Every ‘solution’ that claims to save dairy farms was never designed to fix anything — it was built to extract you, one milk check at a time.

You know the line by now. Every time milk prices crash, every time a farm auction makes the local news, somebody shows up with a binder and a slogan. “Efficiency will save you.” “Diversify into organics.” “Join a co-op — strength in numbers.”

I mean, I’ve heard them all. You probably have too. But here’s the thing that nobody in those meetings will ever say out loud — the system isn’t broken. It’s working exactly the way it was built. It just wasn’t built for you.

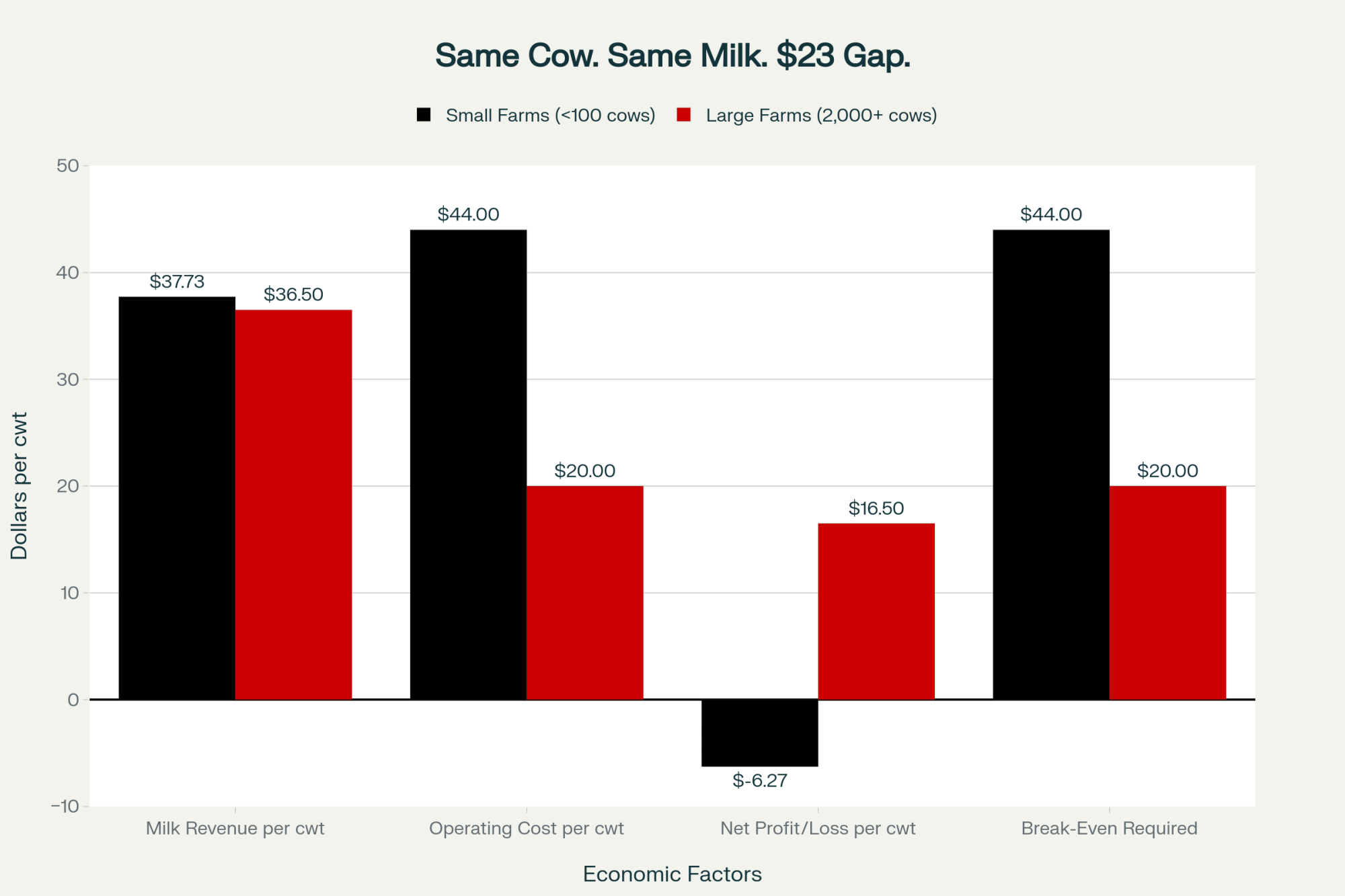

The math nobody wants to admit

Down in Wisconsin, the USDA’s Economic Research Service has been crunching the same numbers for years. Small herds — fewer than 100 cows — produce milk at $42 to $44 per hundredweight. Large herds — 2,000 cows and up — come in at $19 to $20.

That’s a $23 gap that no efficiency app, no robotic milker, and no “farm family tradition” can erase.

I was at a producer meeting in Madison when one co-op board member leaned back and said it plain: “Small dairies are emotionally important, but economically irrelevant.” Brutal. True. That’s the level of quiet truth people at the top already understand but never put in print.

And that’s the problem — your loss is their model.

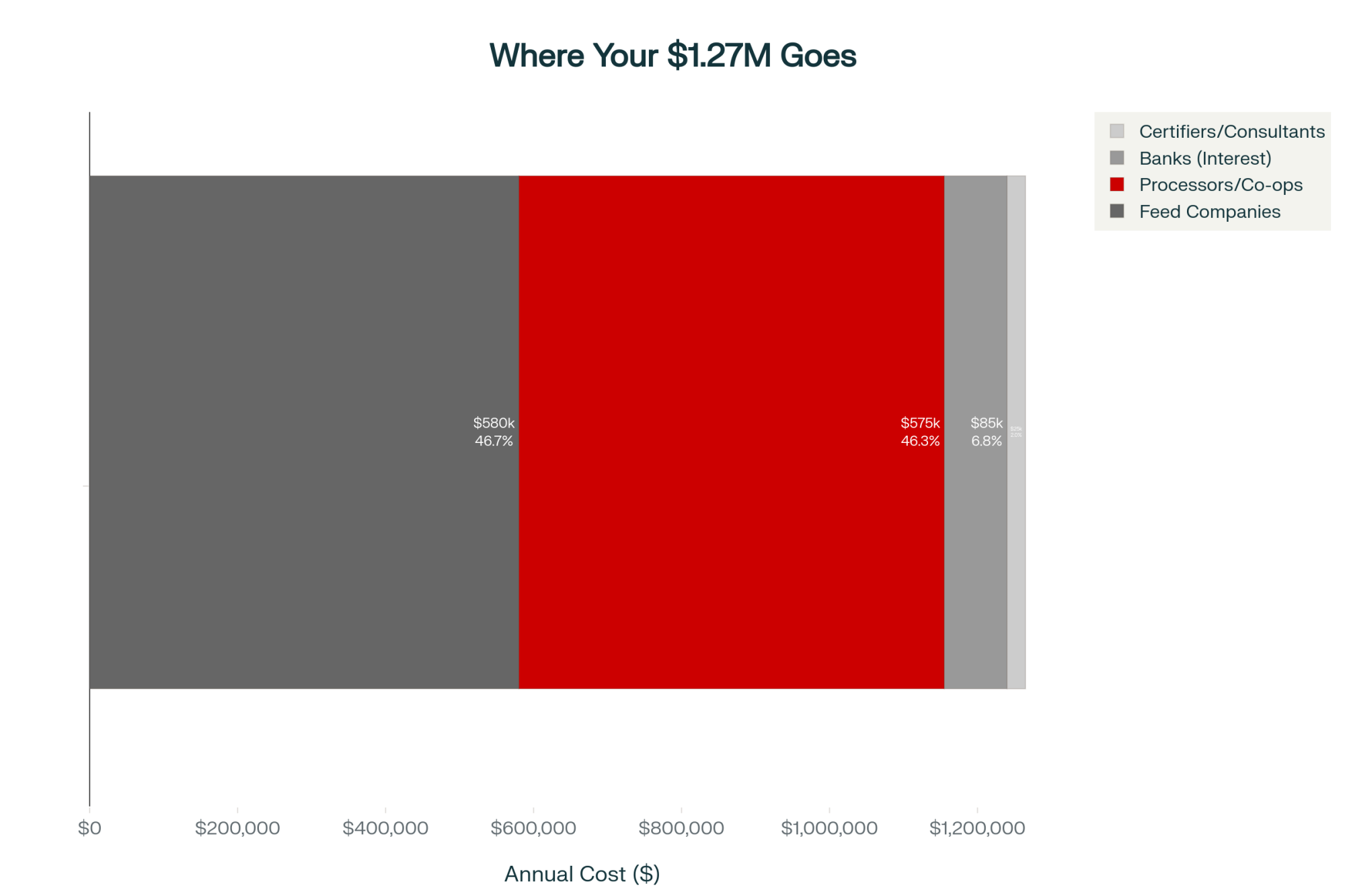

Where the money actually goes

Let’s put real numbers to this thing.

A 250-cow dairy feeding 50 pounds per head per day spends roughly 0,000 a year on feed, per USDA feed cost indices. Feed companies take 8–12% margins on that. That’s $175,000 to $240,000 every three years transferred out of your pocket before you even pay labor.

Add the bank. The Farm Credit System’s nationwide reports list operating and mortgage interest averaging around 6.8%. On a $900,000 land note and a $300,000 operating loan, that’s about $85,000 a year in interest.

Then your co-op or processor adds another chunk. According to Rabobank’s 2025 Dairy Outlook, most processors net around $3.50 per hundredweight after hauling and processing — that’s $575,000 from your production.

So the next time someone says, “You just need to manage costs better,” tell them your losses financed someone else’s record quarter.

An accountant friend of mine told me over lunch, “For every dollar a farm burns in equity, someone up the chain makes six.” That right there should stop the room cold.

The organic trap: paying to play

Here’s another shiny “fix” that just doesn’t add up.

Per the USDA’s National Organic Program, converting a farm means running the land chemical-free for 36 months, and feeding cattle organic rations for 12 months before certification. According to Cornell’s 2024 Organic Dairy Cost study, feed costs jump 30–40%, while tank weights drop 8%.

That’s an extra $180,000 in feed, $10,000 in certifications, and about $40,000 in lost yield a year before you even cash a single “organic premium” check.

Dan Richter, milking 220 cows out in Cashton, said it best: “We made it to certification, but we were broke before the first organic load hit the plant.” He’s not alone — Cornell data shows two-thirds of organic transitions never reach sustainable profitability.

What strikes me most? The programs keep rolling anyway. Because suppliers, certifiers, and consultants still make their margin, no matter what happens to the farm.

Equipment-sharing: good on paper, chaos in practice

You hear it at winter extension meetings — “Form an equipment co-op, cut your costs!”

But University of Minnesota Extension found that those shared projects shave about 10% off upfront ownership costs, while downtime climbs 20% and repair expenses eat another 7%.

A producer from Viroqua told me, “We spent more time arguing over whose turn it was to use the chopper than actually chopping.”

And look, that’s not laziness. That’s just how weather and manure work. You can’t partition urgency. The only folks winning from that plan are the sales reps who sold the machinery in the first place.

Component bonuses: chasing nickels, losing dollars

Processors love to brag about “protein incentives.” USDA Dairy Market News says the average premium sits around $1.25 per hundredweight.

The trouble is… that extra protein costs money. Cornell dairy nutritionists peg the annual ration bump at roughly $75,000, plus $15,000 for consultant fees and testing programs.

Best case — you net maybe $20,000.

Meanwhile, processors get exactly what they want — uniform, high-solids milk without buying a pound of extra grain.

Like one New York nutritionist told me quietly at a conference this year: “Protein bonuses aren’t a windfall. They’re a management leash.”

Co-ops: from shields to siphons

People forget the history — co-ops were started to protect producers from predatory processors. But the GAO’s 2024 Cooperative Governance Report revealed that 78% of major U.S. co-ops now use milk-volume voting.

One member equals one vote? Not anymore. It’s cubic tons of milk per vote now.

A 300-cow operator from Brookings County told me, “My co-op makes more on hauling my milk than I make milking the cows.” The sad thing? That’s not hyperbole.

Even the GAO data shows that cooperative processing divisions now generate more operational profit than they do from member payments. Somewhere along the line, the idea of “member-first” flipped to “margin-first.”

The big picture — and it’s not pretty

The USDA’s Agricultural Projections to 2034 project the U.S. will have 12,000–15,000 dairies left by 2030. We’re sitting around 26,000 now.

Rabobank’s forecast says six processors will control 80% of total U.S. milk flow, while the Council on Dairy Cattle Breeding (2025) reports five Holstein sires now sire 82% of all replacements.

Think about that — market and genetics bottlenecked into half a dozen corporate hands.

And what happens locally? UW–Madison economists calculated that each 100-cow farm loss strips $500,000 from regional rural economies — vet clinics, feed stores, mechanics, and local schools. Drive from Antigo to Arcadia this fall, and you’ll see them: boarded barns, “auction today” signs, and co-ops consolidating routes that used to serve three farms per mile.

That’s not bad luck. That’s a business plan.

“Just one more year…”

You can tell when somebody’s gone from hopeful to cornered — they start saying it. “If we can just make it one more year.”

You know who wants you to “hang on”? The people who profit from delay: bankers, feed mills, processors. Tom Greene calls it “equity farming for other people.”

Every year, small dairies run at a loss, but the rest of the chain keeps cashing checks on time.

That’s the hidden cost of loyalty — the longer you stay, the more they gain.

What you can actually do about it

This part matters because nobody else is going to say it straight.

- Call your accountant, not your lender. The bank lives on time. The accountant lives on truth. Ask them to run your net after unpaid family labor and true depreciation.

- Get a land appraisal. The American Society of Farm Managers and Rural Appraisers says Midwest farmland finally plateaued in 2025 after years of inflation. If you’re considering an exit, waiting means losing margin.

- Run two lists. Stay and lose $100K in equity per year. Exit, keep $2.5 million clean. Math doesn’t lie — it just hurts.

- Make the family meeting happen. Don’t wait until the next refinance or co-op contract cycle. This isn’t quitting; it’s protecting what generations built.

If that sounds heavy, that’s because it is. But so is the weight of hope that never pays off.

The inconvenient truth

The real betrayal here isn’t that the system failed small dairy. It’s that it pretended to save it while quietly making money off every stage of its decline.

This whole setup isn’t chaos — it’s choreography. And it plays out just as designed: the smaller farms provide the illusion of diversity, the mid-tier keeps the supply chain full, and the megas consolidate control.

So tomorrow morning, when you’re tightening hoses or scraping the feed alley, stop and look at your milk check before you start another year of “hanging on.” Ask yourself:

“If everyone else is making money off my losses, how long am I willing to play the game?”

Because the truth is — this system isn’t failing. It’s succeeding exactly the way it was designed to. And that’s the part nobody in a suit will ever say out loud.

KEY TAKEAWAYS

- The dairy system isn’t “broken” — it’s performing exactly as designed. Farmers lose; everyone else wins.

- The economics are brutal: small farms spend twice what megas do to produce the same milk. Passion doesn’t pay bills.

- Every so‑called “solution” — co‑ops, consultants, organic programs — is just a polite way to harvest your last dollars.

- For every dollar of farm equity burned, six show up elsewhere — in feed, finance, or processing profits.

- The smartest play isn’t hope. It’s strategy: scale, specialize, or sell before the system cashes you out.

EXECUTIVE SUMMARY

The small dairy crisis isn’t some tragic accident — it’s the business model. The USDA’s data shows that small farms make milk for $44/cwt, while megas do it for $20. That’s not competition; that’s a setup. Meanwhile, every “solution” — organic transitions, efficiency programs, co-op loyalty — just keeps you milking long enough for everyone else to get paid. Cornell, Rabobank, and GAO reports show how feed dealers, banks, and processors profit from your losses. For every dollar of farm equity burned, six appear upstream. The system isn’t failing; it’s extracting. So if you’re still hanging on, here’s the real math: scale up, specialize, or get out while there’s still something left to save.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The $228,000 Exit Strategy Reshaping Dairy: Inside the 55% Surge in Strategic Bankruptcies – Reveals how Section 1232 allows retiring producers to treat capital gains as dischargeable debt, preserving hundreds of thousands in equity compared to a traditional farm sale. A critical read for anyone considering the “orderly exit” mentioned above.

- Decide or Decline: 2025 and the Future of Mid-Size Dairies – Analyzes the specific “mid-size squeeze” wiping out 700-1,200 cow herds and outlines the three rigid paths—expansion, specialization, or exit—remaining for operations caught in the scale gap.

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – Breaks down the actual math behind beef-on-dairy and digester revenue, providing a financial blueprint for the “narrow path” of producers attempting to stay viable without doubling their herd size.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.