At 4 liters, calves kick in pain. Collars miss lameness 23 days early. The wrong beef sire erases your premium. The December 2025 Journal of Dairy Science has the proof—and the fix.

You know how it goes. You settle into a protocol that works, run it for years, and then someone publishes research that makes you question everything. That’s where we are right now.

The December 2025 Journal of Dairy Science published a collection of studies that should make many of us rethink practices we’ve taken for granted. Colostrum volumes. Lameness detection timing. Beef-on-dairy sire selection. Methane genetics. And here’s what’s interesting—these aren’t separate issues anymore. They’re interconnected pieces of an economic puzzle that either fits together or costs you.

Let me walk you through seven findings that carry genuine financial weight.

1. We’ve Been Overfeeding Colostrum—And the Science Finally Proves It

Here’s something that goes against what many of us learned: that “more is better” approach to first-feeding colostrum? The data suggests we’ve pushed past the point of diminishing returns.

Frederick and colleagues at the University of Guelph published their findings in the Journal of Dairy Science, tracking 88 Holstein heifer calves fed colostrum at 6%, 8%, 10%, or 12% of birth body weight. The apparent absorption efficiency of immunoglobulin G peaked in the 6-8% range—calves fed 8% of body weight reached 24-hour serum IgG concentrations of 37.4 g/L. Push to 12%, and you only reach 43.4 g/L despite feeding 50% more volume.

You’d expect a straight line up. That’s not what happened.

What the researchers documented next matters more than the absorption numbers, honestly. Calves in the 10% and 12% groups showed behavioral distress—specifically, kicking behavior indicating gastrointestinal discomfort. The 10% group recorded 21 total kicks; the 12% group had 40. None in the 6-8% groups. That’s not a subtle signal.

For a 40 kg Holstein calf, 8% body weight works out to 3.2 liters maximum in that first feeding. Push beyond that, and you’re overwhelming the gut’s pinocytosis capacity. The excess antibodies pass through unabsorbed, while the calf shows signs of colic.

I’ve heard from producers who discovered they’d been feeding 4 liters at the first meal for years. The common thread when they switched to 3.2 liters was first feeding with a second feeding at 8 hours? Calf behavior improved noticeably.

The protocol adjustment is straightforward: Weigh the calf. Calculate 8% of body weight. If your colostrum program calls for larger total volumes, split them into smaller volumes. This respects the biology of absorption without sacrificing total IgG delivery.

Now, here’s some important context. Sandra Godden, DVM, at the University of Minnesota, has done foundational work establishing that adequate colostrum volume matters—her research helped move the industry away from underfeeding. Her guidance of feeding up to 10% body weight was a significant advance. What Frederick’s newer research adds is refinement at the upper boundary: the 8% target may be the sweet spot for both absorption efficiency and calf comfort.

Worth noting for those in colder regions: operations with extended birth-to-feeding intervals may need to adjust their timing accordingly. Wisconsin Extension notes that colostrum production tends to slump in fall months, so banking high-quality colostrum from multiparous cows during the peak season makes sense.

And here’s what still matters most—colostrum quality trumps volume every time. A Brix refractometer runs $150-300 and pays for itself the first time it catches a low-quality batch.

2. The Cellular Reality Behind Chronic Lameness—And Why It Keeps Coming Back

This one gets into the cellular level, and frankly, it explains something that’s frustrated a lot of us—why lameness keeps coming back in certain animals, no matter what we do with footbaths and hoof trimming.

Wilson and colleagues at the University of Nottingham published work in the December Journal of Dairy Science examining collagen composition in the digital cushions of 54 cull dairy cows. The finding that jumped out: Animals with lifetime histories of hoof horn lesions had significantly lower Type I collagen proportions.

So why does that matter for your bottom line? Type III collagen is essentially scar tissue. It lacks the tensile strength of Type I, which is necessary for proper shock absorption. When a cow’s digital cushion shifts toward Type III dominance, she’s walking on a compromised foundation—creating a vicious cycle in which each lameness event further degrades the cushion structure.

Here’s where the numbers get uncomfortable. Robcis and colleagues calculated lameness costs at approximately €307.50 per case (roughly $330-340 USD) through comprehensive bioeconomic modeling of 880 farm scenarios, published in the Journal of Dairy Science in 2023. One of their key conclusions: prevention dramatically outperforms treatment in delivering financial returns. That’s probably not surprising to anyone who’s dealt with chronic lameness cases, but having the economic modeling to back it up helps.

The detection gap is what really gets me. Research consistently shows that automated systems significantly outperform human observation for catching lameness early. Farmers typically detect only about one-third of lame cows identified by researchers using standardized scoring—and that’s not a criticism, that’s just the reality of trying to catch subtle gait changes during a busy day. CattleEye’s AI-powered system, now owned by GEA, can detect mobility changes up to 23 days before human detection. That’s more than three weeks of intervention opportunity we’re currently missing.

And here’s something worth thinking about: activity-based monitoring systems measure quantity of movement, not quality. A cow can maintain her step count while fundamentally changing how she distributes weight. By the time activity actually drops enough to trigger an alert, you’ve usually missed the optimal intervention window.

The question to ask any monitoring technology vendor: “What specific behavioral change does your system detect, and at what stage of disease progression does that change become measurable?”

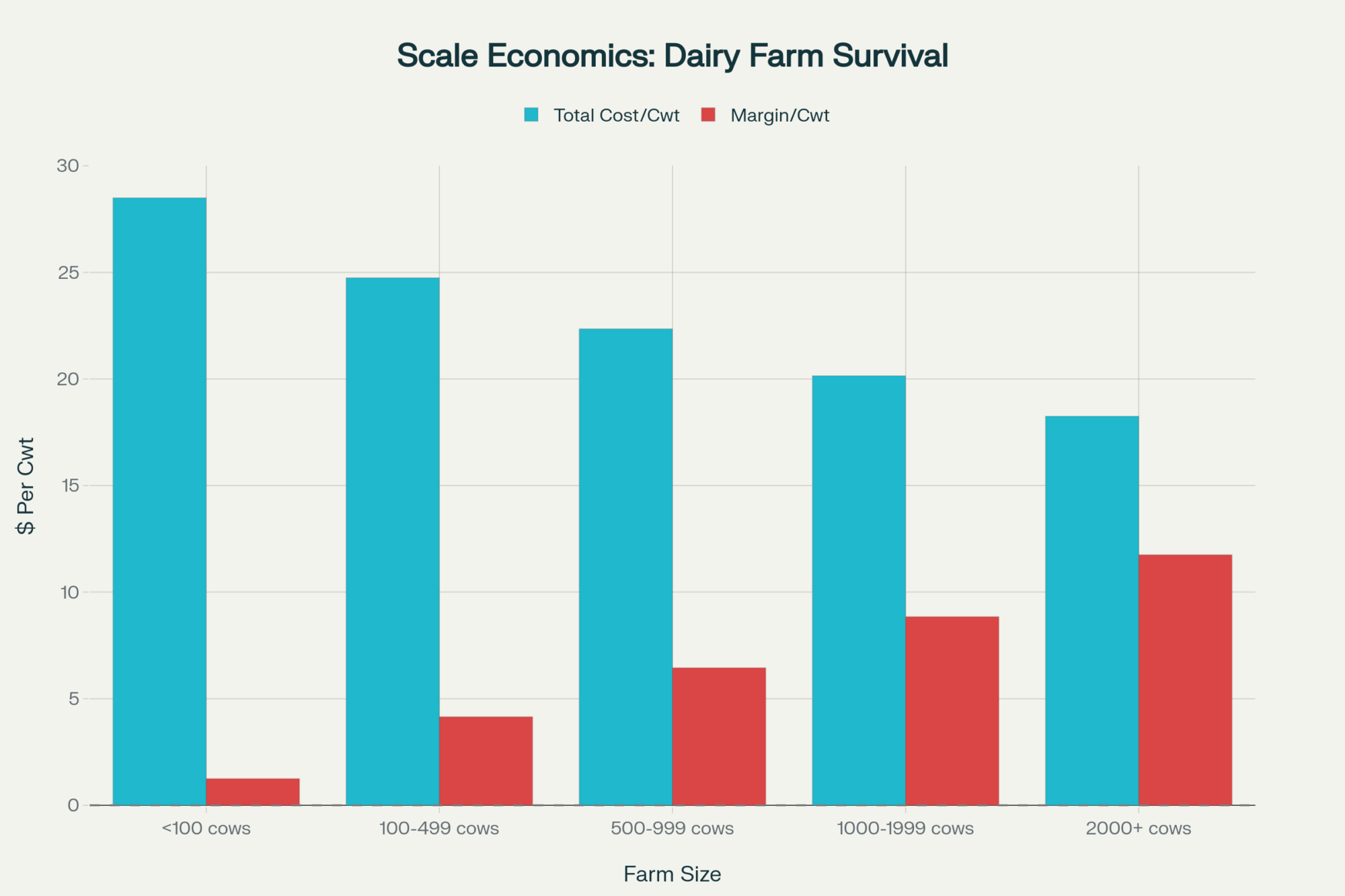

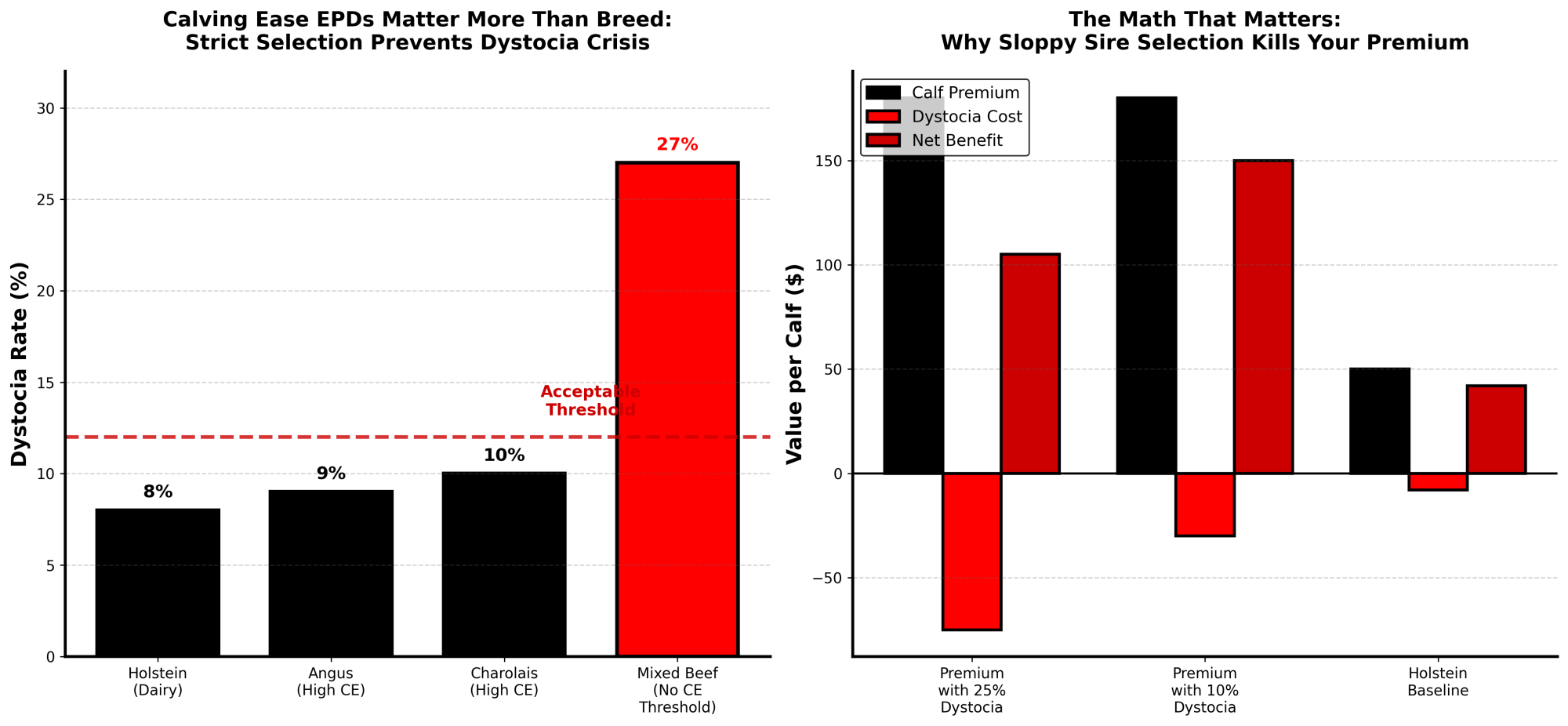

3. Beef-on-Dairy Economics: Where the Real Money Gets Made or Lost

I’ve noticed that beef-on-dairy conversations tend to focus almost exclusively on the calf premium while glossing over what happens at the calving pen. The honest answer is more conditional than either the “always profitable” or “too risky” camps suggest.

A December 2025 Journal of Dairy Science study analyzed 231,000 calving ease records from first-lactation Holstein and Jersey cows inseminated with Angus, Charolais, or Simmental semen, plus 1.2 million records across the first three lactations. What the genetic analysis revealed is that dystocia outcomes depend heavily on sire selection—not just breed, but the calving ease genetics within that breed.

And here’s what’s encouraging: Research from Penn State and the University of Kentucky found that when producers select beef sires with favorable calving ease indices for mature dairy cows—not heifers, cows—dystocia rates showed no significant increase compared to dairy semen. As Tara Felix, Associate Professor of Animal Science at Penn State, noted in her research summary, “Our results suggest that current beef-dairy sire selection parameters in the United States are not negatively affecting the dairy cow.”

But you can’t just grab any beef semen and expect good results. I’ve heard versions of this story from producers across the Midwest—early adopters who chased maximum premiums without paying close attention to calving ease scores, then watched their heifer dystocia rates climb toward 25-30%. The common thread in the operations that turned it around: switching to strict CE requirements and limiting beef breedings to mature cows made the program profitable. “We got greedy on the calf side and forgot about the cow side” is how one producer put it.

Beef-on-Dairy Conditional Framework

The program generally works if you:

- Select beef sires with documented calving ease EPDs—don’t just use whatever semen is cheapest

- Limit beef-cross breeding to mature cows or heifers you’re confident can handle the calf

- Actually monitor your dystocia rates and adjust breed selection if they start climbing

Angus and Hereford with strong CE scores? The economics generally work. Charolais or Belgian Blue without careful selection? That premium can evaporate fast.

4. Methane Genetics: More Tractable Than Most of Us Assumed

There’s been considerable hand-wringing about methane emissions in cattle—you’ve probably seen the headlines. But the genetics work emerging from Canada, Ireland, and New Zealand suggests we have more selection leverage than many assumed. And here’s the part that matters most: it doesn’t require sacrificing production.

Semex UK, working with Lactanet and the University of Guelph, analyzed over 700,000 milk mid-infrared spectroscopy records. The finding that matters most for practical selection decisions: Methane efficiency traits show heritability of approximately 23%—comparable to production traits and dramatically higher than fertility or health traits, which typically run 3-8%.

That heritability number caught my attention. Semex projects that a 20-30% reduction in methane by 2050 is achievable through genetic selection, depending on selection intensity.

The timeline to meaningful herd-level impact looks something like:

- Generation 1 (2 years): 3-4% reduction in daughters’ methane output

- Generation 3 (6-8 years): 10-12% cumulative herd reduction

- Long-term potential: 20-30% reduction through genetics alone

Here’s what should reassure production-focused farmers: The genetic correlation between methane efficiency and milk yield is essentially zero. You can select for high production and low emissions simultaneously without compromise. No trade-off required.

In practice, it’s simpler than overhauling your breeding program. Keep selecting for your primary profit drivers—fat, protein, NM$, health traits. Use Methane Efficiency as a tie-breaker. If two bulls look equivalent on everything that matters to your bottom line today, pick the one with the better Methane Efficiency score. You get the same profitable cow while quietly stripping carbon footprint from your herd with every generation.

International programs are moving fast on this. New Zealand—where pasture-based systems make feed additives impractical at scale—is pursuing genetics as a primary pathway, with their major AI companies developing methane indices for widespread use.

5. Evaluating Methane Feed Additives: The Questions That Actually Matter

The methane-reduction market is flooded with products right now. Some deliver genuine results; many don’t. What I’ve found is that the difference often comes down to asking the right questions before signing purchase orders.

Four Questions Before You Buy Any Methane Additive

Print this. Bring it to your next sales meeting.

- “Show me the DMI data alongside the methane data.” If intake dropped proportionally, you might be looking at an expensive appetite suppressant rather than a real mitigation tool.

- “Is this reduction measured in g/day or g/kg DMI?” The answer tells you whether it’s real mitigation or just feed intake depression. Total daily methane can drop simply because the cow eats less—methane yield per kilogram of dry matter intake is what proves the additive actually alters fermentation.

- “How long did the trials run?” Anything under eight weeks should raise some skepticism about persistence. The rumen microbiome adapts constantly—many oils and plant extracts show impressive 15-20% reductions initially, then methanogens figure out a workaround.

- “Where did the hydrogen go?” This one separates people who understand the biology from people reading a script. Blocking methane means blocking hydrogen disposal. That hydrogen has to end up somewhere—ideally in propionate, which the cow uses for energy and milk. If the vendor can’t explain the hydrogen sink, the rumen might just be becoming stressed rather than more efficient.

Here’s a useful way to think about it: the rumen is essentially a fermentation vat that’s been optimizing itself for millions of years. If someone’s going to claim they’ve fundamentally changed how it works, they need to prove the bugs didn’t just figure out a workaround within a few weeks.

6. You’re Already Paying for Methane Data—You Just Might Not Know It

Most operations already collect Mid-Infrared spectral data through DHI testing. That’s how the lab measures fat and protein percentages. What’s becoming clear is that the same spectral signature can predict methane output—and you’re already generating and paying for those samples.

The biological mechanism is elegant: Acetate and butyrate production in the rumen releases hydrogen, which is converted to methane, while propionate production uses hydrogen as a sink. These metabolic pathways leave signatures in milk fatty acid profiles that MIR spectrometry can detect.

High-methane cow? Her rumen’s churning out acetate. Her milk is rich in de novo fatty acids.

Low-methane cow? More hydrogen is going to propionate. Different fatty acid profile in the tank.

What this means on your farm: The Methane Efficiency scores appearing on genetic evaluations are derived largely from this data you’re already generating. The infrastructure exists. The question is whether you’re using it.

Those de novo fatty acid readings, by the way, have value beyond methane prediction. They’re also indicators of rumen health. Too-low de novo percentages can signal rumen acidosis—something worth monitoring in your transition cows regardless of where you stand on carbon footprints.

7. The BLV Connection: What We Know and What We’re Still Learning

Here’s one where I want to be careful about what we claim versus what we’re still figuring out. Some emerging research suggests associations between BLV status in dams and calf health outcomes, including respiratory disease. But the mechanisms remain unclear, and that uncertainty matters for how you respond.

Three potential pathways deserve consideration:

Altered colostrum immunity: BLV-infected dams may produce colostrum with compromised immune components.

Direct immune effects: Calves may experience some disruption of immune function.

Confounded management: High-BLV herds may systematically differ in biosecurity practices, calf housing density, and ventilation—factors that independently affect respiratory disease.

What we know with greater confidence comes from USDA NAHMS survey data and subsequent research: approximately 94% of U.S. dairy herds have at least one BLV-positive cow, with an average within-herd prevalence of approximately 46% (LaDronka et al., 2018). Economic analyses have found that each 10% increase in herd prevalence is associated with rolling herd average losses in the 430-540 pound range, depending on the study methodology.

My honest assessment: Monitor your herd’s BLV status alongside calf health records. If you’re already pursuing BLV reduction for production and longevity reasons—which the accumulating research supports—any potential calf health benefits would be a bonus. But I wouldn’t recommend major program changes based solely on the calf respiratory associations until we better understand what’s driving them.

Read more: The effect of bovine leukemia virus infection on health and growth of nonreplacement dairy calves

Three Things You Can Do This Month

- Pull your de novo fatty acid data from your last few DHI reports. If you’re not already looking at it, start. It’s a free window into rumen health—and eventually methane efficiency—that you’re already paying for.

- Review your beef-on-dairy sire stack. If you haven’t audited calving ease EPDs recently, do it now. Set a minimum threshold and stick to it. The premium isn’t worth much if you’re burning it on dystocia.

- Adjust your colostrum protocol. Cap first feeding at 8% body weight. Split larger volumes into a second feeding at 6-12 hours. And if you don’t have a Brix refractometer yet… well, you know what to add to the supply order.

Research Evaluation Checklist by Decision Type

For Monitoring Technology:

- What biological change does it actually detect?

- At what disease stage does that change become measurable?

- Does early detection enable a cost-effective intervention, or are you just getting bad news faster?

For Feed Additives:

- Is the effect on yield (per kg DMI) or just production (total daily output)?

- How long did the trials run?

- Can the vendor explain the biology, including what happens to displaced hydrogen?

For Genetic Indexes:

- What’s the heritability and reference population size?

- What are the correlations with traits you already prioritize?

- Is this a new selection focus or a tie-breaker within existing goals?

Your experience matters: Does this match what you’re seeing on your operation? If your data differs—particularly on colostrum volumes, lameness detection, or beef-on-dairy outcomes—we want to hear from you. Regional variation is real, and producer feedback improves future coverage. Drop us a line at editorial@thebullvine.com.

Based on the image provided, here is the digitized data converted into a formatted table.

December 2025 JDS Evidence vs. Industry Standard Protocols

| Practice Area | Traditional Protocol (Industry Standard) | Research-Backed Protocol (December 2025 JDS) | Key Impact (Risk/Benefit) |

| Colostrum First Feeding | • 4+ liters • (~10-12% body weight) • Single feeding | • 3.2 liters max • (8% body weight) • Split into 2 feedings | • 40 kicks vs. 0 kicks(signifying pain) • ↓ Colic distress • ↔ IgG absorption 37-43 g/L |

| Lameness Detection Method | • Visual locomotion scoring • 2-3x per week • Activity monitors | • AI gait analysis • Daily automated scoring • 2D camera systems | • 23-day earlier detection • $350 cost savings • ↓ Chronic lameness cycle |

| Beef-on-Dairy Sire Selection | • Any beef breed • Focus on calf premium • No CE threshold | • Strict CE EPD threshold • Breed-agnostic • Mature cows only | • 10% vs 25% dystocia • +$108 net per calf • ↓ Heifer culling |

| Methane Mitigation Strategy | • Feed additives • $100-150/cow/year • Ongoing cost | • Genetic selection • 23% heritability • One time investment | • 20-30% reduction by 2050 • ↔ Milk production • ↑ Market access |

| Methane Cost Impact | • Annual recurring cost • Variable efficacy • Potential DMI reduction | • Permanent improvement • Compounding gains • Zero production trade-off | • Feed additives: **-$0.35/day** • Genetics: Permanent • ↑ Sustainability credentials |

Key Takeaways:

- Cap first-feeding colostrum at 3.2L (8% BW): Frederick et al. (2025) found calves fed 12% showed 40 colic-like kicks vs. zero at 8%—beyond that, you’re causing discomfort without improving immunity

- Detect lameness 23 days earlier with gait analysis: Activity collars measure steps, not weight distribution; AI catches mobility changes in the $50 prevention window, not the $400 treatment stage

- Enforce calving ease thresholds on beef sires: Genetic analysis of 231,000 records confirms CE EPDs—not breed—determine beef-on-dairy profitability; without strict thresholds, dystocia exceeds 25%

- Add methane efficiency to your sire criteria: At 23% heritability with zero milk yield trade-off, it’s a cost-free addition—use it as a tie-breaker between otherwise equivalent bulls

- Review your de novo fatty acid data: MIR spectral analysis in your DHI reports reflects rumen health and methane patterns—actionable insights you’re already generating

Executive Summary:

The December 2025 Journal of Dairy Science delivers peer-reviewed findings that challenge three protocols most operations haven’t questioned in years—and the financial math demands attention. On colostrum: University of Guelph researchers found that calves fed 12% of body weight had 40 colic-like kicking episodes, versus zero at 8%, making 3.2 liters the new evidence-based first-feeding maximum for typical Holstein calves. On lameness detection: AI gait analysis identifies mobility changes 23 days before activity collars or human observation—that 23-day gap is the difference between $50 early intervention and $400+ treatment costs after lesions develop. On beef-on-dairy: analysis of 231,000 calving records shows profitability hinges on calving ease EPDs, not breed; operations with strict CE thresholds report no increase in dystocia, while those ignoring sire selection see rates climb past 25%. Additionally, methane efficiency is now validated at 23% heritability, with no correlation with milk production—a trait that costs nothing to add to your sire selection criteria. Each finding points to the same conclusion: standard practices are underperforming, and the December 2025 JDS provides the data to fix them.

Editor’s Note: The research discussed here comes from peer-reviewed studies in the December 2025 Journal of Dairy Science and related publications. Economic calculations represent illustrative estimates based on published methodologies and national averages—your costs and returns will vary by region, herd size, and management practices. We welcome producer feedback at editorial@thebullvine.com.

Learn More:

- Matching the Feed to the Calf: Birth to 120 Days – Provides a granular, stage-by-stage nutritional protocol to sustain growth rates after the colostrum phase, helping producers reduce pre-weaning morbidity by up to 22% through consistent feeding targets.

- Dairy Wins, Beef Loses: Inside the 18-Month Window Where $1,400 Calves Meet Record Component Premiums – Analyzes the current market economics driving beef-on-dairy profitability, offering strategic advice on how to stack genetic premiums with component optimization for maximum revenue per stall.

- The Hidden Cost of Lameness: Is AI Exposing Dairy’s Biggest Profit Thief? – Delivers a deep dive into the ROI of automated gait analysis, detailing how early detection technology cuts treatment costs by 15-25% while recovering milk yield lost to invisible mobility issues.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!