What farmers are discovering about climate-driven contamination: Prevention protocols cost $63 per cow annually, but crisis response wipes out six months of profit margins at $128 per cow in just one week

EXECUTIVE SUMMARY: What farmers are discovering across the Midwest is that aflatoxin contamination—long considered a southern problem—is heading north faster than most operations are preparing for it. Michigan State’s climate research shows nearly 90% of corn-growing counties will experience increased contamination by the 2030s, putting thousands of dairy farms at risk of dumping milk worth $20,000 or more per incident. Here’s what’s particularly concerning: processors are already segmenting their supplier base into premium and commodity tiers based on contamination control protocols, with a $2-4 per hundredweight difference that could mean $30,000-50,000 annually for a mid-sized operation. The math on prevention is surprisingly straightforward—at $63 per cow annually (approximately $9,475 for a 150-cow herd)—implementing testing and mycotoxin binders costs less than half what a single seven-day contamination event would. Research from land-grant universities suggests these binders often pay for themselves through improved butterfat tests and reduced fresh cow problems, even without contamination events. Looking ahead, farms that establish laboratory relationships and testing histories now will have market access when processors implement mandatory requirements… while those waiting until 2029 face the prospect of losing premium markets before they can even get test results. The choice is becoming clearer every month: invest in prevention on your timeline, or scramble for solutions when your processor gives you 72 hours to prove control.

You know, I was at a nutrition conference in Madison last month, and I heard the same thing from just about every producer there—”aflatoxin is a southern problem, we don’t deal with that here.”

That confidence? It could become an expensive lesson for thousands of us.

What really caught my attention recently was news from international dairy markets, where contamination events have been hitting major processors—companies with all the quality systems one’d expect. They’re finding aflatoxin M1 in products that passed multiple checkpoints. Every sample exceeds what Europe allows.

And it’s reaching consumers anyway.

What’s worth understanding is the research Dr. Felicia Wu’s team published in Environmental Research Letters in May 2022. They used 16 different climate models to project aflatoxin expansion, and here’s what they found—nearly 90% of corn-growing counties across the Midwest are going to see increased contamination by the 2030s. We’re not talking about a few hot spots here and there. This represents a complete geographic shift northward into regions where most of us have never even tested for the stuff—from Wisconsin to Michigan, Ohio to Pennsylvania, Minnesota to Iowa.

And for those of you milking in New York or Vermont? The eastern dairy regions are seeing similar projections according to the same climate models. Vermont’s roughly 600 dairy operations could face similar challenges to those being addressed in the Midwest. Michigan’s concentrated dairy areas around Allegan and Ottawa counties? They’re right in the expansion zone, too.

The Market Split That’s Already Happening

I’ve been closely watching processor requirements for the past few years, and something interesting is emerging that most people haven’t yet caught on to. The milk market’s basically splitting in two, and the gap’s getting wider every month.

If you pull up the supplier handbooks from any of the big players—Organic Valley, Horizon, even some regional co-ops—you’ll see what I mean. Farms shipping to export programs or premium organic brands? They’re playing by one set of rules. Everyone else? Completely different game.

Here’s what the premium side looks like these days, based on processor documentation:

- Monthly bulk tank testing for aflatoxin M1

- Feed protocols that get audited every year

- Can’t go above 50 parts per billion—that’s matching EU Regulation 165/2010

- Mycotoxin programs with third-party verification

- Getting paid $2 to $4 more per hundredweight, according to recent USDA Agricultural Marketing Service data

And then there’s the commodity side:

- No required testing at the farm level per FDA Compliance Policy Guide 527.400

- Feed documentation is optional

- FDA’s action level sits at 500 parts per billion—ten times higher

- No mycotoxin requirements

- Base pricing, and you’re first to get cut when there’s too much milk

A quality manager at one of the Wisconsin cooperatives—speaking on condition of anonymity—told me they started segmenting their suppliers about three years ago. “The farms with testing history they get first dibs on premium programs. Everyone else is commodity-only, and it’s getting really hard to move up once you’re in that category.”

What’s interesting is that this mirrors what Italian researchers documented in the journal Toxins back in February 2023. They analyzed almost 96,000 milk samples between 2013 and 2021, achieving 98.6% compliance with EU standards. But here’s the thing—they only got there by testing everything and taking immediate action when problems showed up. The farms that couldn’t keep up lost their export access for good.

I’ve noticed even smaller regional processors are getting on board. Several cheese plants in the Midwest are starting enhanced testing requirements in 2026, according to their published supplier notifications.

Now, for those of you running organic operations—here’s something you might not realize. Many organic certifications require testing for aflatoxin B1 in feed, but not necessarily M1 in milk at EU levels. Worth checking your specific certification requirements because processors are starting to look beyond just the organic label.

Why This Isn’t Like Other Feed Problems

You know, I’ve watched producers handle feed issues for decades, and most of us treat aflatoxin like we’d handle moldy silage or wet hay—something to manage when it shows up. But after talking with nutritionists across the region, that’s really the wrong way to think about it.

Consider how we normally handle feed problems. Moldy silage? We decide how much to feed and may add some yeast culture. Bad hay from that late cutting? We supplement around it. Wet corn from a rainy harvest? We monitor the heating process and may add some propionic acid. These are all decisions we control. Our cows, our management, our call.

Aflatoxin’s completely different. The moment your processor finds contamination above their limit—and according to National Milk Producers Federation data from 2024, they’re testing more frequently now—you’re done shipping milk. Not slowed down. Done.

A dairy nutritionist working with farms across Wisconsin, Minnesota, and Iowa—who requested anonymity due to client relationships—shared a recent case. “We had a farm with 15 years of perfect quality records, hit 75 ppb AFM1. That’s below FDA limits but above EU standards. Lost their premium market instantly. Took over a year to qualify again. For a 200-cow operation, that’s easily $45,000 gone.”

And here’s what makes it particularly tricky—USDA Grain Inspection, Packers, and Stockyards Administration’s 2024 annual report shows that black light screening at grain delivery catches roughly half of the contaminated loads—though this varies quite a bit depending on the contamination levels and who’s conducting the inspection. The other half gets through because contamination concentrates in specific areas, or hot spots. Research from Iowa State University Extension on grain quality confirms that just five contaminated kernels per million can push a load over FDA action levels.

For those of you with pasture-based operations, thinking you’re safe—drought-stressed pastures can develop aflatoxin-producing molds too. Nobody’s immune from this.

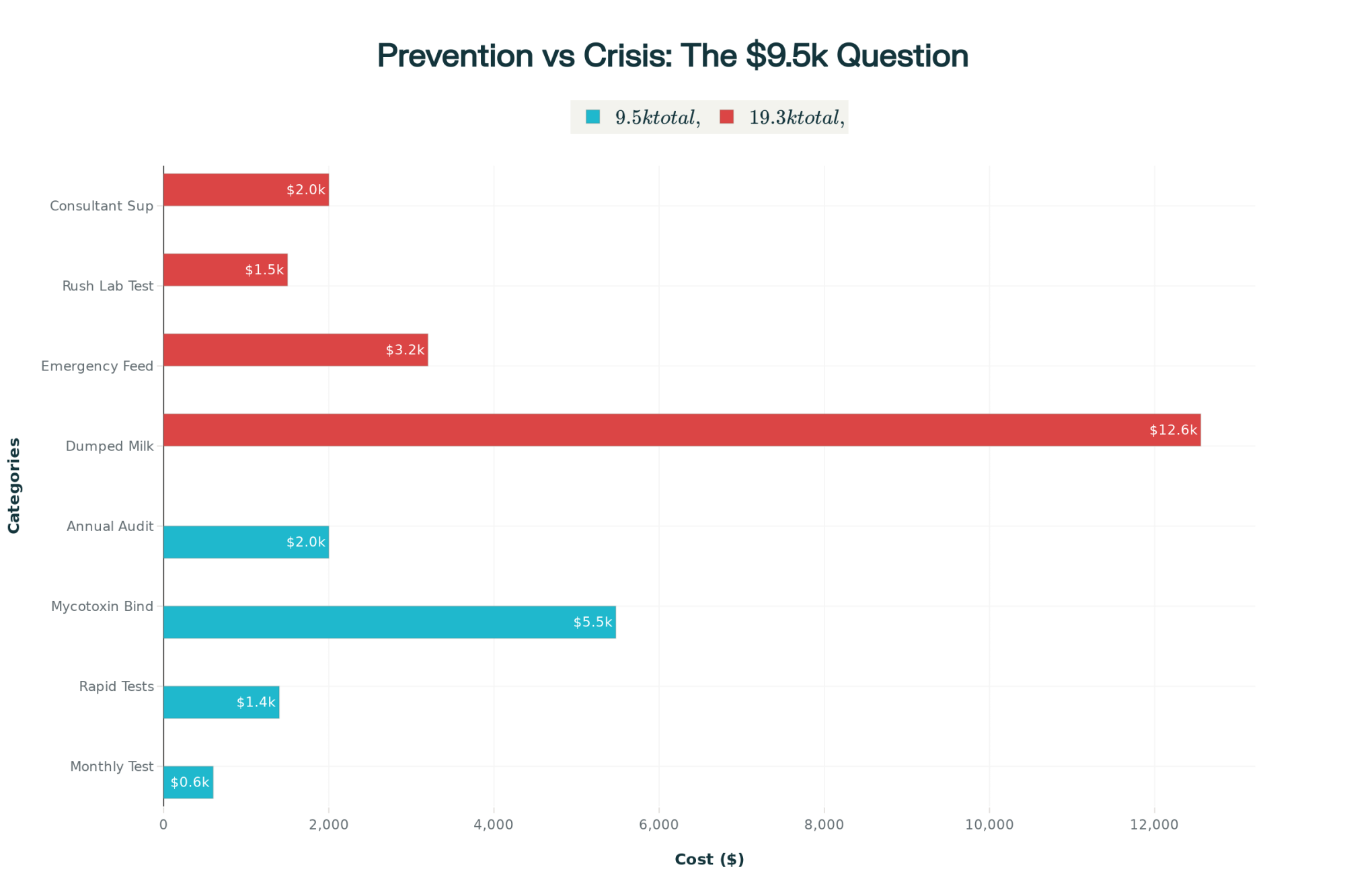

What This Actually Costs (I Did the Math)

Let me break down real numbers based on what we’re seeing right now with recent Class III pricing averaging around $18.40 per hundredweight. I’ve cross-referenced these against current supplier catalogs and the actual payments producers are making.

For a typical 150-cow herd producing 65 pounds per cow daily:

Annual prevention costs:

- Monthly bulk tank testing (12 samples at $50 based on Marshfield Labs pricing): $600

- Rapid test strips for grain (about 200 tests at current Charm Sciences rates): $1,400

- Mycotoxin binders all year (using standard 100g/head/day inclusion): $5,475

- Annual audit from an ISO-certified lab: $2,000

- Total: $9,475 (that’s $63 per cow annually)

One contamination event based on current milk pricing:

- Seven days of dumped milk (9,750 lbs/day × 7 × $18.40/cwt): $12,558

- Emergency feed replacement at typical 30% drought premiums: $3,200

- Rush laboratory testing (HPLC confirmation from accredited lab): $1,500

- Consultant support for crisis response: $2,000

- Total: $19,258 (that’s $128 per cow for just one week)

But here’s what’s really interesting—research published in the Journal of Dairy Science has shown mycotoxin binders can improve milk production during low-level contamination periods. Multiple studies report increases of 3-7 pounds per day. At current prices, that production boost often covers much of the binder cost.

The bigger operations—those 500-cow dairies you see around Wisconsin and Ohio—they get even better economics. Prevention costs drop to around $45 per cow through bulk buying agreements, but crisis costs remain at $125 to $ 140 per cow. You’re still dumping the same percentage of your milk.

Dairy nutrition researchers at land-grant universities have consistently found that mycotoxin binders offer benefits beyond just contamination control. According to the University of Wisconsin Extension’s 2024 dairy nutrition guidelines, “We often see better butterfat tests, usually up a tenth or two, and fewer fresh cow metabolic problems. The prevention often pays for itself even without contamination events.”

When This Hits Your Region

Michigan State’s climate research used the same models NOAA relies on to map out where contamination’s heading. And based on their projections published in 2022, it’s coming faster than most of us realize.

Currently, through 2027, Southern Illinois and Indiana experience problems during drought years—we saw this in 2023. Most operations north of I-70 haven’t experienced it yet. Although extension agents in southern Ohio report that they’re starting to see occasional positives during extremely dry periods.

2028-2030: The problem shifts north. Southern Wisconsin—the Monroe and Janesville areas—plus most of Iowa and northern Illinois, start seeing contamination every few years. University of Minnesota Extension modeling from their 2024 climate adaptation report suggests that what used to occur once in 20 years now happens once in three.

2031-2033: This is when the models indicate real expansion. Central Wisconsin’s dairy country, Minnesota’s concentrated production areas, Michigan’s agricultural zones, Ohio’s dairy regions—they’ll see contamination approaching what Kentucky experiences today.

2034 and beyond: It becomes routine across nearly 90% of Midwest corn counties, according to the Michigan State projections. Processors won’t have a choice—they’ll require testing because they can’t absorb the liability of contaminated milk.

Kansas State University agricultural economists have calculated that significant economic impacts are coming. Their recent outlook estimates regional losses could increase 5- to 8-fold by the mid-2030s based on contamination modeling.

The USDA Economic Research Service documented over $1 billion in agricultural losses from the 2012 drought, with mycotoxin contamination representing a significant component according to their published analysis. That event was supposed to be once in 20 years. Current climate patterns suggest it could become an every-other-year occurrence in some regions by 2030.

As for insurance, from what insurance professionals are telling us, most standard dairy policies exclude mycotoxin contamination unless you purchase specific riders. And those premiums? They’re reflecting the increasing risk.

What Recent Contamination Events Teach Us

Recent international contamination events offer important lessons. Even operations with comprehensive quality systems—such as ISO certifications, laboratory access, and corporate protocols—have had contaminated products reach consumers.

In one recent case, inspectors found no critical violations during routine facility audits. The contamination was only detected through targeted product testing. Multiple batches of children’s products failed EU standards despite passing earlier checkpoints.

What went wrong? Industry analysts suggest that the same issue threatening Midwest operations—reliance on spot checks instead of systematic monitoring —also applies. Each checkpoint appeared fine because continuous aflatoxin testing was not a standard protocol.

Now imagine that scenario across hundreds of Midwest farms during a drought summer in, say, 2031. Processors can’t handle dozens of simultaneous contamination cases. Based on how processors handled the 2012 drought surge—according to those who lived through it, their experiences reveal a great deal—they’ll likely implement rapid decision protocols. Prove you’ve got control within 72 hours or face suspension.

Getting Started Based on Your Size

Different-sized operations need different approaches, but everyone needs to start building infrastructure before contamination becomes routine.

Under 150 cows:

Keep it simple at first. Rapid test kits from established suppliers, such as Charm Sciences or Neogen, typically cost around $200 for starter kits. Test your next five corn deliveries—it takes about five minutes per test. If everything’s clean, you’ve spent less than your monthly DHIA bill, confirming you’re okay. If something tests positive, you’ve potentially saved yourself months of lost income.

Consider teaming up with neighboring farms. State dairy organizations in Wisconsin (Professional Dairy Producers), Minnesota (Milk Producers Association), and Pennsylvania (Center for Dairy Excellence) have been facilitating group purchasing agreements for testing supplies and consultant services since 2024. Several producer groups report successful cost-sharing arrangements for testing equipment.

150 to 400 cows:

This is actually a sweet spot for implementing full prevention protocols. You’re big enough to justify dedicated equipment but nimble enough to change quickly.

Start monthly bulk tank testing immediately. Regional laboratories, such as Marshfield Labs in Wisconsin, MVTL in Minnesota, or the Pennsylvania Animal Diagnostic Laboratory, can provide this service. You need that testing history before processors start requiring it. Add mycotoxin binders to your standard ration—commercial mycotoxin surveys suggest the production response typically covers 70-80% of the cost, even without contamination events.

Over 500 cows:

Larger operations have significant advantages here. Prevention represents less than 1.5% of your typical feed budget according to the University of Wisconsin’s 2024 annual farm financial summary. The real risk isn’t the cost—it’s being the last major operation in your milkshed to implement protocols.

Consider becoming a regional leader in contamination control. Several larger Wisconsin and Ohio operations have successfully piloted testing programs with their processors, positioning themselves as preferred suppliers for premium programs. Some are even helping smaller neighboring farms implement protocols through equipment sharing or group purchasing.

The 72-Hour Rule That Changes Everything

Here’s what most producers don’t understand about processor decision-making during contamination events. When it involves one or two isolated cases, processors typically work with the affected farms for weeks to identify and correct the problems. The major cooperatives all have similar protocols for isolated incidents.

But when contamination becomes widespread? Everything changes.

A procurement manager at a major Midwest cooperative—speaking about their experience during the 2012 drought—explained: “We had 15 farms test positive in 10 days. Our quality team couldn’t handle individual investigations. We implemented a 72-hour rule based on that 2012 experience—provide documented corrective action and clean test results within three days or face suspension.”

This is where preparation becomes critical. Farms with established laboratory relationships—those that send monthly samples, maintain accounts, and know the staff—can often achieve a 24-hour turnaround, even during surge periods. New customers? According to the American Association of Veterinary Laboratory Diagnosticians’ 2024 capacity survey, they face delays of two to three weeks when demand spikes.

The math simply doesn’t work. Processor demands results in 72 hours. Laboratory says 14 days for new accounts. You lose premium market access before test results even arrive.

Where to Invest First

Based on what successful early adopters have shared, here’s a practical implementation sequence:

This month ($2,000-3,000):

- Order rapid test strips from established suppliers

- Set up accounts with accredited laboratories now

- Begin baseline bulk tank testing to establish your clean history

- Start documenting feed deliveries—even smartphone photos with timestamps help

Next 3-6 months ($5,000-8,000):

- Implement systematic feed testing protocols

- Add mycotoxin binders, working with your nutritionist on inclusion rates

- Expand laboratory testing frequency

- Schedule conversations with your processor about future requirements

By year’s end ($8,000-12,000):

- Complete third-party audit from an ISO-certified provider (you can find auditors through the American National Standards Institute directory or your state’s quality certification programs)

- Upgrade documentation systems for better traceability

- Establish crisis response fund (minimum $20,000 recommended)

- Build relationships with alternative market outlets

Total investment over 12 months: $15,000-23,000

Compare that to one contamination event, at a minimum of $19,000, plus the potential loss of premium market access worth $30,000-$50,000 annually for a mid-sized operation.

Questions for Your Processor This Week

Most producers don’t know what to ask until it’s too late. Here are the critical questions:

What are your current AFM1 testing requirements for premium programs? How much advance notice will we receive before requirements change? What documentation do you need for contamination control verification? Which laboratories do you accept for official testing? What’s your specific protocol and timeline if contamination is detected?

Get these answers in writing. Email your field representative today—seriously, this conversation can’t wait.

The Seasonal Pattern Worth Understanding

Dairy nutrition specialists consistently point out that aflatoxin risk peaks during late summer through fall harvest, especially following drought stress. From September to November, corn typically shows the highest contamination risk, according to multi-year USDA grain inspection data.

Smart operations adjust their testing frequency seasonally—doubling tests during high-risk months, then scaling back in winter and spring. It makes economic sense to focus prevention resources when risk is highest.

Several states, including Illinois and Iowa, are developing aflatoxin monitoring programs through their extension services, though funding remains limited so far.

Making Your Decision

Considering everything—recent international contamination events, Michigan State’s peer-reviewed climate projections, and processor requirements already being implemented—the path forward is becoming clearer.

If you’re skeptical about climate projections, that’s understandable. But processors aren’t skeptical. They’re implementing testing requirements now based on risk assessments. Even if your specific farm never sees contamination, lacking documented protocols will exclude you from premium markets.

If you’re concerned about costs, run your own numbers. Seven days of production multiplied by current milk prices equals your minimum crisis cost. Add lost premium access, and you’re looking at months of profit margins eliminated. Prevention—at $9,475 annually for a 150-cow herd—costs less than half what a single contamination event would.

If you think there’s time to wait, consider that laboratory relationships take months to establish. Testing histories require 12-24 months to build. Premium programs often have waiting lists. Starting in 2029, when contamination becomes routine, means you’re already years behind.

If you’re ready to move forward, start this week. Order test strips from reputable suppliers. Contact three laboratories about their services. Schedule that processor meeting. Small steps compound into comprehensive protection.

The producer who told me aflatoxin’s “a southern problem”? He’s right about today. But Michigan State’s research—16 climate models all pointing in the same direction—shows that by 2030, southern problems become Midwest realities. Whether you’re milking in Wisconsin, Iowa, Ohio, Pennsylvania, Michigan, New York, Vermont, or anywhere between.

What is the difference between operations that thrive through this transition and those that struggle? About $63 per cow annually for prevention—yes, that’s $9,475 for a 150-cow operation, but spread across your annual production, it’s manageable.

That’s less than treating one displaced abomasum. It’s a fraction of your monthly fuel costs. And it’s minimal compared to the market access you’re protecting.

Climate patterns are shifting whether we’re ready or not. Processors won’t wait for stragglers. That 89.5% probability across Midwest counties isn’t a maybe—it’s a timeline that’s already in motion.

The only real question is whether you’ll build your prevention system on your schedule over the next 18 months, with time to optimize and establish relationships, or on your processor’s timeline in 72 hours while your milk truck’s being turned away.

One approach costs $63 per cow annually, with time to implement it properly. The other costs $128 per cow in just one week while you’re dumping milk and scrambling for solutions.

The math’s straightforward. The choice should be too. But from what I’m seeing across the industry, most operations are choosing to wait.

That could become an expensive lesson.

KEY TAKEAWAYS

- Prevention delivers 3:1 return on investment: Annual prevention costs of $63/cow protect against weekly crisis costs of $128/cow, plus mycotoxin binders typically improve milk production by 3-7 pounds daily and boost butterfat tests by 0.1-0.15 points

- Start testing protocols immediately for smaller operations: Farms under 150 cows can begin with $200 rapid test kits from Charm Sciences or Neogen, testing five corn deliveries monthly—costing less than your DHIA bill while establishing the clean history processors will require

- Premium market access depends on documentation starting now: Processors are already paying $2-4/cwt more for farms with established testing histories, and building the required 12-24 month documentation takes time you can’t make up during a crisis

- Regional timing varies, but preparation doesn’t: Southern Wisconsin and Iowa see contamination by 2028-2030, while Michigan and Ohio follow by 2031-2033—but laboratory relationships and prevention protocols need 18 months to establish, regardless of location

- The 72-hour processor rule changes everything: During widespread contamination events (like the 2012 drought), processors demand clean test results within three days while new laboratory customers face 14-day waits—making advance preparation the difference between keeping and losing market access

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Mycotoxin Management: Your Guide to Protecting Herd Health and Your Bottom Line – This guide provides a tactical deep-dive into on-farm mycotoxin control. It expands on the main article’s advice by detailing specific symptoms in cows and offering practical strategies for feed storage and bunk management to reduce overall contamination risk.

- The Hidden Paycheck: How Milk Components are Redefining Dairy Profitability – For a strategic market perspective, this analysis reveals how the feed quality protocols discussed in the main article directly translate into higher milk component premiums. It demonstrates how to leverage superior herd health and nutrition to maximize your milk check.

- Precision Feeding: The Digital Revolution Coming to Your Feed Bunk – Explore the next step in mitigation with this look at innovative technology. It shows how automation and data analytics can enhance the mycotoxin binder protocols recommended in the main article, ensuring precise implementation for better herd health and feed efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!