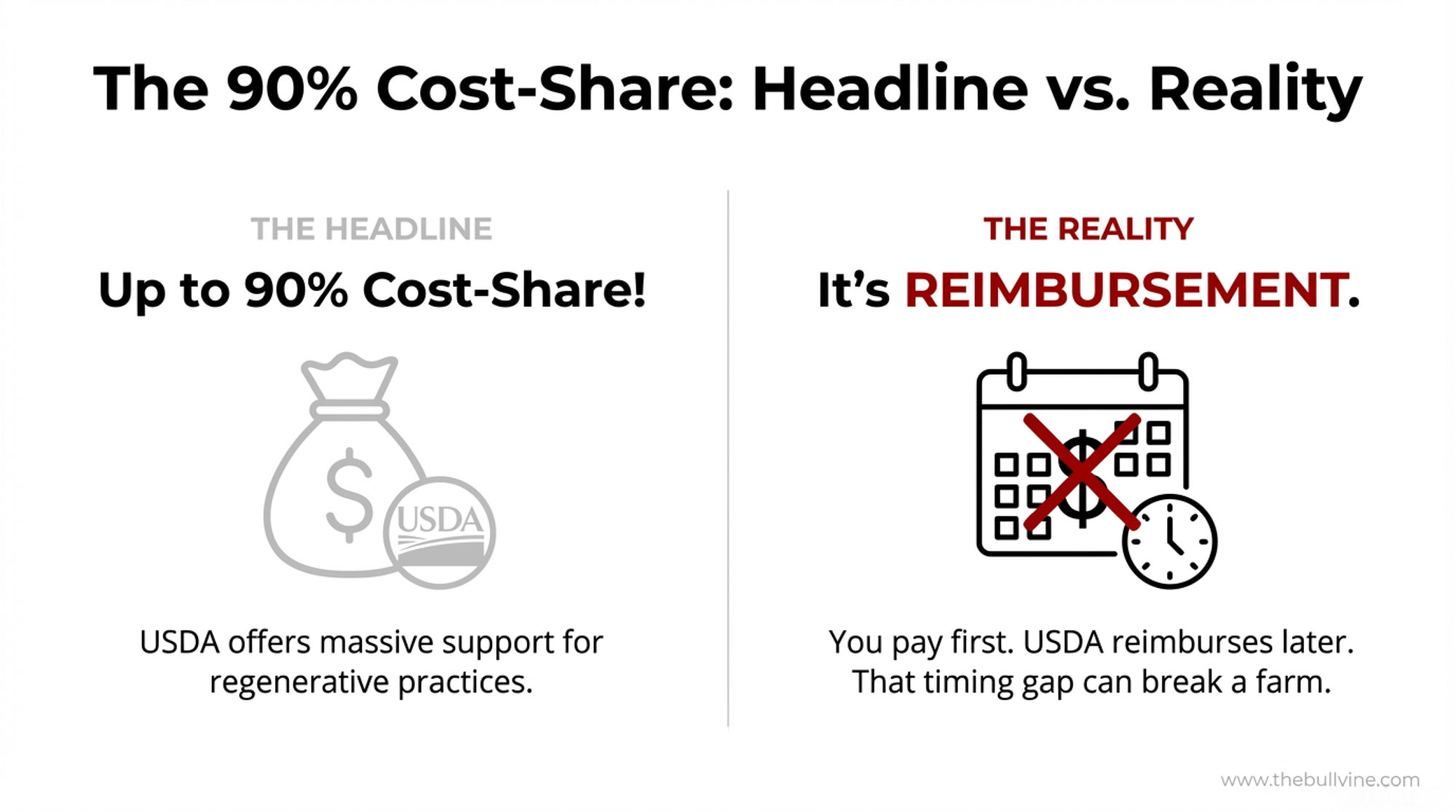

The 90% cost-share headline looks great. The fine print? You pay first. USDA reimburses later. That timing gap breaks some dairy farms.

Executive Summary: Here’s what the $700 million headline won’t tell you: USDA’s new Regenerative Pilot Program offers up to 90% cost-share—but it’s reimbursement, not upfront cash. Dairy farmers must front infrastructure costs (often $30,000-$50,000+ for comprehensive grazing systems) before federal dollars arrive. That capital gap is why beginning farmers participate in federal programs at just 33% compared to 41% for established operations, per November 2024 Congressional Research Service data. Dairy operations do hold a structural advantage—cows and manure address multiple NRCS resource concerns simultaneously, which boosts ranking scores—but transition economics add real risk. A March 2025 WWF-UK study found regenerative transitions typically produce “lowered or negative profitability” in early years before long-term resilience benefits kick in. This program works best as an accelerator for operations already moving toward grazing and soil health, with strong balance sheets to bridge the gap between writing checks and receiving reimbursement.

Picture this: You’re at the kitchen table, coffee getting cold, scrolling through the USDA’s December 10th press release about a new $700 million regenerative agriculture pilot program. The words “farmers first,” “soil health,” and “lower production costs” jump out. Your spouse looks over and asks, “Is this something we should look into?”

It’s a fair question. And the honest answer is: it depends on where your operation stands today.

USDA’s new Regenerative Pilot Program is generating significant interest across dairy country, with good reason. The program bundles EQIP and CSP funding into a single application focused on whole-farm planning, soil testing, and measurable outcomes. For dairies already exploring rotational grazing, improved nutrient management, or soil health practices, the timing could work well.

What I’ve found after digging into the program mechanics and reviewing the financial modeling is that this opportunity fits some operations better than others. The farms positioned to benefit most are those already headed in this direction, with healthy balance sheets to weather a multi-year transition.

Let me walk you through what’s actually going on here.

What the Regenerative Pilot Program Actually Does

The basics are straightforward enough. According to the USDA’s December 10, 2025 announcement, the agency is directing $400 million through EQIP and $300 million through CSP in fiscal year 2026 specifically for regenerative practices.

Producers can now submit a single application covering both programs instead of navigating two separate processes—which, if you’ve dealt with NRCS paperwork before, represents a meaningful improvement.

The whole-farm focus is useful. NRCS staff are directed to address all major resource concerns in your operation—soil erosion, nutrient loss, water quality, habitat, and livestock needs—within a single conservation plan.

Here’s something worth paying attention to: participants must agree to perform soil health testing in the first and last years of the contract, at a minimum, to establish a baseline and record changes over time. That accountability piece matters for demonstrating results.

What’s interesting is the explicit invitation for corporate partnerships. The announcement states that companies interested in partnering can contact the USDA directly. That language opens some doors we’ll explore later.

For dairy, the program’s emphasis on integrating livestock with land management aligns naturally with regenerative principles: keeping soil covered, minimizing disturbance, maintaining living roots, and diversifying species. Cows, manure, forages, and pasture already form an interconnected system on most operations.

The Dairy Advantage: Why Your Operation Scores Well

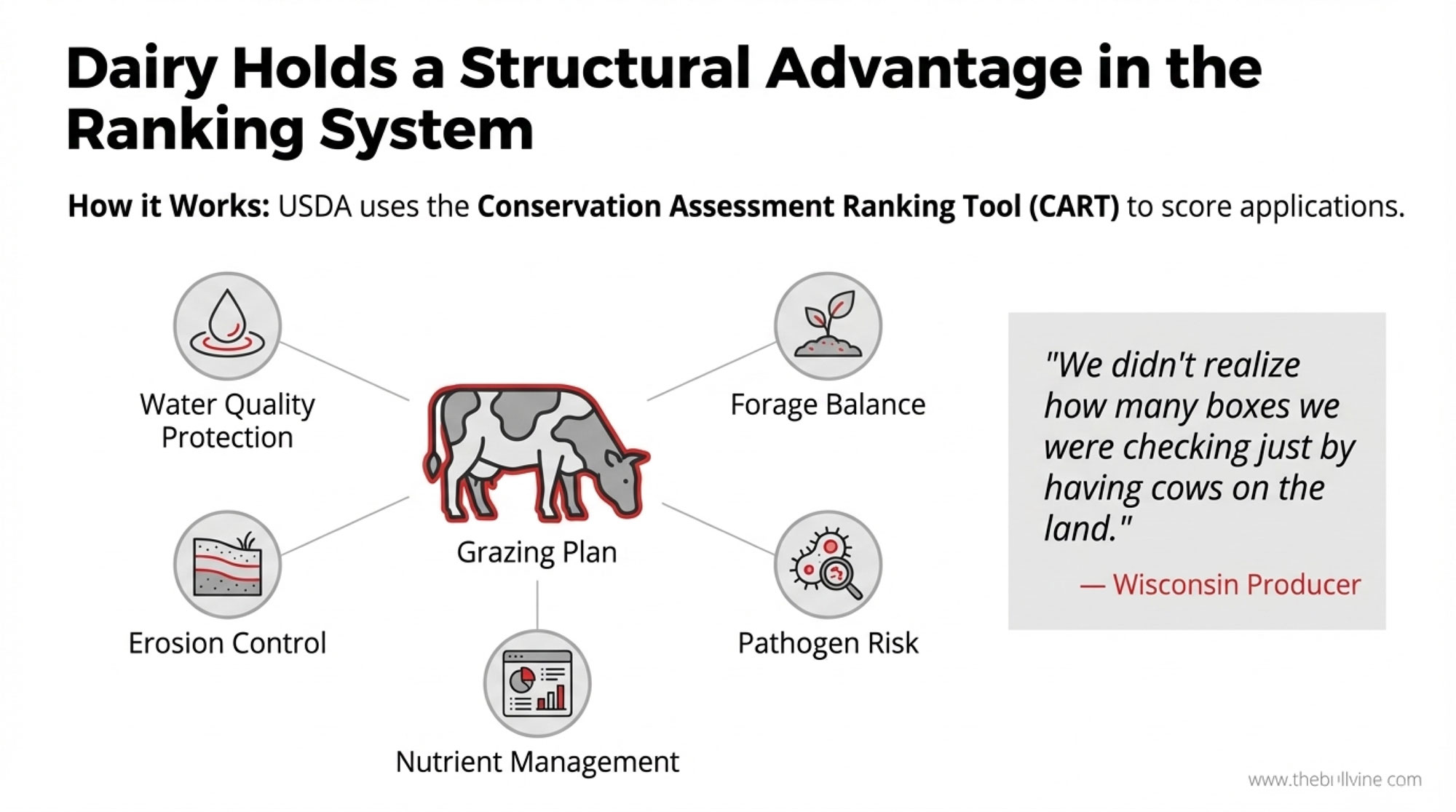

This is where the technical picture gets interesting. NRCS doesn’t fund applications based on who writes the best narrative. They use the Conservation Assessment Ranking Tool (CART), which scores proposals against national resource concerns covering soil, water, air, plants, and animals.

Dairy operations with cows and manure naturally touch more of those concerns at once than a typical row crop farm. Issues such as nutrient management, water quality protection, and forage balance are explicitly listed as resource concerns in NRCS documentation.

When a dairy installs a well-designed rotational grazing system with improved fencing, waterlines, and better nutrient management, NRCS can score improvements across multiple concerns simultaneously—forage balance, water availability, pathogen risk, erosion, and habitat.

I recently spoke with a Wisconsin producer who went through the EQIP process last year. His observation was telling: “We didn’t realize how many boxes we were checking just by having cows on the land.”

That multi-benefit profile tends to drive higher ranking scores than many single-issue cropland practices. Dairy does have a structural advantage in competing for these dollars—but that advantage comes with its own complexity.

The Watershed Factor: Regulatory Context You Need to Know

This doesn’t get enough attention in press releases. Many of the watersheds where regenerative practices are most encouraged are also under Total Maximum Daily Load (TMDL) constraints for nutrients or pathogens under the Clean Water Act.

If you’re in one of these areas, you already know it:

- Chesapeake Bay watershed

- Wisconsin’s Fox River basin

- California’s Central Valley

These are places where state agencies are required to allocate pollution “budgets” among all sources, and permitted CAFOs face increasing scrutiny.

For a dairy in one of these basins, regenerative funding can serve two different purposes. It can be a financial tool to get ahead of emerging standards, using cost-share to build practices that might eventually be required anyway. It also creates documentation showing proactive engagement with water quality concerns.

In many cases, that documentation of good-faith efforts is exactly the right approach. But if you’re in a watershed with active enforcement attention, talk to someone who understands the regulatory landscape before signing a multi-year contract.

The Cash Flow Trap: Why 90% Cost-Share Isn’t Free Money

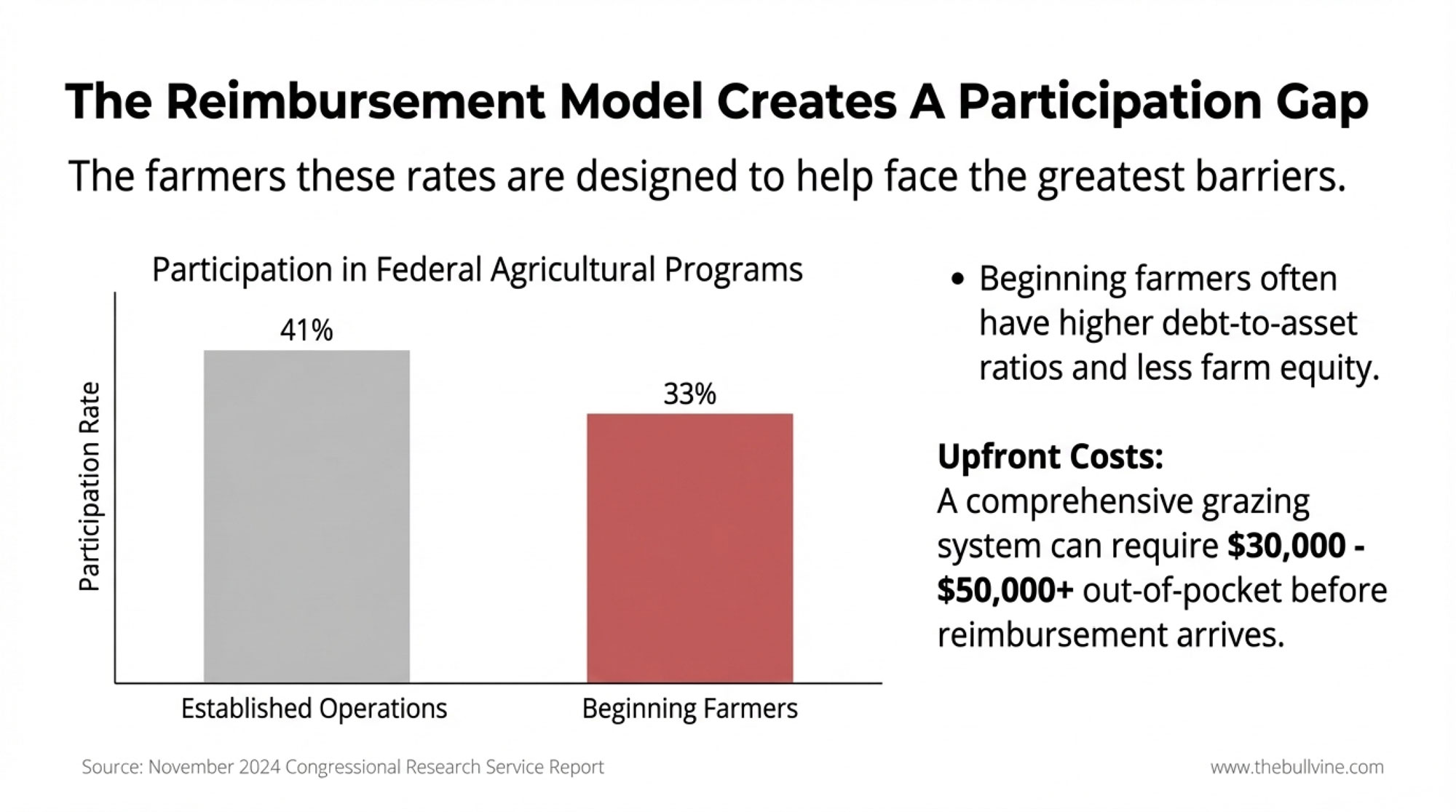

One of the most eye-catching features of USDA conservation programs is the up-to-90% cost-share rate available to historically underserved producers: beginning farmers, socially disadvantaged farmers, veterans, and limited-resource operations. On paper, that represents meaningful support.

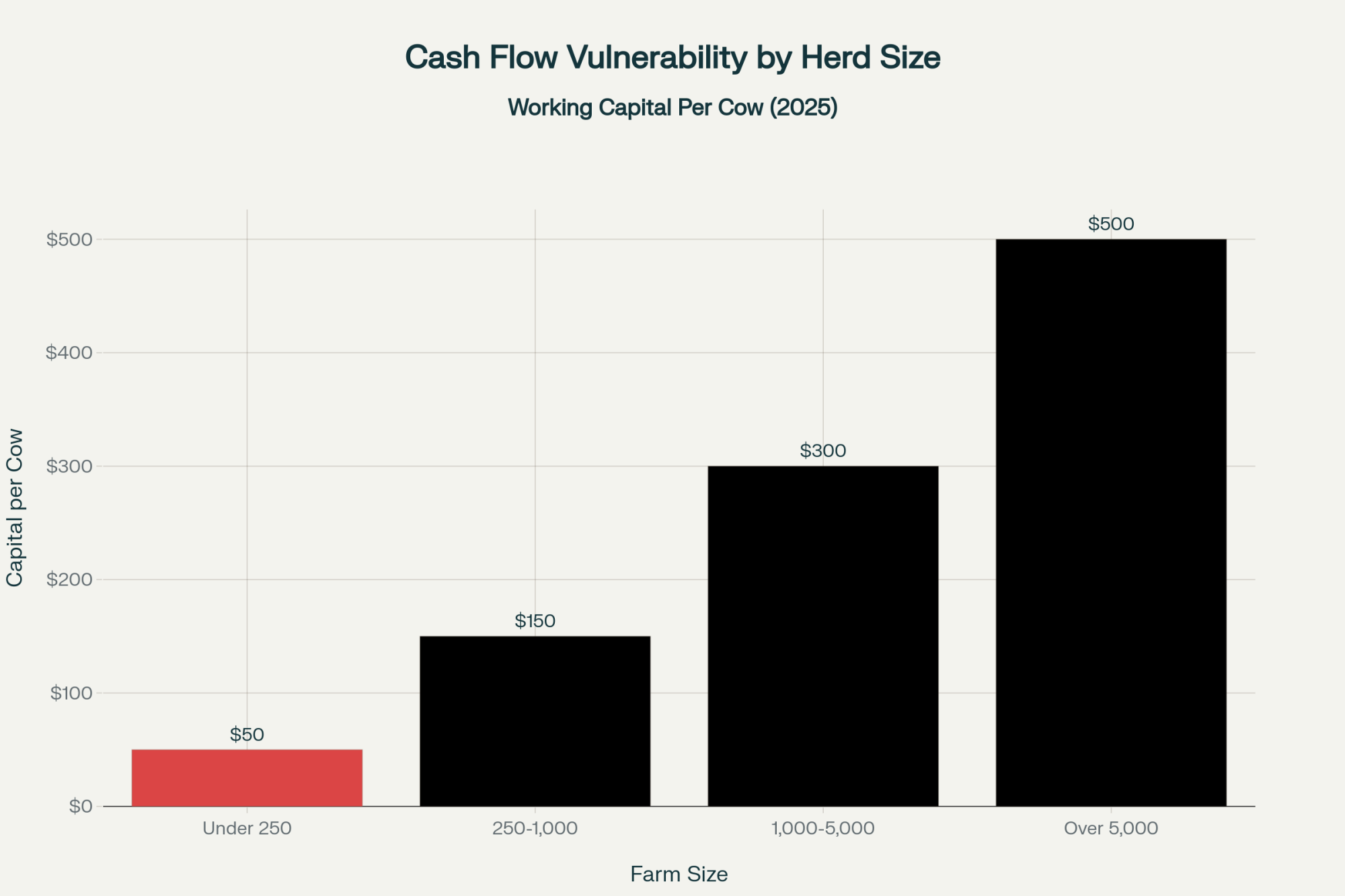

The participation data reveals some challenges worth understanding.

According to a November 2024 Congressional Research Service report on beginning farmers:

- 33% of beginning farmers received direct payments from federal agricultural programs (2013-2017)

- 41% of established operations received payments in the same period

- For participants, payments accounted for 20% of net cash farm income for beginning farmers vs. 14% for established farms

| OPERATION CHARACTERISTIC | BEGINNING FARMERS | ESTABLISHED OPERATIONS |

|---|---|---|

| Federal Program Participation Rate | 33% | 41% |

| Participation Gap vs. Established | ↓ 24% lower | baseline |

| Payment Share of Net Cash Income* | 20% | 14% |

| Typical Debt-to-Asset Ratio | Higher | Lower |

| Farm Equity Position | Lower | Higher |

| Dominant Land Tenure | Rented/Short-term | Owned/Long-term |

*Among participating operations only

Source: Congressional Research Service, November 2024 (2013-2017 data)

What’s happening here? Part of it is awareness and application complexity. But the more significant factor is access to capital.

Here’s the catch: 90% cost-share still means 10% cash upfront—and cost-share is typically reimbursed after the practice is installed, not before.

For a rotational grazing system—fencing, water systems, pasture establishment—the out-of-pocket costs can range from several thousand dollars for basic setups to $50,000 or more for comprehensive systems, depending on your acreage, existing infrastructure, and how much you’re building from scratch. That’s before accounting for the working capital you’ll need during the transition period when milk production may temporarily decline.

| System Type | Total Cost | Farmer 10% | Reimbursement Float | USDA 90% |

|---|---|---|---|---|

| Basic (50 ac) | $15,000 | $1,500 | $2,250 avg | $13,500 |

| Mid-Size (150 ac) | $35,000 | $3,500 | $7,000 avg | $31,500 |

| Comprehensive (300 ac) | $50,000 | $5,000 | $25,000 avg | $45,000 |

The CRS report confirms that beginning farmers typically carry higher debt-to-asset ratios and have less farm equitythan established operations. Many rely on off-farm income to balance the books. They often farm rented or short-term-leased land, which makes it difficult to justify permanent infrastructure investments.

The bottom line: The farmers these enhanced rates are designed to help sometimes face the greatest barriers to participation, regardless of the cost-share percentage.

Regional Reality Check: One Program, Different Impacts

These dynamics vary considerably by geography.

Wisconsin: Dairy operations are dense, and cooperatives have historically been strong. Farmers have more options for pooling resources and sharing knowledge about conservation practices. The state’s nutrient management regulations are relatively mature, so many operations have already implemented foundational practices. For these farms, the regenerative pilot might represent an incremental step rather than a major pivot.

California (Central Valley): The scale is different—larger operations with significant water constraints and air quality regulations layered on top of nutrient concerns. The capital requirements and regulatory complexity are both amplified. But so is the potential impact when operations do commit to regenerative practices.

A Central Valley producer I spoke with recently put it bluntly: “We’ve got CARB breathing down our necks on methane, the water board on nutrients, and now there’s federal money for soil health. The question isn’t whether to do something—it’s whether this particular program fits our timeline and our cash position.”

Northeast: Smaller average herd sizes and proximity to premium urban markets create different opportunities. Grass-fed and organic premiums have more traction here, which can make the transition economics more favorable. But land costs are higher, and available acreage is often tighter, which affects grazing system design.

A $700 million program announced from Washington looks different depending on where you’re standing. Local NRCS offices understand these regional dynamics—those conversations are worth having early.

| REGION | TYPICAL HERD SIZE | INFRASTRUCTURE COST | REGULATORY COMPLEXITY | PREMIUM MARKET ACCESS | TRANSITION CHALLENGE |

|---|---|---|---|---|---|

| Wisconsin | 150-250 cows | $25K-$45K | Moderate (nutrient mgmt) | Moderate (co-op support) | MODERATE |

| California Central Valley | 800-2,000+ cows | $75K-$150K+ | HIGH(water/air/nutrients) | Low-Moderate | HIGH |

| Northeast (NY, VT, PA) | 80-150 cows | $15K-$35K | Low-Moderate | HIGH (organic premiums) | LOW-MODERATE |

| Upper Midwest (MN, IA) | 200-400 cows | $30K-$55K | Moderate | Moderate | MODERATE |

| Southeast (GA, FL, NC) | 100-300 cows | $20K-$40K | Moderate-High (water) | Low | MODERATE-HIGH |

Corporate Partnerships: Opportunity Meets Fine Print

Corporate regenerative programs have become increasingly significant, and they offer real benefits to participating farms. I’ve heard from producers across several states who have developed productive relationships with their buyers.

The upside: Danone North America has enrolled dairies across thousands of acres in its regenerative program, with documented outcomes such as reduced erosion and improved soil carbon. Benefits can include:

- Premium milk pricing (sometimes considerably above conventional rates)

- Technical support and agronomy advice

- More stable market access during volatile periods

The complexity: Processors and brands typically control the regenerative standard, the verification protocol, and the use of on-farm data—including soil tests that public dollars may partly fund. Contracts may include termination clauses, volume limits, or pricing formulas that provide the buyer flexibility if market conditions shift.

We saw how that flexibility works in practice when Danone adjusted its supply chain in August 2021, ending contracts with 89 Northeast organic dairy farms due to what the company described as “growing transportation and operational challenges in the dairy industry, particularly in the northeast.”

Those operations needed to find alternative markets quickly. Many did—Stonyfield announced plans to bring some affected farms into their direct supply program, and Organic Valley welcomed 65 of the displaced operations into their cooperative.

What’s encouraging is how the producer community responded. Farmer-owned cooperatives like Organic Valley offer a different structure—one where every farmer-member has a vote on decisions that impact the co-op, including animal care standards and pay prices. That model has its own trade-offs (cooperative governance isn’t always fast or simple), but for some operations it provides a middle path.

Key questions before signing: Who owns your soil data? What happens if the buyer changes strategy? Will the infrastructure investment still make sense if the premium structure changes?

These aren’t reasons to avoid partnerships—they’re reasons to read contracts carefully.

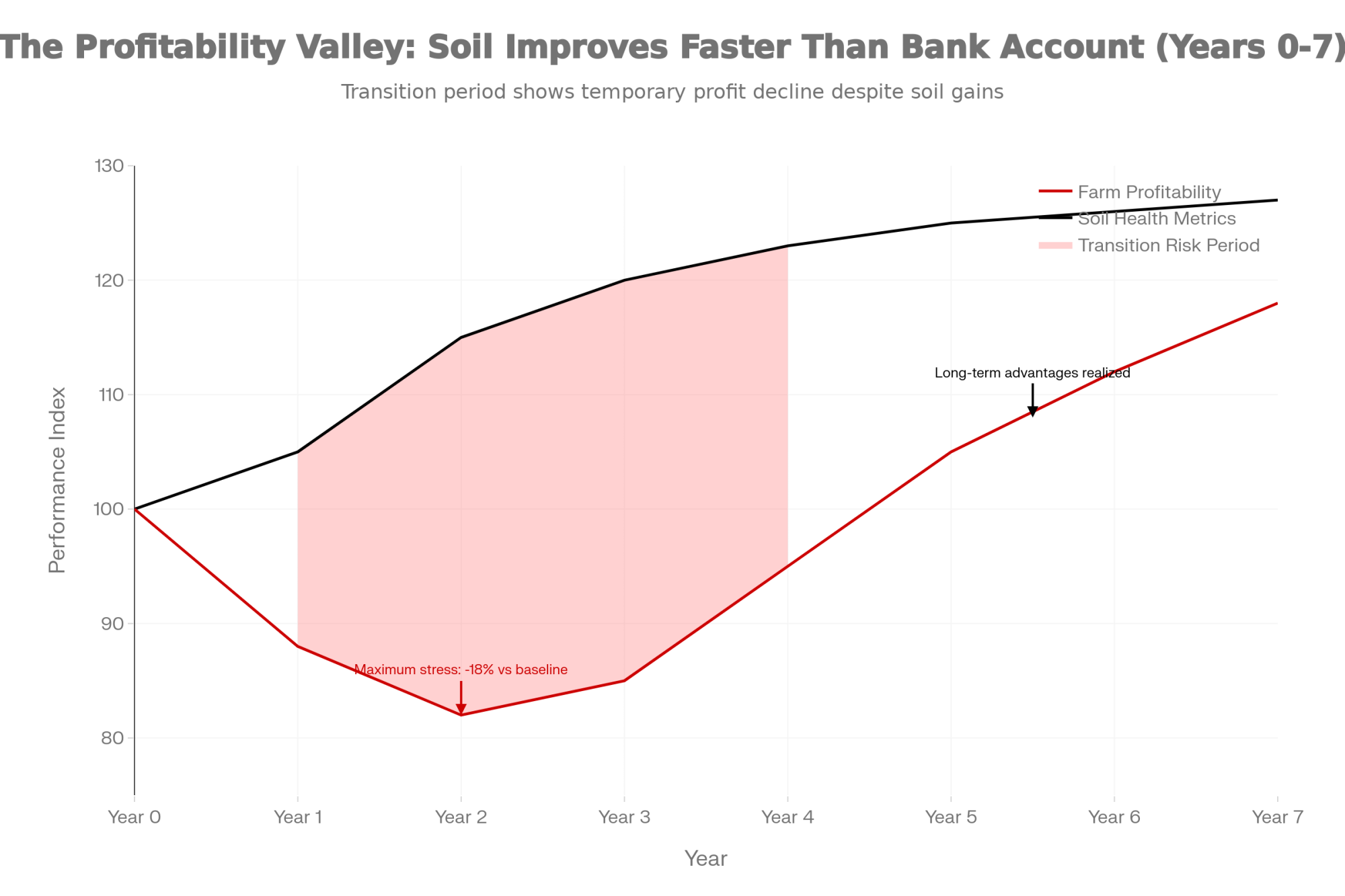

The Transition Valley: When Soil Improves Faster Than Cash Flow

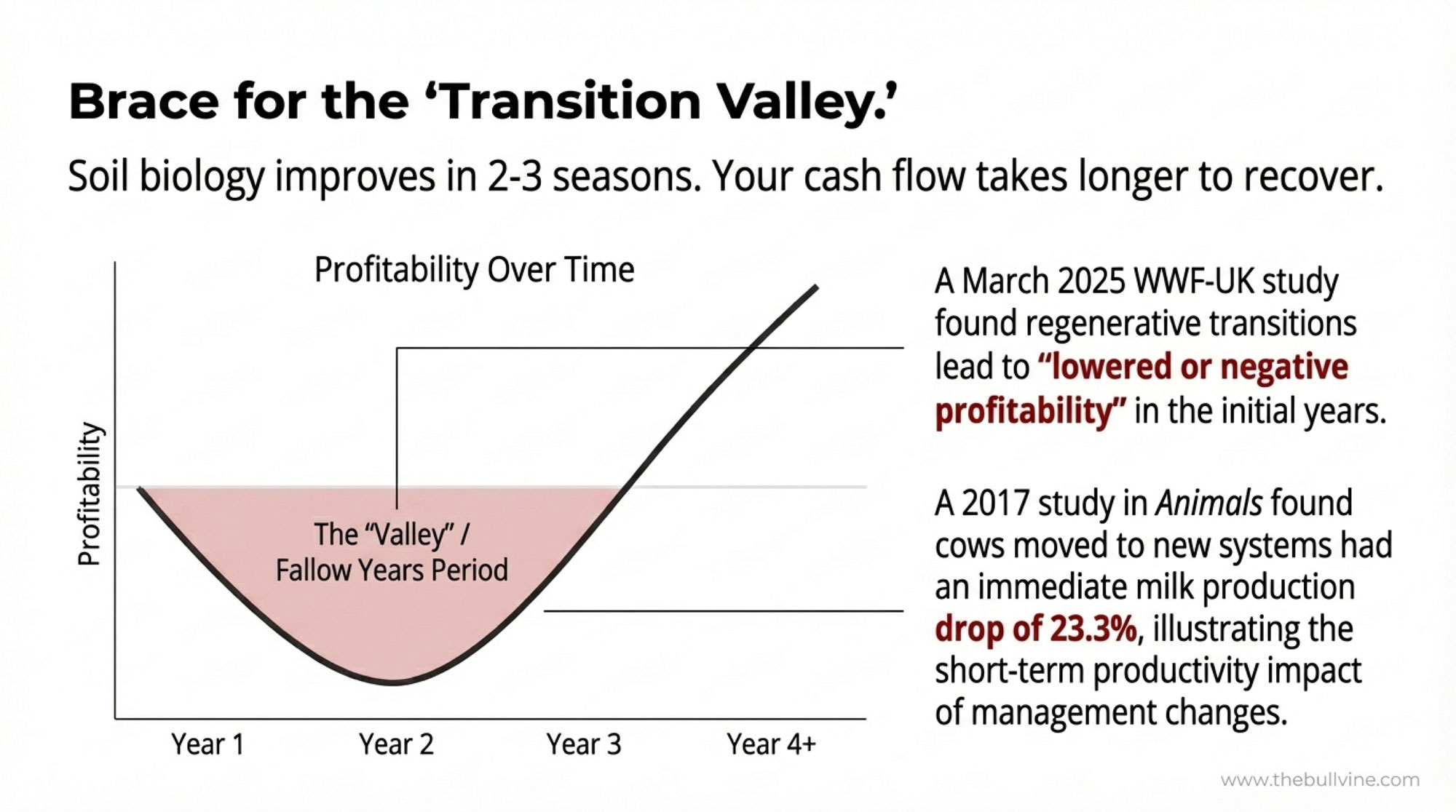

This brings us to something that deserves more attention: the transition economics.

USDA and regenerative advocates often reference “measurable improvements within 2-3 crop seasons.” That’s accurate for soil biology indicators—surface organic matter, infiltration rates, and microbial activity can respond relatively quickly to practices like cover cropping and adaptive grazing.

But dairy economics operate on a different timeline.

Research published in the journal Animals examined what happens when dairy cows experience housing and management transitions. In a 2017 study, cows moved from stanchion-stall housing to free-stall systems showed an immediate milk production drop of 23.3% on the first day following the transfer—from an average of about 31 kg to around 24 kg. Production partially recovered over two weeks.

This study examined housing transitions rather than pasture conversion specifically—but it illustrates an important point: significant management changes affect cow productivity in the short term, with implications for cash flow.

The most comprehensive recent modeling on regenerative transition economics comes from a March 2025 WWF-UK study conducted by Cumulus Consultants and the Andersons Centre. Now, I know what you’re thinking—UK data for American operations? Here’s why it still matters: the biological lag time of soil adaptation is universal. Whether you’re in Devon or Wisconsin, soil biology follows the same fundamental timeline. The microbial communities rebuilding your soil structure don’t care which side of the Atlantic they’re on.

Their findings: across all farm types modeled, the initial years of transition led to “lowered or negative profitability” due to investment costs and lower yields outweighing operational savings in the short term.

The report describes a “fallow years period” where dairy farmers can expect reduced profitability, with the transition timeline varying by starting point. The farms that came out ahead financially were either:

- High-cost intensive operations with significant room to reduce input costs, or

- Already-extensive grazing systems with lower transition costs

What’s encouraging: Regenerative farms often showed greater resilience to input price shocks and extreme weather compared to intensive operations. That long-term stability matters—particularly given recent volatility in feed costs. But you have to navigate the transition successfully to realize those benefits.

| Year | Soil Health Index | Farm Profitability Index | Performance Gap |

|---|---|---|---|

| 0 | 100 | 100 | 0 |

| 1 | 105 | 88 | +17 |

| 2 | 115 | 82 | +33 |

| 3 | 120 | 85 | +35 |

| 4 | 123 | 95 | +28 |

| 5 | 125 | 105 | +20 |

| 6 | 126 | 112 | +14 |

| 7 | 127 | 118 | +9 |

The bottom line on timing: Soil biology may show improvement within 2-3 seasons, but cash flow and profitability often take considerably longer to recover fully.

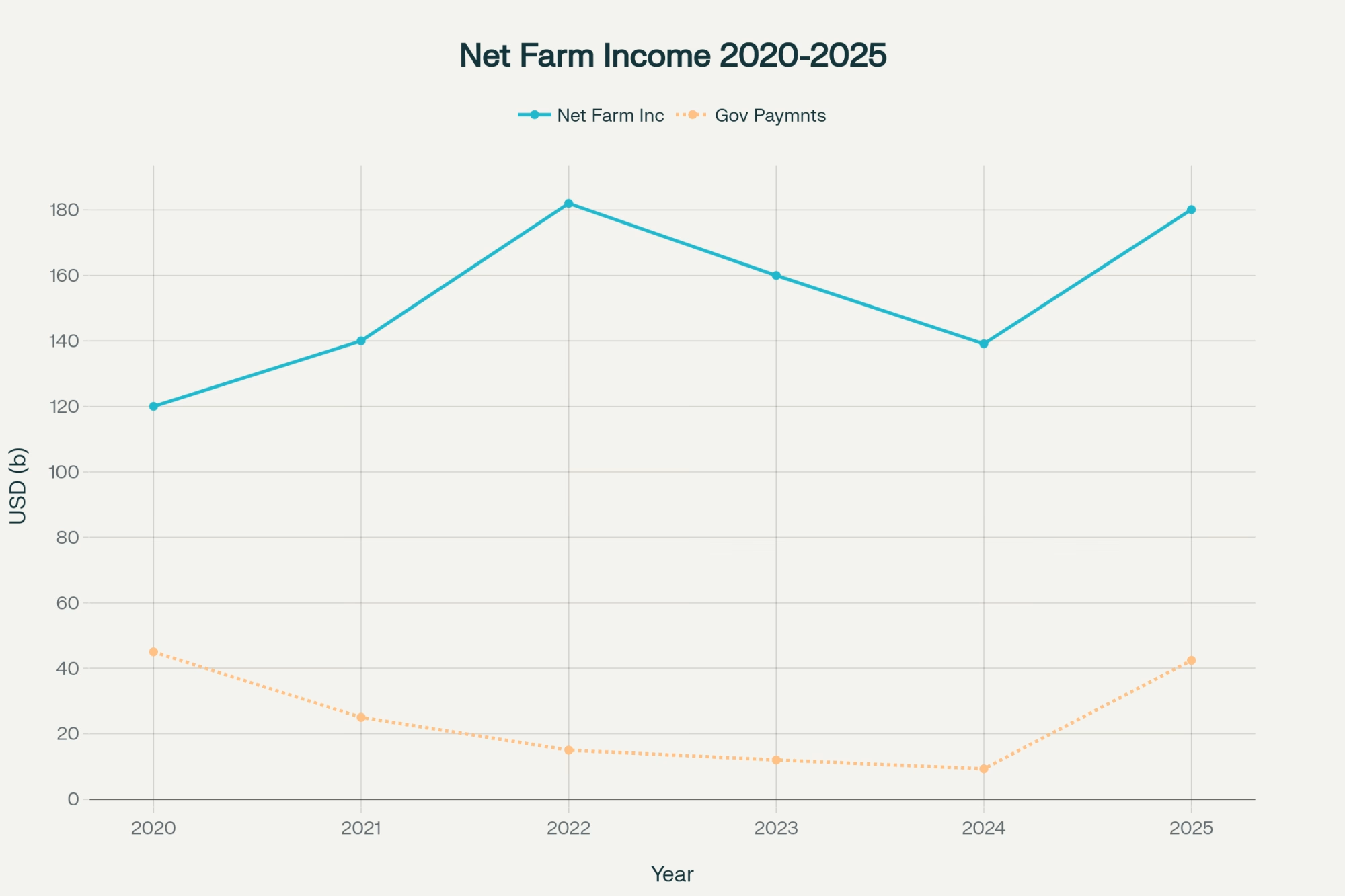

The Political Wild Card

Conservation programs exist within a political framework that changes over time.

The Inflation Reduction Act dedicated approximately $19.5 billion in additional conservation funding, much of it for climate-smart agriculture. Subsequent policy developments have affected how some of that funding flows. In February 2025, USDA announced the release of approximately $20 million in previously paused IRA funding that had been under review—confirming that payment timing had affected some producers waiting on expected funds.

The new regenerative pilot is associated with current USDA leadership priorities. That provides momentum now, but program emphases can shift with administration changes.

EQIP and CSP, as core Farm Bill programs, have demonstrated durability across administrations. Pilot structures and specific funding levels built on top of them may be more variable.

For a farm planning a multi-year transition: plan as if federal dollars are a helpful accelerator, not the foundation of your business plan.

The Five Questions That Actually Matter

So how do you decide whether this program makes sense for your operation?

These aren’t the questions NRCS will ask on your application. They’re the questions worth answering honestly with your banker, your family, and yourself before starting the process.

1. Are your financial ratios positioned for a multi-year transition? Work with your lender to review your debt-to-equity position, current ratio, and working capital. If the numbers are already tight, adding transition stress may stretch the operation further than is comfortable, even with cost-share support.

2. What’s your breakeven milk price if production temporarily declines? This is your stress test. If your breakeven moves into a price range the market rarely supports for extended periods, you’re counting on premium contracts or federal payments to bridge the gap.

3. Do you have a secured premium milk buyer? There’s a meaningful difference between a signed contract and a general intention to pursue premium markets. If the market isn’t locked in before transition, that’s additional uncertainty.

4. Can you cover the upfront costs and manage the reimbursement timeline? Cost-share is reimbursement, not an advance payment. The capital needs to be available when practices are installed, not when NRCS processes the paperwork.

5. Does regenerative transition align with where your operation was already heading? This might be the most important question. If you were already exploring more grazing and soil health practices, federal dollars can accelerate that direction. If the funding is the primary motivation, the transition may prove more challenging.

| CRITICAL QUESTION | STRONG POSITION ✓ | RISK SIGNAL ⚠️ |

|---|---|---|

| 1. Financial Ratios for Multi-Year Transition | Debt-to-equity <40%; working capital covers 6+ months | Debt-to-equity >60%; operating loan near limit |

| 2. Breakeven Milk Price If Production Temporarily Declines | Breakeven $16-18/cwt; margins absorb 10-15% production dip | Breakeven $20+/cwt; no cushion for production drop |

| 3. Premium Milk Buyer Secured? | Signed contract with locked pricing ($3-5/cwt+ premium) | “Exploring options” or unsigned interest letters |

| 4. Upfront Capital Access for Full Project Cost | Can cover 100% project cost + 6mo working capital reserve | Need reimbursement to proceed; only have 10% share |

| 5. Regenerative Direction Alignment | Already grazing/soil-focused; program accelerates existing path | Program is primary motivation; practices otherwise unlikely |

The Bottom Line

The $700 million program is real, and for operations that fit the profile, it represents a meaningful opportunity. Dairy operations do have structural advantages in the ranking system. Well-designed rotational grazing and nutrient management can deliver environmental and economic benefits over time.

This program works best as an accelerator for farms already moving in a regenerative direction, with solid financial foundations and clear market positioning.

For operations that hope federal dollars will address underlying financial challenges or for operations without clear premium market access, the program may not change the fundamental economics. And the transition period—that stretch where soil improvement runs ahead of cash flow recovery—requires adequate reserves to navigate successfully.

The farms that will do well with this aren’t necessarily the largest or most aggressive in pursuing funding. They’re the ones that did the financial homework, understood their market position, and made the decision based on where their operation was already heading.

If you’re sitting at that kitchen table wondering whether to apply, start with the five questions. Have honest conversations with your lender. Run the stress tests.

If the answers align, this could be a good opportunity—the kind of match between federal support and farm direction that doesn’t come along every year.

And if the answers suggest waiting? There’s real wisdom in building your foundation first and learning from how the first wave of participants fare.

The best opportunities are the ones you’re genuinely positioned to capture.

We’ll be tracking how early adopters navigate this program and sharing their experiences in future coverage. If you’re applying or have questions about the process, reach out—your perspective helps us all learn.

For more information on the Regenerative Pilot Program, visit nrcs.usda.gov or contact your local NRCS service center. Additional resources on dairy financial analysis are available through your state’s extension dairy specialists.

Key Takeaways

- The 90% cost-share catch: It’s reimbursement, not an upfront cash payment. You front $30K-$50K+ for infrastructure; USDA pays after installation. Cash-tight operations feel that gap hardest.

- Dairy holds a ranking advantage. Cows and manure address multiple NRCS resource concerns at once—nutrient management, water quality, and forage balance—boosting your score against row crop competition.

- Budget for a profitability dip. WWF-UK’s March 2025 study found regenerative transitions produce “lowered or negative profitability” in early years. Soil responds in 2-3 seasons; cash flow recovery takes longer.

- Beginning farmers face the steepest barrier. November 2024 CRS data: 33% participation vs. 41% for established operations. Higher cost-share rates don’t solve capital access problems.

- The real question: accelerator or lifeline? This program rewards farms already moving toward grazing and soil health. If federal dollars are your rescue plan, the math probably won’t work.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Regenerative Dairy’s $900,000 Reality: The Contract Terms That Make or Break Your Transition – Reveals the critical “Model 1 vs. Model 2” framework for structuring premium contracts and exposes the specific legal terms that separate profitable transitions from financial traps in the current market.

- The Wall of Milk: Making Sense of 2025’s Global Dairy Crunch – Provides the essential global market context for your transition decision, detailing how simultaneous expansion in the U.S., EU, and New Zealand is reshaping milk prices and creating a “24-month trap” for ill-timed investments.

- Revolutionizing Dairy Farming: How AI, Robotics, and Blockchain Are Shaping the Future of Agriculture in 2025 – Explores how automating labor-intensive tasks and leveraging precision data can protect cash flow during transition periods, offering a technological counterweight to the biological risks of soil health conversion.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!