Discover how tech, sustainability, and bold strategies are revolutionizing dairy farming’s future.

The U.S. dairy landscape is undergoing unprecedented transformation. While milk prices continue their volatile dance and input costs steadily climb, a new generation of innovative producers is shattering outdated paradigms, embracing technology, diversifying revenue streams, and reimagining what success looks like in an industry being reborn. Their blueprint isn’t just about survival; it’s the roadmap for thriving in dairy’s next chapter.

The New Dairy Paradigm: Evolution, Not Extinction

The narrative surrounding dairy farming in America has frequently focused on decline, fewer farms, tightening margins, and mounting challenges. However, this perspective misses the remarkable reinvention occurring across the industry. Today’s dairy sector isn’t dying; it’s evolving at an unprecedented pace.

“What we’re witnessing isn’t the end of an era, but rather the birth of a new one,” observes Dr. Megan Richardson, agricultural economist and dairy industry analyst. “The most forward-thinking producers aren’t just adapting to change-they’re actively driving it, much like breeding for genetic improvement rather than accepting what nature provides.”

This evolution is evident in recent industry data. While the total number of dairy operations continues to decrease, with approximately 24,000 remaining as of 2022, representing a 39% decrease from 2017-those that remain display remarkable resilience and innovation. According to USDA Census of Agriculture data, this consolidation occurs at what industry experts describe as a “breathtaking pace,” with projections suggesting a potential 20-25% reduction by 2027. Despite these structural shifts, over the last five years, more than two-thirds of established dairy producers have maintained profitability despite volatile markets and rising input costs.

Are you positioning yourself among the innovators shaping the industry’s future, or are you merely reacting to changes as they come?

Several concurrent revolutions characterize the industry’s transformation:

Technology Integration: Two-thirds of U.S. dairies now employ at least one form of advanced feeding technology, with adoption rates for robotic milking, AI-driven health monitoring, and integrated data systems accelerating rapidly, creating “connected barns” that would be unrecognizable to previous generations.

Revenue Diversification: Approximately 80% of dairy operations now generate income from sources beyond the traditional milk check, with three-quarters involved in at least one beef-on-dairy practice, blending the historically separate worlds of dairy and beef production.

Sustainability Implementation: Over 60% of producers are engaged in at least one formal sustainability practice-from precision manure application to methane digesters-though awareness of comprehensive programs remains an industry challenge.

Workforce Evolution: Many operations now rely on non-family labor for at least half their workforce, with strategic automation helping address persistent labor shortages that threaten daily milk harvests.

Succession Planning: With a quarter of current operators planning to retire within five years, representing over a million cows changing hands, the industry faces a critical transition of assets and knowledge to a new generation.

Behind these statistics are real producers making strategic choices, reshaping the industry’s future. Let’s explore how these transformations play out and what they mean for your operation.

The Technology Revolution: From Adoption to Integration

The dairy barn of 2025 bears little resemblance to its counterpart from even a decade ago. Technology has moved beyond gadgetry to become the backbone of progressive operations, touching everything from TMR mixing and milking to health monitoring and data analysis.

The New Economics of Automation

The business case for technology adoption has never been stronger. Consider these returns on investment:

- Robotic milking systems: While requiring substantial upfront investment ($150,000+ per robot), these systems deliver 5-10% increases in milk yield and labor savings of $0.75-$1.00 per hundredweight. According to recent studies published in the Journal of Dairy Science, farms implementing automatic milking systems (AMS) have reported 5-10% milk yield increases alongside significant reductions in labor requirements, up to 75% for milking-specific tasks and 29% for overall labor. On a 200-cow dairy, this can translate to $75,000+ in annual savings while improving milk quality metrics like SCC and butterfat percentage.

- Precision feeding technologies: Farms implementing advanced TMR systems report 7-12% reductions in feed costs alongside improved feed efficiency. Research from Cornell University’s CNCPS (Cornell Net Carbohydrate and Protein System) nutritional modeling shows these technologies can decrease nitrogen and phosphorus excretion by 15-20% while enhancing feed conversion. When feed represents 40-60% of production costs and the milk-to-feed price ratio determines profitability, these savings quickly accumulate, potentially adding $100+ per cow annually to the bottom line.

- Health monitoring wearables: Early detection of mastitis alone can save $444 per case (including treatment costs, discarded milk, and production losses), according to economic analyses published in Preventive Veterinary Medicine. AI-enabled health monitoring systems predict illness 24-72 hours before visual symptoms appear, with machine learning algorithms like Support Vector Machines (SVM) demonstrating 97% accuracy in classifying cattle behaviors based on sensor data.

But here’s the uncomfortable truth most tech vendors won’t tell you: without proper management protocols, even the most advanced technology becomes an expensive band-aid on deeper operational problems. The farms seeing transformational returns aren’t just buying equipment- they’re reimagining their entire management approach.

Dan Webber, who milks 320 cows in Wisconsin, saw his labor costs drop nearly 30% after installing robotic milkers. “Beyond the numbers, there’s a quality-of-life improvement that’s hard to quantify,” he notes. “No more 4 a.m. milking shifts means I can attend my kids’ school events without constantly checking my watch. It’s like the difference between being tied to the parlor three times a day versus letting the cows set their schedule.”

From Data Collection to Decision Intelligence

The most sophisticated operations move beyond simply collecting data to creating integrated systems that transform information into actionable intelligence. This is similar to how a skilled herdsman reads subtle cow signals at scale and with greater precision.

“Five years ago, we were drowning in data but starving for insights,” explains Sarah Chen, a fourth-generation dairy farmer managing 1,200 cows in California. “Today, our integrated platform pulls together everything from individual cow activity and rumination patterns to milk components, DMI, and weather forecasts. The system doesn’t just tell me what happened yesterday: it helps predict what will happen tomorrow, like knowing which fresh cow might crash before her CMT turns positive.”

This predictive capability represents the next frontier in dairy technology. Farms leveraging IoT and advanced data analytics report 15-20% productivity improvements, with particularly strong returns in reproduction efficiency (conception rates up 5-7%), feed optimization (F: Y ratio improvements of 0.05-0.10), and early health intervention.

The real question isn’t whether you can afford technology, it’s whether you can afford to be left behind as the technological divide between progressive and traditional operations widens by the day.

However, technology adoption isn’t without challenges. Access to capital remains a significant barrier, with 26% of producers citing it as their primary limitation, according to a multi-state survey of dairy farmers conducted by land-grant universities. Additionally, the availability of local technical support was identified as the most critical factor in technology selection decisions, followed by proven research results and simplicity of use.

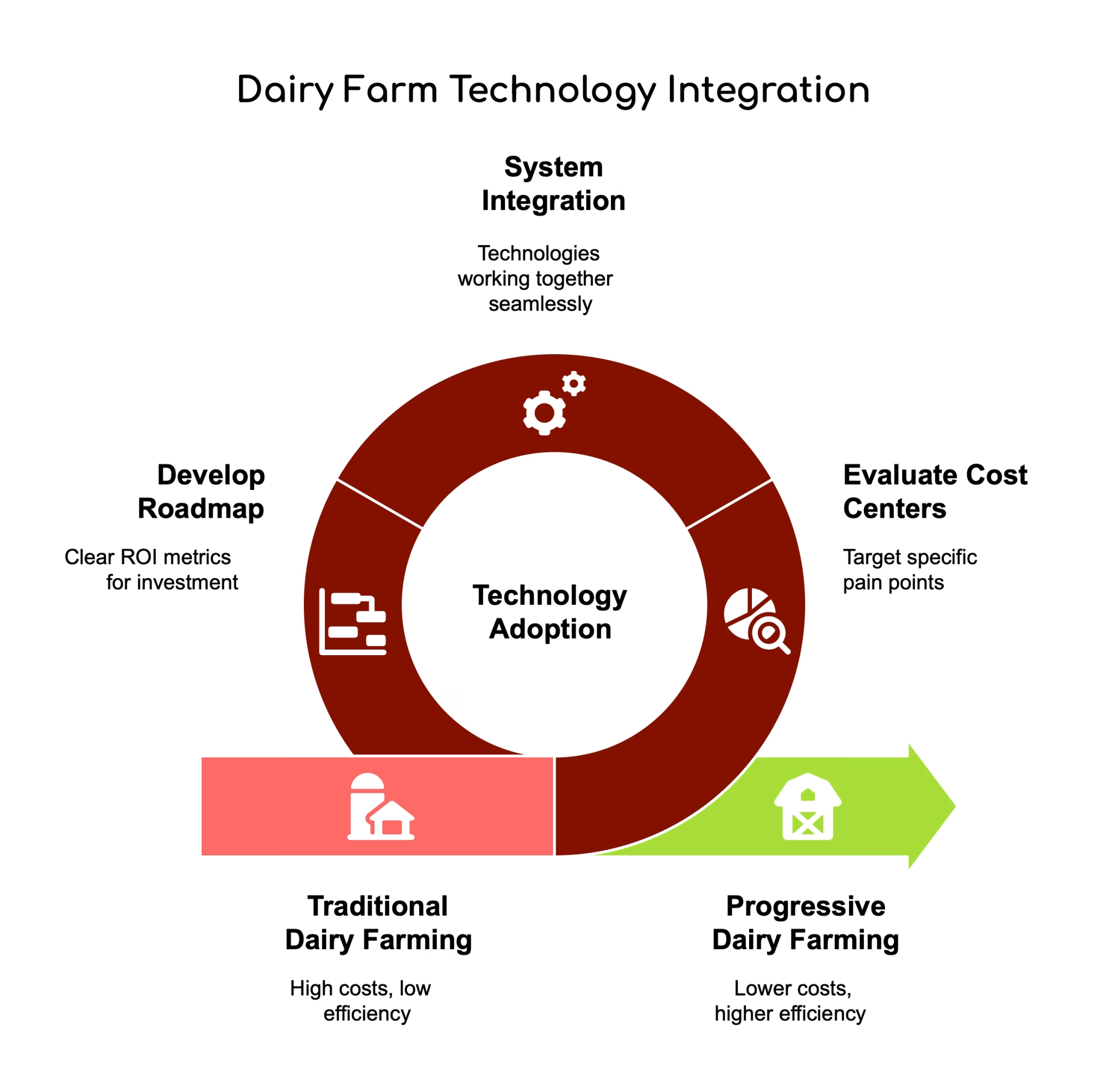

The Bullvine Bottom Line for Your Operation:

- Evaluate your largest cost centers and bottlenecks first, and target technologies that specifically address these pain points

- Consider how different technologies work together as a system rather than in isolation

- Develop a 3–5-year technology adoption roadmap with clear ROI metrics for each investment

Beyond the Milk Check: Diversification as Strategic Imperative

For decades, dairy farming meant one thing: selling milk. Today, however, most successful operations view themselves as milk producers and diversified agricultural enterprises. This shift from single-commodity focus to multiple revenue streams isn’t just a hedge against price volatility; it’s becoming a cornerstone of modern dairy business models.

The Beef-on-Dairy Phenomenon

Perhaps no diversification strategy has gained more traction than beef-on-dairy (BoD) crossbreeding. According to comprehensive industry surveys, an impressive 72% of U.S. dairy farms now incorporate beef genetics into their breeding programs. This represents a fundamental shift in breeding philosophy, evidenced by semen sales data: 7.9 million units of beef sires were sold for use in dairy cattle in 2023, representing 31% of total dairy semen sales.

Yet I’m still encountering producers who view dairy and beef as separate enterprises, refusing to consider how strategic crossbreeding could transform their bottom line. When was the last time you critically evaluated your breeding program’s economic impact beyond producing replacement heifers?

The economics are compelling. According to market analyses from three major land-grant universities, crossbred calves command premiums of $350-$700 per head compared to straight Holstein bull calves, with 80% of participating farmers receiving such premiums. A 500-cow dairy breeding 200 cows annually to beef sires represents potential additional revenue of $ 70,000- $ 140,000, similar to improving your milk price by $0.70-$1.40 per cwt across your entire production.

The beef-on-dairy trend also benefits from favorable market conditions. U.S. cattle inventory recently hit a 73-year low, supporting strong beef prices. The impact on the beef supply chain is already substantial, with BoD cattle accounting for 7% of total U.S. cattle slaughter in 2022 (approximately 2.6 million head), and projections from the USDA Economic Research Service indicate this share could rise to 15% by 2026.

James Thornton, who operates a 400-cow dairy in Pennsylvania, began breeding the bottom quartile of his herd to Angus sires four years ago. “Initially, we were just looking to get better value for our bull calves,” he explains. “But we’ve since expanded into raising some crossbreds to finishing, and now we’re selling branded beef direct to consumers. What started as a minor sideline now accounts for about 15% of our total farm revenue; it’s like adding a profitable heifer-raising enterprise without the same headaches.”

Creating Value on Your Terms

While selling day-old crossbred calves represents the entry point for many, other producers are moving further up the value chain. Recent industry data shows that while the number of producers raising beef-on-dairy animals to finishing weight has moderated, there has been a notable increase in the sale of branded beef products directly from dairy farms.

This follows broader consumer trends showing increased demand for branded beef, particularly high-quality products with specific breed claims and traceability stories. Sophisticated dairy producers are capitalizing on this trend by developing their own branded products and marketing channels, similar to how some have succeeded with farm-branded artisanal cheese.

Let’s be brutally honest: Clinging to a “we just milk cows” mentality in today’s market environment isn’t loyalty to tradition; it’s a failure of imagination that’s leaving money on the table.

Beyond beef-related ventures, successful diversification strategies include:

- On-farm processing: Converting raw milk into cheese, yogurt, ice cream, or flavored milk products to capture retail margins exceeding $20 per cwt equivalent.

- Agritourism: Farm tours, educational workshops, on-farm stores, and event hosting provide additional revenue and valuable community connections, turning your operation’s daily routines into experiences consumers will pay for.

- Crop and forage sales: Leveraging existing land and equipment to produce feed for sale to other operations, particularly in regions with high land values and favorable growing conditions.

- Energy production: Methane digesters and solar installations turn waste products and underutilized space into revenue-generating assets, harvesting manure twice: once for energy and again for fertilizer.

The Bullvine Bottom Line for Your Operation:

- Conduct a resource inventory and identify underutilized assets (land, livestock, skills) that could generate additional revenue.

- Start small with diversification-test, test market demand before major investments

- Consider your competitive advantages- what makes your farm uniquely positioned for specific alternative ventures?

Environmental Sustainability: From Regulatory Burden to Competitive Edge

The concept of sustainability in dairy has evolved dramatically. What was once viewed primarily as an ecological obligation or regulatory burden is increasingly recognized as a business imperative with potential economic benefits. Today’s most progressive producers find that sustainable practices can drive efficiency and market advantage.

Adoption Trends and Business Benefits

Recent industry research reveals that 63% of U.S. dairy producers now implement at least one sustainable practice, according to comprehensive national surveys. However, this statistic masks significant variation in depth and breadth of adoption. Leading operations are going beyond piecemeal approaches to implement comprehensive sustainability strategies that deliver multiple business benefits:

- Water recycling and conservation: On advanced dairy farms, water is recycled up to six times, used for cooling milk in plate coolers, cleaning equipment, flushing barn lanes, and ultimately irrigating crops. According to research from the Innovation Center for U.S. Dairy, this reduces both utility costs and environmental footprint.

- Manure management and nutrient cycling: Beyond regulatory compliance, sophisticated manure handling systems capture value through biogas production while reducing fertilizer expenses. Studies from the University of Wisconsin Dairy Innovation Hub show some operations report annual savings of $70-100 per cow through optimized nutrient management, turning what was once considered a waste disposal problem into a valuable farm resource.

- Precision feeding: Advanced ration formulation and TMR management reduce feed waste and minimize excess nutrient excretion. Cornell University research shows this can decrease nitrogen and phosphorus output by 15-20% while improving feed conversion efficiency.

The industry’s collective progress is measurable: producing a gallon of milk in 2023 required 30% less water, 21% less land, and generated a 19% smaller carbon footprint compared to 2007, according to lifecycle assessments published in the Journal of Dairy Science. These efficiency gains represent both environmental progress and economic savings, like how genetic improvements have simultaneously increased production efficiency and reduced resource intensity.

Global Context: The Dutch Experience

In the Netherlands, where environmental regulations are among the strictest in the world, dairy farms have pioneered circular farming practices that integrate crop production, livestock management, and energy generation. Dutch farms utilizing closed-loop nutrient management systems have demonstrated that sustainability can drive profitability, reducing purchased fertilizer inputs by up to 65% while maintaining or increasing forage yields. This model of regenerative dairy farming offers valuable lessons for U.S. producers facing increasing environmental scrutiny.

The Market Incentive

Forward-thinking producers recognize that sustainability credentials are increasingly valuable in the marketplace. Major processors and retailers are establishing sustainability requirements for their supply chains, and some offer premiums for verified sustainable production practices.

The sustainability divide is widening while some producers view environmental initiatives as costly distractions, others use them to secure price premiums and preferential market access. Which side of this divide will your operation be on five years from now?

“We initially implemented our methane digester because of regulatory pressure,” admits David Keller, who operates an 850-cow dairy in New York. “But we’ve since discovered it’s also a marketing advantage. Our processor’s sustainability program pays a $0.15 per hundredweight premium for farms that meet certain environmental metrics. That’s adding about $45,000 annually to our bottom line, similar to boosting components across the herd.”

Despite these opportunities, a significant awareness gap persists. Many producers implement sustainable practices without connecting them to broader industry programs or failing to document and communicate their efforts for potential market benefit. This disconnect is particularly pronounced among smaller operations and those outside the Western U.S., where sustainability programs have gained stronger traction.

The Bullvine Bottom Line for Your Operation:

- Identify which sustainability practices you’re already implementing but not getting market credit for

- Research processor sustainability programs that offer premiums or preferential contracts

- Start measuring and documenting your operation’s environmental impact; you can’t improve or market what you don’t measure

The Human Element: Solving Dairy’s Most Critical Challenges

With all the advancements in technology and business models, the future of dairy ultimately depends on the people who manage the operations and those who will lead them tomorrow. Two interrelated human capital challenges threaten the industry’s continued evolution: workforce shortages and succession planning gaps.

The Workforce Dilemma

The dairy labor landscape has transformed dramatically. Many operations now rely on non-family employees for at least half their workforce, with immigrant labor particularly vital. A comprehensive national survey found that immigrant workers account for 51% of all dairy labor nationally and produce 79% of America’s milk supply. In Western and Southwestern regions, this dependency approaches 80% according to analyses from the National Milk Producers Federation.

Let’s confront an uncomfortable truth: our industry has become utterly dependent on a workforce that lacks secure legal status or reliable pathways to obtain it. We can’t claim to be strategic business operators while ignoring this existential threat to our labor supply.

Despite this reliance, hiring and retention remain persistent challenges. The physically demanding nature of dairy work, often involving early hours and weekend shifts, makes attracting domestic workers difficult even at competitive wages. Meanwhile, immigration policies add another layer of complexity, as the H-2A agricultural guest worker program is poorly suited for year-round dairy labor needs, unlike seasonal harvests.

Economic modeling published in the Journal of Agricultural Economics demonstrates the potential severity of labor disruptions: a 50% reduction in immigrant dairy labor could result in a $16 billion hit to the U.S. economy. In comparison, complete elimination could increase retail milk prices by as much as 90%.

Innovative producers are responding with multi-faceted solutions:

- Strategic automation: Beyond labor savings, technology investments are reshaping the nature of dairy work. “Our robotic milking system didn’t eliminate jobs-it transformed them,” explains Miguel Rodriguez, herd manager at a 600-cow operation in Idaho. “We now need fewer people in the parlor but more skilled technicians and cow managers. The jobs are less physically demanding and more intellectually engaging, more like herdsmen than milkers.”

- Enhanced compensation strategies: Leading operations are moving beyond competitive wages to comprehensive packages including quality housing, flexible scheduling where operationally feasible, and performance-based incentives tied to milk quality or reproductive efficiency, similar to how premium genetics command higher prices.

- Professional development pathways: Structured training programs and clear advancement opportunities improve retention by showing employees they have a future in the operation. “When we implemented our three-tier advancement program, turnover dropped by 40%,” notes Amanda Chen, HR director for a multi-site dairy enterprise. “People want to know there’s a path from milker to herdsman to manager, just like we develop heifers into productive cows.”

The Succession Imperative: A Step-by-Step Framework

Parallel to workforce challenges is the critical need for effective succession planning. Industry data from multiple national surveys indicates that approximately 25% of current dairy operators plan to retire within the next five years, yet nearly half lack a formal succession plan or are uncertain about their transition strategy.

The numbers are stark: less than one-third of family agricultural businesses survive the transition from first to second generation, and only about 16.5% make it to the third generation. Are we honestly prepared to confront that most dairy farms are one generation away from extinction?

Financial and family dynamics often complicate transitions. Modern dairy operations represent substantial capital investments- land, facilities, equipment, and livestock can easily total millions of dollars. Navigating fair distribution among multiple heirs while maintaining operational viability requires sophisticated planning and open communication.

“My parents avoided the succession conversation for years,” recounts Thomas Weber, a 32-year-old who recently took over management of his family’s 280-cow dairy. “When we finally engaged a transition specialist, we discovered the process would take far longer than anyone expected. Start five years before you think you need to, then double that timeline, much like how you’d begin breeding and raising replacements long before your herd needs them.”

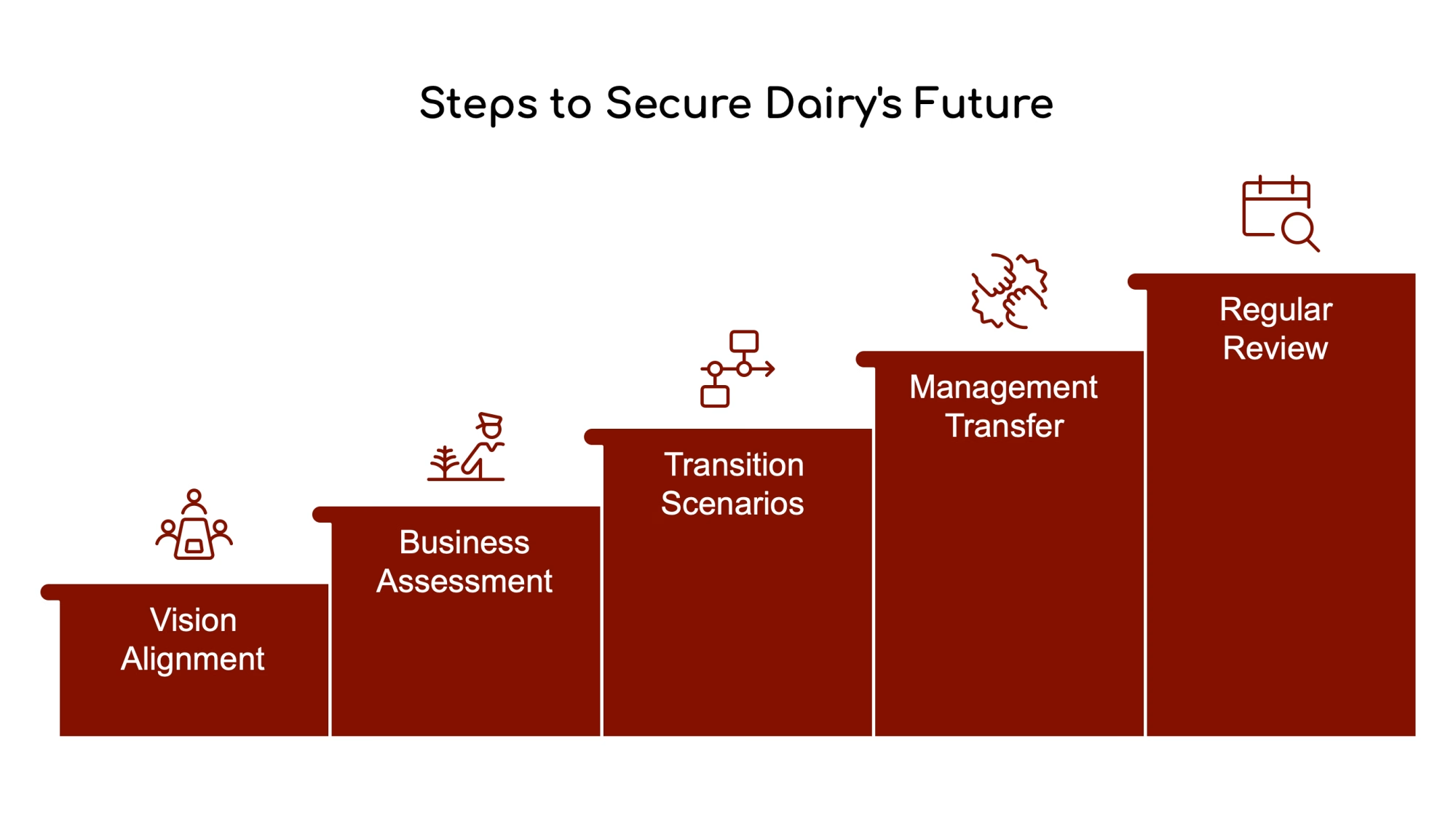

Initial Framework for Kickstarting Your Succession Plan

- Start with vision alignment meetings: Before discussing financial or legal details, gather all potential stakeholders (on-farm and off-farm family members) to discuss values, goals, and aspirations. Use a neutral facilitator to ensure all voices are heard.

- Conduct comprehensive business assessment: Work with agricultural financial specialists to determine true farm value, operational efficiency, and viability. This provides the factual foundation for all future decisions.

- Develop multiple transition scenarios: Develop 2-3 potential transition models with your advisors rather than assuming a single pathway. These might include gradual transfer of management/ownership, partnership structures, or innovative approaches like equity partnerships with non-family members.

- Create a management transfer timeline: Successful transitions typically separate management transfer from ownership transfer, with the next generation assuming increasing management responsibilities before financial ownership changes hands.

- Establish regular review and adaptation processes: Once initiated, commit to reviewing the succession plan quarterly during the transition period and annually thereafter, adapting to changing circumstances, tax laws, and family dynamics.

Despite these challenges, there are encouraging signs. A new generation of dairy leaders is emerging, characterized by technological savvy, business sophistication, and environmental awareness. Various programs, including university extensions, dairy producer organizations, and private foundations, offer these aspiring dairy professionals educational resources and financial support.

The Bullvine Bottom Line for Your Operation:

- Schedule your first succession planning meeting within the next 30 days, even if just to establish timeline goals

- Build your advisory team, identify legal, financial, and farm transition specialists with specific dairy experience

- Conduct an honest assessment of your operation’s transferability, and what changes would make it more attractive to the next generation?

The Next Frontier: Integrating Innovation Across Your Operation

The most successful dairy operations recognize that individual technological advancements, diversification, sustainability, and workforce management don’t exist in isolation. The true pioneers are creating integrated systems where these elements work synergistically, amplifying benefits and creating resilient business models that can withstand market volatility.

The Systems-Thinking Advantage

Ryan Kimball, whose family operates a 750-cow dairy in Wisconsin, describes their approach: “We stopped thinking about ‘projects’ and started thinking about systems. Our robotic milkers weren’t just a labor solution; they generated data that improved our nutrition program, reducing feed costs while enhancing cow health and reducing veterinary expenses. Everything connects, much like how a well-balanced ration addresses multiple nutritional needs simultaneously.”

This systems thinking extends to business models as well. Operations that successfully integrate milk production, value-added processing, and direct marketing create multiple revenue streams while building a buffer against price fluctuations at any point in the value chain, similar to how genetic diversity in a herd protects changing market demands.

Is your operation still addressing challenges in silos, or have you begun to recognize the interconnected nature of modern dairy management?

Consider how these elements might work together in your operation:

- Technology investments that simultaneously address labor challenges, improve animal welfare, and enhance sustainability metrics, like how automated calf feeders improve growth rates while reducing labor and enabling precise nutrition

- Diversification strategies that utilize existing assets and capabilities while creating new market opportunities, similar to how crossbreeding leverages your dairy herd for beef production

- Sustainability initiatives that reduce costs while positioning products for premium markets, such as precision manure application that saves on fertilizer while improving environmental credentials

- Workforce development approaches that combine competitive wages with meaningful work and growth opportunities, creating career paths, not just jobs

Case Study: The Integrated Operation

The Sanchez family dairy in California exemplifies this integrated approach. Their 900-cow operation combines robotic milking technology, intelligent feeding systems, and advanced health monitoring. They’ve installed solar arrays that supply 80% of their electricity needs and implemented water recycling that reduces consumption by 40%.

On the diversification front, they breed 35% of their herd to beef sires, raising some animals to finishing weight while marketing others through regional beef brands. They’ve also developed a small on-farm creamery producing specialty cheeses sold through local retailers and direct-to-consumer channels.

“Each piece reinforces the others,” explains Maria Sanchez. “Our sustainability practices reduced costs while creating a marketing advantage for our specialty products. Our technology investments addressed labor challenges while improving animal welfare, which became part of our brand story. It’s all interconnected how cow comfort simultaneously impacts production, reproduction, and longevity.”

The Bottom Line: Your Blueprint for Future Success

The dairy industry is experiencing evolution and revolution in technology, business models, sustainability practices, and human capital approaches. While challenges abound, so do unprecedented opportunities for operations willing to break from convention and embrace strategic change.

As you consider your operation’s future, focus on these key principles:

- Think systems, not silos: Look for synergies across different aspects of your business, from production practices to marketing approaches-just as you’d view herd health as an integrated system rather than isolated treatments.

- Invest strategically in technology: Prioritize investments that address your specific pain points and offer multiple benefits across the operation, similar to focusing breeding decisions on your herd’s limiting factors.

- Diversify thoughtfully: Explore alternative revenue streams that leverage existing assets and capabilities while creating resilience against market volatility, creating enterprise diversity just as you’d diversify your genetic program.

- Embrace sustainability as an opportunity: Move beyond compliance to view environmental stewardship as a potential source of competitive advantage, turning potential regulatory burdens into marketable attributes.

- Prioritize people: Develop comprehensive workforce development and succession planning strategies to ensure long-term continuity, investing in human capital with the same diligence you apply to herd improvement.

Challenge yourself today: What conventional practice on your farm most deserves critical reevaluation? Whether it’s your breeding program, labor management, or business model, commit to an honest assessment of one area where innovation could transform your operation’s trajectory.

The dairy producers who will thrive in this new landscape combine operational excellence with strategic vision, maintaining the best traditions of animal husbandry and land stewardship while embracing innovations that enhance efficiency, sustainability, and profitability.

The industry’s transformation presents challenges, but for those willing to adapt and innovate, it also offers a pathway to renewed prosperity and purpose. Like the cow that peaks early in lactation with proper transition management, those who invest in preparation and adaptation now will enjoy stronger performance in the years ahead. The future of dairy belongs to the bold.

What’s one bold change you’ve implemented in your operation that’s paying dividends? Share your experience in the comments below; your innovation could be exactly what another producer needs to hear right now.

Key Takeaways:

- Tech is non-negotiable: Two-thirds of dairies use advanced feeding systems, with robotic milkers cutting labor costs by 29% while boosting yields.

- Diversification dominates: 80% of operations now earn beyond milk sales, led by beef-on-dairy crossbreeding ($350–$700 premiums per calf).

- Sustainability pays: Farms using precision nutrient management cut nitrogen waste by 15–20% and tap into $0.15/cwt processor premiums.

- Labor & succession crises: 50%+ of workforces rely on non-family labor, while 46% lack succession plans despite 25% retirements looming.

- Growth mindset wins: 44% of producers plan to expand, blending tradition with tech to future-proof their operations.

Executive Summary:

The U.S. dairy industry is undergoing rapid transformation, driven by technological adoption (robotic milking, AI health monitoring), revenue diversification (72% use beef-on-dairy crossbreeding), and sustainability initiatives (63% of farms implement eco-practices). Despite labor shortages and a looming retirement wave (25% of operators plan to exit in 5 years), younger innovators are leveraging data-driven strategies and alternative revenue streams to boost resilience. While consolidation continues, proactive operators are redefining success through efficiency gains, branded products, and holistic integration of systems-proving adaptability is key to thriving in dairy’s new era.

Learn more:

- Why Dairy Farmers Are Turning to Beef-on-Dairy: A Game Changer in Beef Production

- Revolutionizing Dairy Farming: How AI, Robotics, and Blockchain are Shaping the Future of Agriculture in 2025

- Ensuring the Future: Strategic Succession Plans for Dairy Farmers

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!