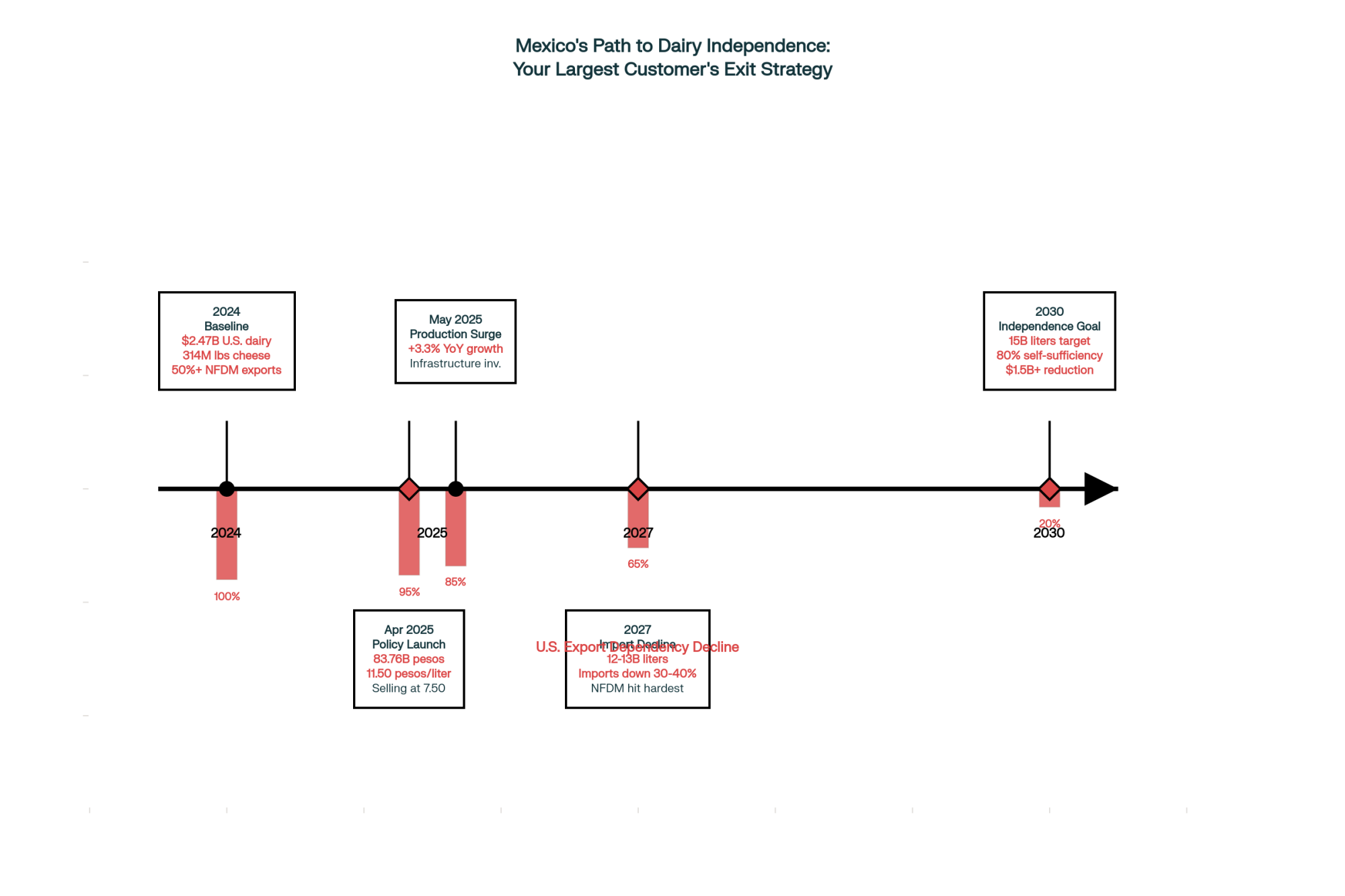

Your milk: Complete nutrition. Coke: Sugar water. They keep 70¢/$, you get 30¢/$. Coke’s secret, Ship syrup, not liquid. Save 87% on shipping. We found dairy’s version.

You know, every time I’m in a grocery store, I can’t help but notice something interesting. These two beverages are sitting right there in the cooler—one’s basically sugar water (we’re talking 87% water with some flavoring thrown in), and the other’s got proteins, minerals, vitamins… pretty much everything nutritionists say we need. Yet here’s what gets me: Coca-Cola’s latest quarterly results show they’re capturing somewhere between 60 and 70% of every retail dollar. Meanwhile, USDA’s March data shows we’re getting about a 30-49% share of the retail dollar as dairy producers.

So I’ve been thinking about this a lot lately, especially when it comes to dairy farm profitability. What makes Coca-Cola’s approach work so well? And maybe more importantly—what can those of us in dairy actually learn from how they do business? Because while we obviously can’t turn Milk into concentrate (wouldn’t that be nice for shipping costs?), there’s definitely some strategies here worth considering.

Two Completely Different Ways of Doing Business

Here’s what’s fascinating when you dig into the numbers. Coca-Cola’s first-quarter 2025 results showed operating margins reaching 32%. They’re capturing 60-70% of retail value, with gross margins reaching up to 80% in some cases. Now compare that to what USDA’s March 2025 dairy market data shows—we’re receiving about $1.97 per gallon when consumers are paying $4.48 at retail. That’s roughly 44% of what folks are shelling out at the store.

What’s creating this gap? Well, the folks at Cornell’s Program on Dairy Markets and Policy have done some interesting work on this. Turns out, raw materials—the actual ingredients Coca-Cola needs—represent just 5% of its revenue. For dairy processors? Raw milk purchases eat up about 50% of their costs. That’s a huge difference right there.

And think about the logistics for a minute. Coca-Cola ships concentrated syrup to bottlers, who then add water, carbonation, and packaging. They’ve basically eliminated 87% of the product’s weight from their shipping and storage costs. Pretty clever, right? Meanwhile, every gallon of our milk must be continuously refrigerated from the moment it leaves the bulk tank. The University of Wisconsin’s Center for Dairy Research has calculated those cold chain costs—we’re looking at 10 to 15 cents per gallon daily just for storage. That adds up quick.

Business Factor | Coca-Cola | Dairy Farmers | Impact |

|---|---|---|---|

| Raw Material Cost | 5% of revenue | 50% of costs | 10x cost advantage |

| Marketing Power | $4.24 billion annually | $420 million (fragmented) | 10x marketing spend |

| Product Control | Proprietary formula, legally protected | Commodity, identical across producers | Pricing power vs. price taker |

| Distribution Model | Ship concentrate, save 87% weight | Ship full product, continuous cold chain | 87% logistics savings |

| Operating Margin | 32% | 8% (typical processor) | 4x margin advantage |

| Retail Value Capture | 60-70% | 30-49% | 2x value retention |

But here’s what I find really interesting… it’s not just about the logistics. It’s about who controls what in the whole system.

When One Brand Rules Them All

So MediaRadar tracked Coca-Cola’s marketing spend for 2023—$4.24 billion annually. That’s billion with a B. One company, one brand family, all pushing the same message everywhere you look. Now, our dairy checkoff program collected about $420 million from producers last year, according to DMI’s annual report. And that gets spread across multiple programs, different regions, sometimes even competing messages when you really think about it.

Coca-Cola keeps incredibly tight control over their formula—it’s legally protected, nobody else can make exactly what they make. But milk from a Holstein in Wisconsin? It’s the same as milk from a Holstein in California, Georgia, or anywhere else, really. We’re all producing essentially the same product while they’ve created something nobody else can legally copy.

Dr. Andrew Novakovic over at Cornell’s Dyson School has this great way of putting it. He says Coca-Cola created scarcity around abundance—they took ingredients you can get anywhere and made them exclusive. We’ve got the opposite problem in dairy. We have abundance without any scarcity, and that’s what makes pricing power so challenging.

You probably remember what happened with Dean Foods back in November 2019. They had over 100 processing plants at their peak, but when they filed for bankruptcy, the court documents showed something interesting. All that processing scale, but zero consumer brand loyalty. When Walmart decided to build its own plant, Dean lost major supply contracts overnight. It really shows how hard it is to build that Coca-Cola-type brand power when you’re dealing with a commodity product.

What Coca-Cola’s Playbook Can Teach Us

Now, looking at what they do well, I see three strategies that some dairy operations are starting to figure out how to use:

Tell Your Story, Not Just Your Specs

Here’s something Coca-Cola figured out ages ago—they don’t sell beverages, they sell feelings. Happiness, refreshment, nostalgia. You’ll never see their ads talking about corn syrup or phosphoric acid, right?

I was talking with a Vermont producer recently who finished her organic transition—took about 6 years and cost around $45,000 in certification fees, based on what Extension tells us—and she had this great insight. She said they stopped trying to sell milk and started selling their values instead. Environmental stewardship, animal welfare, and the whole family farming tradition. Her customers aren’t just buying organic milk anymore; they’re buying into what the farm represents.

The Organic Trade Association’s research supports this. These story-driven premium markets are growing 7 to 9% annually, and they’re projecting the market could hit $3.2 to $5.4 billion by the early 2030s. The operations getting $35 to $50 per hundredweight instead of the usual $20 to $22 commodity price? They’re the ones who’ve figured out how to market their story, not just butterfat levels and protein content.

Down in the Southeast, where summer heat stress can knock production down by 25% in conventional systems (according to their Extension services), several producers have switched to grass-fed operations. Sure, the heat’s still tough, but their story about heat-adapted genetics and pasture-based systems really resonates with consumers looking for local, sustainable products. Many are getting $3 to $4 per hundredweight premiums through regional retail partnerships.

Out in Colorado and New Mexico, where water’s becoming increasingly precious, I’m hearing from producers who’ve turned water conservation into a marketing advantage. They’re documenting their drip irrigation for feed crops, recycling parlor water, and other practices. One producer told me retailers are actually seeking them out because of their sustainability story.

Keep It Simple to Make It Work

Coca-Cola’s concentrate model is all about simplification when you think about it. They make syrup in a handful of facilities, let thousands of bottlers handle all the messy logistics, and focus their energy on brand building and market development.

We’re seeing something similar with beef-on-dairy genetics. The American Farm Bureau Federation’s October data shows that 81% of U.S. dairy herds now use beef semen. That’s huge. And it’s really a simplification strategy—same breeding program, different semen, massive value difference.

Wisconsin producers I’ve talked with are seeing results that match up with what Lancaster Farming’s been reporting—beef crosses averaging around $480 while Holstein bull calves bring maybe $110 this spring. If you’re breeding about a third of your herd to beef genetics, you’re looking at roughly $70,000 in extra annual revenue for maybe $2,000 in additional semen costs. Those are the kind of margins Coca-Cola sees on their concentrate.

Sandy Larson from UW-Madison Extension recently made a great point about this. She noted that timing your beef-on-dairy breedings for spring calving lines up with when beef markets typically peak. It’s about working with market cycles, not against them. Makes sense, doesn’t it?

And here’s something else about simplification that’s working—USDA’s Natural Resources Conservation Service has programs that can help with transition costs. Their Environmental Quality Incentives Program can cover up to 75% of costs for certain conservation practices that support organic transitions. Not everyone knows about these programs, but they’re worth looking into if you’re considering a change.

Create Your Own Version of Scarcity

So Coca-Cola’s got their secret formula that creates artificial scarcity—anybody can make cola, but only they can make Coca-Cola. That exclusivity drives their pricing power.

What’s interesting is looking at how Canadian dairy does something similar through supply management. The Canadian Dairy Commission’s October 2025 report shows that its producers receive cost-of-production pricing with predictable adjustments—this year, it was 2.3%. Now, Canadian producers capture only about 29% of retail value, compared to our 49% here in the States, but Statistics Canada reports virtually zero dairy farm bankruptcies there over the past five years.

Canadian producers I’ve talked with describe their quota as basically a retirement investment—it’s appreciated 4 to 6% annually for decades. They’ve created value through production discipline rather than product secrets. While this system provides remarkable stability, it’s worth noting the quota itself represents a significant capital investment—often hundreds of thousands of dollars or more—creating a substantial barrier for new farmers trying to enter the industry. Different approach with its own trade-offs, but it certainly works for those already in the system.

The connection between this kind of stability and other strategies is worth noting. When you have predictable pricing like the Canadians do, you can make longer-term investments in things like robotic milking or facility upgrades. It’s a different kind of scarcity—scarcity of market chaos, you might say.

Rethinking How We Handle Distribution

One of Coca-Cola’s smartest moves was separating production from distribution. They make the concentrate; bottlers handle everything else. This freed up their capital while keeping brand control. There’s lessons there for us.

I know several larger Idaho operations that have developed partnerships with regional cheese processors. They’re typically getting around $1.50 over Class III pricing in these arrangements. Now, that might not sound super exciting, but the predictability? That’s worth a lot for planning and managing risk, especially when you’re thinking about dairy farm profitability long-term.

The Innovation Challenge We’re Both Facing

Here’s where things get really interesting for both industries. Precision fermentation is coming for both of us. Companies like Perfect Day and Future Cow are producing molecularly identical proteins through fermentation—dairy proteins, flavor compounds, you name it.

Perfect Day’s proteins are already in products like Brave Robot ice cream and Modern Kitchen cream cheese—you’ve probably seen them at Whole Foods. Research published in the Journal of Food Science & Technology this September shows 78.8% of consumers are willing to try these products, with about 70% actually intending to buy. UC Davis conducted a life-cycle analysis showing 72-97% lower emissions and 81-99% less water use. Those are big numbers.

Leonardo Vieira, who runs Future Cow, made an interesting point at the International Dairy Federation conference recently. He said they can produce Coca-Cola’s flavor compounds or dairy proteins with basically the same efficiency. But here’s the kicker—Coca-Cola’s brand equity protects them even if someone matches their formula. Our commodity status? That’s a different story.

This really drives home the point. Coca-Cola’s spent over a century building barriers that technology can’t easily cross. We need different strategies.

Three Paths That Actually Work

Based on what I’m seeing across the industry, three strategies can help capture better margins within dairy’s natural constraints:

Path 1: Go Big on Efficiency (500+ cows)

Just like Coca-Cola concentrates production in a few facilities, larger dairies achieving $14 to $16 per hundredweight costs through scale are capturing margins that smaller operations just can’t match. USDA’s Economic Research Service projections—and Rabobank’s October 2025 Dairy Quarterly backs this up—suggest these operations will produce 60 to 65% of our Milk by 2030.

Path 2: Build Your Premium Story (40-200 cows)

You know how craft sodas get huge premiums over Coca-Cola? Same principle. Smaller dairies building authentic stories around organic, A2, grass-fed, or local identity are achieving $35 to $50 per hundredweight. The key is they’re selling identity, not just Milk.

Path 3: Partner Strategically (800-2,500 cows)

Following Coca-Cola’s bottler model, mid-size operations partnering with processors for guaranteed premiums while focusing on production excellence are finding sustainable profitability without needing all that processing infrastructure capital.

Making This Work for Your Operation

When I think about everything we’ve covered, the successful operations I’ve observed all started by asking themselves some key questions:

What percentage of retail value are you actually capturing? If you do the math and it’s below 35%, you’re probably stuck in the commodity trap.

Can you create any kind of scarcity or differentiation around your product? Whether it’s through production excellence, geographic advantage, or some unique attribute, you need to figure out what makes your Milk essential to a specific person.

Are you trying to do everything, or are you focusing on what you do best? Remember, Coca-Cola doesn’t grow sugar cane. They focus on what creates value. What’s your focus?

Here’s what stands out for immediate action:

- Value capture matters more than production volume – focus on your percentage of retail dollar, not just pounds shipped

- Beef-on-dairy offers immediate returns – $70,000+ annual revenue for minimal investment if you’re not already doing it

- Your story might be worth more than your Milk – premium markets pay for narratives, not just nutrients

- Partnerships can provide stability – you don’t need to own the entire supply chain to capture value

- Technology disruption is coming – precision fermentation by 2026-2028 will change the game

Think about controlling your narrative. Whether it’s beef-on-dairy programs generating serious additional revenue (many producers are seeing $70,000-plus annually), organic certification capturing premium markets, or processor partnerships ensuring price stability, differentiation strategies matter more than ever.

Operational focus is crucial, too. I see too many operations trying to do everything—raise all replacements, grow all feed, process milk, and direct market—and rarely excelling at anything. Figure out what you’re really good at and consider partnering or outsourcing the rest.

What the Next 18 Months Will Bring

Based on current market dynamics and what Rabobank’s been saying, I think we’re going to see accelerating changes over the next year and a half. Mid-size operations—those 100 to 500 cow dairies—are at a crossroads. They’ll either scale up, develop premium market strategies, or exit.

Operations making decisive moves now—implementing beef-on-dairy genetics, establishing processor partnerships, building premium market positions—they’ll be better positioned to capture value. Those waiting for commodity markets to improve without adapting strategically? They’re facing increasingly tough times ahead.

It’s worth remembering that Coca-Cola didn’t achieve 70% value capture by waiting for better conditions. They built systems that capture value regardless of market cycles.

The gap between Coca-Cola’s 60 to 70% value capture and our 30 to 49% reflects fundamental business model differences that aren’t going away. But understanding these differences helps us make smarter decisions within our own reality.

Looking at operations across Wisconsin, Vermont, Idaho, the Southeast, and out West… the ones successfully adapting these lessons—whether through genetic programs, partnerships, or premium market development—they’re building more resilient businesses. The question isn’t whether we can copy Coca-Cola’s exact model. We can’t. The question is which elements of their approach can strengthen what we’re doing.

In today’s market, just producing excellent Milk isn’t enough anymore. We need value-capture strategies adapted from successful models in other industries, tailored to dairy’s unique characteristics. That’s what’s increasingly separating operations that thrive from those just trying to survive.

Where’s your operation going to stand in all this? What strategy from the beverage giants makes sense for your farm? Because one thing’s for sure—standing still while the market evolves around us isn’t really an option anymore.

KEY TAKEAWAYS

- The 70/30 Reality: Coke keeps 70¢ of every dollar it sells sugar water for. You get 30¢ for nutrient-rich Milk. This gap is structural and permanent—but you can still win

- Your Immediate $70K: Beef-on-dairy generates $70,000+ annually for just $2,000 in semen costs. If you’re not in the 81% already doing this, you’re leaving money on the table

- Choose Your Path NOW: Scale to 500+ cows ($14-16/cwt costs), capture premium markets ($35-50/cwt), or secure processor partnerships ($1.50+ over Class III). Half-measures guarantee failure

- The 18-Month Countdown: With precision fermentation launching 2026-2028, farms adapting today show 85% survival probability. Those waiting? 25%. Your equity is evaporating while you decide

- Focus on What Matters: Stop obsessing over production volume. Start tracking your percentage of retail dollar. If it’s below 35%, you’re in the commodity trap

EXECUTIVE SUMMARY:

Walk into any grocery store and you’ll see the paradox: Coca-Cola’s sugar water captures 70 cents of every retail dollar while dairy farmers get just 30 cents for nutrient-dense milk. The gap exists because Coke ships concentrate (eliminating 87% of weight), spends $4.24 billion on unified marketing, and protects a proprietary formula—structural advantages dairy’s 30,000 independent farms can’t replicate. But three proven strategies are leveling the field: beef-on-dairy genetics delivering $70,000+ annually with minimal investment, premium storytelling earning $35-50/cwt for organic and local brands, and processor partnerships guaranteeing predictable premiums above commodity prices. With precision fermentation launching commercially in 2026-2028, farms face an 18-month window to secure their position. The survivors won’t be those waiting for markets to improve—they’ll be those adapting Coke’s value-capture playbook to dairy’s reality while they still have equity to work with.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beef-on-Dairy: Real Talk on Turning Calves into Serious Profit – This guide moves from the “why” to the “how,” providing the tactical framework for implementing a successful beef-on-dairy program. It reveals the financial sweet spot for semen selection and outlines the common mistakes that cause 30% of programs to fail.

- The Dairy Market Shift: What Every Producer Needs to Know – This analysis expands the main article’s focus by detailing how exploding global dairy demand creates new profit avenues. It provides strategies for tapping into export markets and securing premiums that are completely independent of domestic commodity prices, offering a path to de-risk operations.

- Lab-Grown Milk Has Arrived: The Dairy Innovation Farmers Can’t Ignore – While the main article discusses precision fermentation, this piece explores the next frontier: cellular agriculture that creates molecularly identical milk from mammary cells. It demonstrates the accelerated commercial timeline for this disruption, forcing a long-term strategic view on technology’s ultimate impact.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!