Chapter 12 bankruptcies jumped 55% while government payments hit $42.4B—here’s what the courthouse records really reveal

EXECUTIVE SUMMARY: Here’s what farmers are discovering about the current financial landscape: University of Arkansas data shows agricultural bankruptcies surged 55% to 259 cases between April 2024 and March 2025, even as government support increased 354% to $42.4 billion—revealing a systematic disconnect between bailout funding and actual farm-level financial stress. The most concerning pattern involves interest rates jumping from 2.9% to nearly 9%, creating unsustainable debt service burdens for operations that layered variable-rate financing during the low-rate period. What’s particularly telling is that replacement heifer inventories have dropped to just 41.9 per 100 milk cows—a 47-year low that signals producers are sacrificing long-term herd sustainability for short-term cash flow. Recent Federal Reserve data confirms 4.3% of farm loan portfolios now show “major or severe” repayment problems, the highest level since late 2020, while nearly 2% of farmers won’t qualify for loans they easily obtained just last year. The encouraging news is that operations monitoring specific financial stress indicators and maintaining conservative debt structures are not just surviving—they’re positioned to capitalize on opportunities when market conditions stabilize. Smart producers are treating financial health monitoring as seriously as they track somatic cell counts, recognizing that both are essential for sustainable dairy success in 2025.

Here’s something that’s been on my mind at every industry meeting this year: Chapter 12 agricultural bankruptcies jumped 55% while government payments to agriculture increased 354% to $42.4 billion, according to the latest USDA data. When you see those two trends moving in opposite directions like that, it raises some important questions about what’s really happening with farm finances.

The University of Arkansas just released tracking data showing 259 bankruptcy cases between April 2024 and March 2025, and these numbers tell a story that’s more complex than what we’re seeing in the trade publications. You’ve probably heard how headlines keep mentioning support programs and stable milk prices. The courthouse records paint a vastly different picture.

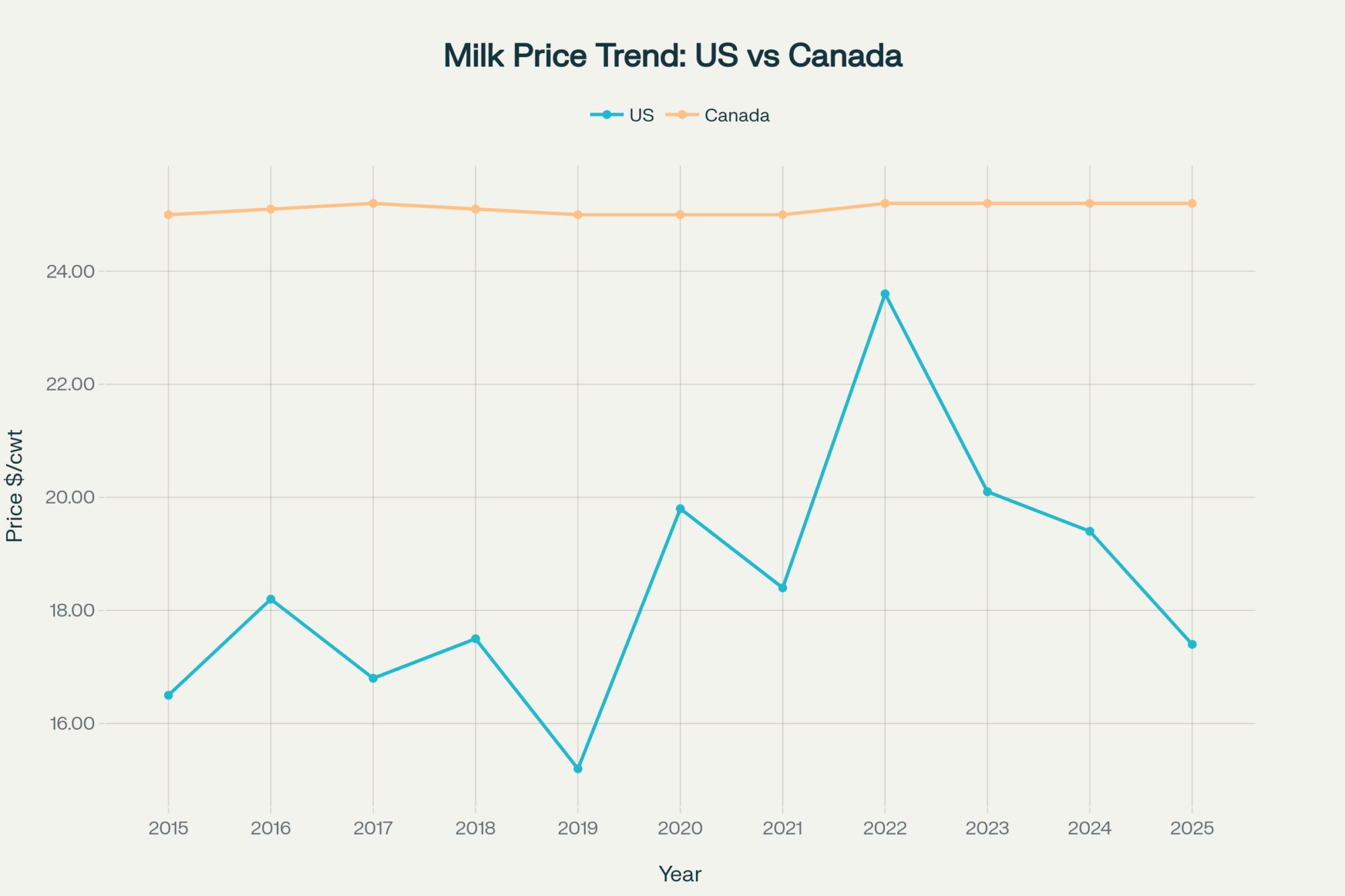

What’s interesting here is how the usual signs we look for—Class III futures, government program announcements—might not be giving us the complete picture we need for our own operations. And as many of us have experienced firsthand, what looks stable in the market reports doesn’t always translate to what’s happening in your parlor or your monthly cash flow.

The Arkansas Pattern: When One State Reveals National Trends

Ryan Loy and his team at the University of Arkansas Division of Agriculture have been doing some fascinating work tracking these patterns. Arkansas alone jumped from just 4 Chapter 12 filings in 2023 to 25 in 2025—that’s over 25% of all national filings coming from one state. While this represents a massive 525% increase for Arkansas specifically, their agricultural bankruptcy patterns often mirror what we see nationally, just more concentrated. It’s like a canary in the coal mine situation.

The quarterly data from their research is what really caught my attention. Q1 2025 brought 88 bankruptcy filings compared to 45 in Q1 2024. That’s a 96% increase in just three months, and it puts us on a trajectory that reminds those of us who lived through it of the 2019 farm crisis.

“Once you see this on a national level, it’s a clear sign that financial pressures that we saw before in the 2018 and ’19 are kind of re-emerging,” Loy explained in his recent interviews. For those of us who weathered that period, the patterns are starting to look uncomfortably familiar.

Traditional dairy regions are feeling similar pressure. Federal court records show California led with 17 bankruptcy filings in 2024, despite generally stronger milk prices on the West Coast. Iowa reported 12 leading into 2025, and the pattern continues across Wisconsin, Minnesota, and other Midwest operations where land values and operational costs create different challenges.

Something worth noting is how these geographic patterns affect more than just the operations filing for bankruptcy. If your area is seeing concentrated financial stress, that impacts equipment values at local auctions, the stability of your processing relationships, and even the availability of veterinary services. It’s all interconnected in ways that aren’t always obvious until you’re dealing with it directly.

The Interest Rate Reality: How 9% Financing Changed Everything

Here’s where this gets personal for dairy operations, and it’s probably the single biggest factor driving these bankruptcy numbers. Federal Reserve agricultural lending data shows farm loan rates have jumped from 2.9% to nearly 9% for many operations over the past two years. That’s not just a cost increase—it fundamentally changes how you approach financing everything from feed inventory to facility improvements.

Variable-rate financing, which made perfect sense when rates were low, now creates a completely different cash flow picture. Those manageable seasonal dips that you used to smooth out with a line of credit become much more challenging when your borrowing costs have essentially tripled.

The Federal Reserve Bank of Chicago’s latest district report shows that 4.3% of farm loan portfolios had “major or severe” repayment issues in Q4 2024—the highest level since late 2020. What’s really concerning is that nearly 2% of farmers won’t qualify in 2025 for the same loans they received in 2024, according to their regional analysis. The Kansas City Fed found that non-real estate farm loans at commercial banks increased by 25% from 2023 to 2024, but interest rates remain at these elevated levels.

Equipment financing has taken a tough hit. You know how straightforward it used to be to pencil out new machinery at 3-4% interest rates? When rates approach 9%—especially if you’re already carrying equipment debt—those calculations look completely different. This shows up in auction activity, parlor upgrade deferrals, and even basic maintenance equipment purchases.

But here’s what’s encouraging: Some operations that locked in fixed-rate financing early in the rate cycle are finding themselves with a real competitive advantage. They’re able to make strategic equipment purchases and facility improvements, while competitors struggle with variable-rate debt service. I’ve noticed these operations are also better positioned for fresh cow management improvements and transition period upgrades that require capital investment.

Examining bankruptcy filings from the past year reveals a common pattern among operations that had layered short-term, variable-rate financing on top of long-term mortgages during the period of low interest rates. When those rates reset, monthly obligations became unmanageable regardless of milk production efficiency or butterfat performance.

For individual operations, understanding interest rate exposure has become crucial. Calculate what percentage of your total debt carries variable rates. Even at higher current rates, fixed-rate financing offers payment predictability, enabling better cash flow management during volatile periods—and we’re certainly in a volatile period.

Lenders are being selective about who gets approved for refinancing. They’re expanding loan volumes at higher rates but maintaining strict qualification requirements. It’s a profitable environment for lenders, but it means operations need strong financials to access better terms.

Government Payments: The Puzzle That Doesn’t Add Up

This is where the data gets really interesting. Agriculture received $42.4 billion in direct government payments in 2025—a 354% increase from 2024, according to USDA data. Yet bankruptcy filings keep climbing.

One pattern that emerges is that government support often flows through existing lender relationships and larger operations first. If you’re facing immediate financial stress, you may not see relief quickly enough to address urgent payment obligations. Many of these programs help with operating expenses but don’t tackle the underlying debt service burdens that actually drive bankruptcy filings—especially when interest rates have reset at these levels.

There’s also a timing issue that affects seasonal cash flow management. Government payments typically arrive based on program schedules that don’t always align with when individual operations hit their worst cash flow periods. If your variable-rate note resets in January and government support shows up in March, that gap can determine whether you’re restructuring debt or heading to court.

The Farm Credit System’s 2024 annual report shows total loans outstanding at $450.9 billion, with real estate mortgage loans at $187.9 billion and production/intermediate-term loans at $81.2 billion. Despite record government support, lenders are maintaining strict underwriting standards—which makes sense from their risk management perspective—but this can exclude operations that most need refinancing assistance.

Replacement Heifers: The Warning Signal We Can’t Ignore

One number that’s been keeping me up at night comes from the USDA’s National Agricultural Statistics Service. The U.S. dairy herd is currently operating with just 41.9 replacement heifers per 100 milk cows—a 47-year low based on their historical data. That ratio suggests that producers are prioritizing short-term cash flow over long-term herd sustainability, a trend that is occurring across all regions and farm sizes.

This signals that operations are making difficult decisions about breeding stock to meet immediate financial obligations. Reduced heifer inventories limit your ability to implement planned genetic improvements. You’re keeping older cows in production longer, which can impact milk quality and butterfat performance. Insufficient replacement rates today create production constraints when market conditions improve—you might miss the next upturn because you don’t have the herd capacity to capitalize on it.

This isn’t just about individual farm decisions. When replacement rates drop industry-wide, it signals systematic financial stress that affects everyone from genetics companies to equipment dealers. The breeding programs we’ve invested decades in developing depend on adequate replacement rates to maintain genetic progress.

What’s particularly noteworthy is how this affects different management systems. Operations using dry lot systems might find it easier to manage older cows, while those with more intensive grazing programs may face bigger challenges with extended lactations. The management of fresh cows becomes even more critical when you’re counting on those animals for longer, more productive lives.

Financial Health Checklist: What to Monitor Monthly

Track these ratios to spot trouble before it becomes critical:

- Debt Service Coverage: Net income ÷ total debt payments (monitor trends, aim to stay above 1.2)

- Working Capital Cushion: (Current assets – current liabilities) ÷ annual milk sales (15%+ provides seasonal buffer)

- Interest Rate Exposure: Variable-rate debt as % of total debt (above 60% creates Fed policy vulnerability)

- Short-Term Debt Balance: Operating loans ÷ total debt (risk increases above 40%)

- Cash Flow Variance: Monthly actual vs. 12-month average (>10% swings during high-cost months signal problems)

Regional Variations and Success Stories

This season, regional variations are worth understanding. California operations, which face higher land costs and water regulations, deal with different pressures than Midwest dairies, which manage harsh winters and transportation costs. Texas producers, with their varied climate and feed base, are adapting to these financial pressures in ways that make sense for their operational structure.

| State | 2024 Bankruptcy Filings | % of National Total | Primary Challenge |

|---|---|---|---|

| California | 17 | 6.6% | Land costs, regulations |

| Iowa | 12 | 4.6% | Transportation, weather |

| Wisconsin | 15 | 5.8% | Equipment debt service |

| Minnesota | 11 | 4.2% | Seasonal cash flow |

| Arkansas | 25 | 9.7% | Variable-rate exposure |

Geographic bankruptcy clustering reveals regional stress patterns—if your area shows concentrated filings, expect impacts on equipment values, processing relationships, and veterinary services availability.

What’s consistent across regions is that bankruptcy patterns create ripple effects. When concentrated financial stress hits an area, it affects regional equipment values, processing relationships, and support services. But there can be opportunities too. Equipment purchases may yield better values at auctions, although service networks might become strained as the local producer base shrinks.

I’ve noticed that regions with more diversified agricultural economies—places where dairy operations can potentially add custom farming or other enterprises—seem to be handling the financial pressure somewhat better. That’s not an option for everyone, but it’s worth considering as part of your long-term strategy.

Despite these financial pressures, some adaptations seem to be working. Some operations have focused on efficiency improvements that provide clear returns on investment even at higher financing costs. Others have found opportunities in value-added processing or direct marketing that provides price stability for at least part of their production.

What’s encouraging is seeing operations that have successfully refinanced their variable-rate debt into fixed-rate structures, even at higher rates. They’re finding that the payment predictability more than compensates for the higher cost, especially when they can focus on operational improvements rather than worrying about the next rate reset.

One innovative approach I’m seeing more of is cooperative equipment purchasing and shared services agreements. Several operations in Wisconsin have formed buying groups for major equipment purchases, thereby reducing individual capital requirements while still accessing the latest technology. Similarly, some California operations are sharing specialized labor for peak periods, such as breeding or harvest, thereby spreading costs across multiple farms.

Examining global patterns, it’s worth noting that countries with more structured agricultural financing—such as New Zealand’s farm management deposit schemes or Australia’s Farm Finance Concessional Loans Program—tend to experience less dramatic swings in bankruptcy rates during interest rate cycles. Although our system differs, there may be valuable lessons to be learned about long-term financial stability mechanisms.

Practical Applications: Managing Current Conditions

Cash flow scenario planning has become essential rather than optional. Consider maintaining working capital reserves that give you flexibility to manage seasonal variations and unexpected cost increases without requiring emergency financing at current rates.

Equipment decisions require more careful analysis now. Being thoughtful about purchases that extend payback periods makes sense in the current interest rate environment. Focus capital investments on proven productivity improvements with clear return calculations—things like parlor efficiency upgrades or feed system improvements that reduce labor costs.

Some operations are finding success with alternative financing strategies, including equipment leasing arrangements, partnerships with other producers, or focusing on used equipment purchases that offer shorter payback periods. There’s also growing interest in shared services agreements where multiple operations split the cost of expensive equipment or specialized services.

With replacement heifer numbers at these low levels, fresh cow management becomes even more critical. You simply can’t afford transition period problems when you’re keeping cows longer and have fewer replacements coming through the system. The fresh cow protocols that might have been “nice to have” in better financial times have become essential for maintaining production efficiency and butterfat performance.

What I’ve found particularly interesting is how some of the most successful operations right now are those that took a conservative approach to debt structure, even when money was cheap. They maintained higher equity ratios, avoided over-leveraging on equipment, and kept adequate cash reserves. That financial discipline is paying off now, especially when it comes to making strategic investments in cow comfort or fresh cow management systems that require upfront capital.

Looking Forward: Building Financial Resilience

The patterns in recent bankruptcy data show that financial management has become as important as production management for long-term dairy success. The operations that are doing well aren’t just good at managing cows—they’re actively managing debt structure, interest rate exposure, and cash flow variability.

Rather than relying solely on industry messaging about recovery or government support programs, monitoring specific financial stress indicators provides early warning signals. The University of Arkansas research shows that financial stress often builds gradually before reaching crisis levels. Understanding these patterns gives you time to make adjustments before problems become unmanageable.

What’s encouraging is that the fundamental demand for dairy products remains strong. Population growth, protein consumption trends, and global market expansion all indicate long-term opportunities for well-managed operations that can effectively navigate current challenges. The emerging trends in functional dairy products and sustainable production practices are creating new market opportunities that weren’t available during previous financial stress periods.

Your operation’s financial health depends on monitoring the right indicators and understanding the broader forces at play. Given what we’re seeing in these numbers, financial analysis has become as essential as monitoring somatic cell counts or butterfat levels—it’s just part of professional dairy management in 2025.

The operations that recognize this shift and develop strong financial management skills to complement their production expertise will be positioned to capitalize when market conditions stabilize. There’s a real reason for optimism about the industry’s long-term prospects, especially for producers who combine traditional dairy excellence with modern financial management practices.

The Bottom Line

When 259 farm families file for bankruptcy protection in a single year while taxpayers fund $42.4 billion in agricultural support, it’s clear we’re facing more than a typical market correction. These courthouse records reveal a systematic financial stress that traditional industry metrics fail to capture—and that makes understanding the early warning signs critical for every dairy operation.

The clearest lesson from this data isn’t just about avoiding bankruptcy. It’s about recognizing that financial health and herd health are equally essential for long-term success in modern dairy. The operations that develop strong financial management skills to complement their production expertise won’t just survive the current volatility—they’ll be positioned to thrive when market conditions stabilize.

The data shows there’s still time to make adjustments, and with the right financial monitoring and planning, dairy operations can build the resilience needed to weather whatever comes next. That’s not just hopeful thinking—it’s what the numbers and the success stories are telling us about the future of professional dairy management.

KEY TAKEAWAYS:

- Monitor your debt service coverage ratio monthly—keep it above 1.2 to maintain borrowing flexibility, especially with variable-rate debt that could reset at decade-high levels, affecting your operation’s cash flow predictability

- Maintain working capital reserves equal to 15%+ of annual milk sales—this buffer provides crucial flexibility during seasonal variations and unexpected cost increases without requiring emergency financing at current 8-9% interest rates

- Prioritize fixed-rate refinancing opportunities while still available—operations successfully locking in predictable payment structures are gaining competitive advantages for strategic investments in fresh cow management and facility improvements

- Focus equipment investments on proven productivity improvements with clear ROI calculations—parlor efficiency upgrades and feed system improvements that reduce labor costs can justify higher financing costs better than speculative technology purchases

- Strengthen fresh cow management protocols as replacement heifer numbers remain at 47-year lows—maximizing productive life and butterfat performance of existing animals becomes critical when fewer replacements are coming through the system

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Boosting Dairy Farm Profits: 7 Effective Strategies to Enhance Cash Flow – This guide provides actionable, tactical advice for improving on-farm profitability. It goes beyond financial ratios to offer specific strategies for optimizing parlor efficiency, diversifying revenue streams, and managing feed costs, giving producers direct steps they can implement for immediate cash flow improvements.

- Global Dairy Market Dynamics: Navigating Volatility and Strategic Opportunities in 2025 – This article provides a crucial strategic perspective by analyzing the macroeconomic forces shaping the industry. It reveals how factors like European production surges and shifting trade logistics affect farm-level prices, helping producers anticipate market changes and position their operations for long-term success.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – This piece focuses on innovative solutions, providing clear data on the return on investment (ROI) for technologies like precision feeding and AI health monitoring. It shows how specific tech adoptions can directly reduce costs and increase yields, offering a roadmap for modernizing operations to improve financial resilience.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.