CVC Capital Partners just bought one of the biggest names in your feed supply chain. Here’s the math on what changes, what might actually improve, and the four moves you should make before the deal closes.

EXECUTIVE SUMMARY: CVC Capital Partners bought dsm-firmenich’s entire Animal Nutrition & Health division on February 9, 2026, for €2.2 billion — carving one of the world’s largest dairy nutrition suppliers into four separate companies by year-end. For a 300-cow Midwest U.S. dairy carrying $73,000–$83,000 a year in mineral, vitamin, and premix exposure through this supply chain, the ownership change is anything but abstract. CVC brings genuine dairy experience through Urus and a proven digital-transformation playbook, but also brings PE margin discipline that typically hits input pricing within the first 24 months. Three structural risks matter most: vitamin allocation now runs through commercial negotiations rather than internal management, over 73% of global vitamin production is concentrated in China, and quarterly return targets can incentivise quiet reformulations that take weeks to show up in your bulk tank. Producers have roughly 10 months before closing to document current formulations, audit feed mill sourcing, trial a second premix supplier, and lock contract terms with substitution-notice and change-of-control protections. That playbook starts with one phone call to your nutritionist — this month.

On February 9, 2026, dsm-firmenich sold its entire Animal Nutrition & Health division to private equity firm CVC Capital Partners for approximately €2.2 billion, including an earnout of up to €0.5 billion. Combined with last year’s €1.5 billion sale of its feed enzymes stake to Novonesis, the total ANH divestiture reaches €3.7 billion — implying a 10x EV/Adjusted EBITDA multiple on the combined value. That’s ANH’s entire €3.5 billion-a-year operation and roughly 8,000 employees changing hands.

Those are the corporate numbers. Here’s the farm-level number: a 300-cow dairy spends roughly $73,000 to $83,000 a year on the minerals, vitamins, and premix that flow through this supply chain, based on the University of Missouri Extension’s 2025 confinement dairy planning budget at $840/ton and 577–656 lbs per cow (a Midwest U.S. estimate — your region’s numbers will differ, but the exposure ratio holds). Minerals and vitamins? Bigger line item than you’d guess. And the companies supplying them just changed hands.

One Division Becomes Four Companies

The nutrition supply chain that used to run through a single integrated ANH division is being carved across four separate businesses — all effective by the end of 2026:

| Entity | What They Supply | Owner | HQ |

| Solutions Company | Premix, performance products, precision services | CVC Capital Partners | Kaiseraugst, Switzerland |

| Essential Products Company | Vitamins, carotenoids, aroma ingredients | CVC Capital Partners | Kaiseraugst, Switzerland |

| Novonesis | Feed enzymes (phytase, xylanase, protease) | Novonesis | Denmark |

| dsm-firmenich (retained) | Bovaer, Veramaris | dsm-firmenich | Kaiseraugst, Switzerland |

dsm-firmenich retains a 20% equity stake in both CVC-owned entities but holds no operational control. Feed enzymes went to Novonesis in a deal completed in June 2025, representing approximately €300 million in annual net sales. Novonesis will continue a long-term commercial relationship with ANH for re-sale of its feed enzymes through the premix network.

So that “single supplier” relationship many producers had? It’s now four commercial relationships with four distinct P&Ls. Four separate sets of incentives deciding what goes into your premix, what it costs, and who picks up the phone when something goes wrong. This is part of a broader consolidation wave reshaping the dairy sector — and it’s accelerating.

| Company Name | What They Supply to Dairy | Owner | Your Risk | Revenue (Annual) |

| Solutions Company | Premix, performance products, precision services | CVC Capital Partners | Third in vitamin allocation queue | ~€2.0–2.5 billion |

| Essential Products Company | Vitamins, carotenoids, aroma ingredients | CVC Capital Partners | 73%+ China concentration; spot market priority | ~€1.0–1.5 billion |

| Novonesis | Feed enzymes (phytase, xylanase, protease) | Novonesis (independent) | Re-sale through premix network only | ~€300 million |

| dsm-firmenich (retained) | Bovaer (methane), Veramaris (omega-3) | dsm-firmenich | Cost-benefit gap; unclear processor co-funding | ~€100–200 million |

The PE Playbook: What Actually Changes on Your Farm

Let’s be honest — “private equity buys a feed company” usually makes producers nervous. Sometimes that’s warranted. Sometimes it isn’t. Here’s how to think about it clearly.

CVC isn’t a nutrition company. They manage roughly €201 billion in assets across 150+ companies with combined annual sales over €165 billion. But here’s the thing that matters for dairy: CVC already owns Urus, which they describe as “a global leader dedicated to serving dairy and beef cattle producers around the world with cutting-edge genetics and customised reproductive services”. They’re not walking into animal agriculture blind. And this isn’t even their first deal with dsm-firmenich — CVC held a majority stake in the ChemicaInvest joint venture with DSM back in 2015.

The return math, simplified: CVC paid roughly 7x normalised EBITDA for ANH. Their recent PE exits have averaged 3.3x invested capital at a 27% gross IRR. If historical patterns hold, a €2.2 billion acquisition needs to grow toward €6–7 billion over a five-to-seven-year hold. That’s the number shaping every pricing, staffing, and product-line decision going forward.

What does that mean in plain language? PE ownership follows a predictable sequence:

- Phase 1 (Years 1–2): Margin improvement — operational efficiencies, overhead reduction, portfolio rationalisation. This is the phase most likely to touch your feed bill.

- Phase 2 (Years 2–5): Bolt-on acquisitions to build scale and market share.

- Phase 3 (Years 5–7): Position for premium-multiple exit or IPO.

The Private Equity Stakeholder Project tracked 129 PE deals in U.S. agriculture between January 2018 and December 2023 using Pitchbook data — outcomes ranged widely, from genuine platform growth to Prima Wawona, where Paine Schwartz Partners merged two profitable stone fruit growers into a single entity that entered Chapter 11. CVC’s track record looks materially different. But the underlying dynamic — new owners optimising for return metrics on a fixed timeline — applies across every PE-owned supplier.

Where PE Ownership Could Actually Help

Here’s where I’ll push back on the doom narrative. PE ownership isn’t all margin pressure and cost-cutting. CVC has been aggressive about deploying AI and digital transformation across its 120+ portfolio companies, classifying each by AI readiness and prioritising where technology can unlock measurable value. ANH already built precision livestock tools — Sustell for farm-level sustainability measurement, Verax for animal health monitoring, and FarmTell for data-driven herd management. Under a PE owner with CVC’s tech orientation, investment in those platforms could accelerate.

Steven Buyse, CVC’s Managing Partner, said in the announcement: “The Solutions Company will continue to drive innovation and efficiency in animal farming, delivering tailored solutions with high proximity to its global customer base. The Essential Products Company will be built as a resilient global leader in essential feed, food, and fragrance ingredients”.

Translation: CVC sees two distinct value-creation stories. The Solutions Company gets the precision services and innovation mandate. The Essential Products Company gets built for supply reliability and cost efficiency. If CVC executes well, producers could see better digital tools, more professionalised logistics, and sharper supply-chain management. That’s a real potential upside.

The catch? Those digital tools and precision services tend to come bundled with longer-term contracts and proprietary data ecosystems. More on that in a minute.

Three Structural Risks That Still Deserve Your Attention

You Might Be Third in the Vitamin Supply Queue

When ANH was one division, vitamin production and premix blending shared a single management team. During the 2023 vitamin price crash — Chinese oversupply drove ANH’s adjusted EBITDA down 91% year-on-year in Q3, with a vitamin price effect of about €120 million — the integrated structure absorbed the hit. When BASF’s Ludwigshafen plant fire in July 2024 sent Vitamin A prices surging from roughly $21/kg to $72/kg — a 243% spike — internal allocation kept the premix business supplied.

Post-split, those allocation decisions become commercial negotiations. The Essential Products Company now serves three customer types:

- dsm-firmenich — contractually guaranteed volumes under a long-term supply agreement, backstopped by a €450 million loan facility and up to €115 million in additional liquidity support from dsm-firmenich

- Spot buyers — willing to pay premium prices during supply squeezes

- The Solutions Company — a customer relationship, not a guaranteed supply line

During a disruption, dairy premix customers could find themselves third in that queue. In November 2022, DSM announced a temporary halt to Rovimix Vitamin A production at its Sisseln, Switzerland, plant for at least 2 months, along with significant reductions in Rovimix Vitamin E-50. DSM stated it would “honour existing contractual commitments” while activating allocation procedures. That kind of allocation triage gets harder when the vitamin producer and the premix blender sit on separate balance sheets — and it’s exactly the type of supply chain vulnerability that dairy producers have been caught flat-footed by before.

The China Concentration Risk Underneath Everything

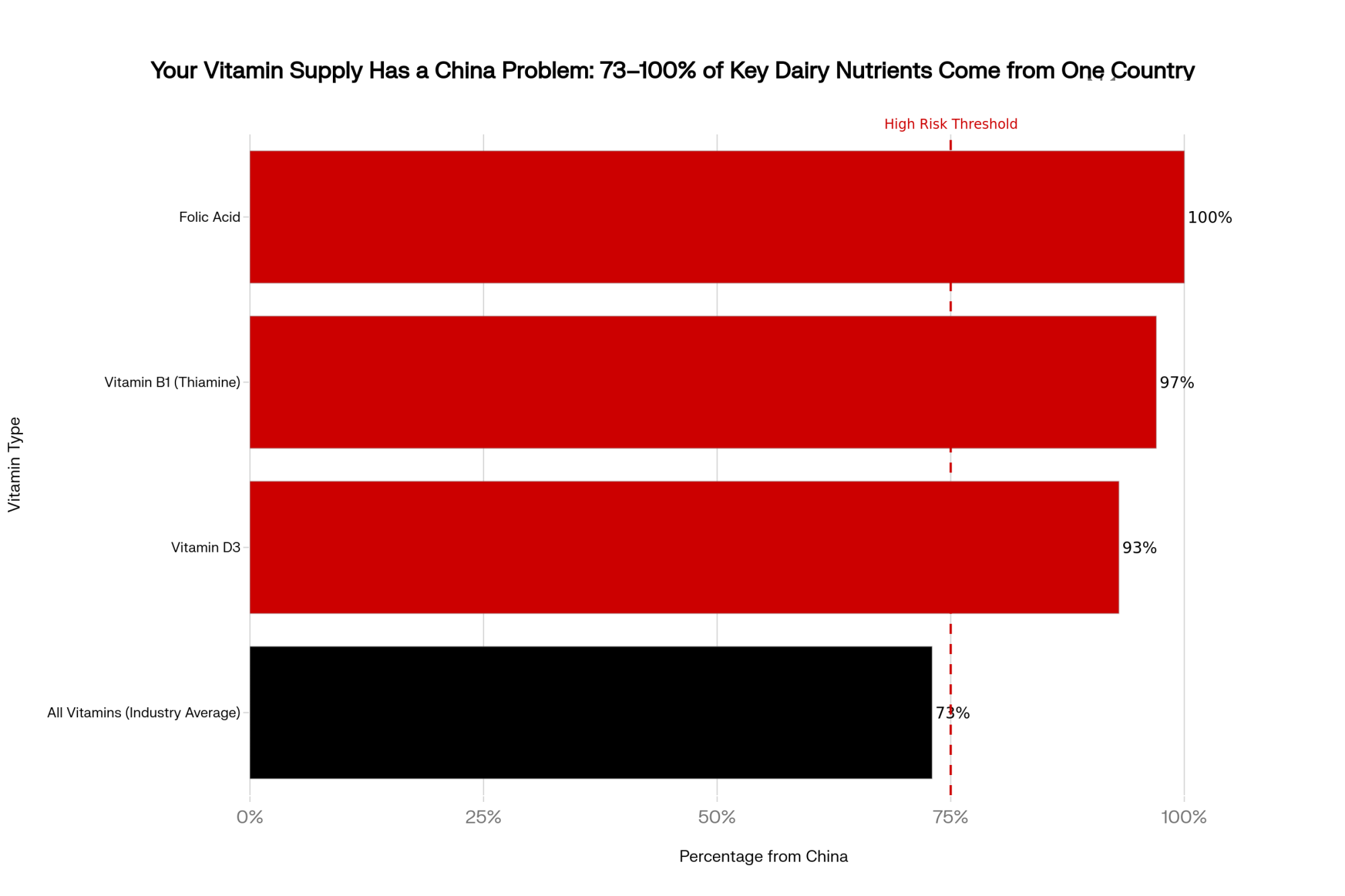

The vitamin CVC market the company is stepping into is arguably the most geopolitically exposed input market in agriculture. AFIA president Constance Cullman told the 2025 NAFB Convention that over 73% of vitamins originate in China. The European Feed Manufacturers’ Federation (FEFAC) puts the concentration even higher for specific vitamins:

- Vitamin D3: ~93% China-sourced

- Vitamin B1: ~97% China-sourced

- Folic acid: nearly 100% China-sourced

“We believe this is a national security issue.” — Constance Cullman, AFIA president, 2025 NAFB Convention

China imposed provisional anti-subsidy tariffs of 21.9% to 42.7% on certain EU dairy products in late 2025. If that escalation touches vitamin exports — or if China simply prioritises domestic supply during a disruption — ANH’s European vitamin capacity becomes CVC’s most strategically valuable asset. And CVC will price it accordingly. On the flip side, CVC has both the capital and the incentive to invest in non-Chinese vitamin capacity — that’s exactly the kind of strategic asset-building that could justify a premium multiple at exit.

Biology Doesn’t Run on Quarterly Reporting

Trevor DeVries at the University of Guelph presented research at the 2019 Western Canadian Dairy Seminar, establishing that “dairy cow health, production, and efficiency are optimized when cows consume consistent rations, both within the day and across days”. More variability between delivered and formulated rations increases the chance that cows won’t perform to expectations.

Here’s the problem: when a margin-driven reformulation — swapping chelated zinc for zinc oxide, trimming vitamin inclusion from above-NRC to minimum-NRC — saves a few dollars per tonne of premix, the production effects may not show in the tank for six to eight weeks. By then, the cost saving has been booked to the current quarter’s EBITDA. The component drift? That’s your problem to diagnose.

This isn’t unique to PE ownership. Any supplier under margin pressure can make these moves. But PE’s quarterly discipline and fixed-horizon exit timeline sharpen the incentive.

Four Moves to Make Before the Deal Closes

The transaction is expected to close by the end of 2026. That gives you roughly 10 months. Use them.

1. Get your formulation on paper. Call your nutritionist and request the complete premix specification for every product you’re running — full ingredient list, inclusion rates, source identifications (not just “zinc” but zinc methionine vs. zinc sulfate vs. zinc oxide), and guaranteed analysis. Dated and signed. This costs nothing, takes one conversation, and enables every other protective move. Without a baseline, you can’t detect reformulations, comparison-shop credibly, or hold anyone accountable.

2. Audit your feed mill’s sourcing. If you’re a 200–400 cow dairy, your premix likely comes through a feed mill, not directly from ANH. Ask three questions: Where do they source vitamins? How many suppliers? What’s the contingency if the primary goes on allocation or raises prices 20%? If your mill single-sources from the Essential Products pipeline, their vulnerability is yours.

3. Test a second supplier on part of your herd. Running 10–15% of volume through an alternative creates a tested backup and real negotiating leverage. Here’s a rough threshold: if your total premix spend exceeds $20,000 a year and you currently single-source, that trial is manageable. The premix market offers genuine options: Trouw Nutrition, Adisseo, Evonik, and regional specialists such as Animine, Devenish Nutrition, and Novus International. The ADM-Alltech joint venture, announced in September 2025, combines Alltech’s 33 feed mills (18 U.S., 15 Canada) with ADM’s 11 U.S. feed mills into a 44-mill network — another competitor entering the space. The trade-off: your nutritionist needs time to validate formulation equivalence, and rumen adaptation matters. Transition gradually.

4. Lock contract terms while there’s an incentive to deal. Before closing, both sides want a smooth handover. Use that to formalise: 30-day written notice before any ingredient substitution; service-level commitments; pricing escalation caps indexed to verifiable benchmarks; and a change-of-control clause allowing renegotiation if either entity is subsequently sold. But remember — long-term contracts cut both ways. When vitamin prices crashed in 2023, locked-in terms would have left you paying above-market rates. Indexed pricing structures beat fixed rates in a volatile input market.

| Action Item | Timeline / Deadline | Cost to Execute | Risk If You Don’t | Who to Call First |

| 1. Document current premix formulation | This month (Feb 2026) | $0 (one phone call) | No baseline to detect reformulations or hold suppliers accountable | Your nutritionist |

| 2. Audit feed mill’s vitamin sourcing | Before April 2026 | $0 (3 questions) | Feed mill’s single-source vulnerability becomes your cash flow crisis | Your feed mill rep |

| 3. Test second premix supplier on 10–15% of herd | May–Aug 2026 | $1,500–$3,000 trial cost | Zero negotiating leverage; no tested backup during allocation squeeze | Independent nutritionist or alt supplier |

| 4. Lock contract terms with substitution protections | Before Oct 2026 (deal close) | Legal review: $500–$1,500 | Eat reformulations and price increases with no recourse or exit clause | Feed supplier + lawyer (change-of-control clause) |

The Bovaer Split: Who Pays for Methane?

dsm-firmenich kept Bovaer and Veramaris while selling everything else. That means the company promoting methane reduction on your farm is no longer the company managing your daily nutrition.

Elanco estimates a potential annual return of “$20 or more per lactating dairy cow” through voluntary carbon markets and government incentives — but that figure reflects projected potential, not observed farm-level returns. Greg Hocking, Mars Snacking’s global VP of R&D for New Innovation Territories, was direct in a December 2025 interview: “Consumers will benefit from these efforts, but we don’t expect them to pay extra for sustainability”. Denmark is moving toward subsidised adoption and may mandate methane-reducing additives. If that regulatory model spreads, processor co-funding could follow.

But the gap between the additive cost and the documented on-farm returns means the economics of voluntary methane programs are still tight. Evaluate any value-chain program carefully — we dug into the details in Bovaer Unleashed: The Controversial Additive Changing Dairy Forever.

What This Means for Your Operation

- Your mineral and vitamin line item is more exposed than it looks. At $242–$275 per cow per year for a Midwest U.S. confinement dairy (University of Missouri Extension, 2025 ), a 10% cost increase means $7,000–$8,000 on a 300-cow operation. Your region’s absolute numbers will differ—benchmark your feed costs against strategic alternatives with your nutritionist.

- The financial incentives behind your supplier just changed — but that’s not automatically bad. PE ownership optimises for 5–7 year return cycles, not 20-year relationships. That could mean tighter margins andbetter digital tools. Verify rather than assume. Watch what actually happens to service levels and product specs.

- Your feed mill is the invisible middleman. If they single-source vitamins from ANH’s Essential Products pipeline, a pricing or allocation squeeze hits you even if your name isn’t on the contract. Ask the question this week.

- Precision services come with strings. If CVC invests in Sustell, Verax, or FarmTell — dsm-firmenich’s existing data platforms — those tools could genuinely improve your herd management. Just understand what data you’re handing over and which contract terms come with it.

- Collective purchasing deserves a conversation. If you sell through a cooperative, ask whether group nutrition procurement is on the board’s agenda. Volume leverage is the strongest counter to supplier concentration — and building financial firewalls against supplier disruption starts with knowing where the risk sits.

Key Takeaways

- Get your complete premix formulation documented this month — dated, signed, with source identifications for every active ingredient. One phone call, zero cost, foundation for everything else.

- Test an alternative premix supplier on 10–15% of your herd before the deal closes. A credible alternative is the only pricing leverage that consistently works in concentrated markets.

- Evaluate whether your nutritionist works for the company selling you premix. If so, get a second opinion from an independent consultant.

- Run the stress test: if premix costs rose 10% while milk prices dropped $2/cwt simultaneously, what does your cash flow look like? Run that number now, not after closing.

- Don’t dismiss PE upside. CVC’s digital investment track record and its existing dairy exposure through Urus mean this could bring genuine improvements in supply-chain efficiency and precision tools. Stay skeptical, but stay open.

- Watch for CVC-branded communications in your feed mill or nutritionist’s feed after closing — that’s the signal the margin-optimisation phase has started.

| Herd Size | Current Annual Premix Cost | After 10% Increase | Annual Cost Impact | Impact as % of Milk Revenue |

| 100 cows | $24,200–$27,500 | $26,620–$30,250 | $2,420–$2,750 | 0.5–0.6% |

| 300 cows | $72,600–$82,500 | $79,860–$90,750 | $7,260–$8,250 | 0.5–0.6% |

| 500 cows | $121,000–$137,500 | $133,100–$151,250 | $12,100–$13,750 | 0.5–0.6% |

| 750 cows | $181,500–$206,250 | $199,650–$226,875 | $18,150–$20,625 | 0.5–0.6% |

| 1,000 cows | $242,000–$275,000 | $266,200–$302,500 | $24,200–$27,500 | 0.5–0.6% |

The Bottom Line

The ownership of your dairy’s nutrition supplier changed on February 9, 2026. Your formulation, your service levels, and your contract terms haven’t changed yet. That gap is your window—and it closes when this deal does at year-end. How are you planning to use it?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Feed Costs Just Rewrote the Dairy Playbook—and Your ZIP Code’s Calling the Shots – Arms you with the metrics to track Income Over Feed Cost (IOFC) like your survival depends on it. This analysis exposes why geography and breed-specific mineral packages now dictate a massive 20% margin swing between competing operations.

- Why Dairy Markets Can’t Self-Correct Anymore: The Hidden Forces Reshaping the Dairy Industry’s Future – Breaks down the brutal math of the 2026-2027 consolidation shakeout. You’ll gain a strategic blueprint for shifting to multi-revenue economics, protecting your equity as global production moves toward operations that no longer rely on milk profits alone.

- The Bovaer Warning: How Denmark’s Methane Mandate Went from Law to Crisis in 6 Weeks – Reveals the high-stakes reality of mandating methane additives before the science is fully settled. This case study deliverscritical exit-trigger strategies and monitoring protocols to protect your genetic progress from regulatory-driven production volatility.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!