What if I told you frozen semen from the 1940s outperforms today’s million-dollar superstars? Gene banks don’t lie.

Look, I’ve worked with Holsteins long enough to know when something smells off. The talk about genomic miracles? Sure, the gains are real—annual genetic progress in Net Merit has actually more than doubled, from $36.90 to $83.33, since genomics became a reality (PMC Genomic Selection Research, 2016). Sire generation intervals dropped from over 10 years to just 2.5 years, letting us stack improvements way faster than before.

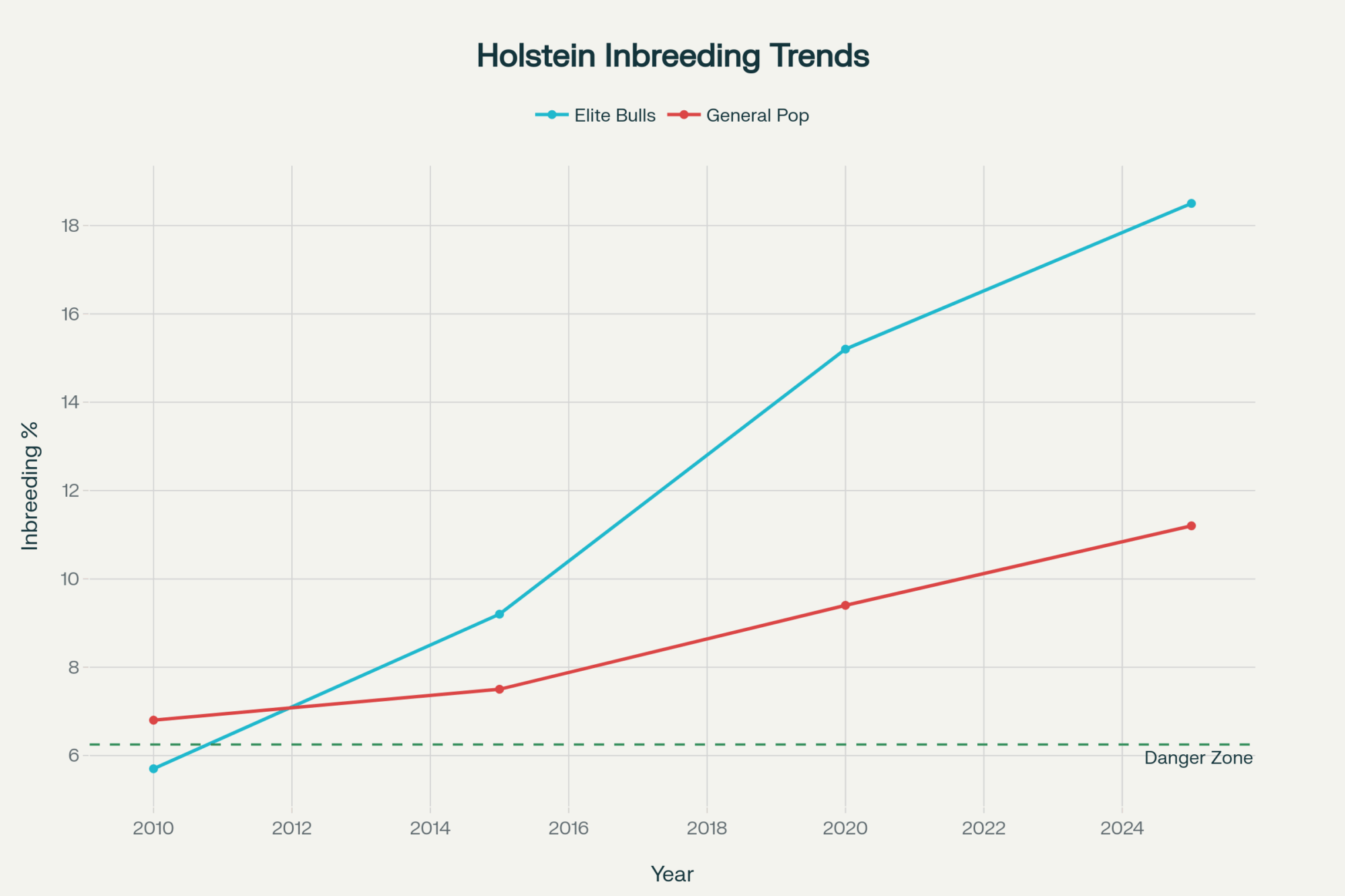

But here’s what isn’t front and center at your co-op meetings: Holstein inbreeding levels in elite U.S. herds have increased from about 5.7% in 2010 to 15.2% by 2020—a 168% rise (USDA/CDCB; The Bullvine Genetic Analysis, 2025). Industry projections show we could reach 18–22% by 2030. That’s nearly triple the widely recognized 6.25% “danger zone” where inbreeding depression hits hard.

The cost? Expert economic analyses place inbreeding losses between $3.6–6.7 billion for U.S. dairies from 2011–2019 (AgEcon Search Economic Analysis). Each 1% inbreeding increase shaves $23–25 off a cow’s lifetime Net Merit, plus shortens productive life and reduces fertility (Dairy Cattle Genetic Improvement, 2024; University Research Compilations, 2024). Have you seen more infertility, lameness, or culling pressure lately? You’re not alone.

How the Big Players Influence the Game

The Council on Dairy Cattle Breeding (CDCB) now manages the world’s largest livestock database—100 million animal records, 10 million genotyped, from 72 countries (CDCB Activity Report, 2024). This sets global benchmarks and puts U.S. breeders in the driver’s seat—but it also keeps information and breeding power in few hands.

Companies like STgenetics don’t just breed—they build bulls. Their bull Captain, for instance, was engineered through proprietary matings. While building Captain, they held back his father Sabre from most catalogs—a classic move to ensure that they got exclusive use of his genetic potential. Not unlike how most AI companies now make all the contract matings before they sell the semen publicly. The result STgenetics now dominates U.S. Net Merit (26.5%) lists.

Strategic Use of “Hidden” Sires: A Recurring Theme in Holstein History

STgenetics’ selective use of Tango Sabre as a foundational “hidden” sire is not a new trick in Holstein breeding. In fact, the practice of restricting access to promising sires—often leveraging them primarily within one herd—has been a tactical play repeated throughout dairy history by breeders looking to sharpen, conserve, or even commercialize elite genetic lines.

Consider these other foundational cases:

- Round Oak Rag Apple Elevation (USA):

One of the all-time breed legends, Elevation’s early semen was tightly managed by his owner and distributed selectively for targeted matings. His initial, controlled use allowed for concentrated genetic gains within certain herds before broader industry access, a move that amplified both his influence and value. - Roybrook Starlite (Canada):

Echoing the herd’s tradition, Starlite was used almost exclusively “in-house” within the Roybrook program to intensify key genetic traits. Only after this internal genetic consolidation were Starlite’s genetics released more broadly, subsequently impacting Canadian and international Holsteins. - Sunny Boy (Dutch Friesian/Holstein):

In the Netherlands, the early distribution of Sunny Boy semen was highly rationed and targeted at strategic clients due to both supply constraints and his growing reputation, allowing the owner (CR Delta) to optimize both returns and influence.

What all of these stories illustrate is simple: the restricted, strategic use of sires—sometimes referred to as “holding back” genetics—has always been part of the playbook for herd improvement, profit generation, and competitive positioning in dairy breeding. Whether it’s Roybrook, Tango Sabre, or legendary sires like Elevation and Sunny Boy, this approach has quietly but decisively shaped the direction and fortunes of the Holstein breed worldwide.

The Gene Bank Discovery Nobody’s Talking About

Here’s the bombshell: USDA researchers used frozen Holstein semen from the NAGP gene bank—samples from bulls whose lineages trace back to the early AI era—and produced daughters that stood toe-to-toe with today’s “elite” sires for production traits, fertility, and health. We’re talking milk yield, component percentages, and reproductive longevity that were all solid, not just a nod to history. The key revelation? These bulls represent Y-chromosome lineages that have completely disappeared from the modern Holstein population.

The genetic bottleneck is even more extreme than most realize. Today, over 99% of Holstein AI sires descend from just two bulls born in the 1950s, which has left our breed with shockingly limited Y chromosome diversity—most historic lines are extinct, but the gene bank kept some rare ones alive just in time.

This isn’t nostalgia—it’s serious genetic insurance. The gene bank holds onto those lost Y-chromosome families, meaning we’re not boxed in if disease, inbreeding, or selection mistakes hammer current genetics. Studies show calves from these “heritage” sires can absolutely match the breed average (and sometimes exceed it) when paired with top modern cows.35 Their daughters aren’t just “novelty” animals; they’ve got the competitive production, health, and especially reproductive longevity that any dairy producer knows is where real profit protection lies.

NOTE: Semen freezing in cattle wasn’t really feasible until the late 1940s and early 1950s. So, when researchers talk about using “genetic samples from the 1940s,” they’re not using semen literally collected and saved during that decade. Here’s the scoop: Almost all gene bank Holstein bull semen samples come from the 1950s onward, when practical cryopreservation methods kicked off. Earlier preservation—prior to the introduction of glycerol and controlled-rate freezing—just wasn’t possible. Before that, artificial insemination was done with fresh semen only, which obviously couldn’t be stored for decades. If a study says they’re restoring 1940s lineages, what they really mean is they’ve found bulls in the gene bank whose ancestry traces back to those early male lines. The actual semen straws were collected and frozen in the 1950s, ’60s, or later—often from older bulls whose sires or grandsires were around in the 1940s. Some gene banks also store embryos, tissue, or blood, but for these Holstein projects, it’s the semen that’s key—and the oldest viable samples only go back as far as the very first days of freezing technology. So, they didn’t save “1940s semen”—they saved semen from descendants or late-surviving individuals from those lines once freezing became feasible. That’s how they’re able to resurrect “lost” genetic lineages, even if it’s not from the literal 1940s.

What Actually Works: Real-World Data for Real Farms

Inbreeding Management Pays, Immediately

A 1% inbreeding reduction saves $23–25 in cow lifetime Net Merit—that’s on the books, not in a catalog (Univ. Compilations, 2024). Farms that cap offspring inbreeding below 6.25% report steady profit improvement and fewer herd-health headaches.

Genomic Testing Adds Up

Testing every dairy heifer at birth can boost herd genetic merit by $400 over two breeding cycles, while cutting replacement costs 35% (Wisconsin Dairy Research, 2024). For large herds, even more ROI.

The Beef-on-Dairy Trap: Short-Term Win, Long-Term Risk

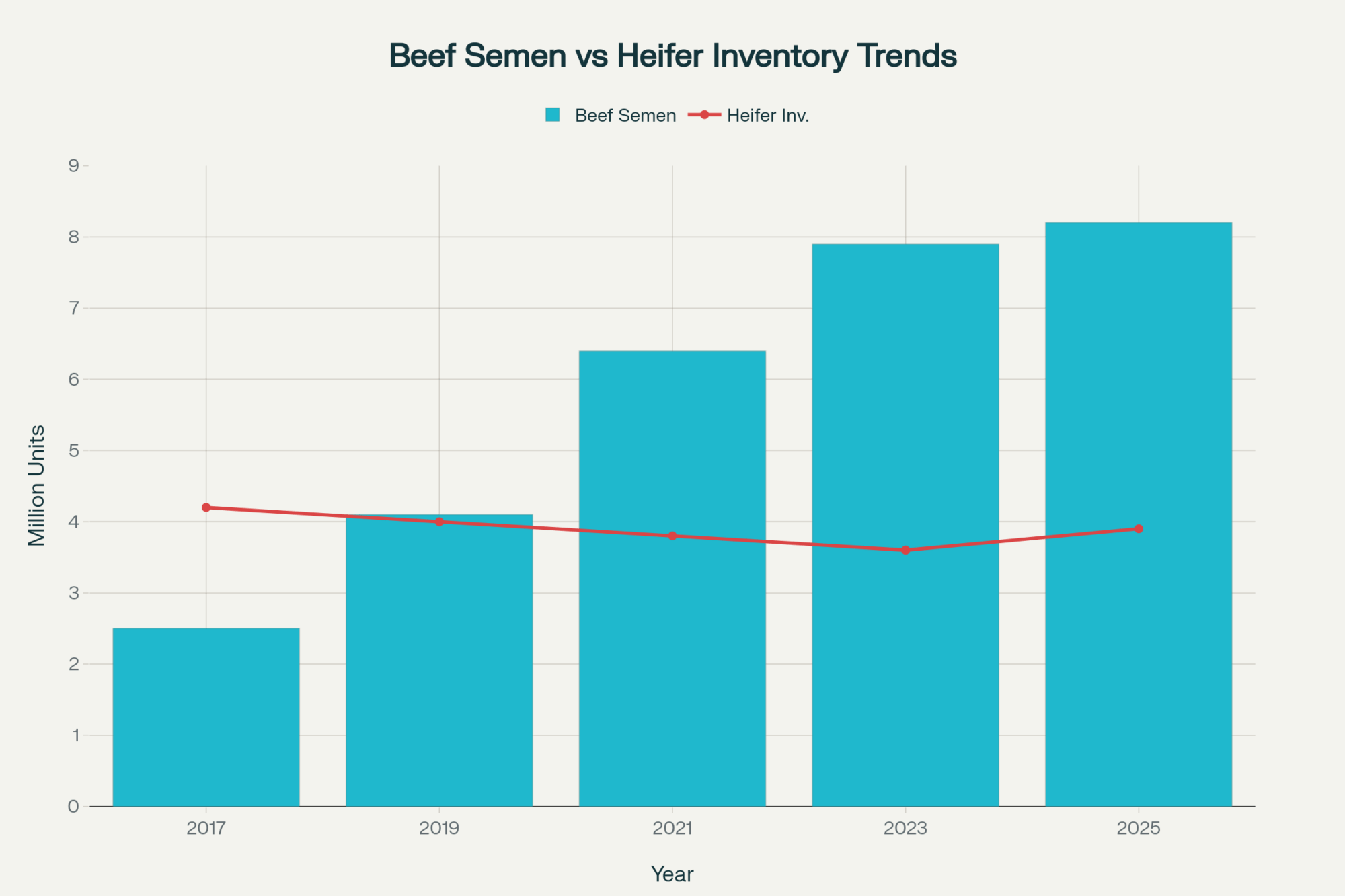

You see it all over: Beef genetics are now used in 72% of U.S. dairy herds (Farm Bureau Market Intel, 2025). Beef semen sales shot up from 1.2 million units (2010) to 9.4 million (2023), putting 3.22 million dairy-beef crossbred calves on the ground last year (NAAB Data).

Crossbred calves bring $400 or more compared to $150 for a pure dairy bull calf—good money, right? But check your records: replacement heifer costs are now $2,870 each, a historic high, while the pool of genetic diversity shrinks tighter (USDA Market Data, 2024).

It’s a vicious cycle—beef-on-dairy takes future dairy animals out of the herd, narrowing our genetic pool, so AI companies must work with fewer—and more related—bloodlines. This accelerates inbreeding, which makes more cows unprofitable, sending more herds to beef-on-dairy as a fallback.

Michigan State research shows $250 more per crossbred calf when beef semen targets heifers with truly poor dairy genetics, as identified by genomics—not random culls (MSU Study, 2024).

We’re trading our dairy breed’s future for today’s calf check.

Your Immediate Action Plan

This Month:

- Ask for up-to-date inbreeding reports on progeny from ALL your AI suppliers.

- Calculate current herd average inbreeding using latest DHIA or, ideally, CDCB genomic parentage records.

- Refuse any matings that would push progeny above 6.25% inbreeding—remember, it’s progeny inbreeding that counts, not just parent averages.

Next Quarter:

- Buy semen from at least three different AI companies to spread genetic risk.

- Explore European outcross (within-breed) options—they’ve documented value for milk component, health, and fertility improvements.

- Budget for genomic testing of every replacement heifer: $35–$50 per sample.

Long-Term Strategy:

- Only use beef semen on genomically verified poor dairy genetics.

- Pilot crossbreeding other dairy breeds for 20–30% of your herd to test for hybrid vigor.

- Get involved in university extension programs and CDCB information sessions for independent updates and honest guidance on managing inbreeding and alternatives.

Your Operation’s Bottom Line

The dollars add up:

- Inbreeding reduction: $23–25 lifetime Net Merit per cow, per 1% drop

- Genomic testing: positive ROI within two cycles

- Targeted beef-on-dairy: $250+ premium per targeted crossbred

- European outcrosses: Documented boosts to solids, health, welfare in multiple trials

Example: Dropping your herd’s inbreeding from 13% to 8% can mean $75,000–$94,000 in better cow value, after adjusting for semen cost.

The Bottom Line

Whether Holstein genetics survive and thrive—or collapse under too much corporate concentration and inbreeding—depends on the choices you make this year and every year after.

The “corporate model” offers quick gains but risks future genetic bottlenecks. The diversity model takes planning, but it’s what keeps herds profitable no matter what the market throws at you.

European co-ops prove there are alternatives to pure volume. Gene banks prove that valuable genetics exist beyond the corporate hype. The smartest producers are managing all their genetics—dairy and crossbred, cows and bulls—as a full-profit “portfolio” now.

Your next breeding decision is a vote for the kind of dairy animal—and industry—we’ll have in 2035.

You can keep chasing catalog rankings, or you can start managing herd genetics like the long-game business it is—diversifying risk, optimizing for the lifetime cow, and building a herd that’s ready for the swings of the future.

The research is clear. The economics work. Forward-looking producers are making the shift, planning their herds for the next generation—not just the next index run.

The big question isn’t whether genetic diversity beats chasing next month’s numbers. The proof is in the milk check.

The only real question is if you’ll move first—or be left to play catch-up when your neighbors, or global competitors, act smarter. It’s your future.

Don’t let marketing dictate your breeding strategy. Let the data, the research, and proven results guide your plan.

KEY TAKEAWAYS:

- Audit your inbreeding levels immediately: Herds dropping from 13% to 8% inbreeding see $75,000-94,000 in improved cow value—but 72% of producers don’t track these numbers, leaving money on the table while competitors gain advantage.

- Strategic beef-on-dairy targets matter: Michigan State research shows targeting genomically-verified poor dairy genetics (not random culls) delivers $250+ premiums per crossbred calf while protecting your replacement pipeline from the industry’s genetic bottleneck.

- European outcross genetics deliver measurable ROI: Commercial trials document significant increases in milk components and health traits using CRV/VikingGenetics Holstein bloodlines, offering proven alternatives to the North American genetic monoculture.

- Genomic testing pays within two breeding cycles: At $35-50 per heifer sample, testing delivers $400+ improvements in herd genetic merit while cutting replacement costs 35%—yet most producers still breed blind in 2025.

- Diversify AI suppliers like investment portfolios: Using semen from 3+ companies while capping progeny inbreeding below 6.25% creates the genetic resilience that separates surviving farms from those caught in tomorrow’s market squeeze.

EXECUTIVE SUMMARY:

While everyone’s celebrating genomic miracles, we’ve uncovered an $6.7 billion disaster hiding in plain sight—Holstein inbreeding has exploded 168% since 2010, and most producers don’t even know their herd’s levels. Every 1% increase in inbreeding costs you $23-25 per cow lifetime, yet AI companies keep pushing the same elite bloodlines that created this mess. Meanwhile, beef-on-dairy—sold as easy money—is actually accelerating the genetic collapse by removing 95,000 potential dairy replacements for every 1% of the national herd. The kicker? USDA researchers just proved that frozen semen from the 1940s produces daughters that match today’s “elite” genetics for production and health. European cooperatives are quietly building an alternative empire based on longevity and resilience, while North American producers chase short-term index gains that compound into generational losses. The hidden war for Holstein genetics isn’t coming—it’s here, and your next breeding decision determines which side of history you’re on.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Dairy’s Bold New Frontier: How Forward-Thinking Producers Are Redefining the Industry – This strategic article demonstrates how next-generation producers are using advanced technologies like AI and robotics to dramatically improve efficiency and diversify revenue. It provides a blueprint for leveraging technology to increase productivity and reduce costs, offering a broader perspective on the industry’s future beyond just genetics.

- Getting Serious About Genomics: Lessons from India’s Dairy Revolution – This tactical piece provides concrete, real-world examples of how producers are using data tracking and genomic testing to cut feed costs and improve milk-to-feed conversion ratios. It reveals how to use these tools to identify your top producers, cull underperformers, and create a more profitable herd, turning genetic strategy into a measurable bottom-line win.

- The Future of Dairy Farming: Embracing Automation, AI, and Sustainability in 2025 – This innovative article showcases the latest emerging technologies that can drive efficiency and create new revenue streams, from automated feed systems to precision breeding. It reveals methods for navigating volatile markets and making smart investments in technology that provide a faster ROI than traditional expansion.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.