Every Monday you delay, you pay $17,500. Every month: $75,000. Your dairy’s 24-month survival plan starts with three decisions.

Executive Summary: Your dairy has 24 months of equity left, and the decision you make this month will determine whether you preserve $700,000 or exit with $250,000. This crisis differs from all others—China’s self-sufficiency, $11 billion in U.S. processing overcapacity, and the worst heifer shortage since 1978 have created a structural transformation that milk price recovery won’t solve. The math is clear: farms that act now can cut monthly losses from $25,000 to $8,000 through targeted culling, feed optimization, and strategic repositioning, while those waiting 6 months lose $450,000 in family wealth. Success requires three time-bound decisions: immediate liquidity management (30 days), strategic recovery positioning (90 days), and viability determination (180 days). The projected loss of 5,000 U.S. dairy farms by 2028 won’t be random—it will precisely separate those who recognized time as their scarcest resource from those who waited for markets to save them.

I recently spoke with a producer in central Wisconsin who summed up the current situation perfectly: “Everyone’s watching milk prices, but what’s actually keeping me up at night is whether I have the equity to make it to when prices recover.” You know, with CME Class III futures hovering around /cwt for Q1 2026 and feed costs finally moderating with corn near .24/bu according to USDA’s latest reports, you might think we’d all be breathing easier. But conversations across the dairy belt—from Pennsylvania tie-stalls to Texas freestalls—they’re revealing something different.

Here’s what I’ve found after running through financial scenarios with extension folks and reviewing real farm numbers: a representative 500-cow dairy with 0,000 in equity has about 24 months of runway at current burn rates. And the thing that really caught my attention? The difference between taking action now versus waiting six months could preserve roughly $450,000 in family wealth. That’s not speculation—it’s what the math consistently shows when you model different timing scenarios.

Understanding the Convergence of Market Forces

Having tracked these cycles since the late ’90s, this downturn feels different. It’s not just one thing we can monitor and respond to—we’re seeing multiple structural shifts happening all at once.

Take China. Rabobank’s recent dairy quarterly indicates they’ve reached about 85% milk self-sufficiency, up from 70% five years ago. We’re talking about a fundamental policy shift toward food security, not a temporary market adjustment. When StoneX analysts discuss how that Chinese import growth story—the one that fueled global expansion for over a decade—is essentially done, they’re describing a permanent change in how global dairy works.

Meanwhile, and the timing couldn’t be worse, the U.S. processing sector has committed somewhere between $8 and $ 11 billion in new capacity, according to what IDFA’s been tracking. Projects across nearly 20 states, from new cheese plants in Texas to expanded drying capacity up in the Upper Midwest. These facilities will need roughly 7-8 billion pounds of additional milk annually when fully operational by mid-2026.

But here’s what really concerns me: the availability of replacement heifers. USDA’s latest cattle inventory shows we’re at 4.38 million head—the lowest since 1978. The National Association of Animal Breeders reports beef semen sales to dairy farms hit 7.9 million units in 2024, up 58% from 2020. Conventional dairy semen? Down to 6.7 million units. These aren’t just statistics… they represent breeding decisions that’ll constrain expansion capacity for the next 24-36 months.

You know what’s interesting about this cycle? The moderate feed costs—corn at $4.24/bu and alfalfa at $222/ton—are actually extending the adjustment period. Back in 2009, when corn hit $6-7/bu, we saw rapid culling and supply correction. Today’s manageable feed costs let farms sustain negative margins longer. Sounds beneficial, right? Until you consider that it delays the market from rebalancing.

The Economics of Scale: A Widening Divide

| Metric | Large Farms (2,500+ cows) | Family Farms (500 cows) | The Gap |

|---|---|---|---|

| Production Cost per cwt | $15.50 – $17.50 | $19.00 – $21.00 | $3.50/cwt |

| Labor Productivity | 300 cows/worker | 60 cows/worker | 240 cows/worker |

| Labor Cost Impact | Baseline | +$1.50 – $2.00/cwt | $1.75/cwt |

| Feed Procurement Advantage | 15-25% volume discount | Truckload pricing | $0.50/cwt |

| Capital Cost per Cow | $4,800 – $6,000 | $7,000 – $9,000 | $2,500/cow |

| Transportation Cost | $0.35/cwt (concentrated regions) | Up to $0.53/cwt | $0.18/cwt |

| Total Structural Disadvantage | Baseline | +$3.50/cwt | $3.50/cwt |

The structural cost advantages larger dairies have reached levels that fundamentally change competitive dynamics. Research from Cornell’s ag economics folks and similar extension programs consistently shows that farms with 2,500+ cows achieve production costs of $15.50-17.50/cwt. Meanwhile, 500-cow dairies face costs of $19-21/cwt based on Penn State Extension benchmarking.

And this isn’t about management quality or work ethic—we all work hard. It’s a mathematical reality. Labor productivity data from Michigan State Extension reveal that large farms are achieving ratios exceeding 300 cows per full-time employee through strategic automation and role specialization. Family operations? We’re typically managing 60 cows per worker despite those 70-hour workweeks we all know too well. At prevailing wage rates, that creates a $1.50-2.00/cwt structural disadvantage.

Feed procurement tells a similar story. Farms purchasing railcar volumes access pricing 15-25% below truckload rates—that’s coming from Wisconsin’s dairy profitability analysis. Given that feed accounts for 50-55% of operating costs across multiple university studies, this differential significantly affects competitiveness.

The capital efficiency gap might be the toughest pill to swallow. A 2,500-cow facility requires an investment of about $12-15 million (works out to $4,800-6,000 per cow). A 500-cow operation? That’s $3.5-4.5 million, but $7,000-9,000 per cow. That permanent efficiency differential compounds over time, especially during extended margin pressure like we’re seeing now.

Regional Dynamics: Where Geography Shapes Destiny

Location has become increasingly determinative of dairy viability. Federal Order data reveals growing disparities that we really need to consider carefully.

Pacific Northwest producers—I really feel for these folks—face particularly challenging economics. Milk hauling costs average $0.53/cwt compared to under $0.35/cwt in concentrated production regions. Combined with cooperative assessments and processing distances, a 500-cow dairy in Washington or Oregon starts each month with a $45,000-50,000 disadvantage relative to competitors in more favorable locations.

California presents different but equally significant challenges. Environmental compliance costs producers are reporting range from $35,000 to $40,000 annually—that translates to $0.35-0.40/cwt. During drought years when water allocations drop 50% and you’re buying on the spot market, UC Davis studies indicate additional costs of $0.30-0.50/cwt.

Now contrast that with the Texas Panhandle, which has emerged as this processing hub. Industry estimates suggest the Amarillo region handles over 1,000 milk tanker loads daily within a 300-mile radius. With five major facilities operational by 2026, competitive procurement dynamics actually support local prices while other regions experience discounts.

Southeast producers navigate their own unique challenges—humidity-driven mastitis pressure and heat-stress management costs Northern operations avoid. Yet proximity to metros such as Atlanta and Charlotte creates premium market opportunities that can offset some of the structural disadvantages for entrepreneurial farms.

The Beef-on-Dairy Calculation: Opportunity and Risk

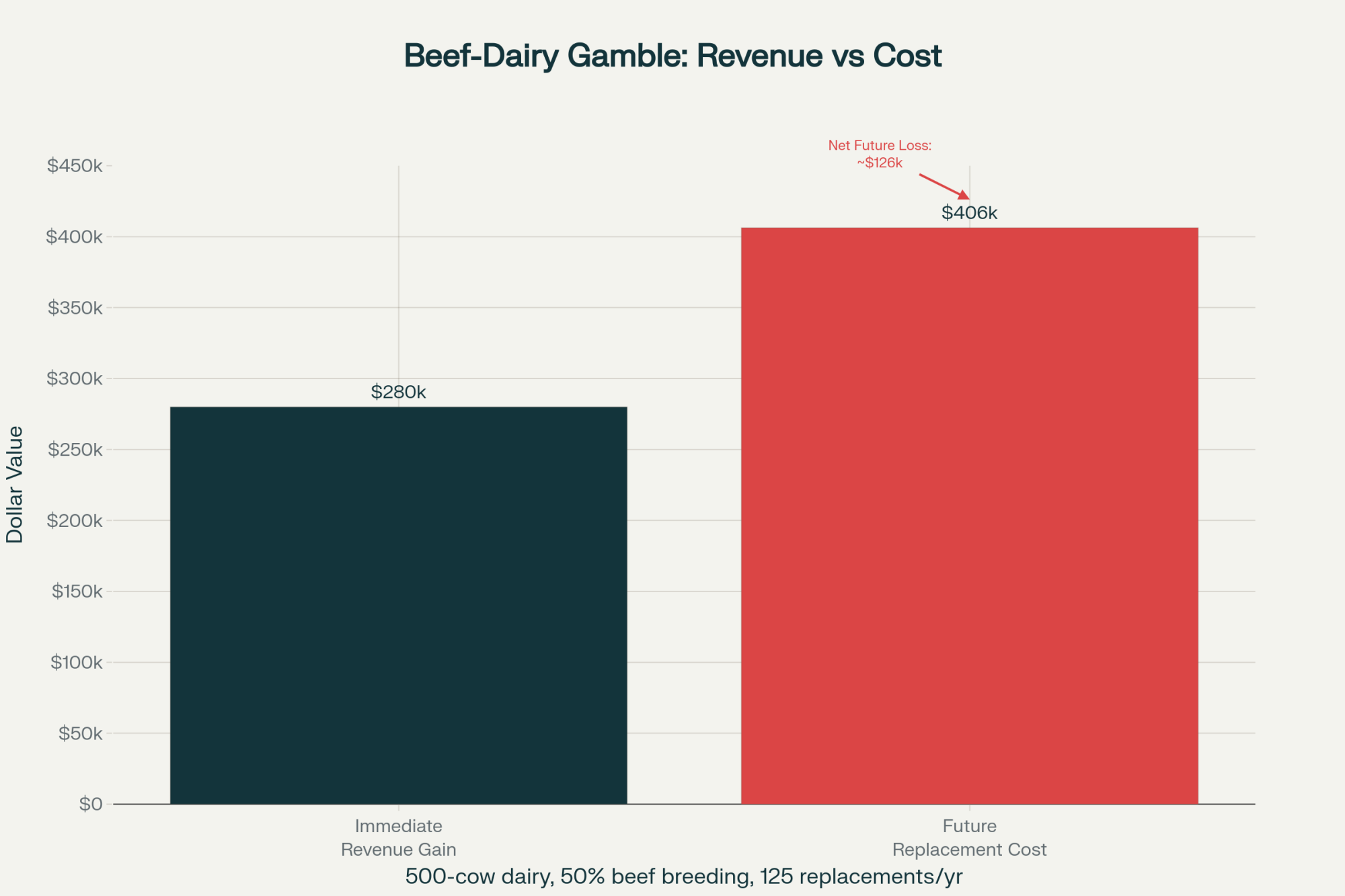

A fascinating development I’ve observed across multiple regions is how beef-on-dairy transformed from supplemental income to a survival strategy. Some farms report beef-cross calf sales now representing 40-50% of total revenue. With crossbred calves bringing $1,400-1,600 versus $100-200 for dairy bulls according to USDA market reports, a 500-cow dairy breeding half its herd to beef generates an additional $270,000-290,000 annually.

CoBank’s analysis, led by economists including Tanner Ehmke, projects that we’ll face an 800,000-head shortage of replacement heifers during 2025-2026. It reflects breeding decisions made when beef prices peaked and producers—understandably—prioritized immediate cash flow over future replacement needs.

University of Wisconsin dairy economists analyzing optimal breeding strategies suggest maintaining about 50% as the maximum sustainable beef breeding percentage. Farms exceeding this threshold—some reached 60-70% when beef prices peaked—essentially traded current survival for future growth capacity. When margins recover, these farms face either purchasing replacements at projected prices of $3,000-3,500 or foregoing expansion opportunities entirely.

The timing mismatch creates particular challenges. Breeding decisions made today determine replacement availability in 24-28 months, yet milk price recovery and heifer availability peaks likely won’t align. Farms that maximized beef revenue may survive the immediate crisis but will be unable to capitalize on the recovery.

The Compound Effect of Delayed Decisions

Through financial modeling using Farm Credit benchmarks and extension tools, a clear pattern emerges about timing’s impact on outcomes. Consider a representative 500-cow Wisconsin dairy with $850,000 in equity, losing $25,000 per month.

Immediate action—culling the bottom 20% based on income over feed cost metrics—generates approximately $200,000 at current cull cow values of $145-157/cwt while reducing monthly feed costs. Ration optimization to achieve $5.00 versus $6.20 per cow daily, following established nutritional guidelines, saves roughly $16,500 monthly. Combined, these actions reduce monthly losses from $25,000 to maybe $8,000-10,000.

After 24 months, early action preserves $650,000-700,000 in equity. That maintains strategic flexibility for expansion, transition to premium markets, or orderly exit if necessary.

But contrast this with delaying these decisions for six months. The farm burns an additional $150,000 in equity while waiting. Lender confidence erodes as equity ratios decline from 55% to 45%. Credit lines face restrictions. By month 24, the remaining equity of $250,000-$350,000 limits options to a distressed sale or continued deterioration.

That $400,000-450,000 difference? It represents the preservation or destruction of generational wealth, determined solely by the timing of actions.

Monitoring Recovery Signals

While I anticipate a 24-36-month adjustment period based on current fundamentals, several indicators could accelerate the recovery. Systematic monitoring helps separate noise from meaningful trends.

Global Dairy Trade auctions provide a 60-90-day forward indication of U.S. price direction, according to university dairy market research. Recent auctions have shown consecutive declines, but three consecutive stable or rising auctions would suggest the market is bottoming. Single auction movements shouldn’t drive decisions, though—trend confirmation matters.

Rationalizing processing capacity would meaningfully affect timing. Should 2-3 facilities announce closures or extended maintenance by Q2 2026, oversupply dynamics could improve faster than baseline projections. Though given the debt loads these facilities carry, continued operation at reduced utilization seems more probable than closure.

Monthly USDA production reports revealing 2%+ year-over-year declines for consecutive months would signal accelerating supply discipline. Combined with heifer shortages, this could create temporary market tightness.

Feed cost dynamics remain a wildcard. Should corn exceed $5.50/bu for 90+ days, forced culling similar to 2009 could compress the adjustment period to 12-18 months. Climate volatility suggests perhaps a 30-40% probability of significant Corn Belt production challenges within 18 months.

Given these signals, here’s how to position your operation for what’s ahead.

Three Strategic Imperatives for Every Operation

Based on extensive analysis and what I’m seeing in the field, every dairy faces three critical decision points over the coming months. Let me walk you through each one, starting with what needs attention immediately.

Decision One: Immediate Liquidity Management (Next 30 Days)

Successful navigation requires generating measurable cash flow improvement within 30 days. And that means confronting difficult culling decisions based on economic metrics rather than sentiment. Cornell Pro-Dairy benchmarks indicate that cows generating under $5 in daily income over feed cost incur ongoing losses regardless of other attributes.

Here’s what I’d tackle this week: Start by pulling DHIA records and ranking every cow by IOFC. Bottom 20% should be evaluated for immediate culling. Yes, it’s hard to cull that fresh heifer who’s just not performing, but keeping her costs you $150-200 monthly.

Comprehensive cost analysis typically identifies $30,000-50,000 in achievable annual savings through systematic review of all inputs and practices. Whether it’s adjusting mineral programs, renegotiating service contracts, or optimizing breeding protocols—the specific opportunities matter less than systematic identification and capture.

Proactive lender engagement before scheduled reviews demonstrates management capability and preserves relationship quality. The distinction between being viewed as proactive versus reactive often determines credit availability during challenging periods.

Decision Two: Strategic Recovery Positioning (Next 90 Days)

Forward-thinking farms must balance current survival with future opportunity. Breeding strategies warrant immediate adjustment—modeling suggests approximately 45% beef, 50% sexed dairy, and 5% conventional optimally balances current revenue with future replacement needs.

Geographic competitive position requires an honest assessment. Farms facing structural location-based disadvantages of $1.50+/cwt must consider whether operational excellence can overcome permanent cost disparities or if strategic alternatives warrant exploration.

Establishing specific, measurable decision criteria removes emotion from critical choices. Clear thresholds—”If Class III futures for Q3 2026 remain below $17.50 by March, we initiate transition planning”—enable rational rather than reactive decision-making.

Decision Three: Long-term Viability Determination (Next 180 Days)

Within six months, a fundamental strategic direction must be established. Well-positioned farms with adequate equity and replacement capacity should prepare for aggressive expansion during recovery. The 2027-2028 period may offer exceptional growth opportunities for prepared operations.

Dairies near metropolitan markets should seriously evaluate premium market transitions. USDA data confirms organic, A2, grass-fed, and direct marketing can deliver $7-12/cwt premiums that fundamentally alter economic equations. While requiring different skill sets, these models may offer superior risk-adjusted returns.

For farms where mathematics indicate strategic exit preserves maximum family wealth, timing remains critical. The difference between planned transition preserving $700,000 and forced liquidation at $200,000 determines whether next-generation education, career transitions, and retirement security remain achievable.

Practical Monitoring Framework

Successful farms systematically track key metrics. Here’s the dashboard I’m recommending producers review weekly:

Weekly Indicators:

- Equity burn rate relative to total equity (are you on track with projections?)

- CME Class III futures curves (watching for sustained moves above $17)

- Feed cost per cow per day (work with your nutritionist to optimize)

Bi-Weekly Reviews:

- Global Dairy Trade trends at GlobalDairyTrade.info

- Local replacement heifer pricing trends

- Regional basis (your mailbox price versus CME benchmark)

Monthly Analysis:

- Months remaining until 40% equity threshold

- USDA milk production reports for supply signals

- Lender relationship temperature check

Additionally, reviewing Dairy Margin Coverage options (even with elevated premiums), forward contracting above breakeven, maintaining sub-70% working capital utilization per Farm Credit guidelines, and preserving capital through lease-versus-purchase decisions warrant immediate attention.

The Path Forward

After extensive analysis and countless producer conversations, one conclusion emerges consistently. Farms that thrive in 2028 won’t be those that perfectly predicted market timing or price bottoms. They’ll be those that recognized in November 2025 that strategic flexibility remained available, understood that monthly delay costs approximately $75,000 in option value, and made difficult decisions while maintaining equity and credit access.

The U.S. dairy industry will emerge smaller and more concentrated—projections suggest declining from about 33,000 to under 28,000 farms by 2028. Whether your operation participates in that future depends not on milk prices but on acting while meaningful choices remain. Agricultural economists consistently observe that survival often depends less on scale or luck than on the gap between when action was needed and when it was taken. That gap remains bridgeable today, but the window is continuing to narrow.

Look, these conversations—with family, lenders, advisors—they’re never easy. Yet the math remains indifferent to our discomfort, and time continues regardless of readiness. For many of us, the greatest challenge isn’t financial analysis or strategic planning but accepting that wealth preservation may require departing from generational patterns. Observing hundreds of transitions has taught me that strategic repositioning carries no shame—only waiting until strategy becomes desperation. The next 24 months will reshape American dairying more significantly than any period since the 1980s. Success isn’t about fighting this transformation—it’s about positioning yourself appropriately within it. And that positioning needs to begin immediately, not when market signals provide comfort.

Time really has become our scarcest resource in this industry. Those who recognize and act on this reality will determine not just their own futures, but the structure of American dairying for the next generation.

Key Takeaways:

- Your burn rate reality: You’re losing $25,000/month with 24 months of equity left—but immediate action cuts this to $8,000/month

- The six-month wealth gap: Act now = preserve $700,000 in family equity. Wait until spring = forced exit at $250,000

- This week’s three moves: 1) Rank every cow by income over feed cost, 2) Cull the bottom 20%, 3) Call your banker before they call you

- Decision deadlines that matter: 30 days (stop the bleeding), 90 days (position for recovery), 180 days (commit to expand or exit)

- Why waiting won’t work: China’s self-sufficient + we overbuilt processing by $11 billion + worst heifer shortage since 1978 = permanent change, not temporary cycle

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Building a Beef-on-Dairy System: Capturing $360,000 in Annual Farm Profit – Reveals specific breeding protocols and management strategies for maximizing beef-cross revenue, including optimal semen selection, calf management systems, and buyer relationship development that complement the 50% breeding threshold discussed in the main analysis.

- Pick Your Lane or Perish: The 18-Month Ultimatum Facing 800-1,500 Cow Dairies – Demonstrates how mid-size operations can navigate the $3-4/cwt disadvantage through strategic positioning, including premium market transitions and operational excellence strategies that align with the 90-day recovery positioning framework.

- The $11 Billion Betrayal: Your Processor Is Building Your Replacement Right Now – Provides insider analysis of processing consolidation dynamics and vertical integration threats, offering defensive strategies for producers facing the overcapacity crisis that will determine market access through 2028.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!