“We saw butterfat jump in three days.” How Michigan farmers and MSU science turned soybeans into dairy profits.

EXECUTIVE SUMMARY: A simple feed change in Michigan is making big waves across the U.S. dairy industry. At Preston Farms, feeding high oleic soybeans—developed with support from Michigan State University (MSU)—boosted butterfat from 4.4% to 4.8% in under a week, while replacing costly palm fats and protein meals with a locally grown crop. The shift, based on extensive research by Dr. Adam Lock, saved the farm hundreds of thousands in inputs and lifted overall profits to more than $1 million per year. Early adopters are proving that this innovation doesn’t just add points of fat—it builds feed independence and sustainability into dairy rations. And as universities and producers nationwide study the results, one thing is clear: sometimes the next big leap for dairy is just a smarter way to feed the cows.

Sometimes the biggest dairy innovations don’t come from a lab or a boardroom—they start right in the feed bunk. That’s what’s happening at Preston Farms in Quincy, Michigan, where a simple change to the ration is improving butterfat performance, cutting feed costs, and rewriting the farm’s milk check.

Brian Preston didn’t set out to pioneer something revolutionary. But his decision to feed high-oleic soybeans, a crop once bred for frying oil rather than feed, has become one of the most quietly disruptive stories in dairying today.

From University Research to On-Farm Success

This breakthrough isn’t luck. It’s the product of years of research at Michigan State University (MSU) led by Dr. Adam Lock, Professor of Dairy Nutrition, whose focus has long been on how different fats affect rumen function and milk composition.

“We didn’t increase the fat level in the ration,” Lock explains. “We changed the kind of fat—and that changed everything.”

Traditional soybeans are loaded with linoleic acid, a polyunsaturated fat known to interfere with rumen microbes and cause milk fat depression. High oleic soybeans, however, reverse that chemical balance. They contain 75–80% oleic acid and under 10% linoleic acid, according to USDA and Pioneer® data (2024). That single change stabilizes rumen fermentation and boosts acetate, an essential precursor to milk fat synthesis.

The result? Cows can handle higher inclusion without the digestive disruption that once scared off nutritionists from pushing soy-based feeds too hard.

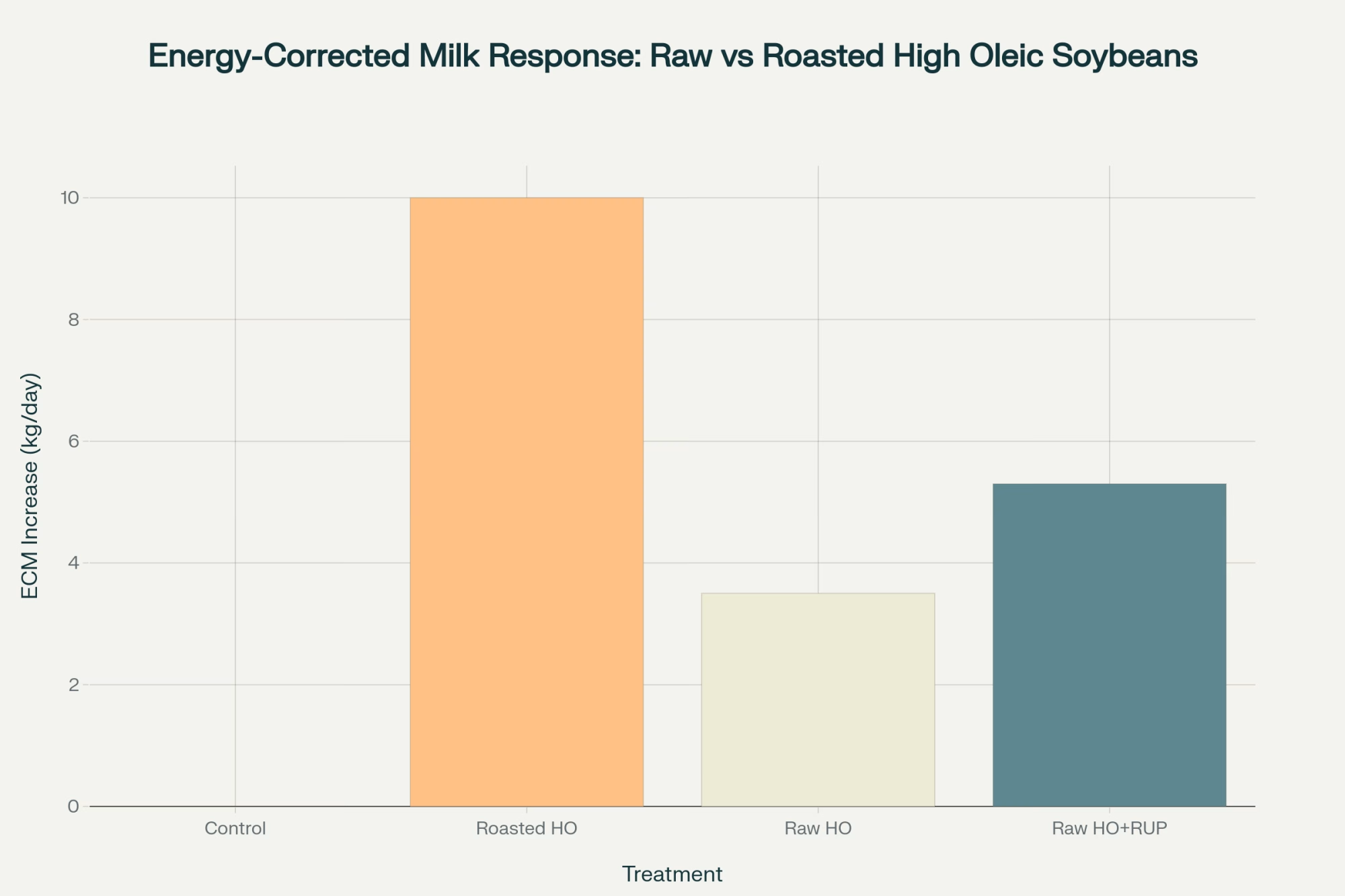

For Lock, the findings weren’t theoretical—they were replicated across multiple MSU feeding trials, later published in the Journal of Dairy Science (2023). And in Preston’s case, it worked exactly as the data suggested.

How Fast Did It Work? Try 72 Hours

In 2024, Preston planted 400 acres of Pioneer® Plenish® high oleic soybeans and began feeding them roasted—about 8 pounds per cow per day—in place of purchased soybean meal, canola meal, and expensive palm-based fats.

Within three days, milk tests came back with an unexpected jump: butterfat up from 4.4% to 4.8%, with milk protein slightly higher too.

“I honestly thought there was a lab error,” Preston laughs. “But it happened again the next week. The cows handled it so well, we kept it in full-time.”

Lock says that kind of immediate response makes sense because oleic acid bypasses much of the rumen’s hydrogenation process, entering the bloodstream faster as an energy source for milk synthesis. Cows use it directly—no lag time, no rumen stress.

That faster conversion means farms see the payoff quickly. As any producer knows, immediate improvements in component yield help confidence spread far faster than any spreadsheet could.

The Economics: Turning Fat into Feed Efficiency

When you quantify it, the economic implications are eye-opening.

Every 0.1 increase in butterfat adds roughly $0.20 per cwt when butterfat sells near $3.23/lb (USDA Agricultural Marketing Service, October 2025). Preston’s 0.4-point jump produced about $1 per cow per day, adding roughly $380,000 annually in butterfat premiums across his 1,000-cow herd.

Then came the ingredient savings.

Tack on feed savings—achieved by replacing high-cost supplements like palm-derived fats and purchased proteinswith roasted soybeans grown right on the farm—and the total improvement exceeded $1 million annually.

“It’s rare to find a single ration change that pays on both ends,” Preston says. “Usually you’re spending to gain production, or cutting cost and losing quality. This time, the cows—and the feed bill—both lined up.”

The Economics Work for Every Herd Size

Why Michigan Is Ahead of the Curve

Michigan’s adoption of this feeding system stems largely from timing and teamwork.

Dr. Lock’s program at MSU, supported by the Michigan Alliance for Animal Agriculture (M-AAA), has spent over a decade translating lipid metabolism science into field-tested protocols. That partnership between the university and producer accelerated on-farm implementation and helped local nutritionists understand how to balance rations for these new soybeans.

“Michigan farmers had years of data before they took the plunge,” Lock says. “That’s what builds trust.”

In contrast, neighboring Wisconsin—the second-largest milk producer in the U.S.—has moved more cautiously. Nutritionists there often wait for validation from the University of Wisconsin-Madison Dairy Science Department, which is currently planning its first high oleic feeding trials for 2026.

It’s understandable. As Lock puts it, “Dairy nutritionists are trained to be risk-averse. When you’ve got millions of pounds of milk at stake, you confirm every feed trend before you move.”

The GMO Conversation: What Farmers Should Know

One of the first questions producers ask is whether the GMO status of these soybeans affects milk markets. The short answer: no.

Under the USDA’s National Bioengineered Food Disclosure Standard (2016), milk or meat from animals fed genetically modified feed is not considered genetically modified because the feed’s DNA does not transfer into milk or meat. After almost a decade of data, no studies—including those conducted by the FDA—have found detectable transference from feed to product.

For non-GMO or organic dairies, the alternative is the Soyleic® variety, developed at the University of Missouri, which achieves nearly identical oleic acid levels through conventional plant breeding. Those beans have done particularly well in identity-preserved markets, though they yield about 5–10% less per acre.

Long-term, both versions show strong potential for dairies seeking greater feed self-sufficiency.

How Many Farms Are Doing This?

| METRIC | CURRENT STATUS | OPPORTUNITY/NEEDED | THE GAP |

|---|---|---|---|

| Dairy Cows on HOS Diet | <1% (75,000 cows) | 20% (1.8M cows) | 1.725M cow opportunity |

| Nutritionists Recommending | 20% (160/800) | 80% for mass adoption | 480 nutritionists needed |

| Roasting Infrastructure | ~75 units | 1,500+ units | 1,425+ units required |

Nationally, adoption remains low — about 70,000 to 80,000 cows on high oleic soybean diets, according to MSU Extension estimates (2025). That’s less than 1% of the total U.S. dairy herd.

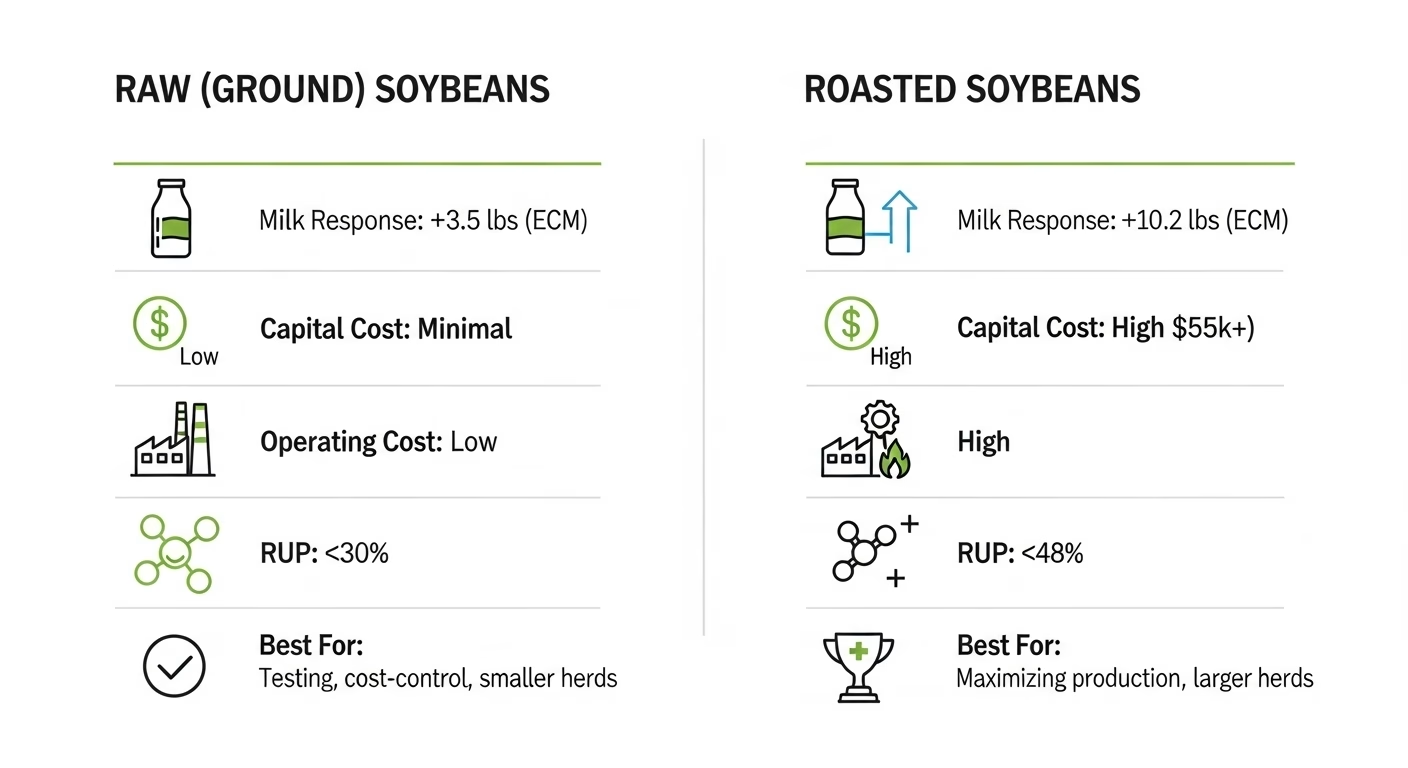

The bottleneck isn’t supply — seed production can easily scale — but rather processing. On-farm roasting is still critical for unlocking feed value, and each roaster typically serves about 1,000 cows daily. Expanding adoption to even 20% of U.S. cows would require more than 1,500 new roasting units.

Some co-ops, especially across the Midwest, are exploring shared roasting programs in which individual farms deliver beans for contract processing.

There’s also a knowledge gap. Only about 20% of the nation’s 800 dairy nutritionists actively recommend high oleic soybean feeding programs (Great Lakes Dairy Nutrition Conference Survey, 2025). Many say they’re waiting for state-level replication trials before updating formulations.

It’s the same cycle seen with bypass proteins in the 1990s—slow at first, then exponential once the local data confirms early wins.

What Cows and Numbers Are Saying So Far

After a full year of feeding high-oleic soybeans, Preston’s herd metrics are stable. Milk yield remains consistent. Reproductive performance—often the first red flag for new fats—has held steady.

Lock’s ongoing work at MSU mirrors those findings, showing no significant difference in ketosis, displaced abomasum, or other metabolic measures compared with control groups. The focus now shifts to multi-year monitoring.

“We’re confident in the short-term biology,” Lock says. “Now it’s about proving sustainability year after year.”

For producers, that’s comforting. As most know, herd-level consistency decides whether an innovation stays or fades.

Practical Starting Points

For producers curious about testing the concept, the learning curve is short and management-friendly:

- Start small: Try 50–100 acres and dedicate one group of cows for trial feeding.

- Roast right: Keep roasting temps between 280–300°F for optimal protein availability.

- Track diligently: Monitor butterfat, dry matter intake, and conception rates over multiple months.

- Work closely with nutritionists: Fine-tune diets to prevent unbalanced fat inclusion.

- Run the ROI: Compare component-based milk revenue with any feed cost shifts.

Early adopters like Preston insist on treating the transition as a management system, not a silver bullet. “We made sure every change was measurable,” he says. “Then we let the data drive whether we stayed with it.”

What’s Interesting About This Development

Three things stand out. First, it highlights how small biological improvements can have huge economic consequenceswhen component pricing drives profitability. Second, it reconnects modern dairying with something age-old: growing and processing one’s own feed to reduce dependency on volatile markets. And third, it demonstrates how collaboration between land-grant universities and farmers creates innovation grounded in real-world application, not lab theory.

“We’ve had feed additives come and go,” Preston says. “This one is different—it’s ours to grow, feed, and control.”

The Bottom Line

For all the advanced technology shaping the dairy world today, sometimes innovation looks as familiar as a roasted soybean.

High oleic feeding strategies may not transform the industry overnight, but evidence from Michigan’s early adopters shows real, sustained improvements in butterfat performance, feed efficiency, and economic stability. The concept works because it fits seamlessly into existing farm systems—it’s scalable, measurable, and backed by solid science.

If the next several years of data across Wisconsin, New York, and beyond confirm what MSU has already seen, this may very well be the next “quiet revolution” in feed efficiency.

As one producer joked after hearing Preston’s story: “The cows might be the best university research partners we’ve ever had.”

Key Takeaways

- A quiet revolution in cow nutrition is underway: high oleic soybeans are raising butterfat and replacing expensive palm fats in dairy rations.

- Preston Farms and MSU researchers demonstrated the impact—a 0.4-point increase in fat and more than $1 million in annual gains from feed efficiency and component premiums.

- Dr. Adam Lock’s studies confirm that oleic-rich fats improve rumen stability and milk components more quickly than traditional rations.

- Nationwide growth depends on expanding roasting infrastructure, education, and replicable regional trials.

- For forward-thinking producers, this strategy offers a real-world, on-farm route to feed self-sufficiency, profitability, and sustainable dairy progress.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Why Smart Dairies Are Spending MORE on Feed at $4.20 Corn (And Banking $100K Extra) – This analysis expands on the main article’s ROI theme by exploring the new economics of dairy nutrition. It reveals why strategic investment in high-quality feed, rather than cost-cutting, is the key to unlocking higher margins in the current market.

- Precision Feeding Strategies Every Dairy Farmer Needs to Know – For producers ready to act, this guide provides a tactical framework for implementation. It details how to use tools like NIR units and diet formulation software to ensure any feed change—like adding high oleic soybeans—delivers maximum nutritional and financial results.

- The Robot Revolution: Transforming Organic Dairy Farms with Smart Tech in 2025 – Looking at the bigger picture, this article explores how innovations like smart feeding systems and automation are reshaping dairy operations. It provides a forward-looking perspective on how technology complements nutritional strategies to drive efficiency and cow welfare.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!