December didn’t just reshuffle the rankings—it exposed who was betting on hype. Top bulls cratered overnight. New kings emerged. Your 2026 matings need a rewrite.

The December 2025 genetic evaluations weren’t just another routine update. They were a full-scale reset of global Holstein rankings—the kind that happens once every decade or so. From the powerhouses of North America to the diverse breeding programs of Europe and Scandinavia, the genetic pecking order has been violently reshuffled. Former leaders have been dethroned. Unexpected champions have been crowned. And for dairy breeders planning their 2026 mating programs, the message is stark: the genetic playbook from August is now obsolete.

This isn’t hyperbole. It’s a hard reality backed by the data. And if you’re still making breeding decisions based on last summer’s rankings, you’re leaving money on the table.

Three Seismic Shifts Defining the New Genetic Reality

The December evaluations revealed three interconnected forces reshaping global Holstein genetics:

- Unprecedented Volatility in Genomic Rankings

Several high-profile sires—bulls that were industry darlings just weeks ago—have experienced dramatic, overnight index drops. In Switzerland, the former #1 sire, Sous-Moron Boston, suffered a stunning 52-point ISET collapse. In Italy, the polled star KNO Ecuador P plummeted an incredible 98 gPFT points. These aren’t statistical blips; they’re textbook examples of genomic risk materializing in real time. - Genetic Concentration Consolidating Around Specific Bloodlines

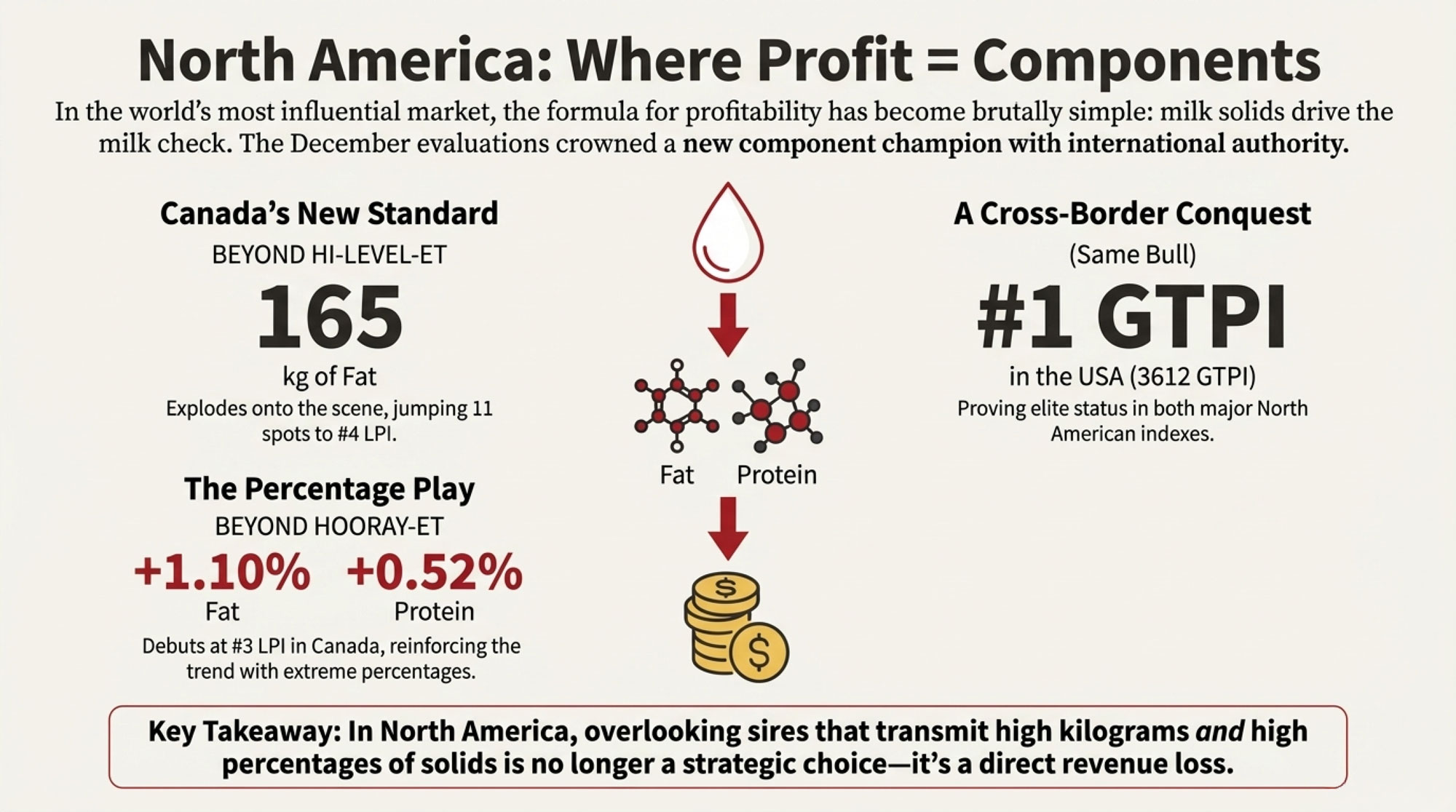

Genosource now controls 22 of the top 30 Net Merit positions in the US—a remarkable 73% market share. The Gameday maternal line underpins three of Switzerland’s top five ISET sires. The Altazazzle bloodline claims four of the top ten proven sire positions in the Netherlands. This concentration delivers elite, consistent results—but it also creates a ticking time bomb for inbreeding and genetic diversity. - Components Are No Longer Optional

From Canada’s BEYOND HI-LEVEL-ET (165 kg Fat) to Germany’s Saturn RDC (+0.88% Fat), the message is universal: with processor payments increasingly tied to milk solids, selecting for high fat and protein is now a direct path to a higher milk check. The days of overlooking component specialists are over.

North America: Where Profit and Components Rule

The North American market continues to set the global pace for Holstein genetics. But the December evaluations revealed two distinct narratives unfolding on opposite sides of the border.

Canada: The Component King Has Arrived

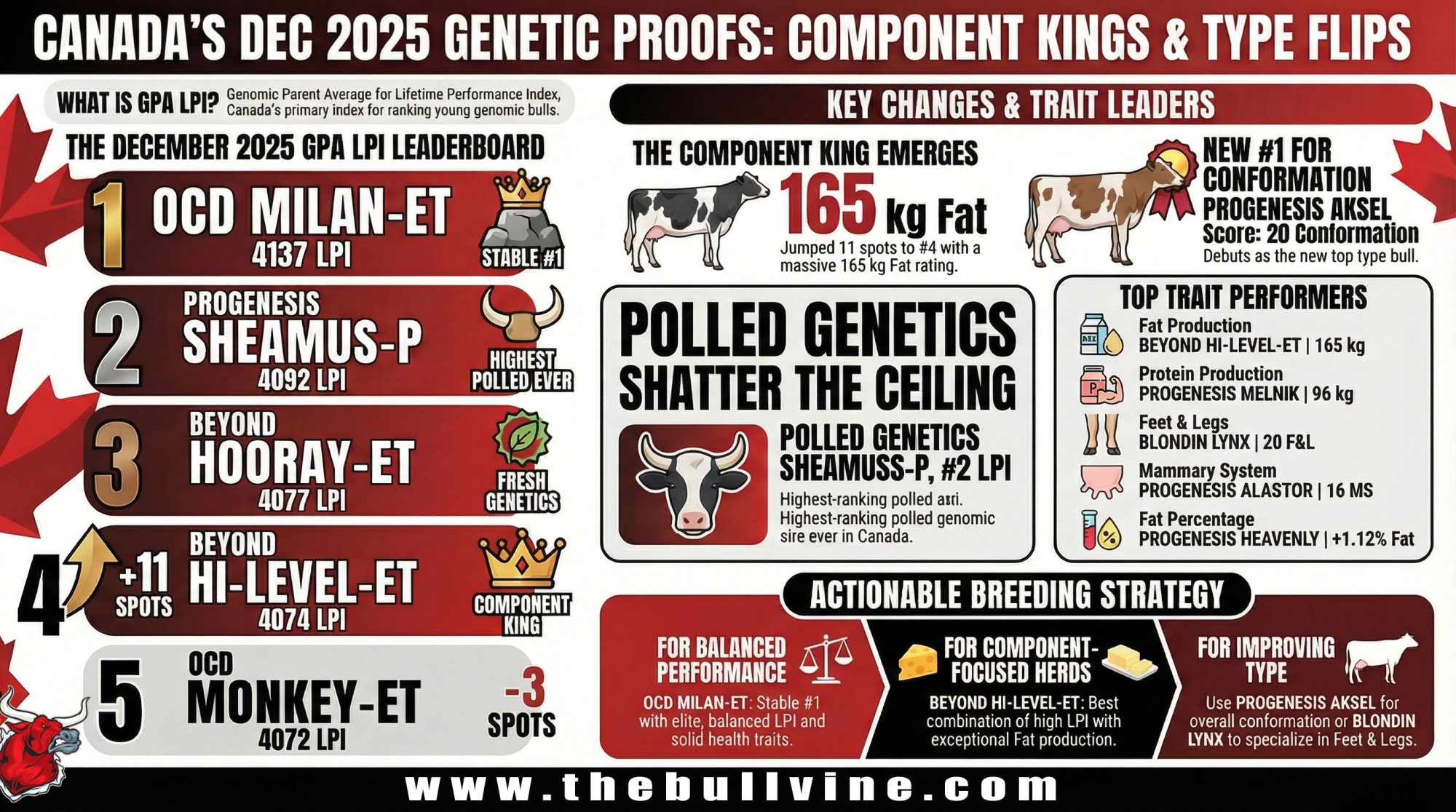

OCD MILAN-ET held his ground as the #1 LPI sire with a solid 19-point gain to 4137 LPI, but the real story belongs to his challengers—three newcomers who have rewritten the options for breeders.

BEYOND HI-LEVEL-ET made the most explosive leap, jumping 11 spots to #4 LPI. His profile reads like a case study in modern profitability: 165 kg Fat on a high-volume base that proves elite milk volume and exceptional component density aren’t mutually exclusive. For breeders paid on component density, he’s become the gold standard.

Then there’s BEYOND HOORAY-ET, who debuted at #3 LPI and immediately established himself as the “percentage specialist.” With +1.10% Fat and +0.52% Protein, his profile is tailor-made for herds targeting premium milk quality.

Perhaps most significant: PROGENESIS SHEAMUS-P shattered the ceiling for polled genetics, debuting at #2 LPI. He’s the highest-ranking polled genomic sire in Canadian history—proof that breeders no longer have to sacrifice elite index performance to access the valuable polled trait.

USA: The Genosource Era Begins

If Canada’s story is about newcomer diversity, the US narrative is about unprecedented consolidation.

Genosource has achieved a historic sweep, capturing 22 of the top 30 Net Merit positions. For context: this represents a 73% market share in the industry’s primary profitability index. That level of concentration is a double-edged sword. On one hand, it offers a clear path to proven, high-profit genetics backed by a program that has cracked the code on profitability. On the other hand, it severely narrows the available gene pool—and that’s a serious concern for long-term herd resilience.

GENOSOURCE RETROSPECT-ET continues his reign as the #1 NM bull at 1296, demonstrating the program’s mastery of the total economic merit formula. But the most explosive newcomer was SAN-DAN ON CALL-ET, who debuted at #3 GTPI with a production profile that demands attention: 1845 Milk and 151 Fat. The fact that he also earned a #9 NM ranking tells you his balanced genetics appeal across multiple profit drivers.

And confirming the component trend: BEYOND HI-LEVEL-ET claimed the #1 GTPI position in the US at 3612, underscoring his international elite status.

Read more: 22 of 30: Genosource’s Historic Sweep of the December 2025 US Holstein Genetic Evaluations

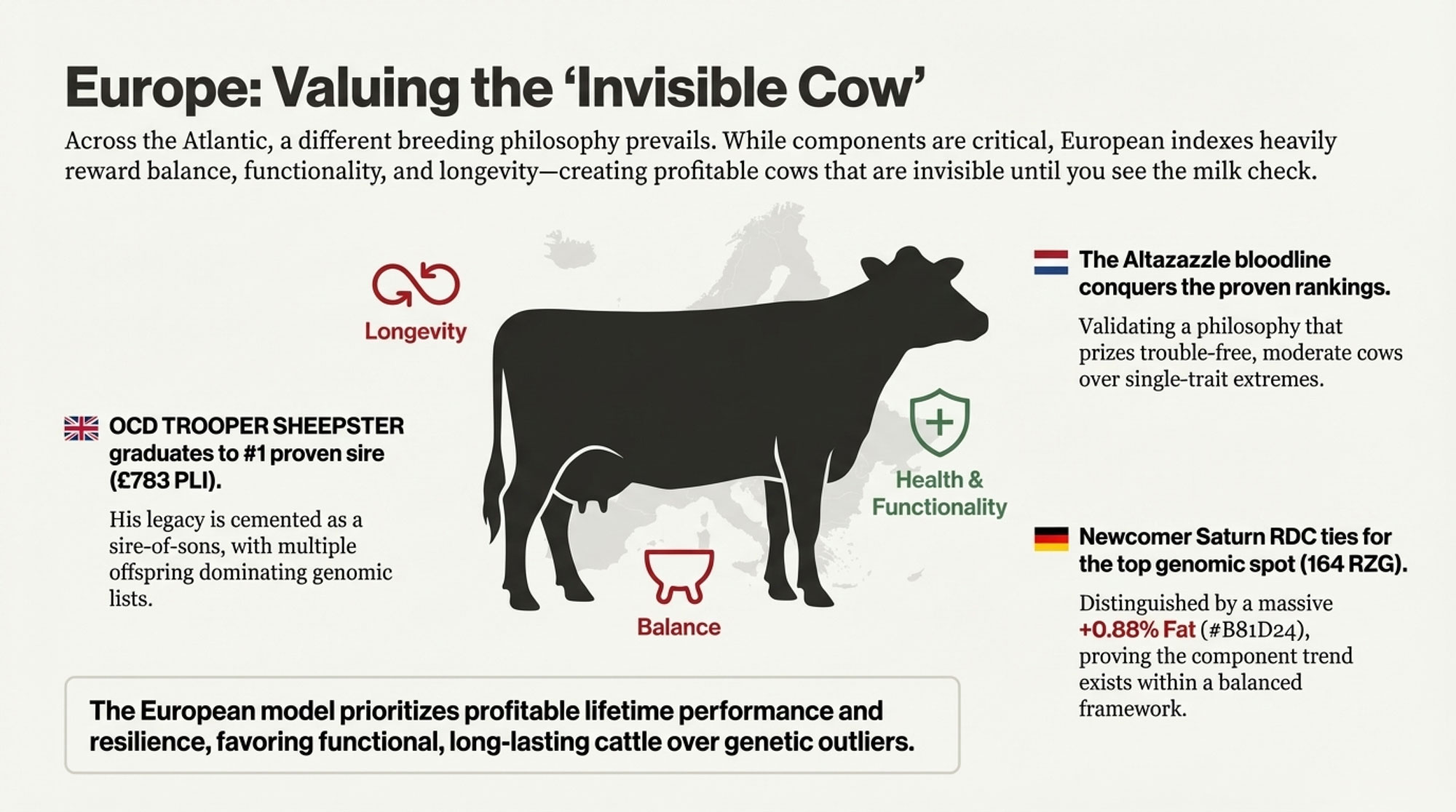

Europe: Bloodlines, Balance, and the Rise of Functional Genetics

Europe’s evaluations revealed a shared philosophy: rewarding balanced, functional cattle designed to thrive in real-world commercial systems. While each country maintains its own index, a common theme emerged in the dominance of bloodlines that consistently deliver both profitability and longevity.

United Kingdom: Sheepster’s Legacy Reshapes the Breed

The new #1 genomic sire is DENOVO COYOTE P, with a PLI of £871. His profile is textbook modern British dairy: exceptional +0.30% fat, commercially valuable A2A2 status, and polled genetics.

But the more significant story belongs to OCD TROOPER SHEEPSTER, who graduated to #1 on the daughter-proven side with a £783 PLI. His true significance extends far beyond his own rank—he’s become a breed-shaping sire of sons. Multiple Sheepster offspring, including BADGER SIEMERS DAY TRIP (#2 genomic) and PROGENESIS PRESTON (#3 genomic), now dominate the young sire lists. This is the kind of bloodline dominance that builds lasting competitive advantage.

Netherlands: Shattering the +400 Barrier

Genosource Moti rewrote the Dutch record books, becoming the first sire to lead the genomic rankings at a remarkable +420 NVI. This isn’t just a personal achievement—it signals that the ceiling for genetic progress continues to rise.

What’s truly revealing, however, is the absolute conquest of the Altazazzle bloodline in the proven rankings. This line claims four of the top ten positions—a clear market vote for what commercial dairies crave: the “invisible cow.” Moderate. Functional. Invisible until you look at the milk check. Their dominance validates a breeding philosophy that prioritizes trouble-free performance over extreme individual traits.

Read more: Genosource Moti Cracks +420 NVI: Inside the December 2025 Dutch Sire Shakeup

Germany: New Champions in Both Populations

For Black & White genomic sires, newcomer Saturn RDC tied for the top with the former leader, Veterano, at 164 RZG. Saturn RDC immediately distinguished himself with a massive +0.88% Fat—the component specialist phenotype that the market is rewarding globally.

The new Red & White genomic leader is Bueno Red at 161 RZG. He offers a rare combination: extreme milk production (+2,159 kg) paired with excellent type (121 RZE). This kind of balanced profile is increasingly valuable as European breeders recognize that extremes in single traits often create hidden costs elsewhere.

The Volatility Report: When Genomic Promise Meets Reality

While some markets celebrated steady progress, Switzerland, Italy, and Scandinavia delivered a masterclass in genomic risk. In these countries, several reigning #1 sires experienced dramatic overnight index drops—a powerful reminder of why risk management matters in breeding programs.

Switzerland & Italy: The Reckoning for Unproven Genetics

In Switzerland, Sous-Moron Boston’s 52-point ISET drop (from +1645 to +1593) wasn’t an anomaly—it was the statistical consequence of reliability risk. Here’s the hard truth: a 75% reliable genomic proof means there’s a 25% chance the bull’s true genetic merit will differ significantly from his initial ranking. For Boston, that risk materialized in index drops that erased millions in projected genetic value overnight.

Read more: Swiss Shakeup: Monset (+1603) Claims ISET Crown as Boston Plummets 52 Points

Italy’s story was even more dramatic. The high-profile polled star KNO Ecuador P plummeted 98 gPFT points as more daughter data recalibrated his initial genomic promise. This is what happens when market enthusiasm outpaces actual proof of reliability.

With the deck reshuffled, Italy’s new international genomic leader is DENOVO LOCUST-ET, with a formidable gPFT of 5450.

Read more: Genosource Moti Cracks +420 NVI: Inside the December 2025 Dutch Sire Shakeup

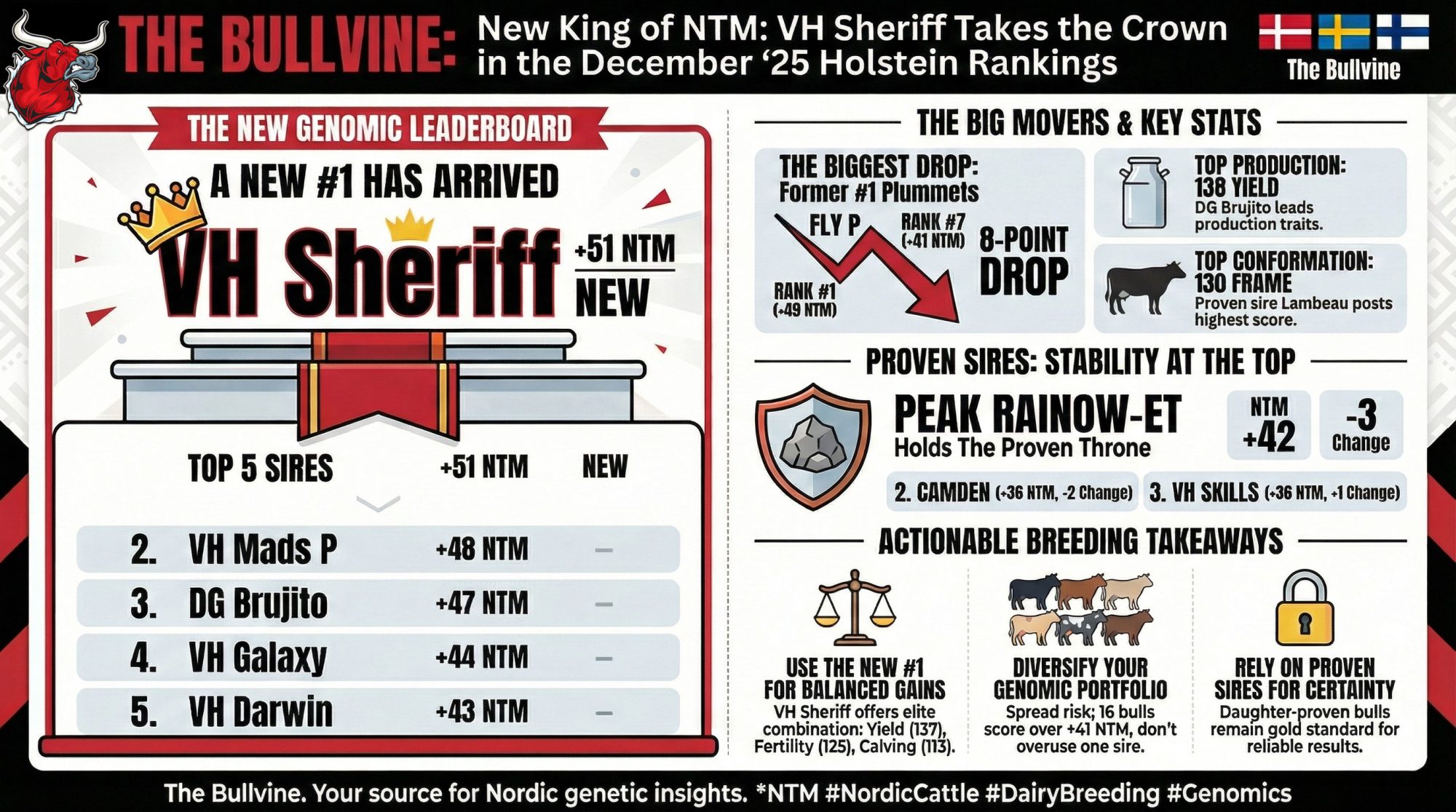

Scandinavia: The Nordic Shakeup

The Nordic Total Merit (NTM) index experienced its own dramatic power struggle. The former genomic leader, Fly P, experienced a precipitous 8-point drop from +49 NTM to +41 NTM—one of the sharpest single-round declines on record for a top bull.

His fall coincided with the spectacular debut of VH Sheriff, who entered the rankings at an exceptional +51 NTM. This contrast illustrates a critical principle: high-potential genomic projections and high-certainty proven results often tell different stories. On the proven sire list, PEAK RAINOW-ET held his position as the reliable leader at +42 NTM, providing a crucial stability anchor.

Four Strategic Imperatives for Your 2026 Breeding Program

The December 2025 proofs delivered clear signals. Here’s how to act on them:

1. Embrace Volatility—and Manage It

The dramatic index drops of bulls like Boston, Ecuador P, and Fly P are the most important risk management lesson of this evaluation cycle. A chart-topping genomic proof is a powerful indicator of potential, but it’s not a guarantee of performance.

Action: Diversify your sire portfolio ruthlessly. Don’t concentrate more than 15-20% of your herd’s matings on any single unproven genomic bull, no matter how impressive his initial ranking. A team of high-quality young sires will always outperform a single superstar who fails to deliver.

2. Follow the Money: Components Drive the Milk Check

From Canada’s component specialists to Germany’s fat-specialists and Switzerland’s balanced bulls, the message is universal. Processor payments increasingly tie to milk solids. Component selection isn’t a nice-to-have anymore—it’s the direct path to higher revenue.

Action: Prioritize sires transmitting high kilograms AND high percentages of fat and protein. These specialists are your best tool for maximizing revenue per hundredweight.

3. Mind the Inbreeding Gap

The genetic concentration around Genosource in the US, the Gameday line in Switzerland, and the Altazazzle line in the Netherlands is a double-edged sword. Yes, these lines deliver elite results. But their dominance increases inbreeding risk in the broader population.

Action: Use mating programs to monitor and manage inbreeding coefficients. Protecting genetic diversity isn’t peripheral—it’s foundational for maintaining fertility, calf vigor, and long-term herd resilience. Be aware of the popular bloodlines and actively seek outcross options to balance your portfolio.

4. Proven Sires Remain Your Foundation

In an era of genomic volatility, the stability of high-reliability, daughter-proven sires is more valuable than ever. Leaders like OCD TROOPER SHEEPSTER in the UK and PEAK RAINOW-ET in Scandinavia provide the kind of anchor every breeding program needs.

Action: Allocate a meaningful portion of your matings to elite proven sires. Use them as a dependable risk-management tool to balance the high potential—but higher risk—of your genomic sire team. They’re not old news; they’re insurance against genomic volatility.

The Bottom Line

The December 2025 evaluations proved that Holstein genetics continues to evolve at a breathtaking pace. The ceiling for genetic progress keeps rising. New champions emerge. Old certainties crumble.

But here’s what shouldn’t change in your breeding strategy: disciplined risk management, relentless focus on the traits that drive profitability, and a balanced portfolio that combines proven reliability with genomic potential. The breeders who master this balance in 2026 will be the ones posting the highest milk checks and building the most resilient herds.

The genetic landscape has been reset. Now it’s time to update your playbook.

KEY TAKEAWAYS:

- Genomic promises just met reality: Switzerland’s #1 cratered 52 points. Italy’s polled star dropped 98. December proved that a 75% reliable proof carries 25% real risk—and millions in value can vanish overnight.

- Components drive the milk check now: Fat and protein specialists dominated from Canada to Germany. Breeders ignoring solids aren’t just behind—they’re bleeding revenue.

- Genosource owns 73% of America’s profit elite: Unprecedented consolidation delivers proven results, but shrinks the gene pool. Opportunity and inbreeding risk now travel together.

- Diversify or pay the price: Cap any unproven genomic sire at 15-20% of matings. A balanced sire team always beats a single superstar who crashes.

- Proven sires are your volatility hedge: Daughter-proven leaders like Sheepster and Peak Rainow deliver what genomic projections can’t—certainty.

EXECUTIVE SUMMARY:

December’s reckoning separated the breeders who understand genomic risk from those who were chasing leaderboard hype. The bulls that cratered aren’t coming back. The bloodlines consolidating power aren’t slowing down. And the component premiums reshaping milk checks aren’t temporary. The question isn’t whether the genetic landscape has changed—it’s whether your breeding program has changed with it. August’s playbook is dead. What’s your 2026 strategy?

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!