Think LSD would affect you? Italy thought the same thing… until June 23rd changed everything for European dairy

EXECUTIVE SUMMARY: Here’s what happened that should scare the hell out of every dairy producer: LSD isn’t staying “over there” anymore—it’s crossed into Europe and the economic fallout is brutal. Thailand’s outbreak data shows affected farms lost $727 per operation compared to $349 for clean herds, with milk production dropping 20-30% during acute phases… and some operations seeing losses up to 50%. Recovery isn’t quick either—we’re talking six months or more to get back to normal production levels, which means your feed conversion ratios go to hell while your cows burn energy fighting this virus instead of filling the bulk tank. The trade response was immediate and devastating: Australia and the UK suspended imports overnight, wiping out decades of market development in a single day. Climate change is extending vector seasons everywhere, making this a when-not-if scenario for most dairy regions. You need to start preparing your biosecurity protocols now, not after LSD shows up in your neighborhood.

KEY TAKEAWAYS

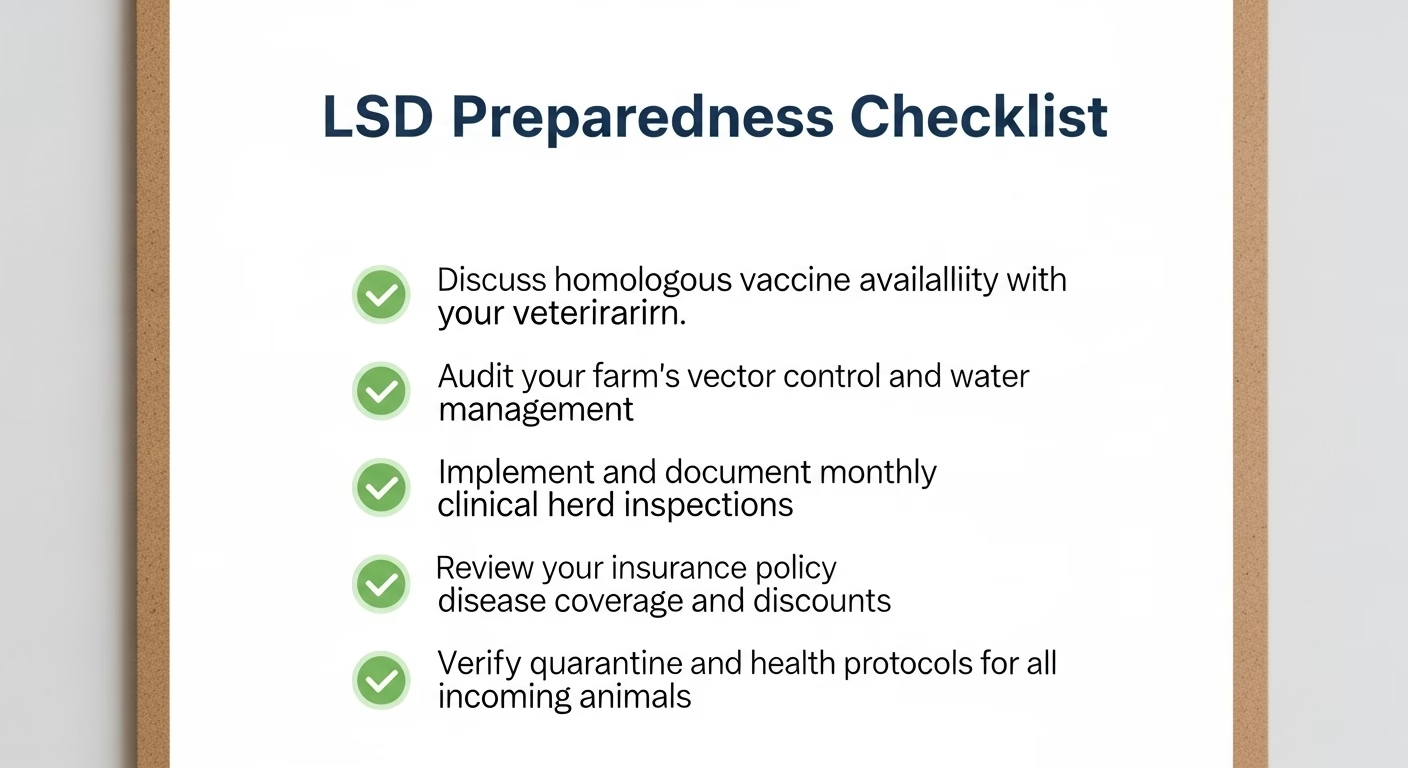

- Vaccination ROI beats outbreak costs by 10:1 — Mass vaccination runs $8-10 per head all-in, while outbreak losses can hit $200-500 per cow monthly during acute phases. Start conversations with your vet about homologous vaccine availability before you need it.

- Vector control investments pay for themselves fast — European operations spending €50,000 on enhanced insect management systems are seeing immediate returns compared to potential 6-month recovery timelines. Audit your standing water, manure management, and housing ventilation this month.

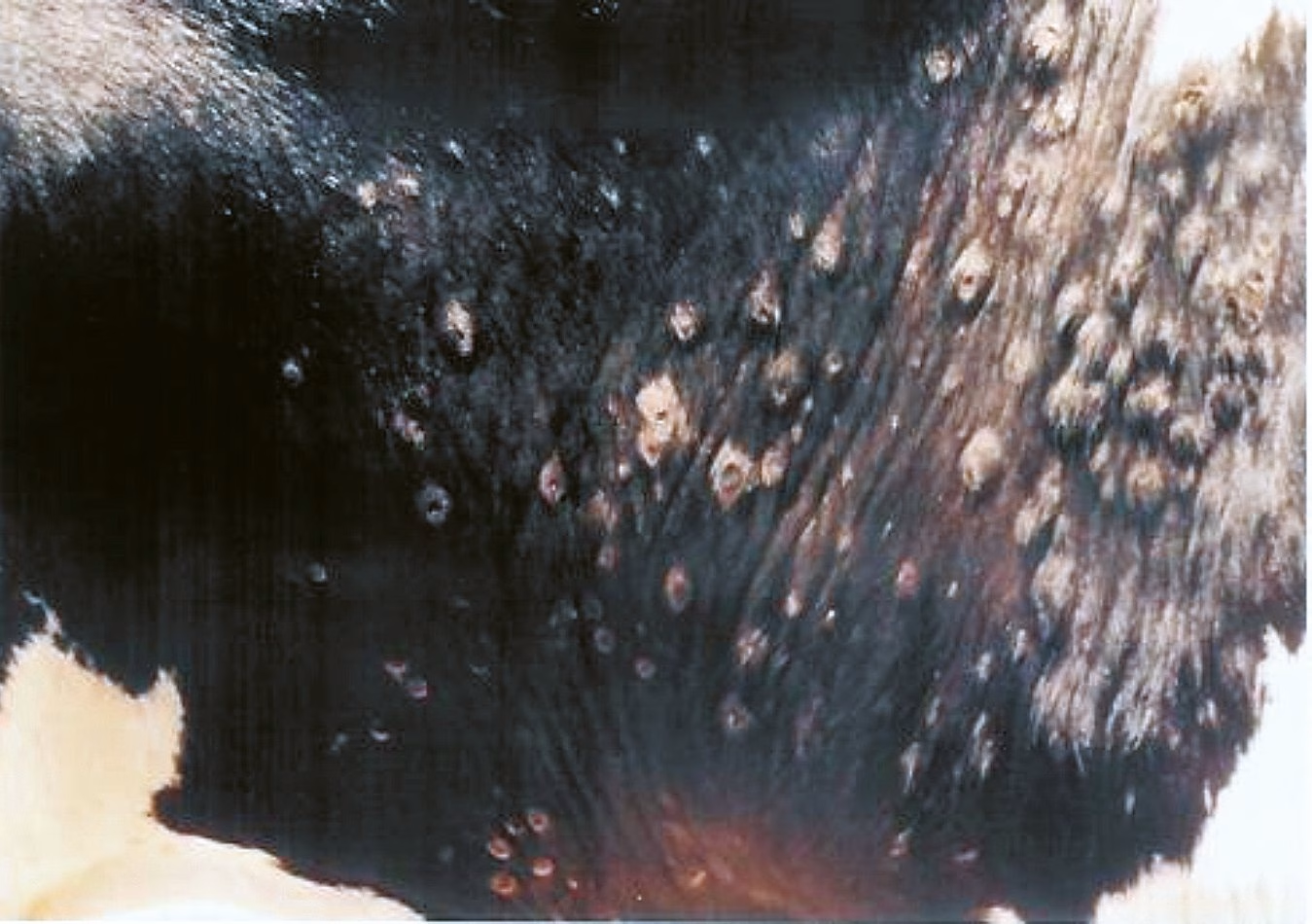

- Monthly clinical inspections are your new normal — Train your crew to spot skin lesions and nodules during high-risk periods (April-October) because early detection is the difference between managing a case and losing your herd. Document everything for insurance and trade certification purposes.

- Insurance companies are already pricing LSD risk — Some providers are offering 3-5% premium discounts for documented biosecurity plans that include vector control measures. That’s $1,500-2,500 back in your pocket on a $50,000 annual premium, plus you’re ahead of the curve when regulations tighten.

- Trade certification requirements are changing fast — Enhanced quarantine protocols and source verification are becoming standard for cattle purchases, so build relationships with suppliers who can meet the new documentation standards before they become mandatory.

You know that feeling when something you’ve been dreading actually happens? That’s exactly what hit me when I heard about Italy’s first LSD case back in June. We’d all been watching this disease tear through Africa and Asia for years, telling ourselves it was “their problem.” Well… not anymore.

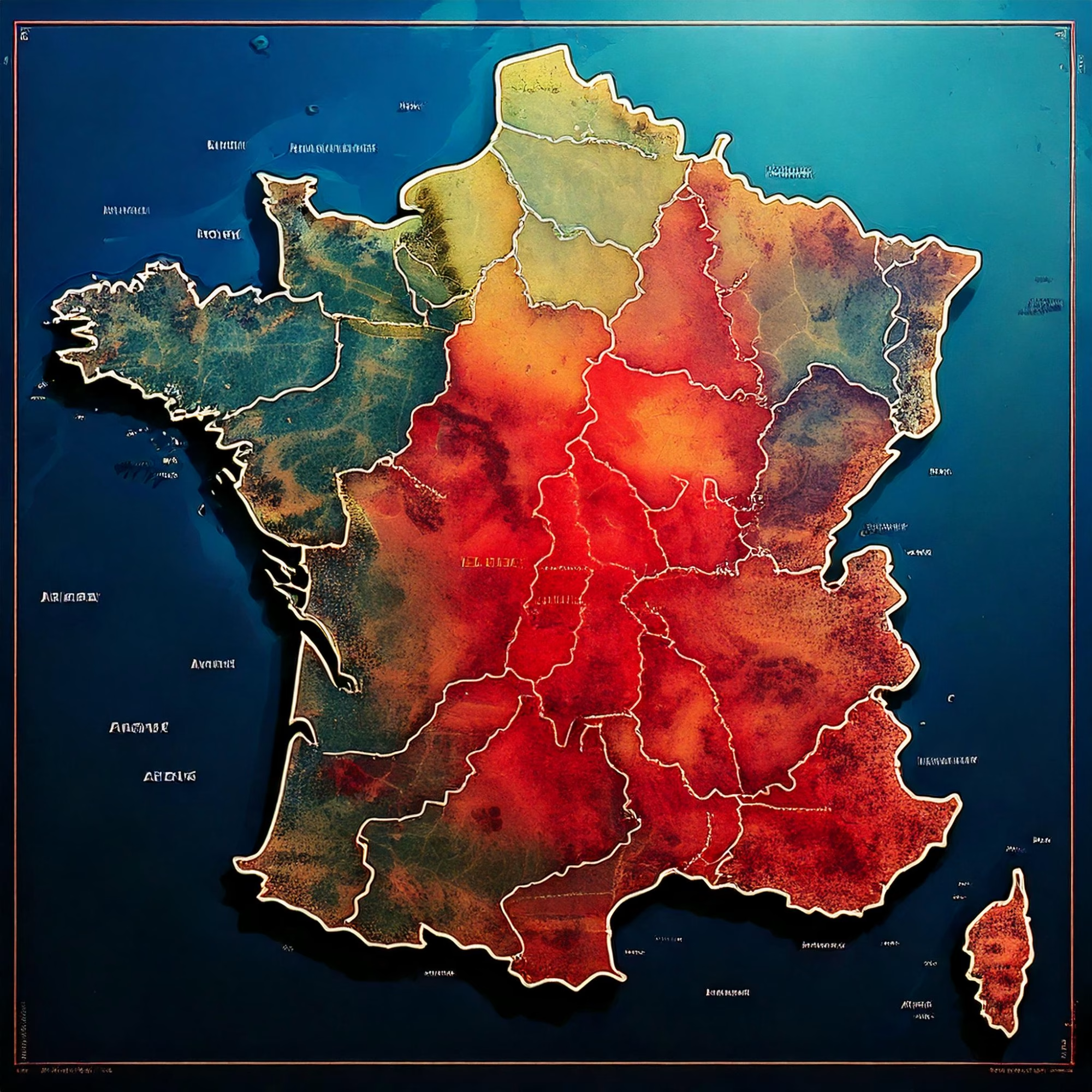

The thing about Lumpy Skin Disease is that most of us dairy folks figured it would stay put in those distant regions. But June 23rd changed everything. Italy confirmed their first case on a farm in Sardinia, and within days, France had their own outbreak up in Chambéry. Their very first case ever.

I’ve been tracking disease patterns for over two decades, and this one’s keeping me up at night.

How Fast Everything Went Sideways

What strikes me about this whole situation is the speed—we’re talking days, not weeks or months. Italy went from zero cases to implementing stamping-out protocols across multiple sites faster than you could say “movement restriction.” France took the nuclear option and depopulated that entire Chambéry operation. When you’re talking about complete herd elimination, you know the veterinary authorities aren’t messing around.

Here’s what really gets you, though… the pathway tells you everything about how vulnerable our cattle movement systems actually are. Contact tracing showed animals moved from that original Sardinian farm straight to Lombardy’s Mantua province, carrying LSD right along with them. Despite all our protocols, despite everything we thought we had, we were still vulnerable.

The trade response was brutal and immediate. Australia pulled Italy and France from their LSD-free country lists faster than you could process an export certificate. Live cattle, genetics, raw milk products—all suspended overnight. The UK followed within hours. I’m talking about twenty years of market development, gone in a single day.

The Numbers That’ll Ruin Your Sleep

I’ve been digging through recent work from the Journal of Dairy Science on Thailand’s 2021 outbreak, and honestly… the economics are terrifying. According to research published in Transboundary and Emerging Diseases (2022), dairy operations during active outbreaks showed average total financial losses of $727 per farm compared to $349 for non-affected operations. That’s not just a statistical difference—that’s real money that determines whether you make your next loan payment or start having very uncomfortable conversations with your banker.

But here’s what really hits home for those of us in the milk business… the production impacts are devastating. You’re looking at milk yield drops that can reach 20-30% during acute phases, and some operations—especially those caught completely off guard—have seen losses pushing 40-50%. Your feed conversion ratios? They basically collapse when cattle are burning energy fighting this virus instead of putting it into the bulk tank.

What’s particularly troubling is how long recovery takes. This isn’t like treating a case of mastitis, where you see improvement in a few days. According to field observations across multiple countries (and I’ve talked to producers who’ve lived through this), it can take six months or more to get back to normal production levels. Factor in the reproductive impacts—and trust me, they’re significant—and you’re looking at a multi-year recovery timeline.

Europe’s Response Actually Worked… Sort Of

The EU’s response impressed me, and I don’t often say that about government responses to anything. They’ve got this vaccine bank system they built after that Balkan disaster from 2015-2017, and it actually functions when they need it to. According to work published in the EFSA Journal (2023), they maintain substantial vaccine reserves with established deployment protocols that can be activated within 48 hours of outbreak confirmation.

What’s fascinating is how much they learned from those Balkan outbreaks. Back then, according to the World Organisation for Animal Health surveillance data, they went from over 7,400 outbreaks in 2016 down to just 385 in 2017. That’s a 95% reduction in one year, and it came down to one thing: mass vaccination campaigns using homologous vaccines, not the cheap alternatives some countries tried.

The current protocol—20-kilometer protection zones with 28-day movement restrictions, 50-kilometer surveillance zones with enhanced monitoring—it’s all based on hard-won experience. The Balkans collectively spent over €20 million during their outbreak period, but they actually eradicated the disease completely. Compare that to the alternative…

Trade Reality That Changes Everything

Here’s where this gets personal for anyone moving genetics or dairy products internationally. I know folks in the genetics business who literally watched their European shipments stop overnight. Years of relationship building, market development, and customer trust—all put on indefinite hold because of disease detection.

That’s how the international trade system works with notifiable diseases under OIE protocols. LSD detection triggers automatic restrictions. It’s not negotiable, it’s not political—it’s just how the system functions globally. And with dairy genetics becoming increasingly international (artificial insemination companies are shipping semen globally now more than ever), these restrictions hit hard and fast.

The ripple effects extend way beyond direct exports, though. Feed suppliers, equipment dealers, and even AI companies feel the pinch when movement restrictions go up. I talked to a Wisconsin-based genetics company last week—they can’t name names, but they’re a major player—and their European business dropped 80% overnight. “Twenty years building those relationships,” the VP told me, “and one disease detection basically shuts it all down.”

The Vector Problem We Can’t Fence Out

This is where it gets really interesting—and honestly, scary. Recent work published in Medical and Veterinary Entomology (2024) has confirmed that stable flies, mosquitoes, and various tick species can all transmit LSD virus between cattle. These aren’t just theoretical vectors—they’re proven disease spreaders in real-world conditions.

The transmission dynamics are eye-opening. According to research from veterinary entomologists, clinical animals are significantly more likely to infect by feeding insects compared to subclinical cases. That differential explains why outbreaks can seem to explode seemingly out of nowhere. You might have subclinical circulation for weeks before seeing your first clinical case, then suddenly you’re dealing with a full-blown outbreak.

Most herd-to-herd spread happens over relatively short distances—often within 2-3 kilometers. What that means for producers in dense dairy regions like the Po Valley, Brittany, or even parts of Wisconsin and California… well, let’s just say traditional biosecurity just got a lot more complicated. You can’t exactly build a fence to keep out flies.

The Vaccination Game Changer

The data from mass vaccination programs tells a compelling story. Research published in Preventive Veterinary Medicine (2023) shows that properly implemented vaccination campaigns using homologous vaccines can achieve up to a 119% reduction in new case numbers. But here’s the critical part—and this is where I’ve seen producers get burned—vaccine choice matters more than most people realize.

Vaccines made from actual LSD virus (homologous vaccines) work. Period. Vaccines based on related poxviruses like sheep pox or goat pox… not so much. I’ve heard from producers in Eastern Europe who used heterologous vaccines and kept seeing cases despite achieving 90% coverage rates in their herds. The serology looked good, but the protection just wasn’t there.

The European experience during the Balkans outbreak proves this point perfectly. Countries that invested in homologous vaccines—Serbia, Bulgaria, North Macedonia—they eliminated the disease. Countries that went with cheaper alternatives because of budget constraints? Some are still dealing with sporadic cases eight years later.

What This Means for Your Bottom Line

Look, the climate data suggests vector seasons are getting longer everywhere. I’m seeing reports from extension services across multiple states showing warmer temperatures and extended insect activity periods. That’s creating more opportunities for disease spread, plain and simple.

According to global surveillance data compiled by veterinary epidemiologists, we’re seeing new countries report LSD outbreaks at a rate that’s frankly alarming. Since 2012, the pattern has been consistent—about 2-3 new countries per year joining the “LSD-affected” list. And that trend isn’t slowing down.

For dairy producers, this changes the biosecurity conversation completely. We’re not just talking about limiting visitors anymore (though that’s still important). We’re talking about integrated vector control programs, standing water management, and manure handling protocols that consider insect breeding sites. It’s a completely different level of operational complexity.

Here’s what monthly clinical inspections need to look like now: Train your crew to recognize skin lesions, nodules, and any suspicious clinical signs. I’m talking about systematic visual inspections of every animal, not just the ones that look “off.” The sooner you catch something, the better your chances of limiting the spread and avoiding worst-case scenarios.

Real Changes Happening Right Now

I’m seeing operations across different regions starting to adapt, and the investment levels are significant. Some dairies in the Netherlands (I can’t name specific operations, but these are 800+ cow facilities) have invested upwards of €50,000 in enhanced vector control—improved ventilation systems, strategic insecticide programs, even housing modifications to reduce insect pressure. That’s real money, but when you consider the alternative…

Others are completely overhauling their cattle purchase protocols. One large dairy in northern Germany told me they’ve extended their quarantine periods from 7 days to 30 days, added pre-movement health screening that goes way beyond basic health certificates, and implemented source verification protocols that would have seemed excessive just two years ago.

The insurance angle is particularly interesting. I’m hearing from farm insurance providers across multiple states that they’re starting to incorporate disease preparedness into their risk assessments. Some are offering premium discounts of 3-5% for operations with documented biosecurity plans that include vector control measures. That might not sound like much, but on a $50,000 annual premium, that’s $1,500-2,500 back in your pocket.

Regional Differences That Actually Matter

What’s fascinating is how different regions are responding based on their specific challenges. Operations in Mediterranean climates—southern Italy, parts of Spain, even southern California—are focusing heavily on vector control because their insect seasons are longer and populations are higher. Makes perfect sense when you think about it.

But up north in places like Denmark, Wisconsin, or even parts of New York, they’re more concerned about cattle movement patterns because their vector pressure is still relatively seasonal. Different problems, different solutions.

Feed costs are playing into the economics, too, and this is where regional differences really show up. Producers in France are telling me they’re paying €300-320 per metric ton for quality corn, up from €200 just three years ago. When you’re already dealing with elevated feed costs, any production hit from disease becomes even more devastating to already tight margins.

The Vaccination Investment Reality Check

Here’s what producers need to understand about vaccination economics, and I’m going to give you real numbers based on recent procurement data. Mass vaccination campaigns using homologous vaccines typically run $4-6 per head for the vaccine itself, plus administration costs. Let’s say you’re looking at $8-10 per head all-in for a proper vaccination program.

Compare that to the documented losses from outbreak situations… according to economic analysis published in the Journal of Dairy Science (2024), affected operations are seeing monthly losses that can run $200-500 per cow during acute phases. The math isn’t complicated—vaccination is cheap insurance.

Countries and regions with pre-positioned vaccine stocks consistently fare better than those scrambling to react. The EU’s vaccine bank model, supported by regional cost-sharing agreements, represents what every major dairy region should be implementing. But it requires upfront investment and political coordination that isn’t always easy to achieve.

Where This All Leads

The European outbreaks of 2025 probably mark the beginning of something much bigger. Vector-borne diseases don’t respect borders, and our global cattle trade networks create pathways for spread that simply didn’t exist fifty years ago. I mean, we’re moving genetics internationally at a scale that would have been unimaginable to previous generations.

Smart producers are already thinking ahead, and the investment levels I’m seeing suggest they’re taking this seriously. Enhanced surveillance systems, improved biosecurity protocols, vaccination preparedness—these aren’t just regulatory compliance exercises anymore. They’re business survival strategies.

What really worries me is how unprepared some regions still are. LSD has been devastating operations across Africa and Asia for decades, but somehow we convinced ourselves it wouldn’t reach European or North American shores. Well, it’s here in Europe now, and the learning curve is steep.

I keep thinking about that genetics company executive I mentioned earlier. Twenty years of building European markets, gone overnight because of disease detection. That’s the new reality we’re all operating in, whether we like it or not.

The Bottom Line for Your Operation

The lesson from Europe is crystal clear: preparation costs way less than reaction. Whether you’re running 50 cows or 5,000, whether you’re in Wisconsin or Waikato, the economics of preparedness versus panic response aren’t even close.

This isn’t just about animal health anymore—it’s about protecting the economic foundation of dairy operations worldwide. Because once LSD gets established in a region, eradication becomes exponentially harder and more expensive. Look at how long it took to clear it from the Balkans, and they had the EU’s resources behind them.

The European dairy industry will adapt, like it always does. We’re resilient that way—we’ve weathered price crashes, regulatory changes, trade wars, and everything else thrown at us. But the cost of that adaptation… that’s what we’re all still calculating.

The producers who get ahead of this curve? They’re the ones who’ll still be in business when the dust settles. And the ones who wait until LSD shows up in their neighborhood? Well, let’s just say the Thailand and Balkan experiences suggest that’s not a strategy you want to bet your operation on.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- France’s LSD Outbreak: Europe’s Biosecurity Crisis Hits Home for Dairy – Reveals tactical biosecurity protocols and immediate action steps European farms implemented during the June 2025 outbreak, providing actionable crisis management strategies that North American producers can adapt before LSD reaches their regions.

- Managing Disease Outbreaks on Dairy Farms: Save from Economic Losses Improve Livestock Health – Demonstrates comprehensive economic modeling for disease outbreak costs and strategic planning frameworks that help producers calculate ROI on prevention investments, enabling data-driven biosecurity budget decisions for maximum profit protection.

- Your vet’s mastitis protocol is costing you $50,000/year – here’s how top farms cut treatment costs 60% – Explores innovative precision disease management technologies and alternative treatment protocols that achieve superior outcomes while reducing costs, showcasing how cutting-edge diagnostic tools and selective therapy approaches can revolutionize your entire herd health strategy.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!