India now produces 31% of the world’s milk—reshaping global dairy production in unprecedented ways.

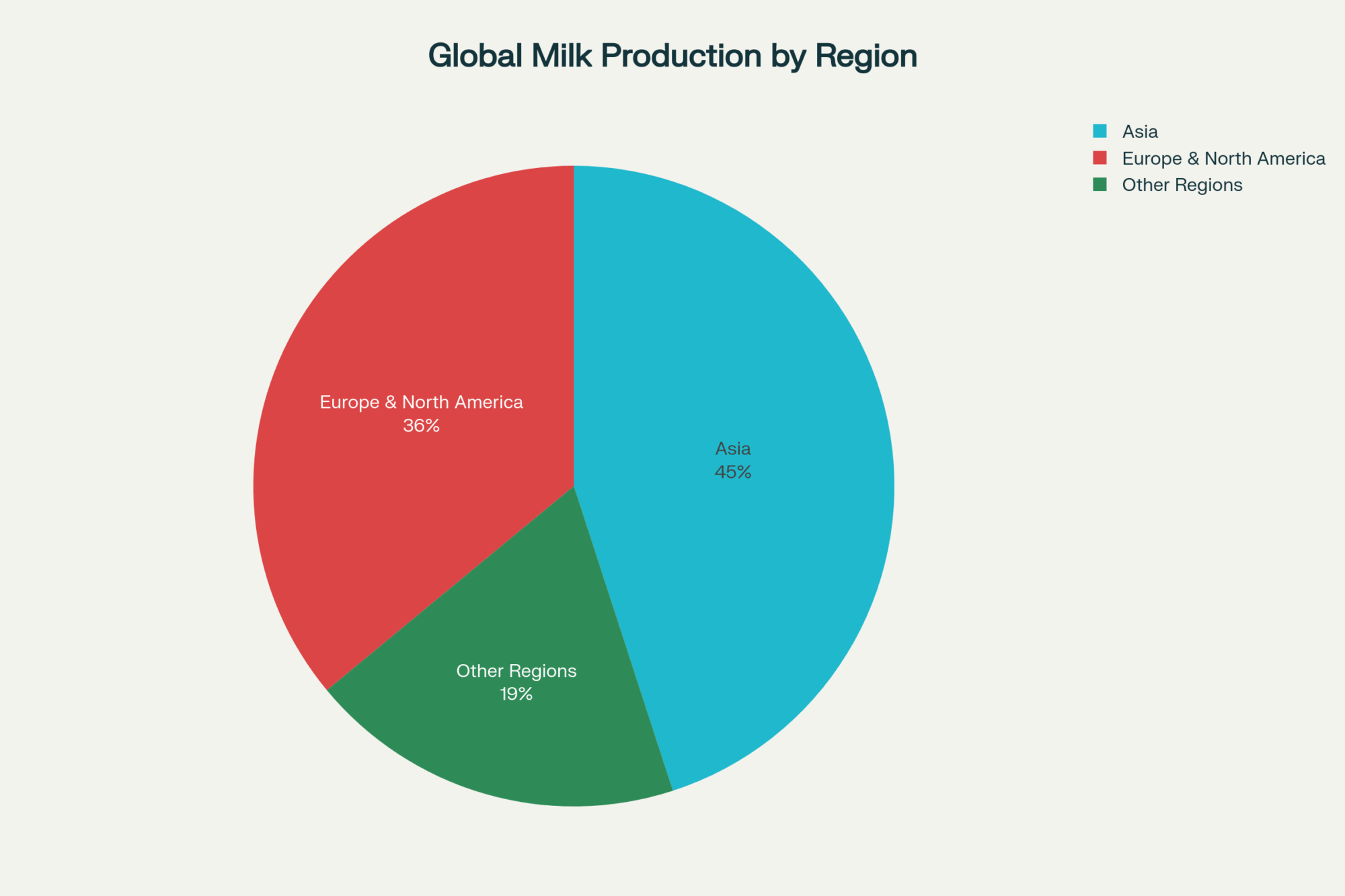

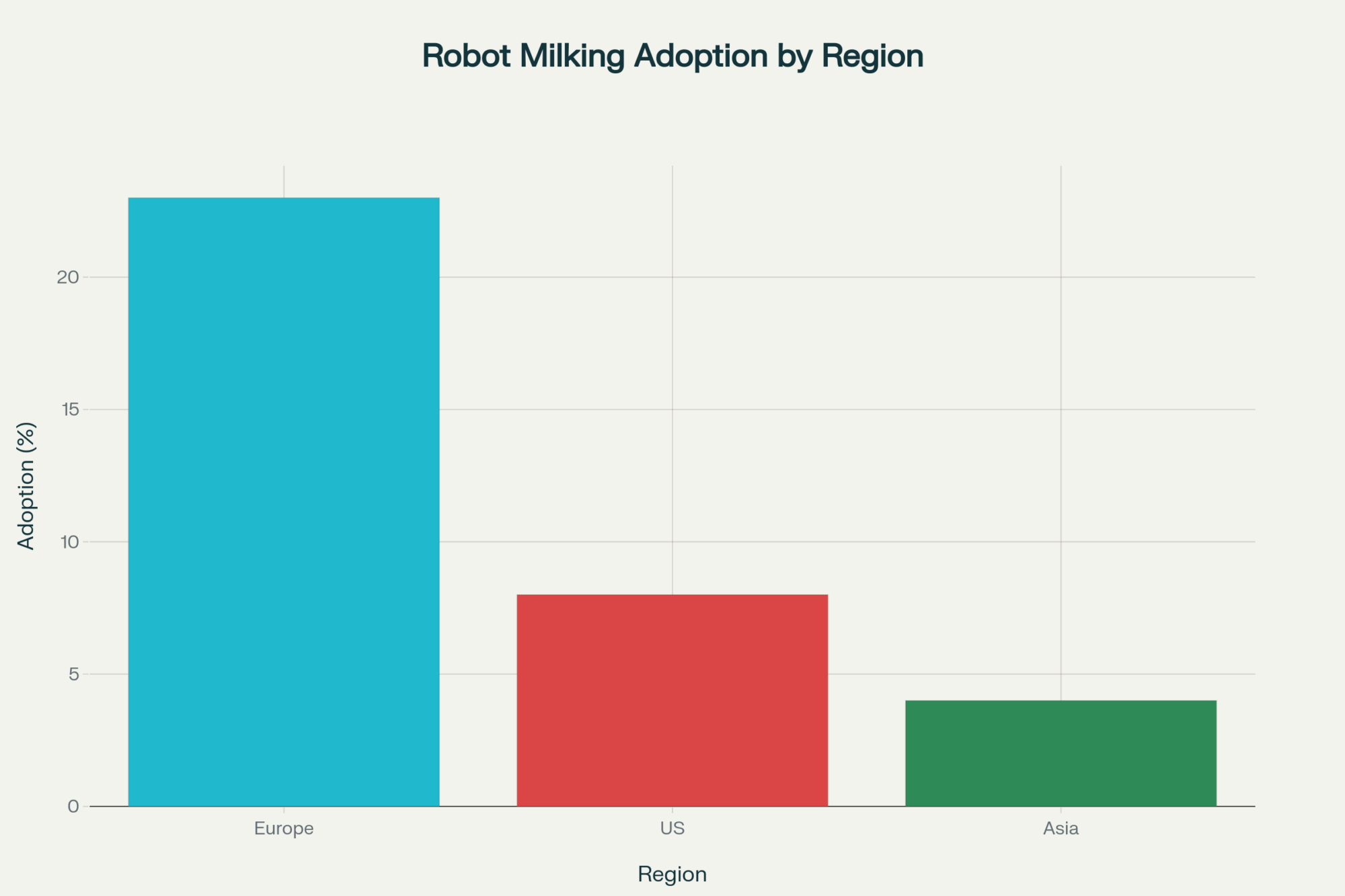

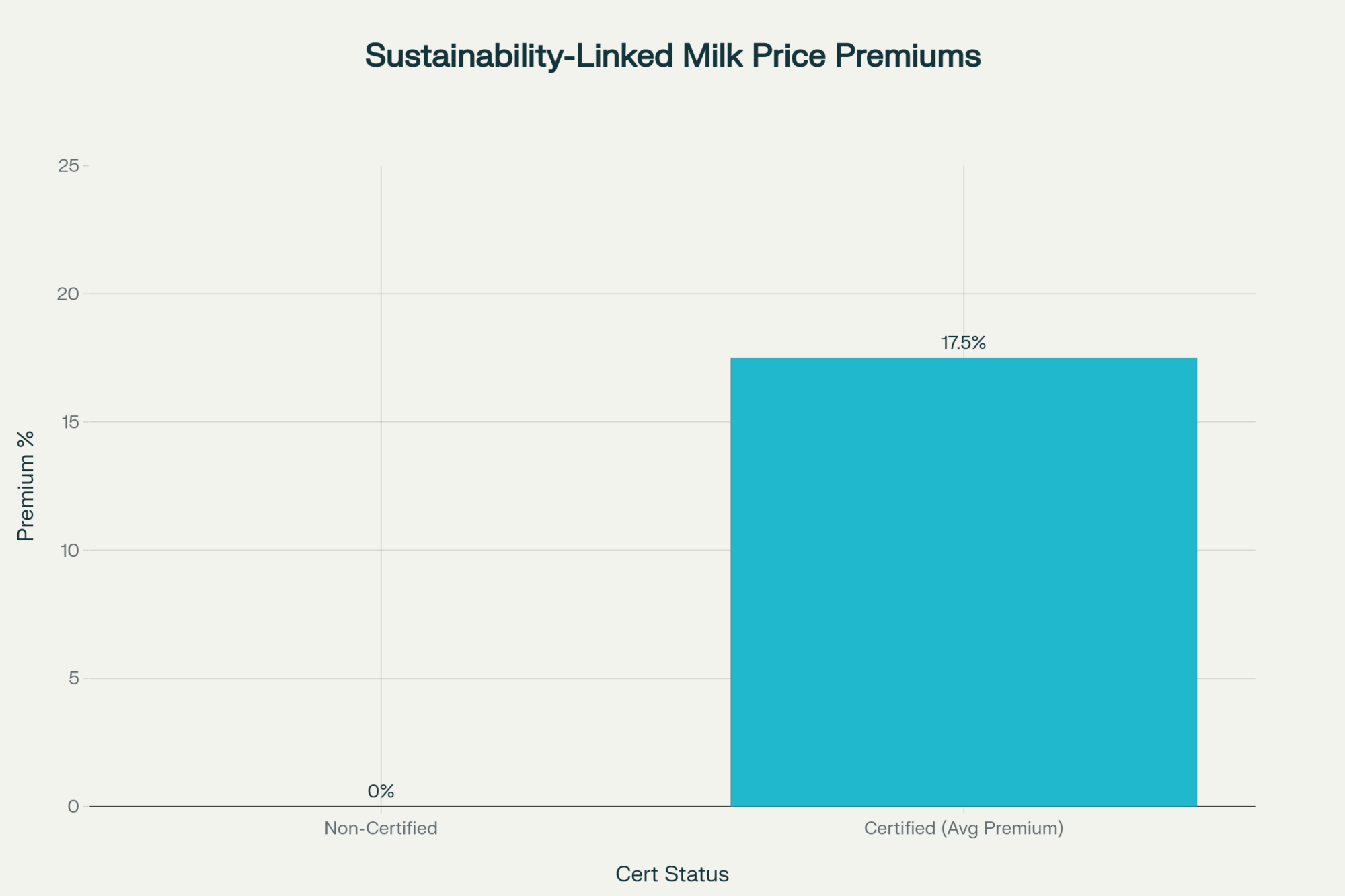

EXECUTIVE SUMMARY: India has surged to lead global milk production, with a roughly 31% share, outpacing the EU, US, and New Zealand combined, driven by a rising middle class and the expansion of cooperatives. Asia now accounts for 45% of global milk production, reshaping market dynamics, while Europe and North America hold approximately 36%. Robotic milking adoption varies dramatically—23% in Europe versus under 10% in other regions—with emerging producers leveraging mobile and AI tech as cost-effective alternatives. What’s particularly encouraging is that sustainably managed dairies are earning an estimated €6.22 more per 100kg milk produced, while carbon footprint variations increasingly shape market access. Trade tensions and certification requirements are shifting competitive landscapes, but this creates opportunities for operations that can adapt quickly. What this means for your operation depends on your region, scale, and infrastructure—with success coming through targeted efficiency improvements, sustainability practices, and understanding niche markets. Recent research shows the key is local adaptation, and staying informed about these industry shifts will position you for long-term resilience.

KEY TAKEAWAYS:

- Precision pays off: Dairies adopting targeted feeding strategies and fresh cow management protocols can achieve up to 15% improvements in butterfat performance and overall milk quality—critical for premium market access.

- Smart tech choices matter: Consider scalable technology investments that match your infrastructure. Mobile monitoring and AI-driven herd management can deliver 60-70% of the benefits of robotics at a fraction of the cost.

- Sustainability drives profits: Environmental practices aren’t just compliance—they’re opening premiums up to 25% while improving herd health and operational consistency, making them essential for market competitiveness.

- Regional strategies work best: Production dynamics vary widely—Asia leads in volume, Europe in efficiency—so your approach should reflect your farm’s unique context, resources, and market position.

- Market access is evolving: Stay current with trade policies and certification requirements, as premium market entry increasingly depends on meeting sustainability and traceability standards.

You know, I was chatting with a colleague from Punjab just last month, and he mentioned how the dairy landscape has shifted dramatically. India, for instance, has surged ahead to become the world’s leading milk producer, clocking in around 216 million metric tons this year. That’s roughly a third of global milk production. To put this in perspective, that’s more than the combined output of the European Union, the United States, and New Zealand.

What’s fueling such growth? Well, it largely stems from a rapidly expanding middle class embracing dairy consumption across all regions—from Punjab’s lush fields to Gujarat’s vibrant cooperatives. This shift is not just about sheer volume but a complex blend of geography, demographics, and how technology and infrastructure get deployed.

We’re seeing Asia holding about 45% of the global dairy production, while North America and Europe together make up around 36%. This isn’t just shifting numbers on a chart—it’s reshaping the whole industry.

Technology Adoption: Different Paths, Different Results

Now, when I think of technology, the story gets a bit nuanced. I had a great conversation recently with a California dairy operator who told me his investment in robotic milking paid off in just under three years. However, friends in India shared that their investments took six years or more to recover due to inconsistent power and internet issues.

In Europe, about 23% of dairy farms are using robotic milking, whereas adoption in the US is around 8%, and many Asian countries are still at 2-6%. But what’s really fascinating is how many producers in emerging markets are adopting mobile apps, IoT monitoring, and AI-powered herd management to capture much of the same benefit without the high costs.

It’s worth noting that this approach—skipping expensive automation for targeted tech solutions—is proving surprisingly effective for operations that can’t justify the infrastructure investment.

The Efficiency Story Gets Complicated

When it comes to efficiency numbers, the Netherlands leads with around 8,500 liters per cow annually, while India is closer to 1,200. That’s a massive seven-fold difference.

But here’s what’s interesting—both systems fit their setups. European operations target premium markets by optimizing butterfat and protein components, focusing heavily on fresh cow and transition period management. You probably know how critical those first 100 days in milk are for setting up the whole lactation curve.

India’s volume-based model taps into cooperative networks and benefits from lower input costs. Millions of smallholder farms, each with just a few animals, collectively create enormous production capacity.

That volume-based approach is facing pressure, though, as rising land prices and shrinking rural labor pools challenge traditional cost advantages. And that’s pushing even small-scale operations to think about genetic improvements and feed efficiency.

Sustainability: From Compliance to Profit Center

Here’s something that caught my attention—sustainability is no longer just a buzzword. It’s impacting profitability. Wageningen University research shows sustainable farms can boost income by around €6.22 per 100 kilograms of milk produced, combining cost savings and price premiums. For a mid-sized dairy, that adds up fast.

Buyers are increasingly seeking sustainability certifications, paying up to 25% premiums for compliant farms. What’s encouraging is that sustainable practices also tend to improve herd health and production consistency—so it’s a genuine win-win.

Carbon footprints are part of the equation, too. New Zealand’s dairy farms average around 0.9 kg of CO2 per liter of milk production, compared with India and Brazil, where footprints can be two to three times higher. This is starting to influence market access and pricing structures in ways we hadn’t seen before.

Trade Dynamics Keep Us on Our Toes

Trade tensions, such as the ongoing challenges between the US and Canada, have resulted in billions of dollars lost in trade opportunities. Meanwhile, Australia and New Zealand are strategically benefiting from shifting Chinese demand and their sustainability advantages, while Russia’s subsidy of export logistics is shaking up the competitive landscape.

Certification, auditing, and traceability now form essential gatekeepers to premium markets, favoring farms with robust infrastructure. That puts farms in regions like Europe and New Zealand in a strong position, while farms in lower-resource areas need to adapt rapidly.

The Plant-Based Reality Check

The plant-based market certainly has traction, holding about 12% in mature dairy markets. But it’s not the tsunami that some predicted. Meanwhile, lactose-free dairy is gaining quietly but steadily, appealing to consumers wanting milk without digestive issues.

We’re also seeing strong growth in niche categories, such as organic, A2, and probiotic-enhanced milks, many of which command price premiums of 15-25%. And interestingly, consumers increasingly blend plant-based and dairy products depending on use—what’s sometimes called “hybrid consumption.”

What This Means for Your Operation

So, what’s the takeaway for you—whether you’re running a 500-cow operation in Wisconsin, a family dairy in Punjab, or a cooperative setup in Canterbury? Understand the unique strengths and circumstances of your operation.

Higher-cost regions can benefit from targeting efficiency and sustainability to tap into premium markets. That means mastering fresh cow protocols, optimizing dry period management, and meeting the certification requirements that open doors to better pricing.

Emerging regions should emphasize scalable, cost-appropriate technologies and gradual efficiency improvements while maintaining their cost advantages.

One-size-fits-all strategies are a thing of the past. Success comes down to mastering the details—fresh cow care, transition management, butterfat performance—while adapting to your local market and environment.

There’s a lot to consider, of course, but what’s encouraging is that curiosity, flexibility, and informed decision-making are what will keep the best farms moving forward. After all, adapting to change has always been at the heart of successful dairy farming.

The key is staying ahead of where the industry’s heading rather than just reacting to where it’s been.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – This article provides a strategic market overview, revealing how production trends in Europe and the US are creating new opportunities. It offers a crucial context to the main article’s global realignment theme by showing how regional economic shifts directly impact your business, helping you prepare for future market volatility.

- The Future of Dairy Farming: Embracing Automation, AI, and Sustainability in 2025 – While the main piece touches on technology, this article dives deeper into how specific innovations like whole-life monitoring and AI are becoming essential. It offers a future-oriented perspective and shows how these smart tech choices can deliver significant efficiency gains and improve herd health, positioning your farm for long-term competitiveness.

- 7 Proven Strategies to Perfect Silage Quality for Maximum Milk Production – This tactical guide provides actionable, on-farm strategies for improving feed management, a key driver of profitability. It complements the main article’s focus on efficiency and sustainability by offering practical steps you can implement immediately to increase milk quality, a crucial factor for accessing premium markets.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.