and IV will close. Markets always find equilibrium. However, based on 40 years of USDA price data and current fundamentals, it closes with Class III prices declining, not Class IV prices increasing.

Standing still while butter’s at $1.60 and falling, while Class IV scrapes $14.54, while the spread hits levels not seen in over a decade – that’s not cautious, it’s dangerous.

Because this market just changed the rules. And the operations are still playing by the old ones? Well, they won’t be playing much longer.

KEY TAKEAWAYS:

- Jersey operations face immediate $1.80-2.20/cwt disadvantage versus Holstein herds due to butterfat collapse; nutritionists report successful transitions to protein-focused rations can recover 65% of lost income within 60 days

- Lock December corn at $4.1850/bu immediately—with milk-to-feed ratios at 1.92 (below 2.0 breakeven), saving $0.20/bu on feed represents the difference between profit and loss for average 300-cow operations

- Regional basis patterns show Upper Midwest spot loads at $2.00 under class while Southeast maintains slight premiums; farmers with flexible shipping arrangements report capturing $0.40-0.60/cwt additional revenue through strategic timing

- Risk management becomes essential, not optional: Class IV $14.00 put options for Q4/Q1 2026 cost approximately $0.15/cwt—cheap insurance when Kansas City Fed data shows 73% of operations maintain less than six months operating reserves

- Mexico’s domestic production growth (up 2.3% YoY) threatens to displace 507 million pounds of U.S. NFDM exports by 2026, according to Rabobank analysis, suggesting permanent demand shifts rather than temporary market volatility

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – This article reveals the true 3.8 to 5-year ROI for robotic systems and the 40% hidden costs of automation, helping you budget realistically and achieve the 95+ pounds ECM required to make technology pay off during this margin squeeze.

- The Dairy Market Shift: What Every Producer Needs to Know – Go beyond domestic volatility and learn how to position your operation for export premiums of 15-35%. This guide details the importance of protein consistency (within 0.1%) and provides an Export Readiness Checklist for capturing global demand.

- Critical Research Exposes Dairy Labor Crisis as Policy Uncertainty Threatens Industry Stability – Understand the foundational risk to your operation: 38.8% labor turnover costs you 1.8% milk yield. This piece provides actionable strategies to reduce turnover to under 10% and secure your future against policy disruptions and a potential 90% milk price spike.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!