Ready to pay mortgage money for a springer? The heifer shortage is here, and it’s not going anywhere.

EXECUTIVE SUMMARY: The U.S. dairy replacement pipeline just hit the wall—we’re down to 3.914 million heifers, the lowest count since 1978. Meanwhile, $10 billion in new processing capacity is coming online, which will demand significantly more milk than we can currently supply. Here’s the kicker: replacement costs have more than doubled, and CoBank’s data shows we’ll lose another 800,000 heifers before any recovery starts in 2027. Farms that keep betting on cheaper replacements are playing with fire. The smart money’s on extending cow longevity by just one month to cut replacement needs by 2.8%—that’s $84 saved per cow annually at today’s prices. Add precision breeding with sexed semen (90% success rate beats the 50-50 gamble), and you’ve got a playbook that actually works. Based on USDA reports and university research, the farms implementing this three-pronged approach currently will own the market, while others struggle with yesterday’s math.

KEY TAKEAWAYS

- Cut replacement costs 2.8% per extra month of cow longevity—focus on transition nutrition and repro management to save $84+ per cow annually while everyone else scrambles for expensive replacements

- Deploy sexed semen strategically on your top 25% genetics—yes, it costs $15 more per straw, but that 90% female success rate beats conventional breeding’s coin flip when heifers cost $4,000+

- Cash in on beef-cross calves from bottom-tier cows—those $1,000+ beef calves pay for your breeding program while you save dairy genetics for actual replacements

- Budget $4,000+ per heifer through 2027—CoBank’s projections show no relief until then, so negotiate group purchases with neighbors and secure flexible credit lines now before cash flow gets tight

- Start culling fewer cows immediately—operations reducing slaughter by 600,000+ head nationally are keeping milk flowing despite the heifer drought, and you need to join them before your competitors do

Walk into a cattle auction anywhere from Bakersfield to Green Bay these days and you’ll witness something that stings like a winter chill—springers hitting $4,200 or more. At a sale in Wisconsin last week, a seasoned dairyman shook his head, watching those prices climb. The young guy next to him just kept his paddle raised. “Either buy now or quit growing,” he said.

This isn’t just another bump in the road or a flash in the pan. The numbers don’t lie; this is a fundamental market reset.

The situation is stark: CoBank’s August 2025 report confirms we’re sitting with the smallest U.S. dairy replacement herd since 1978—3.914 million head as of January 2025. And with $10 billion being poured into new processing plants that demand milk through 2027, while heifer numbers continue to decline by another estimated 800,000 head, every dairy has to rethink its expansion and breeding strategy.

The numbers that change the game

Let’s break down the tough facts. USDA data shows an 18% drop in heifer inventories since 2018—from 4.77 million to just 3.914 million by early 2025. Looking even deeper, the number of heifers expected to calve this year is just 2.5 million—the lowest the USDA has seen in 24 years.

Prices? USDA’s July 2025 reports put the average replacement heifer at $3,010 nationwide—up a whopping 75% from April 2023. However, averages only tell half the story when premium springers are bringing $4,200 or more in Wisconsin or $4,500 or more in central California.

Consider a real-world example: an Eau Claire-area farm added 200 cows a few years ago, budgeting roughly $360K just for replacements. Today, that same addition would require more like $800K, and that’s without factoring in feed, labor, or facility costs.

CoBank doesn’t sugarcoat it—the forecast is for inventories to shrink even more over the next couple of years before any meaningful recovery in 2027.

How we dug this hole

Blame it on the beef market, if you will. When U.S. beef cattle numbers hit historic lows, beef-cross calves became a gold mine. Dairy farmers began breeding more bottom-tier animals to serve as beef sires, and as a result, calf prices soared while replacement heifer values lagged behind.

According to the National Association of Animal Breeders, dairy farmers snagged 7.9 million of the 9.7 million beef semen units sold in 2024—over 80% of all beef semen sales. That’s a far cry from just a few years ago, when beef semen was a small part of their breeding plan.

A good example comes from a Central Valley operation that increased its beef breeding from 20% of its herd in 2019 to nearly 65% by 2022, in an effort to chase calf revenue and stay afloat. Fast forward, and the farm grapples with a dwindling replacement herd and sky-high heifer prices.

The lesson? It wasn’t a conspiracy—it was a thousand individually smart but collectively expensive decisions. When everybody zigged into beef semen, the dairy replacement pipeline zagged.

The $10 billion squeeze: New plants demand milk that heifers aren’t here to make

Just when heifer numbers nose-dived, the industry bet big on new processing plants. Hilmar Cheese’s Dodge City facility is built to process approximately 8 million pounds of milk daily once fully operational. Chobani’s new Rome, NY, plant is targeting a massive 12 million pounds of production daily.

CoBank’s economist Corey Geiger puts it plainly: “Those plants need more milk and better components, especially butterfat and protein. To meet that demand, we need many more replacement heifers in the next few years than we have right now.”

Texas is feeling the heat especially hard. According to the Texas Dairy Association industry analysis, the state’s expanding processing capacity will require significant increases in regional milk supply, putting additional pressure on producers already dealing with tight heifer availability. However, with shrinking heifer inventories, finding those replacement animals is squeezing producers who are already juggling tight margins.

The new playbook: A three-pronged strategy for survival and growth

Prong 1: Master cow longevity

The farms weathering this storm best are pulling cow longevity into sharp focus. According to University of Wisconsin dairy management research, extending productive cow life significantly reduces annual replacement needs, with economic benefits of approximately $84 per cow per year in avoided replacement costs at current market prices.

For example, a dairy planning to add 800 cows might face an expansion cost soaring from $1.44 million in replacements five years ago to over $3.2 million today. Instead of scrapping growth plans, some farms are opting to keep more cows longer—raising the average productive life from 4.2 to 4.8 years and reducing replacement rates from 35% to 28% annually.

This strategy is catching on nationwide. Producers sent 611,600 fewer cows to slaughter than usual between late 2023 and mid-2025—a huge shift helping stabilize milk supply despite fewer heifers.

Prong 2: Leverage genetic horsepower

Many producers don’t realize we’ve been riding a genetics train that’s making the heifer shortage less painful than it could’ve been.

Since 2010, genetic improvement has accelerated, doubling the annual gains in Lifetime Net Merit from $40 to $ 80 per cow. Butterfat content climbed to 4.23% nationally in 2024—shattering decades-old ceilings. Protein jumped from 3.04% in 2004 to 3.29% in 2024.

USDA geneticist Paul VanRaden puts it simply: “A tenth-point bump in butterfat adds approximately $23 per cow per year at current component prices. Farms raising 850 cows just bumped their component premiums by close to $850 a month on the check.”

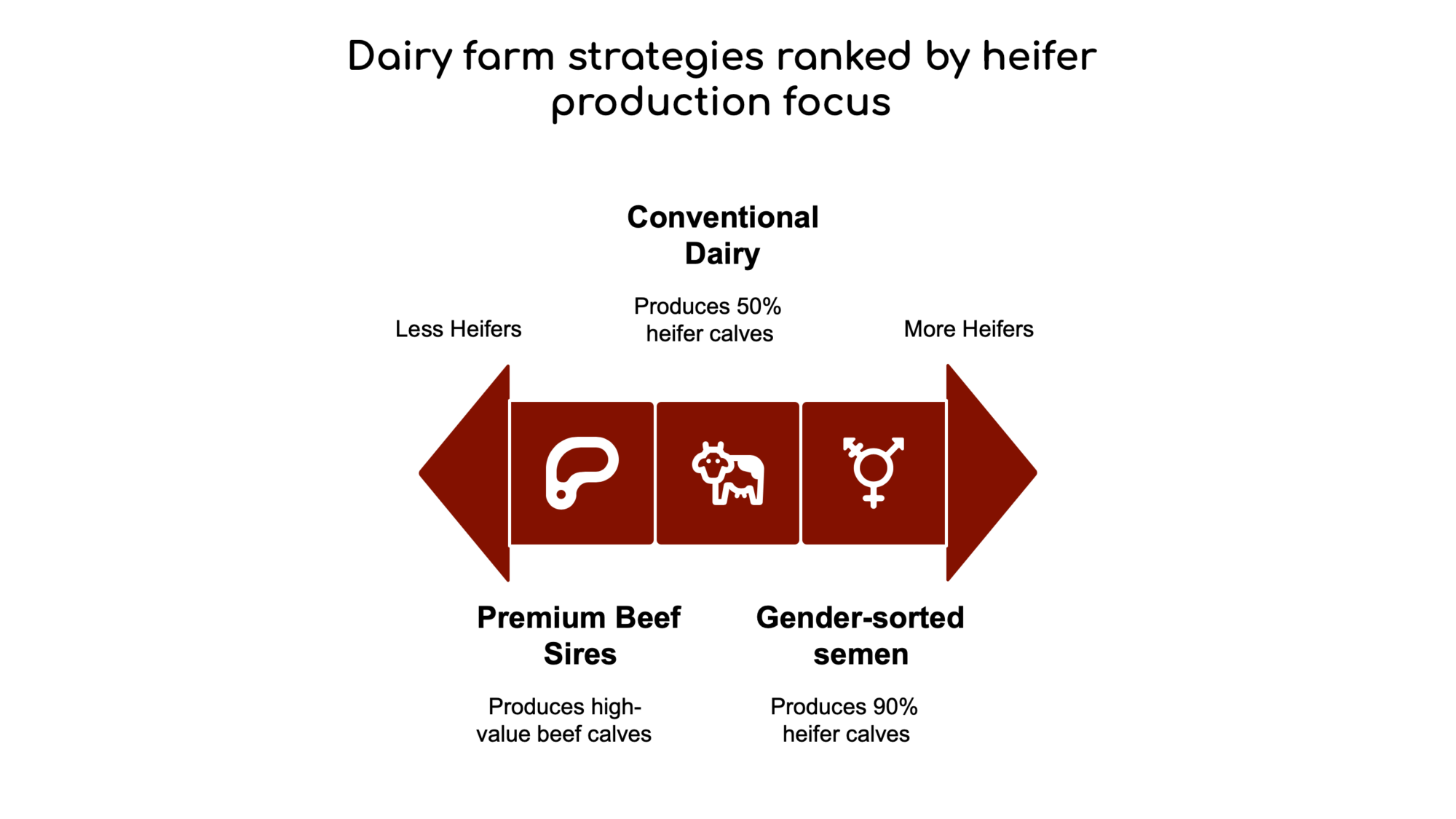

Prong 3: Execute a precision breeding strategy

Gender-sorted semen sales jumped 17.9% in 2024 to almost 10 million units, while conventional dairy semen slipped. The shift makes sense financially.

Dr. Jim Ferguson, Penn State Extension, notes: “Though sexed semen straws run $8-12 more and have slightly lower conception rates, the guaranteed outcome—90% female calves versus 50% conventional—makes them the most cost-effective heifer production strategy in today’s market.”

Here’s how a tiered breeding strategy looks in practice:

Quick Decision Matrix

| Cow Group | Strategy | Straw Cost | Result |

| Top 25% Genetics | Gender-sorted semen | $35-$45 | 90% Heifer success |

| Middle 50% | Conventional Dairy | $20-$25 | 50% Heifer success |

| Bottom 25% | Premium Beef Sires | $25-$30 | High-value beef calves |

When can we expect relief?

CoBank’s modeling, considering 30 months from breeding to milking, shows that pressure will build through 2026, reaching a low point before a modest rebound begins in 2027.

Expect roughly 357,000 fewer fresh heifers in 2025 and 438,000 fewer in 2026. Recovery begins in 2027 as replacements bred in 2024 hit the milking herd, increasing numbers by about 285,000.

Regional winners and losers

Texas is building herds, while others are shrinking. The Lone Star State added 28,000 cows in early 2025 and benefits from lower land costs ($3,850/acre) than Wisconsin ($5,900/acre), along with fewer regulations to slow growth.

Wisconsin lost over 300 dairy farms in 2024, mostly smaller operations folding, but herd size overall stayed steady through consolidation.

In contrast, California’s environmental programs can add significant revenue for participating operations. LCFS credits can add $60-$75 per metric ton of CO2 reduced for qualifying dairies, and combined with renewable energy incentives, can add over $200 per cow annually to the check.

Regional Breakdown Table:

| Region | Land Cost/Acre | Avg Milk Price (July 2025) | Regulation Level | Key Growth Driver / Challenge |

| Texas | $3,850 | $19.20 | Low | Lower regulatory hurdles & land cost |

| Wisconsin | $5,900 | $18.80 | Medium | High land costs challenge consolidation |

| California | $8,200 | $20.40 | High | LCFS credits & high milk price vs. strict regulation |

What you can do today

Here’s a simple checklist to get you ready:

- Calculate your replacement cost (likely well over $4,000 per heifer).

- Segment your herd: Use sexed semen on your top cows and breed the rest to beef sires.

- Focus on cow longevity: Nail transition cow nutrition, hoof care, and repro management.

- Explore cooperative heifer-sharing or custom raising to spread risk.

- Protect cash flow: Budget for longer-term heifer contracts and consider mortality insurance.

An important co-benefit

Fewer replacements mean fewer emissions. Cornell research shows cutting heifer numbers reduces methane emissions by over 12%. Meanwhile, keeping cows longer results in lower emissions per pound of milk, thanks to improved feed efficiency.

The Bottom Line

The $4,000 heifer isn’t a blip. It’s a full reset of dairy economics. If you’re waiting for prices to drop, you’re playing a dangerous game.

Get your cow longevity right, embrace precision breeding, and budget like replacements cost $4,000. The processors betting billions on increased milk production by 2027 aren’t waiting around.

Your breeding decisions today will have a significant impact on your milk situation in three years. It’s time to get serious.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Dairy Profitability: The Transition Cow Tipping Point – This article provides tactical, on-farm strategies for mastering the crucial 60-day transition period. It’s a practical guide for executing the longevity prong of the playbook, revealing how to reduce metabolic issues and boost productive life from day one.

- The Great Heifer Sell-Off: A Red Flag for the Dairy Industry’s Future – For a strategic look at the market forces creating the crisis, this piece explores the economic pressures driving producers to sell heifers. It adds critical context, helping you understand the long-term market dynamics and risks beyond your own farm gate.

- Stop Guessing, Start Knowing: Genomic Testing Accelerates Herd Improvement – This piece dives into the innovative technology behind a precision breeding strategy. It demonstrates how to leverage genomic data to identify your elite females with certainty, ensuring your investment in sexed semen delivers maximum genetic progress and profitability.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!