38,275 tonnes traded, prices still tanked—here’s what smart dairy farmers are doing differently.

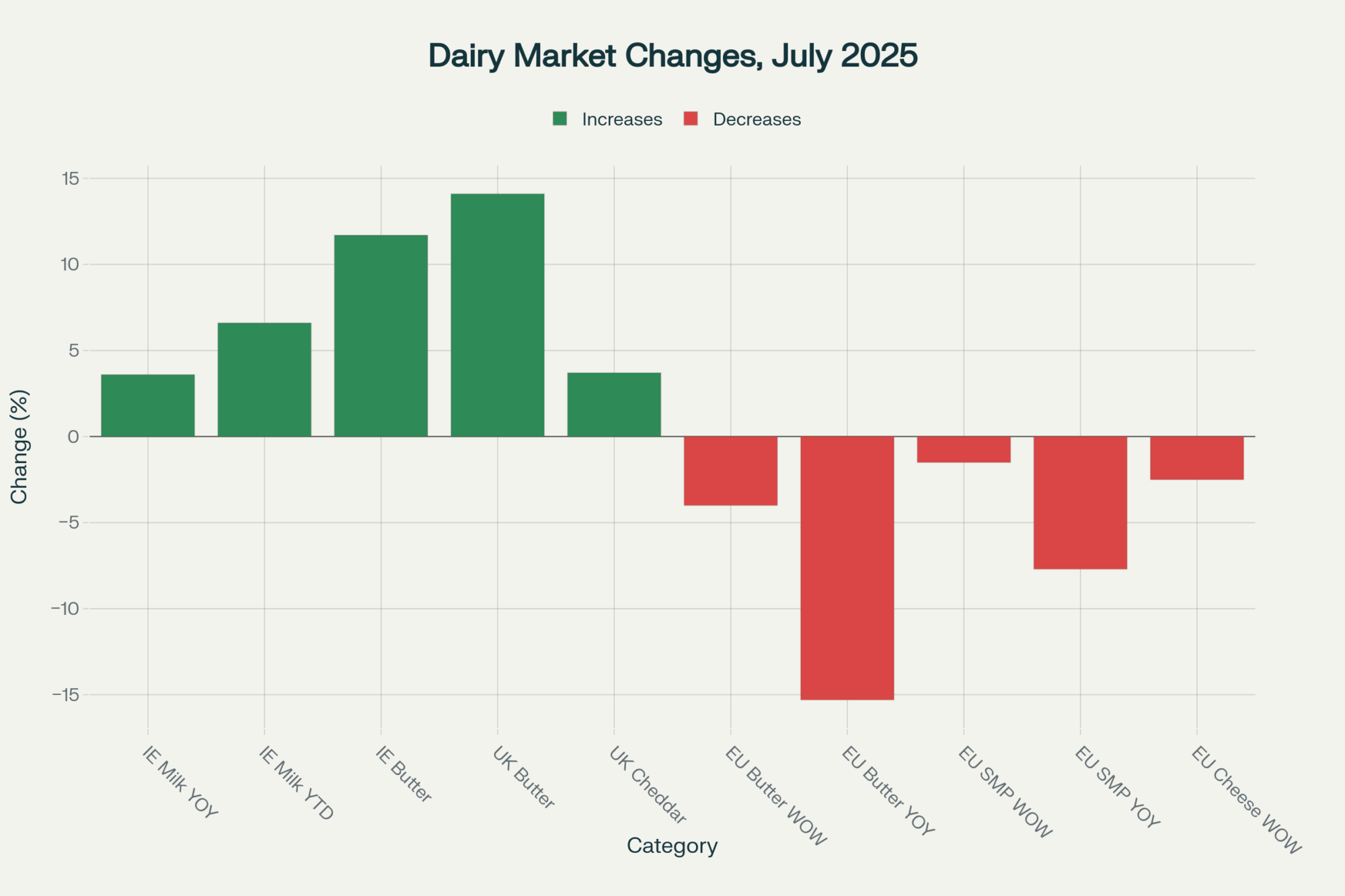

EXECUTIVE SUMMARY: Look, the writing’s on the wall… and it’s not what most folks expect. Ireland’s cranking out 6.6% more milk year-to-date, butter production’s exploded by 11.7%, but guess what? Prices are getting hammered—butter’s down 4%, skim powder’s bleeding worse. The old playbook of “milk more, make more” just died. Smart operators aren’t chasing volume anymore—they’re locking profits through futures contracts, like that Pennsylvania outfit securing 35% of their fall milk at $18.85 per hundredweight. The survivors are the ones optimizing components, hedging feed costs, and investing in tech that actually moves the needle. Don’t wait for this market to force your hand—adapt now or watch margins disappear.

KEY TAKEAWAYS:

- Lock down 25-40% of your milk through Q4 2025 Class III futures —Pennsylvania farms are already securing $18.85/cwt while others wait and worry

- Push butterfat and protein percentages higher —component premiums are your lifeline when commodity prices crater; every 0.1% boost in protein adds real dollars per hundredweight

- Hedge feed ingredients before winter hits —with margin pressure building, getting caught by feed price spikes will kill your profitability faster than low milk prices

- Invest in automation now, not later —labor shortages aren’t going away, and the farms automating feeding and milking are the ones maintaining consistency when others struggle

- Track global supply signals religiously —Ireland’s 11.7% butter surge and China’s 85% domestic production shift are early warnings that’ll hit your local market in 60-90 days

Here’s what caught my attention last week: Singapore Exchange moved an absolute monster volume—38,275 tonnes—yet dairy prices kept bleeding. When you see that kind of disconnect between volume and price action, something fundamental is shifting beneath the surface.

You know that feeling when your milk hauler mentions prices are getting “interesting,” but you’re not quite sure what’s driving it? That was me digging into last week’s futures data. Singapore posted numbers that should have had every trader celebrating, yet whole milk powder barely twitched—down just 0.4% to $3,713. But skim powder? Man, that got absolutely hammered, dropping 3.6% to $2,698.

The thing about institutional money is that when they’re moving serious volume but prices aren’t responding, they’re not buying strength. They’re repositioning for what they know is coming.

Irish Farms Are Living the Genetic Revolution

What’s really driving this supply surge? Ireland’s collections jumped 3.6% year-over-year in July to 1.038 million tonnes, pushing their year-to-date total up 6.6% to 5.83 million tonnes. But here’s what gets me excited about this—it’s not about cramming more cows into fields. This is those genomic investments from 2020-2021 are finally hitting their stride.

I’ve been talking with producers around County Cork, and the stories are remarkably consistent. “Our fresh cows coming off those genomic matings are testing 35 to 40 pounds heavier than their dams did at the same age,” one farmer told me. “The DHIA group I’m in… we’re seeing 2,000-pound lactation gains from bulls we used three seasons back.”

What strikes me about Ireland’s situation is the seasonal component that often gets overlooked. Met Éireann’s July weather data showed rainfall about 15% above normal—perfect for extending the grazing season. When you combine ideal growing conditions with genetic gains hitting maturity simultaneously… well, that’s how you get butter production exploding 11.7% year-over-year to 32.4 thousand tonnes.

The processing side tells its own story. Kerry Group and Glanbia facilities are running butter churns pretty much around the clock. That kind of capacity strain? We haven’t seen it since quota removal.

UK Dairy Grinds Through Brexit Headaches

Across the water, UK operations pulled off something I honestly didn’t expect. Butter production surged 14.1% to 15.9 thousand tonnes in July, with cheese output gaining 1.4% to 43.9 thousand tonnes—including a solid 3.7% bump in cheddar.

Here’s where it gets interesting, though. The Royal Association of British Dairy Farmers survey shows 84% of operations struggling to fill positions. I’ve been hearing from mates in Devon and Cornwall that creameries are running weekend shifts for the first time since 2019, paying 25-30% wage premiums just to keep lines moving.

At least Mother Nature cooperated. After that brutal spring, decent rainfall kept pastures lush across the southwest. But let’s be honest—this labor situation isn’t improving anytime soon. UK producers adapting with automation and premium wages are making it work. Those hoping for cheap labor to return? They’re dreaming.

European Butter Market Reality Check

The price action tells you everything about supply overwhelming demand. EU butter indices crashed €283 last week—that’s a 4% drop landing at €6,711 per tonne, which puts us 15.3% below last year.

Dutch butter took the worst beating, down €360 (-5.3%). German and French prices weren’t much better. When I see regional variation like that, it usually means processors are competing to move inventory they can’t store profitably.

Those private storage programs that propped prices during last year’s rally? They’ve pretty much unwound completely, leaving facilities holding cream they’re struggling to turn into profitable products.

Skim powder’s following the same pattern—down €32 (-1.4%) to €2,338, sitting nearly 8% below 2024 levels. Even specialty cheese markets are showing stress: Cheddar Curd off €100, Young Gouda down €104, and Mozzarella declining €90. When you see that kind of broad-based weakness, it’s not seasonal adjustment… it’s fundamental oversupply.

China’s Playing a Different Game Now

Chinese farmgate prices held around 3.02 Yuan/kg in August, but that masks a 5.8% year-over-year decline. The real story isn’t the price—it’s the strategic shift that’s reshaping global trade patterns.

China’s now producing roughly 85% of their liquid milk domestically, driven by national food security policies. Think about that for a minute. The world’s biggest dairy market has transformed from a consistent importer to a tactical buyer who shows up when prices make sense.

Regional differences inside China matter too. Inner Mongolia keeps ramping up production while coastal provinces stay cautious. What does this means for exporters? You’re dealing with a price-sensitive buyer, has domestic alternatives and doesn’t need to maintain steady import flows anymore.

This isn’t temporary market volatility—this is China’s new normal, and it fundamentally changes how global dairy trade works.

The Efficiency Revolution That’s Breaking All the Old Rules

Here’s what fascinates me about the livestock data. Ireland’s dairy herd dropped 2.0% to 1.58 million head, yet production keeps climbing. Germany’s inventory contracted 2.5% to 3.58 million head—with steeper cuts in Bavaria where environmental restrictions bite hardest. The Netherlands fell 1.0% to 1.53 million head.

New Zealand’s showing different patterns. July slaughter rates jumped 11.9% year-over-year, but cumulative annual numbers remain 6.3% behind last year. That suggests strategic culling of lower-producing animals while maximizing output per cow.

The math is straightforward, but the implications are huge: fewer cows producing significantly more milk means traditional supply-demand forecasting is broken. We’re in uncharted territory where efficiency gains consistently outpace demand growth.

So, What Are the Forward-Thinking Operations Actually Doing?

Based on my conversations, they’re playing defense:

- Securing Margins: They’re forward contracting 25-40% of their fall production using Class III futures for Q4 2025, treating it as price insurance, not speculation. One Pennsylvania operation I know just locked 35% of their October-December milk at .85 per hundredweight. “It’s not about chasing maximum volume,” the manager explained. “We’re securing margins and managing downside risk.”

- Managing Input Costs: Feed ingredient hedging is accelerating, and many are extending payment terms with suppliers—classic margin pressure signals spreading through the supply chain.

- Optimizing for Components: The focus has shifted from maximizing volume to optimizing for butterfat and protein. Premiums here offer crucial protection when commodity prices are weak.

- Investing in Efficiency: Technology investments are now focused on enhancing labor efficiency and reducing input costs, rather than solely improving production. This is no longer optional; it’s essential for survival.

The Reality Check We Need to Have

What we’re witnessing isn’t cyclical oversupply that corrects itself in 18 months. This is a permanent structural change driven by efficiency gains nobody anticipated.

Per-cow productivity improvements from genomic selection, precision feeding, enhanced cow comfort—these advances are hitting maturity simultaneously across major regions. When this efficiency explosion meets adequate feed supplies and favorable weather… well, traditional demand forecasting becomes pretty much useless.

Add macroeconomic factors like inflation affecting consumer spending, and you’ve got persistent downward pressure that’s going to separate strong operations from marginal ones over the next few years.

The producers adapting to this new reality by building financial resilience, optimizing operations, and managing risk strategically? They’ll be the ones defining dairy’s future.

The Bottom Line

September 2025’s market data isn’t just another monthly report—it’s exposing a fundamental shift every commercial operation needs to understand. That record trading volume masking systematic price weakness? It’s institutional money positioning for continued supply pressure.

This isn’t about surviving a temporary downturn anymore. It’s about positioning for success in an industry where efficiency has permanently altered competitive dynamics.

Your next strategic decision isn’t about producing more milk. It’s about producing profitable milk in a world where global abundance is becoming the permanent reality.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The Secret to High Components: It’s More Than Just Genetics – This article provides practical, on-farm strategies for maximizing butterfat and protein through nutrition and management, revealing how to capture the component premiums that are essential for profitability when commodity milk prices are low.

- Dairy Market Crystal Ball: What’s Really in Store for the Next 12 Months – Complementing this article’s supply analysis, this piece offers a broader strategic forecast of global demand, economic pressures, and consumer trends, giving you the long-term perspective needed for better business planning and risk management.

- Beyond Production: The Rise of Sustainability and Efficiency Indexes – While our analysis covers the impact of past genetic gains, this piece explores the future. It demonstrates how to use new indexes like Feed Efficiency to breed a more resilient and profitable herd for tomorrow’s market realities.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!