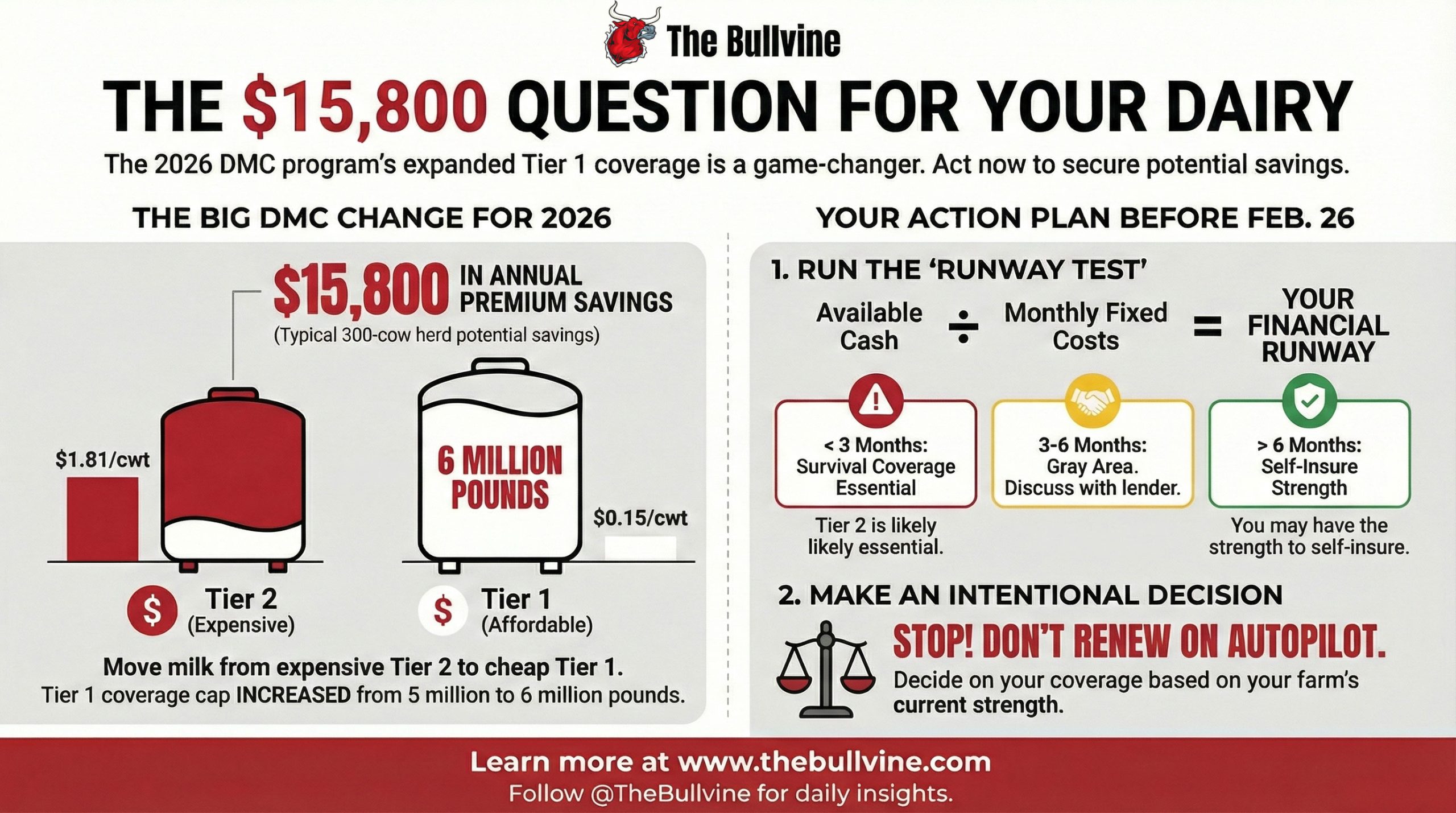

DMC averaged $74K per farm in 2023. In 2026, it got $15,800 better for 300-cow herds. Claim it by February 26—or miss it.

Executive Summary: DMC’s Tier 1 cap just jumped from 5 million to 6 million pounds. For a 300-cow dairy, that single change is worth roughly $15,800 in annual premium savings—money most producers will leave on the table because they’ll renew the way they always have. Before the February 26 deadline, you need to answer one question: Is Tier 2 coverage (about $70/cow, or $20,000/year) still survival insurance, or has your balance sheet improved enough since 2023 that it’s become expensive peace of mind? A quick runway test—available cash divided by monthly fixed costs—tells you where you stand. If you’ve rebuilt working capital and your operation is stronger than it was three years ago, your DMC strategy should reflect that. The $15,800 is there. The only question is whether you’ll claim it.

You know how it goes. You swing by the FSA office, renew your Dairy Margin Coverage more or less on autopilot, and get back to what actually matters—watching fresh cow performance, keeping an eye on butterfat levels, and making sure the transition period isn’t causing problems. In most years, that routine hasn’t hurt too badly.

This year’s different, though.

For the 2026 coverage year, FSA has bumped the Tier 1 coverage limit from 5 million pounds up to 6 million pounds. That’s straight from USDA’s official DMC program page, and they announced it at the Farm Bureau convention earlier this month. The expansion came through in the 2025 farm bill—the “One Big Beautiful Bill,” as it’s been called in the trade press—which also extended DMC through 2031.

Here’s what’s interesting about that change. The folks at Adams Brown, who spend their days running dairy financials, put out an article back in November showing what happens when you shift an extra million pounds from Tier 2 into Tier 1. For a lot of 250- to 350-cow herds, we’re talking premium savings solidly in the five-figure range.

So this year, doing “what we’ve always done” really is a decision. Not just a formality.

What Actually Changed in DMC for 2026?

Let me walk through this piece by piece, because the structure matters.

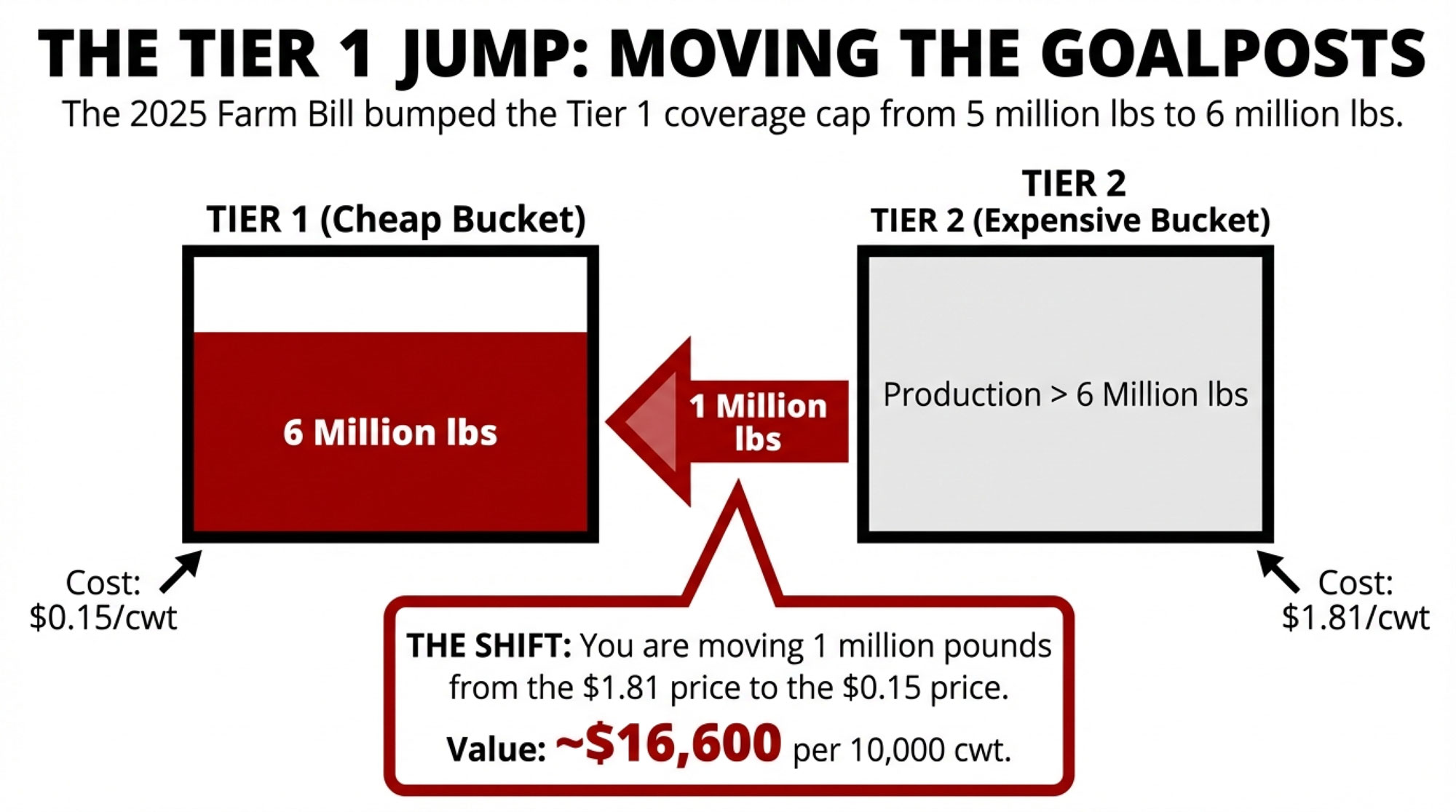

Starting in 2026, that first 6 million pounds of your production history qualifies for Tier 1 coverage. You can pick coverage levels from $4.00 up to $9.50 per hundredweight, in half-dollar increments. And here’s the part that makes Tier 1 so attractive—at the $9.50 level, you’re paying just $0.15 per cwt. That’s from UW-Madison’s DMC policy updates, and the 2026 DMC premium rates haven’t changed on the Tier 1 side from previous years.

Everything above 6 million falls into Tier 2. The coverage there tops out at $8.00 per cwt, and the premium at that level runs about $1.81 per cwt according to the same UW tables.

So any hundredweight you can move from Tier 2 down into Tier 1? You’re trading a $1.81 premium for a $0.15 premium. That’s roughly $1.66 per cwt difference.

Over a million pounds—10,000 cwt—that works out to around $16,600 in potential premium savings. Real money.

One more thing worth noting: FSA is also requiring all operations enrolling for 2026 to establish a new production history using the highest annual production from 2021, 2022, or 2023. That’s on FSA’s program page and confirmed in Adams Brown’s farm bill summary. If your herd has grown since you last updated, this could work in your favor.

Putting This in Cow Terms

It helps to anchor this in actual herds rather than abstract numbers.

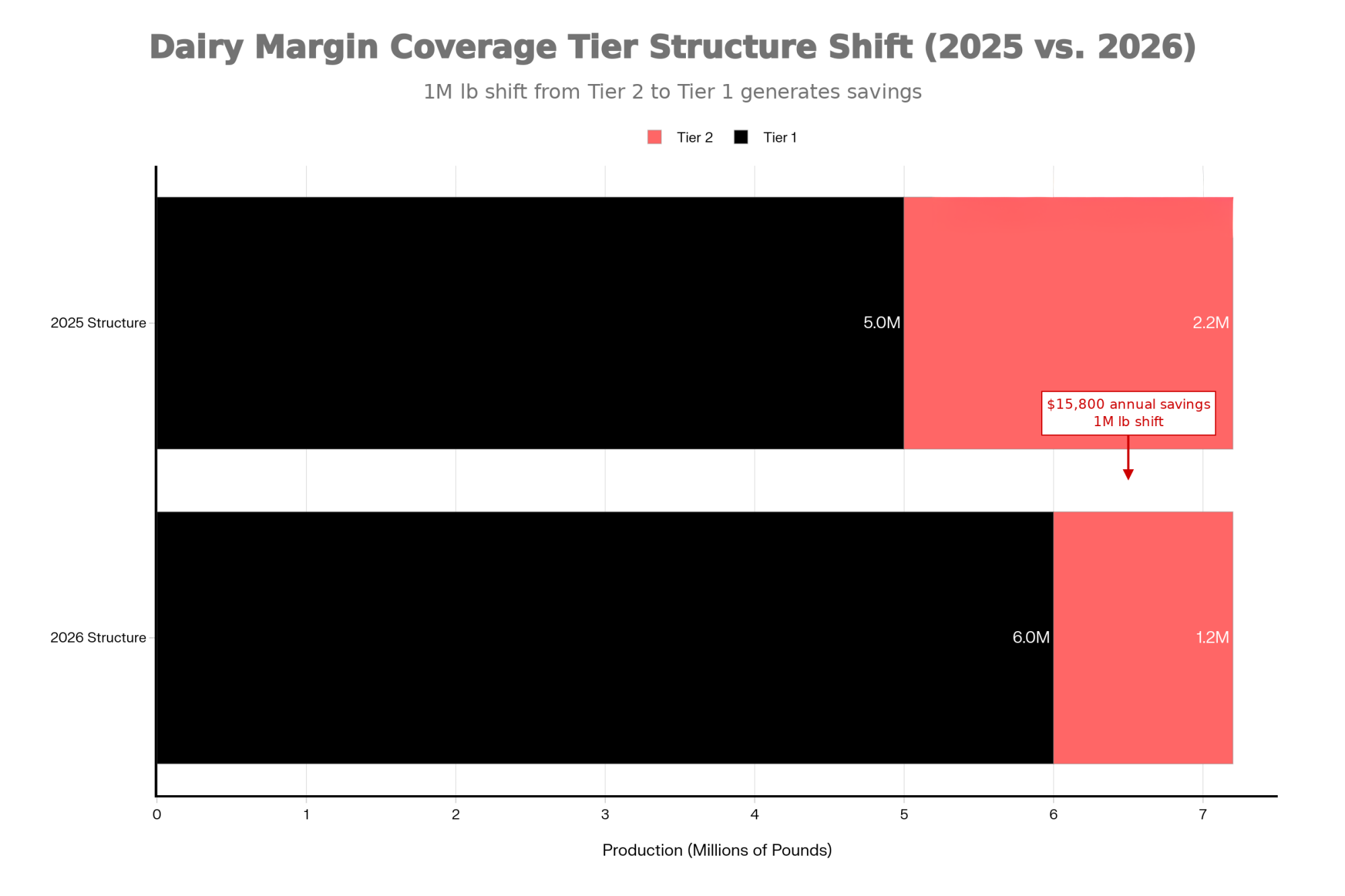

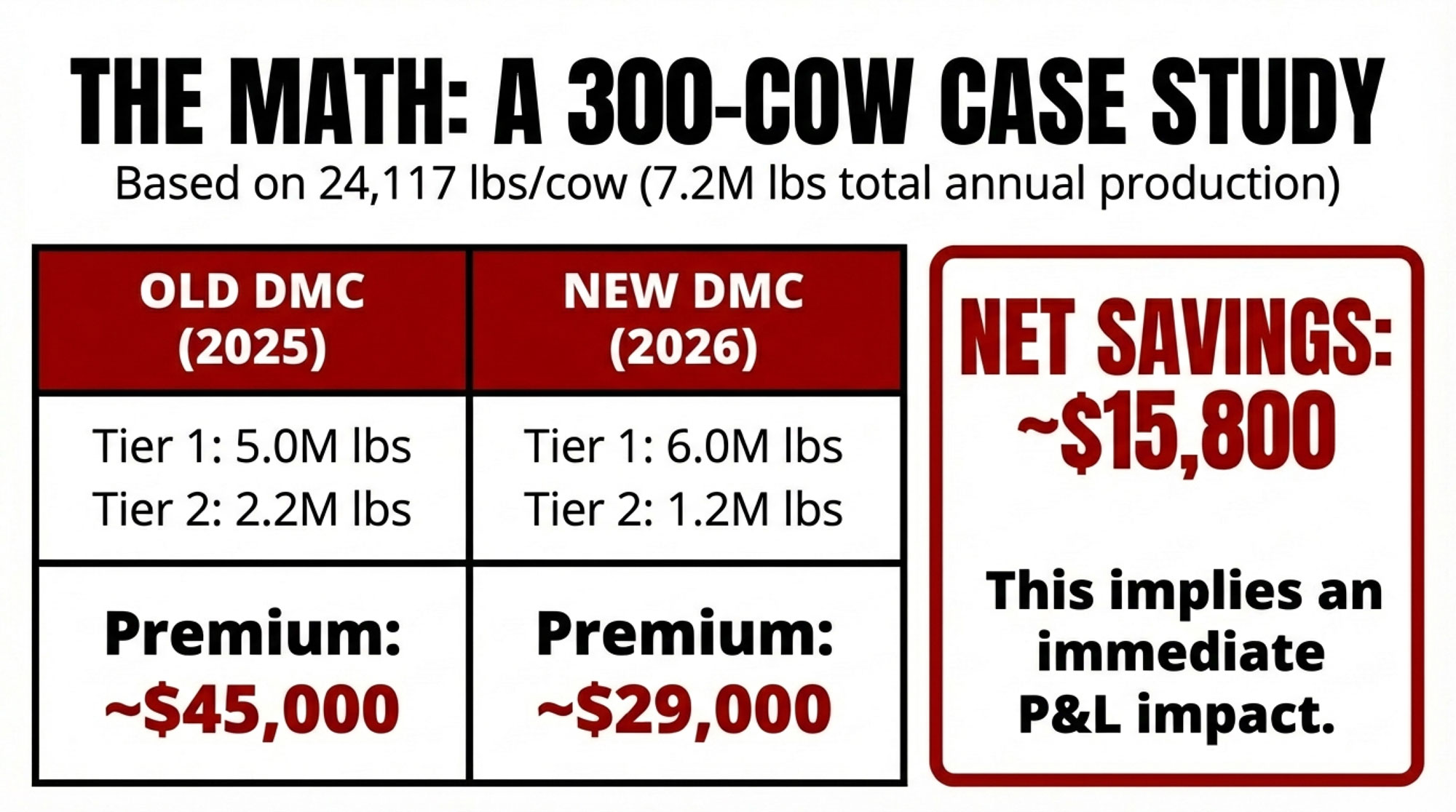

The average U.S. milk production in 2023 came in at 24,117 pounds per cow, up about 30 pounds from 2022. Using that benchmark, 300 cows at average production gives you roughly 7.2 million pounds annually. That’s a pretty common profile in freestall operations across the Midwest and Northeast.

| Year | Tier 1 (Lbs) | Tier 1 Premium/cwt | Tier 2 (Lbs) | Tier 2 Premium/cwt |

|---|---|---|---|---|

| 2025 | 5.0M | $0.15 | 2.2M | $1.81 |

| 2026 | 6.0M | $0.15 | 1.2M | $1.81 |

Under the old DMC structure, that 300-cow herd had 5 million pounds in Tier 1 and 2.2 million in Tier 2. Under the 2026 rules, it’s 6 million in Tier 1 and only 1.2 million in Tier 2.

Run those volumes through current FSA premium rates at 95% coverage, and here’s what you get:

The old structure cost that herd roughly $45,000 a year in premiums—about $7,100 for Tier 1, nearly $38,000 for Tier 2. The new structure? Roughly $29,000—around $8,500 for Tier 1, about $20,700 for Tier 2.

| Metric | Old DMC (2025) | New DMC (2026) |

| Tier 1 Cap | 5.0 Million Lbs | 6.0 Million Lbs |

| Tier 1 Premium ($9.50) | $0.15 / cwt | $0.15 / cwt |

| Tier 2 Premium ($8.00) | $1.81 / cwt | $1.81 / cwt |

| Annual Premium (300 Cows) | ~$45,000 | ~$29,000 |

| Net Savings | – | $15,800 |

That’s approximately $15,800 in annual premium savings. Just because more milk now qualifies for the cheaper coverage tier.

Adams Brown’s worked examples hit the same ballpark when they model what happens as production shifts from Tier 2 to Tier 1. This isn’t a cosmetic tweak—it genuinely moves the needle.

| Herd Size (Cows) | Annual Production (Lbs) | 2025 Premiums | 2026 Premiums | Savings |

|---|---|---|---|---|

| 200 | 4.8M | ~$32,500 | ~$20,800 | ~$11,700 |

| 300 | 7.2M | ~$45,000 | ~$29,000 | ~$16,000 |

| 400 | 9.6M | ~$57,500 | ~$37,000 | ~$20,500 |

| 500 | 12.0M | ~$70,000 | ~$45,000 | ~$25,000 |

| 600 | 14.4M | ~$82,500 | ~$53,000 | ~$29,500 |

What 2023 Taught Us About DMC

You probably remember 2023 without needing much prompting. But it’s worth looking at what DMC actually did that year, because it shapes how a lot of us think about coverage now.

UW-Madison’s 2024 program review showed that DMC margins fell below the $9.50 coverage threshold in 11 out of 12 months during 2023. Several months landed in the mid-$4 to low-$5 per cwt range—some of the weakest margins we’d seen since the program started.

| Month | All Milk Margin ($/cwt) | Tier 1 Payment @ $9.50 Coverage ($/cwt) |

|---|---|---|

| Jan | $4.80 | $4.70 |

| Feb | $5.20 | $4.30 |

| Mar | $4.50 | $5.00 |

| Apr | $5.80 | $3.70 |

| May | $6.20 | $3.30 |

| Jun | $6.50 | $3.00 |

| Jul | $6.10 | $3.40 |

| Aug | $5.90 | $3.60 |

| Sep | $5.40 | $4.10 |

| Oct | $4.70 | $4.80 |

| Nov | $4.30 | $5.20 |

| Dec | $4.60 | $4.90 |

On the payment side, UW-Madison reported that total indemnity payments for 2023 topped $1.27 billion across about 17,059 enrolled operations. That worked out to an average of roughly $74,453 per farm, with about 74.5% of eligible dairies participating.

For producers at the $9.50 coverage level, monthly payments often exceeded $2 per cwt during the worst stretches. Dairy Herd Management described 2023 as a year when DMC was “in the money” almost continuously for herds with higher Tier 1 coverage.

When USDA first rolled out the DMC decision tool in 2019, it partnered with UW-Madison on its development. At the time, Mark Stephenson—then Director of Dairy Policy Analysis at UW—said DMC “offers very appealing options for all dairy farmers to reduce their net income risk due to volatility in milk or feed prices.”

That sounded promising then. 2023 showed what it looks like in real dollars.

So when producers say they’re not going through another margin crash without full coverage, that’s not paranoia. It’s memory. Those DMC payments kept operating loans current, and feed mills paid on a lot of farms.

What’s easy to miss, though—and this is where the 2026 DMC calculation gets interesting—is that many herds used the stronger margins of late 2023 and 2024 to rebuild. Working capital came back. Debt got paid down. Break-even costs dropped.

The Farm You Were vs. The Farm You Are Now

Here’s what I’ve noticed working through this with producers over the past few months.

Going into 2023, a lot of mid-size herds—the 250- to 350-cow operations—were carrying tight balance sheets. Farm-management reports and lender dashboards commonly showed working cash in the $50,000 to $100,000 range, debt service coverage ratios hovering around 1.1 to 1.25, debt-to-asset ratios in the mid-40% to low-50% band, and break-even milk prices pushing toward $19 or $20 per cwt in higher-cost regions.

University finance specialists had been flagging that profile as vulnerable for a while. Any combination of lower milk prices, poor forage quality, or spiking feed costs could push those farms into serious stress.

Fast forward to now, and the picture often looks different. The herds that stayed in business—especially those that collected DMC payments and caught the firmer milk prices of 2024—often rebuilt working capital into the $200,000 to $300,000 range or higher. Debt service coverage ratios improved into the 1.4 to 1.6 band. Debt-to-asset ratios drifted back toward the high 30s or low 40s. Break-even prices fell into the $17 to $18 range, with better forage and tighter overhead.

When you put the last few years of financials side by side, the “farm we were in 2022” and the “farm we are in 2025” can look quite different—even if your gut still feels like it’s living in 2023.

So, before you check those boxes at FSA, are you setting up DMC for the farm you were, or the farm you are now?

What Job Is Tier 2 Actually Doing?

This is where conversations tend to get interesting.

In my experience, Tier 2 ends up playing one of two roles. It’s either survival coverage or peace-of-mind coverage. Both are legitimate. The key is knowing which job it’s doing for you this year.

| Indicator | Tier 2 = Survival Coverage | Tier 2 = Peace-of-Mind Coverage |

|---|---|---|

| Working Capital (Days of Expenses) | <60 days | >120 days |

| Debt Service Coverage Ratio | <1.25 | >1.40 |

| Debt-to-Asset Ratio | >50% | <40% |

| Break-Even Milk Price | >$19/cwt | <$18/cwt |

| Tier 2 Annual Cost (300-cow herd) | ~$20,000–$21,000 (Critical) | ~$20,000–$21,000 (Discretionary) |

| Decision | Must Keep Tier 2 | Can Scale Back or Self-Insure |

When Tier 2 is survival coverage

Tier 2 belongs in the “must-have” column when a farm is financially fragile. Extension finance programs and lenders typically flag farms with working capital covering less than 60 days of expenses, debt service coverage consistently below 1.25, debt-to-asset ratios above 50%, or break-even milk prices creeping toward $19 or higher.

As many of us have seen in Wisconsin freestalls and Western dry lot systems alike, it doesn’t take much to chew through limited cash when you’re that tight. A weather-damaged corn silage crop. Protein prices jumping. A dip in the milk check. On those farms, Tier 2 payments can literally be the difference between riding out a rough stretch and falling behind on bills you can’t afford to miss.

When Tier 2 becomes peace-of-mind coverage

On stronger farms, Tier 2 plays a different role.

When working capital covers 120 days or more of fixed costs, when debt service coverage holds comfortably above 1.4, when leverage sits under 40%, and when break-even prices have moved down into the $17 to $18 range—a farm can shoulder more of its own margin risk without immediately threatening survival.

In that situation, Tier 2 becomes more about smoothing income and reducing stress than about keeping the doors open. The protection is real, but the farm isn’t dependent on those checks to stay solvent.

What Tier 2 actually costs

Back to our 300-cow example. That extra 1.2 million pounds above the Tier 1 cap falls into Tier 2.

Using FSA’s premium table at $8.00 coverage and 95% coverage percentage, premiums on that Tier 2 slice run about $20,000 to $21,000 per year. Spread across the herd’s total production, you’re looking at roughly 28 to 29 cents per cwt, or about $70 per cow per year.

Some operations look at that $70 and say, “That’s a cheap price for peace of mind.” Others—particularly those with longer runway and stronger cash flow—start asking whether that money might work harder paying down principal, upgrading cow comfort, or buying targeted Dairy Revenue Protection for specific high-risk quarters.

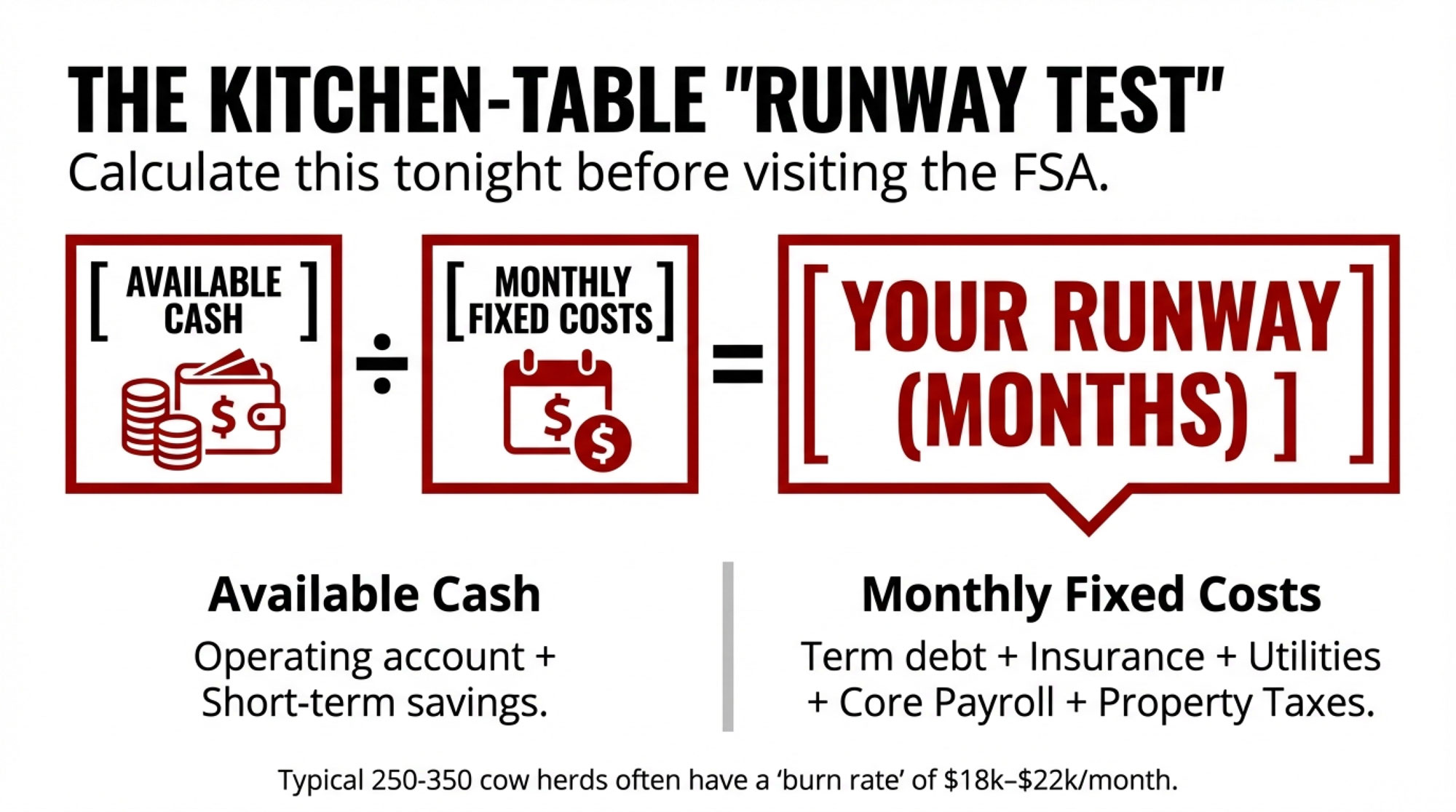

A Kitchen-Table Runway Test

So how do you figure out where you actually stand without building a massive spreadsheet?

A lot of university educators and lenders have gravitated toward a simple runway test. It’s not perfect, but it’s surprisingly useful for getting your bearings.

- Step one: Grab your most recent bank statement showing your operating account and any short-term savings. Pull your latest term-debt statement with the monthly principal and interest. Have a recent milk check handy.

- Step two: Estimate your monthly fixed “burn.” Start with your total monthly term-debt payments, then add the costs that don’t disappear when margins drop—insurance, utilities, property taxes averaged over the year, core payroll for people you realistically can’t cut. Farm-business programs in Wisconsin, Minnesota, and New York commonly see 250- to 350-cow dairies with monthly burns in the $18,000 to $22,000 range, though it varies by region and setup.

- Step three: Divide your available cash by that monthly burn.

That gives you your runway—the number of months you can keep essential bills paid if margins drop and stay ugly.

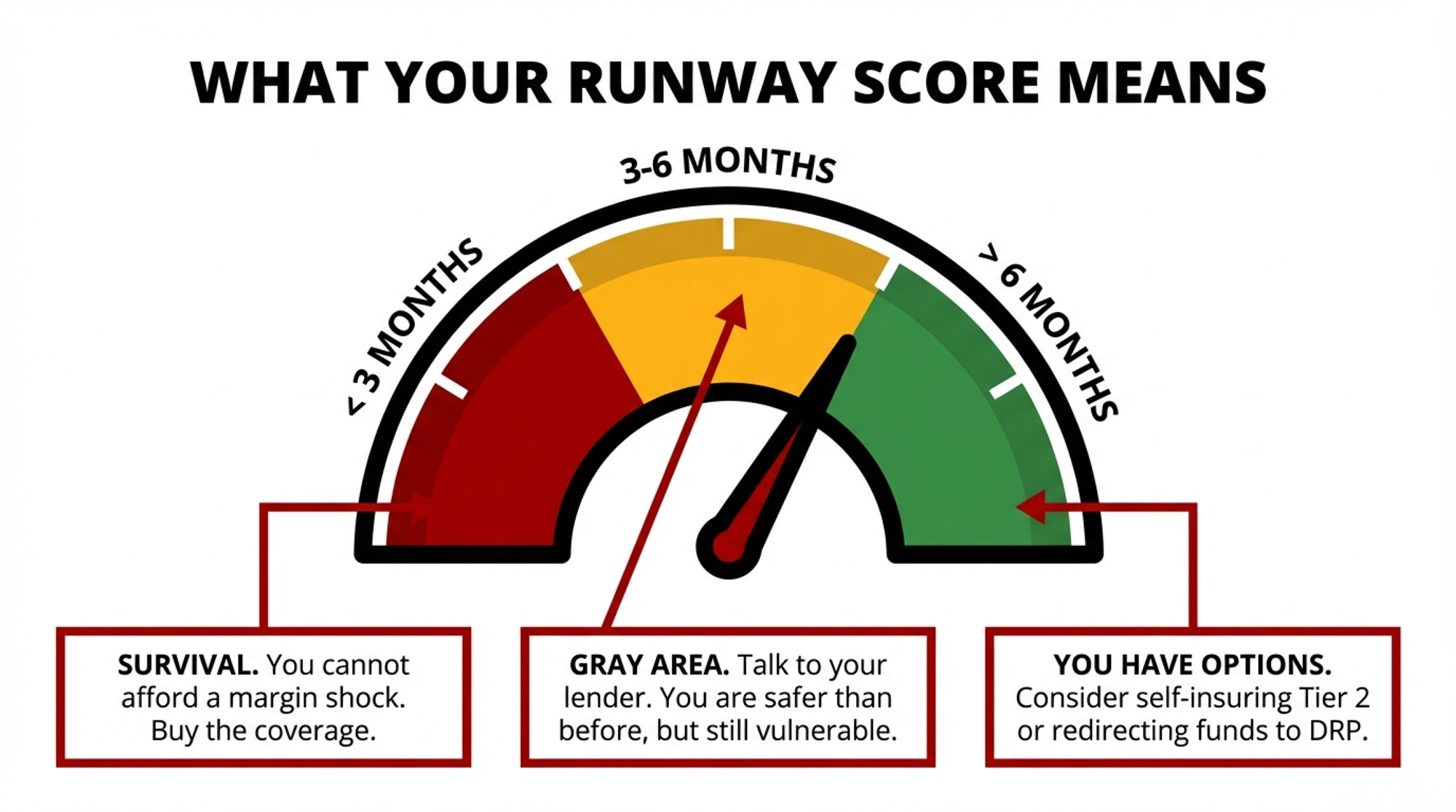

Extension risk-management materials generally talk about 3 to 6 months of working capital as a minimum target, with more than 6 months representing a strong buffer.

In practice:

- Less than 3 months: Tier 2 is probably still survival coverage for your operation.

- 3 to 6 months: Gray area—time for a careful conversation with your lender.

- More than 6 months: There’s room to discuss self-insuring part of that Tier 2 risk.

What’s encouraging is that many Midwest operations running this exercise over the past year have been surprised to find their runway longer than they expected. Not everyone, but enough that it’s changed the tone of the Tier 2 conversation.

| Months of Runway | Financial Status | Tier 2 Coverage Decision |

|---|---|---|

| <3 months | Tight. Vulnerable to margin shocks. | KEEP TIER 2 — Survival coverage; margin failures = serious stress |

| 3–6 months | Gray area. Stronger than tightest farms, not yet confident. | CONSULT YOUR LENDER — Decision depends on debt structure & farm trajectory |

| >6 months | Strong. Solid buffer. | YOU HAVE OPTIONS — Can max Tier 1, skip/scale Tier 2, test self-insurance |

How Bigger Herds Layer Their Risk Tools

For larger operations—500 cows, 1,000 cows, and up—the DMC discussion usually sits inside a broader risk-management framework.

UW-Madison’s 2025 DMC update explicitly notes that “DMC may be combined with DRP or LGM-Dairy to form a more comprehensive risk management framework.” And that’s exactly what we’re seeing in practice.

The pattern in a lot of Wisconsin freestalls and Western systems looks something like this: Use Tier 1 DMC at $9.50 for the first 5 to 6 million pounds as a base safety net. Add Dairy Revenue Protection on a portion of remaining production to lock in revenue floors for specific quarters, especially when futures markets and local basis look shaky. Use Livestock Gross Margin-Dairy selectively when feed cost risk is particularly high.

Risk Management Agency materials show that DRP adoption has been ramping up among larger herds since its 2018 launch. DMC serves as the first layer; DRP and LGM target more specific risks for volumes above Tier 1.

For bigger operations, Tier 2 is one option among several for covering extra production—and the decision about how much to buy sits alongside questions about DRP quarters and feed hedging.

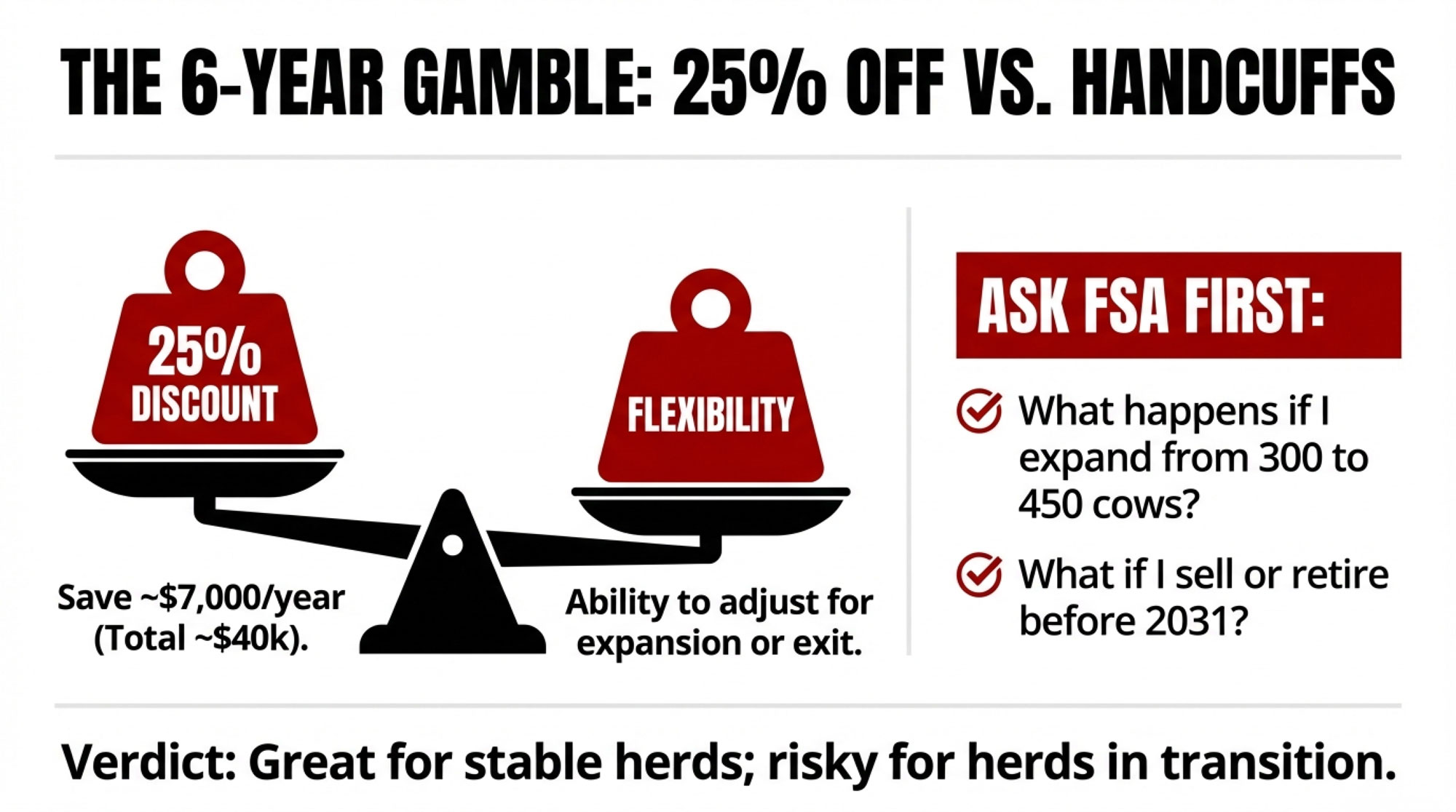

The Six-Year Lock-In: Discount or Commitment?

Now let’s talk about the multi-year option, because it deserves a careful look.

The discount

Under the 2025 farm bill changes, producers can enroll in DMC for a six-year period—2026 through 2031—and receive a 25% discount on premiums throughout. That’s confirmed on FSA’s official program page and in Adams Brown’s farm-bill breakdown.

For our 300-cow example, where annual premiums under the new structure run about $29,000, a 25% discount brings that down to roughly $22,000 per year. That’s around $7,000 in annual savings, or more than $40,000 across six years.

The commitment

The catch—and it’s worth thinking through—is that multi-year enrollment isn’t designed as a “sign now, adjust freely later” arrangement.

USDA describes it as providing stability for both producers and the program. The detailed rules around mid-stream changes are best confirmed with your local FSA office, but the general idea is clear: you’re trading some future flexibility for a lower bill today.

Questions worth asking before you sign

If you’re considering the multi-year option, here are the conversations to have at FSA:

- “If we expect to grow from 300 cows to 450 cows over the next six years, how does our coverage and premium obligation evolve?”

- “If we sell, retire, or transfer the operation before 2031, what happens to the remaining years?”

- “If our risk tolerance changes and we want to adjust Tier 2 coverage after a couple of years, what are our options?”

For stable herds with clear long-term plans, the multi-year discount can be a very good fit. For farms facing major transitions—expansion, succession, shifts in business model—staying year-to-year and letting coverage evolve with the operation might make more sense.

The main thing is asking these questions before you sign.

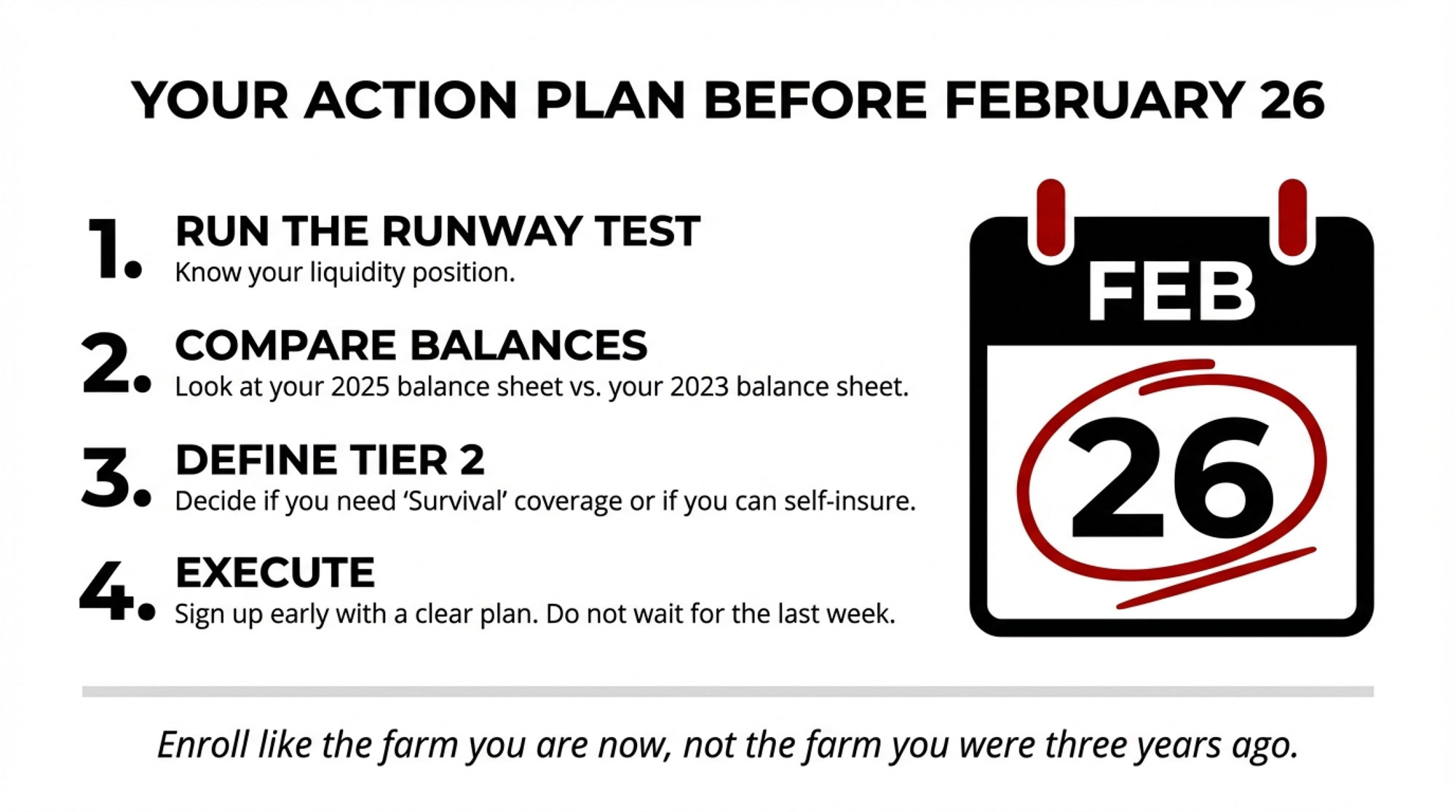

Why February 26 Should Be the Finish Line, Not the Starting Gun

According to FSA, the 2026 DMC enrollment deadline is February 26. Enrollment opened January 12.

What I’ve noticed is that the farms getting the most from DMC treat that deadline as the last day to finalize paperwork on a decision they’ve already worked through—not the day they first start asking what changed.

By mid-January, most dairies are already deep into year-end review. You’re looking at your 2025 income statement and balance sheet. You know how forage turned out. You’ve got a feel for where feed and milk markets might be headed. That’s exactly when DMC strategy belongs in the conversation.

FSA staff consistently say the strongest sign-up meetings happen early in the window, when producers arrive with their questions already answered. It’s the last-week crunch—when everyone’s buried and just trying to avoid missing the deadline—that leads to “just do what we did last year” decisions, even when the farm’s financial picture has shifted significantly.

What If You Cut Tier 2 and 2026 Turns Ugly?

This is the question that sits in the back of everyone’s mind. And honestly, it should.

If you look at your 2025 results, decide you’re strong enough to drop or scale back Tier 2, and then 2026 turns into another rough year, will there be mornings when you wish those Tier 2 checks were coming?

Of course. That’s the nature of insurance. Regret always shows up loudest after the fact.

So instead of asking whether you’ll regret it if the worst happens—because that answer is almost always yes—it’s more useful to ask:

- Given our current runway, debt service coverage, leverage, and break-even, could we realistically survive another difficult margin year using Tier 1 DMC, our cash reserves, and existing credit without Tier 2?

- How much margin risk are we truly comfortable carrying ourselves now, compared to what we could carry going into 2023?

For some farms, after putting the real numbers on the table with their lender, the answer is still: “We’re not quite there yet. Tier 2 is survival coverage for us.”

For others—especially those sitting on more than six months of runway and strong debt service coverage—the answer moves closer to: “We can shoulder more of this ourselves now, and those Tier 2 dollars might work harder somewhere else.”

A test-year approach for stronger herds

What’s emerging in some extension workshops is a “test-year” strategy. It goes like this:

- Max out the expanded Tier 1: 6 million pounds at $9.50.

- Skip Tier 2 for one coverage year.

- Move the money you would have spent on Tier 2 premiums—around $20,000 in the 300-cow example—into a dedicated reserve account earmarked for margin shocks.

If 2026 turns rough, that reserve plus Tier 1 payments gives you a self-funded cushion. If 2026 is decent, you’ve effectively paid that premium to yourself and strengthened your working capital.

It won’t fit everyone, and it absolutely should be run past your lender first. But it shows how stronger balance sheets and a more generous Tier 1 structure are giving some farms more options, not fewer.

Your Action Plan Between Now and February 26

Let me bring this back to the kitchen table.

Tonight or this week:

- Run your runway test. Grab your bank and loan statements and figure out how many months of fixed costs your current cash covers.

- Pull your key ratios. Look at where your debt service coverage, leverage, and break-even landed for 2025.

- Run scenarios with USDA’s DMC Decision Tool. It’s available on FSA’s website and was developed with UW-Madison specifically to help producers compare coverage options using their own production history.

Over the next week or two:

- Decide what job Tier 2 is doing. Is it still survival coverage for your operation, or has it shifted into peace-of-mind territory you might resize?

- Talk with your lender. Bring your runway number and ratios. Ask whether your current position can support self-insuring some risk.

- Ask about multi-year enrollment at FSA. Get clear on what a six-year commitment would mean for your situation.

Before February 26:

- Choose your 2026 structure intentionally. Decide your Tier 1 and Tier 2 levels, whether you’re going year-by-year or locking in for six years, and how that fits with any DRP strategy.

- Walk into FSA with a plan. Use your appointment to execute a decision you’ve already made, based on good information.

The Bottom Line

DMC remains one of the most cost-effective safety nets under the U.S. milk check. But the opportunity in 2026 isn’t just to get enrolled.

It’s to enroll like the farm you’ve become—not the farm you were before 2023—and to line up your coverage with the cows you’re milking, the numbers on your books, and the level of risk you can genuinely live with now.

The 2026 DMC deadline is February 26. If you don’t run this math before then, the odds are high you’ll either overpay for coverage you don’t need, or underinsure a risk your balance sheet still can’t carry.

Neither is where any of us want to be.

Key Takeaways:

- $15,800 is hiding in your 2026 DMC renewal. The Tier 1 cap jumped from 5 million to 6 million pounds—shifting a million pounds from $1.81/cwt premiums down to $0.15 for 300-cow dairies.

- Most producers will miss it. They’ll renew on autopilot without realizing the program changed. Don’t be most.

- Tier 2 runs $70/cow. Is that survival coverage—or an expensive habit? If your balance sheet is stronger than it was in 2023, the answer has likely changed.

- Run the runway test. Cash on hand ÷ monthly fixed costs. Under 3 months = Tier 2 is still essential. Over 6 months = you have real options.

- February 26 deadline. The $15,800 is there. Claim it—or leave it on the table.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- April 2025 Dairy Risk Management Calendar – Reveals the precise steps to layer DMC with Dairy-RP and Chicago puts, arming you with a tactical risk calendar that prevents devastating coverage gaps when market floors shift during the high-stakes Q3 and Q4 windows.

- The Triple Cushion Trap: Why 2025’s Strong Margins Won’t Save You in 2026 – Exposes the temporary nature of 2025’s profit cushions, delivering a strategic roadmap to rebuild working capital and restructure debt before the broader industry consolidation and margin-compression cycle hits full force in late 2026.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – Breaks down how AI health monitoring and precision feeding systems are slashing feed costs by 25% per cow. It delivers an immediate efficiency advantage, transforming operational data into a self-funded safety net during volatile periods.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!