80 million Buffalo Herders Are About to Teach New Zealand’s Dairy Giants a Lesson—Here’s What It Means for Your Farm

EXECUTIVE SUMMARY: Here’s what we’ve uncovered that nobody’s talking about: India’s 80 million dairy families aren’t your typical producers—they’re mostly buffalo herders milking 40-50 liters daily with 7% butterfat content. Meanwhile, NZ’s massive Holstein operations eye this protected market hungrily, but here’s the kicker—buffalo milk dominates 65% of key Indian states, meaning direct substitution won’t happen overnight. We’re looking at potential tech partnerships worth billions, cold chain investments that could cut India’s staggering 50% spoilage rates, and market shifts that could redirect NZ’s export flows as China cools off by 15%. The smart money isn’t betting on trade war—it’s positioning for the innovation partnerships that’ll reshape how two billion consumers get their dairy. Bottom line: those who understand these nuances and act now will capture the opportunities while others scramble to catch up.

KEY TAKEAWAYS

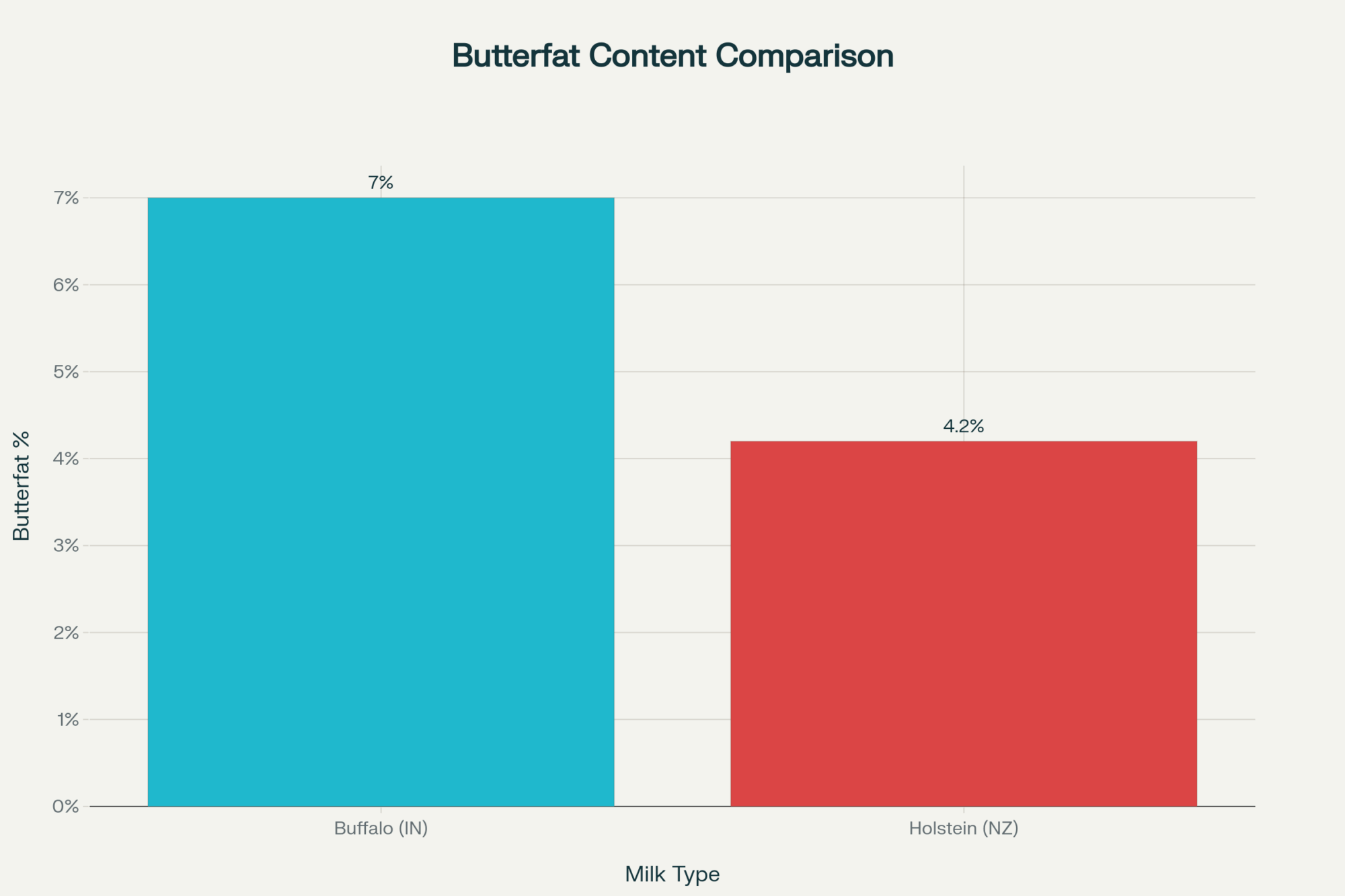

- Respect the species difference—buffalo milk isn’t cow milk: With 65% market share in Punjab and UP, buffalo’s 7% butterfat creates natural market protection. Your move: Assess your herd’s unique strengths (fat content, seasonal patterns) and find your competitive niche before imports shift the landscape (NDDB 2024; ICAR 2024)

- Cold chain upgrades pay massive dividends: India loses 40-50% of milk to spoilage while NZ protects 95% for export—that’s millions in lost revenue daily. Your move: Start with basic chilling improvements at collection points and transport protocols; the ROI is immediate (CIPHET 2024; NZ Food Safety Authority 2024)

- Genomics adoption separates leaders from followers: NZ’s 50% genomic bull usage contrasts sharply with India’s 115 million traditional AI doses annually. Your move: Attend genomic selection workshops now and explore heat-tolerant crossbreeding programs before the competition catches up (DairyNZ 2024; ICAR 2023)

- Market volatility is the new normal—prepare accordingly: China’s 15% drop in NZ imports signals major shifts, while India’s cautious 0.5-2% market opening creates new opportunities. Your move: Review Dairy Revenue Protection options and diversify your market risk exposure before the next disruption hits (China Customs 2025; USDA RMA 2025)

- Policy changes happen faster than you think: India’s never opened dairy in any FTA, but urban consumers spending 18-22% of income on high-priced dairy are demanding change. Your move: Engage with producer associations and stay plugged into policy discussions—regulatory shifts create winners and losers overnight (MEA India 2025; NSSO 2024)

![Generate SEO elements for this The Bullvine article targeting dairy industry professionals:

ANALYSIS REQUIREMENTS:

Identify the article's primary topic and target audience (dairy farmers, industry professionals, agricultural specialists)

Focus on practical, implementation-oriented keywords that dairy professionals would search for

Consider both technical dairy terminology and business/profitability terms

DELIVERABLES:

1. SEO Keywords (5 keywords):

Create a comma-separated list of relevant keywords mixing:

Primary dairy industry terms (dairy farming, milk production, herd management, etc.)

Technology/innovation terms if applicable (precision agriculture, automated milking, genomic testing, etc.)

Business/economic terms (dairy profitability, farm efficiency, ROI, cost reduction, etc.)

Geographic terms if relevant (dairy industry trends, global dairy, etc.)

2. Focus Keyphrase:

Develop a 2-4 word primary keyphrase that captures the article's core topic and would be commonly searched by dairy professionals seeking this information.

3. Meta Description (under 160 characters):

Write a compelling meta description that:

Summarizes the article's main value proposition

Naturally incorporates the focus keyphrase and 1-2 keywords

Appeals to dairy industry professionals

Includes a benefit or outcome (cost savings, efficiency gains, profit increases, etc.)

Uses action-oriented language that encourages clicks

4. Category Recommendation:

Suggest the most fitting category from The Bullvine website (e.g., Dairy Industry, Genetics, Management, Technology, A.I. Industry, Dairy Markets, Nutrition, Robotic Milking, etc.) where this article should be published for maximum relevance and engagement.

FORMAT REQUIREMENTS: Present results in this exact format:

SEO Keywords: [keyword1, keyword2, keyword3, keyword4, keyword5]

Focus Keyphrase: [primary keyphrase]

Meta Description: [compelling description under 160 characters with natural keyword integration]

Category Recommendation: [Best-fit category from The Bullvine’s options]

DAIRY INDUSTRY CONTEXT: Ensure all elements appeal to dairy farmers, agricultural specialists, and industry professionals seeking practical, profitable solutions for their operations.](https://www.thebullvine.com/wp-content/uploads/2025/09/Google_AI_Studio_2025-09-08T17_37_41.620Z.png)

You know what’s wild about the India-New Zealand dairy trade talks underway this September? While everyone’s been glued to what’s happening with China, a negotiation’s brewing that could flip the global dairy scene on its head. We’re talking 80 million Indian smallholders, mostly buffalo herders, facing off against New Zealand’s highly efficient Holstein operations.

Buffalo Milk vs. Cow Milk: More Different Than You Think

Picture a typical dairy family in Karnal, Haryana. They’re milking around 40-50 liters daily. The actual take-home varies with local milk prices, but regions like Haryana show steady income streams from that milk (NDDB, 2024).

It’s not just any milk—these are buffalo giving you nearly 7% butterfat, perfect for the ghee and paneer everyone craves on the subcontinent (NDDB, 2024; ICAR, 2024).

Now compare that to New Zealand’s Holsteins, optimized to produce milk around 4.2% fat (DairyNZ, 2024). And buffalo milk makes up a massive 60-65% of the total in places like Punjab and UP (NDDB, 2024). So, what seems like a simple quota or tariff issue quickly gets complicated once you realize these milks aren’t one-to-one substitutes.

Scale’s a Whole Different Ballgame

New Zealand’s average Canterbury farm runs about 375 cows—a chunk of land, a solid rotation, mostly seasonal calving (DairyNZ, 2024). Meanwhile, Indian smallholders juggle just under three animals, aiming for year-round calving to keep cash flowing (NDDB, 2023; India Livestock Census, 2019).

Breeding is another story. Kiwi farmers have genomic bulls covering half their inseminations, while Indian farmers depend on about 115 million AI doses annually, mostly in traditional setups (NZ Animal Evaluation, 2024; ICAR, 2023). That’s a real game of cat and mouse between tech and tradition.

The Cold Chain: A Challenge and a Massive Chance

India’s cold storage game? Rough. Roughly 6,300 facilities handling what some estimates suggest is about 11% of perishables (NCCD, 2024). And spoilage rates? Could be 40-50% across villages, transport, and retail points (CIPHET, 2024). That’s a lot of lost milk and money.

Contrast that with New Zealand, where 95% of milk for export passes through integrated cold chains monitored by IoT and smart tech (NZ Food Safety Authority, 2024). Fix that cold chain gap in India, and you’re talking a transformative opportunity that punches above most tariff conversations.

China’s Cooling Thirst, India’s Growing Appetite

New Zealand used to lean on China for close to a third of its dairy exports. Whole milk powder shipments fell by 15% through August 2025, driven by China’s expanding domestic capacity (China Customs, 2025).

Canterbury farmers are feeling the squeeze. Thankfully, India’s urban markets are picking up the slack, especially for cheese and butter—products where buffalo milk doesn’t hold sway. However, breaking into India’s complex market is not as straightforward as it appears.

Politics and Milk: The Ultimate Balancing Act

India has never opened dairy in a trade deal—not Australia, not the UK, not the EU—and that’s not just a coincidence (MEA India, 2025). Those 80 million dairy families voted hard in 2024, keen to protect their livelihoods (Election Commission India, 2024).

Yet, urban Indians pay 18-22% of their income on dairy products, which are priced significantly above global averages (NSSO India, 2024). The government is under pressure to juggle consumer relief with rural protection.

On the Kiwi side, Fonterra sold off consumer brands for NZ$3.845 billion to refocus on growth markets (Fonterra, 2025). The challenge: how to boost productivity without breaking the backbone of rural economies.

What This Means for Your Farm or Operation

For producers in the U.S. or Europe, keep in mind—if New Zealand cracks India, expect similar trade demands elsewhere. It’s time to revisit risk management plans. This Dairy Revenue Protection stuff? It’s not optional anymore (USDA RMA, 2025).

If you’re in ag tech or processing, grab your opportunity. India’s supply chains are hungry for investment, imports or no imports (India Dairy Infrastructure Report, 2025).

The Big Divide: Fresh Buffalo vs. Processed Cow Milk

Indian consumers love fresh buffalo milk—the kind you buy fresh down the street. New Zealand’s strength is in processed products: powders, cheeses, and infant formulas.

Even if the market opens fully, foreign milk flooding Indian village economies is unlikely. Market penetration will probably start at a cautious 0.5-2% of demand and grow slowly (Trade Modelling Reports, 2025).

The Bottom Line: Time to Watch and Get Ready

What’s happening in Delhi will ripple through every dairy heartland—from Wisconsin to Canterbury to Punjab. Watch the Global Dairy Trade index for swings. Watch for new technology tie-ups in India. Reassess your supply chain risks.

This isn’t just a trade story—it’s a turning point. For dairy producers worldwide, readiness for this new chapter isn’t a question, but a prerequisite for future success.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Genomic Game Plan: A Sire Selection Strategy That Actually Works – This article provides a tactical playbook for implementing the genomic selection strategies mentioned in our analysis. It details how to translate complex data into practical sire choices that directly boost herd profitability, health, and long-term genetic gain.

- Dairy Market Outlook: Navigating The Twists And Turns Of A Changing Global Market – Complementing our discussion on market volatility, this piece offers a deeper strategic analysis of global dairy trends. It reveals key economic indicators and risk management techniques to help your operation navigate uncertainty and capitalize on international market shifts.

- The Robots Are Here, And They’re Milking It: The Real Scoop On Dairy Automation – To build on the theme of technology, this article explores the innovative future of dairy operations. It provides a real-world look at automation, showcasing how modern robotics can slash labor costs, improve cow welfare, and generate precision data.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!