Butter just crashed below cheese, CME froze up, and the global dairy market is rewriting every play farmers thought they knew. Is your operation ready for the new normal?

Executive Summary: Butter just sank below cheese, CME trades froze, and global dairy pricing rules are being rewritten in real time. What’s fascinating is how quickly protein has stolen butterfat’s thunder—today’s mailbox check is won or lost on what your cows put in the vat, not just how many pounds fill the tank. The flood of new U.S. processing plants won’t rescue margins if exports stall, especially with Europe and New Zealand cranking out more milk to chase slow demand. Input costs might be finally easing, but so are milk prices—so efficiency, not expansion, is the edge that matters most right now. It’s a moment that rewards the bold: managing risk, tweaking diets, and staying lean on labor can make all the difference. Everyone’s watching and waiting, but real leaders will act before they’re forced. The bottom line? In the 2025 milk market, the fastest to adapt will stand to gain, while those standing still will already be behind.

Let’s be honest: what happened last week on the CME was unlike anything we’ve seen since the pandemic. On October 8, not a single contract changed hands—no spot cheese, no butter, no nonfat dry milk, nothing at all. That’s more than a rare occurrence; it’s a signal that uncertainty and risk are now running the show in dairy’s major pricing arena.

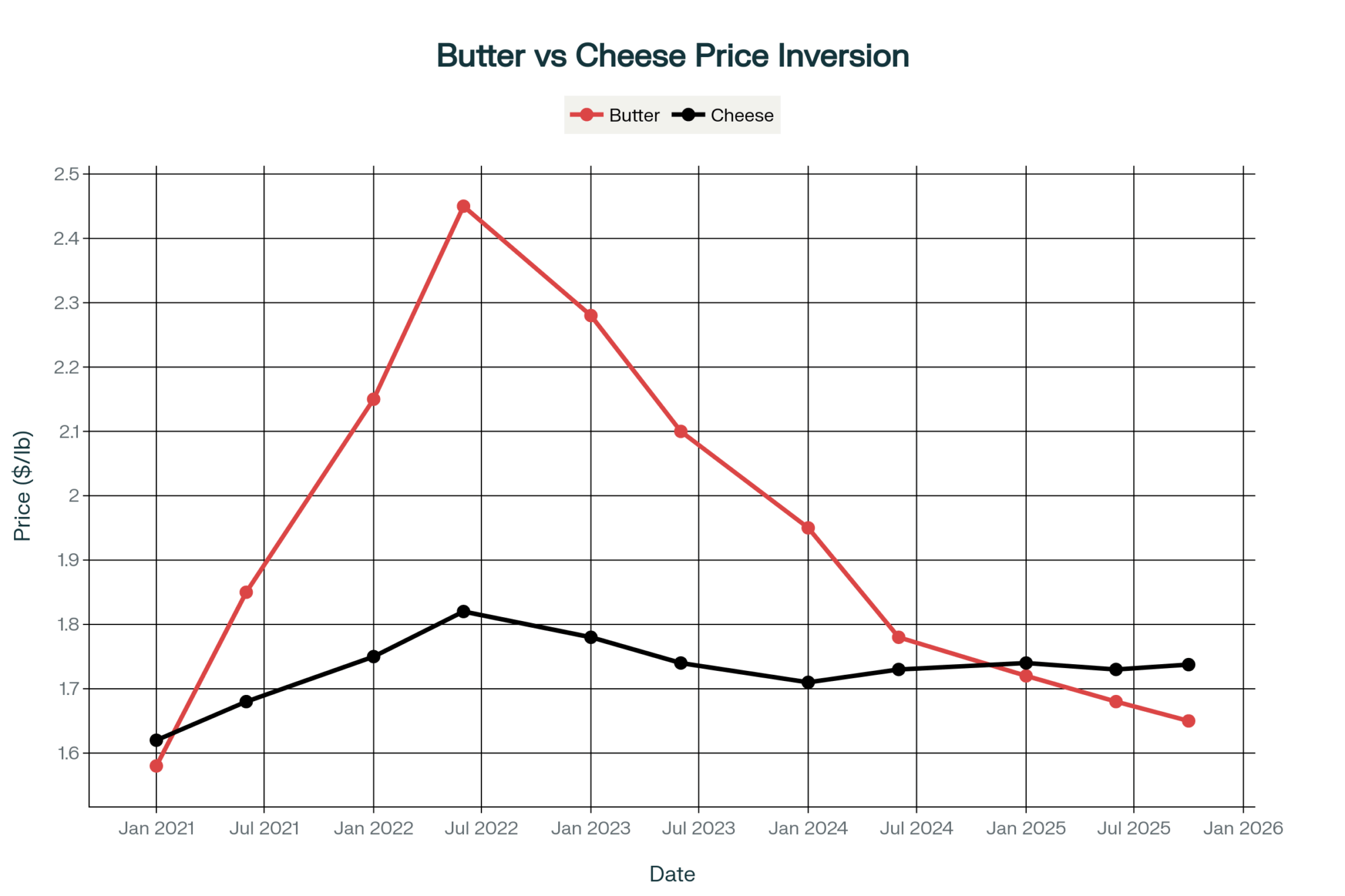

What’s interesting here is that when the market goes silent, it’s usually not confidence—it’s confusion. Butter actually dipped to $1.65/lb, while cheese held at $1.7375/lb. When’s the last time butter traded below cheese? You’d have to dig back to 2021 or early 2022 to find that particular inversion, and the implications for milk pricing—especially for anyone playing the class and component game—are immediate and sweeping.

The GDT Auction: Reading the Global Thermometer

Looking at the numbers from Global Dairy Trade’s TE389 auction (October 7), you get a sense of just how widespread the turbulence is. Here’s a breakdown, with direct source attribution to the GDT/USDA for verification:

| Product | Price Change (%) | Winning Price (US$/tonne) |

| Whole Milk Powder (WMP) | -2.3% | $3,696 |

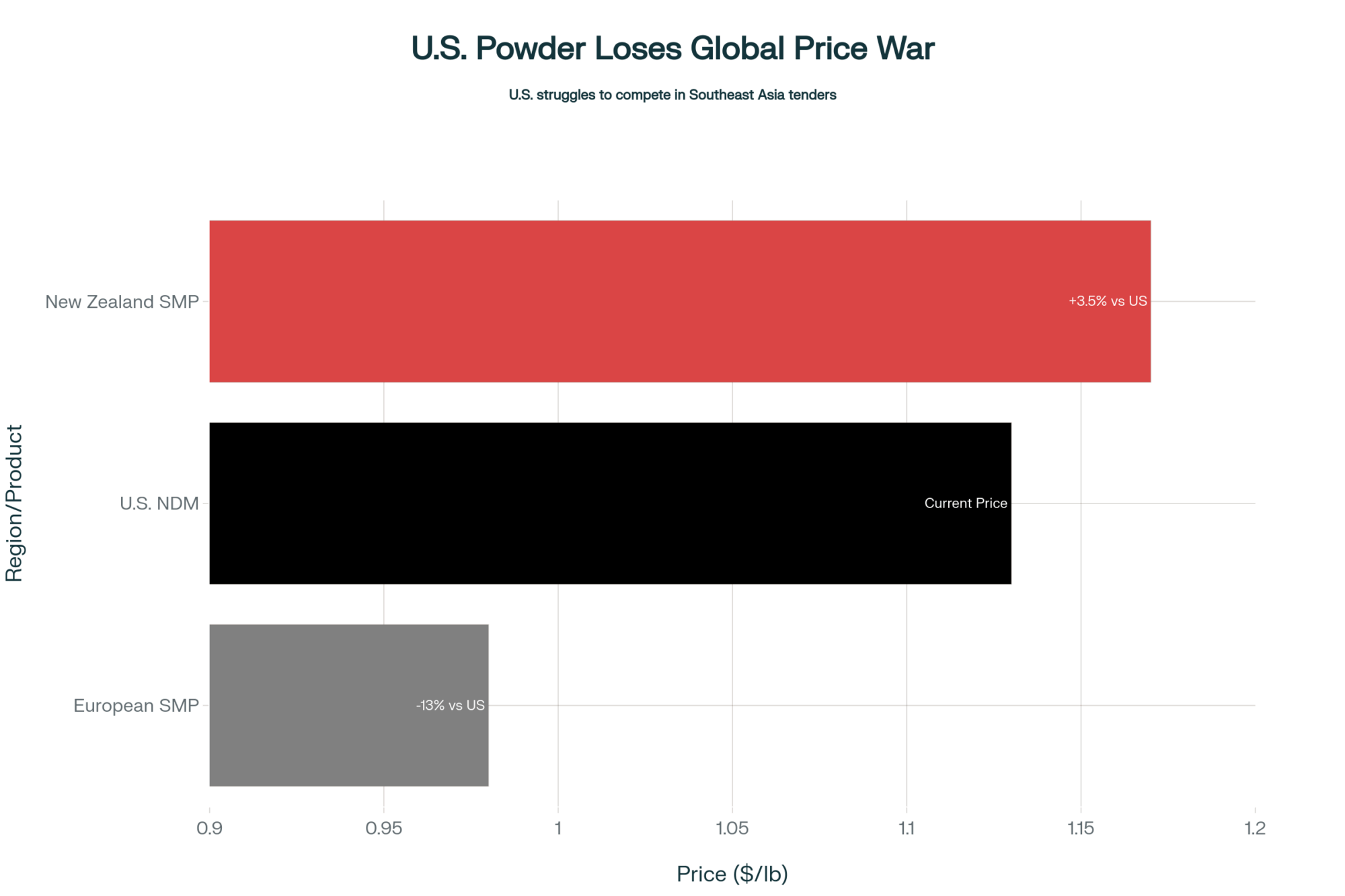

| Skim Milk Powder (SMP) | -0.5% | $2,599 |

| Anhydrous Milk Fat (AMF) | +1.2% | $6,916 |

| Butter | -3.0% | $6,712 |

| Cheddar | +0.8% | $4,858 |

| Mozzarella | -11.8% | $3,393 |

| Buttermilk Powder (BMP) | -2.3% | $2,768 |

The standout? Mozzarella got hammered, losing 11.8%, while AMF eked out a rare gain. What’s worth pausing on here is that Fonterra’s SMP maintains a premium of $105/tonne over the top European competitors—a spread that’s both unusual and unsustainable long-term. Buyers and sellers alike are weighing whether New Zealand is overpriced or if Europe’s downward spiral is a bigger issue.

Europe in the Red: Pressure on Every Front

European dairy prices have been bleeding for months, but the latest quotes make that trend painfully clear. Citing data verified via the EEX and the EU’s weekly surveys:

| Commodity | Weekly Change (%) | Current Spot (€ per tonne) | Year-over-Year (%) |

| Butter | -1.5% | €5,533 | -29.6% |

| SMP | -0.5% | €2,159 | -14.9% |

| WMP | -1.8% | €3,740 | -13.8% |

| Whey | +0.6% | €890 | +0.6% |

| Young Gouda | -2.4% | €3,115 | -36.1% |

What I’ve noticed over the years is that when European butter prices move this sharply, they tend to drag global fat values along with them. The decrease of €2,329 per tonne on butter this year is severe even for volatile markets, and SMP’s year-on-year losses are hardly better. For producers exporting into—or competing with—the EU, these are tough numbers.

The U.S. Spotlight: Processing Boom Meets Margin Squeeze

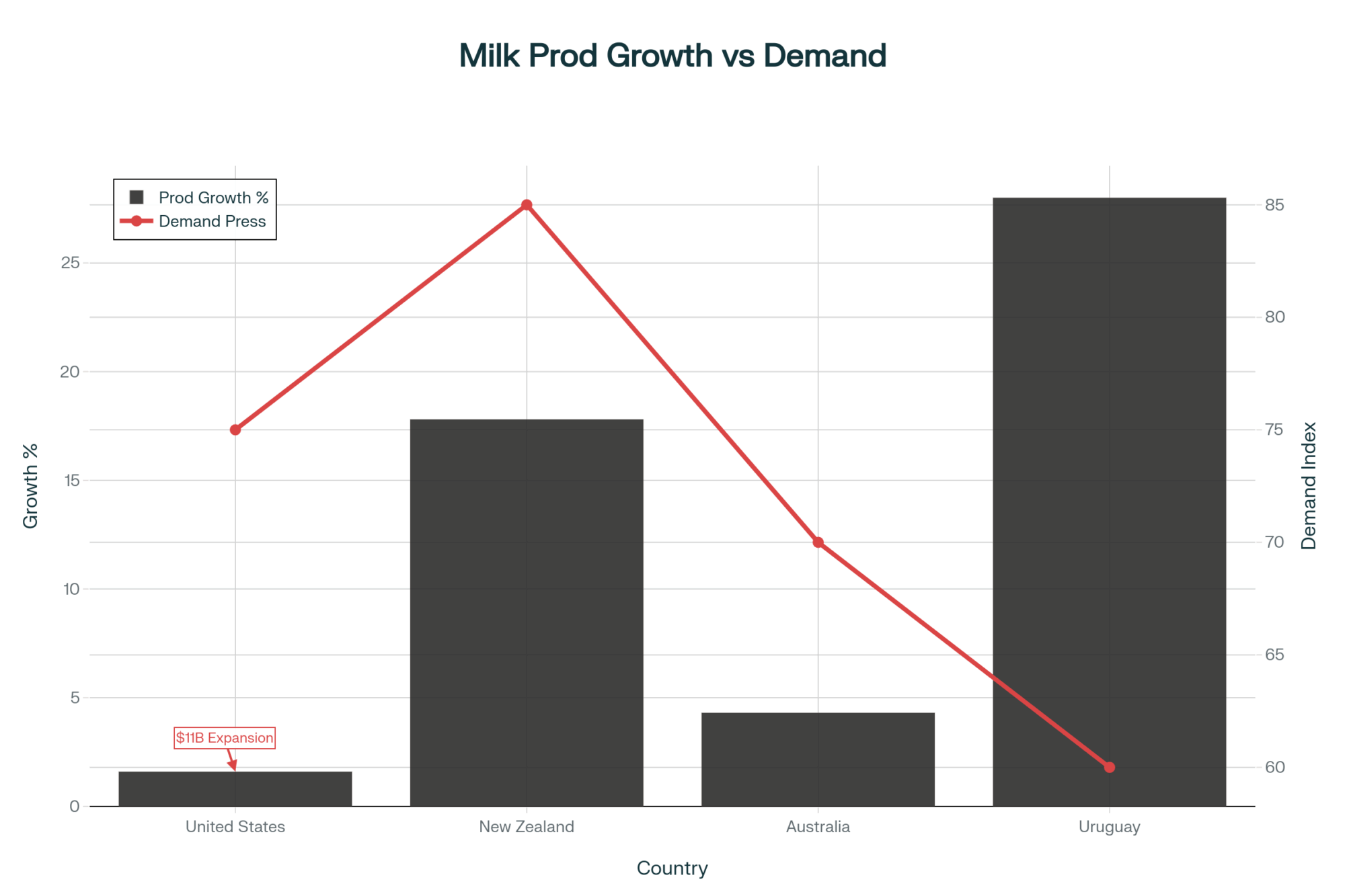

You want to talk about structural shifts? U.S. dairy is investing $11 billion in processing expansion across 50 new and expanded plants in 19 states through 2028, as verified by IDFA and federal development filings. This is happening due to two factors: persistent bottlenecks in cheese and powder production, and a rush to capture more global value as domestic consumption levels off.

But here’s the catch: bigger processing doesn’t necessarily mean bigger margins. As hundreds of millions of new pounds of milk are processed through cheesemakers in states like Texas, South Dakota, and New York, pricing pressure grows—not just due to feed, labor, or weather, but also from global market fluctuations and export volatility. I’ve had processors tell me flat out: “Volume can cannibalize value unless exports hold up.” They’re not wrong.

Component Pricing Clarity: Where’s the Money Now?

Here’s where the new component math really bites. With butter spot at $1.65 and cheese at $1.7375, current theoretical values work out as follows using the USDA Federal Milk Marketing Order Class III and Class IV formula calculations for the week ending October 10, 2025:

- Butterfat: Approx. $2.19/lb

- Protein: Approx. $2.71/lb

For years, protein was the underdog, and butterfat was king. Now? We’re in a market where protein drives the milk check and butterfat takes a back seat. What’s remarkable is how quickly this change came about—a swing like this would have looked improbable just last fall.

What does this mean practically? If you’re near the break-even point, even a small shift in herd average protein—from, say, 3.05% up to 3.12%—could change your bank balance more than anything you do on butterfat. That’s especially true with Class III at $17.19/cwt and Class IV at $14.60/cwt; protein premiums are back in charge, at least for now.

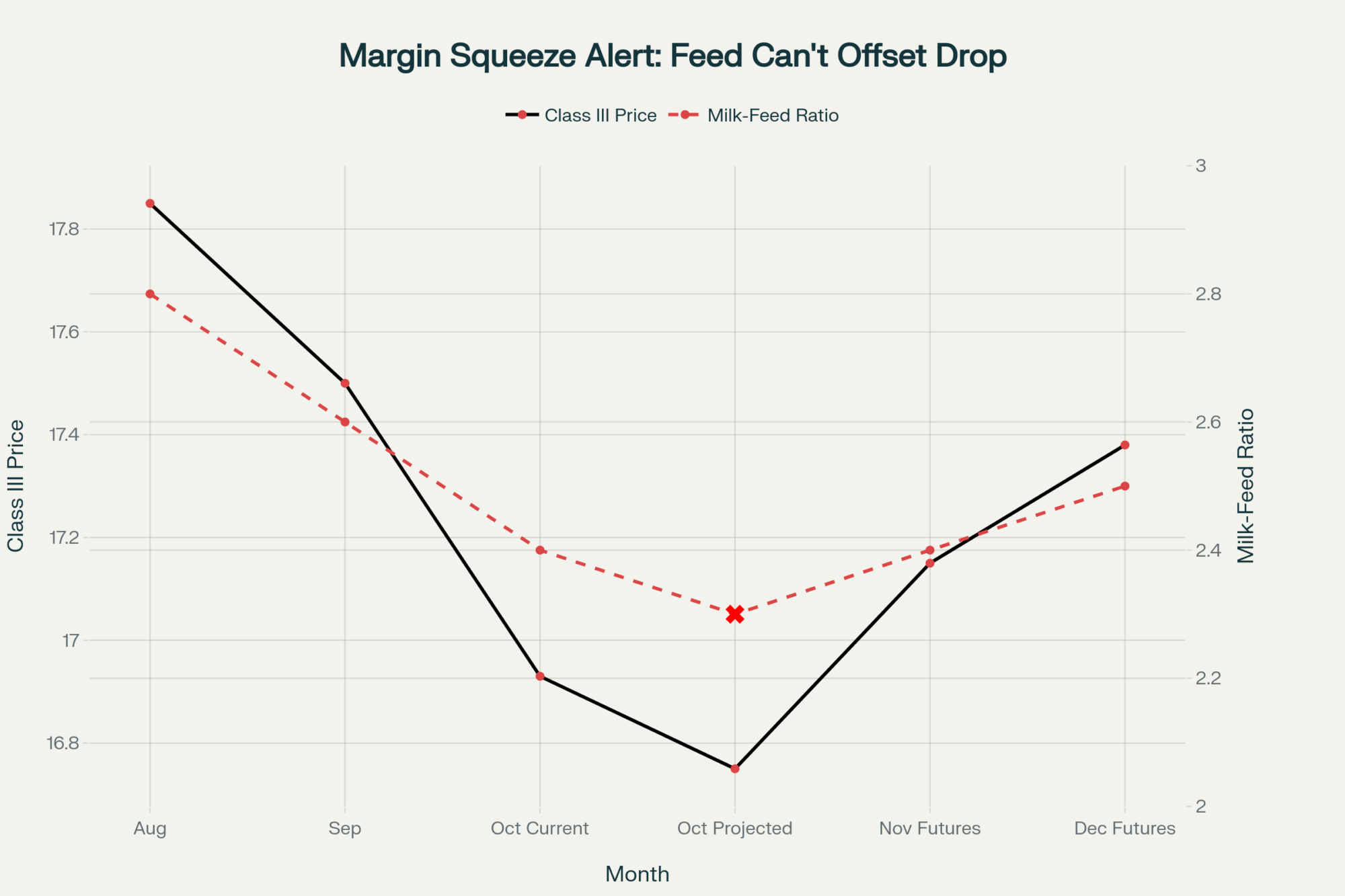

Feed Costs, Herds and Margins: The Reality on the Ground

Now, feed costs are down this fall—corn’s at about $4.13 and soy meal around $275. However, here’s the paradox: margins didn’t exactly return to their original levels. I’ve spoken to several producers who saw input costs ease by 10-15%, but lost even more due to falling milk prices. In this kind of margin environment, efficiency beats expansion. Producers rocking 15–25% better feed efficiency—usually those leveraging precision diets and sharp dry lot management—are far outperforming neighbors still running by last year’s playbook.

It’s also worth noting that with replacement heifer numbers at a multi-decade low, aggressive culling isn’t just a cost control—it’s a competitive advantage. Keep your best cows fresh, don’t hang on to underperformers, and watch the butterfat-protein balance in your breeding goals.

Global Forces: More Milk, More Competition

Let’s talk about the milk waves. The U.S. added another 114,000 cows year-over-year, now at 9.45 million, and lifted production 1.6% in May. Irish and Belgian farmers both reported strong late-summer surges, with Ireland’s August total increasing by 6.8% and Belgium’s by 3.6%.

But what’s striking is the pressure coming from Oceania. New Zealand kicked off its new season with a 17.8% production bump, and Australia pumped up August exports by 4.3% despite back-to-back years of drought. All this is happening while China’s local output and cow numbers are stabilizing or even declining slightly, which complicates demand-side optimism.

Even in South America, Uruguay’s dairy exports are capturing new market share, increasing by 28% in September alone. The takeaway? The competition for export slots—especially for cheese and powders—is intensifying by the month. The world doesn’t need surplus milk from every region at once, especially when consumer demand in places like China remains tepid.

If You’re Milking Cows, Three Moves You Should Consider

Looking at these numbers, what stands out is that there’s no single “right” answer for every farm. But the directional signals are clear:

- Actively Manage Risk: If you can lock in Class III or IV futures at a profit, don’t wait. The market could tighten, but it’s far more likely we stay volatile, and margin squeezes hurt more than missing a few cents.

- Feed for Components, Not Just Volume: It’s a fresh-cow-to-dry-cow world now. Precision feeding, component-oriented breeding, and tighter culling have real paybacks.

- Watch the Processing and Export Play: Growth in U.S. processing capacity is a double-edged sword—great for local demand, tough for global price stability. Farms able to pivot into value-added or more reliable regional supply chains (think specialty cheeses, A2 products, grass-fed claims) may find less risk, more reward.

So, Where Are We Headed?

This past week’s trading freeze isn’t just a blip. It’s a signal that nobody at the big end of the market is sure what’s next. Butter’s below cheese. Protein is paying. The U.S. is betting big on processing, but the world’s awash in milk, and margins are one bad export report from falling through the floor.

However, here’s my perspective, after decades in this space: challenge breeds innovation. The producers who stay nimble, watch the fundamentals, and act decisively on both feed and marketing will come out ahead. It’s not about surviving the tidal wave, it’s about learning how to surf it.

Suppose you’re looking for further reading and validation. In that case, I encourage you to dig into the latest weekly USDA Dairy Market News, spot market details at the CME, EEX, and GDT auction reports, IDFA and federal investment data, and regional herd and feed guidance from your local extension or university resource.

After decades in dairy, I’ve learned: hope can’t milk cows or balance the books. The market’s rewrite is a chance to step up. Those who adapt—fast—will turn volatility into advantage. Those who wait will watch margins vanish.

Key Takeaways:

- Butter dropped below cheese—for the first time in years. Big warning for milk pricing ahead.

- Not a single dairy futures trade at CME; uncertainty just went off the charts.

- Protein now rules the milk check—if you haven’t shifted your herd’s diet, you’re losing dollars.

- U.S. plants are expanding, but global competition and weak demand are causing margins to shrink rapidly.

- Feed your best cows smarter; efficiency now beats herd size every time when profits are tight.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Spring Pasture Powerplay: Balancing Grazing Efficiency with Milk Component Goals – This tactical guide reveals immediate, on-farm methods like using Rumen-Protected Amino Acids (RPAAs) and strategic buffer feeding to optimize milk protein and butterfat. It provides actionable component feeding adjustments and rotational grazing strategies to capture efficiency gains and stabilize rumen health, ensuring your herd can meet the new protein demand.

- Global Dairy Market Dynamics: Navigating Volatility and Strategic Opportunities in 2025 – Extend your strategic understanding beyond the CME freeze with a deep dive into global market drivers. This analysis identifies major trends—from European oversupply and shifting policy to logistics normalization—and emphasizes the data-driven KPIs (like Feed Conversion Ratio) producers must track to maintain competitiveness amid sustained international volatility.

- Your Feed Room’s Hidden $58400 Leak – And How Smart Dairy Farms Are Plugging It – To directly achieve the 15-25% efficiency gains discussed in the main article, this report quantifies the financial risk of feed shrink. It demonstrates how precision feeding technology and real-time tracking can plug losses worth up to $58,400 annually for a 100-cow dairy, turning input cost control into a major profit center.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!