Butter just dropped 2.25¢ but smart farmers locked $1,250/month feed savings. Here’s what most missed about today’s CME action.

EXECUTIVE SUMMARY: Look, I get it – seeing butter tank 2.25¢ in one session makes your stomach drop. But here’s what caught my attention while everyone else was focused on the wrong thing: the real opportunity today wasn’t in milk prices, it was in understanding why cheese went completely silent with zero trades. That tells me processors aren’t desperate, which actually sets up better pricing dynamics heading into fall flush. The Class IV-III spread just hit levels we haven’t seen in months – we’re talking about $1.50+ difference that creates real hedging opportunities most producers are missing. Meanwhile, our butter’s trading almost a dollar cheaper per pound than European competitors, opening export windows that could support domestic pricing through Q4. Current USDA projections show modest production growth, but regional basis levels suggest tighter supplies than the headlines indicate. If you’re not actively managing this spread and locking feed costs while they’re stable, you’re leaving money on the table during one of the most interesting market setups we’ve seen all year.

KEY TAKEAWAYS

- Lock 60-90 days of feed costs immediately – With corn holding at $4.225/bu and meal stable around $284.90/ton, your milk-to-corn ratio sits above 4.0 (historically profitable). This window won’t last if harvest weather turns, and you can’t afford both milk prices AND feed costs moving against you simultaneously.

- Capitalize on that $1.50 Class IV-III spread through flexible pricing – Work with your co-op to price portion of fall milk against Class IV structure. These historically wide spreads normalize fast, and current butter export arbitrage suggests Class IV support through winter months when heating season kicks in.

- Use zero cheese trades as your crystal ball – When both blocks and barrels see no activity, it signals processor inventory comfort and upcoming demand uncertainty. Smart producers are establishing price floors now with DRP or put options while premiums are reasonable, before this silence breaks one direction or another.

- Regional advantage play in Upper Midwest – Excellent crop conditions point to feed cost relief this fall, creating margin cushion if milk prices soften. Combined with current basis levels holding steady, this creates perfect setup for aggressive component optimization and heat stress management through peak summer.

Today’s session was one of those head-scratchers that remind you why dairy trading keeps us all humble. Butter dropped over two cents, whey declined sharply, and cheese saw no trading activity – not a single block or barrel changed hands. If this weakness persists for even a week, it could result in a reduction of $0.20-$0.30 from your August milk check. The actionable move right now? Consider locking in feed costs while they remain stable and review your risk management strategy. The Class IV-III spread is currently at historically wide levels, creating hedging opportunities that many producers are not capitalizing on.

The What: Today’s Numbers at a Glance

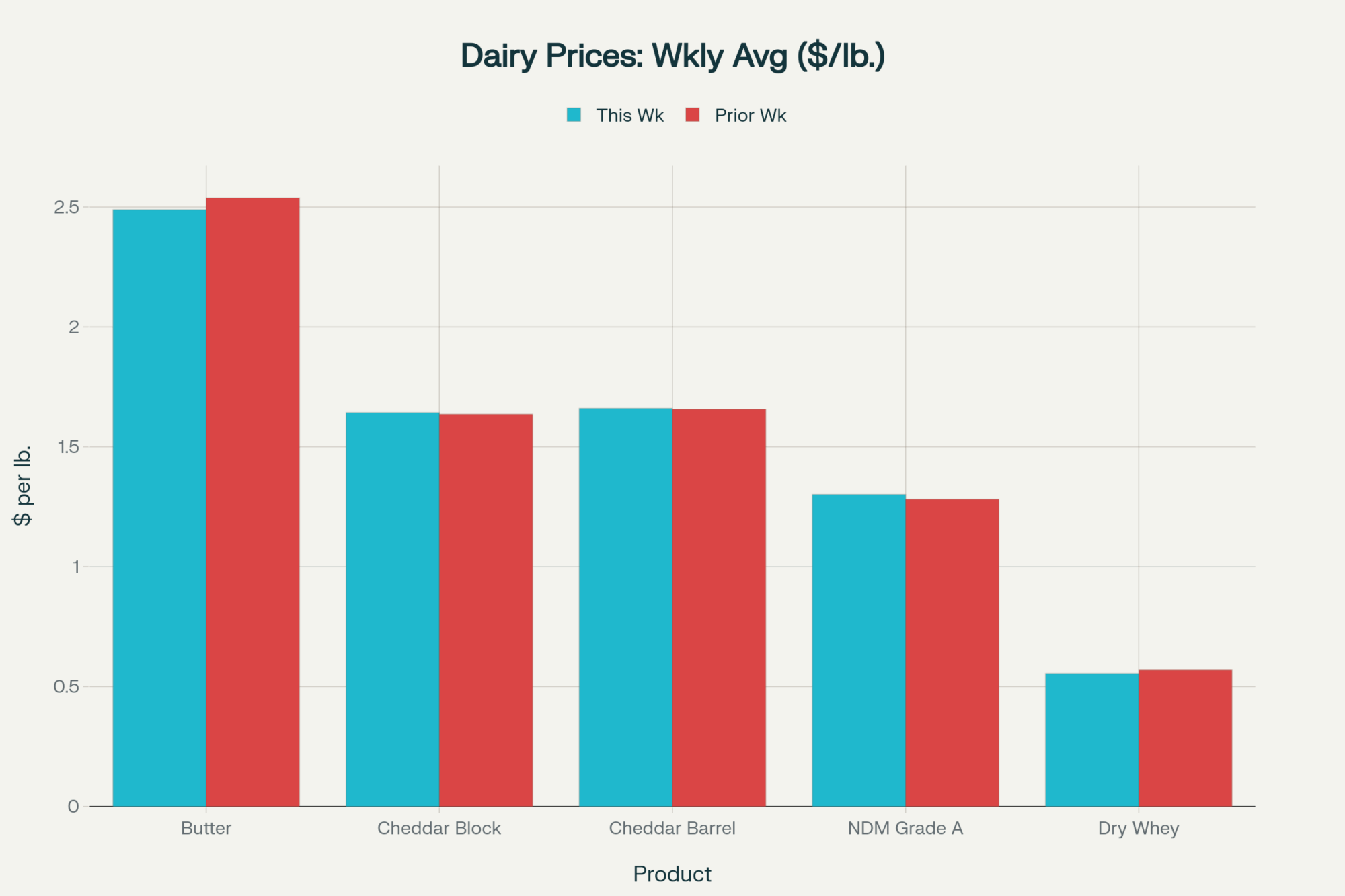

| Commodity | Closing Price | Daily Change | Volume (Loads) | Bids / Offers | What It Means |

| Butter | $2.48/lb | -$0.0225 | 5 | 3 / 5 | Direct pressure on Class IV pricing |

| Cheese Blocks | $1.64/lb | (Unch.) | 0 | 1 / 0 | Market standoff – nobody’s talking |

| Cheese Barrels | $1.66/lb | (Unch.) | 0 | 0 / 1 | Same story as blocks |

| NDM Grade A | $1.30/lb | +$0.0025 | 1 | 3 / 4 | Only bright spot – export demand holding |

| Dry Whey | $0.55/lb | -$0.0150 | 1 | 2 / 5 | Your Class III headwind right here |

Feed Costs: Corn (Dec) held steady at $4.225/bu, soybean meal (Dec) at $284.90/ton, showing modest stability. Milk-to-corn ratio still comfortable above 4.0 – that’s profitable territory for most operations.

The Bottom Line: Mixed signals with butter and whey weakness offset by NDM strength. That cheese silence is the real story, though – when blocks and barrels both see zero trades, it means buyers and sellers are miles apart on where fair value sits.

The Why: What’s Really Driving These Markets

Domestic Dynamics – The Inside Story

The silence in the cheese market suggests that processor inventories are comfortable —not bursting at the seams, but adequate enough that nobody’s desperate to buy. Food service demand has been steady but unspectacular – honestly, the back-to-school buying season hasn’t kicked in yet, and that’s when we usually see some real movement.

Here’s what struck me about today’s trading floor dynamics. Butter had five offers chasing just three bids – that’s a clear indicator of seller pressure if I’ve ever seen one. Whey showed similar imbalances, with five offers and only two bids. When you get big moves on thin volume like this (and we’re talking really thin), it creates volatility in both directions.

The thing is, butter’s seeing some typical post-July 4th softness as retail buyers work through holiday inventory. Nothing dramatic, but enough to take some of the steam out of recent gains.

Global Competition – Where We Stand

Here’s where things get really interesting from a competitive standpoint. Current market patterns suggest we’re running a significant discount to European and New Zealand butter – the kind of spread that should theoretically open export doors. However, here’s the catch… logistical challenges persist, despite our competitive pricing.

The flip side? Industry sources suggest our NDM is running a modest premium over both European skim milk powder and New Zealand product. Not huge money, but enough to make price-sensitive buyers think twice. Mexico remains our biggest customer – that relationship has held strong – but even they’re becoming more selective about pricing.

What’s particularly noteworthy is how this plays out regionally. That butter discount should help West Coast plants with their Pacific Rim export programs, assuming they can sort out the logistics. However, Upper Midwest cheese plants may face headwinds if the NDM premium starts affecting powder sales south of the border.

Production Reality – Summer Heat Taking Its Toll

Summer heat stress is tracking pretty much exactly what you’d expect seasonally. Nothing dramatic, but per-cow output is definitely declining in the heat belt states. Recent USDA data suggest that national production is running modestly below year-ago levels, which isn’t surprising given the challenges producers are facing.

Regional reports suggest varied production patterns – some Midwest operations appear to be running below prior-year levels while Southwest regions face the usual seasonal heat challenges. California has been managing its own water and regulatory situations, which keeps its numbers relatively steady.

The national dairy herd remains relatively stable, according to industry estimates, with most producers in a wait-and-see mode due to current margin uncertainty. Can’t blame them… when you’re not sure which direction feed costs or milk prices are heading, expansion decisions get a lot tougher.

The What’s Next: Futures Signals and Key Things to Watch

Futures Market Structure – Reading the Tea Leaves

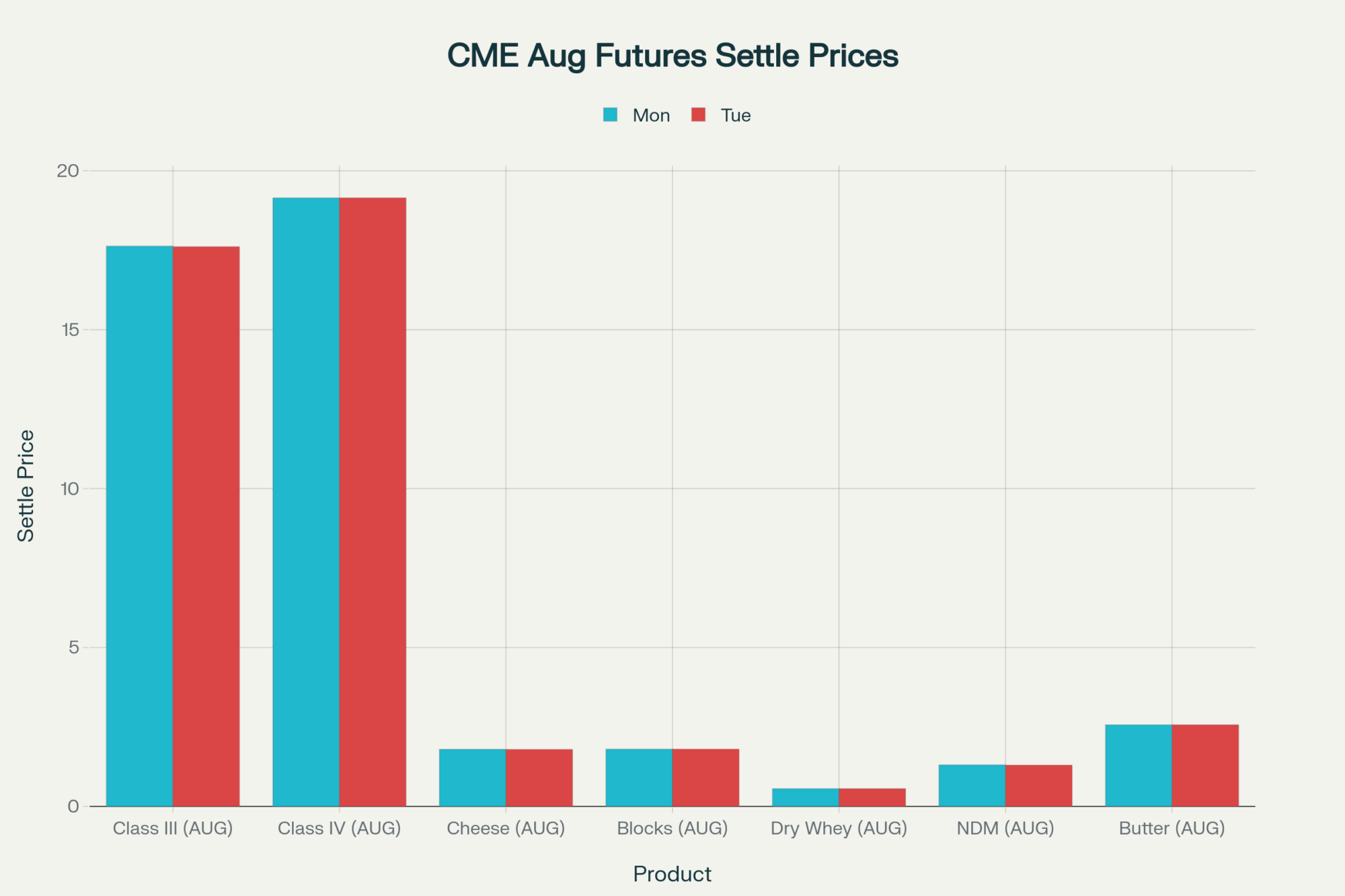

Current August Class III futures are trading in the $17.40-$17.60 range, while Class IV futures hold closer to $19.00. That $1.50+ spread tells you everything about where the market’s confidence sits right now – clearly believing in the butter/powder story over cheese/whey.

Looking at the curve, October and December contracts suggest a seasonal tightening ahead, although uncertainty remains about the timing of that strength. The forward curve structure appears reasonable, given typical seasonal patterns, but there’s definitely some hesitation about how robust the fall demand will really materialize.

Critical Watch Points – What Keeps Me Up at Night

Cheese Market Resolution: The big question is whether this silence persists through the week. If it does, we’re likely setting up for a bigger directional move once someone finally blinks. These standoffs don’t usually last forever.

Butter Support Test: Prices need to hold above $2.40 to maintain confidence. Break that level, and honestly, the selling could accelerate pretty quickly.

Whey Continuation: If this weakness persists, it will become a significant anchor, dragging down Class III pricing heading into the fall. That’s not what producers want to hear right about now.

Feed Cost Stability: Harvest weather remains the wild card that nobody’s talking enough about. Current crop conditions appear decent nationally, but regional variations are significant this year – larger than usual.

Market Sentiment Indicators

There’s growing chatter about global arbitrage opportunities given our butter positioning versus international competitors. Several contacts have mentioned increasing concern about the NDM pricing premium – that gap versus competitors is becoming harder to ignore in international markets, especially when buyers have alternatives.

Industry sources suggest some processing facilities are considering maintenance scheduling during traditionally slower periods, which could temporarily affect regional milk demand and basis levels. Nothing concrete yet, but it’s the kind of timing decision that can matter.

The What to Do: Actionable Strategies for Your Operation

Immediate Actions – This Week

Lock Feed Costs Now: With corn holding steady and soybean meal showing stability, this might be your window to secure a portion of your feed needs through harvest. Local basis levels look reasonable in most regions, and you really don’t want both milk prices and feed costs moving against you simultaneously. Trust me on this one.

Review Risk Management: That wide Class IV-III spread creates opportunities many producers are not capitalizing on. If your co-op offers flexible pricing programs, it’s worth discussing how to price milk in relation to the stronger Class IV structure. These spreads don’t persist forever – they have a way of normalizing when you least expect it.

Near-Term Hedging Considerations

Downside Protection: With fourth-quarter futures still above $18.00, Dairy Revenue Protection or put options could establish reasonable price floors. Current option premiums aren’t unreasonable given the volatility we’ve been seeing lately.

Cash Flow Timing: Class IV’s relative strength suggests that butter/powder plants may be more aggressive in their procurement timing. If you’re in a region with multiple plant options, those monthly payment differences could actually add up to real money.

Operational Focus Areas – What You Can Control

Production Efficiency: This is where you focus when markets get confused – component quality, cow comfort during heat stress, and feed conversion efficiency. Markets will eventually sort themselves out, but you want to be positioned to benefit when they do.

Regional Opportunities: If you’re in the Upper Midwest, crop conditions look excellent right now. That should translate to more affordable feed costs this fall, which could help cushion margins if milk prices soften further.

Risk Scenarios – Thinking Through What-Ifs

Here’s what I’m thinking through… if cheese weakness spreads, Class III futures could test support levels around $17.00. Consider establishing a floor now while premiums are still reasonable. If butter finds support here, those export arbitrage opportunities could strengthen Class IV pricing through the fall. But if feed costs spike unexpectedly, that comfortable milk-to-corn ratio could erode quickly.

Regional Intelligence: What’s Happening Where It Matters

Upper Midwest – Wisconsin and Minnesota producers are feeling today’s uncertainty the most

Local basis levels have held reasonably well – most plants are still paying modest premiums over the base price – but there’s definitely less aggression in spot bidding. Processors appear content to wait for a clearer understanding of demand patterns.

The silver lining? Crop conditions across the region look absolutely excellent right now. Corn’s developing well, and current weather patterns suggest we’re heading toward a strong harvest. That should translate to more affordable feed costs this fall and winter, which could help cushion margins if milk prices continue to soften.

Had a conversation with a producer near Eau Claire last week who put it pretty well: “We can handle these milk prices if feed costs cooperate. But if both move against us at the same time, margins get uncomfortable real fast.”

Southwest – Heat and Feed Cost Pressures

Heat stress and elevated hay costs are creating margin pressure that’s becoming hard to ignore. Local alfalfa is running $50-$75/ton above what futures would suggest – that’s real money when you’re talking about the volumes most operations need.

The drought conditions in some areas aren’t helping matters. Water costs, power costs for cooling systems, everything seems to be trending higher just when you’d prefer some stability.

West Coast – Export Potential vs. Logistics Reality

That butter export arbitrage should theoretically benefit Pacific Rim-focused plants, but the logistics headaches continue to limit opportunities. Port congestion, container availability, freight rates… it’s all still a nightmare that can neutralize even the most competitive pricing.

Still, some plants are finding ways to make it work. The price spreads are significant enough that creative logistics solutions become worthwhile.

The Real Bottom Line

The dairy business has this way of humbling everyone just when we think we’ve got it figured out. Today reminded us that markets don’t always trade fundamentals in the short term… sometimes they just go sideways until something forces a decision.

What’s the key takeaway here? Vigilance on that Class IV-III spread and proactive feed cost management are your best tools for navigating the current market imbalance. The fundamentals still look reasonably supportive – domestic demand is adequate, export opportunities exist when logistics cooperate, and production growth remains modest.

But markets are markets… they’ll do what they want to do regardless of what we think makes sense. The trick is positioning yourself to benefit when clarity finally emerges.

Stay flexible out there. Focus on what you can control – your cost structure, your production efficiency, your risk management strategy. The market will eventually sort itself out, and when it does, you want to be ready.

Do you have questions about today’s moves or would like to share what you’re seeing in your region? The conversation continues in our producer forums. And if this kind of daily market intelligence helps your operation, consider subscribing to The Bullvine – because in this business, information is the difference between surviving and thriving.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Navigating Dairy’s Perfect Storm: 7 Risk Management Moves That Actually Work – This article provides specific, tactical risk management strategies you can implement now. It demonstrates practical methods for building a resilient operation capable of withstanding the kind of market volatility highlighted in our daily report, moving from analysis to action.

- The Future of Dairy: Top 10 Trends That Will Redefine the Industry – To complement the daily market view, this piece zooms out to the strategic level. It reveals the top ten long-term trends, from consumer behavior to global economics, that will ultimately drive the market direction discussed in our report.

- The Robots Are Here: How Automation is Reshaping the Modern Dairy – This forward-looking piece explores how investments in automation and robotics can address labor challenges and boost efficiency. It shows how technology can provide a long-term, structural buffer against the daily price swings and margin pressures we analyze.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.